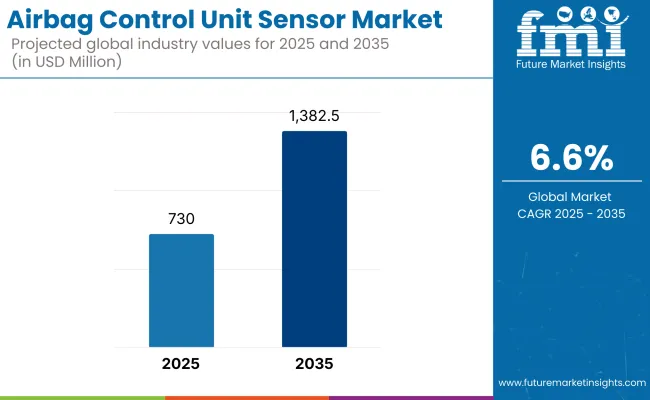

The airbag control unit sensor industry is anticipated to grow gradually, with a size of USD 730.0 million in 2025, and it is expected to reach about USD 1,382.5 million by 2035, growing at a CAGR of about 6.6%. The revenue growth is influenced by increasing demand for vehicle safety, regulatory requirements, and sophisticated crash-sensing technology.

| Market Metrics | Value |

|---|---|

| Industry Size (2025E) | USD 730.0 million |

| Industry Value (2035F) | USD 1,382.5 million |

| CAGR (2025 to 2035) | 6.6% |

Increasing car manufacturing and awareness of car safety, especially in emerging economies, is one of the major contributors to industry expansion. Both governments and consumers are increasingly focusing on protecting occupants, resulting in growing installation rates of airbag systems even in lower-range and mid-range cars.

Regulatory requirements are driving adoption. In the United States, Europe, Japan, and many Latin American nations, automotive safety standards call for the installation of multiple airbags and collision warning systems, generating steady demand for high-performance ACU sensors in all vehicle segments.

The transition to electric and autonomous cars (EVs and AVs) is also driving innovation in sensor technology. EVs and AVs need integrated and smart safety systems with fast response times and high diagnostic capability, opening up new possibilities for smart Airbag Control unit Sensor units with multiple sensor inputs and self-calibration capabilities.

Miniaturization of sensors and MEMS technology are revolutionizing the game. These sensors provide higher sensitivity, faster response time, and better vibration and extreme temperature endurance, resulting in improved performance under diverse driving conditions. They also enable smaller designs, which are ideal for EV platforms and lower vehicle-weight architectures.

Despite its strong growth potential, the system is complex, and integration costs are high. Integrating ACU sensors with other active and passive safety systems, including seatbelt pre-tensioners, adaptive cruise control, and ADAS, requires sophisticated algorithms and sound software, which drives development lead times and product costs.

The shortage of semiconductors has also affected supply chains to some extent, with short-term production postponements and the prioritization of top-end car models for feature-rich sensor integration. In the longer term, the demand path remains upbeat due to increasing levels of safety standards and vehicle automation requirements. The airbag control unit sensors become highly critical as safety becomes of utter importance. With growing regulatory pressure and consumer demand, the industry will continue to grow as vehicles become safer, smarter, and more responsive to real-time crash dynamics.

The airbag control unit sensor industry is rapidly evolving due to increased expectations for the protection of vehicle occupants and the automotive sector's emphasis on intelligent safety systems. The sensors play a key role in evaluating vehicle dynamics at collision and initiating timely airbag deployment with a direct influence on life-saving results.

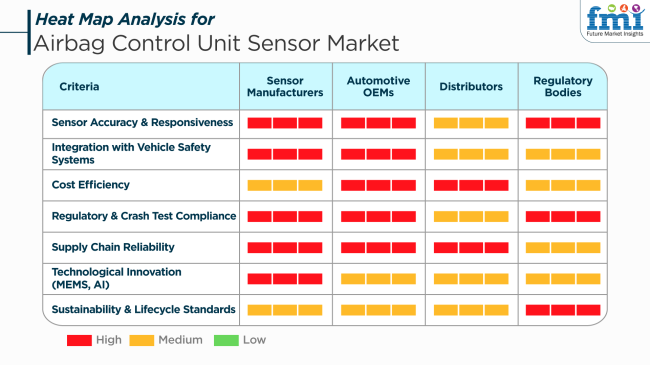

Sensor suppliers are concerned with accuracy, velocity, and reliability. Their research and development work is aimed at improving microelectromechanical systems (MEMS), integration of artificial intelligence, and system miniaturization to enhance compatibility with various vehicle platforms.

The automotive original equipment manufacturers (OEMs) are concerned with cost-effective sensors that are very responsive and fully compatible with new electronic control systems. They insist on strict compliance with international crash test standards and demand high reliability and long-term durability from their suppliers. Distributors highlight reliable logistics and product availability in international industries. They assist manufacturers and OEMs with scalable solutions for diverse vehicle segments, ranging from economy to luxury.

Between 2020 and 2024, the airbag control unit sensor market experienced steady growth, driven by increasing awareness of vehicle safety and the implementation of stringent safety regulations. With time, the usage of ACU sensors increased among vehicles, thus making occupants safer in case of accidents.

Technological advancements have also enhanced sensor accuracy and reliability, therefore enhancing the overall performance of airbag systems. The industry faced limitations during this period due to high installation rates and the need for specialized work repairs.

In the period up to 2025 to 2035, there will be a rapid transformation with changes in technology and evolving safety demands. New-generation sensor technologies, including fusion with artificial intelligence and machine learning, can potentially enhance ACU sensor predictive capability and improve airbag deployment efficiency.

Besides, the increased application of electric and autonomous vehicles will open new opportunities for the application of ACU sensors. Moreover, growth in automotive production in developing regions is expected to spur revenue growth because of access to a larger population and increased demand for vehicle safety features.

Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Sustained growth is driven by growing vehicle safety technology. | Technological innovation-driven growth in sensors and development in emerging region s. |

| Adopting safety regulations, technological innovation, and customer sensitivity. | Adopting AI and machine learning, electric and autonomous cars, and car manufacturing growth in new economies. |

| Focus on enhancing sensor reliability and precision. | Launch of high-order predictive sensors and connectivity with auto automobile networks. |

| More growth in mature economies with established automobile markets. | More growth in emerging economies, with increased access to car technology. |

| Increased safety regulations and standards. | Increased focus on front-end safety technology and coupling with green initiatives. |

| Installation of high-performing sensors with high-speed response. | Innovation of smart sensors with predictive capabilities and vehicle networking integration. |

Supply chain disruptions such as transportation delays and geopolitical tensions are significant threats. Interruptions in supply chains can inhibit the timely arrival of raw materials and components, resulting in production stoppages and unsatisfied customer demand. These disruptions negatively impact sales and long-term business relationships.

Sophisticated sensor technologies are expensive. Designing and installing complex sensors in cars can be costly, and the adoption is less likely in budget-constrained regions. This cost hurdle could curb market growth. Technological innovation and the imperative for innovation bring both opportunity and risk. Firms have to invest in research and development to innovate and enhance product offerings on a continuous basis. The inability to do so can lead to obsolescence and erosion of market share.

Relying on strategic industries like the automotive production sector implies that weakening in such areas can directly affect ACU sensor demand. Varying customer base by the type of vehicles and geography could reduce the effect of such vulnerability.

In conclusion, the airbag control unit sensor industry is at risk of regulatory pressures, supply chain disruption, exorbitant cost of technology, technology shift, and industry-specific economic recessions. Counter-measures against such issues are a necessity for driving growth and competition in this changing business.

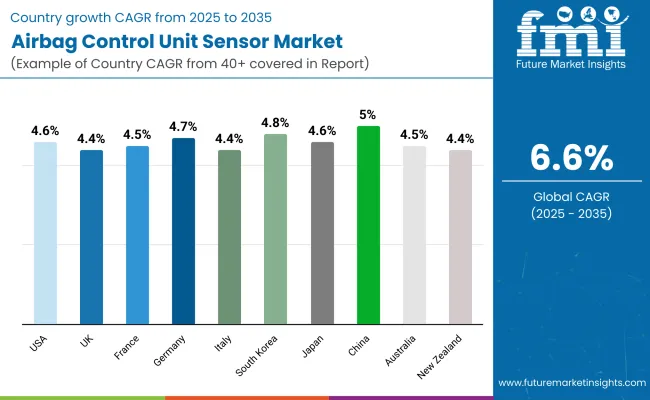

| Countries | Projected CAGR (2025 to 2035) |

|---|---|

| USA | 4.6% |

| UK | 4.4% |

| France | 4.5% |

| Germany | 4.7% |

| Italy | 4.4% |

| South Korea | 4.8% |

| Japan | 4.6% |

| China | 5.0% |

| Australia | 4.5% |

| New Zealand | 4.4% |

The USA is expected to register a CAGR of 4.6% during 2025 to 2035. ADAS uptake in rising vehicles, government focus on car safety, and the surge in EV productions are propelling the demand. Determining crash severity and deployment timing through airbag sensors is crucial in regard to passenger protection.

Major suppliers such as Continental Automotive Systems, Aptiv PLC, and Autoliv Inc. are spending money on next-generation sensors with embedded real-time data processing and inertial measurement capability. Federal Motor Vehicle Safety Standards (FMVSS) keep propelling rigorous design and compliance demands.

The UK will expand at a CAGR of 4.4%. Vehicle safety rules in line with UNECE regulations and increasing consumer demand for high-specification cars are propelling growth. Airbag sensors are increasingly being combined with ECU systems and occupant detection modules in mid and premium-segment vehicles.

Manufacturers such as Sensata Technologies and Bosch UK are creating small and multi-sensor modules that can be used for hybrid and electric drivetrains. Road safety campaigns and initiatives on smart vehicle technology initiated by the government are driving growth.

France is anticipated to record a CAGR of 4.5%. There are automotive electrification trends and EU vehicle safety standards that demand more protection systems. Airbag control unit sensors are the key focus of passive safety strategies in local and export vehicle platforms.

Large producers like Valeo and Faurecia are integrating sensor technology into more advanced occupant protection systems. The high density of car production plants in France and ongoing investment in autonomous vehicle development also further enhance the stability of the industry.

Germany is expected to develop at a CAGR of 4.7%, with leadership in premium car engineering and automotive safety technology. Airbag sensor control is now standard across nearly all vehicle classes and is transitioning to allow multi-stage deployment integrated with collision severity and occupant classification systems.

Bosch, ZF Friedrichshafen AG, and Continental AG continue to dominate high-sensitivity MEMS-based sensor design and adaptive control unit design. National investment in next-generation mobility technology and crash prevention systems enhances the industry's potential in high-performance airbag sensor manufacturing.

Italy is projected to grow at a CAGR of 4.4%. Higher production of small cars and light commercial vehicles is sustaining demand for airbag control units with integrated crash detection. The harmonization of regulations with EU safety standards for pedestrian and occupant protection also drives demand.

Makers such as MagnetiMarelli and STMicroelectronics are also at the forefront of developing smart sensor modules based on European OEM requirements. Constant collaboration with Tier 1 automaker manufacturers further strengthens Italy's role in the regional supply chain.

South Korea is estimated to grow at a CAGR of 4.8%. Domestic automakers are enhancing safety features on local and export vehicle platforms, and airbag control sensors are part of high-performance crash avoidance systems. Miniaturization and the accuracy of software calibration are emphasized.

Hyundai Mobis, Mando Corp, and LG Innotek are putting investments in high-speed sensors and artificial intelligence control units for autonomous safety systems and connected vehicles. National safety ratings and NCAP conformity across the world are impacting industry innovation.

Japan is expected to grow at a CAGR of 4.6% between 2035. High vehicle safety requirements and high urban mobility conditions still fuel demand for integrated airbag control systems. Emphasis on zero-fatality programs is influencing the wider adoption of multi-sensor occupant protection arrays.

Companies like DENSO Corporation, Hitachi Astemo, and Tokai Rika Co. Ltd. are refining crash sensor algorithms and merging sensor fusion technology in order to achieve better performance. Vehicle-to-everything (V2X) integration is being developed using government funding and providing long-term strategic growth paths.

China will lead industry growth at a CAGR of 5.0% with rising production of passenger vehicles and the adoption of stringent regulations. Electric vehicle growth and government-subsidized safety incentives are propelling the use of intelligent airbag systems.

Leading domestic players such as Zhejiang Vie Science & Technology Co., Joyson Safety Systems, and Sensata Technologies China are scaling up production capacities for intelligent airbag ECUs. Integration with telematics platforms and real-time crash diagnosis is also on the rise in urban transport networks.

Australia is forecasted to be growing at a CAGR of 4.5%. Despite the limited domestic base of automotive manufacturing, demand is increasing for aftermarkets and imported cars with enhanced airbag control systems. Demand drivers are the regulatory pressures of ANCAP safety standards and growing occupant safety awareness.

Distributors and suppliers are joining hands with global OEMs to incorporate compliant control sensors and airbag modules in passenger vehicles. Investments in national transport safety modernization offer scope for continued expansion of sales.

New Zealand will expand at a CAGR of 4.4%. Industry expansion is fueled by increased imports of high-tech vehicles with multi-airbag technology and stronger enforcement of vehicle safety regulation standards. Airbag control sensors are becoming more indispensable in used vehicle certification and fleet renewal.

Government road vehicle safety inspection policies and consumer demand for safe means of transport propel growth. Collaboration with Australasian manufacturers ensures access to innovative and standards-based airbag control technologies.

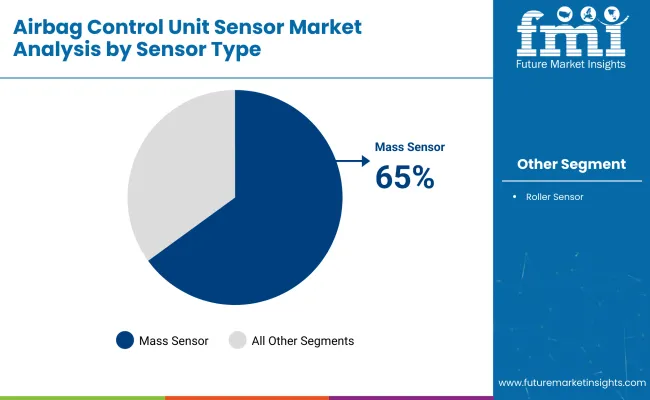

The industry is segmented into mass sensors, which will hold a 65% share by 2025, and roller sensors segment, which has 35% of the share.

The drive for mass sensors is fueled by the high responsiveness they offer as far as frontal and angular impacts are concerned, as well as their ability to be easily integrated with the safety systems of modern vehicles. They hold the central role of deploying the airbags in milliseconds to keep injury at a minimum level in the event of a collision. Leading automotive OEMs like Volkswagen, Stellantis, and Hyundai rely on these control unit powerhouses as mass sensor-based units because of their reliability and compatibility with advanced electronic control systems.

Multi-core airbag control units by Continental AG use MEMS-based mass sensors to deliver real-time crash data for accurate deployment timing. Also, Denso Corporation has developed scalable mass sensor modules that are integrated with ADAS interfaces to improve airbag accuracy and broader vehicle safety functionality.

Rolling sensors contribute to a significant part of the share, but only for small niche markets like utility vehicles, trucks, and SUVs, with the rest usually found in developing countries or retrofitted cars. They offer mechanical durability and electromagnetic interference resistance, making them ideal for use in rugged conditions. Roller sensor-based airbag modules for off-road and commercial vehicle platforms are notably manufactured by Hyundai Mobis and Tokai Rika Co., Ltd., which are highly active in showing a robust mechanical response.

Furthermore, upper-end vehicles and hybrids are starting to have hybrid airbag control systems (made up of mass and roller sensors). ZF Friedrichshafen AG and Joyson Safety Systems are also set to launch the next-generation integrated safety platforms, integrating multiple sensor inputs to handle complex crash dynamics in autonomous and electric vehicles.

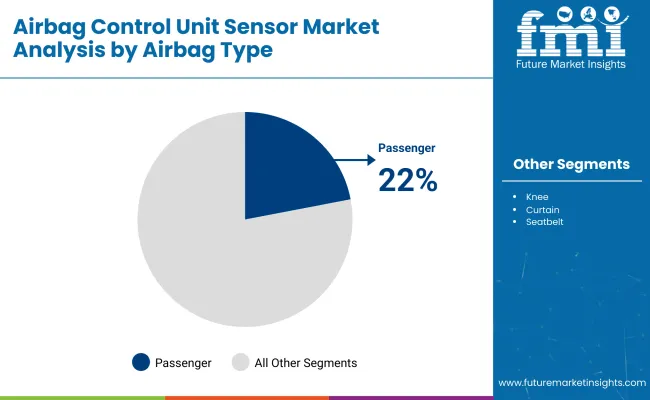

The Airbag Control Unit Sensor Market in 2025 is expected to hold a larger share from both driver and passenger airbags, with the driver airbags estimated at 22%, followed by passenger airbags at 20% of the total industry share. The higher share of driver airbags may be due to the most critical need for driver protection during frontal collisions, among the common and severe types of crash scenarios. Also, driver airbags are a global standard for almost all vehicles and thus have a considerable demand in various automotive segments.

Driver airbags are now probably the most widespread safety devices found in automobiles, as companies like Toyota, Ford, and Honda continue to develop more powerful inflator systems for use in affordable vehicles, increasing serviceability. Top manufacturers, such as Autoliv and Takata, lead the field in the high-performance provisioning of such driver airbag solutions, as their airbag modules are embedded with advanced sensors, providing reliable and rapid deployment in case of a crash.

For instance, the airbag systems offered by Takata use dual-stage inflators along with advanced sensors to ensure that inflation is controlled according to the severity of the impact, thus optimizing driver safety. While passenger airbags account for a slightly lower share, they are nevertheless an essential safety feature. Their role in protecting front-seat occupants during the crash directly creates demand from the luxury and economy car segments alike.

OEMs such as BMW, Mercedes-Benz, and Audi have invested in passenger airbag technologies that address the different needs of the passenger, such as smart airbag systems that adjust deployment according to the passenger's weight and position, as well as the severity of the crash. ZF Friedrichshafen and Joyson Safety Systems are working on passenger airbag technologies to improve protection while minimizing the risk of airbag deployment under certain crash scenarios.

As global safety regulations tighten, compounded by increasing vehicle production numbers, the driver and passenger airbag industries become profitable. Other modern technologies, especially in side airbags, curtain airbags, and knee airbags, complement the protection provided to both drivers and passengers and contribute to the growth of the entire sector.

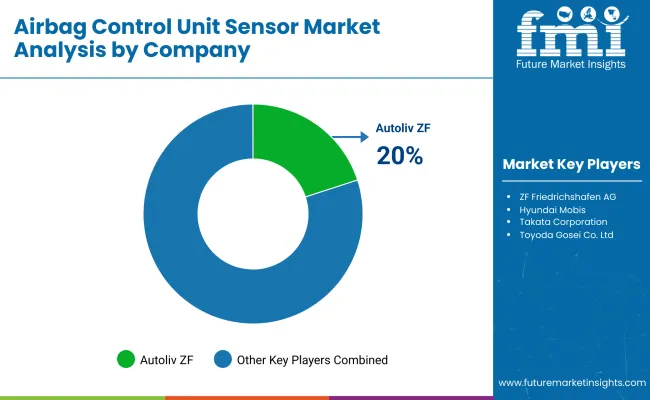

The ACU Sensor industryconsists mostly of specialized high-tech automakers that focus their competition on parameters such as sensor accuracy, sensor response time and integration with vehicle electronic systems. The major players, such as Autoliv, ZF Friedrichshafen AG, and Hyundai Mobis, are focusing on advanced technologies for crash detection that work toward occupant protection and regulatory requirements.

Innovations in crash-sensing algorithms and impact detection provide a key differentiator. Autoliv and ZF Friedrichshafen AG are currently developing AI-driven sensor technology and multi-stage airbag deployment systems. In contrast, Takata Corporation and Toyoda Gosei are combining next-generation accelerometers as well as gyroscope-based crash sensors to ensure better safety for occupants.

Strategic collaborations and partnerships with OEMs play a significant role in the growth. Hyundai Mobis and Nihon Plast Co. Ltd. have formed a strong alliance with automakers to ensure the flawless integration of ACU sensors into the latest vehicle architectures. Jinheng and Corsair Components serve regional and aftermarket needs while focusing on producing airbag sensors offering performance at a minimal cost.

The regulatory mandate for enhanced vehicle safety creates a competitive landscape for automotive vendors, compelling them to secure automotive standard certifications and spread their global footprint. With such demands, R&D-driven firms having strategic alliances with OEMs would have a stronger position in a fluctuating industrial scenario.

Market Share Analysis by Company

| Company Name | Market Share (%) |

|---|---|

| Autoliv ZF | 20-25% |

| ZF Friedrichshafen AG | 15-20% |

| Hyundai Mobis | 12-17% |

| Takata Corporation | 8-12% |

| Toyoda Gosei Co. Ltd. | 5-9% |

| Others (combined) | 30-40% |

| Company Name | Key Offerings and Activities |

|---|---|

| Autoliv ZF | Develops AI-driven crash sensing algorithms for precision airbag deployment. |

| ZF Friedrichshafen AG | Specializes in integrated safety systems and impact detection technologies. |

| Hyundai Mobis | Provides OEM-integrated ACU sensors for global automotive manufacturers. |

| Takata Corporation | Offers gyroscope-based crash detection sensors and side-impact airbag modules. |

| Toyoda Gosei Co. Ltd. | Focuses on advanced acceleration sensors for multi-stage airbag deployment. |

Key Company Insights

Autoliv ZF (20-25%)

Autoliv leads the airbag control unit sensor industry with AI-driven crash detection technologies, ensuring faster and more accurate airbag deployment.

ZF Friedrichshafen AG (15-20%)

ZF strengthens its position with integrated vehicle safety systems, leveraging sensor fusion and adaptive impact response.

Hyundai Mobis (12-17%)

Hyundai Mobis capitalizes on strong OEM partnerships, offering customized ACU sensors for automaker-specific safety applications.

Takata Corporation (8-12%)

Takata remains a key player with next-generation crash sensors, focusing on compact designs and enhanced impact detection.

Toyoda Gosei Co. Ltd. (5-9%)

Toyoda Gosei expands its industry presence with high-precision acceleration sensors, improving airbag response efficiency.

Other Key Players

The segmentation is into Mass Sensors and Roller Sensors, each providing critical input for timely airbag deployment.

The segmentation is into Driver, Passenger, Knee, Curtain, Side, Roll-over, External, Seatbelt, and Medical Airbags, addressing various safety requirements across different vehicle sections.

The segmentation is into Passenger Cars, Commercial/Light Commercial Vehicles, and Heavy Commercial Vehicles. Passenger Cars are further categorized into Compact, Mid-sized, Premium, and Luxury segments.

The report covers North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, and the Middle East & Africa.

The market is estimated to reach USD 730.0 million by 2025.

The market is projected to grow steadily, reaching USD 1,382.5 million by 2035.

China is expected to record a 5.0% CAGR, supported by its rapidly expanding automotive manufacturing sector and rising demand for advanced safety features.

The Autoliv ZF segment is currently leading due to its strong integration into modern vehicles and collaborations with major automakers.

Key players include Autoliv ZF, ZF Friedrichshafen AG, Hyundai Mobis, Takata Corporation, Toyoda Gosei Co. Ltd., Ashimor, KSS, Nihon Plast Co. Ltd., Jinheng, and Corsair Components.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Airbag Propellant Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Airbag Sensors Market

Automotive Airbags Market Size and Share Forecast Outlook 2025 to 2035

Motorcycle Airbag Jacket Market Size and Share Forecast Outlook 2025 to 2035

Automotive Airbag Market Growth - Trends & Forecast 2025 to 2035

Automotive Airbag Controller Unit Market Size and Share Forecast Outlook 2025 to 2035

USA Automotive Airbag Market Analysis – Size, Share & Forecast 2025-2035

China Automotive Airbag Market Outlook – Share, Growth & Forecast 2025-2035

Japan Automotive Airbag Market Report – Trends & Innovations 2025-2035

ASEAN Automotive Airbag Market Analysis – Size, Share & Forecast 2025-2035

Germany Automotive Airbag Market Insights – Demand, Size & Industry Trends 2025-2035

Asia Pacific Airbag Market Growth - Trends & Forecast 2025 to 2035

Controllable Shunt Reactor for UHV Market Size and Share Forecast Outlook 2025 to 2035

Control Room Solution Market Size and Share Forecast Outlook 2025 to 2035

Control Knobs for Panel Potentiometer Market Size and Share Forecast Outlook 2025 to 2035

Controlled-Release Drug Delivery Technology Market Size and Share Forecast Outlook 2025 to 2035

Controlled Environment Agriculture (CEA) Market Size and Share Forecast Outlook 2025 to 2035

Control Cable Market Size and Share Forecast Outlook 2025 to 2035

Control Towers Market Size and Share Forecast Outlook 2025 to 2035

Controlled & Slow Release Fertilizers Market 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA