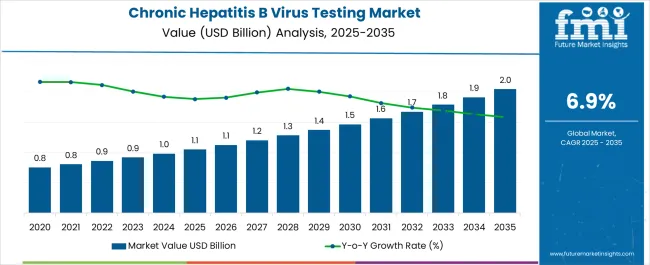

The Chronic Hepatitis B Virus Testing Market is estimated to be valued at USD 1.1 billion in 2025 and is projected to reach USD 2.0 billion by 2035, registering a compound annual growth rate (CAGR) of 6.9% over the forecast period.

| Metric | Value |

|---|---|

| Chronic Hepatitis B Virus Testing Market Estimated Value in (2025 E) | USD 1.1 billion |

| Chronic Hepatitis B Virus Testing Market Forecast Value in (2035 F) | USD 2.0 billion |

| Forecast CAGR (2025 to 2035) | 6.9% |

The chronic hepatitis B virus testing market is witnessing consistent growth owing to rising global prevalence of hepatitis infections, expanding awareness programs, and increasing emphasis on early disease detection. Growing adoption of routine screening in high risk populations, along with the integration of advanced diagnostic tools, is driving demand.

Technological advancements in assay design and sensitivity are improving diagnostic accuracy, enabling early intervention and better treatment outcomes. Strong support from healthcare policies and public health campaigns is further strengthening market penetration.

Hospitals and diagnostic laboratories are increasingly deploying advanced testing kits to address the burden of chronic hepatitis B, ensuring reliable and scalable testing capabilities. The market outlook remains positive as healthcare systems continue prioritizing early detection and disease management strategies to curb infection spread and reduce associated healthcare costs.

The enzyme immunoassay kits segment is expected to represent 47.60% of market revenue by 2025 within the product type category, positioning it as the leading segment. This dominance is supported by the high accuracy, affordability, and scalability of these kits in detecting hepatitis B virus markers.

Their ability to process a large number of samples efficiently has encouraged widespread use in both clinical and research settings. Additionally, their adaptability to automation and compatibility with standard laboratory equipment further reinforces adoption.

Growing investments in improving assay sensitivity and specificity are strengthening confidence among healthcare providers, making enzyme immunoassay kits the preferred product type for chronic hepatitis B virus testing.

The hospitals segment is projected to hold 53.20% of the total market revenue by 2025 under the end user category, making it the most dominant. This leadership position is attributed to the rising number of patient admissions for hepatitis testing and treatment, coupled with the availability of advanced diagnostic infrastructure in hospitals.

Comprehensive care models offered in hospitals, including testing, diagnosis, and treatment, have enhanced patient reliance on these facilities. Furthermore, government screening initiatives and reimbursement policies have encouraged patients to undergo testing in hospital settings.

As hospitals continue to expand their diagnostic capabilities with advanced kits and automated analyzers, this end user segment is expected to sustain its market dominance.

According to market research and competitive intelligence provider Future Market Insights- the market for Chronic Hepatitis B Virus Testing reflected a value of 5.1% during the historical period, 2020 to 2024.

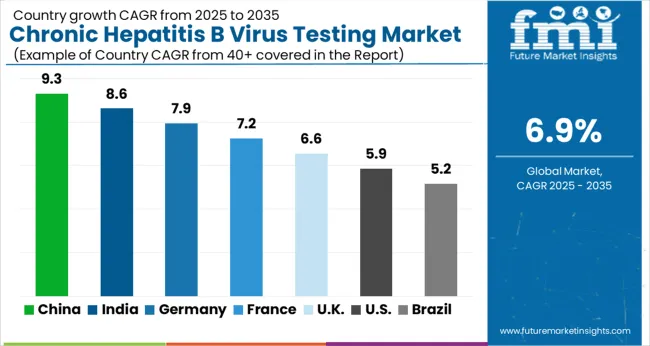

The growth of the market is driven by several factors such as the increasing prevalence of chronic HBV infections, the rising demand for early diagnosis, and the development of advanced diagnostic technologies. The North America region accounted for the largest share of the market, followed by Europe.

This was attributed to the high prevalence of chronic HBV infections in countries such as USA and Canada, as well as the availability of advanced diagnostic technologies in developed countries.Thus, the market for Chronic Hepatitis B Virus Testing is expected to register a CAGR of 6.9% in the forecast period 2025 to 2035.

Rising demand for early diagnosis spurring the demand for testing services

HBV is one of the most common viral infections worldwide, with an estimated 292 million people living with chronic HBV infections. This high prevalence drives the demand for HBV testing and monitoring, as early diagnosis and treatment are crucial to prevent disease progression. Early diagnosis of chronic HBV infection is critical to prevent complications such as cirrhosis and liver cancer. As a result, there is a growing demand for diagnostic tests that can detect the virus in its early stages.

Advances in diagnostic technologies, such as nucleic acid testing (NAT) and point-of-care testing (POCT), have made it easier and faster to detect HBV infections accurately. These technologies have improved the accuracy and sensitivity of HBV testing, leading to more effective diagnosis and treatment.

Governments around the world have launched various initiatives to control the spread of HBV and improve access to testing and treatment. For example, the World Health Organization (WHO) has set a target to eliminate HBV as a public health threat by 2035, which is likely to drive demand for testing.

Public awareness campaigns and education programs have helped to increase awareness about the importance of HBV testing and treatment. As a result, more people are seeking testing for HBV, driving demand for diagnostic tests.

Development of advanced diagnostic technologies bolstering demand for Chronic Hepatitis B Virus Testing Market

Hepatitis B surface antigen (HBsAg) test: This test detects the presence of the HBV surface antigen in the blood, which indicates an active HBV infection.

Hepatitis B core antibody (anti-HBc) test: This test detects the presence of antibodies to the HBV core antigen, which indicates a previous or ongoing HBV infection.

Hepatitis B surface antibody (anti-HBs) test: This test detects the presence of antibodies to the HBV surface antigen, which indicates immunity to HBV or successful vaccination against HBV.

Hepatitis B e antigen (HBeAg) test: This test detects the presence of the HBeAg protein, which indicates active viral replication and a higher risk of transmitting the virus to others.

Hepatitis B viral load test: This test measures the amount of HBV DNA in the blood, which can help to monitor the progression of the infection and the effectiveness of treatment.

Liver function tests: These tests measure levels of enzymes and proteins in the blood that are produced by the liver, such as alanine aminotransferase (ALT) and aspartate aminotransferase (AST), which can indicate liver damage or disease.

Limited access to testing in developing countries along with high cost of testing affecting market growth

Access to testing for chronic HBV infections can be limited in developing countries due to factors such as a lack of healthcare infrastructure, limited resources, and poor public awareness of the disease. The cost of diagnostic tests for chronic HBV infections can be high, which may limit access for some patients, particularly those without adequate insurance coverage.

The accuracy of diagnostic tests for chronic HBV infections can vary, leading to false-positive or false-negative results. This can lead to delays in diagnosis and treatment or unnecessary treatment and monitoring. Stigma and discrimination surrounding HBV infection can deter some patients from seeking testing and treatment, particularly in certain cultures where there may be a strong association between the disease and social stigma.

Many people are unaware of the risk factors for HBV infection and the importance of testing and treatment. This can lead to a lack of demand for testing and lower rates of diagnosis and treatment. While there are treatments available for chronic HBV infection, they may not be effective for all patients and can have significant side effects. This can make it difficult to manage the disease and may limit the effectiveness of testing in some cases.

Presence of established healthcare infrastructure propelling market growth in North America

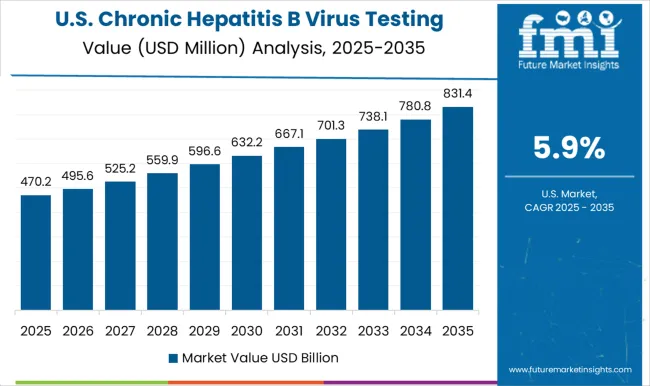

The market growth in North America is driven by factors such as the high prevalence of chronic HBV infection in the region, increasing awareness about the importance of early diagnosis and treatment, and the availability of advanced diagnostic technologies. Additionally, the presence of established healthcare infrastructure and favorable government initiatives to control the spread of HBV have contributed to the growth of the market.

Factors such as a large patient population and a strong focus on research and development in the healthcare industry are contributing to the growth of the market. However, the market in Canada is also expected to grow at a significant rate, driven by factors such as increasing public awareness and government initiatives to improve access to testing and treatment.

Overall, the North America Chronic Hepatitis B Virus Testing Market is expected to continue to grow in the coming years, driven by factors such as increasing demand for accurate and reliable diagnostic tests and a growing focus on disease prevention and management in the healthcare industry. Thus, North America is expected to possess 44% market share for Chronic Hepatitis B Virus Testing Market in 2025.

Increasing number of people undergoing HBV testing boosting market growth

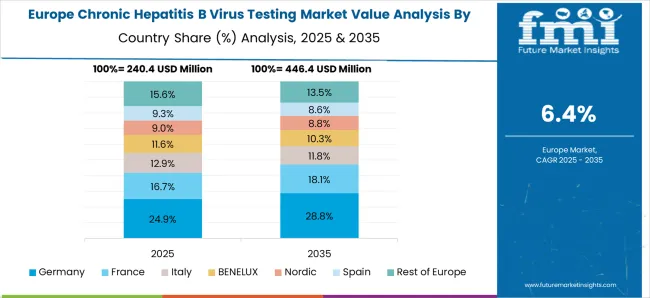

Factors such as increasing demand for accurate and reliable diagnostic tests and a growing focus on disease prevention and management in the healthcare industry is driving the growth of the market in Europe. The market is also expected to grow at a significant rate, driven by factors such as increasing public awareness and government initiatives to improve access to testing and treatment. In addition, the European governments are focusing on developing programs for early detection and treatment of hepatitis B virus infection. This has led to an increase in the number of people undergoing HBV testing, which is driving the growth of the market.

There have been significant advancements in the development of testing technologies for HBV, such as point-of-care tests and nucleic acid testing. This has made testing more accessible and affordable, which has contributed to the growth of the market. Overall, the Europe Chronic Hepatitis B Virus Testing Market is expected to continue to grow in the coming years. Thus, Europe is expected to possess 39% market share for Chronic Hepatitis B Virus Testing Market in 2025.

Reliable results maximizing use of EIA kits for testing Chronic Hepatitis B Virus Testing

Enzyme Immunoassay (EIA) kits are widely used for Chronic Hepatitis B Virus (HBV) Testing, and they are considered to be a reliable and accurate option for detecting HBV infection. EIA kits are laboratory-based tests that detect specific antibodies or antigens to HBV in a patient's blood sample.

EIA kits are highly sensitive and specific, meaning that they can accurately detect the presence of HBV in a patient's blood with a low rate of false-positive or false-negative results. They are also easy to use and can provide results within a short period of time, typically within a few hours. Thus, EIA kits are expected to hold 53% market share for Chronic Hepatitis B Virus Testing Market in 2025.

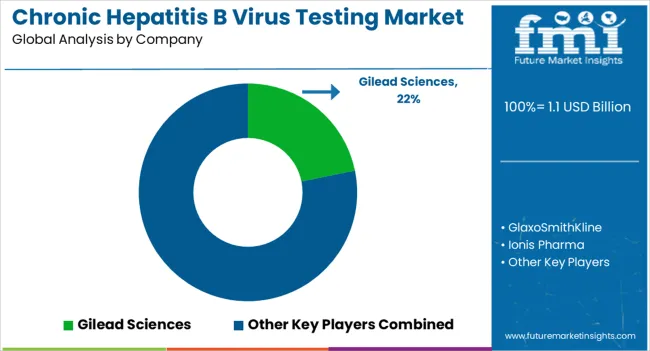

Key players in the Chronic Hepatitis B Virus Testing market are Gilead Sciences, GlaxoSmithKline, Ionis Pharma, Janssen Sciences Ireland, Assembly Biosciences, Janssen and Arrowhead Pharmaceuticals, Roche, Vir Biotechnology, Bio-Rad Laboratories, Inc., DiaSorin S.p.A., Abbott Laboratories, Meridian Bioscience

| Report Attribute | Details |

|---|---|

| Market Value in 2025 | USD 1.1 billion |

| Market Value in 2035 | USD 2.0 billion |

| Growth Rate | CAGR of 6.9% from 2025 to 2035 |

| Base Year for Estimation | 2025 |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

| Segments Covered | Product Type, End User, RegionProduct Type, End User, Region |

| Regions Covered | North America; Latin America; Europe; South Asia; East Asia; Oceania; Middle East & Africa |

| Key Countries Profiled | USA, Canada, Brazil, Mexico, Rest of Latin America, Germany, United Kingdom, France, Spain, Italy, Rest of Europe, India, Malaysia, Singapore, Thailand, Rest of South Asia, China, Japan, South Korea, Austria, New Zealand, GCC countries, South Africa, Israel, Rest of MEA |

| Key Companies Profiled | Gilead Sciences; GlaxoSmithKline; Ionis Pharma; Janssen Sciences Ireland; Assembly Biosciences; Janssen and Arrowhead Pharmaceuticals; Roche; Vir Biotechnology; Bio-Rad Laboratories, Inc.; DiaSorin S.p.A.; Abbott Laboratories; Meridian Bioscience |

| Customization | Available Upon Request |

The global chronic hepatitis b virus testing market is estimated to be valued at USD 1.1 billion in 2025.

The market size for the chronic hepatitis b virus testing market is projected to reach USD 2.0 billion by 2035.

The chronic hepatitis b virus testing market is expected to grow at a 6.9% CAGR between 2025 and 2035.

The key product types in chronic hepatitis b virus testing market are enzyme immunoassay kits, hepatitis b surface antigen test, anti-hepatitis b surface antibody test, anti-hepatitis b core antibody test and point-of-care testing kits.

In terms of end user, hospitals segment to command 53.2% share in the chronic hepatitis b virus testing market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Chronic Sarcoidosis Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Chronic Phase Markers Market Size and Share Forecast Outlook 2025 to 2035

Chronic Venous Occlusions Treatment Market Size and Share Forecast Outlook 2025 to 2035

Chronic Lymphocytic Leukemia Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Chronic Lymphocytic Leukemia Market Size and Share Forecast Outlook 2025 to 2035

Chronic Dryness Repair Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Chronic Skin Redness Care Market Size and Share Forecast Outlook 2025 to 2035

The Chronic Wound Care Market is segmented by product, wound type and distribution channel from 2025 to 2035

Chronic Disease Management Market Size and Share Forecast Outlook 2025 to 2035

Chronic Pulmonary Hypertension Treatment Market Analysis and Forecast by Drug Type, Route of Administration, Distribution Channel, Region through 2035

Chronic Smell and Flavor Loss Treatment Market – Innovations & Growth 2025 to 2035

Chronic Granulomatous Disease (CGD) Management Market – Size, Share & Trends 2025 to 2035

Chronic Refractory Cough Treatment Market – Growth & Innovations 2025 to 2035

Chronic Pain Market Analysis – Growth, Demand & Forecast 2024 to 2034

Chronic Respiratory Diseases Treatment Market

Chronic Brain Damage Treatment: Trends, Growth, and Key Developments

Chronic Obstructive Pulmonary Disease (COPD) Market Trends – Growth & Forecast 2023-2033

Chronic immune thrombocytopenia treatment Market Size and Share Forecast Outlook 2025 to 2035

Late Stage Chronic Kidney Disease Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Hepatitis C Virus (HCV) Testing Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA