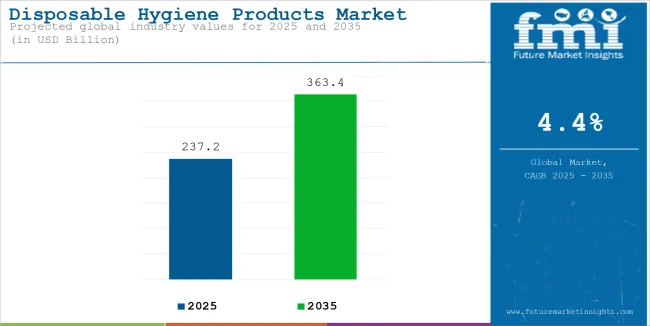

The disposable hygiene products market is estimated to account for USD 237.2 billion in 2025. It is anticipated to grow at a CAGR of 4.4% during the assessment period and reach a value of USD 363.4 billion by 2035.

The sales of disposable hygiene products are on rise because of high disposable incomes, the development of more hygiene consciousness, and the increased entry of products through both digital and offline channels. Environmental and fully biodegradable products will be the focus of the manufacturing industries. The demand for baby diapers and adult incontinence products will rise due to the continuously increasing population of older people as well as the population growth in developing countries.

North America will be at the forefront of advancements, Europe will have stringent policies on sustainability, and Asia Pacific will witness mass urbanization and population growth.

| Metrics | Values |

|---|---|

| Industry Size (2025E) | USD 237.2 billion |

| Industry Value (2035F) | USD 363.4 billion |

| CAGR (2025 to 2035) | 4.4% |

Parents prefer baby diapers that are comfortable, absorbent, and sustainable over other such products. These concerns are also boosting the demand for diaper producers that are affordable yet reliable. On the contrary, in North American nations such as the USA and Japan as well as in European countries like Germany, alongside the traditional disposable ones, parents desire the use of organic, and biodegradable diaper options to lessen their ecological footprint.

In response, diaper manufacturers are coming up with hypoallergenic, chemical-free, and super absorbent baby diapers. For instance, brands like Pampers, Huggies, and MamyPoko have advertised their plant-based and water-saving diaper variants, which ensure functionality and sustainability ultimately. The business model based on subscription plans is also in the process of finding more and more adopters, thus making the diaper purchases easier and more convenient for the parents.

Also, the internet of things (IoT) technology is introducing a newly smart diaper that can change the way of infant care. Not only do the IoT-enabled diapers can detect moisture levels, monitor skin sensitivity, and send real-time alerts to caregivers, but they can also do all of these things at the same time. This ensures that the baby feels comfortable and the parents also get a way of systematically tracking the baby’s hygiene requirements.

The customers are being attracted more to online shopping with perks like delivery convenience, bulk purchase discounts, and subscription models that ensure they will not run out of essentials.

E-commerce companies like Amazon, Walmart, and Alibaba offer a whole new experience of shopping for moms where they can choose baby diapers, tampons, wipes, and sanitary napkins from organic, biodegradable options. DTC brands provide hygiene solutions that are tailor-made besides the regular shopping experience.

For instance, the online-only product releases are redesigned from the brands in which they cooperate with the influencers and social media personalities.

Environmental Impact of Disposable Hygiene Waste

The increasing reliance on these products is significantly contributing to landfill waste and environmental pollution. The majority of conventional hygiene products are constructed from synthetic materials, such as plastics and non-biodegradable polymers, that last for decades. With growing consumption, the products continue to weigh heavily on waste management infrastructure, causing clogged landfills and pollution of natural habitats.

Governments and environmental conservation bodies are implementing radical action to fight against this problem. Stringent plastic waste reduction laws are putting pressure on producers to overhaul their raw material and production patterns.

Policy requirements will demand the use of biodegradable material and promote recycling schemes, which will force the industry players to adopt environmentally friendly methods. Manufacturers that fail to achieve these new standards will face penalties, restrictions, and possible loss of market share.

The hygiene sector must act pre-emptively by prioritizing research and development of recyclable and biodegradable alternatives. Brands must invest in materials that will decompose naturally, reducing their environmental footprint.

Strategic alliances with recycling and waste management companies will further enhance sustainable disposal processes. With environmental concerns still driving consumer demand, green innovation-adopting manufacturers will ensure long-term sustainability and customer loyalty.

Growth of Biodegradable and Sustainable Hygiene Products

Manufacturers have a great opportunity to transform the hygiene sector by launching biodegradable and plant-based disposable products. With sustainability becoming a major buying factor, consumers are actively looking for green solutions. Companies that incorporate organic cotton, bamboo fibers, and superabsorbent biodegradable polymers into products will appeal to environmentally aware consumers.

Material science breakthroughs are making it possible to develop high-performance sustainable hygiene products. This ensures that biodegradable products offer the same comfort and efficiency as traditional products. Brands that invest in sustainable packaging-compostable wrappers and plastic-free containers will further lead the market.

Sustainability-focused companies can maximize their competitive advantage by openly projecting their dedication to green practices. With the world being led by international policies towards cleaner alternatives and consumer pressure moving towards sustainability, businesses that pioneer the biodegradable hygiene revolution will have a solid foundation in the new marketplace. By joining green objectives, corporations can drive innovation, grow market share, and contribute towards making the world a cleaner place.

| Countries & Population (2024) | Per Capita Spending (USD) (2024) |

|---|---|

| USA - 345.4 million | 217.14 |

| China - 1,419.3 million | 84.55 |

| India - 1,450.9 million | 44.80 |

| Japan - 123.2 million | 243.51 |

| Germany - 84.1 million | 332.94 |

| UK - 68.3 million | 366.00 |

| South Korea - 51.7 million | 348.35 |

| Australia - 26.3 million | 570.72 |

Highest Per Capita Expenditure Countries Australian (USD 570.72), UK (USD 366.00), and German (USD 332.94) consumers are the largest spenders on these products. They demand high-quality, eco-friendly, and dermatologically tested hygiene products. Powerful retail distribution networks and high disposable incomes drive market growth in these nations.

Moderate Per Capita Expenditure Countries Japanese (USD 243.51), USA (USD 217.14), and South Korean (USD 348.35) consumers have steady demand for hygiene products. Aging populations, high personal care consciousness, and convenient retail access influence their spending. Biodegradable and intelligent hygiene solution innovations drive these markets.

Emerging Economies with Growth Potential Indian (USD 44.80) and Chinese (USD 84.55) consumers are low spenders on hygiene products but with growth potential. Increased disposable incomes, urbanization, and larger product availability propel demand. Retail proliferation and internet channels offer convenient access to products, and more consumers buy hygiene products.

Disposable Hygiene Products Market Survey Analysis The market is changing with brand reputation, sustainability, and price sensitivity influencing consumer buying behavior in international markets. Market demand is captured by a survey of 300 respondents from the USA, UK, EU, Korea, Japan, Southeast Asia, China, ANZ, and the Middle East conveying different consumer preferences influencing market demand.

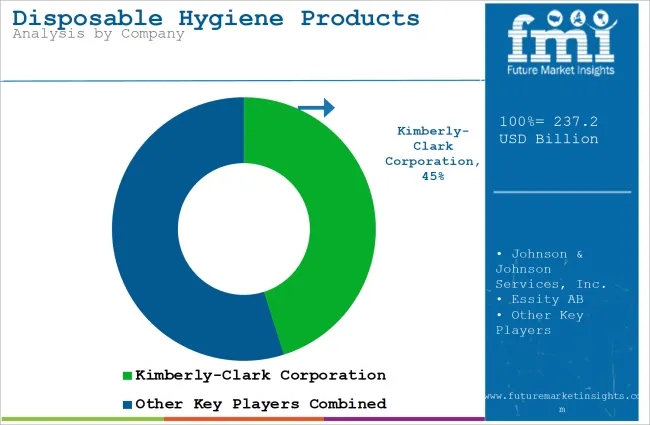

Brand loyalty drives purchasing decisions in Western markets, with 70% of USA respondents, 65% in the UK, and 60% in the EU favoring P&G, Kimberly-Clark, and Unicharm. In contrast, 40% in China and 45% in Southeast Asia are more receptive to budget-friendly alternatives, presenting an opportunity for cost-effective brands.

Opting for eco-friendly products has turned into a significant reason for consumers in the USA (75%), the UK (70%), and the EU (65%) to turn to sustainable hygiene products. Such a disposition is an opportunity for brands to add biodegradable materials and the use of recyclable packaging for the purpose of showing meeting demand.

While 60% of USA and 55% of UK consumers are ready to pay extra for premium hygiene products, only 35%-40% of respondents from China and Southeast Asia share this attitude. Japan and Korea (40%-45%) have a tendency for mid-range products, appreciating both cost-effectiveness and performance.

The online commerce business area is seen as a strong leader of purchasing trends. The survey showed that 55% of American, and 50% of British consumers chose online shopping as their preferred method for acquiring hygiene products. Similarly, China (55%) and Southeast Asia (50%) favor digital retail, which permits the necessity of online distribution strategies. On the other hand, bulk purchasing is also an eminent trend, where 65% of American consumers, and 60% of Chinese consumers prefer to get big pack sizes to save costs.

To penetrate the premium, budget, and bulk-buying sectors and thus achieving growth, brands need to synchronize pricing, sustainability initiatives, and digital development plans.

The disposable hygiene products market is effective primarily in the USA, due to high consumer consciousness, an older population, and a strong need for premium hygiene products. The adult incontinence products market is being fueled by hospitals and nursing homes. Retail infrastructure is very powerful with supermarkets, pharmacies, and e-commerce platforms, and is easily accessible to both.

As healthcare spending soars, hospitals, and homecare service providers buy more adult incontinence products. Users of the goods are starting to express their preference of the super-absorbent and dermatologist tested products. FMI is of the opinion that the USA disposable hygiene products market is anticipated to grow at 4.2% CAGR during the study period.

Reasons for growth

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.2% |

China’s disposable hygiene products market is extending speedily due to urbanization, increasing disposable incomes, and the government-led health campaign. The country's shift from a One-Child Policy to a Two-Child Policy has drastically tasted the rise of baby diapers. The well-off middle class has now shifted this from basic hygiene spending to premium hygiene products, and the adult incontinence products are, also, a result of the rapidly aging population.

The regime facilitates healthcare works by refurbishing health centers and campaigns promoting hygiene through publicity. Besides, it is Alibaba's e-commerce which provides hygiene products both in cities and outside them. FMI is of the opinion that the Chinese disposable hygiene products market is anticipated to grow at 4.5% CAGR during the study period.

Reasons for Growth

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 4.5% |

Manufacturers prioritize biodegradable and chemical-free solutions to align with the nation’s sustainability objectives. The geriatric society as well as the outstanding rate of development in the medical line should be mentioned as decisive constituents in the demand for incontinence hospital-grade products. On the other hand, affluent German customers vote for hypoallergenic and fragrance-free personal care solutions.

Retailers and e-commerce platforms have been developed for such a market that put the value of product safety and the environment respect. FMI is of the opinion that the market in Germany is anticipated to grow at 4.4% CAGR during the study period.

Reasons for Growth

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 4.4% |

The boom in the disposable hygiene products in India is the result of high public health consciousness, government action, and improved income levels. Programs such as Swachh Bharat Abhiyan (Clean India Mission) and Beti Bachao Beti Padhao provide the use of sanitary pads and baby diapers in rural and semi-urban areas. The fast-growing upper middle class is the key driver for the demand of eco-friendly and good quality hygiene products.

The diversely populated India with young people contributes to the modernity as a feminine hygiene option. Not only this, but the e-commerce penetration has made hygiene products accessible to people living in tier-2 and tier-3 cities, as a living standard of people gets better, so does the adoption. FMI is of the opinion that the Indian market is anticipated to grow at 4.6% CAGR during the study period.

Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 4.6% |

The disposable hygiene products sales in Australia is distinctive due to the high consumer awareness, the demand for premium products, and the concerns about sustainability. Australians are the second most significant spenders of personal care and hygiene items on a per capita basis in the world. People find it better to use dermatologically tested, eco-friendly, and environment-friendly products.

The growing population of the elderly in the country leads to the need for incontinence products for adults, which is also subsidized by the government-backed aged care programs. On top of that, by replacing plastic with biodegradable substitutes, manufacturers and supermarkets tackle the problem of environmental pollution.

The increasing trend of luxury wellness and personal care is also the reason why organic feminine hygiene products and hypoallergenic baby diapers are in demand. FMI is of the opinion that the Australian market is anticipated to grow at 4.7% CAGR during the study period.

Reasons for Growth

| Country | CAGR (2025 to 2035) |

|---|---|

| Australia | 4.7% |

The disposable hygiene products sector remains intensely competitive with the main operators taking advantages of their solid brand position, technological advancement, and product sustainability. They pour cash into R&D to improve absorbing capacity, skin-friendliness, and environmental sustainability.

The rise in consumer awareness and demand for personal care and sanitary products, as well as the contribution of a growing elderly population affected by incontinence help in the sales. As a result of this, the top players have broadened their business by means of strategic associations, digital marketing, and product diversification.

By product type, the market is segmented into tampons, toilet paper, tissue paper, wipes, sanitary napkins, baby diapers, adult diapers, and others.

By sales channel, it includes drug stores/pharmacies, online, supermarkets/hypermarkets, and others.

By Region, the market covers North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America.

The industry is projected to witness a CAGR of 4.4% between 2025 and 2035.

The market is slated to witness USD 237.2 billion in 2025.

The industry is anticipated to reach USD 363.4 billion by 2035 end.

Australia is set to grow at 4.7% CAGR during the study period.

The key players operating in the market include Procter & Gamble (P&G), Kimberly-Clark Corporation, Essity AB, Unicharm Corporation, Ontex Group NV, Domtar Corporation, Kao Corporation, Edgewell Personal Care Company, Hengan International Group Co., Ltd., and First Quality Enterprise.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Global Market Volume (Units Pack) Forecast by Region, 2019 to 2034

Table 3: Global Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 4: Global Market Volume (Units Pack) Forecast by Product, 2019 to 2034

Table 5: Global Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 6: Global Market Volume (Units Pack) Forecast by Distribution Channel, 2019 to 2034

Table 7: North America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 8: North America Market Volume (Units Pack) Forecast by Country, 2019 to 2034

Table 9: North America Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 10: North America Market Volume (Units Pack) Forecast by Product, 2019 to 2034

Table 11: North America Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 12: North America Market Volume (Units Pack) Forecast by Distribution Channel, 2019 to 2034

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 14: Latin America Market Volume (Units Pack) Forecast by Country, 2019 to 2034

Table 15: Latin America Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 16: Latin America Market Volume (Units Pack) Forecast by Product, 2019 to 2034

Table 17: Latin America Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 18: Latin America Market Volume (Units Pack) Forecast by Distribution Channel, 2019 to 2034

Table 19: Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 20: Europe Market Volume (Units Pack) Forecast by Country, 2019 to 2034

Table 21: Europe Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 22: Europe Market Volume (Units Pack) Forecast by Product, 2019 to 2034

Table 23: Europe Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 24: Europe Market Volume (Units Pack) Forecast by Distribution Channel, 2019 to 2034

Table 25: East Asia Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 26: East Asia Market Volume (Units Pack) Forecast by Country, 2019 to 2034

Table 27: East Asia Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 28: East Asia Market Volume (Units Pack) Forecast by Product, 2019 to 2034

Table 29: East Asia Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 30: East Asia Market Volume (Units Pack) Forecast by Distribution Channel, 2019 to 2034

Table 31: South Asia Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 32: South Asia Market Volume (Units Pack) Forecast by Country, 2019 to 2034

Table 33: South Asia Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 34: South Asia Market Volume (Units Pack) Forecast by Product, 2019 to 2034

Table 35: South Asia Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 36: South Asia Market Volume (Units Pack) Forecast by Distribution Channel, 2019 to 2034

Table 37: Oceania Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 38: Oceania Market Volume (Units Pack) Forecast by Country, 2019 to 2034

Table 39: Oceania Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 40: Oceania Market Volume (Units Pack) Forecast by Product, 2019 to 2034

Table 41: Oceania Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 42: Oceania Market Volume (Units Pack) Forecast by Distribution Channel, 2019 to 2034

Table 43: MEA Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 44: MEA Market Volume (Units Pack) Forecast by Country, 2019 to 2034

Table 45: MEA Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 46: MEA Market Volume (Units Pack) Forecast by Product, 2019 to 2034

Table 47: MEA Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 48: MEA Market Volume (Units Pack) Forecast by Distribution Channel, 2019 to 2034

Figure 1: Global Market Value (US$ Million) by Product, 2024 to 2034

Figure 2: Global Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 3: Global Market Value (US$ Million) by Region, 2024 to 2034

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 5: Global Market Volume (Units Pack) Analysis by Region, 2019 to 2034

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 8: Global Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 9: Global Market Volume (Units Pack) Analysis by Product, 2019 to 2034

Figure 10: Global Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 11: Global Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 12: Global Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 13: Global Market Volume (Units Pack) Analysis by Distribution Channel, 2019 to 2034

Figure 14: Global Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 15: Global Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 16: Global Market Attractiveness by Product, 2024 to 2034

Figure 17: Global Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 18: Global Market Attractiveness by Region, 2024 to 2034

Figure 19: North America Market Value (US$ Million) by Product, 2024 to 2034

Figure 20: North America Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 21: North America Market Value (US$ Million) by Country, 2024 to 2034

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 23: North America Market Volume (Units Pack) Analysis by Country, 2019 to 2034

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 26: North America Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 27: North America Market Volume (Units Pack) Analysis by Product, 2019 to 2034

Figure 28: North America Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 29: North America Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 30: North America Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 31: North America Market Volume (Units Pack) Analysis by Distribution Channel, 2019 to 2034

Figure 32: North America Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 33: North America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 34: North America Market Attractiveness by Product, 2024 to 2034

Figure 35: North America Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 36: North America Market Attractiveness by Country, 2024 to 2034

Figure 37: Latin America Market Value (US$ Million) by Product, 2024 to 2034

Figure 38: Latin America Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 39: Latin America Market Value (US$ Million) by Country, 2024 to 2034

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 41: Latin America Market Volume (Units Pack) Analysis by Country, 2019 to 2034

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 44: Latin America Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 45: Latin America Market Volume (Units Pack) Analysis by Product, 2019 to 2034

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 48: Latin America Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 49: Latin America Market Volume (Units Pack) Analysis by Distribution Channel, 2019 to 2034

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 52: Latin America Market Attractiveness by Product, 2024 to 2034

Figure 53: Latin America Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 54: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 55: Europe Market Value (US$ Million) by Product, 2024 to 2034

Figure 56: Europe Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 57: Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 58: Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 59: Europe Market Volume (Units Pack) Analysis by Country, 2019 to 2034

Figure 60: Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 61: Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 62: Europe Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 63: Europe Market Volume (Units Pack) Analysis by Product, 2019 to 2034

Figure 64: Europe Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 65: Europe Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 66: Europe Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 67: Europe Market Volume (Units Pack) Analysis by Distribution Channel, 2019 to 2034

Figure 68: Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 69: Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 70: Europe Market Attractiveness by Product, 2024 to 2034

Figure 71: Europe Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 72: Europe Market Attractiveness by Country, 2024 to 2034

Figure 73: East Asia Market Value (US$ Million) by Product, 2024 to 2034

Figure 74: East Asia Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 75: East Asia Market Value (US$ Million) by Country, 2024 to 2034

Figure 76: East Asia Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 77: East Asia Market Volume (Units Pack) Analysis by Country, 2019 to 2034

Figure 78: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 79: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 80: East Asia Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 81: East Asia Market Volume (Units Pack) Analysis by Product, 2019 to 2034

Figure 82: East Asia Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 83: East Asia Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 84: East Asia Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 85: East Asia Market Volume (Units Pack) Analysis by Distribution Channel, 2019 to 2034

Figure 86: East Asia Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 87: East Asia Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 88: East Asia Market Attractiveness by Product, 2024 to 2034

Figure 89: East Asia Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 90: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 91: South Asia Market Value (US$ Million) by Product, 2024 to 2034

Figure 92: South Asia Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 93: South Asia Market Value (US$ Million) by Country, 2024 to 2034

Figure 94: South Asia Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 95: South Asia Market Volume (Units Pack) Analysis by Country, 2019 to 2034

Figure 96: South Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 97: South Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 98: South Asia Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 99: South Asia Market Volume (Units Pack) Analysis by Product, 2019 to 2034

Figure 100: South Asia Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 101: South Asia Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 102: South Asia Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 103: South Asia Market Volume (Units Pack) Analysis by Distribution Channel, 2019 to 2034

Figure 104: South Asia Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 105: South Asia Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 106: South Asia Market Attractiveness by Product, 2024 to 2034

Figure 107: South Asia Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 108: South Asia Market Attractiveness by Country, 2024 to 2034

Figure 109: Oceania Market Value (US$ Million) by Product, 2024 to 2034

Figure 110: Oceania Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 111: Oceania Market Value (US$ Million) by Country, 2024 to 2034

Figure 112: Oceania Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 113: Oceania Market Volume (Units Pack) Analysis by Country, 2019 to 2034

Figure 114: Oceania Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 115: Oceania Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 116: Oceania Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 117: Oceania Market Volume (Units Pack) Analysis by Product, 2019 to 2034

Figure 118: Oceania Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 119: Oceania Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 120: Oceania Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 121: Oceania Market Volume (Units Pack) Analysis by Distribution Channel, 2019 to 2034

Figure 122: Oceania Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 123: Oceania Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 124: Oceania Market Attractiveness by Product, 2024 to 2034

Figure 125: Oceania Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 126: Oceania Market Attractiveness by Country, 2024 to 2034

Figure 127: MEA Market Value (US$ Million) by Product, 2024 to 2034

Figure 128: MEA Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 129: MEA Market Value (US$ Million) by Country, 2024 to 2034

Figure 130: MEA Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 131: MEA Market Volume (Units Pack) Analysis by Country, 2019 to 2034

Figure 132: MEA Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 133: MEA Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 134: MEA Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 135: MEA Market Volume (Units Pack) Analysis by Product, 2019 to 2034

Figure 136: MEA Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 137: MEA Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 138: MEA Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 139: MEA Market Volume (Units Pack) Analysis by Distribution Channel, 2019 to 2034

Figure 140: MEA Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 141: MEA Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 142: MEA Market Attractiveness by Product, 2024 to 2034

Figure 143: MEA Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 144: MEA Market Attractiveness by Country, 2024 to 2034

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

BRICS Disposable Hygiene Products Market Analysis – Size, Share & Trends 2025 to 2035

Disposable Hygiene Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Disposable Hygiene Footwear Market

Disposable Incontinence Products Market Growth - Trends & Forecast 2025 to 2035

Clinical Hand Hygiene Products Market – Trends, Growth & Forecast 2025 to 2035

Men's Intimate Hygiene Products Market Size and Share Forecast Outlook 2025 to 2035

Disposable Medical Gowns Market Size and Share Forecast Outlook 2025 to 2035

Disposable Drills Market Size and Share Forecast Outlook 2025 to 2035

Disposable Food Containers Market Size and Share Forecast Outlook 2025 to 2035

Disposable Protective Apparel Market Size and Share Forecast Outlook 2025 to 2035

Disposable Plates Market Size and Share Forecast Outlook 2025 to 2035

Disposable Umbilical Cord Protection Bag Market Size and Share Forecast Outlook 2025 to 2035

Disposable E-Cigarettes Market Size and Share Forecast Outlook 2025 to 2035

Disposable Pen Injectors Market Size and Share Forecast Outlook 2025 to 2035

Disposable Trocars Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Disposable Cups Market Size and Share Forecast Outlook 2025 to 2035

Products from Food Waste Industry Analysis in Korea Size, Share and Forecast Outlook 2025 to 2035

Disposable Electric Toothbrushes Market Size and Share Forecast Outlook 2025 to 2035

Products from Food Waste in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Hygiene Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA