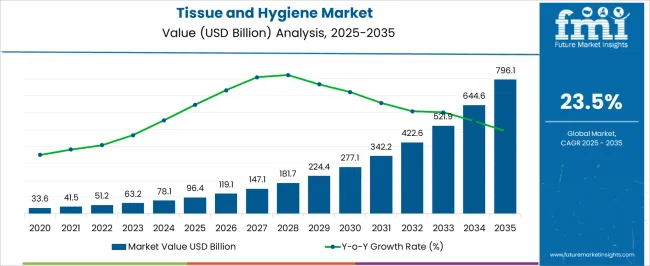

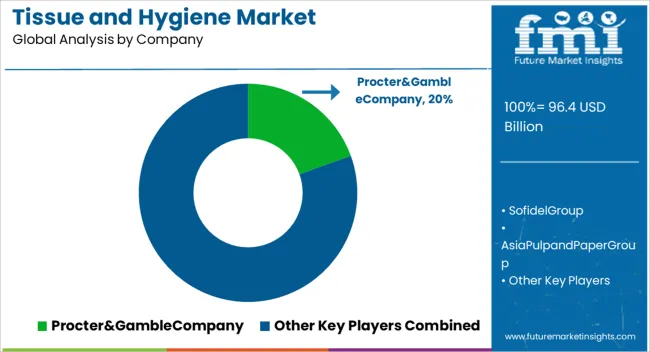

The Tissue and Hygiene Market is estimated to be valued at USD 96.4 billion in 2025 and is projected to reach USD 796.1 billion by 2035, registering a compound annual growth rate (CAGR) of 23.5% over the forecast period.

| Metric | Value |

|---|---|

| Tissue and Hygiene Market Estimated Value in (2025 E) | USD 96.4 billion |

| Tissue and Hygiene Market Forecast Value in (2035 F) | USD 796.1 billion |

| Forecast CAGR (2025 to 2035) | 23.5% |

The tissue and hygiene market is undergoing consistent expansion, supported by heightened health awareness, urbanization, and a rising preference for convenience-centric personal care products. Consumer and institutional demand for disposable hygiene solutions has remained strong, especially as hygiene standards have tightened across industries post-pandemic. Manufacturers are investing in biodegradable, skin-friendly, and dermatologically safe materials to align with environmental expectations and consumer safety.

Technological advancements in production processes, such as touchless dispensing systems and moisture-locking textures, are enhancing product differentiation. With growing concerns about cross-contamination and infectious disease control, hygiene protocols in public and commercial spaces are elevating demand for high-performance tissue products.

Furthermore, the influence of wellness trends and rising disposable income are driving premiumization across personal hygiene lines. As modern retail expands and niche health and beauty stores gain traction, the market is poised for continued diversification and regional penetration.

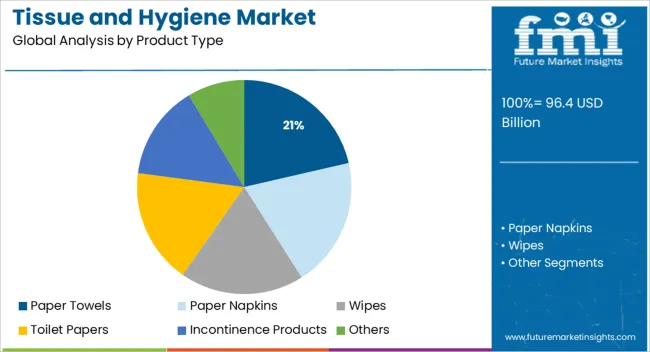

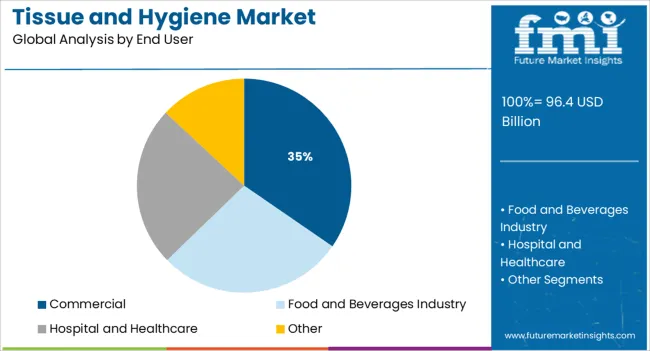

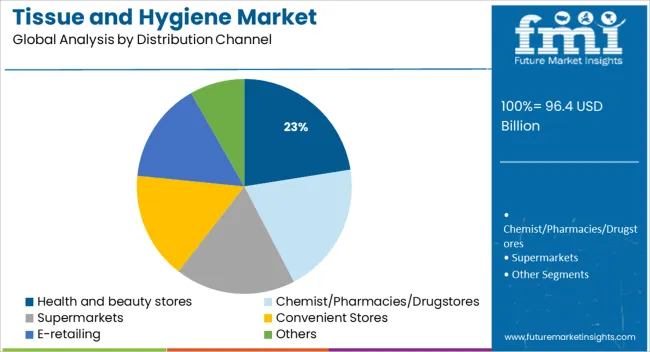

The market is segmented by Product Type, End User, and Distribution Channel and region. By Product Type, the market is divided into Paper Towels, Paper Napkins, Wipes, Toilet Papers, Incontinence Products, and Others. In terms of End User, the market is classified into Commercial, Food and Beverages Industry, Hospital and Healthcare, and Other. Based on Distribution Channel, the market is segmented into Health and beauty stores, Chemist/Pharmacies/Drugstores, Supermarkets, Convenient Stores, E-retailing, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Paper towels are expected to capture 21.4% of total revenue in the product type category by 2025, positioning them as a leading product. This leadership is being driven by their versatility in personal, household, and professional use for surface cleaning, hand drying, and general hygiene maintenance.

Increased public and institutional focus on infection control has made single-use paper towels the preferred alternative to cloth or air dryers, particularly in healthcare and food service environments. Manufacturers are prioritizing absorbency, durability, and sustainable raw materials, making paper towels both functional and eco-conscious.

Consumer preference for convenience and disposability is reinforcing their high usage frequency in homes and commercial spaces. With brand competition focusing on thickness, softness, and absorbent technology, the paper towel segment continues to hold a strong position in the broader tissue and hygiene landscape.

The commercial segment is anticipated to lead with 34.6% of revenue share in 2025 within the end user category. This dominance is supported by institutional requirements across sectors such as hospitality, healthcare, education, and transportation, where hygiene compliance and high-volume usage are critical. Stringent regulatory guidelines have necessitated the widespread use of certified tissue products to ensure sanitation and minimize contamination risks.

Facilities management teams are increasingly deploying standardized hygiene systems, including bulk dispensing of tissue paper, sanitary napkins, and hand hygiene solutions. Enhanced procurement practices among large-scale operators are driving demand for cost-efficient and high-performance hygiene products.

The push for sustainable practices is also prompting commercial entities to transition to eco-labeled tissue supplies, further boosting consumption. With the rise of smart buildings and digitized supply chains, tissue inventory and usage are being optimized in commercial environments, reinforcing their share within the tissue and hygiene market.

In the distribution channel category, health and beauty stores are forecast to contribute 22.5% of total revenue in 2025. This is largely attributed to the growing consumer inclination toward curated, wellness-driven retail experiences where hygiene products are aligned with personal care and self-care trends.

These stores offer premium, niche, and dermatologically approved tissue and hygiene products that appeal to health-conscious consumers seeking both efficacy and safety. Private label expansion, attractive in-store displays, and expert recommendations have elevated trust and brand engagement in this channel.

The ability to bundle hygiene items with skincare, baby care, and wellness solutions has also improved upselling potential and product visibility. Moreover, the rise in urban retail penetration and customer loyalty programs has reinforced the role of health and beauty stores as a critical sales channel for hygiene products, ensuring its growing prominence in the evolving retail landscape.

As the demand for feminine products as tissues, wipes and hygiene products is increasing, the market for tissues and other hygiene goods is increasing rapidly. Using these products in daily life is anticipated to be healthy living. Due to the wide range of uses among customers, demand for tissue and hygiene items like wipes and toilet paper is increasing. Additionally, since tissue and hygiene items are readily disposed of, there will likely be an increase in demand for them on the international market.

Another reason driving the industry's expansion is the rise in consumer demand for recyclable goods. Products that can be recycled are considered safe, not damaging to the environment and cost less to produce new resources internationally. Easily available products due to increased retailing, use of these products by hospitality, entertainment and various other sectors are having positive impact too. All of the aforementioned elements are favouring market expansion.

There is increasing demand for products like tissues and toilet papers, but the disposal problems and stringent rules in many countries for processing and disposal of hygiene products are seemingly affecting the market. The prices of raw materials for manufacturing of these products is also another factor having negative impact on growth.

As tissue papers and toilet papers are made from wood pulp, and require processing for being usable, processing industries are faced by number of problems for use of raw materials and their increasing prices. These are some factors that may limit the tissue and hygiene product market growth.

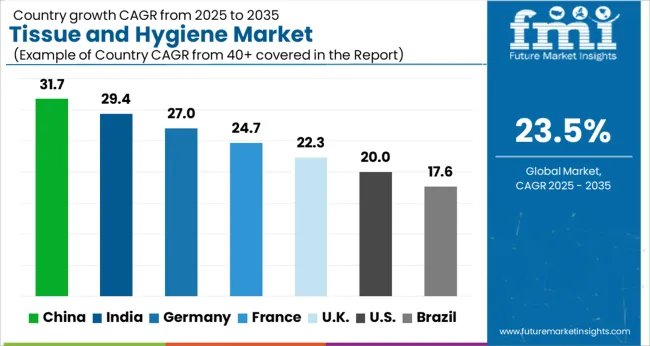

The South-East Asia and China are the biggest market for hygiene and tissue products, observed for about| 68%-70% sales of the products. Along with China, Vietnam, Singapore and Indonesia are also showing good amount of growth in sells, and are becoming target for hygiene products manufacturing industries.

Recently, decreasing birth rates are having negative impact on baby hygiene products, but on the other hand, increasing self-hygiene awareness and habitual use of sanitation products is showing positive impact on the tissue and hygiene products market growth.

Tissue and Hygiene products in America are preferred upon their origin and nature. American Generation Z and Millennials are selecting brands and products which are exclusively Made in America.Promotional advertisements, branding stunts and other marketing ideas are now old for American customers, as they are shopping only with brands providing clean, eco-friendly products, made by domestic brands and companies.

Some key players in the Tissue and Hygiene Products Market are Asia Pulp and Paper Group, Carmen Tissues S.A.E, Clearwater Paper Corporation, Georgia Pacific LLC, Hengan International Group Co. Ltd., Johnson & Johnson, Kimberly-Clark Corporation, Kruger Inc., MPI Papermills Inc., Procter & Gamble Company, Sofidel Group, Svenska Cellulosa Aktiebolaget (SCA), Unicharm Corporation and others.

| Attribute | Details |

|---|---|

| Growth Rate | CAGR of ~23.5% from 2025 to 2035 |

| Base year for estimation | 2024 |

| Historical Data Available for | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative units | Revenue in USD Billion, volume in Units, and CAGR from 2025 to 2035 |

| Report coverage | Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends, pricing analysis |

| Segments covered | Product Type, End User, Distribution Channel, Region |

| Country scope | USA, Canada, Mexico, Germany, UK, France, Italy, Spain, Russia, India, Thailand, China, India, Japan, Australia, Brazil, Argentina, Colombia, Saudi Arabia, UAE, South Africa |

| Key Companies Profiled | MPI Papermills Inc.; Procter Gamble Company; Sofidel Group; Asia Pulp and Paper Group; Carmen Tissues S.A.E; Clearwater Paper Corporation; Georgia Pacific LLC; Hengan International Group Co., Ltd.; Johnson Johnson; Kimberly-Clark Corporation; Kruger Inc.; Svenska Cellulosa Aktiebolaget (SCA); Unicharm Corporatio; Others |

| Customization scope | Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional segment scope. |

| Pricing and purchase options | Avail customized purchase options to meet your exact research needs. |

The global tissue and hygiene market is estimated to be valued at USD 96.4 billion in 2025.

The market size for the tissue and hygiene market is projected to reach USD 796.1 billion by 2035.

The tissue and hygiene market is expected to grow at a 23.5% CAGR between 2025 and 2035.

The key product types in tissue and hygiene market are paper towels, paper napkins, wipes, toilet papers, incontinence products and others.

In terms of end user, commercial segment to command 34.6% share in the tissue and hygiene market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Tissue and Hygiene Paper Packaging Market

Tissue Engineered Skin Substitute Market Size and Share Forecast Outlook 2025 to 2035

Tissue Paper Converting Machine Market Size and Share Forecast Outlook 2025 to 2035

Tissue Extraction System Market Size and Share Forecast Outlook 2025 to 2035

Tissue-Based Genomic Profiling Market Size and Share Forecast Outlook 2025 to 2035

Tissue Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Tissue Paper Unwinding Machine Market Size and Share Forecast Outlook 2025 to 2035

Hygiene Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Tissue Paper Embosser Machine Market Size and Share Forecast Outlook 2025 to 2035

Hygiene Packaging Market Trends & Industry Outlook 2025 to 2035

Tissue Towel Market Analysis - Trends, Growth & Forecast 2025 to 2035

Competitive Overview of Tissue Paper Unwinding Machine Manufacturers

Market Leaders & Share in the Tissue Paper Converting Machine Industry

Tissue Paper Converting Machine Market Trends – Growth, Demand & Forecast 2025-2035

Tissue Sealants & Adhesive Market Insights - Growth & Forecast 2025 to 2035

Tissue Cultured Date Palm Market Trends – Growth & Industry Forecast 2024 to 2034

Tissue Tapes Market

Tissue Roll Unwinders Market

The Soft Tissue Repair Market is segmented by Synthetic, Allograft, Xenograft and Alloplast from 2025 to 2035

Soft Tissue Release Systems Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA