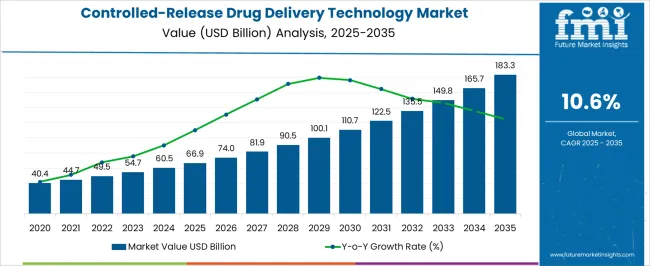

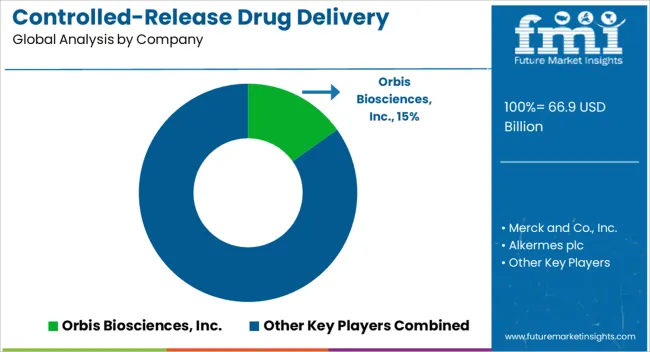

The Controlled-Release Drug Delivery Technology Market is estimated to be valued at USD 66.9 billion in 2025 and is projected to reach USD 183.3 billion by 2035, registering a compound annual growth rate (CAGR) of 10.6% over the forecast period.

| Metric | Value |

|---|---|

| Controlled-Release Drug Delivery Technology Market Estimated Value in (2025 E) | USD 66.9 billion |

| Controlled-Release Drug Delivery Technology Market Forecast Value in (2035 F) | USD 183.3 billion |

| Forecast CAGR (2025 to 2035) | 10.6% |

The Controlled-Release Drug Delivery Technology market is witnessing robust expansion as healthcare systems and pharmaceutical companies increasingly prioritize patient-centric therapies and long-term treatment adherence. The shift toward controlled-release formulations is driven by the need for precise dosing, minimized side effects, and reduced frequency of administration, particularly in the treatment of chronic conditions such as diabetes, cardiovascular disorders, and neurological diseases. Advancements in material sciences, polymer technologies, and nanotechnology are enabling more efficient drug encapsulation and release profiles, which improve therapeutic efficacy while reducing variability in patient response.

Regulatory agencies are also supporting innovation in this area, given the potential to enhance treatment outcomes and lower healthcare costs through improved compliance. Pharmaceutical companies are investing heavily in research collaborations and technology licensing to integrate controlled-release delivery systems into existing and upcoming therapies.

Additionally, the growing demand for injectable and oral controlled-release platforms across both developed and emerging markets is fueling adoption With rising emphasis on precision medicine, sustainability in production processes, and improved drug stability, the market is positioned for strong growth over the forecast period.

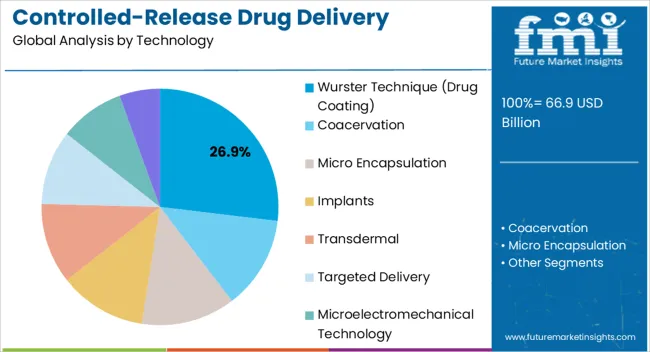

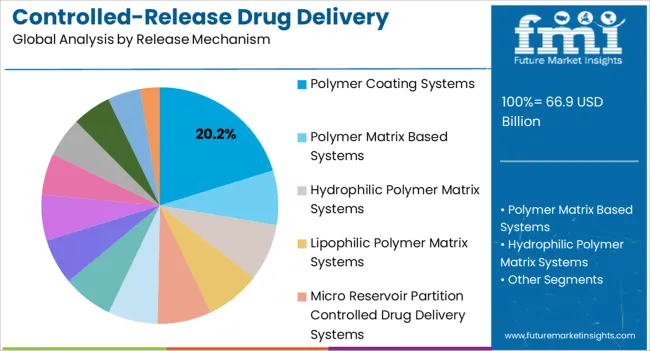

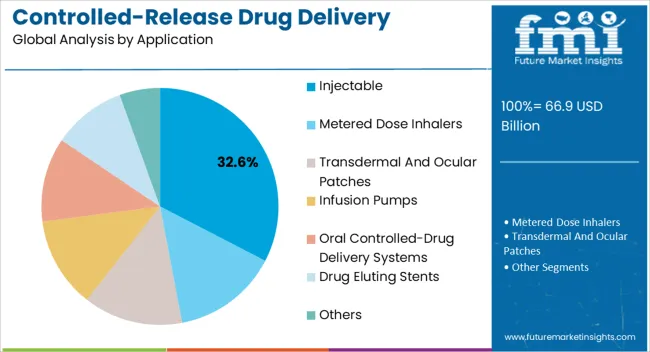

The controlled-release drug delivery technology market is segmented by technology, release mechanism, application, and geographic regions. By technology, controlled-release drug delivery technology market is divided into Wurster Technique (Drug Coating), Coacervation, Micro Encapsulation, Implants, Transdermal, Targeted Delivery, Microelectromechanical Technology, and Others (Liposomes). In terms of release mechanism, controlled-release drug delivery technology market is classified into Polymer Coating Systems, Polymer Matrix Based Systems, Hydrophilic Polymer Matrix Systems, Lipophilic Polymer Matrix Systems, Micro Reservoir Partition Controlled Drug Delivery Systems, Feedback Regulated Drug Delivery Systems, Activation-Modulated Drug Delivery Systems, Mechanically Activated, Osmotic Pressure Activated, Hydrodynamic Pressure Activate, Vapor Pressure Activated, Magnetically Activated, Chemically Activated, pH Activated, Hydrolysis Activated, and Enzyme Activated. Based on application, controlled-release drug delivery technology market is segmented into Injectable, Metered Dose Inhalers, Transdermal And Ocular Patches, Infusion Pumps, Oral Controlled-Drug Delivery Systems, Drug Eluting Stents, and Others. Regionally, the controlled-release drug delivery technology industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Wurster technique segment is projected to hold 26.9% of the controlled-release drug delivery technology market revenue in 2025, establishing it as the leading technology type. This technique has gained prominence due to its effectiveness in producing uniform coatings that control drug release over extended periods. The ability to finely tune release profiles through adjustments in coating thickness and composition has made it highly valuable in pharmaceutical applications.

By enabling precise encapsulation, the Wurster technique enhances bioavailability and minimizes dose dumping risks, improving patient outcomes and compliance. The method is also adaptable to various drug types, including sensitive compounds, which broadens its application range. Pharmaceutical manufacturers are adopting this approach to optimize production efficiency and consistency while meeting stringent regulatory requirements.

Its scalability, coupled with compatibility with both solid dosage forms and multiparticulate systems, further strengthens its market position As controlled-release therapies expand across multiple therapeutic areas, the Wurster technique is expected to remain a cornerstone technology, driven by its reliability, flexibility, and proven performance in commercial drug development.

The polymer coating systems segment is expected to account for 20.2% of the controlled-release drug delivery technology market revenue in 2025, positioning it as a leading release mechanism. Growth in this segment is being driven by the ability of polymer-based coatings to provide tailored release kinetics, stability, and protection for active pharmaceutical ingredients. Advances in biodegradable and biocompatible polymers are enhancing safety and therapeutic performance while reducing the risk of adverse effects.

Pharmaceutical companies are leveraging polymer coating systems to develop innovative oral, injectable, and implantable dosage forms that meet the growing demand for long-acting treatments. The ability to achieve sustained release through layering techniques and polymer blends ensures flexibility in addressing different therapeutic needs.

Furthermore, polymer coatings play a key role in meeting regulatory requirements for consistent performance, product stability, and patient safety As demand for chronic disease therapies and personalized medicine continues to increase, polymer coating systems are expected to maintain significant market relevance, supported by ongoing research and technological innovation in drug delivery science.

The injectable application segment is anticipated to hold 32.6% of the controlled-release drug delivery technology market revenue in 2025, making it the leading application area. Injectable controlled-release systems are being increasingly adopted for chronic disease management, oncology treatments, and hormone therapies where long-term efficacy is essential. These systems provide consistent plasma drug levels, minimize the frequency of dosing, and improve adherence compared to conventional oral formulations.

Biodegradable microspheres, implants, and in situ forming gels are being widely utilized to deliver drugs over extended durations, reducing the treatment burden on patients. Pharmaceutical companies are investing in advanced injectable formulations to expand therapeutic portfolios and extend patent lifecycles, further boosting market growth. Rising demand for biologics and biosimilars, many of which require injectable administration, is also driving adoption of controlled-release systems in this segment.

The ability to combine sustained release with targeted delivery capabilities is strengthening the role of injectables in precision medicine With increasing prevalence of lifestyle-related diseases and innovations in minimally invasive technologies, injectables are expected to sustain their dominance in the market.

Specific focus on the quality-by-design (QbD) approaches for the robust design of dosage forms is expected to change the future landscape of controlled-release drug delivery technologies. While conventional hydrophilic matrix based technologies such as Accuform are being used in the market for several years, recent advancements in the development of oral drug delivery systems such as gastro-retentive drug delivery for controlled release, buoyant systems, mucoadhesive systems for regulated release of anti-viral medications etc.

would increase the penetration of controlled-release drug delivery technologies in the global pharmaceuticals market. Acuform polymer-based patented technology is widely being used in a number of controlled-release formulations such as NUCYNTA ER, Gralise (Depomed Inc.), Janumet XR (Merck), Glumetza (Salix Pharmaceuticals) etc. Wurster coating technology is being used in the drug coating for controlled release of drug since 1976.

Corplex transdermal technology has largely been commercialized in P&G’s Crest product line. Plenty of new controlled-release technologies are in phase to be commercialized in next few years. For instance, MicroCor PTH using MicroCor transdermal technology is being evaluated in phase IIa.

OROS technology which delivers drug in controlled manneris being used in more than 17 commercially available drugs. In case of oral controlled drug delivery, elderly persons and pediatrics constitute the large proportion of consumers for controlled-release drugs due to increase adherence to dosage regime.

Some of the commercially available medications using controlled-release drug delivery technology include Prozac (polymer matrix based system), Avinza (polymer coating), Capoten (enzyme activated system), GLUCOPHAGE XR (polymer matrix based system), Alza (osmotically activated system) etc.

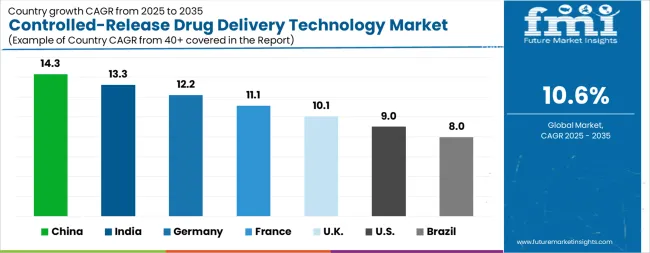

| Country | CAGR |

|---|---|

| China | 14.3% |

| India | 13.3% |

| Germany | 12.2% |

| France | 11.1% |

| UK | 10.1% |

| USA | 9.0% |

| Brazil | 8.0% |

The Controlled-Release Drug Delivery Technology Market is expected to register a CAGR of 10.6% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 14.3%, followed by India at 13.3%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 8.0%, yet still underscores a broadly positive trajectory for the global Controlled-Release Drug Delivery Technology Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 12.2%. The USA Controlled-Release Drug Delivery Technology Market is estimated to be valued at USD 23.3 billion in 2025 and is anticipated to reach a valuation of USD 55.2 billion by 2035. Sales are projected to rise at a CAGR of 9.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 3.1 billion and USD 1.9 billion respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 66.9 Billion |

| Technology | Wurster Technique (Drug Coating), Coacervation, Micro Encapsulation, Implants, Transdermal, Targeted Delivery, Microelectromechanical Technology, and Others (Liposomes) |

| Release Mechanism | Polymer Coating Systems, Polymer Matrix Based Systems, Hydrophilic Polymer Matrix Systems, Lipophilic Polymer Matrix Systems, Micro Reservoir Partition Controlled Drug Delivery Systems, Feedback Regulated Drug Delivery Systems, Activation-Modulated Drug Delivery Systems, Mechanically Activated, Osmotic Pressure Activated, Hydrodynamic Pressure Activate, Vapor Pressure Activated, Magnetically Activated, Chemically Activated, pH Activated, Hydrolysis Activated, and Enzyme Activated |

| Application | Injectable, Metered Dose Inhalers, Transdermal And Ocular Patches, Infusion Pumps, Oral Controlled-Drug Delivery Systems, Drug Eluting Stents, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Orbis Biosciences, Inc., Merck and Co., Inc., Alkermes plc, Johnson and Johnson, Coating Place, Inc., Corium International, Inc., Depomed, Inc., Pfizer, Inc, Aradigm Corporation, and Capsugel |

The global controlled-release drug delivery technology market is estimated to be valued at USD 66.9 billion in 2025.

The market size for the controlled-release drug delivery technology market is projected to reach USD 183.3 billion by 2035.

The controlled-release drug delivery technology market is expected to grow at a 10.6% CAGR between 2025 and 2035.

The key product types in controlled-release drug delivery technology market are wurster technique (drug coating), coacervation, micro encapsulation, implants, transdermal, targeted delivery, microelectromechanical technology and others (liposomes).

In terms of release mechanism, polymer coating systems segment to command 20.2% share in the controlled-release drug delivery technology market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Drug Taste Masking Technologies Market Forecast and Outlook 2025 to 2035

Drug-Gene Interaction Panels Market Size and Share Forecast Outlook 2025 to 2035

Drug Testing Systems Market Size and Share Forecast Outlook 2025 to 2035

Drug Tester Market Size and Share Forecast Outlook 2025 to 2035

Drug Device Combination Products Market Size and Share Forecast Outlook 2025 to 2035

Drug Discovery Enzymes Market Size and Share Forecast Outlook 2025 to 2035

Drug Integrated Polymer Fibers Market Size and Share Forecast Outlook 2025 to 2035

Drug Discovery Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Drug Formulation Market Analysis - Size, Growth, & Forecast Outlook 2025 to 2035

Drug-Induced Dyskinesia Market Size and Share Forecast Outlook 2025 to 2035

Drug Free Depression Treatment Market Size and Share Forecast Outlook 2025 to 2035

Drugs Glass Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Drug Designing Tools Market Growth – Trends & Forecast 2025 to 2035

Drug of Abuse Testing Market Growth – Trends & Forecast 2025-2035

Drug-Induced Immune Hemolytic Anemia Market - Demand & Forecast 2025 to 2035

Drug Discovery Services Market Insights - Trends & Growth 2025 to 2035

Drug Screening Market Overview - Trends, Demand & Forecast 2025 to 2035

Drug Eruptions Treatment Market - Innovations & Future Outlook 2025 to 2035

Drug Discovery Informatics Market Trends - Growth & Future Outlook 2025 to 2035

Drug Testing Equipment Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA