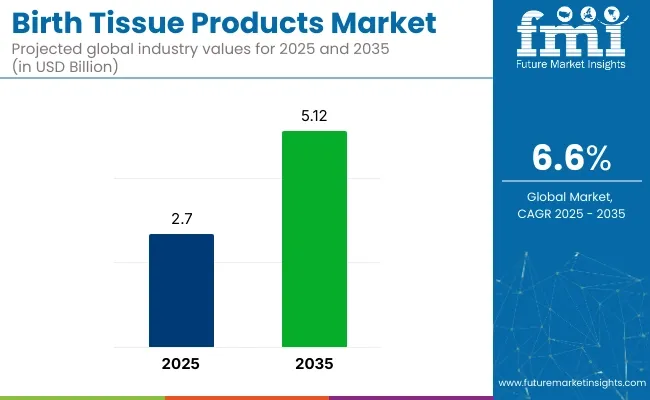

The birth tissue products market is estimated to generate a market size of USD 2.70 billion in 2025 and is expected to reach USD 5.12 billion by 2035, reflecting a compound annual growth rate (CAGR) of 6.6% during the forecast period.

The growth of this market is driven by the increasing adoption of regenerative medicine, advancements in stem cell research, and the growing use of birth tissue products such as umbilical cord blood, stem cells, and placental tissues in therapeutic applications. These products are utilized in a wide range of medical treatments, including those for neurological disorders, autoimmune diseases, and tissue regeneration.

A key driver of the market’s growth is the rising demand for stem cell-based therapies, which use birth tissues as a source of highly regenerative cells. As medical research continues to uncover the potential of stem cells to treat a variety of diseases, the demand for umbilical cord blood and placental tissue is increasing.

Additionally, the growing awareness among expectant parents about the potential life-saving benefits of storing these tissues for future use is contributing to the market’s expansion. Many healthcare providers now offer cord blood banking services, further accelerating market growth.

| Attribute | Value |

|---|---|

| Market Size in 2025 | USD 2.70 Billion |

| Market Size in 2035 | USD 5.12 Billion |

| CAGR (2025 to 2035) | 6.6% |

Recent developments in the birth tissue products market have also seen significant advancements in storage and preservation technologies. Innovations in cryopreservation techniques have enhanced the long-term viability of stored tissues, making them a more reliable resource for future medical treatments. Companies in the market are focusing on improving the quality of storage and ensuring that these tissues maintain their therapeutic potential over time.

On July 31, 2024, MiMedx Group, Inc. launched HELIOGEN™ Fibrillar Collagen Matrix, its first xenograft wound care product featuring Type I/III collagen-as per MiMedx’s press release . Designed for moderately to heavily exudating wounds such as surgical, diabetic, and venous ulcers, HELIOGEN is shelf-stable and moldable to complex wound geometries.

“We are pleased to introduce our first xenograft option representing an important step in pursuit of this objective,” said CEO Joseph H. Capper. This entry underscores MiMedx’s expanding birth-tissue portfolio into advanced surgical wound care and aligns with rising demand for regenerative biomaterials in the market.

As the demand for regenerative medicine grows, the birth tissue products market is expected to experience continued expansion, driven by innovations in storage technology, an increasing number of cord blood banks, and the growing clinical application of stem cell therapies.

The following table presents the projected compound annual growth rate (CAGR) for the global birth tissue products market over various semi-annual periods from 2025 to 2035. The market is expected to grow at a CAGR of 6.5% in the first half (H1) of the 2024 to 2035 decade, while it is going to grow at a slightly higher rate of 7.0% in the second half (H2) of the decade.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 6.5% |

| H2 (2024 to 2034) | 7.0% |

| H1 (2025 to 2035) | 6.6% |

| H2 (2025 to 2035) | 7.1% |

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to decrease slightly to 6.6% in the first half and increase moderately at 7.1% in the second half. In the first half (H1) the market witnessed an increase of 10.00 BPS while in the second half (H2), the market witnessed a decrease of 4.04 BPS.

The global birth tissue products market is poised for significant growth from 2025 to 2035, driven by advancements in regenerative medicine and the expanding scope of wound care. Key segments such as amniotic membrane and wound care are drawing strong investments. Companies like Organogenesis Inc., MiMedx, and Bio Tissue Inc. are driving innovation to deliver effective, next-generation birth tissue solutions for an evolving healthcare landscape.

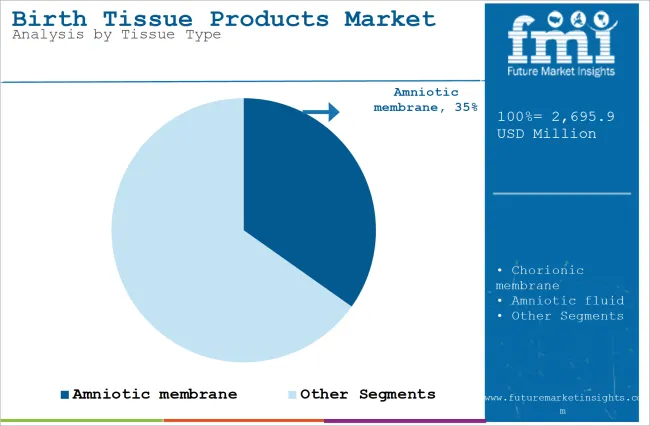

The amniotic membrane segment is projected to hold 34.8% of the market share in 2025. This segment is witnessing rising demand owing to the amniotic membrane’s exceptional regenerative, anti-inflammatory, and anti-scarring properties. It is increasingly used in surgical interventions, ophthalmology, and advanced wound care applications. The growing need for minimally invasive regenerative therapies is further propelling adoption, especially among aging populations and diabetic patients requiring tissue repair.

Leading players such as Organogenesis Inc. and MiMedx are pioneering product innovations with cryopreserved and dehydrated amniotic membrane allografts. These products demonstrate high efficacy in complex wound healing, reducing scar formation and promoting rapid tissue regeneration.

Additionally, clinical advancements in ophthalmic surgeries and orthopedic treatments are driving new applications for amniotic membranes. The segment is also benefiting from favorable regulatory support and growing clinical awareness, which are expanding the market footprint across emerging and developed regions.

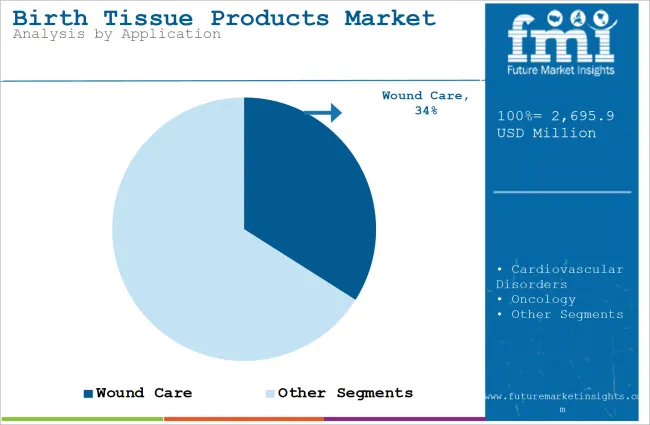

The wound care segment is expected to secure 34.0% of the application segment market share in 2025. Its growth is largely attributed to the escalating incidence of chronic wounds, such as diabetic foot ulcers, venous leg ulcers, burns, and surgical wounds. Birth tissue-based products, rich in extracellular matrix components and growth factors, offer superior healing efficacy, infection control, and scar reduction compared to conventional wound care treatments.

Key companies like BioTissue Inc. and Surgenex LLC are leading advancements in this segment. Recent innovations include multi-layer amniotic grafts and injectable birth tissue therapies tailored for complex and non-healing wounds. The expanding outpatient wound care centers and increasing healthcare spending in advanced therapies are also driving segment growth.

Moreover, supportive reimbursement frameworks in key markets such as the United States are making regenerative wound care products more accessible. This dynamic market landscape positions wound care as a pivotal driver of the birth tissue products market’s sustained expansion.

The Increasing Number of Ophthalmology and Cosmetic Procedure Is a Significant Driver of the Birth Tissue Products Market.

The amniotic membrane and fluid have developed into major therapeutic device tools in the growth of the births tissue products market due to developed and improved medical and cosmetic procedures. In ophthalmology, healthcare experts have mainly used the amniotic membrane transplant due to the non-inflammatory and anti-scarring nature, which is remarkably invaluable in the recovery of the eye.

AMT provides scaffolding for compromised tissue, shielding ocular defects from the external environment, and encourages healing and re-cellularization. Cataract surgery is still widely performed across the globe, with millions of such surgeries taking place every year; thus, innovative ophthalmic solutions are becoming increasingly in demand.

Another related application is that of the amniotic fluid for treating corneal neovascularization following ocular alkali burns, demonstrating expanding applications of birth tissue in ophthalmology.

Cosmetic surgery is using the regenerative property of amniotic fluid to rejuvenate the skin. The introduction of amniotic fluid to the dermal layers causes increased collagen synthesis and reduced manifestations of aging; this enhances skin health, creating a holistic alternative to conventional cosmetic therapy. Demand for holistic, non-invasive aesthetic solutions has increased usage by various birth tissue products in cosmetic surgery.

These tendencies in both ophthalmology and cosmetic surgery help drive the growth of the market for birth tissue products. Increasing awareness among specialists in their safety, efficacy, and regenerative capabilities is leading to widespread adoption across medical specialties.

The Increased Adoption of Amniotic Membrane for Various Applications Is Driving Significant Growth in The Birth Tissue Products Market.

The increasing adoption of amniotic membrane for multiple applications is resulting in high growth in the Birth Tissue Products Market. In ophthalmology, amniotic membrane has emerged as an essential tool to promote healing in patients with ocular injuries and degenerative conditions.

Its anti-inflammatory, anti-scarring, and regenerative properties help support damaged tissue, reduce inflammation, and protect ocular defects from external factors that could worsen degeneration. Most extractions of cataracts, millions a year on the Earth, have today become extractions in which an increasingly important part of the process involves the use of an amniotic membrane transplant made by ophthalmologists in operations.

Besides ophthalmology, it is increasingly applied in other fields of medicine because of its regenerative property. This is because its healing ability is accelerative and could be used for the wound healing process, burn care, and tissue repair. The rejuvenating skin and increased production of collagen may make amniotic membrane patients searching for cosmetic surgery choose a more natural form of traditional treatments than others. As the cosmetic industry continues to grow in demand for non-invasive, holistic solutions, it is expected that the use of amniotic membrane will be further expanded.

This broad scope of applications for amniotic membrane across a range of specialties is where the growth is generated for the birth tissue products market, with providers increasingly finding it safe and therapeutic for use.

The Rise in The Number of Caesarean Deliveries Worldwide Is Significantly Driving the Expansion of the Birth Tissue Products Market

The global increase in caesarean delivery is a major driving force behind the increasing birth tissue products market, especially concerning placenta-based therapies. One of the major complications that follow increased caesarean sections is the accumulation of the accreta placenta, which attaches more deeply than it should to the uterine wall, often culminating in peripartum hysterectomy.

As the number of caesarean births keeps rising, so are cases of placenta accreta, hence the growing need for the medical community to find solutions on how to handle such complications.

More interest is being received for placenta-derived products in the form of placental membranes and umbilical cord tissue. The regenerative qualities of umbilical cord tissue, particularly Wharton's jelly, restore wounds and repair tissue effectively.

Health care providers make use of amniotic membranes to speed the healing process and eliminate postoperative infections that have occurred after a cesarean section. Their anti-inflammatory and antimicrobial qualities significantly improve tissue regeneration and prevent surgical complications.

Worldwide caesarean section rates have been projected to increase, making nearly one third of all babies born by that method by the year 2030. More birth tissue product demand will eventually be seen rising in the midst of this ever-increasing maternal and fetal outcome improvement. For this reason, the market also expands with ever-increasing calls for effective medical treatments in the field of obstetrics.

Long Gestation Period and Time to Market Due to Protracted Clinical Trials Is a Significant Restraint for The Birth Tissue Products Market.

The development and commercialization of new amniotic membrane products are subject to several significant restraints, largely because of the lengthy clinical trials process, the natural gestation period, and various limitations within the healthcare ecosystem.

Clinical trials are an integral part of ascertaining the safety and efficacy of these products, but it is often drawn out, resource-intensive, and costly. The extended timeline in clinical trials is likely to result in delayed commercialization of such innovative amniotic membrane products, thus also leading to economic losses for those companies that had invested in its development.

Another significant challenge is the natural gestation period of about 280 days. The long gestation period may cause unexpected delays or complications in the trial process, which further disrupts timelines and increases development costs. Such interruptions can hinder the pace at which new products hit the market.

The growth of amniotic membranes is further constrained by factors, including a deficiency of skilled professionals in the field of medicine. The removal and transplantation of these amniotic membranes are difficult procedures that are complicated by requirements for specialized knowledge and training; hence, regions with a paucity of such skills could be a setback. Complications such as sepsis among others also keep the therapies away from widespread implementation.

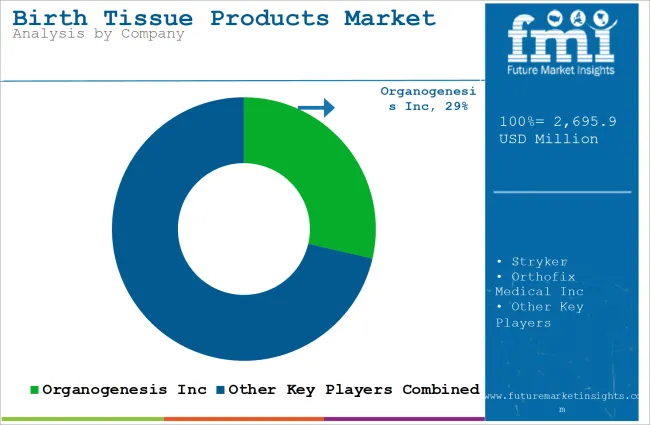

Tier 1 companies include the market leaders, holding 55.3% of the share in global market and these companies are engaged in strategic partnerships and acquisitions for enhancing their portfolio of products and access to cutting-edge technology. Besides this, they extend extensive clinical trials for the justification of safety and efficacy of their products. Some key companies are under tier 1. These include Stryker, Integra LifeSciences Holdings Corporation, Organogenesis Inc. and MIMEDX.

Tier 2 companies include mid-size players having presence in specific regions and highly influencing the local market and holds around 21.9% market share. They typically pursue partnerships with academic institutions and research organizations to leverage emerging technologies and expedite product development. These companies often emphasize agility and adaptability, allowing them to quickly bring new treatments to market, additionally targeting specific types medical conditions.

Additionally, they focus on cost-effective production methods to offer competitive pricing. Prominent companies in tier 2 include mtf Biologics, Amiox medical (Tissue Tech, Bio-tissue), Osiris (Smith & Nephew), AlloSource, VIVEX Biologics, Inc., Orthofix Medical Inc

Finally, Tier 3 companies, such as E Surgenex, LLC., Next Biosciences, C, NuVision Biotherapies Ltd., Merakris Therapeutics, Amnio Technology, LLC. And others They specialize in specific products and cater to niche markets, adding diversity to the industry.

Overall, while Tier 1 companies are the primary drivers of the market, Tier 2 and 3 companies also make significant contributions, ensuring the birth tissue products sales remains dynamic and competitive.

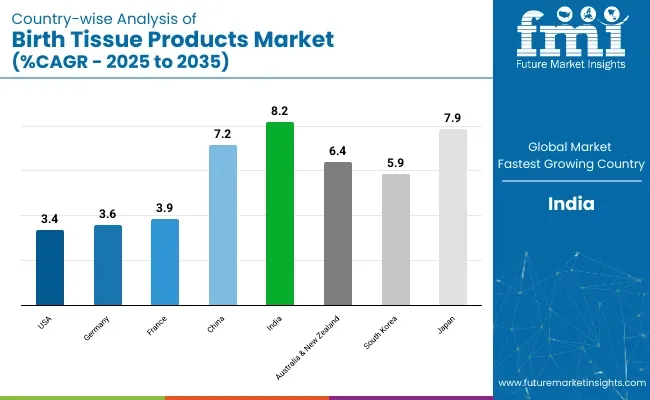

The section below covers the industry analysis for the birth tissue products market for different countries. Market demand analysis on key countries in several regions of the globe, including North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe and Middle Ease & Africa, is provided.

The United States is anticipated to remain at the forefront in North America, with higher market share through 2035. In South Asia & Pacific, India is projected to witness a CAGR of 6.8% by 2035.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| USA | 3.4% |

| Germany | 3.6% |

| France | 3.9% |

| China | 7.2% |

| India | 8.2% |

| Australia & New Zealand | 6.4% |

| South Korea | 5.9% |

| Japan | 7.9% |

The United States is expected to grow at a CAGR of 3.4% from 2025 to 2035, remaining the market leader in North America for birth tissue products.

Placenta-derived products, especially amniotic membranes, are more in demand. There is the very high level of caesarean births in the United States, meaning more than 30% birth deliveries in USA occurs via C-section, and that also leads to increased cases like placenta accreta, an abnormally adherence placenta toward the uterine wall where surgical interventions in recovery are typically more complex for extended periods of time.

Known for their regenerative properties, amniotic membranes help in the improvement of post-surgical recovery by enhancing tissue healing, reducing inflammation, and minimizing scarring, which are all very essential in the management of complications arising from such cases.

The number of C-sections continues to rise, so does the demand for effective, biologically sourced therapies, which makes amniotic membrane products key solutions in obstetrics. Additionally, with an increasing focus on improving maternal health outcomes and reducing surgical risks, the market demand for these placenta-derived products keeps growing, thereby solidifying their place in the USA healthcare system.

Germany is the largest absorber tissue space market in Europe, and will grow at an impressive CAGR of 3.6% between 2025 and 2035.

Germany's active integration of regenerative medicine into mainstream healthcare This factor greatly boosts the birth tissue products market. The health sector in this country is set up to provide an efficient health delivery system to increase surgical recovery and general outcome among patients. That perfectly suits what placenta-derived products are mainly used for-to regenerate- amniotic membranes and umbilical cord tissues, used extensively in numerous treatment procedures.

As Germany is keen on using advanced, non-invasive treatments, birth tissue products have become an integral part of many clinical practices. Patients receive faster recovery times and improved overall results through the use of these products in tissue regeneration and healing, driving the demand for the market. This trend not only consolidates Germany's position in regenerative medicine but also boosts the interest of the world in the potential of birth tissue products.

Japan is expected to lead the Asia-Pacific region with a CAGR of 7.9% through 2035 in the birth tissue products market.

Major investment in regenerative medicine has been one of the factors driving the growth of Japan in Birth Tissue Products Market. The country had been in the forefront of stem cell therapy and tissue engineering, an innovation which precipitated new models in medical solutions. With that imperative in research and development, the application of placenta-derived products such as amniotic membranes and umbilical cord tissue multiplied in present applications: wound healing, ophthalmology, and tissue regeneration.

These regenerative products quite fit the bill of Japan's interest in seeking improvement in patients' outcomes and advancing treatments in healthcare. The country's supportive environment for scientific innovation coupled with government funding and collaborations between research institutions and private companies accelerates the adoption of these birth tissue products.

As regenerative medicine remains top in Japan's agenda, there will be a rise in demand for placenta-derived products, and thus it will lead the market globally.

The market players are using strategies to stay competitive, such as product differentiation through innovative formulations, strategic partnerships with healthcare providers for distribution. Another key strategic focus of these companies is to actively look for strategic partners to bolster their product portfolios and expand their global market presence.

Recent Industry Developments in Birth Tissue Products Market

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 2.70 billion |

| Projected Market Size (2035) | USD 5.12 billion |

| CAGR (2025 to 2035) | 6.6% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for dollar sales |

| Tissue Types Analyzed (Segment 1) | Placenta, Amniotic Membrane, Chorionic Membrane, Amniotic Fluid, Umbilical Cord Tissue, Umbilical Veins, Wharton's Jelly |

| Applications Analyzed (Segment 2) | Cardiovascular Disorders, Oncology, Dermatology, Musculoskeletal, Wound Care, Ophthalmology |

| End-users Analyzed (Segment 3) | Hospitals, Birth Centers, Academic & Research Institutes |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, Middle East and Africa (MEA) |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, ANZ, GCC Countries, South Africa |

| Key Players influencing the Birth Tissue Products Market | Organogenesis Inc, Stryker, Orthofix Medical Inc, MIMEDX, Surgenex, LLC., Next Biosciences, Skye Biologics Holdings, LLC, NuVision Biotherapies Ltd, Merakris Therapeutics, BioTissue Inc. |

| Additional Attributes | dollar sales, CAGR trends, tissue type segmentation, application demand, end-user distribution, competitor dollar sales & market share, regional adoption trends |

The market is segmented on the basis of tissue type: placenta, amniotic membrane, chorionic membrane, amniotic fluid, umbilical cord tissue, umbilical veins and Wharton's jelly

The market can be segmented as follows based on application: cardiovascular disorders, oncology, dermatology, musculoskeletal, wound care and ophthalmology.

This market can also be segmented by end user - hospitals, birth centers and academic & research institutes.

The report covers the key countries of North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia and Middle East and Africa (MEA).

The global birth tissue products market is projected to witness CAGR of 6.6% between 2025 and 2035.

The global birth tissue products industry stood at USD 2,534.9 million in 2024.

The global birth tissue products market is anticipated to reach USD 5,123.1 million by 2035 end.

India is set to record the highest CAGR of 8.2% in the assessment period.

The key players operating in the global birth tissue products market include Organogenesis Inc, Stryker, Orthofix Medical Inc, MIMEDX, Surgenex, LLC. , Next Biosciences , Skye Biologics Holdings, LLC , NuVision Biotherapies Ltd, Merakris Therapeutics , BioTissue Inc., SURGILOGIX and others.

Table 01: Global Market Value (USD Million) Analysis, 2020 to 2025, By Tissue Types

Table 02: Global Market Value (USD Million) Analysis, 2020 to 2025, By Application

Table 03: Global Market Value (USD Million) Analysis, 2020 to 2035, By End User

Table 04: Global Market Value (USD Million) Analysis, 2020 to 2025, By Region

Table 05: North America Market Size (USD Million) Analysis 2020 to 2025 and Forecast 2025 to 2035, By Country

Table 06: North America Market Size (USD Million) Analysis 2020 to 2025 and Forecast 2025 to 2035, By Tissue Types

Table 07: North America Market Size (USD Million) Analysis 2020 to 2025 and Forecast 2025 to 2035, By Application

Table 08: North America Market Size (USD Million) Analysis 2020 to 2025 and Forecast 2025 to 2035, By End User

Table 09: Latin America Market Size (USD Million) Analysis 2020 to 2025 and Forecast 2025 to 2035, By Country

Table 10: Latin America Market Size (USD Million) Analysis 2020 to 2025 and Forecast 2025 to 2035, By Tissue Types

Table 11: Latin America Market Size (USD Million) Analysis 2020 to 2025 and Forecast 2025 to 2035, By Application

Table 12: Latin America Market Size (USD Million) Analysis 2020 to 2025 and Forecast 2025 to 2035, By End User

Table 13: East Asia Market Size (USD Million) Analysis 2020 to 2025 and Forecast 2025 to 2035, By Country

Table 14: East Asia Market Size (USD Million) Analysis 2020 to 2025 and Forecast 2025 to 2035, By Tissue Types

Table 15: East Asia Market Size (USD Million) Analysis 2020 to 2025 and Forecast 2025 to 2035, By Application

Table 16: East Asia Market Size (USD Million) Analysis 2020 to 2025 and Forecast 2025 to 2035, By End User

Table 17: South Asia & Pacific Market Size (USD Million) Analysis 2020 to 2025 and Forecast 2025 to 2035, By Country

Table 18: South Asia & Pacific Market Size (USD Million) Analysis 2020 to 2025 and Forecast 2025 to 2035, By Tissue Types

Table 19: South Asia & Pacific Market Size (USD Million) Analysis 2020 to 2025 and Forecast 2025 to 2035, By Application

Table 20: South Asia & Pacific Market Size (USD Million) Analysis 2020 to 2025 and Forecast 2025 to 2035, By End UserDescription

Table 21: Western Europe Market Size (USD Million) Analysis 2020 to 2025 and Forecast 2025 to 2035, By Country

Table 22: Western Europe Market Size (USD Million) Analysis 2020 to 2025 and Forecast 2025 to 2035, By Tissue Types

Table 23: Western Europe Market Size (USD Million) Analysis 2020 to 2025 and Forecast 2025 to 2035, By Application

Table 24: Western Europe Market Size (USD Million) Analysis 2020 to 2025 and Forecast 2025 to 2035, By End User

Table 25: Eastern Europe Market Size (USD Million) Analysis 2020 to 2025 and Forecast 2025 to 2035, By Country

Table 26: Eastern Europe Market Size (USD Million) Analysis 2020 to 2025 and Forecast 2025 to 2035, By Tissue Types

Table 27: Eastern Europe Market Size (USD Million) Analysis 2020 to 2025 and Forecast 2025 to 2035, By Application

Table 28: Eastern Europe Market Size (USD Million) Analysis 2020 to 2025 and Forecast 2025 to 2035, By End User

Table 29: Middle East & Africa Market Size (USD Million) Analysis 2020 to 2025 and Forecast 2025 to 2035, By Country

Table 30: Middle East & Africa Market Size (USD Million) Analysis 2020 to 2025 and Forecast 2025 to 2035, By Tissue Types

Table 31: Middle East & Africa Market Size (USD Million) Analysis 2020 to 2025 and Forecast 2025 to 2035, By Application

Table 32: Middle East & Africa Market Size (USD Million) Analysis 2020 to 2025 and Forecast 2025 to 2035, By End User

Figure 01: Global Market Split By Region, 2025 (E)

Figure 02: Global Market Split By Tissue Types, 2025 (E)

Figure 03: Global Market Split By Application, 2025 (E)

Figure 04: Global Market Split By End User, 2025 (E)

Figure 05: Market - COVID-19 Impact, 2020-2035

Figure 06: Global Market Size (USD Million) Analysis, 2020 to 2025

Figure 07: Global Market Size (USD Million) & Y-o-Y Growth (%) Analysis, 2025 to 2035

Figure 08: Global Market Absolute USD Opportunity Analysis, 2025-2032

Figure 09: Global Market Analysis By Tissue Types-2025 & 2035

Figure 10: Global Market Y-o-Y Growth Projections By Tissue Types, 2025 to 2035

Figure 11: Global Market Attractiveness Analysis by Tissue Types, 2025 to 2035

Figure 12: Global Market Analysis By Application, 2025 & 2035

Figure 13: Global Market Y-o-Y Growth Projections By Application, 2025 to 2035

Figure 14: Global Market Attractiveness Analysis by Application, 2025 to 2035

Figure 15: Global Market Share Analysis (%) By End User, 2025 & 2035

Figure 16: Global Market Y-o-Y Growth (%) By End User, 2025 to 2035

Figure 17: Global Market Attractiveness Analysis, By End User, 2025 to 2035

Figure 18: Global Market Analysis By Region, 2025 & 2035

Figure 19: Global Market Y-o-Y Growth Projections By Region, 2025 to 2035

Figure 20: Global Market Attractiveness Analysis by Region, 2025 to 2035

Figure 21: North America Market Share, By Tissue Types (2025 A)

Figure 22: North America Market Share, By Application (2025 A)

Figure 23: North America Market Share, By End User (2025 A)

Figure 24: North America Market Share, By Country (2025 A)

Figure 25: North America Market Value (USD Million) Analysis, 2020 to 2025

Figure 26: North America Market Value (USD Million) & Y-o-Y Growth (%), 2025 to 2035

Figure 27: North America Market Attractiveness Analysis By Tissue Types, 2025 to 2035

Figure 28: North America Market Attractiveness Analysis By Application, 2025 to 2035

Figure 29: North America Market Attractiveness Analysis By End User, 2025 to 2035

Figure 30: North America Market Attractiveness Analysis By Country, 2025 to 2035

Figure 31: USA Market Value Proportion Analysis, 2025

Figure 32: Global Vs. USA Growth Comparison

Figure 33: USA Market Share Analysis (%) By Tissue Types, 2025 to 2035 (F)

Figure 34: USA Market Share Analysis (%) By Application, 2025 to 2035 (F)

Figure 35: USA Market Share Analysis (%) By End User, 2025 to 2035 (F)

Figure 36: Canada Market Value Proportion Analysis, 2025

Figure 37: Global Vs. Canada Growth Comparison

Figure 38: Canada Market Share Analysis (%) By Tissue Types, 2025 to 2035 (F)

Figure 39: Canada Market Share Analysis (%) By Application, 2025 to 2035 (F)

Figure 40: Canada Market Share Analysis (%) By End User, 2025 to 2035 (F)

Figure 41: Latin America Market Share, By Tissue Types (2025 A)

Figure 42: Latin America Market Share, By Application (2025 A)

Figure 43: Latin America Market Share, By End User (2025 A)

Figure 44: Latin America Market Share, By Country (2025 A)

Figure 45: Latin America Market Value (USD Million) Analysis, 2020 to 2025

Figure 46: Latin America Market Value (USD Million) & Y-o-Y Growth (%), 2025 to 2035

Figure 47: Latin America Market Attractiveness Analysis By Tissue Types, 2025 to 2035

Figure 48: Latin America Market Attractiveness Analysis By Application, 2025 to 2035

Figure 49: Latin America Market Attractiveness Analysis By End User, 2025 to 2035

Figure 50: Latin America Market Attractiveness Analysis By Country, 2025 to 2035

Figure 51: Brazil Market Value Proportion Analysis, 2025

Figure 52: Global Vs. Brazil Growth Comparison

Figure 53: Brazil. Market Share Analysis (%) By Tissue Types, 2025 to 2035 (F)

Figure 54: Brazil Market Share Analysis (%) By Application, 2025 to 2035 (F)

Figure 55: Brazil Market Share Analysis (%) By End User, 2025 to 2035 (F)

Figure 56: Mexico Market Value Proportion Analysis, 2025

Figure 57: Global Vs. Mexico Growth Comparison

Figure 58: Mexico Market Share Analysis (%) By Tissue Types, 2025 to 2035 (F)

Figure 58: Mexico Market Sha9e Analysis (%) By Application, 2025 to 2035 (F)

Figure 60: Mexico Market Share Analysis (%) By End User, 2025 to 2035 (F)

Figure 61: Argentina Market Value Proportion Analysis, 2025

Figure 62: Global Vs. Argentina Growth Comparison

Figure 63: Argentina Market Share Analysis (%) By Tissue Types, 2025 to 2035 (F)

Figure 64: Argentina Market Share Analysis (%) By Application, 2025 to 2035 (F)

Figure 65: Argentina Market Share Analysis (%) By End User, 2025 to 2035 (F)

Figure 66: East Asia Market Share, By Tissue Types (2025 A)

Figure 67: East Asia Market Share, By Application (2025 A)

Figure 68: East Asia Market Share, By End User (2025 A)

Figure 69: East Asia Market Share, By Country (2025 A)

Figure 70: East Asia Market Value (USD Million) Analysis, 2020 to 2025

Figure 71: East Asia Market Value (USD Million) & Y-o-Y Growth (%), 2025 to 2035

Figure 72: East Asia Market Attractiveness Analysis By Tissue Types, 2025 to 2035

Figure 73: East Asia Market Attractiveness Analysis By Application, 2025 to 2035

Figure 74: East Asia Market Attractiveness Analysis By End User, 2025 to 2035

Figure 75: East Asia Market Attractiveness Analysis By Country, 2025 to 2035

Figure 76: China Market Value Proportion Analysis, 2025

Figure 77: Global Vs. China Growth Comparison6

Figure 78: China Market Share Analysis (%) By Tissue Types, 2025 to 2035 (F)

Figure 79: China Market Share Analysis (%) By Application, 2025 to 2035 (F)

Figure 80: China Market Share Analysis (%) By End User, 2025 to 2035 (F)

Figure 81: Japan Market Value Proportion Analysis, 2025

Figure 82: Global Vs. Japan Growth Comparison

Figure 83: Japan Market Share Analysis (%) By Tissue Types, 2025 to 2035 (F)

Figure 84: Japan Market Share Analysis (%) By Application, 2025 to 2035 (F)

Figure 85: Japan Market Share Analysis (%) By End User, 2025 to 2035 (F)

Figure 86: South Korea Market Value Proportion Analysis, 2025

Figure 87: Global Vs. South Korea Growth Comparison

Figure 88: South Korea Market Share Analysis (%) By Tissue Types, 2025 to 2035 (F)

Figure 89: South Korea Market Share Analysis (%) By Application, 2025 to 2035 (F)

Figure 90: South Korea Market Share Analysis (%) By End User, 2025 to 2035 (F)

Figure 91: South Asia & Pacific Market Share, By Tissue Types (2025 A)

Figure 92: South Asia & Pacific Market Share, By Application (2025 A)

Figure 93: South Asia & Pacific Market Share, By End User (2025 A)

Figure 94: South Asia & Pacific Market Share, By Country (2025 A)

Figure 95: South Asia & Pacific Market Value (USD Million) Analysis, 2020 to 2025

Figure 96: South Asia & Pacific Market Value (USD Million) & Y-o-Y Growth (%), 2025 to 2035

Figure 97: South Asia & Pacific Market Attractiveness Analysis By Tissue Types, 2025 to 2035

Figure 98: South Asia & Pacific Market Attractiveness Analysis By Application, 2025 to 2035

Figure 99: South Asia & Pacific Market Attractiveness Analysis By End User, 2025 to 2035

Figure 100: South Asia & Pacific Market Attractiveness Analysis By Country, 2025 to 2035

Figure 101: India Market Value Proportion Analysis, 2025

Figure 102: Global Vs. India Growth Comparison

Figure 103: India Market Share Analysis (%) By Tissue Types, 2025 to 2035 (F)

Figure 104: India Market Share Analysis (%) By Application, 2025 to 2035 (F)

Figure 105: India Market Share Analysis (%) By End User, 2025 to 2035 (F)

Figure 106: Indonesia Market Value Proportion Analysis, 2025

Figure 107: Global Vs. Indonesia Growth Comparison

Figure 108: Indonesia Market Share Analysis (%) By Tissue Types, 2025 to 2035 (F)

Figure 109: Indonesia Market Share Analysis (%) By Application, 2025 to 2035 (F)

Figure 110: Indonesia Market Share Analysis (%) By End User, 2025 to 2035 (F)

Figure 111: Thailand Market Value Proportion Analysis, 2025

Figure 112: Global Vs. Thailand Growth Comparison

Figure 113: Thailand Market Share Analysis (%) By Tissue Types, 2025 to 2035 (F)

Figure 114: Thailand Market Share Analysis (%) By Application, 2025 to 2035 (F)

Figure 115: Thailand Market Share Analysis (%) By End User, 2025 to 2035 (F)

Figure 116: Philippines Market Value Proportion Analysis, 2025

Figure 117: Global Vs. Philippines Growth Comparison

Figure 118: Philippines Market Share Analysis (%) By Tissue Types, 2025 to 2035 (F)

Figure 119: Philippines Market Share Analysis (%) By Application, 2025 to 2035 (F)

Figure 120: Philippines Market Share Analysis (%) By End User, 2025 to 2035 (F)

Figure 121: Malaysia Market Value Proportion Analysis, 2025

Figure 122: Global Vs. Malaysia Growth Comparison

Figure 123: Malaysia Market Share Analysis (%) By Tissue Types, 2025 to 2035 (F)

Figure 124: Malaysia Market Share Analysis (%) By Application, 2025 to 2035 (F)

Figure 125: Malaysia Market Share Analysis (%) By End User, 2025 to 2035 (F)

Figure 126: Vietnam Market Value Proportion Analysis, 2025

Figure 127: Global Vs. Vietnam Growth Comparison

Figure 128: Vietnam Market Share Analysis (%) By Tissue Types, 2025 to 2035 (F)

Figure 129: Vietnam Market Share Analysis (%) By Application, 2025 to 2035 (F)

Figure 130: Vietnam Market Share Analysis (%) By End User, 2025 to 2035 (F)

Figure 131: Australia & New Zealand Market Value Proportion Analysis, 2025

Figure 132: Global Vs. Australia & New Zealand Growth Comparison

Figure 133: Australia & New Zealand Market Share Analysis (%) By Tissue Types, 2025 to 2035 (F)

Figure 134: Australia & New Zealand Market Share Analysis (%) By Application, 2025 to 2035 (F)

Figure 135: Australia & New Zealand Market Share Analysis (%) By End User, 2025 to 2035 (F)

Figure 136: Western Europe Market Share, By Tissue Types (2025 A)

Figure 137: Western Europe Market Share, By Application (2025 A)

Figure 138: Western Europe Market Share, By End User (2025 A)

Figure 139: Western Europe Market Share, By Country (2025 A)

Figure 140: Western Europe Market Value (USD Million) Analysis, 2020 to 2025

Figure 141: Western Europe Market Value (USD Million) & Y-o-Y Growth (%), 2025 to 2035

Figure 142: Western Europe Market Attractiveness Analysis By Tissue Types, 2025 to 2035

Figure 143: Western Europe Market Attractiveness Analysis By Application, 2025 to 2035

Figure 144: Western Europe Market Attractiveness Analysis By End User, 2025 to 2035

Figure 145: Western Europe Market Attractiveness Analysis By Country, 2025 to 2035

Figure 146: Germany Market Value Proportion Analysis, 2025

Figure 147: Global Vs. Germany Growth Comparison

Figure 148: Germany Market Share Analysis (%) By Tissue Types, 2025 to 2035 (F)

Figure 149: Germany Market Share Analysis (%) By Application, 2025 to 2035 (F)

Figure 150: Germany Market Share Analysis (%) By End User, 2025 to 2035 (F)

Figure 151: France Market Value Proportion Analysis, 2025

Figure 152: Global Vs. France Growth Comparison

Figure 153: France Market Share Analysis (%) By Tissue Types, 2025 to 2035 (F)

Figure 154: France Market Share Analysis (%) By Application, 2025 to 2035 (F)

Figure 155: France Market Share Analysis (%) By End User, 2025 to 2035 (F)

Figure 156: Spain Market Value Proportion Analysis, 2025

Figure 157: Global Vs. Spain Growth Comparison

Figure 158: Spain Market Share Analysis (%) By Tissue Types, 2025 to 2035 (F)

Figure 159: Spain Market Share Analysis (%) By Application, 2025 to 2035 (F)

Figure 160: Spain Market Share Analysis (%) By End User, 2025 to 2035 (F)

Figure 161: Italy Market Value Proportion Analysis, 2025

Figure 162: Global Vs. Italy Growth Comparison

Figure 163: Italy Market Share Analysis (%) By Tissue Types, 2025 to 2035 (F)

Figure 164: Italy Market Share Analysis (%) By Application, 2025 to 2035 (F)

Figure 165: Italy Market Share Analysis (%) By End User, 2025 to 2035 (F)

Figure 166: BENELUX Market Value Proportion Analysis, 2025

Figure 167: Global Vs. BENELUX Growth Comparison

Figure 168: BENELUX Market Share Analysis (%) By Tissue Types, 2025 to 2035 (F)

Figure 169: BENELUX Market Share Analysis (%) By Application, 2025 to 2035 (F)

Figure 170: BENELUX Market Share Analysis (%) By End User, 2025 to 2035 (F)

Figure 171: Nordic Countries Market Value Proportion Analysis, 2025

Figure 172: Global Vs. Nordic Countries Growth Comparison

Figure 173: Nordic Countries Market Share Analysis (%) By Tissue Types, 2025 to 2035 (F)

Figure 174: Nordic Countries Market Share Analysis (%) By Application, 2025 to 2035 (F)

Figure 175: Nordic Countries Market Share Analysis (%) By End User, 2025 to 2035 (F)

Figure 176: United kingdom Market Value Proportion Analysis, 2025

Figure 177: Global Vs. United kingdom Growth Comparison

Figure 178: United kingdom Market Share Analysis (%) By Tissue Types, 2025 to 2035 (F)

Figure 179: United kingdom Market Share Analysis (%) By Application, 2025 to 2035 (F)

Figure 180: United kingdom Market Share Analysis (%) By End User, 2025 to 2035 (F)

Figure 181: Eastern Europe Market Share, By Tissue Types (2025 A)

Figure 182: Eastern Europe Market Share, By Application (2025 A)

Figure 183: Eastern Europe Market Share, By End User (2025 A)

Figure 184: Eastern Europe Market Share, By Country (2025 A)

Figure 185: Eastern Europe Market Value (USD Million) Analysis, 2020 to 2025

Figure 186: Eastern Europe Market Value (USD Million) & Y-o-Y Growth (%), 2025 to 2035

Figure 187: Eastern Europe Market Attractiveness Analysis By Tissue Types, 2025 to 2035

Figure 188: Eastern Europe Market Attractiveness Analysis By Application, 2025 to 2035

Figure 189: Eastern Europe Market Attractiveness Analysis By End User, 2025 to 2035

Figure 190: Eastern Europe Market Attractiveness Analysis By Country, 2025 to 2035

Figure 191: Poland Market Value Proportion Analysis, 2025

Figure 192: Global Vs. Poland Growth Comparison

Figure 193: Poland Market Share Analysis (%) By Tissue Types, 2025 to 2035 (F)

Figure 194: Poland Market Share Analysis (%) By Application, 2025 to 2035 (F)

Figure 195: Poland Market Share Analysis (%) By End User, 2025 to 2035 (F)

Figure 196: Hungary Market Value Proportion Analysis, 2025

Figure 197: Global Vs. Hungary Growth Comparison

Figure 198: Hungary Market Share Analysis (%) By Tissue Types, 2025 to 2035 (F)

Figure 199: Hungary Market Share Analysis (%) By Application, 2025 to 2035 (F)

Figure 200: Hungary Market Share Analysis (%) By End User, 2025 to 2035 (F)

Figure 201: Romania Market Value Proportion Analysis, 2025

Figure 202: Global Vs. Romania Growth Comparison

Figure 203: Romania Market Share Analysis (%) By Tissue Types, 2025 to 2035 (F)

Figure 204: Romania Market Share Analysis (%) By Application, 2025 to 2035 (F)

Figure 205: Romania Market Share Analysis (%) By End User, 2025 to 2035 (F)

Figure 206: Czech Republic Market Value Proportion Analysis, 2025

Figure 207: Global Vs. Czech Republic Growth Comparison

Figure 208: Czech Republic Market Share Analysis (%) By Tissue Types, 2025 to 2035 (F)

Figure 209: Czech Republic Market Share Analysis (%) By Application, 2025 to 2035 (F)

Figure 210: Czech Republic Market Share Analysis (%) By End User, 2025 to 2035 (F)

Figure 211: Middle East & Africa Market Share, By Tissue Types (2025 A)

Figure 212: Middle East & Africa Market Share, By Application (2025 A)

Figure 213: Middle East & Africa Market Share, By End User (2025 A)

Figure 214: Middle East & Africa Market Share, By Country (2025 A)

Figure 215: Middle East & Africa Market Value (USD Million) Analysis, 2020 to 2025

Figure 216: Middle East & Africa Market Value (USD Million) & Y-o-Y Growth (%), 2025 to 2035

Figure 217: Middle East & Africa Market Attractiveness Analysis By Tissue Types, 2025 to 2035

Figure 218: Middle East & Africa Market Attractiveness Analysis By Application, 2025 to 2035

Figure 219: Middle East & Africa Market Attractiveness Analysis By End User, 2025 to 2035

Figure 220: Middle East & Africa Market Attractiveness Analysis By Country, 2025 to 2035

Figure 221: GCC Countries Market Value Proportion Analysis, 2025

Figure 222: Global Vs. GCC Countries Growth Comparison

Figure 223: GCC Countries Market Share Analysis (%) By Tissue Types, 2025 to 2035 (F)

Figure 224: GCC Countries Market Share Analysis (%) By Application, 2025 to 2035 (F)

Figure 225: GCC Countries Market Share Analysis (%) By End User, 2025 to 2035 (F)

Figure 226: Kingdom of Saudi Arabia Market Value Proportion Analysis, 2025

Figure 227: Global Vs. Kingdom of Saudi Arabia Growth Comparison

Figure 228: Kingdom of Saudi Arabia Market Share Analysis (%) By Tissue Types, 2025 to 2035 (F)

Figure 229: Kingdom of Saudi Arabia Market Share Analysis (%) By Application, 2025 to 2035 (F)

Figure 230: Kingdom of Saudi Arabia Market Share Analysis (%) By End User, 2025 to 2035 (F)

Figure 231: Türkiye Market Value Proportion Analysis, 2025

Figure 232: Global Vs. Türkiye Growth Comparison

Figure 233: Türkiye Market Share Analysis (%) By Tissue Types, 2025 to 2035 (F)

Figure 234: Türkiye Market Share Analysis (%) By Application, 2025 to 2035 (F)

Figure 235: Türkiye Market Share Analysis (%) By End User, 2025 to 2035 (F)

Figure 236: Northern Africa Market Value Proportion Analysis, 2025

Figure 237: Global Vs. Northern Africa Growth Comparison

Figure 238: Northern Africa Market Share Analysis (%) By Tissue Types, 2025 to 2035 (F)

Figure 239: Northern Africa Market Share Analysis (%) By Application, 2025 to 2035 (F)

Figure 240: Northern Africa Market Share Analysis (%) By End User, 2025 to 2035 (F)

Figure 241: South Africa Market Value Proportion Analysis, 2025

Figure 242: Global Vs. South Africa Growth Comparison

Figure 243: South Africa Market Share Analysis (%) By Tissue Types, 2025 to 2035 (F)

Figure 244: South Africa Market Share Analysis (%) By Application, 2025 to 2035 (F)

Figure 245: South Africa Market Share Analysis (%) By End User, 2025 to 2035 (F)

Figure 246: Israel Market Value Proportion Analysis, 2025

Figure 247: Global Vs. Israel Growth Comparison

Figure 248: Israel Market Share Analysis (%) By Tissue Types, 2025 to 2035 (F)

Figure 249: Israel Market Share Analysis (%) By Application, 2025 to 2035 (F)

Figure 250: Israel Market Share Analysis (%) By End User, 2025 to 2035 (F)

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Preterm Birth Diagnostic Test Kit Market Forecast and Outlook 2025 to 2035

Preterm Birth Prevention and Management Market Analysis - Size, Share, and Forecast 2025 to 2035

Preterm Births and PROM Testing Market Size and Share Forecast Outlook 2025 to 2035

Doula & Birth Coaching Services Market Trends – Growth to 2035

Tissue Engineered Skin Substitute Market Size and Share Forecast Outlook 2025 to 2035

Tissue Paper Converting Machine Market Size and Share Forecast Outlook 2025 to 2035

Tissue Extraction System Market Size and Share Forecast Outlook 2025 to 2035

Tissue-Based Genomic Profiling Market Size and Share Forecast Outlook 2025 to 2035

Tissue Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Tissue Paper Unwinding Machine Market Size and Share Forecast Outlook 2025 to 2035

Tissue Paper Embosser Machine Market Size and Share Forecast Outlook 2025 to 2035

Tissue and Hygiene Market Size and Share Forecast Outlook 2025 to 2035

Tissue Towel Market Analysis - Trends, Growth & Forecast 2025 to 2035

Competitive Overview of Tissue Paper Unwinding Machine Manufacturers

Market Leaders & Share in the Tissue Paper Converting Machine Industry

Tissue Paper Converting Machine Market Trends – Growth, Demand & Forecast 2025-2035

Tissue Sealants & Adhesive Market Insights - Growth & Forecast 2025 to 2035

Tissue Cultured Date Palm Market Trends – Growth & Industry Forecast 2024 to 2034

Tissue Tapes Market

Tissue and Hygiene Paper Packaging Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA