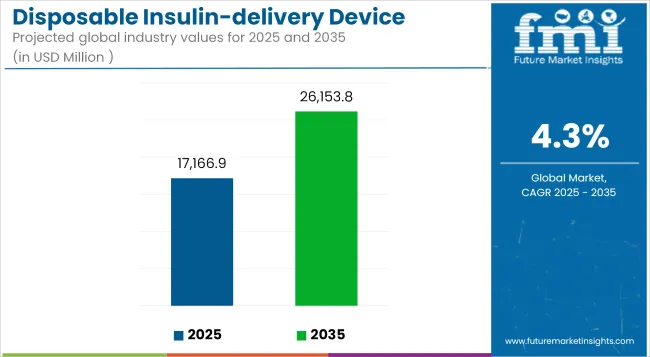

The Disposable Insulin-delivery Device Market is expected to reach USD 17,166.9 Million by 2025 and is expected to steadily grow at a CAGR of 4.3% to reach USD 26,153.8 Million by 2035. In 2024, cirrhosis management market have generated roughly USD 16,459.2 Million in revenues.

The disposable delivery device of insulin is the miniature 'fill-it-once' apparatus that gives a predetermined or programmable-batch dose of insulin attached to the body for a specified time. Unlike the conventional syringes or insuline pens, these devices-such as patch pumps-are capable of providing convenient continuous subcutaneous delivery of insulin without any requirement for repeated intrusive manual injections.

An increase in incidence of diabetes, particularly type 2 diabetes, and an increasing demand for easy to use, needle-free, pain-free patient-oriented insulin delivery are viewed as catalysts toward the higher adoption of smart insulin delivery devices attribute to the growth of the market.

They have evolved and become much more intelligent and accurate with technological innovations, often including Bluetooth connectivity or compatibility with glucose monitors. Moreover, such developments are now making it easier for constant advantageous reimbursement and patient education to increase their uptake even in developed and emerging healthcare markets with boosting unmanned installations.

Key Market Metrics

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 17,166.9 Million |

| Industry Value (2035F) | USD 26,153.8 Million |

| CAGR (2025 to 2035) | 4.3% |

The historical events that would shape the development of the disposable insulin-delivery device were paramount between 2020 and 2024. COVID-19 caused a heightened perception toward management of diseases, especially chronic diseases like diabetes, and promoted home- and self-care solutions that help limit hospital visits. In this regard, the adoption of wearable and disposable insulin-delivery devices was accelerated to facilitate easy delivery of insulin.

The rising incidence of diabetes, particularly with the young due to lifestyle changes during the lockdowns, raised the need for simple-to-handle management tools. At the same time, technological advancements, inconspicuous patch pumps and smart disposable injectors for those patients, enhancing comfort and compliance.

These same health systems moved to remote monitoring and telemedicine, connecting these devices with apps and continuous glucose monitors (CGMs). Beyond these, government programs and favorable reimbursement policies made accessing these devices easy, especially in the United States, Europe, and parts of Asia. These are few of the factors that are significantly contributing to the growth of the market.

Increasingly, users are choosing non-invasive, pain-free, and discreet devices, making patch pumps and injectable wearables a very desirable prospect. Bluetooth-enabled devices with mobile app connectivity promote better disease control and real-time monitoring. Furthermore, solid healthcare infrastructure, progressive reimbursement options, and extensive coverage by insurers maximize the affordability of these devices.

Adoption is further fueled by the thrust for home-based care after COVID-19 and increased awareness in diabetes self-management. Strong engagement of major industry players further contributes to the availability and innovation of products in the region.

Europe's increasing disposable insulin device use is propelled mostly by the growing prevalence of diabetes in the aging populations. There is great consideration toward individual care adapted to patients, with disposable devices providing comfort, convenience, and compliance compared to standard insulin regimen.

The emergence of technologically advanced, wearables offering discreet and continuous insulin delivery matches up with the needs of modern-day consumers. Furthermore, government support, universal health care frameworks, and reimbursement policies in Germany, France, and the UK ensure further access and anticipates market growth.

Faster acceptance of diabetes self-management and a shift towards comfortable, less invasive insulin delivery solutions in the form of convenient, disposable devices have strengthened market development growing.

Government initiatives geared toward diabetes care, stringent healthcare regulations, and insurance support are fuelling this market. Affordable devices manufactured by local companies also facilitate their accessibility. Trends in mobile health technology, including remote monitoring devices, are also attractive in the context of digital healthcare.

High Cost and Limited Accessibility of Disposable Insulin-delivery Devices hinders their Market Growth

Major impediments to adoption of disposable insulin-delivery devices would actually include high price as perceived in the low and even middle-income economies. Though more comfortable and easier, whereas traditional insulin pens and syringes are more cost-effective, the limited insurance coverage to really account for any out-of-pocket expenses on the consumer has made it a global bane for hasty adoption of smarter solutions by most. On top of that, poor distribution and diabetes education for rural and underserved populations obviously hinder access.

Diabetes dissimilarity in care arises since the overwhelming majority of the diabetic populace cannot enjoy the advantages of insulin-delivery technology today. Without robust reimbursement avenues or local manufacturing, along with public education platforms, the utilization of these devices in full scale is to a huge extent curtailed, and with high-cost healthcare as a chief issue for most.

Technological Advancements and Smart Integration

Technologically, the smart integration with the digital health arena and smart monitoring systems presents the widest opportunity for disposable insulin delivery devices. Wearable technology advancement and miniaturized sensors allow these devices to talk to CGMs, mobile apps, and cloud systems for real-time glucose monitoring and insulin management.

This way, personalized and data-driven diabetes management is enabled, improving patient outcomes and compliance. As consumers look for solutions that are automated and less demanding, smart disposables have become intuitive solutions that do not interfere with complex insulin regimens.

Surge in Demand for Wearable Patch Pumpsanticipates the Growth of the Market

Disposable pumps, small and discreet, which have been developed to deliver continuous subcutaneous insulin infusion with minimal user interaction. Their adhesive-backed, tubeless design is designed to enhance patient compliance, easy-only and painless dosing for type 2 diabetic patients.

Players like Insulet have taken the lead with the Omnipod line, and more manufacturers are targeting form factors and programmatic delivery systems. With diabetes on the rise globally, especially among the younger, technology-savvy demographic, wearable devices have become a keystone in the growth strategy of this category and in competitive differentiation among players.

Rising Preference forAll-in-One Disposable Devices demonstrates the Growth of the Market

The industry has seen significant interest in all-in-one disposable insulin devices currently redefining the diabetes world. These devices bring insulin storage, delivery, and adhesion under a single small patch-like construction, devoid of tubing or several pieces. In as much as they are short profiled and go easy on setup time, they are welcomed by most active-lifestyle people and younger populations.

Likewise, there has always been a fear that the user might forget to do the cleaning or might not be compliant with the device if being asked to carry out the necessary maintenance every time after using it. Most of the major players continue to innovate brands that will also improve wear times and provide the utmost comfort.

Strategies to bask in the ease-of-use put them quickly into getting adopted in both developed-renowned regions and in territories with slow adoption from everybody which makes tubeless disposables THE mainstream growth-drivers in the insulin delivery market.

Growth in Pediatric and Adolescent Patient Adoption

Increasing types of disposable insulin-delivery devices used for children as well as for adolescents anticipate the growth of the market. These populations seize the ease, comfort, and decline in injection duration by the use of automated delivery to be able to suppress fear or reservation against the traditional insulin administration.

Though kids' devices continue to mount pressure on Type 1 diabetes incidence in children globally, industry participants are working toward developing products to aid these young patients.

Expansion into Low- and Middle-Income Countries (LMICs)

With health systems in the front seat and India inc, diabetes is nothing now with these LMICs rushing forward. They decided that the issue is to introduce thermometer, VFS, civil society cooperation, pediatric and insulin foundation, and importers of disposables. Worldwide, such structures have designed several programs emphatically featuring public-private partnerships and local government intervention for virulent non-communicable diseases (NCDs).

These programs underscore key interventions like aiding child-specific device acceptance within the wide public, and encouragement to be given for governments competing against one another with highly interesting program proposals, with unanimous support from CEOs at action and intervention levels, toward private-donation funding sources.

The market for disposable insulin delivery devices was seen to grow very strongly during the years 2020 to 2024, due to the increasing prevalence of diabetes along with the growing awareness for self-care, and demand for simple and hassle-free methods of insulin delivery. Home-based diabetes care during the COVID-19 pandemic saw a rise in demand.

The market will witness growth from 2025 to 2035 as a result of aging populations, increasing lifestyle-related diabetes cases, and growing adoption from emerging economies. Advances in wear formats, longer wear-time patches, and greater insurance coverage will propel further growth; On the other hand, penetration into pediatric and rural markets will open fresh opportunities, making disposables a preferred option globally.

| Category | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Safety regulations and usability related to home-use disposable insulin delivery devices are in for increased regulatory scrutiny, with emphasis on integration with diabetes care plans |

| Technological Advancements | Expansion is noted for tubeless, self-contained, easy-to-use insulin pumps and disposable pens with longer wear times and prefilled cartridge-based products. |

| Consumer Demand | Demand for simple disposable products was heightened by demand for ease of self-care and non-invasive insulin administration, mostly ignited during the pandemic. |

| Market Growth Drivers | The average increase of diabetes cases, especially in the developed world, better health awareness, and government programs aimed at fostering better diabetes management. |

| Sustainability | Focus on small, single-use disposable pens with prefilled cartridges to decrease waste and initiatives to alleviate packaging complexities. |

| Category | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Anticipated tightening of safety labeling, clinical efficacy requirements, and global regulatory harmonization. Tougher guidelines for use of long-term devices and expanding approval for patient-specific insulin delivery technology. |

| Technological Advancements | Continued advancements towards intelligent insulin delivery systems with self-adjusting capabilities, connectivity to mobile apps for real-time tracking, and sophisticated wearable insulin patch pumps for more precise and individualized dosing. |

| Consumer Demand | Emerging economies are witnessing more adoption because of affordability and convenience, and with the growth in mobile health solutions. |

| Market Growth Drivers | Increase in the number of patients with type 1 and type 2 diabetes in developing economies and aging population; growing health insurance coverage and improved accessibility to disposable insulin delivery systems shall continue to propel adoption. |

| Sustainability | Emphasis on biodegradable products and greener packaging avenues due to consumer demand for sustainability and governmental pressure towards less healthcare waste in disposable devices. |

The high incidence of diabetes in the United States and the growing trend toward home diabetes care foster strong demand for disposable insulin delivery devices. The expansion of health insurance and technological breakthroughs are the major growth drivers making insulin delivery inexpensive and convenient, especially for the elderly and urban populations.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 3.2% |

Market Outlook

Use of disposable insulin delivery devices is favored by the high-quality healthcare network in Germany and well-developed diabetic care centers. Government health policies relating to chronic disease management and public health programs also help boost market growth. With increasing demands for portable and handy insulin delivery systems, the elderly population will be an added demand driver.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 3.8% |

Market Outlook

The sudden rise in diabetes cases, especially among the middle class, is pushing the demand for disposable insulin delivery devices in India. Rising healthcare awareness, government programs supporting chronic disease care, and improving access to inexpensive medical devices in rural and semi-urban areas are the key factors fueling market growth.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 5.6% |

China's booming diabetic population along with government-backed healthcare reform is fueling the disposable insulin delivery devices market. An upward trend in the utilization of technologically advanced devices by urban and rural populations, coupled with the rising level of insurance coverage and improved economic status, positions China as a growth hub for these devices.

Market Growth Drivers

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 6.2% |

Japan's highly developed diabetes care system and its elderly population are the major driving forces for the adoption of disposable insulin delivery devices. The diversity in healthcare will also sustain demand with an increase in insurance coverage for diabetes care. Japan's innovations in medical technology will also propel the market.

Market Growth Drivers

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.8% |

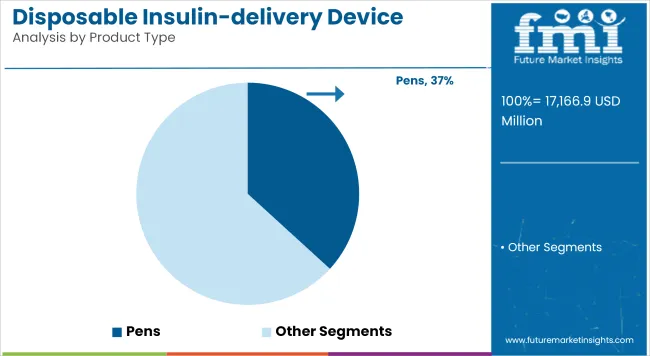

Delivery pumps dominate the market due to their ability to provide precise and continuous insulin infusion

Continuous infusion of insulin is the most conventional means of glycemic control and adoption of this technology has driven the use of these disposable insulin deliverers, mainly because it is expected to improve glycemic control compared to traditional methods.

The technology has been in vogue among Type 1 diabetes patients and patients on intense insulin therapy mainly because of the lifestyle flexibility and a reduced risk of hypoglycemia. Portable insulin pumps are small and discreet; therefore, with one, you do not have to endure the discomfort of shots every day, thus adding to the convenience of use.

Their effectiveness when used with digital monitoring software and CGM systems only serves to enhance their popularity. Apart from these reasons, good clinical support and insurance coverage also play a part in their popularity in developed geographies.

The patches segment holds a substantial market share due to its user-friendly, needle-free delivery mechanism

The patches segment has a great share of the market because of its easy-to-use, needle-free delivery system, which maximizes patient compliance, particularly for the elderly and children. Insulin delivery by these products transdermally does not require any technical skills that make them suited to be used at home.

The painless application and the ease of disposal resolve two main patient concerns pertaining to healthcare experience, which are injection-induced anxiety and hygiene. Growing demand for portable and non-invasive devices therefore, gives weight to their rising popularity.

Technology advancements in micro-needle patch technologies and wearables form factors are increasing the efficacy of patches, leading to further demand in various regions, especially in emerging markets, where ease of use is most sought after.

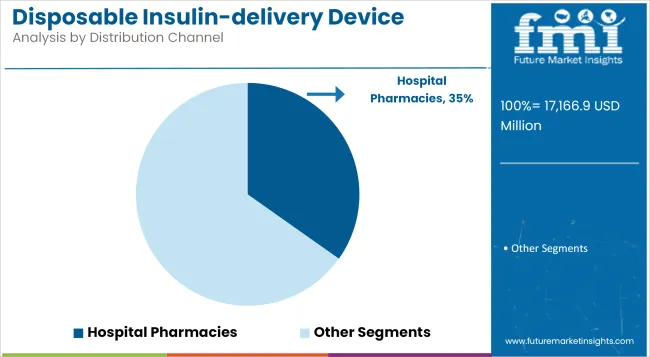

The hospital pharmacies segment dominates the market due to their direct association with inpatient care

Due to direct links with inpatient treatment and referrals from specialists, hospital pharmacies have an edge over other segments with respect to newly diagnosed diabetic patients or complicated cases. Beginning insulin therapy and educating patients are done in hospitals, and once introduced, disposable devices tend to be used more at that point.

Availability of healthcare professionals in the hospital assures the correct use of the device and management of dosage, which builds user confidence. With government tenders and insurance claims encouraged in developed economies, the bulk purchase and supply through hospital pharmacies have proved to benefit their market standing. Their consistency with overall care protocols and clinical guidelines further strengthens them in holding their position at the market forefront.

Retail pharmacies hold a substantial market share due to their widespread accessibility and convenience

The reason why retail pharmacies hold a good chunk of the market is because they extend their market reach and offer convenience to patients who need insulin-delivery devices refilled regularly. Retail pharmacies are among the most important conduits for the chronic illnesses, like diabetes, in urban and semi-urban localities.

Most Retail pharmacies tend to offer walk-in services to those outpatient populations while providing personalized counseling, affordable and loyalty schemes. Nevertheless, nexus with e-commerce sites and telepharmacy solutions add to the reach and convenience for use, especially for long-term insulin therapy patients. More and more diabetes-related over-the-counter care products are available, alongside an increase in public consciousness, which boosts continuous growth in this segment.

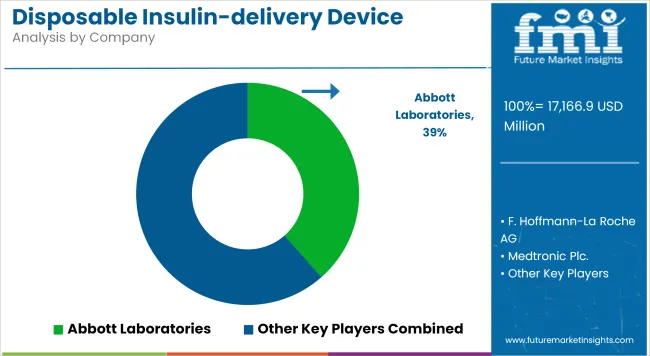

High competition in disposable insulin-delivery devices due to numerous factors, such as product developments, regulatory changes, and ever-growing patient-friendly options. Big companies compete on the miniaturization of the product, usability, and compatibility with glucose-monitoring platforms in order to make their devices compatible with the lifestyle of patients and improve patient compliance.

The market is guided by the FDA, EMA, and other regulators on the basis of the elements such as safety, efficacy, and suitability for digital health. Major players thrive and remain competitive through strategic alliances with health care providers and payers, as well as with technology companies to allow for the accelerated birth of large-scale adoption and insurance reimbursement.

Regionally and locally, competitors are catching up with cost-efficient products and growing networks of distribution for price-sensitive markets and underserved segments, thus creating an even more competitive scenario globally.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Abbott Laboratories | 33.6% to 38.5% |

| F. Hoffmann-La Roche AG | 20.4% to 22.6% |

| Medtronic Plc. | 15.1% to 17.2% |

| Johnson & Johnson | 4.6% to 6.8% |

| Other Companies (combined) | 12.1% to 15.4% |

| Company Name | Key Offerings/Activities |

|---|---|

| Abbott Laboratories | Abbott is a global leader in diabetes care, providing the FreeStyle Libre integrated continuous glucose monitoring system. This is complementary to Abbott's focus on technologies delivering insulin. |

| F. Hoffmann-La Roche AG | Roche has developed a patch-based disposable insulin delivery solution that pairs with glucose monitors and personalized dose management algorithms to contribute positively toward patient outcomes. |

| Medtronic Plc. | Medtronic is heavily invested in insulin pump technology such as disposable insulin patch pumps, contributing to ease of use and accuracy. It emphasizes developing hybrid closed-loop systems which couple delivery devices to real-time CGM for automating basal insulin delivery and providing assistance for Type 1 patients. |

| Johnson & Johnson | Johnson & Johnson has concentrated on disposable wearable insulin-delivery patches. Its aim is to develop user-friendly devices that lessens the burden of injections focusing on non-invasive and unobtrusive insulin delivery for patient- centred diabetes management. |

Key Company Insights

Delivery Pumps,Patches, Pens, Syringes and Others

Type I Diabetes and Type II Diabetes

Hospital Pharmacies, Retail Pharmacies, Online Sales and Diabetes Clinics

The overall market size for cirrhosis management market was USD 17,166.9 Million in 2025.

The cirrhosis management market is expected to reach USD 26,153.8 Million in 2035.

Rising Diabetes Prevalence and increase in preference of people for seeking home-based care anticipates the growth of the disposable insulin-delivery device market.

The top key players that drives the development of disposable insulin-delivery device market are Abbott Laboratories, F. Hoffmann-La Roche AG, Medtronic Plc. and Johnson & Johnson.

Delivery pumps segment by product is expected to dominate the market during the forecast period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Disease Indication, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Disease Indication, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Disease Indication, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Disease Indication, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 20: Latin America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Disease Indication, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Disease Indication, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Western Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 28: Western Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 29: Western Europe Market Value (US$ Million) Forecast by Disease Indication, 2018 to 2033

Table 30: Western Europe Market Volume (Units) Forecast by Disease Indication, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 36: Eastern Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Disease Indication, 2018 to 2033

Table 38: Eastern Europe Market Volume (Units) Forecast by Disease Indication, 2018 to 2033

Table 39: Eastern Europe Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 40: Eastern Europe Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 44: South Asia and Pacific Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Disease Indication, 2018 to 2033

Table 46: South Asia and Pacific Market Volume (Units) Forecast by Disease Indication, 2018 to 2033

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 48: South Asia and Pacific Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 51: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 52: East Asia Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 53: East Asia Market Value (US$ Million) Forecast by Disease Indication, 2018 to 2033

Table 54: East Asia Market Volume (Units) Forecast by Disease Indication, 2018 to 2033

Table 55: East Asia Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 56: East Asia Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 60: Middle East and Africa Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Disease Indication, 2018 to 2033

Table 62: Middle East and Africa Market Volume (Units) Forecast by Disease Indication, 2018 to 2033

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 64: Middle East and Africa Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Disease Indication, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 10: Global Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Disease Indication, 2018 to 2033

Figure 14: Global Market Volume (Units) Analysis by Disease Indication, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Disease Indication, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Disease Indication, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 18: Global Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 21: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 22: Global Market Attractiveness by Disease Indication, 2023 to 2033

Figure 23: Global Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Disease Indication, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 34: North America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Disease Indication, 2018 to 2033

Figure 38: North America Market Volume (Units) Analysis by Disease Indication, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Disease Indication, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Disease Indication, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 42: North America Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 45: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 46: North America Market Attractiveness by Disease Indication, 2023 to 2033

Figure 47: North America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Disease Indication, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 58: Latin America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Disease Indication, 2018 to 2033

Figure 62: Latin America Market Volume (Units) Analysis by Disease Indication, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Disease Indication, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Disease Indication, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 66: Latin America Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Disease Indication, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Western Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) by Disease Indication, 2023 to 2033

Figure 75: Western Europe Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 82: Western Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 85: Western Europe Market Value (US$ Million) Analysis by Disease Indication, 2018 to 2033

Figure 86: Western Europe Market Volume (Units) Analysis by Disease Indication, 2018 to 2033

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Disease Indication, 2023 to 2033

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Disease Indication, 2023 to 2033

Figure 89: Western Europe Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 90: Western Europe Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 93: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 94: Western Europe Market Attractiveness by Disease Indication, 2023 to 2033

Figure 95: Western Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Eastern Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 98: Eastern Europe Market Value (US$ Million) by Disease Indication, 2023 to 2033

Figure 99: Eastern Europe Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 106: Eastern Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Disease Indication, 2018 to 2033

Figure 110: Eastern Europe Market Volume (Units) Analysis by Disease Indication, 2018 to 2033

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Disease Indication, 2023 to 2033

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Disease Indication, 2023 to 2033

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 114: Eastern Europe Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 117: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 118: Eastern Europe Market Attractiveness by Disease Indication, 2023 to 2033

Figure 119: Eastern Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 120: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia and Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 122: South Asia and Pacific Market Value (US$ Million) by Disease Indication, 2023 to 2033

Figure 123: South Asia and Pacific Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 130: South Asia and Pacific Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Disease Indication, 2018 to 2033

Figure 134: South Asia and Pacific Market Volume (Units) Analysis by Disease Indication, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Disease Indication, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Disease Indication, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 138: South Asia and Pacific Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 141: South Asia and Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 142: South Asia and Pacific Market Attractiveness by Disease Indication, 2023 to 2033

Figure 143: South Asia and Pacific Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 146: East Asia Market Value (US$ Million) by Disease Indication, 2023 to 2033

Figure 147: East Asia Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 148: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 154: East Asia Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 157: East Asia Market Value (US$ Million) Analysis by Disease Indication, 2018 to 2033

Figure 158: East Asia Market Volume (Units) Analysis by Disease Indication, 2018 to 2033

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Disease Indication, 2023 to 2033

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Disease Indication, 2023 to 2033

Figure 161: East Asia Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 162: East Asia Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 165: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 166: East Asia Market Attractiveness by Disease Indication, 2023 to 2033

Figure 167: East Asia Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 168: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 170: Middle East and Africa Market Value (US$ Million) by Disease Indication, 2023 to 2033

Figure 171: Middle East and Africa Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 178: Middle East and Africa Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Disease Indication, 2018 to 2033

Figure 182: Middle East and Africa Market Volume (Units) Analysis by Disease Indication, 2018 to 2033

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Disease Indication, 2023 to 2033

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Disease Indication, 2023 to 2033

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 186: Middle East and Africa Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 189: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 190: Middle East and Africa Market Attractiveness by Disease Indication, 2023 to 2033

Figure 191: Middle East and Africa Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 192: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Disposable NPWT Devices Market Trends – Growth & Forecast 2024-2034

Disposable Medical Gowns Market Size and Share Forecast Outlook 2025 to 2035

Disposable Drills Market Size and Share Forecast Outlook 2025 to 2035

Disposable Food Containers Market Size and Share Forecast Outlook 2025 to 2035

Disposable Protective Apparel Market Size and Share Forecast Outlook 2025 to 2035

Disposable Plates Market Size and Share Forecast Outlook 2025 to 2035

Disposable Hygiene Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Disposable Umbilical Cord Protection Bag Market Size and Share Forecast Outlook 2025 to 2035

Disposable E-Cigarettes Market Size and Share Forecast Outlook 2025 to 2035

Disposable Pen Injectors Market Size and Share Forecast Outlook 2025 to 2035

Disposable Trocars Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Disposable Cups Market Size and Share Forecast Outlook 2025 to 2035

Disposable Electric Toothbrushes Market Size and Share Forecast Outlook 2025 to 2035

Disposable Barrier Sleeves Market Size and Share Forecast Outlook 2025 to 2035

Device-Embedded Biometric Authentication Market Size and Share Forecast Outlook 2025 to 2035

Disposable Plastic Pallet Market Size and Share Forecast Outlook 2025 to 2035

Disposable Curd Cups Market Size and Share Forecast Outlook 2025 to 2035

Disposable Egg Trays Market Size and Share Forecast Outlook 2025 to 2035

Disposable Blood Pressure Cuffs Market Analysis - Size, Share & Forecast 2025 to 2035

Disposable Cutlery Market Size, Growth, and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA