The brain tumor drugs market is valued at USD 3.15 billion in 2025. As per FMI’s analysis, the brain tumor drugs market will grow at a CAGR of 9.2% and reach USD 7.50 billion by 2035. Cancer continues to be a prevalent public health issue and the second most common cause of death in the United States. The growing geriatric population, combined with the development of aggressive brain tumor subtypes, is expected to propel the growth of brain tumor therapeutics.

In 2024, the industry for brain tumor drugs saw considerable development, led by advances in targeted therapeutics and increasing interest in precision medicine. Drugmakers redoubled efforts to develop new drug formulations that target cancer cells selectively while leaving healthy tissue intact, diminishing the side effects of conventional therapies. The increased application of immunotherapy and combination therapies further transformed the industry, providing more effective regimens of treatment for aggressive and recurrent tumors.

As the industry enters 2025, innovation will speed up, driven by increased incorporation of biomarker-guided therapies and AI-assisted diagnostic equipment. The growing prevalence of brain tumors, especially in aging populations and those exposed to environmental risk factors, is fueling demand for more targeted treatment options. With continued clinical studies and greater investment in oncology, the industry is well set for long-term growth, opening up new avenues for patient-specific, high-effectiveness treatments.

| Metric | Value |

|---|---|

| Industry Value (2025E) | USD 3.15 billion |

| Industry Value (2035F) | USD 7.50 billion |

| CAGR (2025 to 2035) | 9.2% |

The brain tumor drug sector is well on its way to a robust growth curve, fueled by the development of targeted therapies and increased early-stage diagnoses. Growing incidence among older populations and enhanced screening technologies are fueling demand for targeted treatments, such as immunotherapy and biomarker-directed drugs. Innovative pharmaceutical companies spearheading personalized medicine can win, while standard chemotherapy regimens are threatened with obsolescence in a changing therapeutic environment.

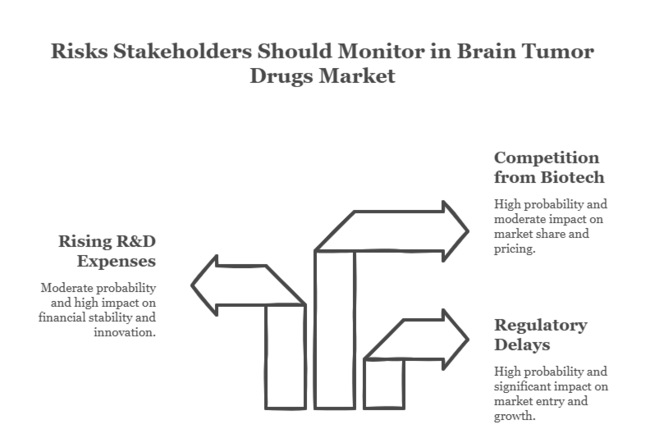

| Risk | Probability & Impact |

|---|---|

| Regulatory Delays and Compliance Issues -Stricter regulatory environments and delayed approval times can slow time-to-market, impacting top-line growth and competitive advantage | High Probability - Significant Impact |

| Rising R&D Expenses and Uncertain Returns -Growing expenses of clinical trials and the inherent risk of new drug development may push finances to their limits and hamper innovation. | Moderate Probability - High Impact |

| Amplified Competition from Upcoming Biotech Game-Changers - The fast rate of innovation in the smaller biotech companies can result in groundbreaking treatments that disrupt traditional players, exerting pressure on industry share and pricing strategies. | High Probability - Moderate Impact |

| Priority | Immediate Action |

|---|---|

| Expand Investment in Immunotherapies | Emphasize R&D in targeted therapies and immunotherapies; begin collaborations with biotech companies to accelerate drug development. |

| Integrate AI-Driven Diagnostics | Partner with technology companies to incorporate AI in early detection of brain tumors ; initiate pilot programs at major oncology centers. |

| Strengthen Global Distribution Channels | Increase distribution networks and obtain alliances with new healthcare sectors; evaluate regulatory needs for segment entry. |

To stay ahead, companies need to invest strategically in next-generation brain tumor medicines, emphasizing targeted therapies and immunotherapies, while hastening the adoption of AI-based diagnostics. This will not only keep pace with increasing demand for personalized medication but also facilitate faster time-to-market through partnerships and regulatory alignment.

Through reinforcing distribution channels and access to emerging sectors, firms can expand globally. Finally, this intelligence calls for a definitive road map focusing on innovation, regulatory flexibility, and global expansion to seize the fast-expanding opportunity in the brain tumor drugs industry.

The demand for conventional drugs like Temozolomide, Carmustine, and Cisplatin continues because of their effectiveness against many types of brain tumors. But the growing use of targeted therapies like Bevacizumab, Gefitinib, and Erlotinib will drive growth in this industry segment. These new drugs are becoming important players as they have the potential to target cancer cells specifically, making them more effective and personalized forms of treatment.

With the focus moving towards precision medicine, the drug class segment will keep changing, offering more targeted and less toxic drugs, which are anticipated to pick up considerable momentum during the forecast period. FMI forecasts that the drug class segment will grow at a CAGR of 8.5% from 2025 to 2035.

Targeted therapy will experience the most growth in this category, fueled by breakthroughs in molecular and genetic studies. These targeted therapies, which target specific genetic mutations or molecular targets, are offering more effective treatments with fewer side effects than conventional chemotherapy. Chemotherapy will continue to be a significant treatment option, especially for aggressive brain tumors, but its growth will be moderated as immunotherapy makes inroads.

Immunotherapy is becoming a promising cure for tumors that prove hard to treat with conventional drugs. The technique provokes the body's own immune system into attacking and killing tumor cells, bringing hope for patients who had few choices of treatment. FMI forecasts that the therapy segment will grow at a CAGR of 9.5% from 2025 to 2035.

Glioblastoma is still one of the most difficult and malignant forms of brain tumor, and its treatment will continue to fuel demand for successful therapies. Meningioma, more commonly a benign tumor, has been experiencing increasing numbers due to improved detection and better imaging capabilities, though in general it still has a good prognosis. Pituitary tumors, while less common, are also likely to make a considerable contribution to industry growth as treatment becomes better.

The expansion here will be driven significantly by continued research into the molecular biology of these tumors and the creation of increasingly effective and targeted therapies that are specifically designed to each indication. FMI forecasts that the indication segment will grow at a CAGR of 9.0% from 2025 to 2035.

Hospital pharmacies remain the predominant distribution channel for brain tumor medications due to their involvement in delivering sophisticated treatments and specialized care. Retail pharmacies and online pharmacies, however, are increasing industry share as patients more and more want convenience and accessibility to drugs. Online pharmacies are specifically poised to experience a precipitous increase in usage due to the expanding movement of e-commerce and digital health platforms.

As personalized medicines increase, efficient distribution through a range of channels will become more important. FMI forecasts that the distribution channel segment will grow at a CAGR of 8.7% from 2025 to 2035.

The USA is a key player in the brain tumor medicines industry, due to advanced research, established health infrastructure, and high rates of adoption of newer therapies. The nation is the leader in terms of new drug development and approvals, with investments in immunotherapies and targeted therapies at a high scale. The rise in brain tumors, along with an aging population, is stimulating demand for innovative treatments.

Moreover, high levels of healthcare expenditure and government efforts to fuel research and innovation are the main drivers of industry growth. The industry will continue to grow at a fast rate, with strong support for new drug approval and incorporation into clinical practice. FMI opines that CAGR of the USA is projected at 9.4% from 2025 to 2035.

India is experiencing fast growth in the industry for brain tumor drugs, mainly because of a huge population base and increasing awareness of neurological disorders. With improved healthcare infrastructure and growing access to advanced treatment facilities, the segment is growing, particularly in urban areas.

The increasing incidence of brain tumors, owing to lifestyle changes, environmental exposure, and improved diagnosis, is driving demand. Also, the nation's affordable drug prices and government healthcare programs are expected to make treatments more affordable. FMI forecasts that India's CAGR is projected to be 8.8% from 2025 to 2035.

China's brain tumor drugs segment is witnessing rapid growth owing to the country's huge population and soaring incidence of brain tumor cases. Expansion of healthcare services and growing access to sophisticated medical technology have resulted in improved diagnosis and treatment. China is putting more emphasis on oncology research and development, and the government is providing incentives to enhance innovation in cancer therapies.

With a definite thrust towards healthcare reforms, the Chinese industry would be growing at a healthy rate, especially with healthcare expenditures increasing in the future.FMI opines that CAGR of China is projected at 9.1% from 2025 to 2035.

The UK brain tumor medicines industry is poised to register consistent growth on account of a robust healthcare system and greater government expenditure in cancer research. Growth in awareness regarding brain tumors, advanced diagnostic technologies, and augmented demand for tailored therapies is propelling the sector.

The NHS has been instrumental in enhancing access of patients to innovative therapies such as immunotherapy and targeted medications. The industry will be helped by sustained emphasis on precision medicine and growing acceptance of complex treatment protocols in both private and public health facilities. FMI forecasts that CAGR of the UK is projected at 9.0% from 2025 to 2035.

Germany's established healthcare network and medical research leadership make it a prime force in the industry for brain tumor drugs. As there is a high degree of awareness about conditions related to brain tumors and with an aging population, demand is rising for innovative therapies. Germany's robust pharma industry, supported by top-of-the-line research centers, is actively formulating new treatments, such as immunotherapy and targeted drugs.

Being a center for drug innovation and clinical trials, Germany's industry is anticipated to rise steadily, with much emphasis on customized medicine and state-of-the-art diagnostics. FMI projects that CAGR of Germany is projected at 9.3% from 2025 to 2035.

South Korea's brain tumor pharmaceuticals industry will witness strong growth, fueled by its sophisticated healthcare infrastructure and high rate of medical technology adoption. With a growing prevalence of neurological conditions and brain tumors, demand for advanced treatments is on the rise. South Korea has also improved in the area of biotechnology, which has resulted in the creation of innovative therapies, such as targeted therapy and immunotherapy.

As the healthcare sector continues to grow with an emphasis on customized care, the pharmaceutical industry will be looking to take advantage of increasing demand. FMI opines that the CAGR of South Korea is projected at 9.0% from 2025 to 2035.

Japan's brain tumor drugs industry is dominated by excellent medical research infrastructure and high quality healthcare delivery. The rising incidence of brain tumors, along with Japan's elderly population, is fueling demand for sophisticated treatments. Japan boasts a well-developed biotechnology industry, and Japanese pharma players are leaders in developing new therapies for brain tumors.

The industry in Japan is favored by a very encouraging regulatory framework that allows for faster approval of novel treatments. With the emphasis on precision medicine and immunotherapies, the industry is likely to experience consistent growth in the forecast period. FMI forecasts that CAGR of Japan is projected at 9.2% from 2025 to 2035.

France's industry for brain tumor medications is on a gradual yet consistent growth path, fueled by a growing awareness of brain tumor diseases and improvements in medical technologies. With its well-developed healthcare infrastructure and high level of government support for cancer research, the sector is poised to maintain its upward growth path.

Increasing demand for targeted therapies and immunotherapies is observed as personalized medicine gains popularity in clinical practice. French drug firms are concentrating more on finding innovative treatments, and the growth of the healthcare industry is ensuring that treatments are available. FMI projects that CAGR of France is projected at 8.9% from 2025 to 2035.

The Italian brain tumor pharmaceuticals sector is anticipated to expand steadily, driven by rising brain tumor diagnoses and the increasing need for advanced treatment. Italy's well-developed healthcare system and robust pharmaceutical industry are at the heart of the sector growth, with specific emphasis on targeted and immunotherapies.

Government spending on cancer research and efforts to enhance access to innovative treatments are driving industry growth. Growing cases of neurological disease, especially within the elderly segment, are also likely to contribute to further increasing demand for good therapies. FMI forecasts that CAGR of Italy is projected at 8.7% from 2025 to 2035.

Australia and New Zealand are both experiencing steady growth in the industry for brain tumor drugs, stimulated primarily by the aging population and increased awareness of neurological diseases. The region has well-developed healthcare systems providing patients with access to advanced medicine treatments and therapy. Australia specifically is committed to integrating personalized medicine and immunotherapy into treatment, with a particular focus on enhanced patient outcomes.

As medical expenses rise and diagnostic equipment becomes better, demand for sophisticated brain tumor medicines will rise further. FMI opines that CAGR of Australia-New Zealand is projected at 8.8% from 2025 to 2035.

| Countries | Regulatory and Policy Impact |

|---|---|

| US | FDA oversees approvals for brain tumor medication. State-level regulations such as Proposition 65 affect drug manufacture. |

| India | Indian FDA oversees approvals but has more availability of generics. New drug approval is sluggish. |

| China | NMPA oversees approvals. Policies favor local manufacture, which affects foreign drug entries. |

| UK | EMA guidelines for approvals, with NHS regulations affecting access and price. |

| Germany | BfArM oversees approvals. Stringent following of EU regulations for new drugs. |

| South Korea | MFDS oversees approvals. Policies are centered on drug affordability, particularly for biologics. |

| Japan | PMDA manages approvals. Control of prices and national health programs affect access to treatments. |

| France | ANSM manages approvals with a priority on patient protection. Delay in approval for novel treatments. |

| Italy | AIFA manages approvals with a priority on cost-saving and long approval for new treatment. |

| Australia-New Zealand | TGA and Medsafe manage approvals for safety and cost-effectiveness of drug access. |

The brain tumor drugs industry has a diversified competitive scenario with many biotech and pharmaceutical firms industriously involved in developing and marketing drugs. Leading firms are turning to competitive pricing strategies to increase the affordability of treatments for patients while maintaining profitability. They are also spending heavily on research and development to launch new therapies, such as targeted therapies and immunotherapies, which are essential in treating various brain tumors.

In recent breakthroughs, Merck & Co. took a major step by acquiring Modifi Biosciences in October 2024 for as much as USD 1.3 billion. The acquisition provides Merck with access to promising experimental cancer treatments, including those against brain cancers, like glioblastomas.

The other significant acquisition took place in September 2024 when Stryker Corporation bought NICO Corporation. This action strengthens Stryker's portfolio of minimally invasive neurosurgical solutions for the treatment of brain tumors. Moreover, Bristol-Myers Squibb finalized the acquisition of Karuna Therapeutics in March 2024 for USD 14 billion and introduced KarXT, an antipsychotic medication, to their portfolio, strengthening their capabilities in neuroscience.

Roche dominates the brain cancer therapeutics market with a commanding share of 25-30%, driven largely by its blockbuster anti-angiogenic drug Avastin, a key treatment for glioblastoma. The company’s established leadership in oncology translates strongly into the central nervous system (CNS) malignancy space.

Merck & Co. holds approximately 18-22% of the market, leading the immuno-oncology segment with its PD-1 inhibitor Keytruda, which is increasingly used in treating CNS malignancies. Merck’s strong clinical pipeline and first-mover advantage in immunotherapy have reinforced its position in this high-growth sector.

Bristol-Myers Squibb captures around 12-15% of the market, playing a pivotal role with Opdivo in the treatment of recurrent glioblastoma. The company’s expertise in checkpoint inhibitors and its expanding neuro-oncology portfolio position it as a major competitor in the brain cancer therapeutics space.

Novartis commands about 10-12% market share, focusing primarily on BRAF/MEK inhibitors targeting rare brain tumor subtypes. Its specialized precision medicine approach differentiates Novartis in niche but critical segments of the brain cancer market.

Pfizer holds an 8-10% share, specializing in ALK and ROS1 inhibitors for treating brain metastases. Its targeted therapies offer solutions for patients with metastatic spread to the brain, expanding Pfizer’s reach beyond traditional oncology into neuro-oncology.

Amgen accounts for approximately 5-7% of the market, with a growing presence built around bispecific antibodies in its neuro-oncology pipeline. The company’s innovative biologic approaches are beginning to shape new therapeutic possibilities for brain tumor treatment.

The market is shifting towards novel therapies such as targeted therapies and immunotherapies, with huge progress in precision medicine.

Firms are committing to research and development, growing their portfolios, and entering into strategic collaborations to address increasing patient needs.

Firms are required to meet stringent approval guidelines and procedures, with a greater focus on patient safety and treatment efficacy.

Artificial intelligence and precision medicine use are enhancing the accuracy of treatment and patient outcomes in the brain tumor therapy field.

Mergers and acquisitions are assisting firms in broadening their therapeutic portfolios, increasing R&D strengths, and enhancing their industry positions.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Therapy, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by Indication , 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by Therapy, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Indication , 2018 to 2033

Table 10: North America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Therapy, 2018 to 2033

Table 14: Latin America Market Value (US$ Million) Forecast by Indication , 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 16: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 17: Europe Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 18: Europe Market Value (US$ Million) Forecast by Therapy, 2018 to 2033

Table 19: Europe Market Value (US$ Million) Forecast by Indication , 2018 to 2033

Table 20: Europe Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 21: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: South Asia Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 23: South Asia Market Value (US$ Million) Forecast by Therapy, 2018 to 2033

Table 24: South Asia Market Value (US$ Million) Forecast by Indication , 2018 to 2033

Table 25: South Asia Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 26: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 27: East Asia Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 28: East Asia Market Value (US$ Million) Forecast by Therapy, 2018 to 2033

Table 29: East Asia Market Value (US$ Million) Forecast by Indication , 2018 to 2033

Table 30: East Asia Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 31: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Oceania Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 33: Oceania Market Value (US$ Million) Forecast by Therapy, 2018 to 2033

Table 34: Oceania Market Value (US$ Million) Forecast by Indication , 2018 to 2033

Table 35: Oceania Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 36: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 37: MEA Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 38: MEA Market Value (US$ Million) Forecast by Therapy, 2018 to 2033

Table 39: MEA Market Value (US$ Million) Forecast by Indication , 2018 to 2033

Table 40: MEA Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Therapy, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Indication , 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Therapy, 2018 to 2033

Figure 13: Global Market Value Share (%) and BPS Analysis by Therapy, 2023 to 2033

Figure 14: Global Market Y-o-Y Growth (%) Projections by Therapy, 2023 to 2033

Figure 15: Global Market Value (US$ Million) Analysis by Indication , 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Indication , 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Indication , 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 21: Global Market Attractiveness by Drug Class, 2023 to 2033

Figure 22: Global Market Attractiveness by Therapy, 2023 to 2033

Figure 23: Global Market Attractiveness by Indication , 2023 to 2033

Figure 24: Global Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 25: Global Market Attractiveness by Region, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Therapy, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Indication , 2023 to 2033

Figure 29: North America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 30: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Therapy, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Therapy, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Therapy, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Indication , 2018 to 2033

Figure 41: North America Market Value Share (%) and BPS Analysis by Indication , 2023 to 2033

Figure 42: North America Market Y-o-Y Growth (%) Projections by Indication , 2023 to 2033

Figure 43: North America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 44: North America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 45: North America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 46: North America Market Attractiveness by Drug Class, 2023 to 2033

Figure 47: North America Market Attractiveness by Therapy, 2023 to 2033

Figure 48: North America Market Attractiveness by Indication , 2023 to 2033

Figure 49: North America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 50: North America Market Attractiveness by Country, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Therapy, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) by Indication , 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 55: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 56: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 57: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 58: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 59: Latin America Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 60: Latin America Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 61: Latin America Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) Analysis by Therapy, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Therapy, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Therapy, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Indication , 2018 to 2033

Figure 66: Latin America Market Value Share (%) and BPS Analysis by Indication , 2023 to 2033

Figure 67: Latin America Market Y-o-Y Growth (%) Projections by Indication , 2023 to 2033

Figure 68: Latin America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 69: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 70: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Drug Class, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Therapy, 2023 to 2033

Figure 73: Latin America Market Attractiveness by Indication , 2023 to 2033

Figure 74: Latin America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 75: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 76: Europe Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 77: Europe Market Value (US$ Million) by Therapy, 2023 to 2033

Figure 78: Europe Market Value (US$ Million) by Indication , 2023 to 2033

Figure 79: Europe Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 80: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 81: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 82: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 83: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 84: Europe Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 85: Europe Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 86: Europe Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 87: Europe Market Value (US$ Million) Analysis by Therapy, 2018 to 2033

Figure 88: Europe Market Value Share (%) and BPS Analysis by Therapy, 2023 to 2033

Figure 89: Europe Market Y-o-Y Growth (%) Projections by Therapy, 2023 to 2033

Figure 90: Europe Market Value (US$ Million) Analysis by Indication , 2018 to 2033

Figure 91: Europe Market Value Share (%) and BPS Analysis by Indication , 2023 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections by Indication , 2023 to 2033

Figure 93: Europe Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 94: Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 95: Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 96: Europe Market Attractiveness by Drug Class, 2023 to 2033

Figure 97: Europe Market Attractiveness by Therapy, 2023 to 2033

Figure 98: Europe Market Attractiveness by Indication , 2023 to 2033

Figure 99: Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 100: Europe Market Attractiveness by Country, 2023 to 2033

Figure 101: South Asia Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 102: South Asia Market Value (US$ Million) by Therapy, 2023 to 2033

Figure 103: South Asia Market Value (US$ Million) by Indication , 2023 to 2033

Figure 104: South Asia Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 105: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 106: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 107: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 108: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 109: South Asia Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 110: South Asia Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 111: South Asia Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 112: South Asia Market Value (US$ Million) Analysis by Therapy, 2018 to 2033

Figure 113: South Asia Market Value Share (%) and BPS Analysis by Therapy, 2023 to 2033

Figure 114: South Asia Market Y-o-Y Growth (%) Projections by Therapy, 2023 to 2033

Figure 115: South Asia Market Value (US$ Million) Analysis by Indication , 2018 to 2033

Figure 116: South Asia Market Value Share (%) and BPS Analysis by Indication , 2023 to 2033

Figure 117: South Asia Market Y-o-Y Growth (%) Projections by Indication , 2023 to 2033

Figure 118: South Asia Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 119: South Asia Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 120: South Asia Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 121: South Asia Market Attractiveness by Drug Class, 2023 to 2033

Figure 122: South Asia Market Attractiveness by Therapy, 2023 to 2033

Figure 123: South Asia Market Attractiveness by Indication , 2023 to 2033

Figure 124: South Asia Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 125: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 126: East Asia Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 127: East Asia Market Value (US$ Million) by Therapy, 2023 to 2033

Figure 128: East Asia Market Value (US$ Million) by Indication , 2023 to 2033

Figure 129: East Asia Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 130: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 131: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 132: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: East Asia Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 135: East Asia Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 136: East Asia Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 137: East Asia Market Value (US$ Million) Analysis by Therapy, 2018 to 2033

Figure 138: East Asia Market Value Share (%) and BPS Analysis by Therapy, 2023 to 2033

Figure 139: East Asia Market Y-o-Y Growth (%) Projections by Therapy, 2023 to 2033

Figure 140: East Asia Market Value (US$ Million) Analysis by Indication , 2018 to 2033

Figure 141: East Asia Market Value Share (%) and BPS Analysis by Indication , 2023 to 2033

Figure 142: East Asia Market Y-o-Y Growth (%) Projections by Indication , 2023 to 2033

Figure 143: East Asia Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 144: East Asia Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 145: East Asia Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 146: East Asia Market Attractiveness by Drug Class, 2023 to 2033

Figure 147: East Asia Market Attractiveness by Therapy, 2023 to 2033

Figure 148: East Asia Market Attractiveness by Indication , 2023 to 2033

Figure 149: East Asia Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 150: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 151: Oceania Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 152: Oceania Market Value (US$ Million) by Therapy, 2023 to 2033

Figure 153: Oceania Market Value (US$ Million) by Indication , 2023 to 2033

Figure 154: Oceania Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 155: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 158: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 159: Oceania Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 160: Oceania Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 161: Oceania Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 162: Oceania Market Value (US$ Million) Analysis by Therapy, 2018 to 2033

Figure 163: Oceania Market Value Share (%) and BPS Analysis by Therapy, 2023 to 2033

Figure 164: Oceania Market Y-o-Y Growth (%) Projections by Therapy, 2023 to 2033

Figure 165: Oceania Market Value (US$ Million) Analysis by Indication , 2018 to 2033

Figure 166: Oceania Market Value Share (%) and BPS Analysis by Indication , 2023 to 2033

Figure 167: Oceania Market Y-o-Y Growth (%) Projections by Indication , 2023 to 2033

Figure 168: Oceania Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 169: Oceania Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 170: Oceania Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 171: Oceania Market Attractiveness by Drug Class, 2023 to 2033

Figure 172: Oceania Market Attractiveness by Therapy, 2023 to 2033

Figure 173: Oceania Market Attractiveness by Indication , 2023 to 2033

Figure 174: Oceania Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 175: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 176: MEA Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 177: MEA Market Value (US$ Million) by Therapy, 2023 to 2033

Figure 178: MEA Market Value (US$ Million) by Indication , 2023 to 2033

Figure 179: MEA Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 180: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 181: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 182: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 183: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 184: MEA Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 185: MEA Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 186: MEA Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 187: MEA Market Value (US$ Million) Analysis by Therapy, 2018 to 2033

Figure 188: MEA Market Value Share (%) and BPS Analysis by Therapy, 2023 to 2033

Figure 189: MEA Market Y-o-Y Growth (%) Projections by Therapy, 2023 to 2033

Figure 190: MEA Market Value (US$ Million) Analysis by Indication , 2018 to 2033

Figure 191: MEA Market Value Share (%) and BPS Analysis by Indication , 2023 to 2033

Figure 192: MEA Market Y-o-Y Growth (%) Projections by Indication , 2023 to 2033

Figure 193: MEA Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 194: MEA Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 195: MEA Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 196: MEA Market Attractiveness by Drug Class, 2023 to 2033

Figure 197: MEA Market Attractiveness by Therapy, 2023 to 2033

Figure 198: MEA Market Attractiveness by Indication , 2023 to 2033

Figure 199: MEA Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 200: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Brain Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Brain Fitness Market Size and Share Forecast Outlook 2025 to 2035

Brain Computing Interfaces Market Size and Share Forecast Outlook 2025 to 2035

Brain Cancer Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Brain Metastasis Therapeutics Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Brain-Computer Interface Implant Market Analysis Size and Share Forecast Outlook 2025 to 2035

Brain Implants Market Size and Share Forecast Outlook 2025 to 2035

Brain Imaging and Neuroimaging Market Size and Share Forecast Outlook 2025 to 2035

Brain Health Supplement Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Brain Biomarker Market Trends and Forecast 2025 to 2035

Brain Mint Market Analysis by Functionality, Consumer Orientation, Sales Channel and Region Through 2035

Brain Monitoring Systems Market is segmented by Lateral Flow Readers and Kits and Reagents from 2025 to 2035

Brain Fingerprinting Technology Market

Brain Tumor Treatment Market Analysis-- Size and Share Forecast Outlook 2025 to 2035

Deep Brain Stimulator Market Size and Share Forecast Outlook 2025 to 2035

Kids’ Brain Health Supplements Market Size and Share Forecast Outlook 2025 to 2035

Bovine Brain Extract Size and Share Forecast Outlook 2025 to 2035

Chronic Brain Damage Treatment: Trends, Growth, and Key Developments

Auditory Brainstem Response Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Wireless Brain Sensors Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA