The Chronic Brain Damage Management market is expected to garner a market value of USD 1.03 billion in 2025 and is expected to accumulate a market value of USD 2.03 billion by registering a CAGR of 7% in the forecast period 2025 to 2035.

In 2024, the Chronic Brain Damage Management market further exhibited steady progress, fueled by advances in both clinical interventions and technological advancements. A number of key developments aided this advancement, most notably within the field of targeted therapies.

Pharmaceutical firms recorded significant progress through new drug approvals, most importantly in the realms of neuroprotective agents as well as neurorestorative therapy. Also, neuro stimulation devices like transcranial magnetic stimulation (TMS) became popular as effective adjuncts in the treatment of brain damage, especially for patients with MDD, OCD and migraines.

The growing emphasis on personal medicine and patient-specific interventions in 2024 resulted in enhanced treatment outcomes. Healthcare professionals also changed their strategies to incorporate integrated care, with rehabilitation and mental health interventions playing a more central role in treatment protocols.

The industry is projected to continue to grow throughout the projection period between 2025 and 2035. Merging artificial intelligence and machine learning into diagnostic and treatment planning operations will most probably simplify patient care, enhancing early diagnosis and customization of therapies based on individual specifications. In addition, the increasing number of clinical trials and funds for research, especially for regenerative medicine and advanced neuro prosthetics, will fuel innovation.

| Metrics | Values |

|---|---|

| Industry Size (2025E) | USD 1.03 Billion |

| Industry Value (2035F) | USD 2.03 Billion |

| CAGR(2025 to 2035) | 7% |

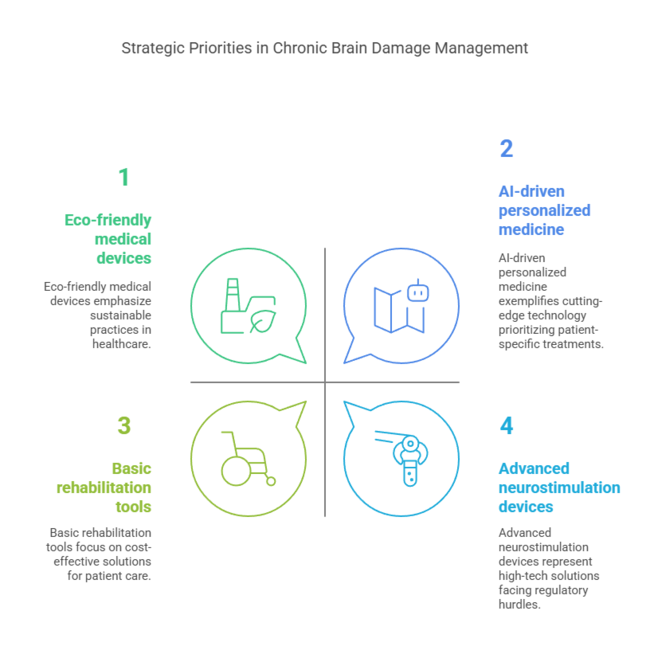

The Chronic Brain Damage Management industry is driven by innovation in personalized treatments, neurostimulation technology, and regenerative medicine. The most significant drivers are the increasing incidence of brain injury and neurological diseases and an upsurge in research grants.

Companies that make investments in novel treatments, personalized therapies, and AI-based technologies will be winners, whereas companies lagging in embracing these developments risk losing market share.

Invest in Regenerative and Personalized Therapies

Executives need to make investments in personalized medicine, neurorestorative medicines, and neuro stimulation technologies to remain competitive. These would deliver the highest potential for long-term industry expansion and better patient outcomes.

Align with Advances in Diagnostics and Treatment Technology

Executives must turn their attention to combining AI, machine learning, and cutting-edge diagnostics to make treatment planning more efficient and enhance early intervention. Getting in front of the curve in these technology-driven changes will make treatments more precise and boost industrial responsiveness.

Strengthen R&D and Forge Strategic Partnerships

Developing strategic partnerships with research institutes and working alongside tech firms in AI and neuro prosthetic fields will be essential. Investment in R&D, complemented by growth into new treatment areas and technologies, will fuel competitive differentiation and innovation.

| Risk | Probability & Impact |

|---|---|

| Regulatory Changes | High Probability, High Impact |

| Technological Failures in Devices | Medium Probability, High Impact |

| Industry Fragmentation | Medium Probablity, High Impact |

| Priority | Immediate Action |

|---|---|

| Invest in AI-driven Diagnostics | Conduct a feasibility study on integrating AI technologies for early diagnosis of brain damage. |

| Strengthen Regulatory Compliance | Initiate discussions with regulatory bodies to ensure swift approval of new treatments. |

| Expand Research on Neurorestorative Therapies | Launch a pilot program focused on regenerative medicine and neurorestorative treatments. |

To stay ahead, the customer must invest in AI diagnostics and tailor-made therapies and advance through regulatory environments. Short-term action needs to be on combining frontier technologies such as neuro stimulation and regenerative therapy into the standard product offerings.

By entering strategic partnerships and putting R&D efforts at the forefront, the business can differentiate itself within a fast-changing industry and lay the grounds for long-term success within the therapeutic arena.

| Country | Policies, Regulations, and Mandatory Certifications |

|---|---|

| US | FDA approval required for devices/drugs. CMS reimbursement policies impact adoption. HIPAA compliance for patient data. |

| India | CDSCO approval for drugs/devices. AYUSH certifications for traditional therapies. Mandatory clinical trials for new treatments. |

| China | NMPA approval for medical products. Strict data localization laws. TCM (Traditional Chinese Medicine) certifications for some therapies. |

| UK | MHRA approval for drugs/devices. NHS guidelines influence treatment adoption. GDPR compliance for data. |

| Germany | EMA (EU-wide) and BfArM approvals. Strict reimbursement policies under G-BA. GDPR compliance. |

| South Korea | MFDS approval required. Reimbursement policies under NHIS impact industrial access. |

| Japan | PMDA approval mandatory. SAKIGAKE designation for innovative therapies. MHLW guidelines shape adoption. |

| France | EMA and ANSM approvals. Haute Autorité de Santé (HAS) evaluations for reimbursement. GDPR compliance. |

| Italy | AIFA approval for drugs/devices. GDPR compliance. Regional healthcare policies affect adoption. |

| Australia-New Zealand | TGA (Australia) and MedSafe (NZ) approvals. PBS (Australia) and PHARMAC (NZ) influence reimbursement. |

The USA industry for the management of chronic brain damage is expected to increase strongly during the period from 2025 to 2035. The USA has the advantage of a sound health infrastructure, advanced technology, and heavy investments in R&D.

The increase in the aging population, coupled with increased awareness of brain injury and neurological diseases, is fueling demand for sophisticated treatments like neurostimulation devices, rehabilitation therapies, and neurological surgery.

In addition, government reimbursement schemes such as Medicare and Medicaid are providing wider access to therapies. The USA will probably continue to be the largest sector due to its advanced infrastructure, technological advancement in medical devices, and rising health expenditure.

FMI opines that the United States chronic brain damage management sales will grow at nearly 7.5% CAGR through 2025 to 2035.

In the UK, the chronic brain damage management industry will grow significantly during the period from 2025 to 2035. The National Health Service (NHS) is a major driver of growth, as government spending on neurological disease management and rehabilitation is increasing.

Also, the incidence of brain injuries, especially in the elderly, is driving the demand for novel treatments.

As more treatments get endorsed by the National Institute for Health and Care Excellence (NICE), advanced therapies will become more accessible. The sector will continue to make advancements in the non-invasive therapies, with management of chronic brain damage being made more accessible to more people.

FMI opines that the United Kingdom chronic brain damage management sales will grow at nearly 6.8% CAGR through 2025 to 2035.

France's chronic brain damage management industry is expected to expand rapidly during the period 2025 to 2035. The nation is experiencing a rise in brain injuries, especially due to accidents and strokes, resulting in an increasing need for rehabilitation technologies.

Government-sponsored healthcare programs, such as universal health coverage, provide access to therapies such as neuro stimulation and cognitive rehabilitation. Additionally, France is improving the implementation of patient-focused healthcare policies and investment in brain disorder research.

FMI opines that the France chronic brain damage management sales will grow at nearly 6.9% CAGR through 2025 to 2035.

Germany's chronic brain damage treatment industry is anticipated to witness growth during the period between 2025 and 2035. Germany's robust healthcare infrastructure and advanced medical research facilities are key drivers for the evolution and acceptance of sophisticated neuro therapies.

Brain injuries are anticipated to grow in prevalence in Germany due to an aging population, thus leading to greater demand for chronic brain damage treatments. Also, Germany is a pioneer in the implementation of new technologies, for example, neuro stimulation devices and rehabilitation robots.

Policies by the government and insurance coverage in the statutory health system are set to further spur the sector’s growth as patients increasingly have access to more novel therapies.

FMI opines that Germany’s chronic brain damage management sales will grow at nearly 7.2% CAGR through 2025 to 2035.

Italy's industry for chronic brain damage management is sustained by Italy's health system, with its combination of public and private services, and by the growing incidence of neurodegenerative diseases, stroke, and traumatic brain injury.

Regional programs and attention to better brain health outcomes are expected to propel growth. In addition, Italy is likely to experience greater demand for rehabilitation therapies and sophisticated neurological devices because the aging population will rise.

Government emphasis on enhancing neurological treatment, coupled with advances in producing medical devices, will drive market growth.

FMI opines that Italy’s chronic brain damage management sales will grow at nearly 6.5% CAGR through 2025 to 2035.

South Korea's chronic brain damage management industry will grow between 2025 and 2035. South Korea's strong healthcare system and government expenditure on neuro technologies are drivers of growth for the industry.

Demand for chronic brain damage management will increase with the aging population, the prevalence of neurological conditions, and more emphasis on cognitive rehabilitation. Support from the government for medical research and technological advancement will be key to driving industry growth.

More patients will be able to make use of the nation's sophisticated healthcare system and insurance coverage, making treatment more affordable.

FMI opines that the South Korea chronic brain damage management sales will grow at nearly 7.4% CAGR through 2025 to 2035.

Japan's industry for the management of chronic brain damage is predicted to increase in the upcoming decade. An aging population and the growing prevalence of chronic conditions such as stroke and neurodegenerative diseases make Japan an important industry opportunity for the management of chronic brain damage.

The Japanese government's emphasis on care for the elderly and rehabilitation services is assisting in the growth of the industry =. Innovative neurostimulation and rehabilitation therapies are gaining steam with the strength of healthcare policy and insurance regimes behind them.

Market growth rates, however, are a fraction lower than for other industries based on the prohibitive expense of sophisticated treatments as well as the inadequate market size of some treatments of chronic brain injury.

FMI opines that Japan's chronic brain damage management sales will grow at nearly 7.6% CAGR through 2025 to 2035.China

China's management industry for chronic brain damage will grow fast from 2025 to 2035. Its huge and aging population, along with rising traumatic brain injury and stroke rates, will increase the demand for both therapeutic and rehabilitative care.

Government backing for healthcare reforms, coupled with greater investment in healthcare infrastructure and research, will drive the adoption of innovative brain damage management technologies.

China's growing middle class and rising emphasis on healthcare are likely to drive industry growth further, making it one of the most profitable markets for chronic brain damage treatments in the world.

FMI opines that the China chronic brain damage management sales will grow at nearly 7.8% CAGR through 2025 to 2035.

The Australia and New Zealand chronic brain damage management industry is expected to grow steadily between 2025 and 2035. The National Disability Insurance Scheme (NDIS) in Australia is particularly important in ensuring access to therapy for individuals with brain injuries, while New Zealand's healthcare system also offers integrated rehabilitation services.

Both nations have challenges with aging populations and rising healthcare demands, which will propel the demand for sophisticated neuro stimulation devices, rehabilitation equipment, and therapies. Furthermore, government policies aimed at enhancing brain injury care and assistance for medical innovations will also promote market growth in the region.

FMI opines that the Australia-NZ chronic brain damage management sales will grow at nearly 7.0% CAGR through 2025 to 2035.

The diagnosis segment contributes the most to global chronic brain damage management, with 6.9% CAGR over the years 2025 to 2035. CT and MRI remain the cornerstones of the analysis of head trauma. However, new developments remain important to identify injuries early and monitor evolving pathology.

These imaging techniques are useful to know the extent of damage in the brain, which is important for planning an effective treatment. Blood tests will be more important, helping assess biomarkers such as protein that seep into the bloodstream after a brain injury, allowing more tailored treatments.

Brain tests especially cognitive and neurologic evaluations will continue to be central in assessing the course of damage to the brain. Advancements in diagnostic tools, coupled with increased accessibility, will drive growth in this segment as technology continues to develop.

The treatment type segment is expected to witness a steady growth with a CAGR of 6.9% from 2025 to 2035. Occupational therapy, physical therapy and speech therapy will continue to be vital treatments for brain injury patients as they try to enhance their motor skills, cognitive skills and speech.

Brain damage can cause a host of social and emotional effects that make psychotherapy an important part of treatment. A greater number of these rehabilitation programs tailored to the specific needs of patients would lead to the growth of this segment as more healthcare providers and rehabilitation centers provide personalized correctional rehabilitation services.

Improving the efficacy of these therapies through novel techniques and technologies is anticipated to improve patient outcomes, thereby expanding the segment.

The growth rate for the chronic brain damage management end-user segment is expected to cross 6.9% CAGR from 2025 to 2035. Institutions should be equipped for the management of brain injuries but will not take over the role of hospitals as the main centers for treating these brain-injured patients for a wide range of diagnoses and therapies.

Specializing in brain health and neurological disorders, neurology clinics will also be in greater demand, providing patients with concentrated management and more advanced treatment options.

Independent pharmacies will be critical in providing patients the medications, rehabilitation devices and treatment aids they need particularly patients managing their disease at home. As the awareness of brain injuries and chronic brain damage continues to grow, these settings will be instrumental in delivering comprehensive care, fuelling the segment's continuous growth.

The treatment industry for chronic brain damage is fragmented, with many companies competing based on price, innovation, collaboration, and expansion.

In January 2025, Johnson & Johnson bought Intra-Cellular Therapies for $14.6 billion to strengthen its portfolio in neuroscience with treatments for neurological disorders in the central nervous system.

In October 2024, Lundbeck signed a deal to buy Longboard Pharmaceuticals for $2.6 billion to gain access to its epilepsy drug, bexicaserin, for treating severe childhood epilepsies. These strategic steps indicate the sector's emphasis on building neurological treatment choices through huge investments and acquisitions.

Medtronic plc commands a dominant share of approximately 28% in the chronic brain damage management industry. Its leadership is not accidental it stems from a deliberate long-term bet on building a diversified portfolio of neuromodulation and neuro-monitoring devices.

Rather than relying purely on organic product innovation, Medtronic invested heavily in acquiring adjacent technologies and integrating them into holistic treatment solutions, making it the default partner for hospitals and neurological rehabilitation centers worldwide.

Boston Scientific Corporation holds around 22% of the market, a reflection of its strategic pivot over the past decade. Recognizing that neurology would outpace traditional cardiovascular markets in growth, the company aggressively expanded its neurological division through selective acquisitions and internal R&D.

Its stronghold today is anchored by rehabilitation technologies that move beyond basic symptom management into functional recovery a subtle but crucial shift, signaling its ambition to dominate outcome-driven therapies rather than commoditized device sales.

Abbott Laboratories, with an estimated 17% market share, has positioned itself as a technological innovator rather than a traditional medical device manufacturer. Its focus on brain-computer interface technologies - once considered speculative has paid off as adoption rates climbed, especially among elite neurorehabilitation clinics. Abbott’s neurological monitoring systems, which seamlessly integrate with broader healthcare platforms, have further strengthened its ecosystem lock-in, making switching costs for hospitals prohibitively high.

Johnson & Johnson captures about 14% of the industry, demonstrating the power of cross-division integration. Unlike competitors that rely solely on devices, J&J's playbook leverages its pharmaceutical assets to deliver a fuller continuum of care: surgical solutions supported by drug therapies tailored for neuroprotection and cognitive recovery.

This integrated strategy is both its strength and its weakness while it offers bundled solutions that others struggle to match, it also exposes J&J to regulatory complexity and slower product cycles compared to pure-play neurotechnology firms.

The remaining 19% of the market is fragmented among smaller players like Nevro Corp, Liva Nova PLC, and a growing cohort of neurotechnology startups. These challengers are not merely "filling gaps" many are attacking the fundamental assumptions of legacy players, pioneering new modalities such as closed-loop neuromodulation, neuroplasticity-driven rehabilitation, and minimally invasive brain repair techniques.

Although their market share today is small, their existential threat to incumbents is growing, especially as venture capital and government grants increasingly flow toward disruptive neurological technologies rather than incremental device improvements.

Imaging studies, Blood tests, Brain evaluations

Occupational therapy, Physical therapy, Psychotherapy, Speech or language therapy

Hospitals, Neurology Clinics, Independent Pharmacies

North America, Latin America, Europe, East Asia, South Asia, Oceania, Middle East & Africa

The primary treatments include occupational therapy, physical therapy, psychotherapy, and speech or language therapy.

It is diagnosed through imaging studies, blood tests, and brain evaluations.

North America, Europe, and East Asia are expected to see significant growth in the coming years.

Hospitals are the primary settings for diagnosing and treating chronic brain injuries, offering comprehensive care.

Advanced diagnostic tools and innovative therapies, such as neuro stimulation, are improving treatment outcomes.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Injury Type, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Diagnosis, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by Treatment, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Injury Type, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by Diagnosis, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Treatment, 2018 to 2033

Table 10: North America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by Injury Type, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Diagnosis, 2018 to 2033

Table 14: Latin America Market Value (US$ Million) Forecast by Treatment, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 16: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 17: Europe Market Value (US$ Million) Forecast by Injury Type, 2018 to 2033

Table 18: Europe Market Value (US$ Million) Forecast by Diagnosis, 2018 to 2033

Table 19: Europe Market Value (US$ Million) Forecast by Treatment, 2018 to 2033

Table 20: Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 21: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: South Asia Market Value (US$ Million) Forecast by Injury Type, 2018 to 2033

Table 23: South Asia Market Value (US$ Million) Forecast by Diagnosis, 2018 to 2033

Table 24: South Asia Market Value (US$ Million) Forecast by Treatment, 2018 to 2033

Table 25: South Asia Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 26: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 27: East Asia Market Value (US$ Million) Forecast by Injury Type, 2018 to 2033

Table 28: East Asia Market Value (US$ Million) Forecast by Diagnosis, 2018 to 2033

Table 29: East Asia Market Value (US$ Million) Forecast by Treatment, 2018 to 2033

Table 30: East Asia Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 31: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Oceania Market Value (US$ Million) Forecast by Injury Type, 2018 to 2033

Table 33: Oceania Market Value (US$ Million) Forecast by Diagnosis, 2018 to 2033

Table 34: Oceania Market Value (US$ Million) Forecast by Treatment, 2018 to 2033

Table 35: Oceania Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 36: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 37: MEA Market Value (US$ Million) Forecast by Injury Type, 2018 to 2033

Table 38: MEA Market Value (US$ Million) Forecast by Diagnosis, 2018 to 2033

Table 39: MEA Market Value (US$ Million) Forecast by Treatment, 2018 to 2033

Table 40: MEA Market Value (US$ Million) Forecast by End User, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Injury Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Diagnosis, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Treatment , 2023 to 2033

Figure 4: Global Market Value (US$ Million) by End User, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Injury Type, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Injury Type, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Injury Type, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Diagnosis, 2018 to 2033

Figure 13: Global Market Value Share (%) and BPS Analysis by Diagnosis, 2023 to 2033

Figure 14: Global Market Y-o-Y Growth (%) Projections by Diagnosis, 2023 to 2033

Figure 15: Global Market Value (US$ Million) Analysis by Treatment , 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Treatment , 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Treatment , 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 21: Global Market Attractiveness by Injury Type, 2023 to 2033

Figure 22: Global Market Attractiveness by Diagnosis, 2023 to 2033

Figure 23: Global Market Attractiveness by Treatment , 2023 to 2033

Figure 24: Global Market Attractiveness by End User, 2023 to 2033

Figure 25: Global Market Attractiveness by Region, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Injury Type, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Diagnosis, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Treatment , 2023 to 2033

Figure 29: North America Market Value (US$ Million) by End User, 2023 to 2033

Figure 30: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by Injury Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Injury Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Injury Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Diagnosis, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Diagnosis, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Diagnosis, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Treatment , 2018 to 2033

Figure 41: North America Market Value Share (%) and BPS Analysis by Treatment , 2023 to 2033

Figure 42: North America Market Y-o-Y Growth (%) Projections by Treatment , 2023 to 2033

Figure 43: North America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 44: North America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 45: North America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 46: North America Market Attractiveness by Injury Type, 2023 to 2033

Figure 47: North America Market Attractiveness by Diagnosis, 2023 to 2033

Figure 48: North America Market Attractiveness by Treatment , 2023 to 2033

Figure 49: North America Market Attractiveness by End User, 2023 to 2033

Figure 50: North America Market Attractiveness by Country, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Injury Type, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Diagnosis, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) by Treatment , 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) by End User, 2023 to 2033

Figure 55: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 56: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 57: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 58: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 59: Latin America Market Value (US$ Million) Analysis by Injury Type, 2018 to 2033

Figure 60: Latin America Market Value Share (%) and BPS Analysis by Injury Type, 2023 to 2033

Figure 61: Latin America Market Y-o-Y Growth (%) Projections by Injury Type, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) Analysis by Diagnosis, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Diagnosis, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Diagnosis, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Treatment , 2018 to 2033

Figure 66: Latin America Market Value Share (%) and BPS Analysis by Treatment , 2023 to 2033

Figure 67: Latin America Market Y-o-Y Growth (%) Projections by Treatment , 2023 to 2033

Figure 68: Latin America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 69: Latin America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 70: Latin America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Injury Type, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Diagnosis, 2023 to 2033

Figure 73: Latin America Market Attractiveness by Treatment , 2023 to 2033

Figure 74: Latin America Market Attractiveness by End User, 2023 to 2033

Figure 75: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 76: Europe Market Value (US$ Million) by Injury Type, 2023 to 2033

Figure 77: Europe Market Value (US$ Million) by Diagnosis, 2023 to 2033

Figure 78: Europe Market Value (US$ Million) by Treatment , 2023 to 2033

Figure 79: Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 80: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 81: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 82: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 83: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 84: Europe Market Value (US$ Million) Analysis by Injury Type, 2018 to 2033

Figure 85: Europe Market Value Share (%) and BPS Analysis by Injury Type, 2023 to 2033

Figure 86: Europe Market Y-o-Y Growth (%) Projections by Injury Type, 2023 to 2033

Figure 87: Europe Market Value (US$ Million) Analysis by Diagnosis, 2018 to 2033

Figure 88: Europe Market Value Share (%) and BPS Analysis by Diagnosis, 2023 to 2033

Figure 89: Europe Market Y-o-Y Growth (%) Projections by Diagnosis, 2023 to 2033

Figure 90: Europe Market Value (US$ Million) Analysis by Treatment , 2018 to 2033

Figure 91: Europe Market Value Share (%) and BPS Analysis by Treatment , 2023 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections by Treatment , 2023 to 2033

Figure 93: Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 94: Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 95: Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 96: Europe Market Attractiveness by Injury Type, 2023 to 2033

Figure 97: Europe Market Attractiveness by Diagnosis, 2023 to 2033

Figure 98: Europe Market Attractiveness by Treatment , 2023 to 2033

Figure 99: Europe Market Attractiveness by End User, 2023 to 2033

Figure 100: Europe Market Attractiveness by Country, 2023 to 2033

Figure 101: South Asia Market Value (US$ Million) by Injury Type, 2023 to 2033

Figure 102: South Asia Market Value (US$ Million) by Diagnosis, 2023 to 2033

Figure 103: South Asia Market Value (US$ Million) by Treatment , 2023 to 2033

Figure 104: South Asia Market Value (US$ Million) by End User, 2023 to 2033

Figure 105: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 106: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 107: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 108: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 109: South Asia Market Value (US$ Million) Analysis by Injury Type, 2018 to 2033

Figure 110: South Asia Market Value Share (%) and BPS Analysis by Injury Type, 2023 to 2033

Figure 111: South Asia Market Y-o-Y Growth (%) Projections by Injury Type, 2023 to 2033

Figure 112: South Asia Market Value (US$ Million) Analysis by Diagnosis, 2018 to 2033

Figure 113: South Asia Market Value Share (%) and BPS Analysis by Diagnosis, 2023 to 2033

Figure 114: South Asia Market Y-o-Y Growth (%) Projections by Diagnosis, 2023 to 2033

Figure 115: South Asia Market Value (US$ Million) Analysis by Treatment , 2018 to 2033

Figure 116: South Asia Market Value Share (%) and BPS Analysis by Treatment , 2023 to 2033

Figure 117: South Asia Market Y-o-Y Growth (%) Projections by Treatment , 2023 to 2033

Figure 118: South Asia Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 119: South Asia Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 120: South Asia Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 121: South Asia Market Attractiveness by Injury Type, 2023 to 2033

Figure 122: South Asia Market Attractiveness by Diagnosis, 2023 to 2033

Figure 123: South Asia Market Attractiveness by Treatment , 2023 to 2033

Figure 124: South Asia Market Attractiveness by End User, 2023 to 2033

Figure 125: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 126: East Asia Market Value (US$ Million) by Injury Type, 2023 to 2033

Figure 127: East Asia Market Value (US$ Million) by Diagnosis, 2023 to 2033

Figure 128: East Asia Market Value (US$ Million) by Treatment , 2023 to 2033

Figure 129: East Asia Market Value (US$ Million) by End User, 2023 to 2033

Figure 130: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 131: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 132: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: East Asia Market Value (US$ Million) Analysis by Injury Type, 2018 to 2033

Figure 135: East Asia Market Value Share (%) and BPS Analysis by Injury Type, 2023 to 2033

Figure 136: East Asia Market Y-o-Y Growth (%) Projections by Injury Type, 2023 to 2033

Figure 137: East Asia Market Value (US$ Million) Analysis by Diagnosis, 2018 to 2033

Figure 138: East Asia Market Value Share (%) and BPS Analysis by Diagnosis, 2023 to 2033

Figure 139: East Asia Market Y-o-Y Growth (%) Projections by Diagnosis, 2023 to 2033

Figure 140: East Asia Market Value (US$ Million) Analysis by Treatment , 2018 to 2033

Figure 141: East Asia Market Value Share (%) and BPS Analysis by Treatment , 2023 to 2033

Figure 142: East Asia Market Y-o-Y Growth (%) Projections by Treatment , 2023 to 2033

Figure 143: East Asia Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 144: East Asia Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 145: East Asia Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 146: East Asia Market Attractiveness by Injury Type, 2023 to 2033

Figure 147: East Asia Market Attractiveness by Diagnosis, 2023 to 2033

Figure 148: East Asia Market Attractiveness by Treatment , 2023 to 2033

Figure 149: East Asia Market Attractiveness by End User, 2023 to 2033

Figure 150: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 151: Oceania Market Value (US$ Million) by Injury Type, 2023 to 2033

Figure 152: Oceania Market Value (US$ Million) by Diagnosis, 2023 to 2033

Figure 153: Oceania Market Value (US$ Million) by Treatment , 2023 to 2033

Figure 154: Oceania Market Value (US$ Million) by End User, 2023 to 2033

Figure 155: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 158: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 159: Oceania Market Value (US$ Million) Analysis by Injury Type, 2018 to 2033

Figure 160: Oceania Market Value Share (%) and BPS Analysis by Injury Type, 2023 to 2033

Figure 161: Oceania Market Y-o-Y Growth (%) Projections by Injury Type, 2023 to 2033

Figure 162: Oceania Market Value (US$ Million) Analysis by Diagnosis, 2018 to 2033

Figure 163: Oceania Market Value Share (%) and BPS Analysis by Diagnosis, 2023 to 2033

Figure 164: Oceania Market Y-o-Y Growth (%) Projections by Diagnosis, 2023 to 2033

Figure 165: Oceania Market Value (US$ Million) Analysis by Treatment , 2018 to 2033

Figure 166: Oceania Market Value Share (%) and BPS Analysis by Treatment , 2023 to 2033

Figure 167: Oceania Market Y-o-Y Growth (%) Projections by Treatment , 2023 to 2033

Figure 168: Oceania Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 169: Oceania Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 170: Oceania Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 171: Oceania Market Attractiveness by Injury Type, 2023 to 2033

Figure 172: Oceania Market Attractiveness by Diagnosis, 2023 to 2033

Figure 173: Oceania Market Attractiveness by Treatment , 2023 to 2033

Figure 174: Oceania Market Attractiveness by End User, 2023 to 2033

Figure 175: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 176: MEA Market Value (US$ Million) by Injury Type, 2023 to 2033

Figure 177: MEA Market Value (US$ Million) by Diagnosis, 2023 to 2033

Figure 178: MEA Market Value (US$ Million) by Treatment , 2023 to 2033

Figure 179: MEA Market Value (US$ Million) by End User, 2023 to 2033

Figure 180: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 181: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 182: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 183: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 184: MEA Market Value (US$ Million) Analysis by Injury Type, 2018 to 2033

Figure 185: MEA Market Value Share (%) and BPS Analysis by Injury Type, 2023 to 2033

Figure 186: MEA Market Y-o-Y Growth (%) Projections by Injury Type, 2023 to 2033

Figure 187: MEA Market Value (US$ Million) Analysis by Diagnosis, 2018 to 2033

Figure 188: MEA Market Value Share (%) and BPS Analysis by Diagnosis, 2023 to 2033

Figure 189: MEA Market Y-o-Y Growth (%) Projections by Diagnosis, 2023 to 2033

Figure 190: MEA Market Value (US$ Million) Analysis by Treatment , 2018 to 2033

Figure 191: MEA Market Value Share (%) and BPS Analysis by Treatment , 2023 to 2033

Figure 192: MEA Market Y-o-Y Growth (%) Projections by Treatment , 2023 to 2033

Figure 193: MEA Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 194: MEA Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 195: MEA Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 196: MEA Market Attractiveness by Injury Type, 2023 to 2033

Figure 197: MEA Market Attractiveness by Diagnosis, 2023 to 2033

Figure 198: MEA Market Attractiveness by Treatment , 2023 to 2033

Figure 199: MEA Market Attractiveness by End User, 2023 to 2033

Figure 200: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Chronic Sarcoidosis Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Chronic Phase Markers Market Size and Share Forecast Outlook 2025 to 2035

Chronic Venous Occlusions Treatment Market Size and Share Forecast Outlook 2025 to 2035

Chronic Lymphocytic Leukemia Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Chronic Lymphocytic Leukemia Market Size and Share Forecast Outlook 2025 to 2035

Chronic Dryness Repair Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Chronic Skin Redness Care Market Size and Share Forecast Outlook 2025 to 2035

Chronic immune thrombocytopenia treatment Market Size and Share Forecast Outlook 2025 to 2035

Chronic Hepatitis B Virus Testing Market Size and Share Forecast Outlook 2025 to 2035

The Chronic Wound Care Market is segmented by product, wound type and distribution channel from 2025 to 2035

Chronic Pulmonary Hypertension Treatment Market Analysis and Forecast by Drug Type, Route of Administration, Distribution Channel, Region through 2035

Chronic Smell and Flavor Loss Treatment Market – Innovations & Growth 2025 to 2035

Chronic Refractory Cough Treatment Market – Growth & Innovations 2025 to 2035

Chronic Pain Market Analysis – Growth, Demand & Forecast 2024 to 2034

Chronic Obstructive Pulmonary Disease (COPD) Market Trends – Growth & Forecast 2023-2033

Chronic Respiratory Diseases Treatment Market

Chronic Disease Management Market Size and Share Forecast Outlook 2025 to 2035

Chronic Granulomatous Disease (CGD) Management Market – Size, Share & Trends 2025 to 2035

Late Stage Chronic Kidney Disease Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Brain Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA