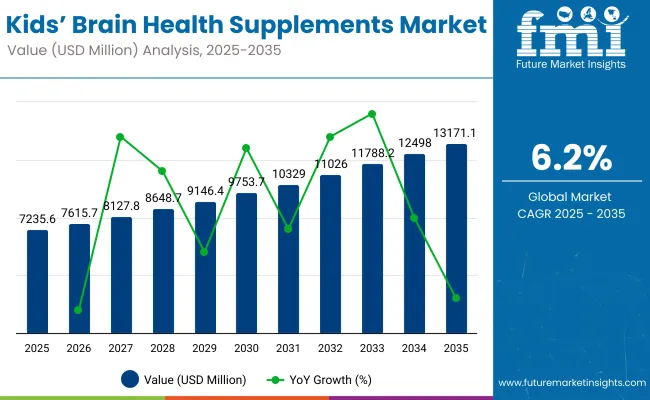

The Kids’ Brain Health Supplements Market is expected to record a valuation of USD 7,235.6 Million in 2025 and USD 13,171.1 Million in 2035, with an increase of USD 5,932 Million, which equals a growth of over 82% over the decade. The overall expansion represents a CAGR of 6.2% and a near doubling of market size.

Kids’ Brain Health Supplements Market Key Takeaways

| Metric | Value |

|---|---|

| Market Estimated Value in (2025E) | USD 7,235.6 million |

| Market Forecast Value in (2035F) | USD 13,171.1 million |

| Forecast CAGR (2025 to 2035) | 6.2% |

This trajectory reflects a growing prioritization of cognitive well-being in early childhood, with functional nutrition increasingly positioned as a preventive tool by health-conscious caregivers. From 2025 to 2030, the market is projected to grow from USD 7,235.6 Million to USD 9,756 Million, contributing USD 2,521 Million, or approximately 43% of the total decade growth.

This growth phase is expected to be shaped by heightened adoption in North America and Europe, where early education outcomes, attention support, and memory enhancement claims are being actively targeted by supplement developers. Gummy and chewable formulations are likely to dominate due to higher child compliance and palatability.

Between 2030 and 2035, an additional USD 3,426 Million is projected to be added, contributing 57% of the forecasted growth. This acceleration is expected to be fueled by expansion into Asia-Pacific and Latin American regions, as market penetration deepens through e-commerce and pediatric practitioner recommendations. Ingredient innovation particularly in nootropics and omega-3 alternatives is anticipated to shift value generation toward clinically backed formulations, with direct-to-consumer (DTC) brands and digital platforms poised to lead in consumer engagement and retention.

From 2020 to 2024, the Kids’ Brain Health Supplements Market expanded from USD 5.61 million to USD 7,235.6 million, fueled by heightened awareness of early-life cognitive development and increased pediatrician-led supplementation. During this period, the competitive landscape was led by major nutrition conglomerates, which accounted for over 60% of the market revenue, with brands like Nestlé, Abbott, and Reckitt dominating through clinically supported DHA and multivitamin offerings. Product differentiation emphasized clean-label claims, allergen-free compliance, and taste innovation.

In 2025, the market is projected to reach USD 7,235.6 million, with consumer demand shifting toward functional blends featuring nootropics, adaptogens, and psychobiotics. By 2035, the value is expected to rise to USD 13,171.1 million, with digital-first players capturing share through e-commerce, personalized subscription kits, and AI-linked recommendation platforms.

Leading incumbents are anticipated to pivot toward hybrid business models that integrate clinical transparency, microbiome-focused personalization, and caregiver education ecosystems. Competitive edge will move beyond formulation efficacy to include delivery format innovation, regulatory foresight, and digital engagement scalability.

Growth in the Kids’ Brain Health Supplements Market is being driven by heightened awareness among parents regarding early cognitive development and preventive brain health strategies. Increased screen exposure and academic pressures have been linked to rising concerns over focus, memory, and mental fatigue in children, prompting demand for targeted nutritional solutions.

A surge in pediatric recommendations and endorsements from healthcare professionals has validated the use of supplements in child wellness routines. Plant-based, allergen-free, and sugar-conscious formulations have been prioritized by formulators to meet evolving consumer expectations.

The expansion of clean-label and clinically backed ingredients such as omega-3s, herbal nootropics, and micronutrients has been instrumental in supporting trust and efficacy claims. Greater accessibility through online retail and personalized e-commerce platforms has allowed niche brands to scale quickly.

Furthermore, innovations in child-friendly formats like gummies and chewables have enhanced compliance, while digital health campaigns have increased caregiver engagement, accelerating sustained category adoption across developed and emerging economies.

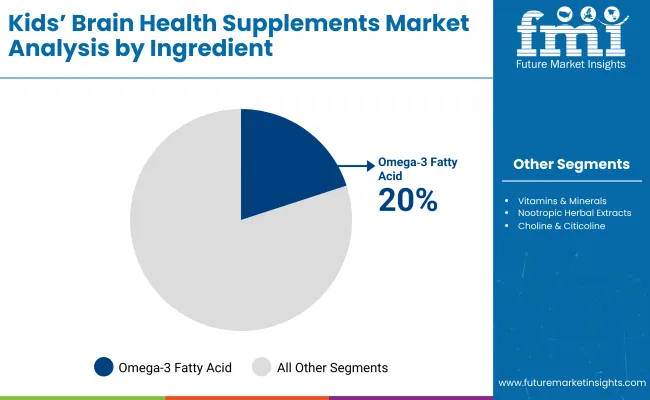

The Kids’ Brain Health Supplements Market has been segmented based on ingredient type, formulation type, and health benefit, each contributing uniquely to consumer adoption patterns. Ingredients such as omega-3 fatty acids, nootropics, and micronutrients have been prioritized for their clinically validated roles in neural development and mental performance.

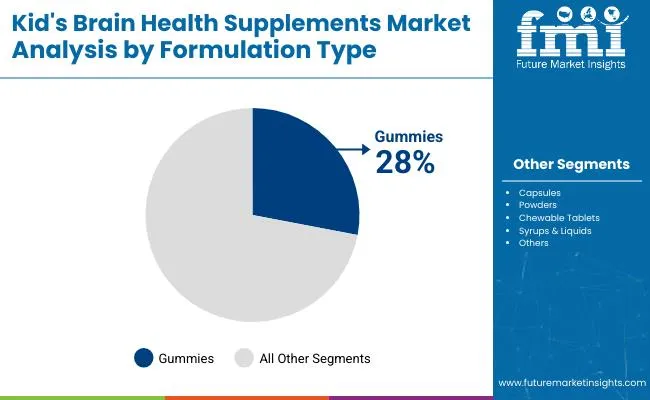

Formulation choices especially gummies and chewables have been guided by child compliance and ease of dosing. Meanwhile, demand has been further segmented by targeted outcomes including cognitive enhancement, attention support, and mood stabilization.

These segments have been shaped by evolving parental expectations, rising scientific backing, and market accessibility. Over the forecast period, segment-level innovation is expected to influence brand differentiation, pricing strategies, and cross-category convergence across pediatric nutrition and mental wellness platforms.

| Ingredient Segment | Share (%) |

|---|---|

| Omega 3 Fatty Acids (DHA, EPA) | 20% |

| Vitamins & Minerals | 15% |

| Nootropic Herbal Extracts | 12% |

| Choline & Citicoline | 10% |

| Phosphatidylserine | 8% |

| Adaptogens | 8% |

| Amino Acids | 8% |

| Antioxidants | 7% |

| Probiotics & Prebiotics | 7% |

| Other Nutrients | 5% |

Omega‑3 fatty acids are projected to contribute 20% of the Kids’ Brain Health Supplements Market revenue in 2025, maintaining their position as the leading ingredient group. Their dominance has been driven by extensive clinical validation of DHA and EPA in supporting early brain structure, neuron signaling, and long-term memory formation. Pediatricians and health organizations have widely endorsed omega-3s, reinforcing trust among caregivers.

Innovation in taste-masked delivery formats and sustainably sourced algal oils has expanded accessibility, especially in allergen-sensitive populations. As research around long-chain polyunsaturated fatty acids continues to evolve, the omega-3 segment is expected to remain central to pediatric neurodevelopment strategies and is likely to experience sustained investment by both legacy and emerging brands.

| Formulation Type | Share (%) |

|---|---|

| Gummies | 28% |

| Capsules | 25% |

| Powders | 20% |

| Chewable Tablets | 15% |

| Syrups & Liquids | 12% |

Gummies are forecasted to hold the highest market share in 2025, contributing 28% of total revenue across the formulation segment. Their dominance has been enabled by superior palatability, visual appeal, and ease of administration factors that strongly influence parental purchasing decisions for children. Taste innovation, clean-label certifications, and sugar-conscious formulations have further positioned gummies as the preferred delivery format.

The segment’s rise has also been supported by social media and influencer-led marketing targeting modern parents, while DTC brands have leveraged this format for subscription-based growth. As multinutrient stacking within a single gummy becomes increasingly viable through microencapsulation technologies, this segment is expected to further consolidate its leadership across global markets.

| Health Benefit | Share (%) |

|---|---|

| Cognitive Development | 25% |

| Memory & Concentration | 22% |

| Attention & Focus | 18% |

| Learning Support | 15% |

| Stress & Mood | 12% |

| Sleep Support | 8% |

Cognitive development is projected to lead the health benefit segment in 2025 with a 25% revenue share, reflecting its role as the foundational focus of most pediatric supplementation strategies. Market demand has been anchored in early-age brain maturation, language development, and academic performance improvement.

Parents are increasingly seeking solutions that promise long-term developmental advantages, and brands have responded with child-safe formulations backed by neuroscience. Educational institutions and pediatric health practitioners have reinforced the adoption of these products through structured wellness programs. This segment is expected to remain dominant as first-time parents in urban markets prioritize early cognitive milestones, supported by clinical trials and ingredient transparency.

Regulatory scrutiny, evolving parental attitudes, and formulation complexity continue to shape the growth trajectory of the Kids’ Brain Health Supplements Market, even as new research-backed ingredients and digital retail models unlock novel opportunities for targeted, compliant, and scalable neuro-nutrition.

Driver - Pediatric Neurodevelopment Framed as a Public Health Priority

The prioritization of early brain development as a national health objective by governments and public health agencies has significantly influenced the supplement industry’s approach to children’s cognitive nutrition. Policies promoting early-life interventions such as fortification, school-based wellness programs, and maternal-child health linkages have expanded the perceived legitimacy of pediatric brain health supplementation.

As child development becomes intertwined with national educational outcomes and future workforce readiness, investments into evidence-based brain-supporting interventions have been accelerated through public-private collaborations. Scientific endorsement of critical periods in early neurodevelopment has shifted supplement positioning from optional enhancement to preventive necessity. This shift has been further reinforced by pediatricians and developmental psychologists recommending structured nutrition during formative years, thereby embedding supplements into long-term child wellness ecosystems.

Trend - Clinical Trial Integration into Pediatric Nutraceutical Branding

A growing shift has been observed toward the integration of randomized, pediatric-specific clinical trials into supplement branding strategies. Rather than relying on generic adult-derived claims, brands are pursuing proprietary trials to generate child-specific evidence on cognitive, attentional, and behavioral outcomes.

This approach has been driven by increased regulatory expectation, but also by heightened caregiver skepticism toward exaggerated wellness claims. Clinical datasets are now being used not only for formulation validation but also for marketing differentiation in saturated digital environments. As transparency becomes central to consumer trust, clinical-grade documentation is expected to be embedded into product storytelling, platform education, and influencer campaigns, setting new benchmarks for accountability and efficacy.

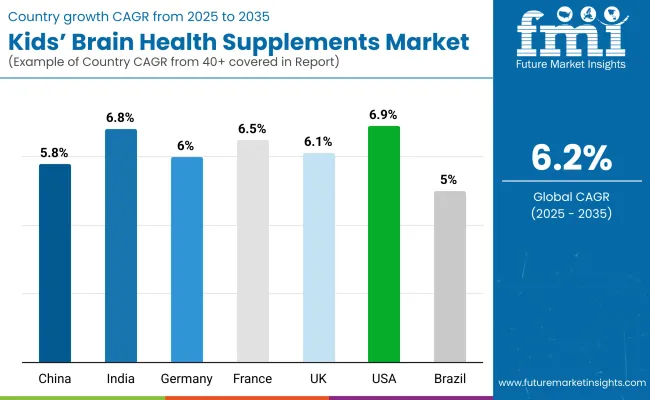

| Countries | CAGR |

|---|---|

| China | 5.80% |

| India | 6.87% |

| Germany | 6.08% |

| France | 6.50% |

| UK | 6.10% |

| USA | 6.96% |

| Brazil | 5.05% |

Marked disparities in growth dynamics have been observed across major economies in the Kids’ Brain Health Supplements Market, shaped by national health policies, pediatric nutrition awareness, and regulatory infrastructure. The United States is projected to grow at a CAGR of 6.96% through 2035, supported by mainstream integration of functional supplements in child healthcare routines, widespread retail channel maturity, and increasing clinical adoption among pediatricians.

In China, where a 5.8% CAGR has been forecast, growth is being reinforced by government-backed school nutrition programs and rising urban household expenditure on child cognitive wellness, although regulatory bottlenecks around ingredient approvals remain a limiting factor.

India, at 6.87% CAGR, is expected to advance more rapidly, fueled by increasing middle-class access to brain health supplements, aggressive e-commerce penetration, and localized manufacturing investments. Germany (6.08%), France (6.50%), and the UK (6.10%) are projected to maintain steady expansion within Europe, driven by clean-label demand, strong regulatory enforcement, and increasing adoption among holistic wellness-focused parents. European markets are further distinguished by R&D-led innovation in botanical nootropics and DHA alternatives.

Brazil, growing at 5.05%, reflects early-stage adoption, where market penetration remains fragmented but rising awareness through pediatricians and social campaigns is expected to unlock new urban demand. Regionally, market maturity, ingredient trust, and distribution infrastructure are expected to define performance differentials.

| Year | USA Kids’ Brain Health Supplements market (USD Million) |

|---|---|

| 2025 | 1736.5 |

| 2026 | 1,833.2 |

| 2027 | 1,930.9 |

| 2028 | 2,028.1 |

| 2029 | 2,138.1 |

| 2030 | 2,265.3 |

| 2031 | 2,416.4 |

| 2032 | 2,547.7 |

| 2033 | 2,704.7 |

| 2034 | 2,855.6 |

| 2035 | 3,004.9 |

The Kids’ Brain Health Supplements Market in the United States is projected to expand at a CAGR of 5.6% between 2025 and 2035, underpinned by the institutionalization of pediatric wellness and integration of cognitive nutrition into mainstream healthcare.

High trust in clinically substantiated formulations has driven engagement from pediatricians and behavioral health professionals, positioning supplements as integral to early-life developmental support. Policy-driven school nutrition programs and growing collaboration between nutraceutical firms and digital health platforms have further strengthened market visibility.

Academic and behavioral interventions are increasingly being complemented with targeted nootropic blends and omega-rich formulations, tailored to address attention, memory, and learning challenges among school-aged children. The healthcare segment has seen progressive adoption, particularly within functional medicine and child psychology practices.

A CAGR of 6.10% has been projected for the UK Kids’ Brain Health Supplements Market between 2025 to 2035, supported by growing integration of cognitive health products into school-age nutrition routines. Institutional trust in functional supplements has been enhanced by NHS-backed preventive health campaigns and rising acceptance among general practitioners.

A CAGR of 6.87% has been forecast for the Kids’ Brain Health Supplements Market in India, driven by rising urban affluence, digital penetration, and the medicalization of school performance. Pediatricians have increasingly incorporated cognitive formulations into growth and behavior consultations.

A CAGR of 5.80% has been projected for China’s Kids’ Brain Health Supplements Market between 2025 to 2035, shaped by state-led child development programs and rising consumer inclination toward early-life functional health. Urban families have increasingly adopted brain supplements as a form of educational advantage.

| Countries | 2025 |

|---|---|

| UK | 20.40% |

| Germany | 20.78% |

| Italy | 11.22% |

| France | 14.14% |

| Spain | 9.59% |

| BENELUX | 6.38% |

| Nordic | 5.49% |

| Rest of Europe | 12% |

| Countries | 2035 |

|---|---|

| UK | 19.18% |

| Germany | 21.31% |

| Italy | 11.38% |

| France | 14.72% |

| Spain | 9.34% |

| BENELUX | 5.06% |

| Nordic | 5.82% |

| Rest of Europe | 13% |

Germany’s Kids’ Brain Health Supplements Market is projected to grow at a CAGR of 6.08% from 2025 to 2035, anchored by its well-established preventive healthcare culture and high functional ingredient standards. Parents have shown increasing preference for clinically validated and allergen-free products.

| Ingredient Segment | Share (%) |

|---|---|

| Omega 3 Fatty Acids (DHA, EPA) | 22% |

| Vitamins & Minerals | 14% |

| Nootropic Herbal Extracts | 11% |

| Choline & Citicoline | 10% |

| Adaptogens | 8% |

| Amino Acids | 8% |

| Phosphatidylserine | 7% |

| Antioxidants | 7% |

| Other Brain Boosting Nutrients | 7% |

| Probiotics & Prebiotics | 6% |

The Kids’ Brain Health Supplements Market in Japan is projected at USD 470.31 million in 2025, with omega3 fatty acids contributing 22% of the total market value, while vitamins & minerals account for 14%, reflecting a deeply rooted emphasis on foundational nutrition and cognitive precision. The consistent lead of omega-3s has been driven by their integration into prenatal and early-life care protocols, with DHA-rich supplements gaining clinical traction among pediatricians and child development experts.

A strong consumer orientation toward functional foods and evidence-based supplementation has reinforced trust in vitamins, minerals, and nootropic botanicals particularly those aligned with Kampo (traditional Japanese medicine). Increasing preference for amino acids and adaptogens, such as Ltheanine and Rhodiola, has also been observed, supported by their perceived impact on calm focus and stress regulation during academic routines.

| Formulation Segment | Share (%) |

|---|---|

| Gummies | 30% |

| Capsules | 25% |

| Powders | 18% |

| Chewable Tablets | 14% |

| Syrups & Liquids | 13% |

The Kids’ Brain Health Supplements Market in South Korea is projected at USD 311.1 million in 2025, with gummies contributing 30% of total market value and capsules holding 25%, reflecting a clear consumer preference for format convenience and child compliance. The rapid rise in gummy adoption has been driven by Korean caregivers' emphasis on visual appeal, flavor masking, and dosage ease particularly for young children undergoing early cognitive development stages.

A robust domestic nutraceutical ecosystem and aggressive product innovation cycles have positioned South Korea as a trendsetter in functional food-tech fusion. Capsules continue to gain traction among older children and teens due to their association with clinical efficacy and measurable outcomes.

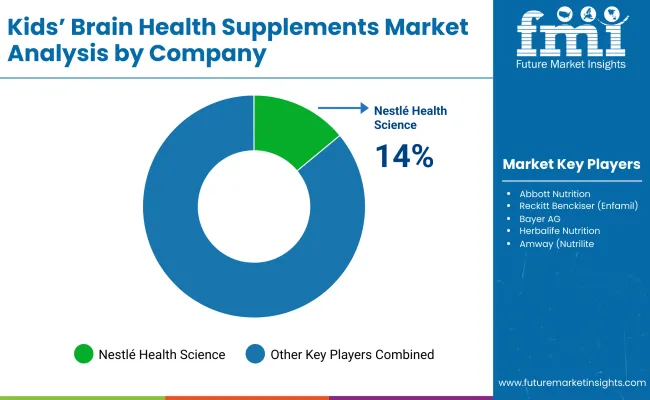

| Company | Global Value Share 2025 |

|---|---|

| Nestlé Health Science | 14% |

| Others | 86% |

The Kids’ Brain Health Supplements Market is moderately fragmented, with global nutrition majors, specialized pediatric supplement brands, and clean-label innovators competing across pediatric wellness, education, and clinical nutrition channels.

Global leaders such as Nestlé Health Science, Abbott Nutrition, and Reckitt Benckiser (Enfamil) have retained significant market presence, driven by established pediatric trust, R&D-backed formulations, and integrated distribution through both healthcare systems and retail networks. Their strategies have increasingly prioritized clinical validation, doctor-endorsed product lines, and multi-format offerings tailored to developmental stages.

Mid-sized players including Bayer AG, Amway (Nutrilite), and Herbalife Nutrition have been focused on functional formulation layering, especially in cognitive support blends featuring omega-3s, choline, and adaptogens. These companies are accelerating reach through e-commerce optimization, mobile health platforms, and wellness education campaigns targeted at parents and caregivers.

Specialist brands such as SmartyPants Vitamins, Nordic Naturals, and MegaFood have been differentiated by their commitment to clean-label certifications, allergen-free profiles, and high-transparency sourcing. Regional success has been achieved through flavor innovation, doctor-approved pediatric lines, and influencer-driven parent engagement.

As consumer expectations evolve, competitive advantage is shifting toward clinically supported claims, sustainability-driven sourcing, and personalized product ecosystems, including subscription models and data-linked supplementation paths tailored to children’s age and cognitive needs.

Key Developments in Kids’ Brain Health Supplements Market

| Item | Value |

|---|---|

| Quantitative Units | USD 7,235.6 Million |

| Ingredient Type | Omega 3 Fatty Acids (DHA, EPA), Phosphatidylserine, Nootropic Herbal Extracts, Vitamins & Minerals, Adaptogens, Probiotics & Prebiotics, Amino Acids, Antioxidants, Choline & Citicoline , Other Brain Boosting Nutrients |

| Formulation Type | Gummies, Capsules, Powders, Chewable Tablets, Syrups & Liquids |

| Health Benefit | Cognitive Development, Memory & Concentration, Attention & Focus, Learning Support, Stress & Mood Regulation, Sleep Support |

| Age Group | Toddlers (1-3 years), Preschoolers (4-5 years), School-aged Children (6-12 years), Adolescents (13-17 years) |

| Sales Channels | Online Retail, Pharmacies & Drugstores, Health & Nutrition Stores, DTC Brands, Practitioner Channels |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Korea |

| Key Companies Profiled | Nestlé Health Science, Abbott Nutrition, Reckitt Benckiser (Enfamil), Bayer AG, Herbalife Nutrition, Amway (Nutrilite), Nature’s Way, SmartyPants Vitamins, Nordic Naturals, Mega Food |

| Additional Attributes | Growth driven by cognitive health awareness, child-friendly formulations, regulatory alignment for pediatric claims, rise of psychobiotics and nootropics, e-commerce acceleration, premiumization in developed markets, and ingredient transparency as a competitive differentiator |

The global Kids’ Brain Health Supplements Market is estimated to be valued at USD 7,235.6 million in 2025.

The market size for the Kids’ Brain Health Supplements Market is projected to reach USD 13,171.1 million by 2035.

The Kids’ Brain Health Supplements Market is expected to grow at a 6.2% CAGR between 2025 and 2035.

The key formulation types in the Kids’ Brain Health Supplements Market are gummies, capsules, powders, chewable tablets, and syrups & liquids.

In terms of formulation, the gummies segment is expected to command 30% share in the Kids’ Brain Health Supplements Market in 2025.

Research Methodology

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Kids’ Eyewear Market Report – Trends & Forecast 2024-2034

Kids’ Food and Beverages Market Analysis by Product Type, Age Group, Category, Distribution Channel and Region through 2035

Brain Mint Market Analysis by Functionality, Consumer Orientation, Sales Channel and Region Through 2035

Brain Fitness Market Size and Share Forecast Outlook 2025 to 2035

Brain Implants Market Size and Share Forecast Outlook 2025 to 2035

Brain Biomarker Market Trends and Forecast 2025 to 2035

Brain Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Brain Tumor Drugs Market Forecast & Analysis: 2025 to 2035

Brain Tumor Treatment Market Analysis-- Size and Share Forecast Outlook 2025 to 2035

Brain Cancer Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Brain Monitoring Systems Market is segmented by Lateral Flow Readers and Kits and Reagents from 2025 to 2035

Brain Computing Interfaces Market Size and Share Forecast Outlook 2025 to 2035

Brain Metastasis Therapeutics Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Brain Imaging and Neuroimaging Market Size and Share Forecast Outlook 2025 to 2035

Brain Fingerprinting Technology Market

Brain-Computer Interface Implant Market Analysis Size and Share Forecast Outlook 2025 to 2035

Brain Health Supplement Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Deep Brain Stimulator Market Size and Share Forecast Outlook 2025 to 2035

Bovine Brain Extract Size and Share Forecast Outlook 2025 to 2035

Chronic Brain Damage Treatment: Trends, Growth, and Key Developments

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA