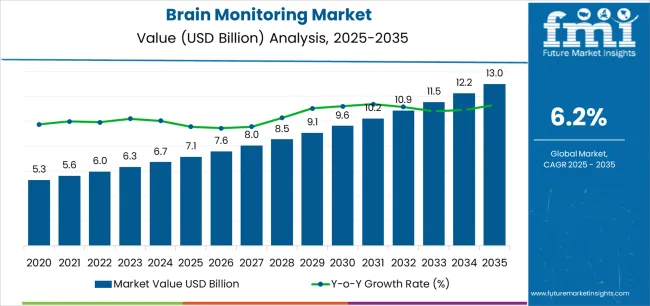

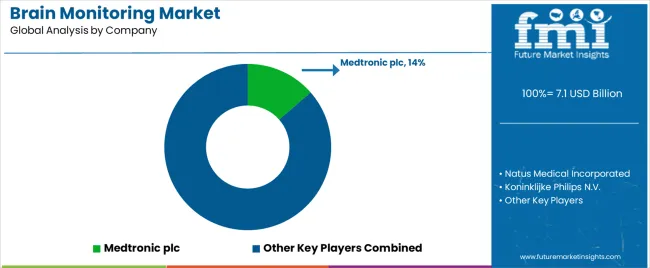

The Brain Monitoring Market is estimated to be valued at USD 7.1 billion in 2025 and is projected to reach USD 13.0 billion by 2035, registering a compound annual growth rate (CAGR) of 6.2% over the forecast period.

The brain monitoring market is gaining momentum due to rising incidences of neurological disorders, growing demand for continuous brain function assessment, and increasing adoption of non-invasive diagnostic technologies. Advances in neuroimaging and electrophysiology have improved diagnostic accuracy, enabling real-time monitoring for critical care and surgical applications.

The market is also benefiting from the integration of wireless and wearable technologies, which facilitate remote neurological assessment and home-based care. Expanding healthcare infrastructure, particularly in emerging economies, is improving access to brain monitoring equipment.

Additionally, growing investments in neuroscience research and clinical innovation are enhancing product development. With the prevalence of conditions such as epilepsy, stroke, and traumatic brain injury rising globally, demand for advanced brain monitoring solutions is expected to continue expanding over the forecast period.

| Metric | Value |

|---|---|

| Brain Monitoring Market Estimated Value in (2025 E) | USD 7.1 billion |

| Brain Monitoring Market Forecast Value in (2035 F) | USD 13.0 billion |

| Forecast CAGR (2025 to 2035) | 6.2% |

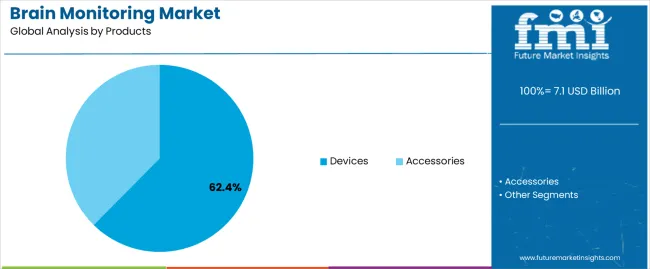

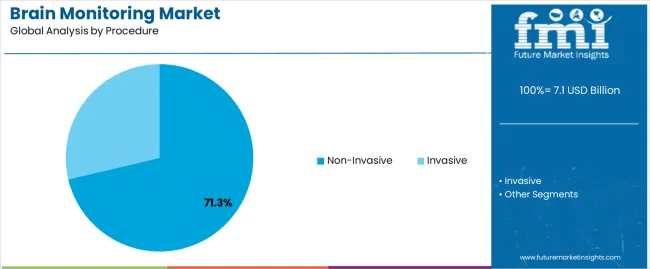

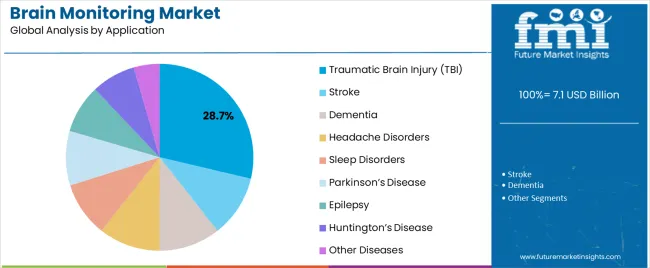

The market is segmented by Products, Procedure, Application, and End User and region. By Products, the market is divided into Devices and Accessories. In terms of Procedure, the market is classified into Non-Invasive and Invasive. Based on Application, the market is segmented into Traumatic Brain Injury (TBI), Stroke, Dementia, Headache Disorders, Sleep Disorders, Parkinson’s Disease, Epilepsy, Huntington’s Disease, and Other Diseases. By End User, the market is divided into Hospitals, Neurology Centres, and Clinics & ASC. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

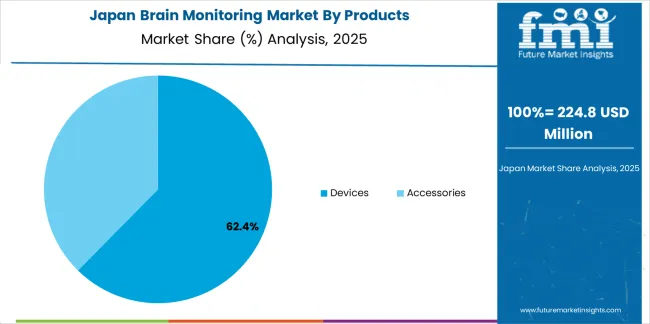

The devices segment leads the product category, accounting for approximately 62.4% share of the brain monitoring market. This segment’s dominance is supported by the widespread use of EEG, MEG, and intracranial pressure monitoring systems in hospitals and research institutions.

Continuous technological innovation has enhanced signal accuracy, miniaturization, and patient comfort, expanding clinical and research applications. Demand is also driven by the rising incidence of neurological disorders requiring real-time monitoring for diagnosis and treatment optimization.

Increased funding for healthcare modernization and the growing adoption of portable brain monitoring devices have further reinforced the segment’s position. As hospitals continue integrating digital health tools, the devices segment is expected to remain central to market growth.

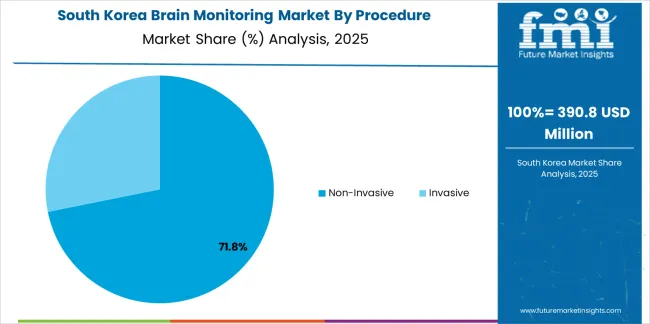

The non-invasive segment dominates the procedure category with approximately 71.3% share, driven by patient preference and the clinical advantages of reduced infection risk and minimal recovery time. This approach leverages advanced imaging and sensor technologies to capture brain activity without surgical intervention.

The segment’s expansion is supported by the adoption of EEG, MRI, and near-infrared spectroscopy systems across healthcare facilities. Rising demand for safe, repeatable diagnostic techniques in both acute and long-term neurological care has bolstered adoption rates.

With ongoing improvements in imaging resolution and signal interpretation, non-invasive methods are expected to maintain their leadership through continued clinical validation and patient-centered innovation.

The traumatic brain injury (TBI) segment accounts for approximately 28.7% share of the application category, reflecting the growing burden of head trauma cases worldwide. Increasing accident rates, sports-related injuries, and combat-related trauma have heightened the need for precise brain function assessment.

Brain monitoring systems play a vital role in detecting intracranial pressure changes and guiding therapeutic interventions in TBI management. The segment’s growth is further supported by expanding rehabilitation and post-acute care infrastructure, where continuous monitoring aids recovery assessment.

With rising awareness of early diagnosis and improved survival rates through timely intervention, the TBI segment is projected to sustain its leading role within the application spectrum.

Miniaturization Technology Advancements Reshape the Market's Landscape

The market for brain monitoring is evolving because of technological advancements in miniaturization; businesses are using small, lightweight devices to satisfy consumer demands for portability and convenience.

This development puts businesses in an advantageous position in industries like home healthcare and ambulatory settings, where mobility is essential. In the rapidly changing field of portable neuro-monitoring systems, miniaturization tactics promote product differentiation, collaborate with mobile technology suppliers, and increase overall competitiveness.

Leveraging Brain-computer Interfaces Presents Opportunities in the Market

Enhancing accessibility through the use of brain-computer interfaces (BCIs) is a cutting-edge business prospect with significant societal implications. Businesses that specialize in creating BCIs for people with disabilities can help people with motor impairments live better lives and have more options.

This opportunity complies with inclusive design principles and opens up new market leadership and differentiation possibilities by fostering prospective partnerships with assistive technology businesses, rehabilitation facilities, and accessibility and inclusion-focused groups.

Integration with Digital Therapeutics Can Broaden the Scope of Offerings in the Market

The incorporation of brain activity monitoring data into digital prescriptions and treatments is a progressive business approach that converts brain monitoring systems into all-encompassing treatment approaches. Businesses that follow this trend provide comprehensive strategies integrating digital treatments based on evidence with real-time monitoring.

This creates a distinct market position at the nexus of therapeutic solutions and diagnostics, opening doors for partnerships with pharmaceutical firms, healthcare providers, and digital health platforms. It's a calculated move that enhances the range of services offered and advances the idea of more efficient and well-rounded patient care.

| Attributes | Details |

|---|---|

| Market CAGR (2020 to 2025) | 8.1% |

The brain monitoring market size expanded at an 8.1% CAGR from 2020 to 2025. The demand for efficient brain monitoring tools is growing due to the rising prevalence of neurological conditions such as epilepsy, Parkinson's disease, Alzheimer's disease, and stroke.

These illnesses are becoming more common as the world's population ages, which is driving up demand for brain monitoring and diagnosis tools.

Preventive healthcare practices are growing more popular as people become more aware of how important it is to keep the brain healthy. The need for tools and technology that provide ongoing monitoring of brain activity is driving growth in the market for brain monitoring equipment, both medical and consumer-oriented.

Beyond conventional healthcare, brain monitoring technology is being used in gaming, education, and wellness. By creating novel use cases and reaching new customer groups, cross-industry cooperation with tech firms, game developers, and educational institutions continues to boost market growth.

In the coming years, the demand for consumer-grade brain monitoring devices is predicted to be driven by the growing consumer interest in self-care and health monitoring. The market for technologies that assess and optimize individual brain health is expected to grow as people become more conscientious about their health and well-being.

Brain monitoring technology adoption is expected to be impacted by global healthcare trends such as customized treatment, value-based care, and a move toward preventative healthcare. These trends are supported by incorporating brain data into holistic healthcare strategies, propelling market expansion.

| Trends |

|

|---|---|

| Opportunities |

|

| Challenges |

|

| Segment | Devices (Products) |

|---|---|

| Value CAGR (2025 to 2035) | 6.3% |

Based on products, the devices segment is projected to expand at a 6.3% CAGR through 2035.

| Segment | Invasive (Procedure) |

|---|---|

| Value CAGR (2025 to 2035) | 6.1% |

Based on the procedure, the invasive segment is predicted to surge at a 6.1% CAGR through 2035.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| United States | 6.8% |

| United Kingdom | 5.1% |

| China | 7.3% |

| Japan | 7.6% |

| South Korea | 8.3% |

The demand for brain monitoring in the United States is projected to rise at a 6.8% CAGR through 2035.

The sales of brain monitoring in the United Kingdom are expected to increase at a 5.1% CAGR through 2035.

The brain monitoring market growth in China is estimated to have a 7.3% CAGR through 2035.

The demand for brain monitoring technologies in Japan is anticipated to rise at a 7.6% CAGR through 2035.

The sales of brain monitoring solutions in South Korea are expected to surge at an 8.3% CAGR through 2035.

The brain monitoring market is driven by well-known industry giants with a global presence and set industry standards, such as Koninklijke Philips and Medtronic. Creative startups that challenge conventional methods, such as BrainScope and Advanced Brain Monitoring, add to the market's vibrancy.

It is customary to collaborate with research institutes, which promotes quick invention. Regional approaches differ, with North America emphasizing conformity and Asia Pacific aligning with local goals.

Recent Developments

The global brain monitoring market is estimated to be valued at USD 7.1 billion in 2025.

The market size for the brain monitoring market is projected to reach USD 13.0 billion by 2035.

The brain monitoring market is expected to grow at a 6.2% CAGR between 2025 and 2035.

The key product types in brain monitoring market are devices and accessories.

In terms of procedure, non-invasive segment to command 71.3% share in the brain monitoring market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Brain Monitoring Systems Market is segmented by Lateral Flow Readers and Kits and Reagents from 2025 to 2035

Monitoring Tool Market Size and Share Forecast Outlook 2025 to 2035

Brain Fitness Market Size and Share Forecast Outlook 2025 to 2035

Brain Computing Interfaces Market Size and Share Forecast Outlook 2025 to 2035

Brain Cancer Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Brain Metastasis Therapeutics Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Brain-Computer Interface Implant Market Analysis Size and Share Forecast Outlook 2025 to 2035

Brain Implants Market Size and Share Forecast Outlook 2025 to 2035

Brain Imaging and Neuroimaging Market Size and Share Forecast Outlook 2025 to 2035

Brain Health Supplement Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Brain Tumor Treatment Market Analysis-- Size and Share Forecast Outlook 2025 to 2035

Brain Biomarker Market Trends and Forecast 2025 to 2035

Brain Tumor Drugs Market Forecast & Analysis: 2025 to 2035

Brain Mint Market Analysis by Functionality, Consumer Orientation, Sales Channel and Region Through 2035

Brain Fingerprinting Technology Market

Pet Monitoring Camera Market Size and Share Forecast Outlook 2025 to 2035

Deep Brain Stimulator Market Size and Share Forecast Outlook 2025 to 2035

Pain Monitoring Devices Market Size and Share Forecast Outlook 2025 to 2035

Dose Monitoring Devices Market - Growth & Demand 2025 to 2035

Motor Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA