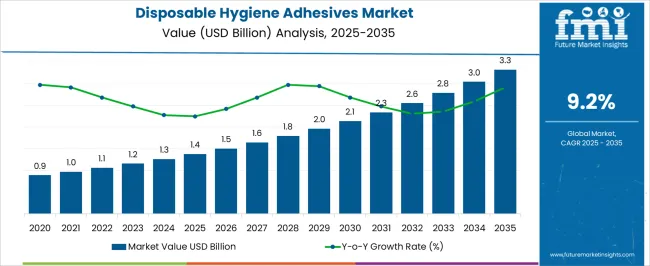

The Disposable Hygiene Adhesives Market is estimated to be valued at USD 1.4 billion in 2025 and is projected to reach USD 3.3 billion by 2035, registering a compound annual growth rate (CAGR) of 9.2% over the forecast period.

| Metric | Value |

|---|---|

| Disposable Hygiene Adhesives Market Estimated Value in (2025 E) | USD 1.4 billion |

| Disposable Hygiene Adhesives Market Forecast Value in (2035 F) | USD 3.3 billion |

| Forecast CAGR (2025 to 2035) | 9.2% |

The Disposable Hygiene Adhesives market is witnessing steady growth due to the rising global demand for baby diapers, feminine hygiene products, and adult incontinence items. Increasing awareness about hygiene, coupled with lifestyle changes and an aging population, is supporting consumption. Manufacturers are adopting advanced adhesive technologies to improve product comfort, flexibility, and durability while ensuring skin safety.

Sustainability trends are also reshaping the market, with companies focusing on bio-based adhesive innovations to address environmental concerns and regulatory requirements. Growing urbanization, rising disposable incomes, and heightened hygiene awareness in emerging economies are expanding the consumer base. Additionally, healthcare-associated applications such as surgical drapes and medical wear are fueling growth in institutional and hospital demand.

The integration of adhesives with breathable films, elastic attachment systems, and multi-layered cores is improving the performance of hygiene products Strong investments in R&D, coupled with expanding distribution networks in Asia Pacific, Africa, and Latin America, are shaping market expansion As consumer preferences shift toward high-performance and eco-friendly products, the Disposable Hygiene Adhesives market is expected to sustain growth and create long-term opportunities for global and regional manufacturers.

The disposable hygiene adhesives market is segmented by origin, type, application, end user, end-use industry, and geographic regions. By origin, disposable hygiene adhesives market is divided into Synthetic and Natural. In terms of type, disposable hygiene adhesives market is classified into Adhesives. Based on application, disposable hygiene adhesives market is segmented into Core Adhesive (Or Fluff Pad Adhesive), Construction Adhesive (Or Bonding Adhesive), Positioning Adhesive, Elastic Adhesive, Frontal Tape Adhesive, Side Tape Adhesive, and Others. By end user, disposable hygiene adhesives market is segmented into Baby & Infant Care, Feminine Care, Adult Care, Specific Or Specialty Care, and Others. By end-use industry, disposable hygiene adhesives market is segmented into Personal Care, Healthcare, Pharmaceutical, and Other. Regionally, the disposable hygiene adhesives industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

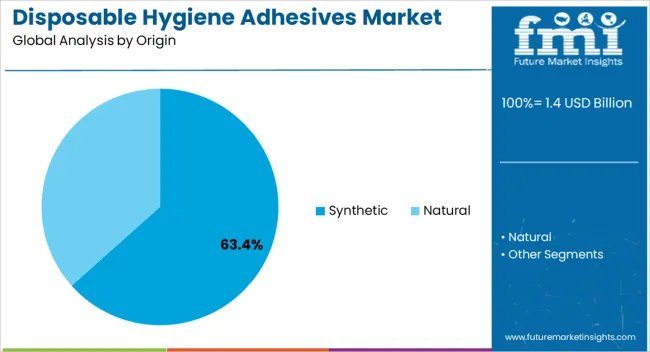

The synthetic origin segment is projected to account for 63.4% of the Disposable Hygiene Adhesives market revenue in 2025, making it the dominant origin category. This growth is being driven by the consistent performance, cost-effectiveness, and wide availability of synthetic materials used in adhesives for hygiene products. Synthetic adhesives ensure strong bonding, high durability, and stability under varying conditions, making them preferred for high-volume production in diapers, sanitary pads, and incontinence products.

Their compatibility with multiple substrates, including nonwoven fabrics and films, enhances product versatility. Manufacturers benefit from established supply chains and scalable production, allowing synthetic adhesives to be deployed efficiently across global markets. Moreover, ongoing developments in hot-melt and pressure-sensitive technologies are further strengthening adoption.

While bio-based adhesives are gradually entering the market, synthetics continue to dominate due to their proven reliability and affordability The segment’s strong market share reflects the balance it provides between performance and manufacturing economics, positioning synthetic adhesives as the backbone of disposable hygiene product development.

The adhesives type segment is expected to hold 58.9% of the market revenue in 2025, establishing itself as the leading type. Growth in this segment is attributed to the increasing requirement for adhesives in structural bonding, elastic attachment, and positioning applications in hygiene products. Adhesives are critical in ensuring the performance and comfort of disposable items, as they provide secure bonding of components such as core layers, back sheets, and stretch panels.

Advanced adhesive formulations allow for improved breathability, softness, and reduced skin irritation, which align with consumer demand for comfort and safety. Their versatility enables usage across baby diapers, feminine hygiene pads, and adult incontinence products.

The adhesive segment’s dominance is also reinforced by continuous improvements in hot-melt technology, which ensures efficient manufacturing processes with lower energy consumption As demand for disposable hygiene products grows globally, adhesives remain indispensable in enabling product innovation, quality enhancement, and compliance with safety standards, positioning them at the center of market expansion strategies.

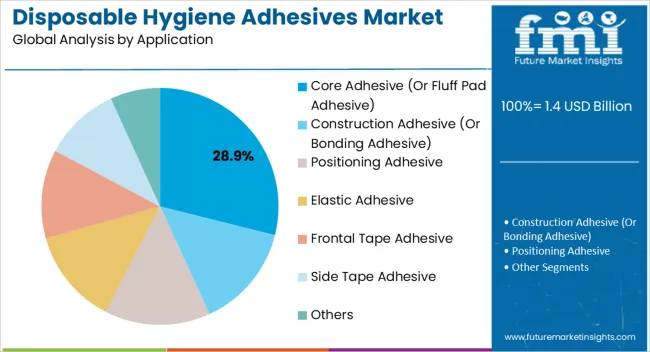

The core adhesive application segment, also known as fluff pad adhesive, is anticipated to account for 28.9% of the market revenue in 2025, making it a leading application area. This dominance is being reinforced by the critical role core adhesives play in bonding absorbent materials within hygiene products. Their ability to ensure the structural integrity of cores directly impacts the performance of diapers, pads, and incontinence items, providing leakage protection and user comfort.

Core adhesives are engineered to maintain strong bonds under wet conditions while allowing flexibility and breathability, which are essential for comfort. Their widespread use across high-volume disposable product categories makes them vital to manufacturing.

Advances in adhesive chemistry are enhancing performance by improving fluid distribution and reducing bulk, aligning with consumer preferences for thinner, lightweight hygiene products As global demand for absorbent hygiene items continues to rise, particularly in emerging markets with growing populations and healthcare needs, the core adhesive segment is expected to sustain strong growth and remain central to innovation in product design.

Disposable hygiene adhesives are now used extensively in the production of user-friendly and eco-friendly hygiene solutions. The manufacturing of disposable hygiene goods, including feminine care items, adult care items, and baby diapers (nappies), mostly uses disposable hygiene adhesives.

Additionally, these adhesives are employed in hygiene products including surgical drapes, hospital bed pads, and medical dressings. Disposable hygiene items are often used to absorb liquids or solids with little leakage and adequate comfort.

As customer requirements and expectations change, the disposable hygiene industry continues to adapt. New trends arise over time, influencing product designs, production techniques, and performance. As a result, adhesives used in baby care, adult incontinence, and feminine care products are changing.

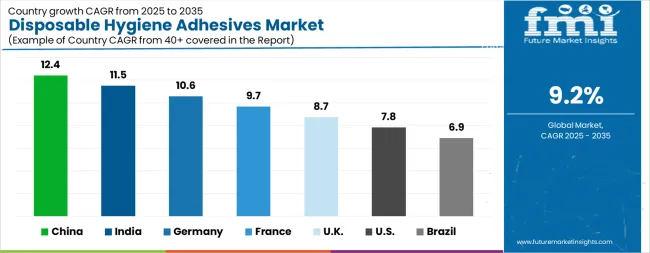

| Country | CAGR |

|---|---|

| China | 12.4% |

| India | 11.5% |

| Germany | 10.6% |

| France | 9.7% |

| UK. | 8.7% |

| USA | 7.8% |

| Brazil | 6.9% |

The Disposable Hygiene Adhesives Market is expected to register a CAGR of 9.2% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 12.4%, followed by India at 11.5%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 6.9%, yet still underscores a broadly positive trajectory for the global Disposable Hygiene Adhesives Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 10.6%. The USA Disposable Hygiene Adhesives Market is estimated to be valued at USD 517.9 million in 2025 and is anticipated to reach a valuation of USD 1.1 billion by 2035. Sales are projected to rise at a CAGR of 7.8% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 63.3 million and USD 41.4 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.4 Billion |

| Origin | Synthetic and Natural |

| Type | Adhesives |

| Application | Core Adhesive (Or Fluff Pad Adhesive), Construction Adhesive (Or Bonding Adhesive), Positioning Adhesive, Elastic Adhesive, Frontal Tape Adhesive, Side Tape Adhesive, and Others |

| End User | Baby & Infant Care, Feminine Care, Adult Care, Specific Or Specialty Care, and Others |

| End-Use Industry | Personal Care, Healthcare, Pharmaceutical, and Other |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

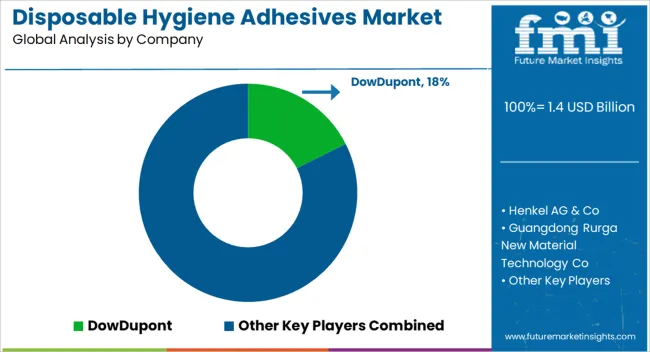

| Key Companies Profiled | DowDupont, Henkel AG & Co, Guangdong Rurga New Material Technology Co, Foreverest Resources Ltd, GitAce, Nordson Corporation, Bostik SA, and H.B. Fuller |

The global disposable hygiene adhesives market is estimated to be valued at USD 1.4 billion in 2025.

The market size for the disposable hygiene adhesives market is projected to reach USD 3.3 billion by 2035.

The disposable hygiene adhesives market is expected to grow at a 9.2% CAGR between 2025 and 2035.

The key product types in disposable hygiene adhesives market are synthetic and natural.

In terms of type, adhesives segment to command 58.9% share in the disposable hygiene adhesives market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Disposable Hygiene Products Market Analysis by Product Type, Sales Channel, and Region through 2025 to 2035

Disposable Hygiene Footwear Market

BRICS Disposable Hygiene Products Market Analysis – Size, Share & Trends 2025 to 2035

Disposable Medical Gowns Market Size and Share Forecast Outlook 2025 to 2035

Disposable Drills Market Size and Share Forecast Outlook 2025 to 2035

Adhesives for Electric Vehicle Power Batteries Market Forecast and Outlook 2025 to 2035

Disposable Food Containers Market Size and Share Forecast Outlook 2025 to 2035

Disposable Protective Apparel Market Size and Share Forecast Outlook 2025 to 2035

Disposable Plates Market Size and Share Forecast Outlook 2025 to 2035

Disposable Umbilical Cord Protection Bag Market Size and Share Forecast Outlook 2025 to 2035

Disposable E-Cigarettes Market Size and Share Forecast Outlook 2025 to 2035

Disposable Pen Injectors Market Size and Share Forecast Outlook 2025 to 2035

Disposable Trocars Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Adhesives And Sealants Market Size and Share Forecast Outlook 2025 to 2035

Disposable Cups Market Size and Share Forecast Outlook 2025 to 2035

Disposable Electric Toothbrushes Market Size and Share Forecast Outlook 2025 to 2035

Hygiene Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Disposable Barrier Sleeves Market Size and Share Forecast Outlook 2025 to 2035

Disposable Plastic Pallet Market Size and Share Forecast Outlook 2025 to 2035

Disposable Curd Cups Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA