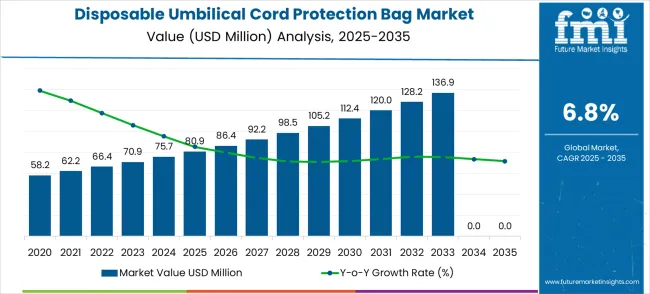

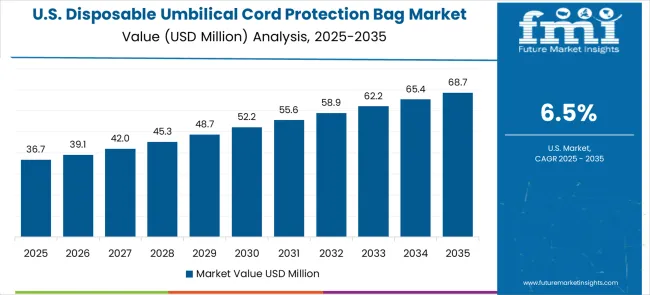

The disposable umbilical cord protection bag market is valued at USD 80.9 million in 2025 and is likely to reach USD 156.1 million by 2035, reflecting a CAGR of 6.8%. This steady growth trajectory highlights a consistent demand pattern driven by increasing birth rates in emerging economies, rising awareness of neonatal hygiene, and adoption of disposable medical products in maternity care. Over the decade, the market nearly doubles in size, adding USD 75.2 million in absolute terms. Year-on-year data shows a gradual but sustained upward trend, with no significant downturns, indicating a resilient market supported by stable healthcare investment and growing adoption in hospitals and maternity care centers globally.

Trend analysis of the market reveals that growth remains consistently positive throughout the forecast period. From USD 80.9 million in 2025, the market expands to USD 86.4 million in 2026, an increase of 6.8%, aligning closely with the overall CAGR. The growth maintains similar momentum each year, reaching USD 105.2 million by 2029 and USD 136.9 million by 2033. This smooth upward progression suggests that market expansion is driven by predictable factors such as incremental healthcare expenditure increases, improved access to disposable neonatal products, and gradual penetration into mid-tier hospitals and clinics in developing regions.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 80.9 million |

| Market Forecast Value (2035) | USD 156.1 million |

| Market Forecast CAGR | 6.8% |

A trendline visualization of the market trajectory would align closely with a polynomial growth curve. The yearly increments, ranging from USD 5.5 million in the early years to USD 9.9 million toward the later years, indicate that growth accelerates modestly as the decade progresses. This acceleration reflects wider adoption of disposable umbilical cord protection products due to rising clinical guidelines, stricter infection control protocols, and increasing awareness among healthcare professionals and expectant mothers. Technological innovation in materials and packaging, along with cost optimization, further supports the upward slope in the long-term trendline.

From a long-term perspective, the market shows a stable growth pattern with limited volatility. The CAGR of 6.8% confirms steady expansion without abrupt fluctuations, while the decade-long trend demonstrates a consistent upward slope. This trend positions the market as a steady growth segment within neonatal care products, driven by predictable healthcare demand and gradual market penetration. The long-term outlook suggests continued adoption with moderate acceleration toward the later years, making the market an attractive target for sustained investment and innovation in disposable medical products.

Market expansion is being supported by the rapid increase in healthcare facility construction worldwide and the corresponding need for advanced neonatal care equipment that provides superior protection and sterile assurance for umbilical cord management. Modern healthcare facilities rely on consistent infection prevention protocols and equipment quality to ensure optimal patient safety including maternity wards, neonatal units, and specialized pediatric facilities. Even minor contamination risks can require comprehensive protocol adjustments to maintain optimal healthcare standards and patient protection.

The growing complexity of neonatal care requirements and increasing demand for sterile protection solutions are driving demand for disposable umbilical cord protection bags from certified manufacturers with appropriate safety capabilities and technical expertise. Healthcare facilities are increasingly requiring documented sterility assurance and product reliability to maintain treatment quality and infection prevention effectiveness. Medical standards and safety protocols are establishing standardized umbilical cord care procedures that require specialized protection products and trained medical personnel.

The Disposable Umbilical Cord Protection Bag market is entering a new phase of growth, driven by demand for sterile medical care, healthcare facility expansion, and evolving safety and regulatory standards. By 2035, these pathways together can unlock USD 40-50 million in incremental revenue opportunities beyond baseline growth.

Pathway A -- Advanced Material Leadership (Non-Woven Fabric) The non-woven fabric segment already holds the largest share due to its superior sterility and protection characteristics. Expanding product innovation, material enhancement, and regulatory compliance can consolidate leadership. Opportunity pool: USD 12-16 million.

Pathway B -- High-Demand Healthcare Applications (Hospitals & Neonatal Units) Hospitals account for the majority of demand. Growing healthcare infrastructure, especially in emerging economies, will drive higher adoption of disposable umbilical cord protection bags for patient safety management. Opportunity pool: USD 10-14 million.

Pathway C -- Home Care & Clinic Growth Professional home healthcare services and specialized clinics are expanding, especially in urban centers. Protection bags tailored for home care applications (easy-use, sterile packaging, caregiver-friendly) can capture significant growth. Opportunity pool: USD 6-8 million.

Pathway D -- Emerging Market Expansion Asia-Pacific, Middle East, and Latin America present growing demand due to rising healthcare infrastructure. Targeting distribution networks and affordable product lines will accelerate adoption. Opportunity pool: USD 4-6 million.

Pathway E -- Enhanced Sterility & Safety Compliance With stricter medical safety regulations, there is an opportunity to promote enhanced sterility features and regulatory-compliant product innovations. Opportunity pool: USD 3-4 million.

Pathway F -- Premium Protection Features Protection bags with antimicrobial properties, enhanced barrier protection, and specialized sizing offer premium positioning for specialized healthcare facilities and high-risk patient environments. Opportunity pool: USD 2-3 million.

Pathway G -- Service, Training & Educational Value Recurring revenue from medical training programs, proper usage education, and healthcare professional certification creates a long-term value stream. Opportunity pool: USD 2-3 million.

Pathway H -- Digital Integration & Compliance Tracking Digital tracking systems, compliance monitoring, and usage analytics can elevate disposable umbilical cord protection bags into "smart medical" equipment while strengthening healthcare facility management. Opportunity pool: USD 1-2 million.

The market is segmented by material type, application, and region. By material type, the market is divided into cotton, non-woven fabric, and others. Based on application, the market is categorized into hospital, home care, clinic, and others. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

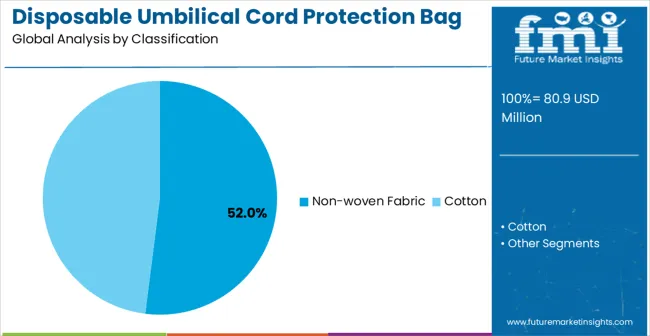

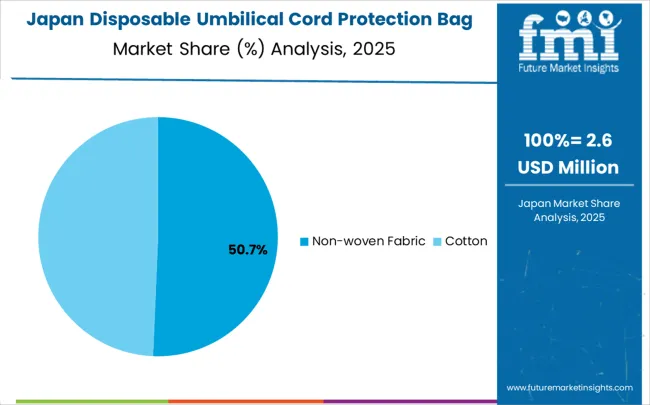

In 2025, the non-woven fabric disposable umbilical cord protection bag segment is projected to capture around 52% of the total market share, making it the leading material category. This dominance is largely driven by the widespread adoption of advanced synthetic materials that provide superior sterility, durability, and protection characteristics for medical applications. Non-woven fabric protection bags are particularly favored for their ability to deliver effective barrier protection while maintaining breathability and comfort, ensuring optimal care conditions. Healthcare facilities, maternity hospitals, neonatal units, and pediatric centers increasingly prefer this material, as it meets stringent medical safety requirements without imposing excessive cost burdens or storage complications. The availability of well-established product lines, along with comprehensive sterilization options and regulatory approvals from leading manufacturers, further reinforces the segment's market position. This material category benefits from consistent demand across regions, as it is considered a practical and reliable solution for facilities of varying sizes and specializations. The combination of safety, performance, and cost-effectiveness makes non-woven fabric umbilical cord protection bags a dependable choice, ensuring their continued popularity in the medical equipment market.

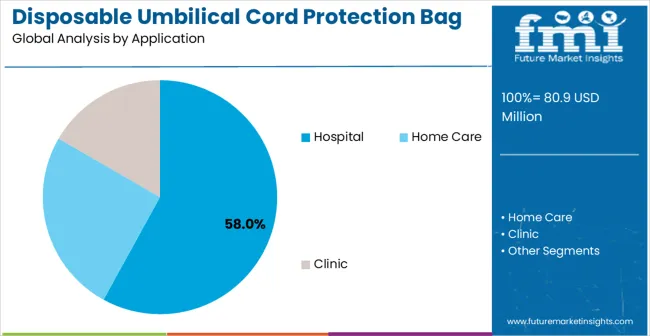

The hospital segment is expected to represent 58% of disposable umbilical cord protection bag demand in 2025, highlighting its position as the most significant application sector. This dominance stems from the unique operational needs of hospital environments, where consistent sterility and infection prevention are critical to patient safety and treatment outcomes. Hospitals often feature specialized maternity and neonatal departments that require comprehensive umbilical cord care protocols throughout extended treatment periods, necessitating reliable and sterile protection equipment. Disposable umbilical cord protection bags are particularly well-suited to these environments due to their ability to provide consistent sterility assurance and easy disposal, even during intensive care activities. As hospitals expand globally and emphasize improved patient safety standards, the demand for disposable umbilical cord protection bags continues to rise. The segment also benefits from heightened regulatory compliance requirements within the healthcare industry, where operators are increasingly prioritizing infection prevention and sterility assurance as essential quality measures. With hospitals investing in advanced patient care protocols and safety standards, disposable umbilical cord protection bags provide an essential solution to maintain high-performance medical care. The growth of specialized healthcare networks, coupled with increased focus on neonatal care standards, ensures that hospitals will remain the largest and most stable demand driver for disposable umbilical cord protection bags in the forecast period.

The market is advancing steadily due to increasing healthcare facility development and growing recognition of disposable medical product advantages over reusable alternatives. The market faces challenges including higher ongoing costs compared to reusable options, need for proper waste disposal systems in medical facilities, and varying regulatory requirements across different healthcare regions. Safety optimization efforts and product development programs continue to influence equipment advancement and market adoption patterns.

The growing development of advanced non-woven fabric systems is enabling higher protection effectiveness with improved breathability and enhanced sterility characteristics. Advanced material technologies and optimized fiber structures provide superior barrier protection while maintaining patient comfort requirements. These technologies are particularly valuable for large healthcare operators who require reliable product performance that can support extensive neonatal care operations with consistent safety results.

Modern disposable umbilical cord protection bag manufacturers are incorporating advanced sterile packaging features and ergonomic design improvements that enhance medical professional efficiency and product effectiveness. Integration of advanced sterilization indicators and optimized packaging design enables superior safety assurance and comprehensive infection prevention capabilities. Advanced product features support operation in diverse healthcare environments while meeting various safety requirements and medical specifications.

| Country | CAGR (2025-2035) |

|---|---|

| China | 9.2% |

| India | 8.5% |

| Germany | 7.8% |

| Brazil | 7.1% |

| United States | 6.5% |

| United Kingdom | 5.8% |

| Japan | 5.1% |

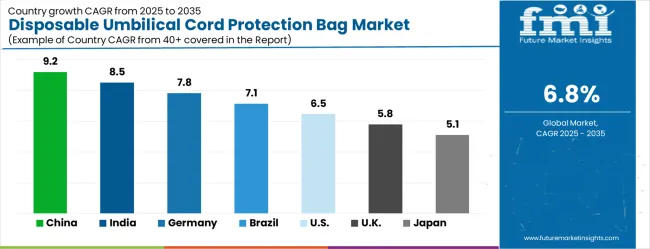

The market is growing rapidly, with China leading at a 9.2% CAGR through 2035, driven by strong healthcare facility development and increasing adoption of advanced medical protection products. India follows at 8.5%, supported by rising healthcare infrastructure development and growing awareness of neonatal care safety solutions. Germany grows steadily at 7.8%, integrating disposable medical technology into its established healthcare infrastructure. Brazil records 7.1%, focusing healthcare facility modernization and medical equipment upgrade initiatives. The United States shows solid growth at 6.5%, focusing on safety enhancement and regulatory compliance. The United Kingdom demonstrates steady progress at 5.8%, maintaining established medical care applications. Japan records 5.1% growth, concentrating on technology advancement and quality optimization.

The report covers an in-depth analysis of 40+ countries; top-performing countries are highlighted below.

China is expected to register a CAGR of 9.2% between 2025 and 2035, supported by rising healthcare infrastructure, growing birth rates in urban and semi-urban areas, and government initiatives to improve maternal and newborn care. Disposable umbilical cord protection bags are increasingly adopted for neonatal safety, infection control, and convenience in hospitals and maternity centers. Domestic manufacturers are focusing on cost-effective designs, high-quality materials, and large-scale production to meet demand. Hospitals and birthing centers are increasingly adopting disposable solutions to reduce cross-contamination. Rising awareness among parents regarding newborn hygiene and healthcare standards further fuels growth. Collaborations between hospitals and manufacturers ensure compliance with quality and safety standards, boosting adoption across China.

India is forecasted to expand at a CAGR of 8.5% during 2025–2035, driven by rising healthcare expenditure, government focus on maternal health programs, and increasing institutional deliveries. Disposable umbilical cord protection bags are valued for ease of use, hygiene, and safety. Indian manufacturers are investing in efficient production and affordable designs to cater to hospitals and maternity clinics across urban and rural areas. Demand is supported by growing hospital networks, increased access to prenatal care, and rising awareness of infection prevention in neonatal care. Public health initiatives such as Janani Suraksha Yojana enhance adoption. Expansion of private maternity hospitals and healthcare chains further stimulates the market.

Germany is projected to grow at a CAGR of 7.8% from 2025 to 2035, supported by strong healthcare infrastructure, strict hygiene regulations, and rising preference for single-use medical products. Disposable umbilical cord protection bags are integrated into standardized birthing protocols to ensure newborn safety and hygiene. German manufacturers focus on innovation in product design, compliance with EU safety standards, and ecofriendly materials. Hospitals are increasingly adopting disposable solutions to meet infection control mandates and improve operational efficiency. Growth is supported by the country’s advanced healthcare system, technological integration in maternity wards, and focus on patient safety. Export of high-quality disposable products to other European markets further strengthens the sector.

Brazil is expected to grow at a CAGR of 7.1% during 2025–2035, driven by expanding healthcare infrastructure, increasing hospital births, and government programs for maternal and newborn health. Disposable umbilical cord protection bags are valued for hygiene, safety, and convenience in maternity care. Local manufacturers focus on affordable production and compliance with national healthcare standards. Growth is fueled by increased institutional deliveries, public health campaigns, and rising demand for infection prevention measures. Adoption in rural healthcare centers is also growing due to portability and ease of use. Partnerships between medical device manufacturers and healthcare providers enhance availability and quality of these products.

The United States is projected to grow at a CAGR of 6.5% between 2025 and 2035, supported by rising healthcare expenditure, increasing institutional births, and growing awareness of neonatal infection prevention. Disposable umbilical cord protection bags are increasingly adopted in hospitals, birthing centers, and maternity wards for hygiene and convenience. Manufacturers focus on innovative designs, compliance with FDA regulations, and green manufacturing processes. Demand is supported by hospital expansions, upgrades in maternity care facilities, and rising patient expectations. Growth is also supported by increasing use of disposable neonatal care products in home birthing and midwifery services. Collaborations between hospitals and manufacturers ensure product quality and regulatory compliance.

The United Kingdom is forecasted to grow at a CAGR of 5.8% from 2025 to 2035, driven by institutional healthcare improvements, rising awareness of neonatal hygiene, and increasing adoption of single-use medical products. Disposable umbilical cord protection bags are valued for hygiene, convenience, and infection prevention in maternity care. UK manufacturers focus on high-quality materials, regulatory compliance, and innovative product designs. Growth is supported by expansions in NHS maternity wards, increasing hospital birth rates, and rising demand in private healthcare. Partnerships with international suppliers enable access to advanced production technologies, further improving product performance.

Japan is expected to grow at a CAGR of 5.1% during 2025 to 2035, driven by adoption in hospitals, maternity wards, and home birthing facilities. Disposable umbilical cord protection bags are valued for hygiene, convenience, and safety in neonatal care. Japanese manufacturers focus on product quality, compliance with stringent healthcare standards, and efficiency in production. Growth is supported by increasing healthcare expenditure, high hospital birth rates, and expanding maternity care infrastructure. Demand is also driven by private healthcare facilities and a rising focus on infection prevention. Collaborations with global manufacturers support innovation and product diversification in Japan.

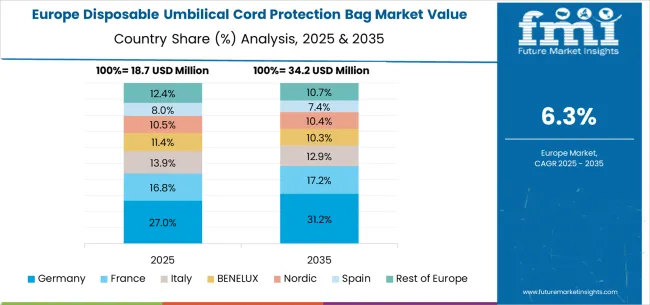

The disposable umbilical cord protection bag market in Europe is forecast to expand from USD 22.4 million in 2025 to USD 39.8 million by 2035, registering a CAGR of 5.9%. Germany will remain the largest market, holding 26.5% share in 2025, easing to 25.8% by 2035, supported by strong healthcare infrastructure and advanced neonatal care standards. The United Kingdom follows, rising from 19.2% in 2025 to 19.8% by 2035, driven by NHS modernization and specialized maternity units. France is expected to maintain stability from 16.5% to 16.3%, reflecting consistent healthcare facility investments. Italy holds around 14.2% throughout the forecast period, supported by regional healthcare improvements and hospital modernization programs. Spain grows from 11.8% to 12.4% with expanding healthcare infrastructure and increased focus on patient safety protocols. BENELUX markets maintain 6.2% to 6.1%, while the remainder of Europe hovers near 5.6%--5.8%, balancing emerging Eastern European healthcare development against mature Nordic markets with established medical device adoption patterns.

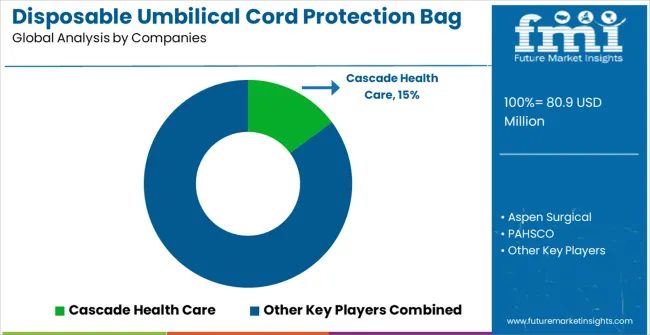

The market is defined by competition among specialized medical equipment manufacturers, healthcare product companies, and medical device solution providers. Companies are investing in advanced material development, product safety optimization, sterile packaging improvements, and comprehensive quality assurance capabilities to deliver reliable, safe, and cost-effective medical protection solutions. Strategic partnerships, technological innovation, and market expansion are central to strengthening product portfolios and market presence.

Cascade Health Care offers comprehensive disposable medical protection solutions with established manufacturing expertise and professional-grade healthcare equipment capabilities. Aspen Surgical provides specialized medical device products with focus on safety reliability and operational efficiency. PAHSCO delivers cost-effective medical solutions with focus on accessibility and healthcare-friendly operation. EDM Medical Solutions specializes in healthcare equipment with advanced disposable technology integration.

Busse Hospital Disposables offers professional-grade medical equipment with comprehensive service support capabilities. Laerdal Medical delivers established healthcare solutions with advanced medical device technologies. PSI Dispo provides specialized medical protection equipment with focus on safety optimization. Jinshikang Medical Equipment, Zhongentai Medical Technology, Kangjiale Medical Equipment, Yuan Medical Technology, Jianlang Medical, Dabo Medical Device, Zhongsheng Xianghe Sanitary Materials, Jiute Medical Technology, and Shengguang Medical Product offer specialized manufacturing expertise, product reliability, and comprehensive development across global and regional market segments.

| Item | Value |

|---|---|

| Quantitative Units | USD 80.9 million |

| Material Type | Cotton, Non-woven Fabric |

| Application | Hospital, Home Care, Clinic, Others |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Country Covered | China, India, Germany, Brazil, United States, United Kingdom, Japan, and 40+ countries |

| Key Companies Profiled | Cascade Health Care, Aspen Surgical, PAHSCO, EDM Medical Solutions, Busse Hospital Disposables, Laerdal Medical, PSI Dispo, Jinshikang Medical Equipment, Zhongentai Medical Technology, Kangjiale Medical Equipment, Yuan Medical Technology, Jianlang Medical, Dabo Medical Device, Zhongsheng Xianghe Sanitary Materials, Jiute Medical Technology, Shengguang Medical Product |

| Additional Attributes | Dollar sales by material type and application segment, regional demand trends across major markets, competitive landscape with established medical equipment manufacturers and emerging technology providers, customer preferences for different material options and protection features, integration with healthcare facility management systems and medical protocols, innovations in sterile packaging efficiency and safety assurance technologies, and adoption of advanced material design features with enhanced protection capabilities for improved patient care workflows. |

The global disposable umbilical cord protection bag market is estimated to be valued at USD 80.9 million in 2025.

The market size for the disposable umbilical cord protection bag market is projected to reach USD 156.1 million by 2035.

The disposable umbilical cord protection bag market is expected to grow at a 6.8% CAGR between 2025 and 2035.

The key product types in disposable umbilical cord protection bag market are non-woven fabric and cotton.

In terms of application, hospital segment to command 58.0% share in the disposable umbilical cord protection bag market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Disposable Medical Gowns Market Size and Share Forecast Outlook 2025 to 2035

Disposable Drills Market Size and Share Forecast Outlook 2025 to 2035

Disposable Food Containers Market Size and Share Forecast Outlook 2025 to 2035

Disposable Protective Apparel Market Size and Share Forecast Outlook 2025 to 2035

Disposable Plates Market Size and Share Forecast Outlook 2025 to 2035

Disposable Hygiene Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Disposable E-Cigarettes Market Size and Share Forecast Outlook 2025 to 2035

Disposable Pen Injectors Market Size and Share Forecast Outlook 2025 to 2035

Disposable Trocars Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Disposable Cups Market Size and Share Forecast Outlook 2025 to 2035

Disposable Electric Toothbrushes Market Size and Share Forecast Outlook 2025 to 2035

Disposable Barrier Sleeves Market Size and Share Forecast Outlook 2025 to 2035

Disposable Plastic Pallet Market Size and Share Forecast Outlook 2025 to 2035

Disposable Curd Cups Market Size and Share Forecast Outlook 2025 to 2035

Disposable Egg Trays Market Size and Share Forecast Outlook 2025 to 2035

Disposable Blood Pressure Cuffs Market Analysis - Size, Share & Forecast 2025 to 2035

Disposable Cutlery Market Size, Growth, and Forecast 2025 to 2035

Disposable Spinal Instruments Market Analysis - Size, Share, and Forecast 2025 to 2035

Disposable Lids Market Analysis - Growth & Forecast 2025 to 2035

Disposable Face Mask Market Insights – Growth & Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA