The global market for disposable endoscopes will be driven to major growth with increasing concerns regarding cross-contamination, rise in minimally invasive procedures, and cost-effective medical solutions. They alleviate infection concerns associated with reusable endoscopes, improve patient safety, and do not require endoscope reprocessing.

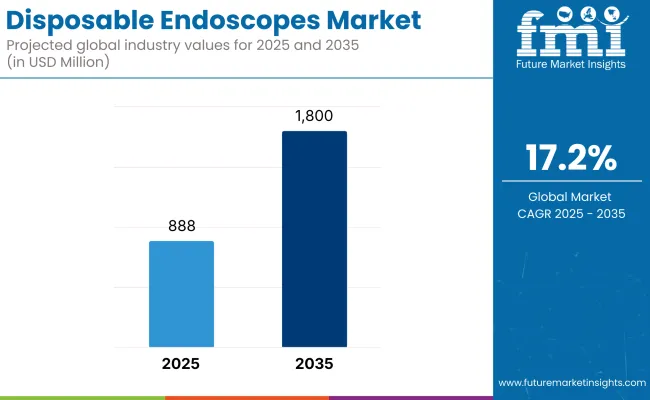

Analysts can expect the value of the market to grow to roughly USD 8,88 Million by 2035, pursuing a Compound Annual Growth Rate (CAGR) of 17.2% of the forecast between 2025 and 2035. Some key drivers fueling market growth are the growing use of disposable medical equipment, increasing healthcare expenditure, and strict infection control regulations.

The disposable endoscopes market in North America is driven by the well-established healthcare system, high adoption of advance medical technologies, and stringent standards prescribed for infection control. More significantly this is true in the United States, where regulatory risk factors revolve around patient safety and other intense healthcare regulatory requirements.

This in addition to the growing number of endoscopic procedures and government initiatives promoting disposable medical equipment in turn fuels the market growth for disposable medical equipment. The growing consciousness regarding HAIs have also induced hospitals and clinics to switch to single-use devices to maximize the patient safety as well as operational efficiency further propelling the demand of disposable endoscopes in the region.

Europe disposable endoscopes market is primarily driven by Germany, UK, and France. Countries that have already cemented their dominance in the markets for Infection Prevention have put regulations, rules, regulations, and advances in medical technologies in place. In this region, the healthcare industry prioritizes patient safety which results in the movement of disposable endoscopes from the reusable endoscopes to minimize the risk of infection.

Research untitled to market growth is supported by investments in healthcare infrastructure. Moreover, growing awareness regarding hospital-acquired infections coupled with benefits provided by single-use medical devices including reduction in risk of cross-contamination, decreased requirement for cleaning and disinfection of medical devices and high efficiency also propel the disposable endoscopes market in Europe.

The disposable endoscopes market in Asia-Pacific is projected to witness the highest growth during the forecast period with the rising healthcare awareness, the increasing disposable incomes, and the growing patient pool.

A number of states and not only China, but also India and Japan are investing heavily in medical technology, medicine modernization and infection control. Increasing adoption of minimally invasive procedures coupled with government initiatives to enhance accessibility to healthcare services are bolstering market growth.

Challenge

Pricey and Eco-Friendly Concern

Healthcare facilities need to weigh infection control benefits and needs against the cost limitations. The rising amount of medical waste produced due to single-used endoscopes is another aspect leading to environmental concerns and increased the interest in finding biodegradable disposal and recycling methods.

Challenges of Regulatory and Compliance

Manufacturers face challenges owing to stringent regulatory requirements for medical device approval and compliance with safety standards. Investing in the research, development, and quality controls necessary to meet ever-changing regulatory compliance standards is a major cost.

Opportunity

Infection Control and Patient Safety

Increasing focus on infection control in healthcare facilities is projected to boost disposable endoscope market growth. The device removes the risk of cross-contamination that can occur with reusable endoscopes which makes them especially useful in hospitals, ambulatory surgical centers and diagnostic clinics.

Technological Advancements and Expanding Applications

Advancements in endoscopic technology, featuring HD imaging, wireless connectivity, and AI-assisted diagnosis, are improving disposable endoscopes. They vary in specialty including gastroenterology, pulmonology, urology, ENT, etc.

During 2020 to 2024, the Disposable Endoscopes Market grew significantly owing to rise in concerns about hospital-acquired infections (HAIs), need for improved patient safety. The COVID-19 pandemic accelerated this to another level as healthcare providers promoted sterile, single-use medical devices. But high costs and environmental concerns were significant hurdles. Manufacturers responded with the development of cost-effective solutions, and the continued exploration of biodegradable materials.

Vision For 2025 to 2035: The global market is poised to grow due to the rising focus on minimally invasive procedures, advancements in endoscopic imaging, AI-driven diagnostics, and robotic-assisted procedures. Sustainable materials and recycling programs will address environmental concerns. Moreover, the increasing incidence rate of gastrointestinal, respiratory, and urological disorders will boost the demand for disposable endoscopes, especially in outpatient and home-care environments.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035.

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Monitoring adherence to infection prevention and control guidelines and from medical device safety standards |

| Demand for Disposable Endoscopes | Expansions in hospitals and ambulatory surgical centers |

| Industry Adoption | Use in gastrointestinal, pulmonology, and urology procedures |

| Supply Chain and Sourcing | Reliance on traditional medical device manufacturers and global vendors |

| Market Competition | Dominance of leading medical device manufacturers and reusable endoscope suppliers |

| Market Growth Drivers | Greater emphasis on infection control, prevention of hospital-acquired infections, and minimally invasive procedures |

| Sustainability and Waste Management | Single-use devices pose a potential problem with medical waste |

| Integration with Digital Health | Professional Environment: Restricted interface with AI and telemedicine platforms |

| Future of Disposable Endoscopes | Growth driven by demand at hospitals and surgical centers |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter environmental regulations, adoption of biodegradable materials, and streamlined device approvals |

| Demand for Disposable Endoscopes | Expansion into home-based diagnostics, telemedicine, and AI-assisted endoscopic procedures |

| Industry Adoption | Growth in robotic-assisted endoscopy, AI-integrated imaging, and advanced minimally invasive diagnostics |

| Supply Chain and Sourcing | Shift toward sustainable manufacturing, localized production, and cost-efficient supply chains |

| Market Competition | Entry of AI-driven diagnostic companies, sustainable endoscope developers, and innovative medical startups |

| Market Growth Drivers | Advancements in endoscopic technology, personalized diagnostics, and eco-friendly disposable medical devices |

| Sustainability and Waste Management | Adoption of recycling programs, biodegradable endoscopes, and regulatory incentives for sustainable healthcare |

| Integration with Digital Health | Expansion of AI-powered diagnostics, cloud-based endoscopic data storage, and remote patient monitoring |

| Future of Disposable Endoscopes | Increased adoption in home healthcare, point-of-care diagnostics, and AI-enhanced medical imaging solutions |

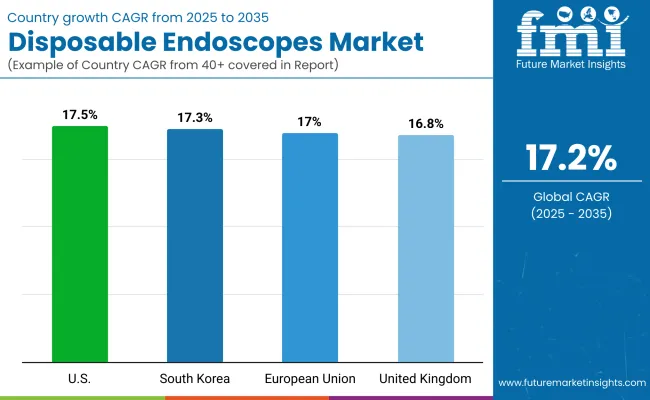

The market is driven by concerns regarding cross-contamination, increasing prevalence of diseases and stringent regulations by the FDA to promote single-use of medical devices. The cost-effectiveness and lower sterilization costs of disposable endoscopes over reusable alternatives are also fuelling their adoption. This is supported by the presence of major manufacturers for medical devices and robust healthcare infrastructure in the region.

| Region | CAGR (2025 to 2035) |

|---|---|

| United States | 17.5% |

Hospital and diagnostic center infection standardization guidelines have increased demand for disposable endoscopes in the U.K. Rising hospital-acquired infections (HAIs) and government mandates around patient safety are propelling the move to single-use endoscopic devices. Also, the market is being driven by the increasing popularity of minimally invasive procedures and the growing adoption of advanced healthcare technologies.

| Region | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 16.8% |

Europe is poised to be an important market for disposable endoscopes due to its stringent environment of medical safety regulations and an increase in the healthcare expenditure, leading to an increasing number of endoscopic procedures in the aging population. Increasing prevalence of GI and pulmonary diseases further drives the demand.

Moreover, technological developments, as well as growing awareness regarding the advantages offered by single-use endoscopic devices, are further propelling the market growth through adoption across the healthcare establishments.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 17.0% |

The increasing focus on infection control measures from government initiatives and growing burden of chronic diseases are contributing to the rapid growth of South Korea disposable endoscopes market, thereby leveraging the global disposable endoscopes market.

Increasing use of single-use medical devices in hospitals and diagnostic centers in the country, coupled with a strong emphasis on the enhancement of healthcare infrastructure is driving the demand. Moreover, increasing medical tourism and inclination towards less invasive procedures further drive market growth Key Market Insights.

| Region | CAGR (2025 to 2035) |

|---|---|

| South Korea | 17.3% |

Emerging Trends, GEO Market Scenario the global Disposable Endoscopes Market is showing steady growth, driven by the rising demand for sterile and single-use medical devices to minimize cross-contamination. With the evolution of disposable endoscopes, healthcare facilities seem to focus more and more on infection control and patient safety. Their affordability and wider availability continue to increase the application of disposable endoscopes in hospitals, ambulatory surgical centers, and diagnostic centers.

Disposable endoscopes are having huge advantages over reusable models with less maintenance costs, no sterilization, and fewer chances of pathogens transmission. These are especially important in procedures in which sterility is critical, such as bronchoscopy, cystoscopy and gastrointestinal exams.

The market growth is also influenced by calls from regulatory authorities for the adoption of disposable medical devices to enhance patient safety and help eliminate difficulties from healthcare systems.

In addition, advances in disposable endoscopes, including high-definition imaging, improved flexibility, and other advances in manoeuvrability1 have expanded their use in many different medical disciplines. Increasing prevalence of respiratory disorders, gastrointestinal diseases, and urological conditions is significantly fueling the demand growth of disposable endoscopes, particularly in case of outpatient and emergency departments, in which fast diagnosis and intervention are required.

The market of disposable endoscopes is segmented into Bronchoscopes, Cystoscopes, Gastroendoscopes, and Other. In the intensive care unit (ICU) and emergency department, single-use bronchoscopes are frequently employed for airway management and lung diagnostics. Due to their capacity to avoid patient cross-contamination among critically ill patients, they are generally used as a first line in hospitals.

Cystoscope is a kind of endoscope that used in urology to view inside bladder. In addition, rising incidence of urinary tract infections (UTIs) & bladder cancer is also anticipated to contribute significantly towards the growth of market for disposable cystoscopes. Even other disposable endoscopes, such as duodenoscopes, esophagoscopes, hysteroscopes, and laryngoscopes, are growing in trend, especially in outpatient surgery centers where prompt and sterile processes are necessary.

Owing to high patient volume and stringent infection control practices, hospitals have the highest share in the disposable endoscopes end user market segment. The increasing focus by the healthcare industry on reducing healthcare-associated infections (HAIs) has resulted in the use of disposable endoscopes as a means for hospitals to increase patient safety and improve workflow efficiency.

The widespread acceptability of the devices is because of the immense cost-savings in avoiding costly and time-consuming reprocessing or sterilization processes.

Increasing disposable endoscopes demand from ambulatory surgical centers and diagnostic centers is also expected to propel market growth. They require effective, sterile devices for these outpatient procedures, which presents single-use endoscopes as a very interesting alternative. Furthermore, the rising demand for minimally invasive diagnostics and therapeutics in nonhospital-based settings also contributing to the rising demand for disposable endoscopes.

However, the environmental footprint of this process in the form of tons of medical waste generated has led stakeholders to move toward sustainable clinical practices, including endoscopy. The push for greener healthcare innovation, worldwide initiatives to aid sustainability, and growing concern around medical pollution are propelling efforts to make endoscopes biodegradable and/or recyclable.

These manufacturers are also focusing on improving the durability and imaging capabilities of disposable endoscopes to optimize procedural outcome and clinician efficiency.

Because of the steady enhancements made in endoscopic innovation and expanding reception of dispensable endoscopes in clinical offices overall, the disposable endoscopes market is set for proceeding with development. With the integration of artificial intelligence (AI) and added imaging characteristics, disposable endoscopes are set to revolutionize the market, becoming a vital segment of modern medical diagnosis and therapy.

Increasing demand for disposal endoscopes across diverse endoscopic applications, and rising adoption of single-use medical devices to contain the prevalence of infections are some of the major factors contributing to the growth of the global disposable endoscopes market. The rising regulation and HAI prevention protocols are among the prominent factors fortifying the disposition of disposable endoscopes in gastroenterology, bronchoscopy, urology, and ENT procedures.

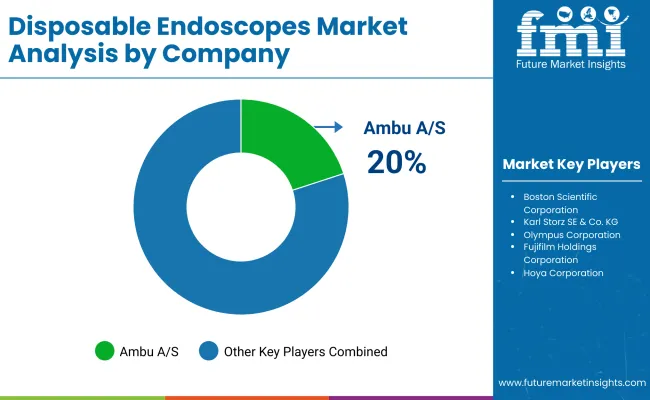

Market Share Analysis by Key Players & Manufacturers

| Company/Organization Name | Estimated Market Share (%) |

|---|---|

| Ambu A/S | 20-25% |

| Boston Scientific Corporation | 15-20% |

| Karl Storz SE & Co. KG | 12-16% |

| Olympus Corporation | 8-12% |

| Fujifilm Holdings Corporation | 5-9% |

| Other Manufacturers | 30-40% |

| Company/Organization Name | Key Offerings/Activities |

|---|---|

| Ambu A/S | Market leader in single-use endoscopes with innovative visualization and infection control solutions. |

| Boston Scientific Corporation | Advanced disposable endoscopes designed for bronchoscopy, urology, and gastroenterology applications. |

| Karl Storz SE & Co. KG | Cutting-edge disposable endoscopic solutions with a focus on ergonomic design and high-definition imaging. |

| Olympus Corporation | Compact and efficient single-use endoscopes for a variety of diagnostic and therapeutic procedures. |

| Fujifilm Holdings Corporation | Cost-effective and high-performance disposable endoscopes for medical and surgical applications. |

Key Market Insights

Ambu A/S (20-25%)

Ambu is the leader of disposable endoscope with its visionary high-quality single-use visualization system.

Boston Scientific Corporation (15-20%)

Boston Scientific is a leading supplier of disposable endoscopes in bronchoscopy, urology, and gastrointestinal, procedures

Karl Storz SE & Co. KG (12-16%)

Karl Storz specializes in ergonomically designed, high-definition, single-use endoscopic solutions.

Olympus Corporation (8-12%)

By using Olympus disposable endoscopes, you can achieve superior performance, comfort, reliability, and efficiency.

Fujifilm Holdings Corporation (5-9%)

Fujifilm focuses on economical high-performance imaging disposable endoscopes.

Other Key Players (30-40% Combined)

The disposable endoscopes market is witnessing innovations from multiple manufacturers, including:

The overall market size for Disposable Endoscopes market was USD 18, 00 Million in 2025.

The Disposable Endoscopes market is expected to reach USD 888 Million in 2035.

Rising infection control concerns, minimally invasive procedures, and hospital demand will drive disposable endoscopes market growth.

The top 5 countries which drives the development of Disposable Endoscopes market are USA, European Union, Japan, South Korea and UK.

Ambulatory surgical centers and diagnostic centers demand supplier to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2022

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2022

Table 3: Global Market Value (US$ Million) Forecast by Product, 2018 to 2022

Table 4: Global Market Volume (Units) Forecast by Product, 2018 to 2022

Table 5: Global Market Value (US$ Million) Forecast by End User, 2018 to 2022

Table 6: Global Market Volume (Units) Forecast by End User, 2018 to 2022

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2022

Table 8: North America Market Volume (Units) Forecast by Country, 2018 to 2022

Table 9: North America Market Value (US$ Million) Forecast by Product, 2018 to 2022

Table 10: North America Market Volume (Units) Forecast by Product, 2018 to 2022

Table 11: North America Market Value (US$ Million) Forecast by End User, 2018 to 2022

Table 12: North America Market Volume (Units) Forecast by End User, 2018 to 2022

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2022

Table 14: Latin America Market Volume (Units) Forecast by Country, 2018 to 2022

Table 15: Latin America Market Value (US$ Million) Forecast by Product, 2018 to 2022

Table 16: Latin America Market Volume (Units) Forecast by Product, 2018 to 2022

Table 17: Latin America Market Value (US$ Million) Forecast by End User, 2018 to 2022

Table 18: Latin America Market Volume (Units) Forecast by End User, 2018 to 2022

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2022

Table 20: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2022

Table 21: Western Europe Market Value (US$ Million) Forecast by Product, 2018 to 2022

Table 22: Western Europe Market Volume (Units) Forecast by Product, 2018 to 2022

Table 23: Western Europe Market Value (US$ Million) Forecast by End User, 2018 to 2022

Table 24: Western Europe Market Volume (Units) Forecast by End User, 2018 to 2022

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2022

Table 26: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2022

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Product, 2018 to 2022

Table 28: Eastern Europe Market Volume (Units) Forecast by Product, 2018 to 2022

Table 29: Eastern Europe Market Value (US$ Million) Forecast by End User, 2018 to 2022

Table 30: Eastern Europe Market Volume (Units) Forecast by End User, 2018 to 2022

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2022

Table 32: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2022

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by Product, 2018 to 2022

Table 34: South Asia and Pacific Market Volume (Units) Forecast by Product, 2018 to 2022

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by End User, 2018 to 2022

Table 36: South Asia and Pacific Market Volume (Units) Forecast by End User, 2018 to 2022

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2022

Table 38: East Asia Market Volume (Units) Forecast by Country, 2018 to 2022

Table 39: East Asia Market Value (US$ Million) Forecast by Product, 2018 to 2022

Table 40: East Asia Market Volume (Units) Forecast by Product, 2018 to 2022

Table 41: East Asia Market Value (US$ Million) Forecast by End User, 2018 to 2022

Table 42: East Asia Market Volume (Units) Forecast by End User, 2018 to 2022

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2022

Table 44: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2022

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Product, 2018 to 2022

Table 46: Middle East and Africa Market Volume (Units) Forecast by Product, 2018 to 2022

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by End User, 2018 to 2022

Table 48: Middle East and Africa Market Volume (Units) Forecast by End User, 2018 to 2022

Figure 1: Global Market Value (US$ Million) by Product, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by End User, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2022

Figure 5: Global Market Volume (Units) Analysis by Region, 2018 to 2022

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Product, 2018 to 2022

Figure 9: Global Market Volume (Units) Analysis by Product, 2018 to 2022

Figure 10: Global Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by End User, 2018 to 2022

Figure 13: Global Market Volume (Units) Analysis by End User, 2018 to 2022

Figure 14: Global Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 16: Global Market Attractiveness by Product, 2023 to 2033

Figure 17: Global Market Attractiveness by End User, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Product, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by End User, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2022

Figure 23: North America Market Volume (Units) Analysis by Country, 2018 to 2022

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Product, 2018 to 2022

Figure 27: North America Market Volume (Units) Analysis by Product, 2018 to 2022

Figure 28: North America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by End User, 2018 to 2022

Figure 31: North America Market Volume (Units) Analysis by End User, 2018 to 2022

Figure 32: North America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 34: North America Market Attractiveness by Product, 2023 to 2033

Figure 35: North America Market Attractiveness by End User, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Product, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by End User, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2022

Figure 41: Latin America Market Volume (Units) Analysis by Country, 2018 to 2022

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Product, 2018 to 2022

Figure 45: Latin America Market Volume (Units) Analysis by Product, 2018 to 2022

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by End User, 2018 to 2022

Figure 49: Latin America Market Volume (Units) Analysis by End User, 2018 to 2022

Figure 50: Latin America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Product, 2023 to 2033

Figure 53: Latin America Market Attractiveness by End User, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Western Europe Market Value (US$ Million) by Product, 2023 to 2033

Figure 56: Western Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 57: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2022

Figure 59: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2022

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Western Europe Market Value (US$ Million) Analysis by Product, 2018 to 2022

Figure 63: Western Europe Market Volume (Units) Analysis by Product, 2018 to 2022

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 66: Western Europe Market Value (US$ Million) Analysis by End User, 2018 to 2022

Figure 67: Western Europe Market Volume (Units) Analysis by End User, 2018 to 2022

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 70: Western Europe Market Attractiveness by Product, 2023 to 2033

Figure 71: Western Europe Market Attractiveness by End User, 2023 to 2033

Figure 72: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Eastern Europe Market Value (US$ Million) by Product, 2023 to 2033

Figure 74: Eastern Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2022

Figure 77: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2022

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by Product, 2018 to 2022

Figure 81: Eastern Europe Market Volume (Units) Analysis by Product, 2018 to 2022

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by End User, 2018 to 2022

Figure 85: Eastern Europe Market Volume (Units) Analysis by End User, 2018 to 2022

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 88: Eastern Europe Market Attractiveness by Product, 2023 to 2033

Figure 89: Eastern Europe Market Attractiveness by End User, 2023 to 2033

Figure 90: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 91: South Asia and Pacific Market Value (US$ Million) by Product, 2023 to 2033

Figure 92: South Asia and Pacific Market Value (US$ Million) by End User, 2023 to 2033

Figure 93: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2022

Figure 95: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2022

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: South Asia and Pacific Market Value (US$ Million) Analysis by Product, 2018 to 2022

Figure 99: South Asia and Pacific Market Volume (Units) Analysis by Product, 2018 to 2022

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 102: South Asia and Pacific Market Value (US$ Million) Analysis by End User, 2018 to 2022

Figure 103: South Asia and Pacific Market Volume (Units) Analysis by End User, 2018 to 2022

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 106: South Asia and Pacific Market Attractiveness by Product, 2023 to 2033

Figure 107: South Asia and Pacific Market Attractiveness by End User, 2023 to 2033

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 109: East Asia Market Value (US$ Million) by Product, 2023 to 2033

Figure 110: East Asia Market Value (US$ Million) by End User, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 112: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2022

Figure 113: East Asia Market Volume (Units) Analysis by Country, 2018 to 2022

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: East Asia Market Value (US$ Million) Analysis by Product, 2018 to 2022

Figure 117: East Asia Market Volume (Units) Analysis by Product, 2018 to 2022

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 120: East Asia Market Value (US$ Million) Analysis by End User, 2018 to 2022

Figure 121: East Asia Market Volume (Units) Analysis by End User, 2018 to 2022

Figure 122: East Asia Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 124: East Asia Market Attractiveness by Product, 2023 to 2033

Figure 125: East Asia Market Attractiveness by End User, 2023 to 2033

Figure 126: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 127: Middle East and Africa Market Value (US$ Million) by Product, 2023 to 2033

Figure 128: Middle East and Africa Market Value (US$ Million) by End User, 2023 to 2033

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2022

Figure 131: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2022

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Product, 2018 to 2022

Figure 135: Middle East and Africa Market Volume (Units) Analysis by Product, 2018 to 2022

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by End User, 2018 to 2022

Figure 139: Middle East and Africa Market Volume (Units) Analysis by End User, 2018 to 2022

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 142: Middle East and Africa Market Attractiveness by Product, 2023 to 2033

Figure 143: Middle East and Africa Market Attractiveness by End User, 2023 to 2033

Figure 144: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Disposable Medical Gowns Market Size and Share Forecast Outlook 2025 to 2035

Disposable Drills Market Size and Share Forecast Outlook 2025 to 2035

Disposable Food Containers Market Size and Share Forecast Outlook 2025 to 2035

Disposable Protective Apparel Market Size and Share Forecast Outlook 2025 to 2035

Disposable Plates Market Size and Share Forecast Outlook 2025 to 2035

Disposable Hygiene Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Disposable Umbilical Cord Protection Bag Market Size and Share Forecast Outlook 2025 to 2035

Disposable E-Cigarettes Market Size and Share Forecast Outlook 2025 to 2035

Disposable Pen Injectors Market Size and Share Forecast Outlook 2025 to 2035

Disposable Trocars Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Disposable Cups Market Size and Share Forecast Outlook 2025 to 2035

Disposable Electric Toothbrushes Market Size and Share Forecast Outlook 2025 to 2035

Disposable Barrier Sleeves Market Size and Share Forecast Outlook 2025 to 2035

Disposable Plastic Pallet Market Size and Share Forecast Outlook 2025 to 2035

Disposable Curd Cups Market Size and Share Forecast Outlook 2025 to 2035

Disposable Egg Trays Market Size and Share Forecast Outlook 2025 to 2035

Disposable Blood Pressure Cuffs Market Analysis - Size, Share & Forecast 2025 to 2035

Disposable Cutlery Market Size, Growth, and Forecast 2025 to 2035

Disposable Spinal Instruments Market Analysis - Size, Share, and Forecast 2025 to 2035

Disposable Lids Market Analysis - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA