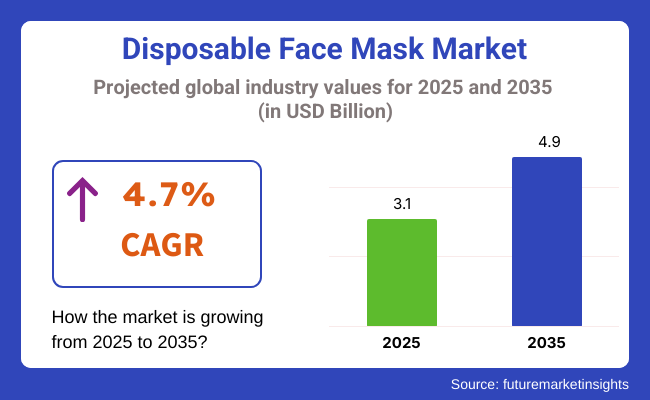

The disposable face mask market is estimated to be USD 3.1 billion in 2025 and is expected to increase at a 4.7% CAGR over the forecast period from 2025 to 2035. The industry size is expected to reach USD 4.9 billion by 2035. Among the key drivers of this growth is the ongoing emphasis on hygiene and airborne infection control in healthcare, industrial, and public environments around the world.

Although the urgency of the COVID-19 pandemic has passed, steady demand is being driven by institutional buying in hospitals, labs, and high-risk work areas. Disposable face masks remain critical in protecting healthcare professionals and patients from surgical and diagnostic procedures. Moreover, governmental regulations and industry standards continue to necessitate the use of protective gear, which encourages repeated use of products in primary applications.

The demand is also fueled by shifts in consumer behavior, particularly in highly populated and pollution-prone locations. In North America's urban areas and the Asia-Pacific, daily wearing masks persists during flu epidemics and polluted regions. Consistent use has created a stabilized baseline level of demand, and firms have introduced skin-friendly, breathable, and hypoallergenic material to maximize comfort for long periods of use.

Material science technological advancements are contributing their share towards enhancing filtration performance and breathability. Firms are focusing on the application of nanofibers, biodegradable goods, and antimicrobial treatments, offering differentiation within a historically commoditized industry. Branding is shifting towards quality, certification, and environmental impact rather than quantity.

eCommerce has become a leading mode of distribution, particularly for bulk orders and custom designs meant for the consumer as well as medical professional use. Although pricing pressures exist, the industry is nonetheless well-supported by the low unit price and high turnover of disposable masks. Innovation, compliance with regulations, and supply chain resiliency will be critical to sustaining growth as the industry approaches a post-pandemic norm.

The face mask industry will be segmented into Disposable Face Masks based on Product Type. By 2025, Non-woven Masks will likely hold the largest industry share, amounting to 36.3%, just ahead of Protective Masks at 35.2%.

Non-woven Masks rule because of their economical nature and ease of manufacture, as well as their acceptance in a variety of medical and non-medical applications. These masks are made from a combination of synthetic fibers pressed into a thin sheet of material that provides a good filtration-to-breathability ratio. Their use in the general population for personal protection against dust, pollution, and airborne pathogens made them increasingly popular throughout the COVID-19 pandemic.

With that, companies such as 3M, Honeywell, GlaxoSmithKline, and Medline mass-produced these masks. This basic filtration face mask is chosen mainly for industries needing a level of filtration without the necessity of advanced filtration, i.e., retail and transportation.

Conversely, Protective Masks, usually constructed with advanced materials like N95 or KN95, are estimated to grab a share of 35.2% of the industry in 2025. These masks provide higher protection due to their filtration features and are preferred by healthcare workers, frontline workers, and those in high-risk areas.

The rising awareness regarding air quality and recommendations from regulatory authorities is contributing to the increase in demand for protective face masks. 3M, Kimberly-Clark, and Medtronic are incumbent companies in the industry for providing high-performance masks, especially during a crisis when superior protection is a must.

In the industry by application type, Personal Use will hold the largest share in 2025, at 62%. In contrast, Industrial Use is likely to capture 38% of the industry.

Masks for personal use, which consist of non-surgical face masks used by individuals to protect themselves against dust, pollutants, allergens, and pathogens, are expected to dominate the industry. Personal health awareness, air quality-related concerns, and public health measures taken due to the COVID-19 pandemic have made masks an indispensable part of the lives of many.

The pandemic has developed in people a lot of consciousness about hygienic behavior and public safety, and masks for personal use have become a part of life for individuals of all social strata. Manufacturers such as 3M, Kimberly-Clark, and P&G have ramped up their production of non-woven and cloth masks for the ordinary consumer. These masks are hence available through retail channels, including supermarkets, pharmacies, and online platforms, making them highly accessible and in great demand.

Industrial use masks capture 38% of the industry share and are used in manufacturing, healthcare, and construction environments, where workers are exposed to hazardous materials, dust, or airborne contaminants. Masks such as N95 respirators are primarily used to protect from fine particles and are critical in industries where health and safety regulations are stringent.

N95 and KN95 are specifically in demand in the healthcare sector for infection control in hospitals, clinics, and emergency medical services. Big players such as Honeywell, 3M, and Medline manufacture and supply these masks in high-risk settings where there is a greater risk of airborne diseases.

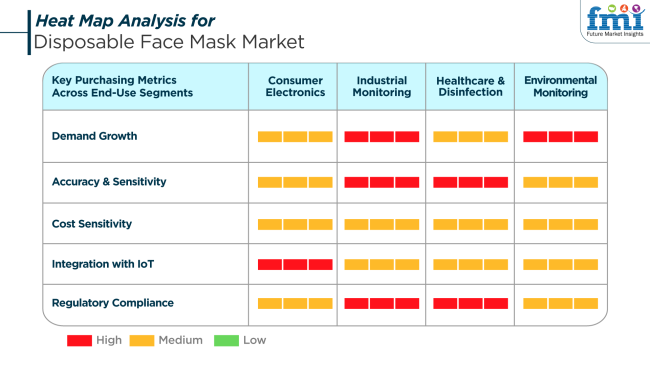

In disinfection and healthcare, disposable face masks are subjected to the utmost degree of accuracy and conformity. They must adhere to high-filtration efficiency standards and material safety standards, and therefore, quality control is extremely important. Consistent hospital and clinical use ensures consistent demand, with a great deal of sensitivity to price and brand loyalty.

Industrial surveillance segments mainly apply face masks for dust, fumes, and chemicals. Demand is increasing at a high rate in this segment due to improving occupational safety standards. Policy and worker health measures are driving bulk purchasing, especially in mining, construction, and manufacturing.

In public use and environmental monitoring, face masks serve protective and precautionary purposes. Seasonal air pollution and outbreaks have made it standard in certain regions of the globe. Consumers seek eco-friendly and disposable products that provide improved airflow. Though price sensitivity is immense in this industry, mass consumption supports volumetric growth on retail and offline channels.

One of the most significant risks to the disposable face mask industry is commoditization. With little differentiation between generic mask types, intense price competition can erode profit margins for low-cost manufacturers and even low-cost manufacturers in general. This is exacerbated by excess capacity from pandemic-era production increases and further fueled by resulting excess inventory and volatile pricing.

Environmental sustainability is also a big challenge. Growing concern regarding plastic pollution and single-use has led to questioning traditional polypropylene-based masks. Future demand can be influenced by regulatory intervention or consumer backlash against non-biodegradable disposables. Businesses that are unable to move to eco-friendly materials can suffer from reputational and compliance-related failures.

The geopolitical tensions and international supply chain disruptions continue to impact supply chain stability. Raw material availability, export prohibitions, and labor shortages can potentially cause production cycle and delivery time volatility. To reduce such risks, companies are turning towards regional manufacturing hubs and supplier network diversification to ensure stable output and response to industry volatility.

Between 2020 and 2024, the disposable face mask industry experienced an unprecedented surge as a result of the worldwide COVID-19 pandemic. Face masks emerged as a necessary precautionary gear in healthcare settings and in the overall consumer industry.

Demand increased not only from hospitals and clinics but also from the masses for everyday protection. Governments in Asia, North America, and Europe rolled out mask mandates, which drove sales volumes aggressively. Production increased rapidly as manufacturers ramped up and extended product lines- moving from surgical masks to 3-ply and KN95 variants.

During the period of 2025 to 2035, the industry will shift toward more focus on sustainability, innovation, and health preparedness. The demand for environmentally friendly masks using biodegradable and compostable materials will rise. The healthcare industry will maintain steady demand, and pandemic preparedness will become integral to national health plans.

Advances in technology will also contribute to the creation of masks with greater filtration, antimicrobial coating, and even embedded sensors for medical diagnostics in clinics. While all this happens, government regulation in terms of medical-grade quality and environmental regulation will influence manufacturing and supply chains. Public institutions and workplaces may continue to maintain seasonal or situational face mask policies.

Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| COVID-19 pandemic, global health crisis, and required mask use. | Sustainability emphasis, healthcare readiness, and need for advanced materials. |

| General public, healthcare providers, and public services. | Mainly healthcare and institution segments, with focused public use in crowded locations or seasonal requirements. |

| 3-ply masks, surgical masks, and N95/KN95 respirators. | Green masks, better filtration technologies, and intelligent masks with onboard sensors. |

| Limited emphasis on sustainability; large-scale production using synthetic materials. | Growing demand for biodegradable, compostable, and recyclable mask material. |

| Emergency-use approvals and accelerated approvals. | Stringent environmental regulation and innovation-driven regulatory revisions. |

| Pharmacies, hospitals, e-commerce sites, and broad-based retail. | Streamlined supply to healthcare systems, specialty retailers, and environmentally sustainable product channels. |

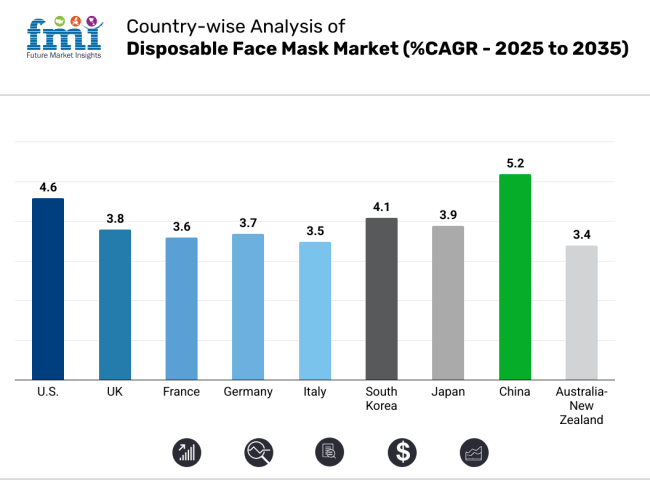

The USA industry is anticipated to register a 4.6% CAGR growth over the forecast period. The USA industry is still gaining advantages from increased awareness of public health, strong regulation, and large healthcare spending. Although the demand urgency due to the pandemic has started to recede, institutional and consumer channels are embracing face masks as preventive healthcare measures long-term.

Hospitals, clinics, and even schools are including disposable masks as part of routine inventory to curb infection risk. This is an indication of a larger change in health protocols following COVID-19. Workplace health and safety requirements across industries like food processing, manufacturing, and retail also account for steady demand.

Having established domestic manufacturers with extensive distribution networks also ensures growth. Advances in filtration technology and comfort-driven designs are promoting frequent replacement and use of masks, fueling volume sales.

Combined with increased consumer demand for certified, high-quality products, the industry is poised for consistent growth. Online retail channels are also increasingly contributing to fulfilling consumer demand through subscription models and bulk purchase options. The confluence of regulatory support, awareness, and innovation will keep driving the industry in the USA during the forecast period.

The UK industry is forecasted to develop at 3.8% CAGR through the period under study. The UK industry is expected to be stable and moderately growing, driven by ongoing healthcare system requirements and an increasingly aware public attitude towards personal hygiene and infection control.

With the robust integration of face masks in medical environments, especially hospitals, care homes, and dental practices, the demand is constant. Public transport systems and urban locations also experience a level of voluntary use during flu outbreaks and health alerts. Consumer demand in the retail sector is increasing towards higher-quality masks with improved filtration efficiency and comfort, which supports high-end product segments.

The high safety standards and regulation needs in the UK are supporting demand for compliant products. In the meantime, efforts by the government and health agencies to prepare for upcoming health emergencies have set long-term procurement plans for personal protective equipment, such as masks.

The French industry will grow at 3.6% CAGR over the forecast period. In France, the industry is changing as the healthcare industry redefines readiness procedures. Although mass usage across the general populace has fallen from the peak of the pandemic, steady demand by hospitals, aged care homes, and clinics maintains a solid base of consumption.

Disposable face masks have become a standard part of infection control measures, especially during flu epidemic seasons and peak hospital visitation periods. The French government still keeps emergency stockpiles and long-term supply agreements, which steadies procurement levels. Furthermore, increased environmental awareness is causing demand for biodegradable and green versions of disposable masks, creating product innovation and premiumization.

Public and private healthcare institutions alike are increasingly focusing on quality certifications and indigenous manufacturing capabilities, supporting the development of local producers. Since mask use has become institutionalized within specific industries like pharmaceuticals, veterinary care, and public service sectors, repeated purchases drive continuous industry expansion.

Although consumer demand has slowed, healthcare-led demand, policy congruence, and innovation in sustainable products are expected to continue, placing the French industry on a steady growth path.

The German industry is expected to grow at 3.7% CAGR over the study period. Germany's industry is expected to grow steadily with sustained application in healthcare facilities and a strict strategy towards public health management.

Germany's well-developed hospital infrastructure, along with stringent regulatory compliance standards, has incorporated disposable face masks as a norm in outpatient and inpatient facilities. Medical staff, laboratory technicians, and frontline workers in various industries provide a steady base demand.

Industries that necessitate compliance with hygienic manufacturing processes, including pharmaceuticals, electronics, and food processing, also encourage the continuous use of masks. Germany's advanced production industry and automation investment guarantee a consistent supply of quality masks, minimizing dependence on imports and allowing for quick response to supply and demand fluctuations.

Higher health awareness among the population has affected seasonal uptake, especially during the time of respiratory disease outbreaks. Sustainability trends are starting to impact product development, too, with growing demand for biodegradable disposable ones.

Corporate and public sector procurement continues to play a major role, too, being driven by safety policies for the long term. This balanced structure of demand, both from institutional and industrial channels, is anticipated to maintain the German industry on a healthy growth trajectory until 2035.

The industry in Italy is anticipated to grow at 3.5% CAGR throughout the study. Institutional usage persists in the industry in Italy as general consumer uptake transitions towards targeted, seasonal usage patterns. Italian healthcare professionals are the foremost drivers of demand, and hospitals, clinics, and elderly care facilities regularly need disposable face masks for everyday use.

The nation's experience throughout the COVID-19 pandemic has transformed public health measures to include stockpiling and supply chain continuity of protective gear. There is increasing demand for high-performance face masks from targeted consumer groups, especially in urban areas and during episodes of high air pollution or disease spread.

Production locally has been revived, with local producers being incentivized to service national needs. Also, Italy's vibrant textile and fashion sector has introduced design aspects into the production of masks, making them more consumer-facing, particularly with younger consumers. Private institutional customers and public procurement contracts have kept up consistent purchasing habits.

The industry is further influenced by changing safety requirements and a preference for skin-friendly, hypoallergenic materials. With demand now better anchored in institutional and niche consumer applications, the Italian industry will be growing at a slow but steady pace.

South Korea's industry will grow at a 4.1% CAGR throughout the study period. South Korea has robust industry dynamics for disposable face masks with backing from well-developed healthcare infrastructure, high population density, and cultural adaptation towards mask use.

Even beyond health crises, wearing face masks is a habitual behavior for individuals for reasons such as seasonal allergies, pollution, and protection from the cold. Such normalized behavior heavily drives regular consumer-level demand. In the medical and industrial sectors, face mask consumption is still strong because of strict safety and hygiene laws.

The government still holds emergency inventories and works closely with local manufacturers to distribute them quickly in times of health alerts. Technological advancements like better breathability and filtration have fueled product differentiation and customer loyalty. South Korea's strong manufacturing base, renowned for high-quality output and innovation, allows for both local supply and exports.

Additionally, the sale of masks through online platforms, such as mobile commerce and subscription-based services, boosts industry convenience and accessibility. Underpinned by healthcare systems, technology innovation, and cultural habits, the industry in South Korea is poised to register robust and sustainable growth.

The study anticipates Japan's industry growth at 3.9% CAGR during the forecast period. In Japan, the use of disposable face masks has been an integral part of cultural life, even before the pandemic around the world. Urbanization levels are high, as is the proportion of elderly people, and air pollution issues drive regular consumption among the masses. The healthcare industry in the nation is a reliable source of demand with habitual use by hospitals, clinics, and outpatient units.

Retail and institutional customers both continue to appreciate masks with higher comfort, breathability, and filtration properties. Advances in technology in material science have enabled the manufacturing of lighter and more skin-compatible masks, making the frequency of use even greater. The local manufacturing sector is strong, with ongoing innovation in packaging, fit, and disposable hygiene items. The confidence that consumers have in Japanese-made products is high, supporting solid brand loyalty.

Seasonal demand fluctuations are typical, with high peaks during flu and allergy seasons. The government also assists local producers with regulatory clarity and preparedness planning. With a mature and educated consumer base, Japan's industry is set for stable growth during the forecast period.

The China industry will grow at 5.2% CAGR over the study period. China is likely to dominate the growth in the industry because of its huge manufacturing base, dense population, and increased post-pandemic consciousness. Government policies remain supportive of healthcare readiness, and disposable face masks are viewed as critical in preventing the spread of communicable diseases.

Large-scale applications in hospitals, public transport, schools, and workplaces generate persistent demand. In addition, China's export capacities make it a world supplier of disposable masks with both domestic and foreign channels of demand.

Domestic design innovations combined with affordable large-scale production make Chinese products very competitive. The growth in the e-commerce system also further enhances consumer reach, including via social commerce platforms. Concerns for the environment are fueling interest in biodegradable and reusable mask technologies and driving R&D in environmentally friendly disposables.

With ongoing domestic awareness about pollution, hygiene, and personal health, consumer acceptance of everyday mask-wearing will continue. All these forces put together ensure China continues to be at the front in both demand and supply across the world of disposable face masks.

The Australia-New Zealand industry is anticipated to grow at 3.4% CAGR over the study period. The industry in the Australia-New Zealand region is moving from pandemic-induced peaks toward a normalized, institutionalized demand pattern. Healthcare institutions, elder care facilities, and first responders continue to be demand drivers, where masks are a part of routine operating procedures. Public authorities still have emergency inventories to provide continuity in procurement.

Consumer-grade use is episodic and related to seasonal diseases, air pollution events, and local outbreaks. Public health awareness campaigns, together with travel guidelines, maintain episodic spikes in demand. Regional production has grown to improve local self-sufficiency, particularly after supply chain disruptions during the pandemic.

This region's eco-aware consumers are starting to prefer green and biodegradable mask alternatives, nudging manufacturers toward innovation. Additionally, government collaboration with suppliers ensures quality control and compliance with safety regulations. While the industry is relatively mature, future growth is expected to stem from innovation in sustainable products, healthcare policy evolution, and public readiness planning.

The industry remains highly competitive as it is shaped by advancements in filtration technology, regulatory requirements, and growing awareness of health on the part of consumers. It is dominated by 3M with its formidable brand name recognition, diversified portfolios, and strong emphasis on the supply of mask products that maintain high standards for safety and comfort for both healthcare and industrial end-use markets.

Honeywell International Inc. comes close, with a wide array of disposable respiratory protection products that are renowned for their ergonomic design and improved breathability, making them a popular option among healthcare professionals and industrial staff.

Moldex-Metric, Inc. is another notable company, dominating with its brightly colored, quick-fitting, and highly performing disposable masks, most in demand among the construction and manufacturing industries. Kimberly-Clark Corporation has found a prestigious niche by supplying secure and reasonably priced disposable face masks mainly addressed at healthcare units and consumers.

On the other hand, uvex group is spreading its horizon in the European region, tapping the power of German engineering and technological innovation in making available masks with high protection capabilities coupled with comfort. Other players like Kowa American Corporation, SAS Safety Corp., and The Gerson Companies continue to contribute to the industry through specialized and niche offerings that cater to different user segments.

Market Share Analysis by Company

| Company | Estimated Market Share (%) |

|---|---|

| 3M | 18-22% |

| Honeywell International Inc. | 15-18% |

| Moldex-Metric, Inc. | 11-14% |

| Kimberly-Clark Corporation | 9-12% |

| uvex group | 7-10% |

| Other Players | 27-32% |

Key Company Insights

3M dominates the disposable face mask industry with a projected 18-22% industry share, backed by its reliability for quality, innovation, and adherence to strict safety standards. The diversified product array of 3M, ranging from N95 respirators to general-purpose masks, has established it well in both the healthcare and industrial markets.

Honeywell International Inc. holds an industry share of 15-18%, with ergonomically molded masks that focus on comfort, breathability, and efficient filtration. Its medical masks are highly accepted in medical, industrial, and consumer settings to expand its industry. Moldex-Metric, Inc. maintains approximately 11-14% industry share due to its clear, high-tech mask styles that make it easy to comply in work settings while providing superior filtration protection.

Kimberly-Clark Corporation takes about 9-12% industry share with its efficient, affordable disposable masks, particularly for healthcare and institutional customers. uvex group holds a 7-10% stake, emphasizing high-performance, comfortable masks for professional and consumer markets in Europe.

The competitive industry is also supported by other companies like Kowa American Corporation, SAS Safety Corp., The Gerson Companies, DACH, and JIANGSU TEYIN IMP. & EXP. CO., LTD., which add to the dynamic competition with niche product offerings to specific needs.

By product type, the industry is segmented into protective masks, dust masks, and non-woven masks.

By application, the industry is divided into industrial and personal applications.

By distribution channel, the industry is categorized into online and offline channels.

By region, the industry is segmented into North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and the Middle East & Africa.

The industry is slated to reach USD 3.1 billion in 2025.

The industry is predicted to reach a size of USD 4.9 billion by 2035.

Key companies include 3M, Honeywell International Inc., Moldex-Metric, Inc., Kimberly-Clark Corporation, uvex group, Kowa American Corporation, SAS Safety Corp., The Gerson Companies, Inc., DACH, and JIANGSU TEYIN IMP. & EXP. CO., LTD.

China is the focus, with a CAGR of 5.2% during the forecast period.

Non-woven masks are being widely used

Table 1: Global Market Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Global Market Volume (Units) Forecast by Region, 2019 to 2034

Table 3: Global Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 4: Global Market Volume (Units) Forecast by Product, 2019 to 2034

Table 5: Global Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 6: Global Market Volume (Units) Forecast by Application, 2019 to 2034

Table 7: Global Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 8: Global Market Volume (Units) Forecast by Distribution Channel, 2019 to 2034

Table 9: North America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 10: North America Market Volume (Units) Forecast by Country, 2019 to 2034

Table 11: North America Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 12: North America Market Volume (Units) Forecast by Product, 2019 to 2034

Table 13: North America Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 14: North America Market Volume (Units) Forecast by Application, 2019 to 2034

Table 15: North America Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 16: North America Market Volume (Units) Forecast by Distribution Channel, 2019 to 2034

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 18: Latin America Market Volume (Units) Forecast by Country, 2019 to 2034

Table 19: Latin America Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 20: Latin America Market Volume (Units) Forecast by Product, 2019 to 2034

Table 21: Latin America Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 22: Latin America Market Volume (Units) Forecast by Application, 2019 to 2034

Table 23: Latin America Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 24: Latin America Market Volume (Units) Forecast by Distribution Channel, 2019 to 2034

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 26: Western Europe Market Volume (Units) Forecast by Country, 2019 to 2034

Table 27: Western Europe Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 28: Western Europe Market Volume (Units) Forecast by Product, 2019 to 2034

Table 29: Western Europe Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 30: Western Europe Market Volume (Units) Forecast by Application, 2019 to 2034

Table 31: Western Europe Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 32: Western Europe Market Volume (Units) Forecast by Distribution Channel, 2019 to 2034

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 34: Eastern Europe Market Volume (Units) Forecast by Country, 2019 to 2034

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 36: Eastern Europe Market Volume (Units) Forecast by Product, 2019 to 2034

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 38: Eastern Europe Market Volume (Units) Forecast by Application, 2019 to 2034

Table 39: Eastern Europe Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 40: Eastern Europe Market Volume (Units) Forecast by Distribution Channel, 2019 to 2034

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 42: South Asia and Pacific Market Volume (Units) Forecast by Country, 2019 to 2034

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 44: South Asia and Pacific Market Volume (Units) Forecast by Product, 2019 to 2034

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 46: South Asia and Pacific Market Volume (Units) Forecast by Application, 2019 to 2034

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 48: South Asia and Pacific Market Volume (Units) Forecast by Distribution Channel, 2019 to 2034

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 50: East Asia Market Volume (Units) Forecast by Country, 2019 to 2034

Table 51: East Asia Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 52: East Asia Market Volume (Units) Forecast by Product, 2019 to 2034

Table 53: East Asia Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 54: East Asia Market Volume (Units) Forecast by Application, 2019 to 2034

Table 55: East Asia Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 56: East Asia Market Volume (Units) Forecast by Distribution Channel, 2019 to 2034

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 58: Middle East and Africa Market Volume (Units) Forecast by Country, 2019 to 2034

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 60: Middle East and Africa Market Volume (Units) Forecast by Product, 2019 to 2034

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 62: Middle East and Africa Market Volume (Units) Forecast by Application, 2019 to 2034

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 64: Middle East and Africa Market Volume (Units) Forecast by Distribution Channel, 2019 to 2034

Figure 1: Global Market Value (US$ Million) by Product, 2024 to 2034

Figure 2: Global Market Value (US$ Million) by Application, 2024 to 2034

Figure 3: Global Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 4: Global Market Value (US$ Million) by Region, 2024 to 2034

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 6: Global Market Volume (Units) Analysis by Region, 2019 to 2034

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 9: Global Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 10: Global Market Volume (Units) Analysis by Product, 2019 to 2034

Figure 11: Global Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 12: Global Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 13: Global Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 14: Global Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 15: Global Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 16: Global Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 17: Global Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 18: Global Market Volume (Units) Analysis by Distribution Channel, 2019 to 2034

Figure 19: Global Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 20: Global Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 21: Global Market Attractiveness by Product, 2024 to 2034

Figure 22: Global Market Attractiveness by Application, 2024 to 2034

Figure 23: Global Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 24: Global Market Attractiveness by Region, 2024 to 2034

Figure 25: North America Market Value (US$ Million) by Product, 2024 to 2034

Figure 26: North America Market Value (US$ Million) by Application, 2024 to 2034

Figure 27: North America Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 28: North America Market Value (US$ Million) by Country, 2024 to 2034

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 30: North America Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 33: North America Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 34: North America Market Volume (Units) Analysis by Product, 2019 to 2034

Figure 35: North America Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 36: North America Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 37: North America Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 38: North America Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 39: North America Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 40: North America Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 41: North America Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 42: North America Market Volume (Units) Analysis by Distribution Channel, 2019 to 2034

Figure 43: North America Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 44: North America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 45: North America Market Attractiveness by Product, 2024 to 2034

Figure 46: North America Market Attractiveness by Application, 2024 to 2034

Figure 47: North America Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 48: North America Market Attractiveness by Country, 2024 to 2034

Figure 49: Latin America Market Value (US$ Million) by Product, 2024 to 2034

Figure 50: Latin America Market Value (US$ Million) by Application, 2024 to 2034

Figure 51: Latin America Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 52: Latin America Market Value (US$ Million) by Country, 2024 to 2034

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 57: Latin America Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 58: Latin America Market Volume (Units) Analysis by Product, 2019 to 2034

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 61: Latin America Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 62: Latin America Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 65: Latin America Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 66: Latin America Market Volume (Units) Analysis by Distribution Channel, 2019 to 2034

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 69: Latin America Market Attractiveness by Product, 2024 to 2034

Figure 70: Latin America Market Attractiveness by Application, 2024 to 2034

Figure 71: Latin America Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 72: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 73: Western Europe Market Value (US$ Million) by Product, 2024 to 2034

Figure 74: Western Europe Market Value (US$ Million) by Application, 2024 to 2034

Figure 75: Western Europe Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 76: Western Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 78: Western Europe Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 81: Western Europe Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 82: Western Europe Market Volume (Units) Analysis by Product, 2019 to 2034

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 85: Western Europe Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 86: Western Europe Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 89: Western Europe Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 90: Western Europe Market Volume (Units) Analysis by Distribution Channel, 2019 to 2034

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 93: Western Europe Market Attractiveness by Product, 2024 to 2034

Figure 94: Western Europe Market Attractiveness by Application, 2024 to 2034

Figure 95: Western Europe Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 96: Western Europe Market Attractiveness by Country, 2024 to 2034

Figure 97: Eastern Europe Market Value (US$ Million) by Product, 2024 to 2034

Figure 98: Eastern Europe Market Value (US$ Million) by Application, 2024 to 2034

Figure 99: Eastern Europe Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 102: Eastern Europe Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 106: Eastern Europe Market Volume (Units) Analysis by Product, 2019 to 2034

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 110: Eastern Europe Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 114: Eastern Europe Market Volume (Units) Analysis by Distribution Channel, 2019 to 2034

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 117: Eastern Europe Market Attractiveness by Product, 2024 to 2034

Figure 118: Eastern Europe Market Attractiveness by Application, 2024 to 2034

Figure 119: Eastern Europe Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 120: Eastern Europe Market Attractiveness by Country, 2024 to 2034

Figure 121: South Asia and Pacific Market Value (US$ Million) by Product, 2024 to 2034

Figure 122: South Asia and Pacific Market Value (US$ Million) by Application, 2024 to 2034

Figure 123: South Asia and Pacific Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2024 to 2034

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 126: South Asia and Pacific Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 130: South Asia and Pacific Market Volume (Units) Analysis by Product, 2019 to 2034

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 134: South Asia and Pacific Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 138: South Asia and Pacific Market Volume (Units) Analysis by Distribution Channel, 2019 to 2034

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 141: South Asia and Pacific Market Attractiveness by Product, 2024 to 2034

Figure 142: South Asia and Pacific Market Attractiveness by Application, 2024 to 2034

Figure 143: South Asia and Pacific Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2024 to 2034

Figure 145: East Asia Market Value (US$ Million) by Product, 2024 to 2034

Figure 146: East Asia Market Value (US$ Million) by Application, 2024 to 2034

Figure 147: East Asia Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 148: East Asia Market Value (US$ Million) by Country, 2024 to 2034

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 150: East Asia Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 153: East Asia Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 154: East Asia Market Volume (Units) Analysis by Product, 2019 to 2034

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 157: East Asia Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 158: East Asia Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 161: East Asia Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 162: East Asia Market Volume (Units) Analysis by Distribution Channel, 2019 to 2034

Figure 163: East Asia Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 165: East Asia Market Attractiveness by Product, 2024 to 2034

Figure 166: East Asia Market Attractiveness by Application, 2024 to 2034

Figure 167: East Asia Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 168: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 169: Middle East and Africa Market Value (US$ Million) by Product, 2024 to 2034

Figure 170: Middle East and Africa Market Value (US$ Million) by Application, 2024 to 2034

Figure 171: Middle East and Africa Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2024 to 2034

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 174: Middle East and Africa Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 178: Middle East and Africa Market Volume (Units) Analysis by Product, 2019 to 2034

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 182: Middle East and Africa Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 186: Middle East and Africa Market Volume (Units) Analysis by Distribution Channel, 2019 to 2034

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 189: Middle East and Africa Market Attractiveness by Product, 2024 to 2034

Figure 190: Middle East and Africa Market Attractiveness by Application, 2024 to 2034

Figure 191: Middle East and Africa Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 192: Middle East and Africa Market Attractiveness by Country, 2024 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Disposable Medical Gowns Market Size and Share Forecast Outlook 2025 to 2035

Disposable Drills Market Size and Share Forecast Outlook 2025 to 2035

Disposable Food Containers Market Size and Share Forecast Outlook 2025 to 2035

Disposable Protective Apparel Market Size and Share Forecast Outlook 2025 to 2035

Disposable Plates Market Size and Share Forecast Outlook 2025 to 2035

Disposable Hygiene Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Disposable Umbilical Cord Protection Bag Market Size and Share Forecast Outlook 2025 to 2035

Disposable E-Cigarettes Market Size and Share Forecast Outlook 2025 to 2035

Disposable Pen Injectors Market Size and Share Forecast Outlook 2025 to 2035

Disposable Trocars Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Disposable Cups Market Size and Share Forecast Outlook 2025 to 2035

Disposable Electric Toothbrushes Market Size and Share Forecast Outlook 2025 to 2035

Disposable Barrier Sleeves Market Size and Share Forecast Outlook 2025 to 2035

Disposable Plastic Pallet Market Size and Share Forecast Outlook 2025 to 2035

Disposable Curd Cups Market Size and Share Forecast Outlook 2025 to 2035

Disposable Egg Trays Market Size and Share Forecast Outlook 2025 to 2035

Disposable Blood Pressure Cuffs Market Analysis - Size, Share & Forecast 2025 to 2035

Disposable Cutlery Market Size, Growth, and Forecast 2025 to 2035

Disposable Spinal Instruments Market Analysis - Size, Share, and Forecast 2025 to 2035

Disposable Lids Market Analysis - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA