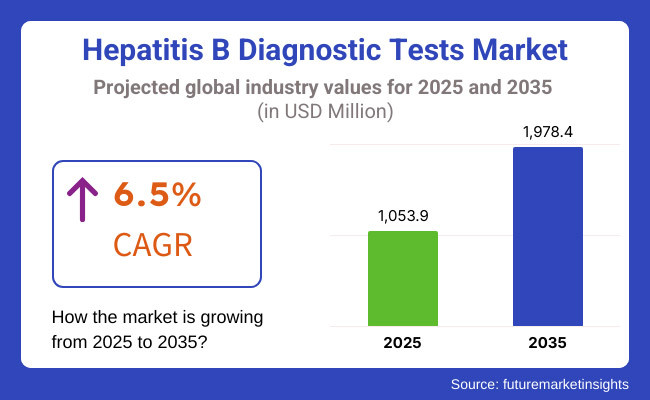

The hepatitis b diagnostic tests market is expected to reach approximately USD 1,053.9 million in 2025 and expand to around USD 1,978.4 million by 2035, reflecting a compound annual growth rate (CAGR) of 6.5% over the forecast period.

The growth trend for the Hepatitis B diagnostics tests market is not suddenly perceived as such but is rather a gradual increase in disease burden awareness as well as the public awareness at large concerning early detection.

Healthcare and government organizations have scaled up screening exercises in high-prevalence areas, thereby adding to the increasing demand for reliable diagnostic solutions. Current technologies for testing such as PCR-based assays for improved detection accuracy and enzyme immunoassays (EIA) are now allowing intervention and management of the disease at a much earlier stage.

Major improvements in the field of diagnostics have further strengthened the market prospects. Production of quick test kits and point-of-care devices has rendered more remote and resource-limited areas accessible. In addition, multiplex testing platforms permit simultaneous detection of hepatitis B and co-infections, improving the efficiency and outcomes for the patient.

There is also increased investment towards diagnostic infrastructure and government-supported screening programs, ultimately resulting in the market presence of available tests, besides promising measures for better disease control efforts worldwide.

Growth rates in the Hepatitis B Diagnostic Tests Market have been steadily rising over time due to increasing rates of hepatitis B infection, increased awareness about early diagnosis and treatment, as well as developments in diagnostic technology.

In the beginning, the market was almost entirely based on conventional serological tests, ELISA being widely used due to high sensitivity and specificity. Gradually, however, the advent of molecular diagnostic technology (e.g. PCR) further improved detection accuracy, encouraging greater acceptance.

The market has also changed with the introduction of POC testing kits, which offer rapid and easy to perform testing, especially in resource-limited settings. Government-sponsored screening programs along with vaccination campaigns have boosted much demand.

Emerging trends of automated and multiplexed diagnostic platforms have also enhanced efficiency across centralized laboratories and decentralized healthcare facilities. Partnerships between medical and diagnostic businesses are growing into a greater access to market and shaping the future of innovations in hepatitis B diagnostics.

The North American Hepatitis B diagnostics tests market is growing because of mounting public health campaigns, high adoption of advanced diagnostic technologies, and robust presence of major diagnostic companies. The USA dominates the region on the back of widespread screening programs, presence of FDA-approved diagnostic assays, and growing awareness regarding Hepatitis B vaccinations and early diagnosis.

Challenges such as elevated prices of molecular diagnostic tests, health care disparities, and compliance regulations cap market expansion. Expansion in the usage of quick POC tests, increase in digital health platforms for screening hepatitis, and increasing collaboration among diagnostic companies and health care agencies are poised to spur future growth in North America.

Europe is one of the important markets for hepatitis B diagnostic tests wherein there are strong government initiatives and investments going up for infectious disease diagnostics while the other one is the growing need for home-based and self-testing kits. Major marker countries like Germany, France, and the UK are benefiting from very well-structured healthcare systems, government-backed screening programs, and increased acceptance of both serological and molecular methods.

Challenges expected to affect the market expansions include the regulatory complexities under the European Medicines Agency (EMA), differences in national healthcare policies, and budget constraints facing public health programs.

Further shaping the European market landscape are the rising interests in early detection strategies, increased investments into next-generation diagnostic tools, and expansion of initiatives designed to eliminate hepatitis. AI-assisted diagnostics and digital integration of patient records are further optimising hepatitis screening and management efficiency through technology advancements.

The Asia-Pacific region is experiencing a surge in the Hepatitis B diagnostic tests market with large disease burden, improving government-initiated awareness activities, and growing adoption of economical rapid test kits. China, India, and Japan are the major markets with developing healthcare infrastructure, rising demand for mass screening programs for hepatitis, and a growing interest in research on diagnostics.

Still, affordability concerns, absence of standard testing protocols, and scarcity of molecular tests in rural regions can act as deterrents to market penetration. The rising number of international diagnostic companies, growth in decentralized testing laboratories, and increased government health agencies-private sector partnerships are propelling market growth. In addition, improved mobile-based diagnostic programs and rising availability of low-cost, high-sensitivity rapid test kits are enhancing early detection levels in the region.

Challenges

Limited Access to Screening in Low-Income Regions is Significantly Affecting the Overall Market Growth

Major challenges exist for the Hepatitis B diagnostic market in low-income areas due to lack of healthcare infrastructure, advanced testing technologies, and qualified healthcare professionals. Most health facilities in developing countries are ill-equipped to provide adequate Hepatitis B screening, leading to gross under-diagnosis of the disease.

Such prolonged and grossly lopsided diagnoses raise transmission risks and contribute heavily to the already unhealthy burden of chronic hepatitis complications, namely cirrhosis and hepatocellular carcinoma.

On top of that, the financial front turns against governments and health organizations willing to perform extensive screening methods unlike the ones currently in place. This means that the high price of diagnostics, especially for PCR and ELISA, has made them inaccessible to most at-risk populations.

On top of that, the geographic barriers, especially for those residing in rural or interior communities where health facilities hardly reach, further complicate the matter. Compounding this is the fact that, without enough screening programs, unaware infectees will remain just that, undiagnosed, with delayed treatment only beginning to augment the already elevated disease burden within such localities.

Opportunities

Advancements in Molecular and Multiplex Diagnostic Technologies Emerging as an Upcoming Opportunity for Manufacturers

Hepatitis B diagnostics tests market has substantial growth potential with increasing demand for rapid home-based diagnostic kits, the expansion of AI-based diagnostic platforms, and increasing acceptance of portable molecular testing devices. Developments in multiplex diagnostic assays for the detection of viral markers, integration of blockchain for secure management of diagnostic data, and expansion of hepatitis awareness programs by global health organizations drive the market.

Rising research on innovative biosensor-based hepatitis detection systems, growing direct-to-consumer testing services, and development of smart diagnostic instruments for remote screening may provide new avenues for industry growth. Further innovations are spearheaded and made accessible due to growing partnerships between biotech firms and government agencies aimed at eradicating Hepatitis B.

The increasing demand for home-based and point-of-care (POC) testing is transforming the Hepatitis B diagnostic landscape.

There is a specific relevance of this trend to remote, underserved regions, where lack of infrastructure and limited finances prevent people from reaching a diagnostic facility. POC testing is being promoted actively by governments and healthcare organizations to improve screening rates and ensure early intervention via decreased disease progression risk. Advancements in lateral flow assays and nucleic acid-based POC devices boost test accuracy and reliability, further improving the adoption of home-based Hepatitis B diagnostics systems.

Governments and healthcare organizations are proactively campaigning for home-based testing to enhance disease surveillance and control. Such testing initiatives are being supported by various NGOs and public health agencies that conduct awareness programs and subsidized testing to motivate increased screening.

Advancements in diagnostics now include lateral flow assays and nucleic acid-based POC devices, which enhance test accuracy, sensitivity, and specificity in bringing these tests closer to reliability of using conventional laboratory alternative methods.

The application of both multiplex and smart diagnostic solutions is affecting changes in the Immunodiagnostics for Moldova revolution in the Hepatitis B diagnostic test market.

The major innovation that multiplex and smart diagnostic solutions bring into the Hepatitis B diagnostics field is simultaneous detection of multiple infectious diseases in a single test. Indeed, conventional strategies leave separate assays for each pathogen, increasing the testing costs, time for processing, and resource utilization.

However, advanced multiplex diagnostic platforms engage in the more-likely-done simultaneous identification for Hepatitis B along with other co-infections such as Hepatitis C, among others, HIV, and other viral or bacterial pathogens.

These innovations are meant for high-risk sections of the population, such as those immunocompromised, and in endemic regions, where co-infections suffer greatly. Smart technologies for diagnosis complement automation, artificial intelligence in data analysis interpretation, and connectivity through clouds.

Through such changes, the smart methods lead to really enhancing productivity as well as the manual error-free process of contacting patients remotely. They contribute significantly to strengthening the global control and prevention of Hepatitis B through improving diagnostic accuracy, reducing turnaround time, and enabling comprehensive disease management.

Between 2020 and 2024, the Hepatitis B diagnostic tests market witnessed steady growth due to increasing global disease prevalence, heightened awareness, and expanded screening programs. Advances in enzyme immunoassay (EIA) kits, polymerase chain reaction (PCR) assays, and rapid point-of-care (POC) testing improved diagnostic accuracy and accessibility. Government-led hepatitis elimination initiatives and collaborations with international health organizations further boosted early detection efforts.

From 2025 to 2035, market expansion will be driven by the adoption of cost-effective, high-sensitivity diagnostic solutions, particularly in resource-limited regions. The development of multiplex testing and non-invasive diagnostic tools will enhance screening efficiency, while improved healthcare infrastructure will ensure broader access.

As the market evolves, manufacturers and healthcare providers must focus on regulatory approvals, strategic partnerships, and continuous innovation to align with global hepatitis elimination goals and meet the growing demand for effective, affordable diagnostic solutions.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Focus on safety and effectiveness of diagnostic tests, regulatory authorities streamlining approvals for pioneering assays for addressing unmet clinical needs. |

| Technological Advancements | Installation of complete guidelines for cutting-edge diagnostic technologies with standard protocols ensuring patient safety while inducing competition and cost-effectiveness. |

| Consumer Demand | Increased adoption of enzyme immunoassays and PCR methods improving diagnostic speed and sensitivity, resulting in better detection rates for Hepatitis B infections. |

| Market Growth Drivers | Increased use of artificial intelligence and machine learning in diagnosis systems speeding up the discovery of new biomarkers and the optimization of test procedures. |

| Sustainability | Greater awareness driving more demand for effective and convenient testing, with patients demanding early detection to control and prevent disease worsening. |

| Supply Chain Dynamics | Increased trend towards individualized and home testing solutions, with consumers and practitioners working together to customize diagnostic processes according to the unique risk factor and health profiles of each. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Focus on safety and effectiveness of diagnostic tests, regulatory authorities streamlining approvals for pioneering assays for addressing unmet clinical needs. |

| Technological Advancements | Installation of complete guidelines for cutting-edge diagnostic technologies with standard protocols ensuring patient safety while inducing competition and cost-effectiveness. |

| Consumer Demand | Increased adoption of enzyme immunoassays and PCR methods improving diagnostic speed and sensitivity, resulting in better detection rates for Hepatitis B infections. |

| Market Growth Drivers | Increased use of artificial intelligence and machine learning in diagnosis systems speeding up the discovery of new biomarkers and the optimization of test procedures. |

| Sustainability | Greater awareness driving more demand for effective and convenient testing, with patients demanding early detection to control and prevent disease worsening. |

| Supply Chain Dynamics | Increased trend towards individualized and home testing solutions, with consumers and practitioners working together to customize diagnostic processes according to the unique risk factor and health profiles of each. |

Market Outlook

Despite being a constant progress of the Hepatitis B diagnostics market in the USA, its growth is due to increasing incidences of Hepatitis B infections and emphasis on detection and treatment at an earlier stage. Due to various public health initiatives such as awareness campaigns and government vaccination programs, an improved contribution has been seen with regard to screening rates.

As mandated by stringent policies within the healthcare system and based on recommendations made by various organizations, such as the CDC and WHO, routine testing is also compellingly favored for this population group, especially those at high risk such as healthcare workers, pregnant women, and people with liver disease.

An advanced healthcare infrastructure propels the growth of the market in view of the emergence of high-precision diagnosing techniques like PCR-based assays, enzyme immunoassay (EIA) methods, and rapid test kits. Continuous investment in research and development has also yielded better and fast-acting diagnostics, with enhanced sensitivity incorporated into Hepatitis B screening procedures across hospitals, diagnosis centers, and community healthcare setups.

Market Growth Factors

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| 2025 to 2035 | 3.2% |

Market Outlook

The Hepatitis B diagnostic testing market in China is expected to be buoyed by the country's enormous disease burden and increasing health expenditure. Among the nations of the world, China has one of the highest prevalence rates for Hepatitis B and thus it has mobilized itself in undertaking extensive screening and vaccination programs against the disease. Government policies aimed at and encouraging early diagnosis and boosting funding for research and diagnostics for hepatitis are helping the market grow.

Growth in the health care infrastructure, especially in rural areas and areas underdeveloped in many parts of the world, allows for the provision of advanced diagnosis, for example, enzyme immunoassays (EIA) and polymerase chain reaction (PCR). Moreover, with the increased accessibility of cost-effective rapid test kits and better reimbursement policies, early detection activities will grow, making Hepatitis B screening geographically more available.

Market Growth Factors

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| 2025 to 2035 | 5.5% |

Market Outlook

The Indian market for hepatitis B diagnosis is on an ever-increasing upward spiral, caused by the high burden of the disease and, indeed, the enhanced awareness of public health. Millions of people are living with hepatitis B, which has forced the government to intensify efforts aimed at early detection through national immunization programs, awareness programs, and mass screening initiatives. These national initiatives are targeted to high-risk groups, including pregnant women, health care workers, and those with liver disease.

The advancement of healthcare systems in remote areas has empowered access to diagnostic facilities. The use of cost-effective solutions, namely rapid test kits and enzyme immunoassays (EIA), has added to the affordability to screen for the disease.

Government-backed schemes, along with increased private sector investments in creating diagnostic infrastructure, further augur well for the growth of the market. More and more hospitals and diagnostic centers are applying advanced polymerase chain reaction (PCR) tests, thus improving accuracy and early detection of diseases across the nation.

Market Growth Factors

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| 2025 to 2035 | 5.9% |

Market Outlook

Germany's Hepatitis B diagnostic tests market is ever-increasing owing to high-end healthcare infrastructure along with a strong research base and active public health policy. In fact, the type of healthcare system that Germany has for early detection of diseases leads to the acceptance of many advanced diagnostic technologies including enzyme immunoassays (EIA), polymerase chain reaction (PCR) assays, and rapid test kits. These methods having high precision improve detection accuracy but also add benefits by making prompt intervention possible.

Research and development orientation within Germany has always been a source of continuous innovation in diagnostic solutions, including multiplex testing platforms to enable simultaneous screening for multiple infections. Initiatives on promoting hepatitis awareness and improved reimbursement policies come from the government and will spur market growth.

Further, there are many auspicious collaborations between research institutions, diagnosis companies, and healthcare providers at work to drive technological advancements forward so that Germany once again takes the lead in Hepatitis B diagnosis and disease management.

Market Growth Factors

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| 2025 to 2035 | 4.1% |

Market Outlook

Because of increased infection rates and continuous efforts made to improve health accessibility, the Hepatitis B diagnostic tests market in Brazil is expanding. The government has set up a nationwide vaccination and screening program used to combat the spread of Hepatitis B from high-risk populations. Public health campaigns, reinforced with the international health organizations, such as WHO and PAHO, are raising awareness and encouraging early detection.

There is also investment in improving access to diagnostic services, for example, health infrastructure in regions that are underserved. The shift to using cost-effective rapid test kits and immunoassays (EIA) here polymerase chain reaction (PCR) assays improves accuracy and efficiency with regard to diagnosis. Moreover, government subsidies coupled with expanded insurance coverage are making Hepatitis B testing affordable, thus adding the impetus behind the market. These collective efforts are ensuring diagnostic reach at the earliest possible intervention and sobering up the movement of disease across Brazil.

Market Growth Factors

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| 2025 to 2035 | 4.3% |

Enzyme Immunoassay (EIA) kits dominate the Hepatitis B diagnostic tests market due to their high widespread applicability in large-scale screening programs.

The increasing global burden of disease related to Hepatitis B is coupled with rising blood transfusion safety regulations, which are paired with the increasing popularity of EIA kits in centralized diagnostic labs. Annexation of North America and Europe-the two regions that have the highest EIA kit usage-is attributed to advanced healthcare infrastructures and strong regulatory guidelines.

Meanwhile, Asia-Pacific has started growing rapidly in the app adoption due to increased awareness and government-led Hepatitis B screening programs. Emerging trends include automated immunoassay analyzers powered by AI, multiplex EIA panels under which Hepatitis B and liver function tests can be carried out simultaneously, and portable EIA systems for decentralized diagnostics in the future.

Point-of-Care (POC) testing kits are gaining traction in the Hepatitis B diagnostic tests market due to their convenience and rapid results

Hepatitis B tests at the point of care (POC) are really becoming better known in settings with limited resources, emergency departments, and general community health programs for fast and early detection. These kits provide results that require laboratory equipment that includes specialized instrumentation and can perform mass screening, rural health testing, and self-testing programs.

The market is expanding because of rising demand for decentralized Hepatitis B testing; increasing awareness from WHO global elimination programs for viral hepatitis; and advancement in rapid immunochromatographic assays. Asia-Pacific and Africa are significant adopters because of the rising prevalence of Hepatitis B but also because access to a centralized laboratory is typically limited.

In North America and Europe, investments are being made in advanced POC devices for real-time monitoring, integration of artificial intelligence with digital POC readers, smartphone-based diagnostic applications for Hepatitis B, and next-generation microfluidic POC kits for improved sensitivity.

Hospitals dominate the end-user segment of the Hepatitis B diagnostic tests market due to their pivotal role in providing diagnosis and treatment to high-risk patients.

Hospitals are the largest end-user for Hepatitis B diagnostic tests, as they are the service-oriented diagnostic centers for inpatients and outpatients, including prenatal testing, emergency cases, and pre-surgical assessments for Hepatitis B. Chronic Hepatitis B cases are also being managed primarily in hospitals, which means repeated serological and liver function tests.

Rising hospitalization cases due to liver complications, increased integration of automated immunoassay systems in hospital laboratories and increasing demand for Hepatitis B screening in surgical wards and in maternity wards drive their market. North America and Europe have more developed hospital-based diagnostics, with Asia-Pacific growing remarkably fast as governments enforce more stringent Hepatitis B screening mandates.

Future trends will involve AI technology for hospital-based diagnostic platforms, automated laboratory workflows integrating Hepatitis B testing with electronic medical records (EMRs), and next-generation rapid hospital-based POC analyzers.

Diagnostic centers dominate the end-user segment of the Hepatitis B diagnostic tests market due to their high-volume testing.

High-throughput centers are gaining popularity as specialized facilities for Hepatitis B testing, especially for blood donor screening, prenatal care, and epidemiological studies. These centers apply advanced serological and molecular diagnostic methods, including PCR and next-generation sequencing, to identify Hepatitis B viral load and mutations.

The increasing demand for earlier detection of Hepatitis B, growing government support for the establishment of centralized diagnostic facilities, and increased partnerships from the public health side with diagnostic chains are driving growth of the market. North America and Europe have been leaders in the high-end diagnostics center testing, whereas Asia-Pacific is witnessing growth because of the healthcare investment in infectious disease diagnostics.

Future innovations are expected to include cloud-based diagnostic platforms for Hepatitis B screening, AI predictive analytics enabling viral load assessment, and multiplexed molecular tests combining Hepatitis B with liver disease biomarkers.

The market for diagnostic tests for Hepatitis B is rather competitive, propelled by the increasing number of hepatitis B infections, the heightened awareness regarding early detection of diseases, and advancements in both molecular and immunoassay-based diagnostic technologies.

In line with this, companies are investing in high-sensitivity rapid test kits, automated lab-based assays, and point-of-care diagnostic solutions to get ahead in competition. The market is constituted by well-established diagnostic firms, biotechnological innovators, and a host of newly emerging manufacturers of tests, all curving the future of hepatitis B testing.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Roche Diagnostics | 22-26% |

| Abbott Laboratories | 18-22% |

| Siemens Healthineers | 10-14% |

| Bio-Rad Laboratories | 8-12% |

| Danaher Corporation (Beckman Coulter) | 5-9% |

| Other Companies (combined) | 25-35% |

| Company Name | Key Offerings/Activities |

|---|---|

| Roche Diagnostics | Market leader offering high-performance hepatitis B molecular and immunoassay testing solutions. |

| Abbott Laboratories | Develops advanced hepatitis B diagnostic platforms, including ELISA and chemiluminescence immunoassays. |

| Siemens Healthineers | Specializes in automated hepatitis B viral load testing and antigen/antibody detection systems. |

| Bio-Rad Laboratories | Provides high-sensitivity serological and molecular assays for hepatitis B detection and monitoring. |

| Danaher Corporation (Beckman Coulter) | Offers hepatitis B testing solutions integrated into automated diagnostic workflows. |

Key Company Insights

Roche Diagnostics (22-26%)

This key player on the Hepatitis B Diagnostics market offers a full spectrum of molecular and serological assays for the detection of the virus, monitoring of the viral load, and assessment of treatment response. Highly specific PCR solutions of Roche Diagnostics lie with fully automated testing platforms that offer excellent accuracy, efficiency, and scalability to the global healthcare providers.

Abbott Laboratories (18-22%)

Abbott Laboratories is in the forefront of the immunoassay Hepatitis B diagnostics, providing an array of high-sensitivity tests in laboratories and settings for point-of-care. With the ARCHITECT and the Alinity platforms, HBsAg and antibody screening is done so that the detection of early infection and management of patients may be facilitated in an automated, reliable, and cost-effective manner.

Siemens Healthineers (10-14%)

Playing a vital role in infectious disease diagnostics, Siemens Healthineers manufactures advanced laboratory platforms incorporating Hepatitis B testing. Using immunoassay and molecular diagnostic solutions such as Atellica and ADVIA Centaur systems, a high throughput, automated and accurate detection of Hepatitis B markers can be performed-hence improving-across-hospital and clinical laboratory diagnostics efficiency.

Bio-Rad Laboratories (8-12%)

Recognized for high sensitivity Hepatitis B serological and molecular testing for research as well as clinical diagnostics, Bio-Rad Laboratories' immunoassays and real-time PCR-based assays provide accurate detection of Hepatitis B infection with confidence in case monitoring. Their quality control measures assure diagnostic reliability for healthcare settings around the world.

Danaher Corporation (Beckman Coulter) (5-9%)

Danaher Corporation, through its Beckman Coulter division, offers integrated and automated Hepatitis B testing solutions for clinical laboratories. High-throughput immunoassay analyzers found in its DxI series provide efficient and precise detection of Hepatitis B markers. The company is focused on streamlining workflows to improve laboratory productivity and patient outcomes.

Other Key Players (25-35% Combined)

Besides the leading companies, there exist a number of manufacturers who contribute to the Hepatitis B diagnostics market with large pools of technological advancement and an outlay of product diversity. Companies like Thermo Fisher Scientific, Grifols, Ortho Clinical Diagnostics, and bioMérieux bring innovation in diagnostics for a wider distribution of reliable Hepatitis B screening and disease monitoring tools worldwide.

These companies focus on expanding the reach of hepatitis B diagnostic solutions, offering competitive pricing and cutting-edge innovations to meet diverse clinical and laboratory diagnostic needs.

Enzyme Immunoassay Kits (Hepatitis B Surface Antigen Test, Anti-Hepatitis B Surface Antibody Test, Anti-Hepatitis B Core Antibody Test), Point-of-Care Testing Kits (Strips, Cassettes/Cards)

Hospitals, Clinics, Diagnostic Centers and Home Care.

North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa

The global Hepatitis B Diagnostic Tests industry is projected to witness CAGR of 6.5% between 2025 and 2035.

The global Hepatitis B Diagnostic Tests industry stood at USD 989.6 million in 2024.

The global Hepatitis B Diagnostic Tests industry is anticipated to reach USD 1,978.4 million by 2035 end.

India is expected to show a CAGR of 5.9% in the assessment period.

The key players operating in the global Hepatitis B Diagnostic Tests industry are Bio-Rad Laboratories, Inc., DiaSorin S.p.A., Abbott Laboratories, Meridian Bioscience, bioMérieux SA Inc., Vista Diagnostics International, Overview, J.Mitra & Co. Ltd., Siemens Medical Solutions USA, Inc., General Biologicals Corporation and others.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by End User, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by End User, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 16: Latin America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by End User, 2018 to 2033

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 21: Western Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 22: Western Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 23: Western Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 24: Western Europe Market Volume (Units) Forecast by End User, 2018 to 2033

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 28: Eastern Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 29: Eastern Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 30: Eastern Europe Market Volume (Units) Forecast by End User, 2018 to 2033

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 34: South Asia and Pacific Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 36: South Asia and Pacific Market Volume (Units) Forecast by End User, 2018 to 2033

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 39: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 40: East Asia Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 41: East Asia Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 42: East Asia Market Volume (Units) Forecast by End User, 2018 to 2033

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 46: Middle East and Africa Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 48: Middle East and Africa Market Volume (Units) Forecast by End User, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by End User, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 9: Global Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 13: Global Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 16: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 17: Global Market Attractiveness by End User, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by End User, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 27: North America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 31: North America Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 34: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 35: North America Market Attractiveness by End User, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by End User, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 45: Latin America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 49: Latin America Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 53: Latin America Market Attractiveness by End User, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Western Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 56: Western Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 57: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Western Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 63: Western Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 66: Western Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 67: Western Europe Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 70: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 71: Western Europe Market Attractiveness by End User, 2023 to 2033

Figure 72: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Eastern Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 74: Eastern Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 81: Eastern Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 85: Eastern Europe Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 88: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 89: Eastern Europe Market Attractiveness by End User, 2023 to 2033

Figure 90: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 91: South Asia and Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 92: South Asia and Pacific Market Value (US$ Million) by End User, 2023 to 2033

Figure 93: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 99: South Asia and Pacific Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 102: South Asia and Pacific Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 103: South Asia and Pacific Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 106: South Asia and Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 107: South Asia and Pacific Market Attractiveness by End User, 2023 to 2033

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 109: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 110: East Asia Market Value (US$ Million) by End User, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 112: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 113: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 117: East Asia Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 120: East Asia Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 121: East Asia Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 122: East Asia Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 124: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 125: East Asia Market Attractiveness by End User, 2023 to 2033

Figure 126: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 127: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 128: Middle East and Africa Market Value (US$ Million) by End User, 2023 to 2033

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 131: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 135: Middle East and Africa Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 139: Middle East and Africa Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 142: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 143: Middle East and Africa Market Attractiveness by End User, 2023 to 2033

Figure 144: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Rabies Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Bacterial Diagnostics in Aquaculture Market Insights - Growth & Forecast 2025 to 2035

Hepatitis - B Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Brain Cancer Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Breast Cancer Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Tuberculosis Diagnostics Market

AI-enabled Diagnostic Imaging Market

Diagnostic Exosome Biomarkers Market Trends – Growth & Forecast 2025 to 2035

Blood Urea Nitrogen Diagnostics Market

Preterm Birth Diagnostic Test Kit Market Forecast and Outlook 2025 to 2035

Breast Cancer Screening Tests Market Size and Share Forecast Outlook 2025 to 2035

Chronic Hepatitis B Virus Testing Market Size and Share Forecast Outlook 2025 to 2035

Cardiac Biomarker Diagnostic Test Kits Market Analysis – Trends & Forecast 2025 to 2035

Xylose Absorption Tests Market

IgE Allergy Blood Tests Market Size, Growth, and Forecast 2025 to 2035

In Vitro Diagnostic Substrate Market Size and Share Forecast Outlook 2025 to 2035

Oncology Based Molecular Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Anti-microbial/Anti-fungal Tests Market Size and Share Forecast Outlook 2025 to 2035

Antibiotic Resistance Testing and Diagnostic Devices Market Size and Share Forecast Outlook 2025 to 2035

Breast & Prostate Cancer Diagnostics Market in Europe – Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA