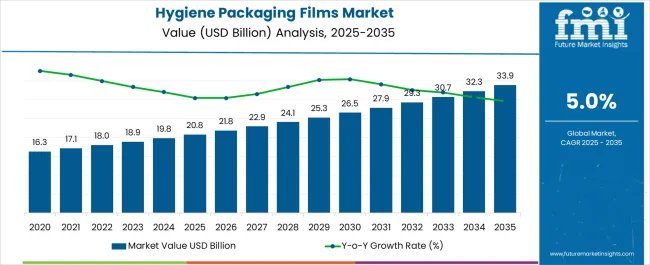

The Hygiene Packaging Films Market is estimated to be valued at USD 20.8 billion in 2025 and is projected to reach USD 33.9 billion by 2035, registering a compound annual growth rate (CAGR) of 5.0% over the forecast period.

| Metric | Value |

|---|---|

| Hygiene Packaging Films Market Estimated Value in (2025 E) | USD 20.8 billion |

| Hygiene Packaging Films Market Forecast Value in (2035 F) | USD 33.9 billion |

| Forecast CAGR (2025 to 2035) | 5.0% |

The hygiene packaging films market is witnessing significant growth, driven by increasing consumer demand for sanitized, durable, and breathable packaging materials in personal care and healthcare applications. Enhanced awareness of hygiene and product safety is accelerating the shift toward high-performance films that offer moisture regulation, odor control, and microbial resistance.

Manufacturers are focusing on developing films with advanced barrier properties and sustainable polymer compositions, aligning with environmental goals and regulatory frameworks. Global investment in personal hygiene, along with rising birth rates and aging populations in emerging economies, is fostering volume demand for diaper, feminine hygiene, and incontinence product packaging.

Technological innovations in film extrusion and recyclability are expected to support new product launches and high-speed manufacturing efficiency. The industry is also benefiting from backward integration of raw materials and digital traceability solutions, improving supply chain resilience and quality control.

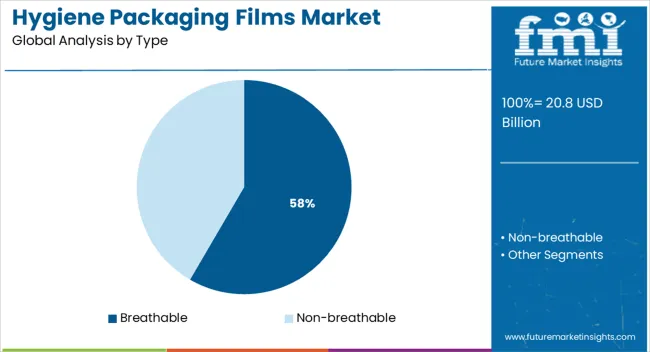

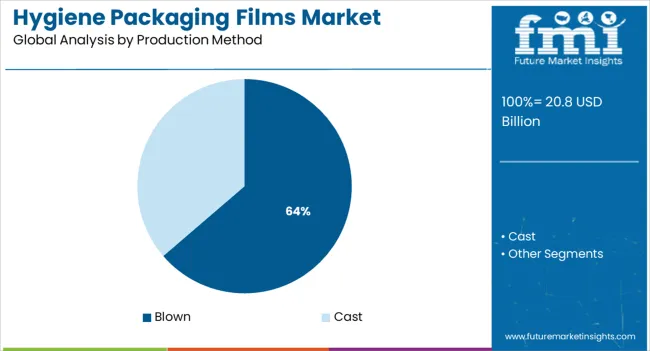

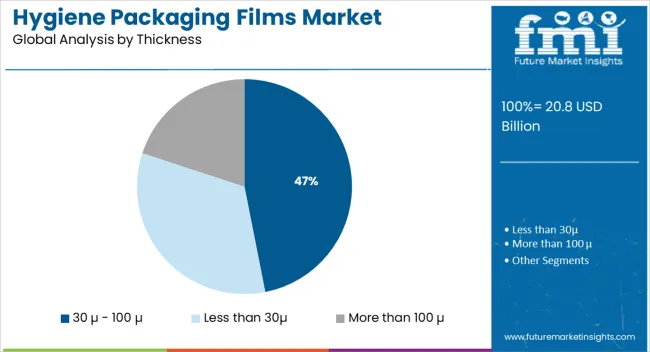

The market is segmented by Type, Production Method, Thickness, and Packaging Application and region. By Type, the market is divided into Breathable and Non-breathable. In terms of Production Method, the market is classified into Blown and Cast. Based on Thickness, the market is segmented into 30 µ - 100 µ, Less than 30µ, and More than 100 µ. By Packaging Application, the market is divided into Diapers, Sanitary Napkins, Wipes, Adult Incontinence, Paper Towels, Bathroom Tissues, and Surgical Drapes. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Breathable films are projected to account for 58.4% of the overall hygiene packaging films market revenue in 2025, making them the dominant product type. Their widespread adoption is being driven by performance benefits in ventilation, moisture management, and wearer comfort.

The permeability of breathable films enables optimal skin health, particularly in hygiene applications such as baby diapers and adult incontinence products. Rising demand for thin, stretchable, and soft-touch films that mimic textile-like properties has reinforced their relevance in premium product categories.

Manufacturers are increasingly incorporating microporous structures and co-extruded materials that improve tensile strength without compromising airflow. With consumer preference shifting toward skin-friendly and dermatologically safe packaging, breathable films are expected to remain a key enabler of innovation and differentiation in hygiene product lines.

Blown film extrusion is forecast to hold 63.7% of the total market share by 2025, emerging as the leading production method in hygiene packaging films. This method’s popularity is underpinned by its ability to deliver multilayer film structures with uniform thickness and high strength-to-weight ratios.

Blown film lines allow for precise control of film properties such as elongation, breathability, and barrier performance critical attributes for hygiene applications. The process is compatible with a wide range of polyolefins and biodegradable materials, supporting sustainable production objectives.

In-line printing and lamination compatibility further enhance the value proposition for manufacturers targeting branded consumer segments. The method’s scalability and energy efficiency have contributed to its dominance, especially in regions where continuous output and material optimization are key operational goals.

Films with a thickness range of 30 µ to 100 µ are expected to account for 46.9% of the market revenue in 2025, ranking as the most preferred segment by thickness. This preference is linked to the balance these films offer between structural integrity and material economy.

In hygiene applications, this thickness range supports tear resistance, sealability, and printing compatibility while maintaining product comfort and usability. Such films are widely used for wrap and barrier layers in multi-part hygiene products where weight minimization and material cost efficiency are critical.

The growing trend toward lightweight packaging and use of less raw material per unit is further reinforcing the dominance of this segment. Moreover, advancements in thin-gauge film processing have improved mechanical performance, enabling lower thickness without sacrificing protective attributes.

Hygiene Packaging Films are basically multilayer co-extruded films that are used for the packaging of products such as baby diapers, adult incontinence, bathroom tissues, moist towelettes, paper towel, sanitary napkins and other female hygiene products. Hygiene packaging films are produced up three to four layers and has a thickness ranging from 10µ to 150µ.

Hygiene packaging films are capable of high technology printing. The ink system for printing is designed such that it ensures high resistance to fading. Both breathable and non-breathable materials can be used to manufacture hygiene packaging films. Hygiene packaging films made from cast method contains CaCO3 which is breathable, this is achieved by stretching the film to form micro holes.

Hygiene packaging films reduces the risk of skin irritation as it is soft, drape-able, comfortable and safe. Hygiene packaging films enables efficient production in the manufacture of the final products. Hygiene packaging films are easy to print and are available with or without micro-perforation.

Special mechanical features of the hygiene packaging films guarantees high stability. Polypropylene and polyethylene resins are often used to manufacture hygiene packaging films.

These resins meet the requirement needed for hygiene packaging film which include, smooth surface, good sealing, and tear propagation resistance, low gel levels and easy cutting. Hygiene packaging films are used for the single wrapping of sanitary napkins.

Hygiene packaging films are suitable for packaging sanitary towels due to outstanding properties at mechanical stress also for other sectors where high speed welding and packaging is needed.

The demand for hygiene packaging films is expected to rise during the forecast, mainly due to the rise in consumer awareness for personal care to avoid contagious diseases. Berry Global Group is one of the leading manufacturers of hygiene packaging films.

The company provides films, non-woven and laminates provide comfort and protection across a range of diapers and pant application area. Hygiene packaging films manufacturers are offering films that deliver differentiating softness and bulk along with high visual attractiveness.

Hygiene packaging films offer functionality with high breathability, heat and moisture vapor release. Hygiene packaging films used for packaging wipes are capable of providing form and function with a variety of closure options that provide flat and tight seal preventing the moisture from entering.

Hygiene packaging films are produced with high quality raw material to give optimal stiffness strength and sealing properties. Despite the positive outlook of the hygiene packaging films market, the growth in the use of pulp & paper for hygiene packaging is likely to hamper the market for hygiene packaging films.

By combining cellulosic and pulp fiber technology, pulp & paper material is used for the packaging of personal hygiene products such as sanitary napkins, diapers, wipe, tissues etc.

The Hygiene Packaging Films market report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain.

The report provides in-depth analysis of Hygiene Packaging Films market trends, macroeconomic indicators and governing factors along with Hygiene Packaging Films market attractiveness as per segments. The Hygiene Packaging Films report also maps the qualitative impact of various market factors on Hygiene Packaging Films market segments and geographies.

The global hygiene packaging films market is estimated to be valued at USD 20.8 billion in 2025.

The market size for the hygiene packaging films market is projected to reach USD 33.9 billion by 2035.

The hygiene packaging films market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in hygiene packaging films market are breathable and non-breathable.

In terms of production method, blown segment to command 63.7% share in the hygiene packaging films market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hygiene Packaging Market Trends & Industry Outlook 2025 to 2035

Women Hygiene Care Product Market Growth, Trends and Forecast from 2025 to 2035

Dental Hygiene Devices Market Size and Share Forecast Outlook 2025 to 2035

Dental Hygiene Instrument Market Analysis by Product, Application, Usage, End User, and Region through 2025 to 2035

Patient Hygiene Aids Market – Demand & Forecast 2024 to 2034

Feminine Hygiene Product Market Analysis – Growth & Forecast 2025 to 2035

Disposable Hygiene Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Tissue and Hygiene Market Size and Share Forecast Outlook 2025 to 2035

Disposable Hygiene Products Market Analysis by Product Type, Sales Channel, and Region through 2025 to 2035

Disposable Hygiene Footwear Market

Tissue and Hygiene Paper Packaging Market

Stethoscope Hygiene Devices Market Size and Share Forecast Outlook 2025 to 2035

Cleaning and Hygiene Product Market Report – Demand & Trends 2024-2034

Clinical Hand Hygiene Products Market – Trends, Growth & Forecast 2025 to 2035

Men's Intimate Hygiene Products Market Size and Share Forecast Outlook 2025 to 2035

BRICS Disposable Hygiene Products Market Analysis – Size, Share & Trends 2025 to 2035

Industrial and Institutional Hand Hygiene Chemicals Market - Trends & Forecast 2025 to 2035

Packaging Supply Market Size and Share Forecast Outlook 2025 to 2035

Packaging Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tubes Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA