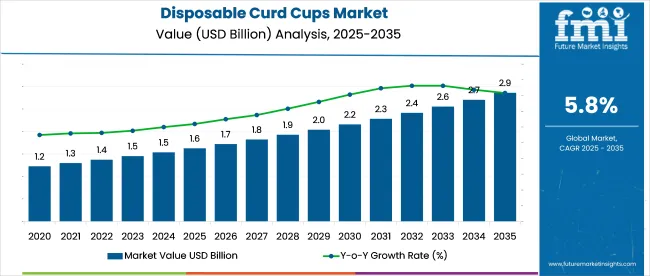

The Disposable Curd Cups Market is estimated to be valued at USD 1.6 billion in 2025 and is projected to reach USD 2.9 billion by 2035, registering a compound annual growth rate (CAGR) of 5.8% over the forecast period.

The disposable curd cups market is witnessing sustained growth, driven by the rising demand for hygienic, convenient, and cost effective dairy packaging solutions. Industry news and packaging company updates have highlighted the increasing adoption of disposable cups in the dairy sector, aimed at enhancing product shelf life and ensuring food safety during distribution.

Manufacturers have focused on material innovations and scalable production techniques to meet the growing consumption of packaged curd, particularly in urban markets. Additionally, the foodservice and retail segments have fueled demand for pre portioned, ready to eat dairy products further supporting market expansion. Regulatory guidelines promoting food grade, recyclable packaging materials have influenced product development strategies.

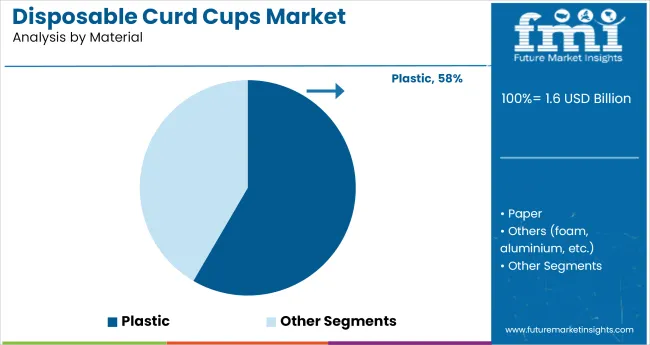

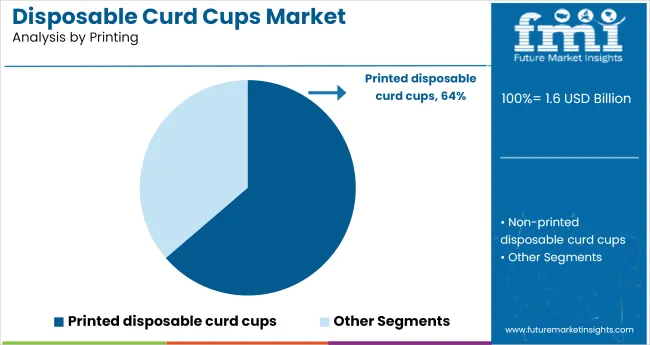

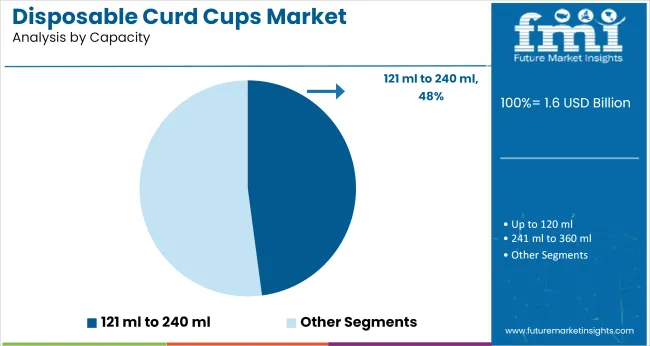

Looking ahead, the market is poised for growth through the introduction of biodegradable materials, customized branding on packaging, and automation in filling and sealing processes. Segmental growth is led by Plastic material type, Printed disposable curd cups in printing preferences and the 121 ml to 240 ml capacity range, reflecting manufacturer and consumer preferences for practical, branded, and mid sized packaging.

The market is segmented by Material, Printing, and Capacity and region. By Material, the market is divided into Plastic, Paper, and Others (foam, aluminium, etc.). In terms of Printing, the market is classified into Printed disposable curd cups and Non-printed disposable curd cups.

Based on Capacity, the market is segmented into 121 ml to 240 ml, Up to 120 ml, 241 ml to 360 ml, and Above 360 ml. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Plastic segment is projected to account for 58.4% of the disposable curd cups market revenue in 2025, continuing to lead among material categories. Growth in this segment has been driven by plastic’s lightweight, durable, and cost efficient characteristics, making it the preferred choice for mass scale dairy packaging.

Manufacturers have adopted food grade plastics such as polypropylene and polystyrene, ensuring compliance with safety standards while optimizing production costs. Plastic cups have been widely favored by curd producers due to their excellent sealing capabilities, extended shelf life, and resistance to moisture absorption.

Additionally, plastic’s compatibility with automated molding and filling equipment has supported manufacturing efficiency. Industry initiatives focusing on recyclable plastics have further strengthened this segment’s position, addressing growing environmental concerns. With dairy companies prioritizing affordable packaging solutions that offer functional and protective benefits, the Plastic segment is expected to maintain its market leadership in the foreseeable future.

The Printed disposable curd cups segment is projected to contribute 63.7% of the disposable curd cups market revenue in 2025, reinforcing its dominance in the printing category. Growth in this segment has been driven by the increasing importance of brand visibility and product differentiation in the competitive dairy market.

Dairy brands have widely adopted printed packaging to enhance shelf appeal, communicate nutritional information, and build brand identity. Advances in flexographic and digital printing technologies have enabled high resolution, cost effective customization of disposable curd cups, even for small production batches.

Furthermore, regulatory requirements for clear labeling of food contact packaging have fueled the adoption of printed cups. Consumer preference for attractive, branded packaging in ready to eat dairy products has also contributed to segment growth. As the dairy industry continues to emphasize visual branding and regulatory compliance, the Printed disposable curd cups segment is expected to retain its dominant market share.

The 121 ml to 240 ml capacity segment is projected to hold 47.9% of the disposable curd cups market revenue in 2025, leading the market among capacity segments. Growth of this segment has been driven by the consumer demand for single serve and midsized curd portions suitable for individual consumption and on the go convenience.

Dairy manufacturers have favored this capacity range to cater to urban consumers seeking portion controlled, affordable dairy products that fit daily dietary needs. Retail packaging trends have indicated strong sales volumes in the 121 ml to 240 ml range, balancing production efficiency and consumer affordability.

Additionally, the food service industry has adopted this capacity segment for catering, quick service restaurants, and institutional dining where standardized serving sizes are essential. As curd consumption trends continue to favor individual packs over bulk containers, the 121 ml to 240 ml segment is expected to sustain its growth, driven by its practicality and market alignment with consumer eating habits.

Disposable curd cups are a type of disposable tableware food packaging which is manufactured with the goal of single-use after the single consumption. The disposable curd cups are available in two packaging formats, paper, and plastic. These disposable curd cups are manufactured using high-impact polystyrene (HIPS) and are available in all shapes and sizes.

The disposable curd cups are easy to handle, leak-free, and recyclable. Owing to the high-grade HIPS plastic, these disposable curd cups are capable of withstanding the acidity of the curd. These disposable curd cups are available with closable lids which add enhanced protection to the storage and transportation of the curd cups. These disposable curd cups are available in plain as well as the printed cup formats.

The disposable curd cups are available in different shapes and sizes and are customized into various shapes and sizes depending upon the customized requirements in the design and prints of the cup.

The majority of the manufacturers involved in manufacturing disposable curd cups are involved in the elimination of the plastic with the other packaging materials like thin metal cups made from aluminium, paper board cups, etc.

The disposable paper curd cups are also manufactured from the recyclable paper waste material which is also enhancing the sustainability trend and also is responsible for creating less pollution with less release of carbon emissions. The disposable cups with the use of sustainable or green tags are enhancing the packaging properties of the product thereby also leading to an increase in the sales of the product.

The disposable curd cups are manufactured with the use of paper-based or recyclable plastic material. Compared to the traditional curd cups, the disposable curd cups are completely disposable with the minimum release of carbon emission in the air as compared to the traditional curd cups which uses rigid plastic materials which have a high density of plastic material which on burning leads to cause pollution and are not decomposable.

The disposable cups are also lighter in weight as compared to the traditional curd cups as it makes the use of lighter plastic material in comparison with the traditional curd cups.

The disposable curd cups involve the latest technology in the manufacturing of the disposable cups which can be a restraining factor of the new entrants or the local players operating in the market. Also, the disposable curd cups are not able to withstand the high pressure when stacked together during transportation and storage.

Therefore, the disposable curd cups require additional packaging for the safety of the curd inside the cups which will prevent the spillage of the food product (curd) while transportation and storage.

The following global key players such as

Key Asian players manufacturing disposable curd cups are Leetha Group, Jallan Polypack India, Swan International, Durga Polyplast, Guangzhou Jianxin Plastic Products Co., Ltd., and Wuhan Yoon Import & Export Co., Ltd.

The manufacturers involved in the manufacturing of disposable curd cups are involved in investing in the new technology which will boost the production of disposable curd cups. Also, the increasing demand for disposable curd cups owing to the increasing concern of sustainability is encouraging to enter the new entrants in the disposable curd cups market.

The majority of the manufacturers involved in the manufacturing of the disposable curd cups are strategizing the most use of waste that is generated and then utilizing it into the manufacturing of the new product. The disposable curd cups with the use of the 'green tags' can enhance the packaging characteristics and can also help to deliver an enhanced customer satisfaction experience while handling and opening the packaging.

The majority of the key players manufacturing disposable curd cups have their presence in the USA which is the key factor driving the growth of the disposable curd cups market. Adding to this, also the changing consumer, as well as manufacturer orientation towards the sustainable manufacturing and packaging of the products, is propelling the demand for disposable cold cups.

The continuously developing technology along with the well tech-updated packaging machinery is uplifting the demand for the disposable curd cups market.

The global disposable curd cups market is estimated to be valued at USD 1.6 billion in 2025.

The market size for the disposable curd cups market is projected to reach USD 2.9 billion by 2035.

The disposable curd cups market is expected to grow at a 5.8% CAGR between 2025 and 2035.

The key product types in disposable curd cups market are plastic, paper and others (foam, aluminium, etc.).

In terms of printing, printed disposable curd cups segment to command 63.7% share in the disposable curd cups market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

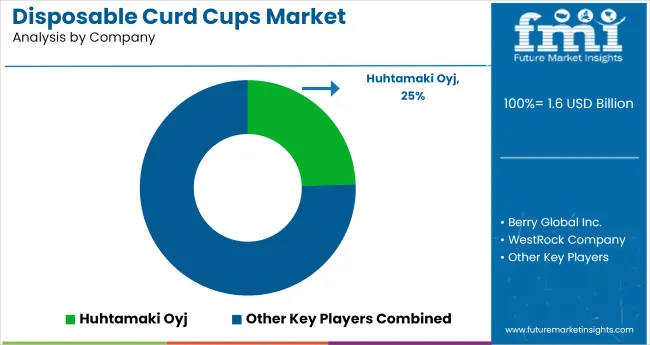

Market Share Insights for Disposable Curd Cups Providers

Disposable Medical Gowns Market Size and Share Forecast Outlook 2025 to 2035

Disposable Drills Market Size and Share Forecast Outlook 2025 to 2035

Disposable Food Containers Market Size and Share Forecast Outlook 2025 to 2035

Disposable Protective Apparel Market Size and Share Forecast Outlook 2025 to 2035

Disposable Plates Market Size and Share Forecast Outlook 2025 to 2035

Disposable Hygiene Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Disposable Umbilical Cord Protection Bag Market Size and Share Forecast Outlook 2025 to 2035

Disposable E-Cigarettes Market Size and Share Forecast Outlook 2025 to 2035

Disposable Pen Injectors Market Size and Share Forecast Outlook 2025 to 2035

Disposable Trocars Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Disposable Electric Toothbrushes Market Size and Share Forecast Outlook 2025 to 2035

Disposable Barrier Sleeves Market Size and Share Forecast Outlook 2025 to 2035

Disposable Plastic Pallet Market Size and Share Forecast Outlook 2025 to 2035

Disposable Egg Trays Market Size and Share Forecast Outlook 2025 to 2035

Disposable Blood Pressure Cuffs Market Analysis - Size, Share & Forecast 2025 to 2035

Disposable Cutlery Market Size, Growth, and Forecast 2025 to 2035

Disposable Spinal Instruments Market Analysis - Size, Share, and Forecast 2025 to 2035

Disposable Lids Market Analysis - Growth & Forecast 2025 to 2035

Disposable Face Mask Market Insights – Growth & Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA