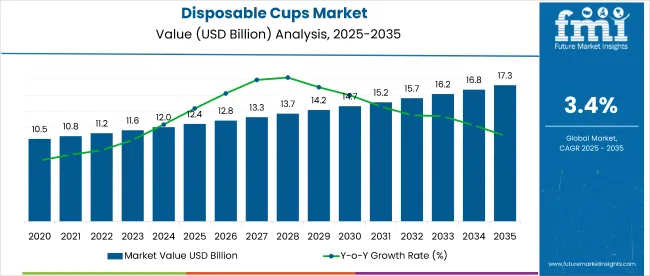

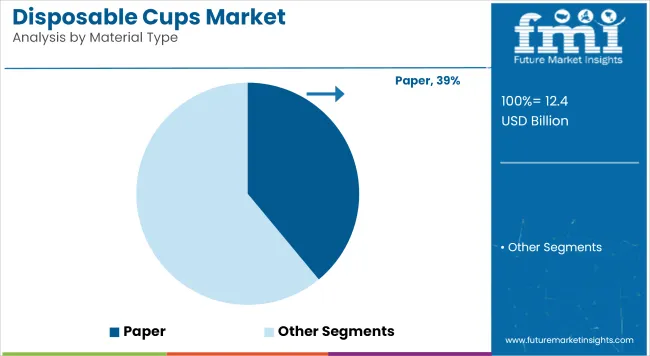

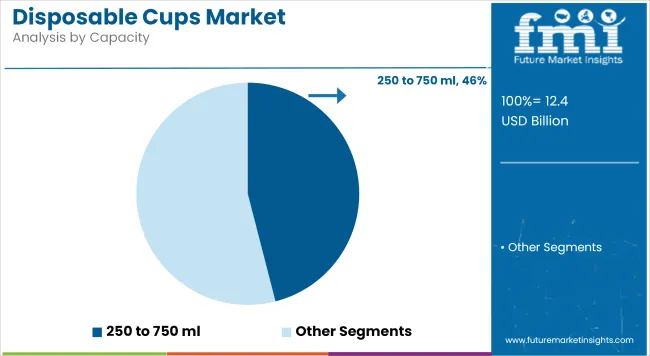

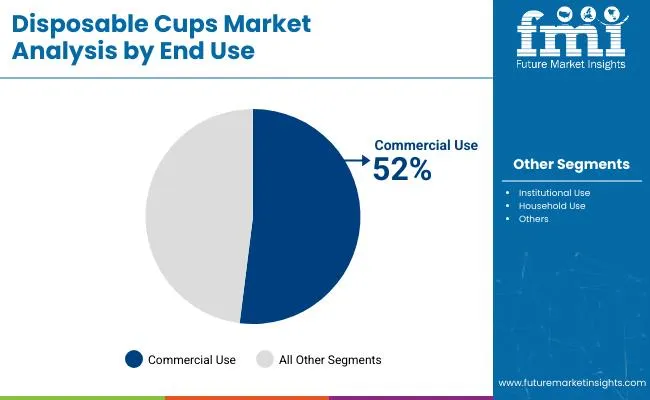

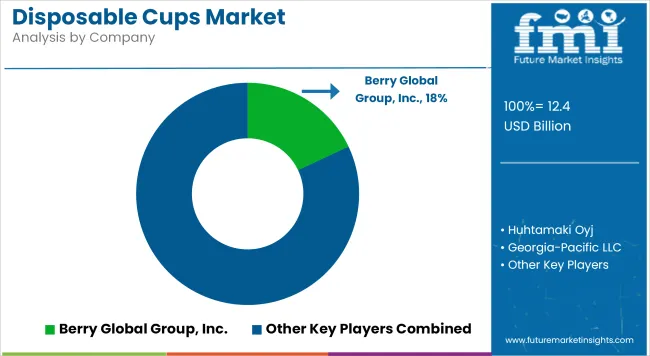

The Disposable Cups market is valued at USD 12.4 billion in 2025 and is projected to reach USD 17.3 billion by 2035, expanding at a CAGR of 3.4%. The 250-750 ml capacity segment is expected to hold 46.0% share in 2025, while paper cups account for 39.0%. Commercial use constitutes 52.0% of end-use demand.

| Attribute | Detail |

|---|---|

| Market Size (2025) | USD 12.4 billion |

| Market Size (2035) | USD 17.3 billion |

| CAGR (2025 to 2035) | 3.4% |

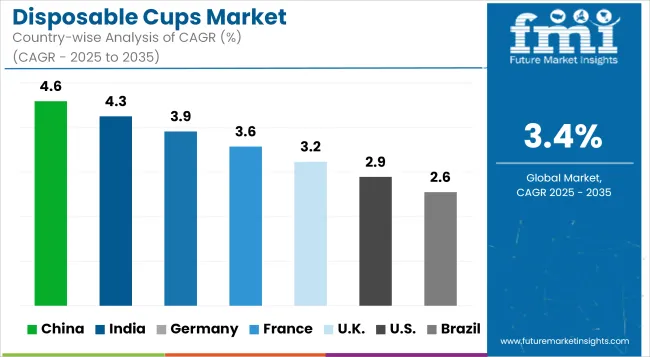

The market is forecast to grow fastest in China (CAGR 4.6%), followed by India (4.3%) and Germany (3.9%). Market leadership is held by Berry Global Group, Inc. (18.0%). Growth is underpinned by rising quick-service restaurant demand, eco-friendly material adoption, and resilient financing models that mitigate capital-expenditure constraints.

Growth has been underpinned by rising demand for on-the-go beverage consumption across quick-service restaurants and convenience outlets, which drove a 5.2% year-on-year increase in disposable cup utilization in 2024. Investment has been spurred by regulatory encouragement for eco-friendly materials, leading to a 12.0% uptick in biodegradable paper-cup adoption.

Restraints have been imposed by high capital-expenditure requirements for paper lining and coating equipment, as well as intermittent supply-chain disruptions affecting resin and pulp availability. Skill-gap challenges in automated forming processes have further tempered capacity expansion among midsize manufacturers. Emerging opportunities are being presented by bio-based polymer innovations, which promise a 7.0% reduction in lifecycle emissions and are projected to capture up to 15.0% of material share by 2028.

Moreover, short-run, variable-print capabilities are enabling localized branding, fostering new revenue streams. Trends are being shaped by the digital integration of smart packaging features, such as QR-code traceability and NFC-enabled inventory tracking-which are projected to enhance consumer engagement by 20.0% over the next five years. Overall, the disposable cups market is positioned for steady growth, with strategic investments in sustainable materials and digital workflow solutions set to offset prevailing restraints.

The Disposable Cups market is segmented by material type; plastic; paper; foam; bagasse; by capacity; less than 250 ml; 250 to 750 ml; above 750 ml; by application; food-spreads; sausages & dressings; confectionery; dairy-ice cream; yogurt; drinks; beverages-hot; cold; by sales channel; manufacturers (direct sales); retail-hypermarket; supermarket; convenience stores; specialty stores; distributors; online; by end use; commercial use-hotels & cafes; full-service restaurants; quick service restaurants; venues & catering; mobile food vendors; bakery & patisserie; institutional use-schools & colleges; offices; hospitals; airports & railways; household use; and by region; North America; Latin America; Europe; Middle East and Africa; East Asia; South Asia; Oceania.

In 2025, paper emerged as the leading material type in the disposable cups market, accounting for 39.0% of global revenues-driven by compliance with plastic-reduction mandates and growing demand for compostable alternatives. Adoption was further supported by a 12.0% year-on-year rise in foodservice chains opting for biodegradable solutions.

Despite this, cost pressures from raw pulp volatility and the need for internal polyethylene linings presented structural barriers to scaling. Foam and plastic variants continued to dominate price-sensitive institutional contracts, limiting the pace of substitution.

A concealed disruptor emerged in the form of bio-coated paper cups, forecast to reduce carbon emissions by 7.0% and capture 15.0% market share by 2028, prompting new supply partnerships across Asia-Pacific converters.

In 2025, the 250 to 750 ml segment dominated the disposable cups market with a 46.0% share, reflecting its versatility across both food and beverage categories. This range met standard portioning needs for cold drinks, specialty coffee, and quick-serve dairy, offering optimal balance between cost-efficiency and consumer convenience.

Growth was constrained by rising material costs and machine reconfiguration downtime for mid-volume SKUs. The under-250 ml segment remained prominent in institutional setups, but was pressured by ongoing packaging rationalization.

A hidden disruptor emerged from the rapid rollout of tamper-evident lid compatibility in the 250-750 ml range, projected to boost adoption in delivery-first channels and increase segment revenue by 8.5% by 2028.

In 2025, beverages accounted for the majority of disposable cups market demand, with hot beverages comprising the largest sub-segment. Growth was led by rising consumption of takeaway coffee, tea, and specialty drinks across urban centers, which fueled a 6.3% annual increase in hot beverage cup sales.

Food-related applications such as yogurt, ice cream, and confectionery remained niche, largely confined to branded retail promotions and QSR limited-time offers. However, multi-layer cup formats with insulated linings faced slower uptake in dairy due to cost-sensitivity.

In 2025, retail emerged as the leading sales channel for disposable cups, driven by bulk purchasing from hypermarkets, supermarkets, and convenience stores. The retail segment captured a significant share, supported by rising household consumption and B2B procurement by small foodservice operators. Specialty stores offered branded compostable SKUs, catering to eco-conscious buyers.

Direct sales by manufacturers remained strong among large institutional buyers, especially in the hospitality and education sectors, but faced friction due to limited customization options and lead-time constraints. Online sales, while smaller in share, registered the fastest growth at 8.1% CAGR, supported by D2C models and subscription-based purchasing.

A hidden disruptor came from the bundling of cups with other packaging products on e-commerce platforms.

In 2025, commercial use accounted for 52.0% of disposable cups market revenues, led by quick service restaurants, cafes, and mobile food vendors. Growth was underpinned by increased demand for takeaway and delivery, with foodservice operators prioritizing speed, portion consistency, and brandable cup surfaces for marketing visibility.

Institutional use-spanning schools, offices, hospitals, and transit hubs-remained steady but was constrained by budget limitations and continued reliance on plastic-based SKUs. Household use, while smaller, saw modest growth driven by lifestyle convenience and increased in-home consumption of ready-to-drink beverages.

A hidden disruptor emerged from venue and catering-specific demand, where custom-print disposable cups for events and seasonal promotions delivered a 5.7% margin premium and are forecast to capture an incremental 6.0% share by 2029.

From 2025 to 2035, China is projected to lead the global disposable cups market with a CAGR of 4.6%, driven by smart-city packaging mandates and increased demand across mobile food vendors and convenience retail. India follows with 4.3%, supported by state-level plastic bans and the rapid expansion of QSR chains.

Germany is expected to grow at 3.9%, where reusable cup pilot programs and eco-certification standards dominate procurement. France (3.6%) benefits from the AGEC law’s push toward bio-coated paper formats, while the UK (3.2%) sees growth tied to post-Brexit supply chain adaptation and plastic levies.

The USA trails at 2.9%, limited by regulatory fragmentation but anchored by sustained demand from hot beverage chains. Brazil is projected to expand at 2.6%, where cost-sensitive regions slow uptake of sustainable alternatives despite pilot programs in premium retail and catering.

The USA disposable cups market is projected to expand at a CAGR of 2.9% from 2025 to 2035. Demand remains anchored in the quick-service restaurant segment, yet growth is tempered by regulatory pressure on single-use plastics. Several states have imposed bans or material mandates that are accelerating the transition to paper and bagasse-based formats. National chains are responding through compostable and recyclable SKUs, but high switching costs persist.

Consumer preference for convenience remains strong, particularly for hot beverages, although sustainability claims are increasingly scrutinized by advocacy groups.

The UK disposable cups market is forecast to grow at a CAGR of 3.2% through 2035. Post-Brexit material sourcing constraints continue to affect cost dynamics, prompting retailers and food chains to prioritize domestic or EU-adjacent suppliers. The national levy on single-use plastics has pushed commercial operators to adopt higher-margin compostable paper SKUs.

Consumers show strong preference for sustainability-labelled cups, particularly in high-footfall transport hubs and universities.

France’s disposable cups market is expected to grow at a 3.6% CAGR from 2025 to 2035. The AGEC law continues to reshape the product mix, mandating alternatives to single-use plastic. Paper cups dominate volume, while foam and plastic variants are nearly phased out in retail and foodservice settings.

Consumers favor minimal-print, recyclable designs, and distributors have begun to offer certified compostable SKUs bundled with lids.

Germany is set to grow at a CAGR of 3.9% in the disposable cups market through 2035. The Packaging Act (VerpackG) continues to drive returnable system innovation, even as single-use demand holds steady in takeout and catering. Demand is skewed toward premium eco-designs that comply with Blue Angel standards.

Consumer demand for recycled fiber content has increased; however, manufacturing costs remain elevated due to energy tariffs and supply chain compliance checks.

India’s disposable cups market is forecast to grow at a CAGR of 4.3% from 2025 to 2035. Growth is propelled by expanding urban foodservice outlets, especially in tier-2 and tier-3 cities. Government initiatives banning select plastic types have driven a strong pivot toward paper and bagasse cups, particularly in institutional catering and transport stations.

Price remains a critical factor, but public-sector tenders are increasingly including sustainability criteria in RFPs.

China leads global growth with a 4.6% CAGR expected through 2035. The government's push toward a circular economy, coupled with smart-city rollout, is driving automation in manufacturing and packaging. Demand is being driven by mobile food vendors, café chains, and convenience retail, with a rising share of bio-polymer blends.

Brand owners are investing in nearshoring and robotics to reduce labor costs and enhance customization.

Brazil’s disposable cups market is projected to grow at a slower 2.6% CAGR from 2025 to 2035. Adoption of sustainable materials remains limited outside tier-1 cities, where cost sensitivity and inconsistent regulation delay scaling. However, large-format retail and stadium catering segments are beginning to trial compostable cups.

Market growth is dependent on import dynamics and localized production incentives.

The disposable cups market is characterized by a mix of global packaging giants and regional converters, with competition shaped by cost-efficiency, material innovation, and regulatory compliance. Major players such as Berry Global, Huhtamaki, and Dart Container have maintained dominance by offering scalable production capacity, vertically integrated supply chains, and expanded portfolios across paper, plastic, and compostable materials. These incumbents are increasingly investing in biodegradable solutions to align with shifting regulatory frameworks across the USA, EU, and APAC.

Mid-tier players and private-label manufacturers continue to capture regional contracts, particularly in fast-growing markets like India and Brazil, where price competitiveness is key. However, limited access to next-generation coating technologies and weak recycling infrastructure hinder their scale. Digital printing capabilities and short-run customization have become points of differentiation, particularly in events-based and QSR-specific cup variants.

Startups and innovators are reshaping the market at the material level. Firms focusing on bio-coated paper, bagasse, and PLA-lined solutions are gaining traction among environmentally certified outlets and premium foodservice operators. Technology-led disruptors offering recyclable barrier linings and tamper-evident lid integration are being closely watched by legacy players, some of whom are initiating acquisitions or licensing deals.

Winners will likely be those with end-to-end material traceability, regional manufacturing agility, and the ability to meet localized compliance with minimal cost inflation.

| Metric | Details |

|---|---|

| Market Covered | Global Disposable Cups Market |

| Historical Year | 2020 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2025 to 2035 |

| Units | USD Billion |

| Segmentation | By Material Type; By Capacity; By Application; By Sales Channel; By End Use; By Region |

| Material Type | Plastic; Paper; Foam; Bagasse |

| Capacity | Less than 250 ml; 250 to 750 ml; Above 750 ml |

| Application | Food (Spreads, Sausages & Dressings, Confectionary, Dairy - Ice Cream, Yogurt, Drinks); Beverages (Hot, Cold) |

| Sales Channel | Manufacturers (Direct Sales); Retail (Hypermarkets, Supermarkets, Convenience Stores, Specialty Stores); Distributors; Online |

| End Use | Commercial Use (Hotels & Cafes, Full-Service Restaurants, Quick Service Restaurants, Venues & Catering, Mobile Food Vendors, Bakery & Patisserie); Institutional Use (Schools & Colleges, Offices, Hospitals, Airports & Railways); Household Use |

| Regions Covered | North America; Latin America; Europe; Middle East & Africa; East Asia; South Asia; Oceania |

| Countries Covered | United States, United Kingdom, Germany, France, China, India, Brazil, Japan, South Korea, Australia, plus 40+ other national markets |

| Key Companies | Berry Global Group, Inc.; Huhtamaki Oyj ; Dart Container Corporation; Georgia-Pacific LLC; Pactiv Evergreen Inc.; Genpak LLC; Lollicup USA, Inc.; Greiner Packaging International GmbH; ConverPack, Inc.; Duni AB |

The global disposable cups market is estimated to be valued at USD 12.4 billion in 2025.

The market size for the disposable cups market is projected to reach USD 17.3 billion by 2035.

The disposable cups market is expected to grow at a 3.4% CAGR between 2025 and 2035.

The key product types in disposable cups market are paper, plastic, foam and bagasse.

In terms of capacity, less than 250 ml segment to command 42.8% share in the disposable cups market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Competitive Breakdown of Disposable Cups Providers

Disposable Curd Cups Market Size and Share Forecast Outlook 2025 to 2035

Market Share Insights for Disposable Curd Cups Providers

Disposable Medicine Measuring Cups Market

Disposable Medical Gowns Market Size and Share Forecast Outlook 2025 to 2035

Disposable Drills Market Size and Share Forecast Outlook 2025 to 2035

Disposable Food Containers Market Size and Share Forecast Outlook 2025 to 2035

Disposable Protective Apparel Market Size and Share Forecast Outlook 2025 to 2035

Disposable Plates Market Size and Share Forecast Outlook 2025 to 2035

Disposable Hygiene Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Disposable Umbilical Cord Protection Bag Market Size and Share Forecast Outlook 2025 to 2035

Disposable E-Cigarettes Market Size and Share Forecast Outlook 2025 to 2035

Disposable Pen Injectors Market Size and Share Forecast Outlook 2025 to 2035

Disposable Trocars Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Disposable Electric Toothbrushes Market Size and Share Forecast Outlook 2025 to 2035

Disposable Barrier Sleeves Market Size and Share Forecast Outlook 2025 to 2035

Disposable Plastic Pallet Market Size and Share Forecast Outlook 2025 to 2035

Disposable Egg Trays Market Size and Share Forecast Outlook 2025 to 2035

Disposable Blood Pressure Cuffs Market Analysis - Size, Share & Forecast 2025 to 2035

Disposable Cutlery Market Size, Growth, and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA