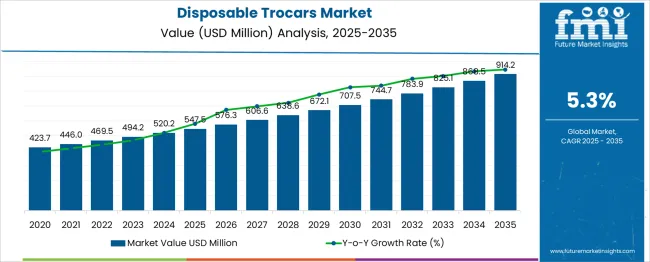

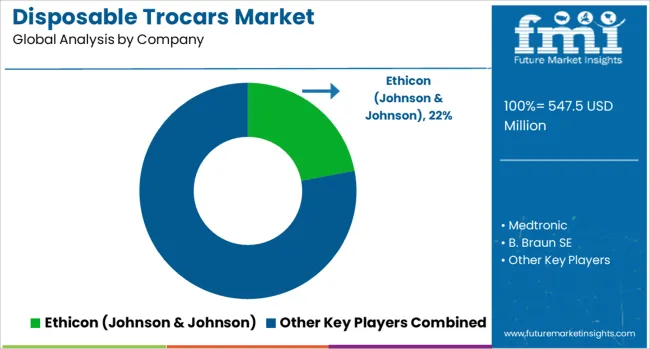

The global disposable trocars market is projected to grow from USD 547.5 million in 2025 to approximately USD 914.2 million by 2035, recording an absolute increase of USD 366.67 million over the forecast period. This translates into a total growth of 66.96%, with the market forecast to expand at a compound annual growth rate of 5% between 2025 and 2035.

The overall market size is expected to grow by approximately 1.67X during the same period, supported by increasing adoption of minimally invasive surgical procedures, rising prevalence of chronic diseases requiring surgical intervention, and growing focus on patient safety and infection control in surgical environments.

Between 2025 and 2030, the disposable trocars market is projected to expand from USD 547.5 million to USD 705.42 million, resulting in a value increase of USD 157.89 million, which represents 43.1% of the total forecast growth for the decade. This phase of growth will be shaped by increasing adoption of laparoscopic and robotic surgical procedures, expanding healthcare infrastructure in emerging markets, and growing emphasis on single-use medical devices to prevent cross-contamination. Medical device manufacturers are expanding their disposable trocar portfolios to address the increasing demand for specialized surgical access solutions across various surgical specialties.

From 2030 to 2035, the market is forecast to grow from USD 705.42 million to USD 914.2 million, adding another USD 208.78 million, which constitutes 56.9% of the overall ten-year expansion. This period is expected to be characterized by advancement in trocar design technologies, integration with surgical navigation systems, and development of specialized trocars for emerging surgical techniques. The growing adoption of value-based healthcare and focus on reducing surgical complications will drive demand for high-quality disposable trocars with enhanced safety features and improved patient outcomes.

Between 2020 and 2025, the disposable trocars market experienced steady expansion, driven by increasing preference for minimally invasive surgical procedures and growing awareness of infection control in surgical settings. The market developed as healthcare providers recognized the benefits of single-use surgical instruments in reducing hospital-acquired infections and improving surgical efficiency. The COVID-19 pandemic accelerated the adoption of disposable medical devices, reinforcing the importance of infection prevention in surgical environments and establishing disposable trocars as essential surgical instruments.

| Metric | Value |

|---|---|

| Estimated Value in 2025 | USD 547.5 million |

| Forecast Value in 2035 | USD 914.2 million |

| Forecast CAGR 2025 to 2035 | 5% |

Market expansion is being supported by the increasing global adoption of minimally invasive surgical procedures and the corresponding demand for specialized surgical access devices that enable precise and safe tissue penetration. Modern surgical practices emphasize reduced patient trauma, faster recovery times, and improved surgical outcomes, driving the need for advanced trocar systems that facilitate laparoscopic and robotic surgical techniques. Disposable trocars provide surgeons with sterile, single-use instruments that eliminate concerns about cross-contamination while offering consistent performance across surgical procedures.

The growing emphasis on patient safety and infection control in healthcare settings is driving hospitals and surgical centers to adopt disposable surgical instruments that reduce the risk of healthcare-associated infections. Healthcare cost pressures and focus on operational efficiency are creating demand for disposable trocars that eliminate sterilization costs and processing time while ensuring reliable surgical access. The rising prevalence of chronic diseases requiring surgical intervention and the expanding elderly population are also contributing to increased surgical procedure volumes and corresponding demand for surgical access devices across multiple medical specialties.

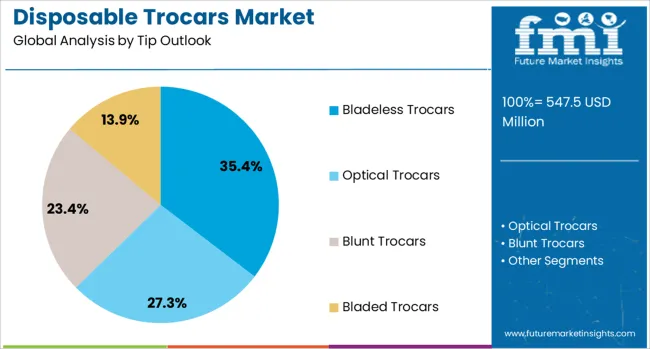

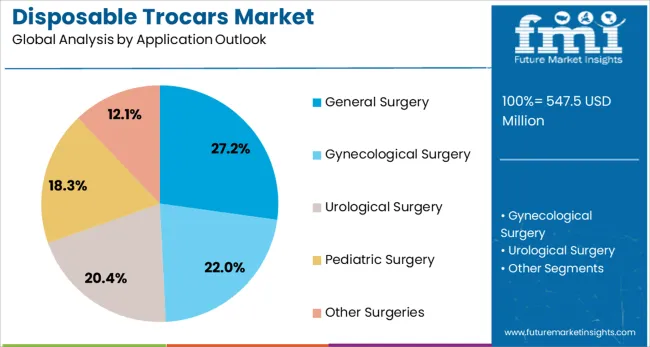

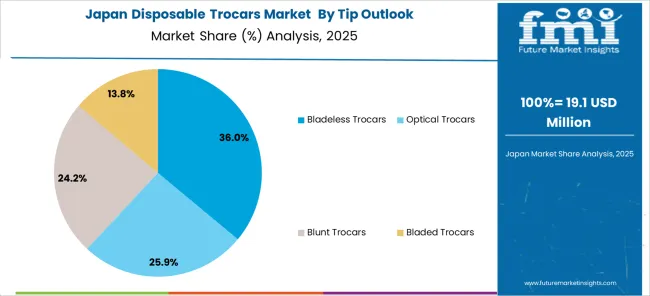

The market is segmented by tip type, application and region. By tip type, the market is divided into bladeless trocars, optical trocars, blunt trocars, and bladed trocars. Based on application, the market is categorized into general surgery, gynecological surgery, urological surgery, pediatric surgery, and other surgeries. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

The bladeless trocars segment is projected to account for 35.4% of the disposable trocars market in 2025, establishing its position as the preferred technology for safe surgical access across multiple specialties. Bladeless trocars utilize innovative penetration mechanisms that minimize tissue trauma while providing reliable access to surgical sites, addressing surgeon concerns about patient safety and procedure efficiency. The technology offers superior control during insertion while reducing the risk of vascular and organ injury compared to traditional bladed designs.

This tip type represents the evolution of surgical access technology toward safer and more predictable surgical techniques that align with modern minimally invasive surgery principles. Clinical evidence supporting reduced complication rates and improved surgical outcomes continues to drive adoption among surgeons and healthcare institutions. With increasing focus on patient safety and surgical quality metrics, bladeless trocars provide healthcare providers with advanced surgical access solutions that support better clinical outcomes. Their proven safety profile and operational advantages ensure continued market leadership, making them the primary technology driving disposable trocar market growth.

General surgery applications are projected to represent 27.19% of disposable trocars demand in 2025, reflecting the broad utilization of laparoscopic techniques across diverse surgical procedures, including cholecystectomy, appendectomy, hernia repair, and bariatric surgery. This application segment benefits from the widespread adoption of minimally invasive techniques that reduce patient morbidity while improving surgical outcomes and hospital efficiency. General surgeons increasingly rely on disposable trocars for consistent surgical access that supports various laparoscopic procedures.

The segment is supported by growing surgical case volumes in general surgery, driven by aging demographics and increasing prevalence of conditions requiring surgical intervention. Additionally, training programs and surgical education emphasize laparoscopic techniques that require specialized trocar systems for optimal surgical access and patient safety. As healthcare systems prioritize surgical efficiency and patient outcomes, general surgery applications will continue to drive significant demand for disposable trocars, reinforcing their position as the largest application segment in the surgical access device market.

The disposable trocars market is advancing steadily due to increasing adoption of minimally invasive surgical procedures and growing emphasis on infection control in healthcare settings. However, the market faces challenges including cost pressures in healthcare systems, competition from reusable alternatives, and regulatory requirements for medical device approval. Innovation in trocar design and expansion of surgical applications continue to influence product development and market growth patterns.

The increasing adoption of laparoscopic and robotic surgical procedures is driving demand for specialized trocar systems that enable precise surgical access with minimal tissue trauma. Surgical training programs and continuing medical education emphasize minimally invasive techniques that require advanced trocar technology for optimal patient outcomes and procedural success. Medical device companies are collaborating with surgical societies and training institutions to develop educational programs that promote proper trocar utilization and surgical technique advancement.

Modern surgical environments are incorporating digital technologies, including surgical navigation systems, augmented reality, and procedural analytics, that require compatible trocar systems for optimal integration. Smart trocar designs with embedded sensors and connectivity features are enabling real-time monitoring of insertion parameters and surgical site access. These technological advances support improved surgical precision while providing data for quality improvement and surgical outcome optimization initiatives.

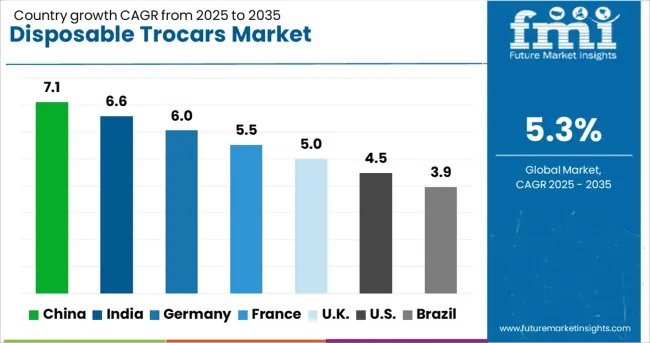

| Countries | CAGR 2025 to 2035 |

|---|---|

| China | 7.1% |

| India | 6.5% |

| Germany | 6% |

| France | 5.5% |

| UK | 4.9% |

| USA | 4.4% |

| Brazil | 3.9% |

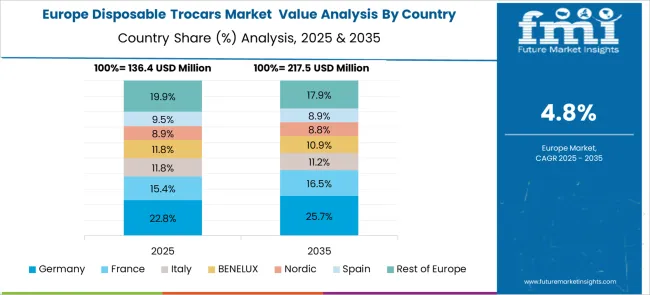

The disposable trocars market is experiencing varied growth globally, with China leading at a 7.1% CAGR through 2035, driven by healthcare infrastructure expansion, increasing surgical case volumes, and rising adoption of minimally invasive surgical techniques across major hospital systems. India follows at 6.5%, supported by growing healthcare access, medical tourism development, and increasing focus on surgical quality and patient safety standards. Germany shows strong growth at 6%, emphasizing surgical innovation and advanced medical technology adoption. France records 5.5%, focusing on healthcare modernization and surgical excellence. The United Kingdom shows 4.9% growth, prioritizing NHS efficiency and surgical outcome improvement.

The report covers an in-depth analysis of 40+ countries; six top-performing countries are highlighted below.

Revenue from disposable trocars in China is projected to exhibit strong growth with a CAGR of 7.1% through 2035, driven by massive healthcare infrastructure development and increasing adoption of minimally invasive surgical techniques across tier-1 and tier-2 cities. The country's expanding middle class and growing healthcare expenditure are creating significant demand for advanced surgical devices that meet international quality standards. Major international and domestic medical device companies are establishing manufacturing and distribution capabilities to serve the growing market for surgical access devices.

Revenue from disposable trocars in India is expanding at a CAGR of 6.6%, supported by growing healthcare infrastructure, increasing surgical case volumes, and expanding medical tourism industry that emphasizes international quality standards. The country's large population base and rising healthcare awareness are driving demand for advanced surgical access devices that support improved surgical outcomes and patient safety. Government healthcare initiatives and private sector investment are establishing modern surgical facilities that require high-quality disposable medical devices.

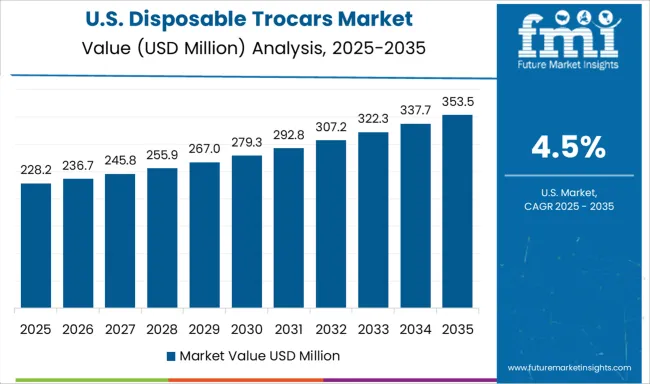

Demand for disposable trocars in the U.S. is projected to grow at a CAGR of 4.5%, supported by value-based healthcare initiatives and focus on surgical quality metrics that favor advanced surgical access devices. American healthcare systems are increasingly adopting disposable surgical instruments that support infection control while improving surgical efficiency and patient outcomes. The market is characterized by strong emphasis on clinical evidence and cost-effectiveness analysis for medical device adoption decisions.

Revenue from disposable trocars in Japan is projected to grow at a CAGR of 5.8% through 2035, driven by the country's commitment to surgical innovation and integration of advanced medical technologies in surgical procedures. Japanese healthcare systems prioritize surgical quality and patient safety while emphasizing technological advancement and procedural efficiency. Medical device companies collaborate with leading hospitals and surgical centers to develop next-generation trocar systems that support advanced surgical techniques.

Revenue from disposable trocars in the UK is projected to grow at a CAGR of 4.9% through 2035, supported by NHS modernization initiatives and focus on surgical excellence that emphasizes patient safety and operational efficiency. British healthcare systems value clinical evidence and cost-effectiveness while prioritizing infection control and surgical quality improvement. The market benefits from established procurement processes and standardization initiatives that support consistent adoption of high-quality surgical access devices.

Revenue from disposable trocars in Germany is projected to grow at a CAGR of 6% through 2035, supported by the country's emphasis on surgical innovation, quality standards, and advanced medical technology adoption. German healthcare systems prioritize surgical excellence while emphasizing patient safety and technological advancement in surgical procedures. The market benefits from strong medical device industry presence and collaboration between manufacturers and healthcare providers.

The disposable trocars market is characterized by competition among established medical device manufacturers, specialized surgical instrument companies, and emerging technology developers. Companies are investing in product innovation, clinical research, regulatory compliance, and surgical education programs to deliver safe, effective, and user-friendly trocar systems. Product quality, clinical evidence, and surgeon training support are central to strengthening competitive positions and market presence in surgical access device markets.

Ethicon (Johnson & Johnson), U.S.-based, leads the market with 22% global value share, offering comprehensive trocar portfolios with focus on surgical innovation and clinical excellence. Medtronic, Ireland-based, provides extensive surgical access solutions with emphasis on minimally invasive surgery and integrated surgical systems. B. Braun SE, Germany-based, delivers high-quality trocar systems with advanced safety features and surgeon-friendly designs. Applied Medical Resources Corporation, U.S.-based, focuses on innovative surgical access technology and comprehensive surgeon training programs. Cooper Surgical Inc., U.S.-based, specializes in women's healthcare and gynecological surgery applications with dedicated trocar solutions. Teleflex Incorporated, U.S.-based, provides specialized surgical access devices with focus on critical care and surgical applications. CONMED Corporation, U.S.-based, offers comprehensive surgical instrument portfolios including advanced trocar systems for multiple specialties.

| Items | Values |

|---|---|

| Quantitative Units 2025 | USD 547.5 Million |

| Tip Type | Bladeless trocars, Optical trocars, Blunt trocars, Bladed trocars |

| Application | General surgery, Gynecological surgery, Urological surgery, Pediatric surgery, Other surgeries |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Ethicon (Johnson & Johnson), Medtronic, B. Braun SE, Applied Medical Resources Corporation, CooperSurgical Inc., Teleflex Incorporated, CONMED Corporation, and others |

| Additional Attributes | Sales by trocar diameter and length specifications, surgical specialty adoption patterns, competitive landscape analysis, regulatory approval timelines, product innovation trends, clinical evidence development, and surgeon training program effectiveness |

The global disposable trocars market is estimated to be valued at USD 547.5 million in 2025.

The market size for the disposable trocars market is projected to reach USD 914.2 million by 2035.

The disposable trocars market is expected to grow at a 5.3% CAGR between 2025 and 2035.

The key product types in disposable trocars market are bladeless trocars, optical trocars, blunt trocars and bladed trocars.

In terms of application outlook, general surgery segment to command 27.2% share in the disposable trocars market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Disposable Medical Gowns Market Size and Share Forecast Outlook 2025 to 2035

Disposable Drills Market Size and Share Forecast Outlook 2025 to 2035

Disposable Food Containers Market Size and Share Forecast Outlook 2025 to 2035

Disposable Protective Apparel Market Size and Share Forecast Outlook 2025 to 2035

Disposable Plates Market Size and Share Forecast Outlook 2025 to 2035

Disposable Hygiene Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Disposable Umbilical Cord Protection Bag Market Size and Share Forecast Outlook 2025 to 2035

Disposable E-Cigarettes Market Size and Share Forecast Outlook 2025 to 2035

Disposable Pen Injectors Market Size and Share Forecast Outlook 2025 to 2035

Disposable Cups Market Size and Share Forecast Outlook 2025 to 2035

Disposable Electric Toothbrushes Market Size and Share Forecast Outlook 2025 to 2035

Disposable Barrier Sleeves Market Size and Share Forecast Outlook 2025 to 2035

Disposable Plastic Pallet Market Size and Share Forecast Outlook 2025 to 2035

Disposable Curd Cups Market Size and Share Forecast Outlook 2025 to 2035

Disposable Egg Trays Market Size and Share Forecast Outlook 2025 to 2035

Disposable Blood Pressure Cuffs Market Analysis - Size, Share & Forecast 2025 to 2035

Disposable Cutlery Market Size, Growth, and Forecast 2025 to 2035

Disposable Spinal Instruments Market Analysis - Size, Share, and Forecast 2025 to 2035

Disposable Lids Market Analysis - Growth & Forecast 2025 to 2035

Disposable Face Mask Market Insights – Growth & Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA