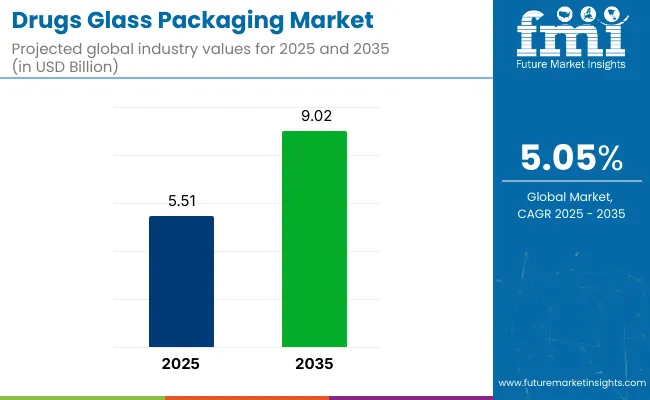

The global drugs glass packaging market will witness a steady rise, reaching nearly USD 9.02 billion by 2035, up from USD 5.51 billion in 2025. This growth, paced at a CAGR of 5.05%, is being fueled by pharmaceutical sector reliance on chemically inert and durable materials for injectable drug safety. With cartridges projected to account for 35% of all units and injection applications commanding half the market by 2025, the industry is leaning heavily on glass to meet evolving standards in biologics and vaccine delivery.

Glass packaging continues to be preferred due to its chemical stability, inert nature, and superior protection against contamination, all of which are crucial for preserving the integrity of sensitive drugs. The expanding biopharmaceuticals sector, coupled with the rising demand for vaccines, will further fuel the adoption of glass packaging in the pharmaceutical industry.

The demand for glass packaging solutions is driven by the increasing need for sustainable and safe drug delivery systems. Growing concerns about plastic pollution and environmental impact are encouraging the shift toward glass packaging, a biodegradable and recyclable alternative. Additionally, regulatory compliance and global health initiatives are anticipated to further drive the demand for high-quality, secure packaging solutions for vaccines and injectables.

“We see an opportunity for the industry to improve drug filling quality and performance capabilities by transitioning to Corning’s coated vial technology,” said Olivier Rousseau, CEO of SGD Pharma. This statement underscores the growing trend of adopting next-generation glass vials, focusing on improving drug delivery precision and manufacturing efficiency. As the industry continues to evolve, sustainability and regulatory compliance will play pivotal roles in shaping the future of drug glass packaging, contributing to the industry's steady growth through 2035.

The industry is projected to grow with significant investments in cartridges, injection applications, and borosilicate glass, driven by the increasing demand for safe and efficient pharmaceutical packaging solutions.

Cartridges are expected to account for 35% of the share in 2025. Their use in secure drug delivery systems for injectable medications is crucial, especially in managing chronic diseases.

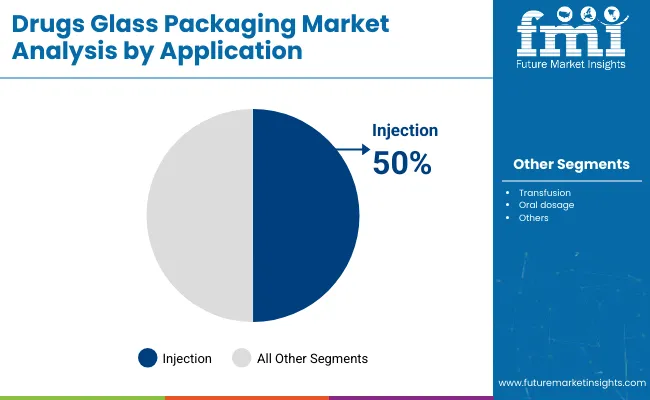

Injection applications are projected to account for 50% of the industry share in 2025. Glass containers, including vials, ampoules, and pre-filled syringes, are preferred for injectable pharmaceuticals due to their resistance to chemical reactions and ability to preserve the integrity of sensitive formulations.

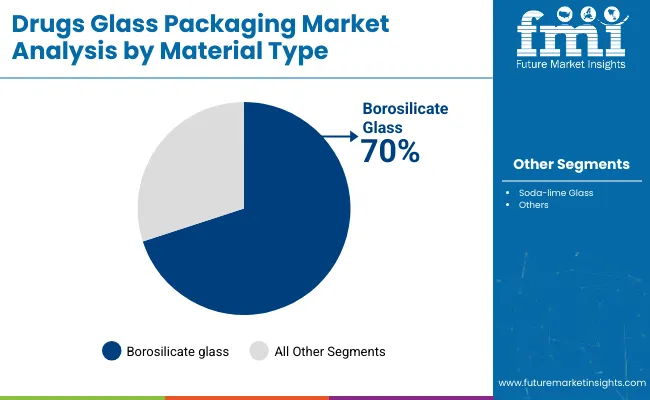

Borosilicate glass is anticipated to hold 70% of the industry share by 2025, due to its unique properties such as high resistance to thermal shock, chemical durability, and non-reactivity with drugs. This makes borosilicate glass ideal for packaging sensitive medications, particularly biologics and injectables.

The industry is driven by rising demand for injectable medicines and biologic treatments. However, regulatory challenges and cost pressures are limiting industry growth and accessibility.

Increasing demand for injectable medicines is driving industry growth

The demand for injectable medicines is being significantly boosted by the rising prevalence of chronic diseases and the growing need for biologic treatments. Glass packaging, known for its chemical resistance and ability to maintain drug stability, is being increasingly preferred for packaging injectables.

Pharmaceutical companies are increasingly seeking reliable and safe packaging solutions to ensure the efficacy and safety of injectable drugs. This trend is driving the growth of the industry, as injectable drugs require packaging materials that provide durability and protect from external contamination.

Regulatory challenges and cost pressures are limiting industry expansion

The industry is being faced with challenges related to stringent regulatory requirements and cost pressures. Compliance with regulations governing the safety and quality of pharmaceutical packaging requires continuous investment in quality control and certification processes.

Additionally, the high cost of raw materials and manufacturing processes is impacting the affordability of glass packaging solutions. These factors are limiting the accessibility of glass packaging, particularly for small and medium-sized pharmaceutical manufacturers, and may hinder broader industry expansion. Overcoming these challenges is essential for supporting long-term industry growth.

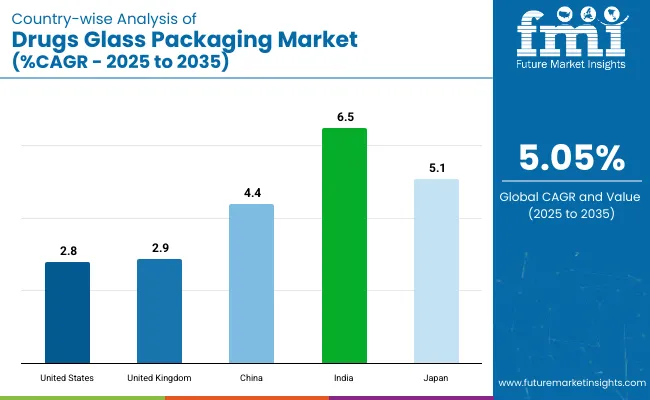

The industry is expected to experience steady growth through 2035. This growth is driven by rising demand for durable and safe pharmaceutical packaging solutions. Industrialization in China and India is contributing significantly to industry growth, while innovation in packaging materials and sustainability is being emphasized in mature industries such as the United States and the United Kingdom.

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 2.8% |

| United Kingdom | 2.9% |

| China | 4.4% |

| India | 6.5% |

| Japan | 5.1% |

The United States industry is expected to grow at a CAGR of 2.8% through 2035. Growth is supported by rising demand for tamper-proof, durable packaging solutions that maintain the integrity of pharmaceuticals.

The United Kingdom industry is projected to grow at a CAGR of 2.9% through 2035. This growth is driven by the increasing need for high-quality packaging solutions in the pharmaceutical sector and the growing demand for eco-friendly alternatives.

The industry is expected to grow at a CAGR of 4.4% through 2035. Rapid industrialization and rising pharmaceutical production are driving the demand for packaging solutions that ensure drug safety.

The industry is expected to grow at a CAGR of 6.5% through 2035. Growth is being driven by the expanding pharmaceutical industry and the increasing production of generic drugs.

The industry is projected to grow at a CAGR of 5.1% through 2035. Growth is supported by the country’s advanced pharmaceutical sector, which focuses heavily on drug safety and packaging quality.

The global industry is characterized by a diverse range of suppliers. Key players like Schott AG and Gerresheimer AG hold dominant positions due to their extensive product portfolios, technological advancements, and strong global presence in the pharmaceutical, biotechnology, and healthcare sectors.

Other prominent players, such as Corning Incorporated and Stevanato Group, cater to specialized industries, offering durable and innovative packaging solutions for sensitive drug formulations. Emerging companies like Nipro Corporation and PGP Glass target regional industries with cost-effective and niche product offerings.

Recent Drugs Glass Packaging Industry News

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 5.51 billion |

| Projected Market Size (2035) | USD 9.02 billion |

| CAGR (2025 to 2035) | 5.05% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value, million for units sold |

| Types Analyzed (Segment 1) | Cartridges; Vials; Ampoules; Syringes |

| Applications Covered (Segment 2) | Injection, Transfusion, Oral dosage forms |

| Materials Covered (Segment 3) | Borosilicate glass; Soda-lime glass |

| Regions Covered | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Countries Covered | United States; Canada, United Kingdom; Germany; France; Italy; Spain; Netherlands, China; India; Japan; South Korea; Australia, Brazil; Mexico; Argentina, Saudi Arabia; UAE; South Africa; Egypt; Turkey |

| Key Players Influencing the Industry | SCHOTT AG; Gerresheimer AG; NIPRO CORPORATION; SGD Pharma; West Pharmaceutical Services Inc.; PGP Glass; Ajanta Bottle Pvt. Ltd.; Becton, Dickinson and Company; Amcor; Berry Global; Borosil |

| Additional Attributes | Dollar sales by product type (cartridges, vials, ampoules, syringes); Regional trends in glass packaging for pharmaceuticals; Adoption of borosilicate glass vs soda-lime glass; Technological innovations in pharmaceutical packaging |

The industry is segmented into cartridges, vials, ampoules, and syringes.

The industry includes injection, transfusion, and oral dosage forms.

The industry covers borosilicate glass and soda-lime glass.

The industry spans North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

The industry is expected to reach USD 9.02 billion by 2035.

The industry size is projected to be USD 5.51 billion in 2025.

The industry is expected to grow at a CAGR of 5.05%.

Key suppliers include SCHOTT AG, Gerresheimer AG, NIPRO CORPORATION, SGD Pharma, West Pharmaceutical Services Inc., PGP Glass, Ajanta Bottle Pvt. Ltd., Becton, Dickinson and Company, Amcor, Berry Global, and Borosil.

Growth is driven by the increasing demand for drugs packaging, safety, and product integrity in the healthcare industry.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Orphan Drugs Market Size and Share Forecast Outlook 2025 to 2035

Retinal Drugs And Biologics Market

Topical Drugs Packaging Market Growth & Forecast 2025 to 2035

Antiviral Drugs Market Size and Share Forecast Outlook 2025 to 2035

Cytotoxic Drugs Market Analysis – Growth, Trends & Forecast 2025-2035

3D Printed Drugs Market Outlook – Growth, Demand & Forecast 2025-2035

Depression Drugs Market

Parenteral Drugs Packaging Market

Brain Tumor Drugs Market Forecast & Analysis: 2025 to 2035

Infertility Drugs Market Analysis - Size, Share & Forecast 2025 to 2035

Expectorant Drugs Market Trend Analysis Based on Drug, Dosage Form, Product, Distribution Channel, and Region 2025 to 2035

Cannabinoid Drugs Market

Clot Busting Drugs Market Size and Share Forecast Outlook 2025 to 2035

Psychotropic Drugs Market Growth - Industry Trends & Outlook 2025 to 2035

Critical Care Drugs Market Analysis – Trends, Demand & Forecast 2024-2034

Anti-Malarial drugs Market

Antimetabolite Drugs Market Size and Share Forecast Outlook 2025 to 2035

Fish-Oil Based Drugs Market Analysis – Trends, Share & Growth Forecast 2024-2034

Plasma-Derived Drugs Market

Antithrombotic Drugs Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA