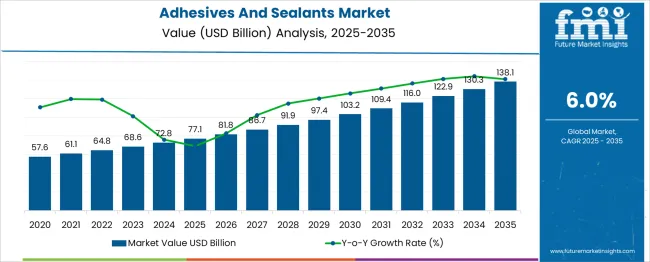

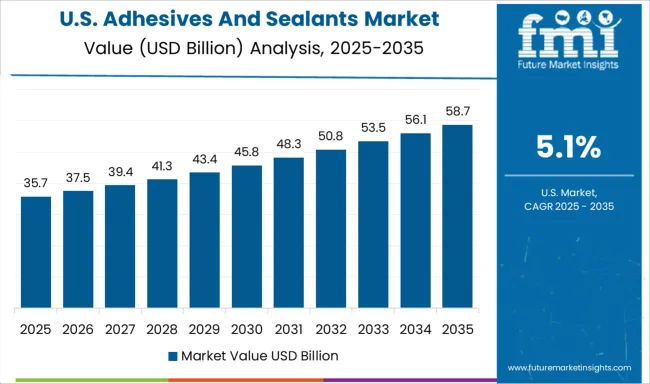

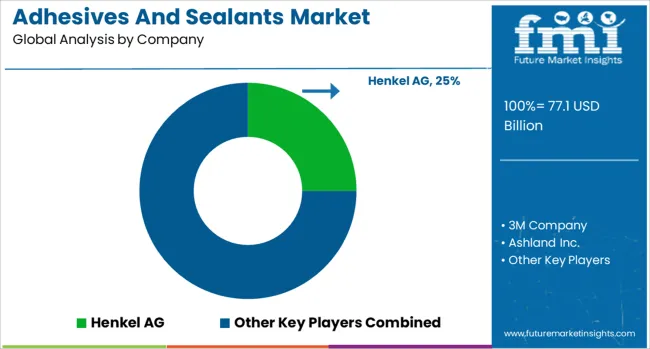

The global adhesives and sealants market is projected to grow from USD 77.1 billion in 2025 to approximately USD 138.1 billion by 2035, recording an absolute increase of USD 61.0 billion over the forecast period. This translates into a total growth of 79.1%, with the market forecast to expand at a CAGR of 6 % between 2025 and 2035. The overall market size is expected to grow by nearly 1.8X during the same period, supported by the rising adoption of advanced adhesive technologies and increasing demand for high-performance bonding solutions across construction, automotive, and packaging industries.

Between 2025 and 2030, the adhesives and sealants market is projected to expand from USD 77.1 billion to USD 103.85 billion, resulting in a value increase of USD 26.72 billion, which represents 43.8% of the total forecast growth for the decade. This phase of growth will be shaped by rising demand for sustainable adhesive solutions in construction applications, increasing adoption of high-performance sealants in automotive manufacturing, and growing consumer preference for DIY home improvement projects. Manufacturers are expanding their production capabilities to address the growing complexity of modern bonding requirements across diverse industries.

From 2030 to 2035, the market is forecast to grow from USD 103.85 billion to USD 138.1 billion, adding another USD 34.28 billion, which constitutes 56.2% of the overall ten-year expansion. This period is expected to be characterized by widespread adoption of smart adhesive technologies, integration of bio-based raw materials, and development of specialized formulations for emerging applications. The growing emphasis on sustainable construction practices and electric vehicle manufacturing will drive demand for more sophisticated adhesive and sealant products with enhanced technical performance.

| Metric | Value |

| Estimated Value in (2025E) | USD 77.1 Billion |

| Forecast Value in (2035F) | USD 138.1 Billion |

| Forecast CAGR (2025 to 2035) | 6 % |

Market expansion is being supported by the rapid increase in construction activities worldwide and the corresponding need for advanced bonding solutions in building and infrastructure projects. Modern construction applications rely on high-performance adhesives and sealants to ensure structural integrity, weatherproofing, and energy efficiency. The growing complexity of automotive manufacturing and increasing emphasis on lightweight materials are driving demand for specialized adhesive solutions from certified suppliers with appropriate technical expertise and quality standards.

The expanding packaging industry and rising e-commerce activities are creating significant demand for reliable adhesive solutions that provide product protection and brand differentiation. Environmental regulations promoting sustainable materials are establishing new requirements for bio-based and low-emission adhesive formulations that require advanced manufacturing capabilities and specialized technical knowledge.

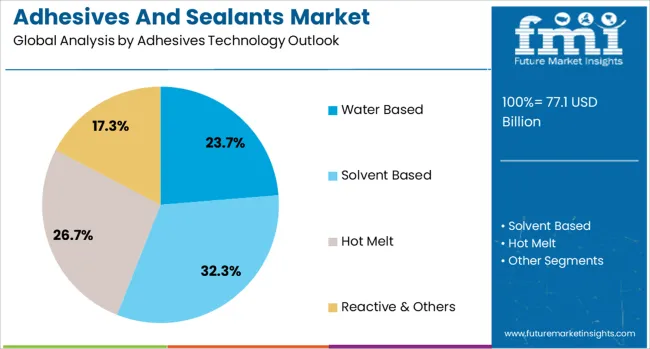

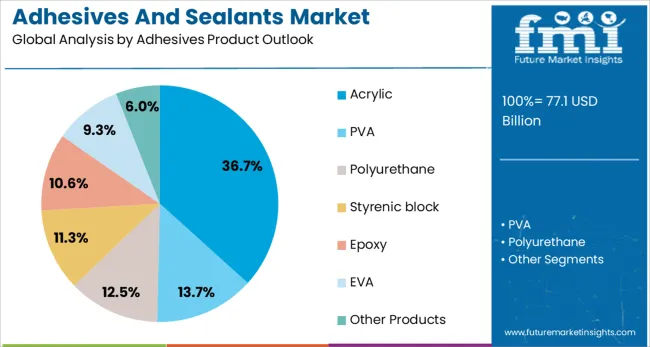

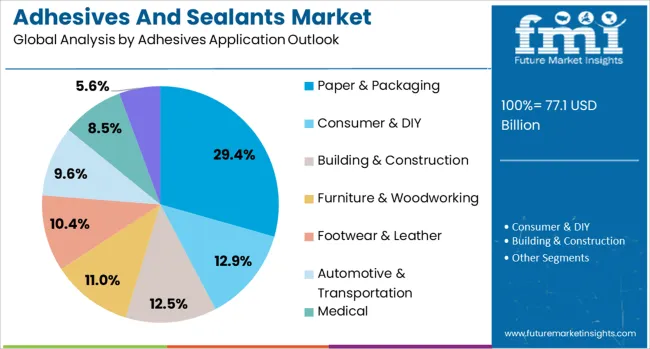

The market is segmented by technology, product outlook, application, and region. By technology, the market is divided into water-based, solvent-based, hot melt, and reactive adhesives. Based on product outlook, the market is categorized into acrylic, PVA, polyurethane, styrenic block, epoxy, EVA, and other products for adhesives, and silicones, polyurethanes, acrylic, and polyvinyl acetate for sealants. In terms of application, the market is segmented into paper and packaging, consumer and DIY, building and construction, furniture and woodworking, footwear and leather, automotive and transportation, medical, and other applications. Regionally, the market is divided into China, India, Germany, France, United Kingdom, United States, and Brazil.

Water-based adhesives are projected to account for 23.7% of the market in 2025. This leading share is supported by the widespread adoption of environmentally friendly bonding solutions across packaging, construction, and consumer applications. Water-based formulations provide excellent performance while maintaining low volatile organic compound emissions, making them the preferred choice for indoor applications and consumer products. The segment benefits from established manufacturing processes and comprehensive regulatory approval across multiple markets.

Acrylic adhesives are expected to represent 36.7% of the product segment in 2025. This dominant share reflects the versatility and superior performance characteristics of acrylic-based bonding solutions across diverse applications. Modern acrylic formulations deliver excellent adhesion, durability, and weather resistance, making them suitable for both indoor and outdoor applications. The segment benefits from continuous product innovation and expanding application scope in automotive, construction, and industrial markets.

Paper and packaging applications are projected to contribute 29.4% of the market in 2025. This significant share reflects the growing demand for reliable adhesive solutions in packaging operations, driven by expanding e-commerce activities and consumer goods manufacturing. Packaging adhesives require specific performance characteristics including fast-setting properties, temperature resistance, and food-safe formulations. The segment is supported by continuous innovation in packaging technologies and increasing consumer demand for sustainable packaging solutions.

Construction applications are estimated to hold 44.7% of the sealants market share in 2025. This dominance reflects the critical importance of sealing solutions in building and infrastructure projects, where weather resistance, structural integrity, and energy efficiency are paramount. Construction sealants must provide long-term durability while withstanding diverse environmental conditions. The segment benefits from global infrastructure development and increasing emphasis on energy-efficient building practices.

The adhesives and sealants market is advancing steadily due to increasing construction activities and growing recognition of advanced bonding technology benefits. However, the market faces challenges including raw material price volatility, need for specialized application equipment, and varying performance requirements across different end-use industries. Standardization efforts and certification programs continue to influence product quality and market development patterns.

The growing deployment of environmentally friendly adhesive and sealant formulations is enabling development of high-performance products with reduced environmental impact. Bio-based raw materials and low-emission formulations provide superior bonding performance while maintaining sustainability credentials. These products are particularly valuable for indoor applications and consumer products where health and environmental considerations are paramount.

Modern adhesive manufacturers are incorporating advanced technologies including structural adhesives with enhanced strength properties and smart formulations that respond to environmental conditions. Integration of nanotechnology and advanced polymer chemistry enables more precise bonding capabilities and comprehensive performance optimization. Advanced formulations also support bonding of next-generation materials including composites and advanced alloys.

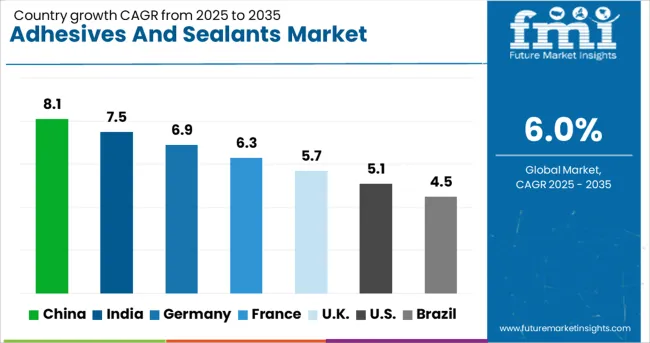

| Country | CAGR (2025-2035) |

| China | 8.1% |

| India | 7.5% |

| Germany | 6.9% |

| France | 6.3% |

| United Kingdom | 5.7% |

| United States | 5.1% |

| Brazil | 4.5% |

The adhesives and sealants market demonstrates robust growth across major economies, with China leading at an 8.1% CAGR through 2035, driven by massive construction activities and expanding manufacturing industries. India follows at 7.5%, supported by infrastructure development and growing automotive production. Germany records 6.9% growth, emphasizing technical innovation and manufacturing excellence. France shows 6.3% expansion, driven by automotive and aerospace applications. The United Kingdom demonstrates 5.7% growth, focusing on construction and consumer markets. The United States records 5.1% growth, supported by established industrial infrastructure, while Brazil grows at 4.5% with developing construction and automotive sectors. The report covers an in-depth analysis of 40+ countries; top-performing countries are highlighted below.

Revenue from adhesives and sealants in China is projected to exhibit the highest growth rate with a CAGR of 8.1% through 2035, driven by massive infrastructure development projects and expanding manufacturing activities across automotive, electronics, and consumer goods industries. The growing construction sector and increasing adoption of advanced bonding technologies are creating significant demand for high-performance adhesive and sealant solutions. Major manufacturers are establishing comprehensive production facilities to support the growing population of quality-conscious industrial customers.

Government infrastructure investment programs are mandating adoption of advanced construction materials including high-performance sealants, driving demand for certified suppliers throughout major metropolitan and industrial regions. Manufacturing modernization initiatives are supporting development of specialized production facilities and technical expertise that enhance capabilities across industrial processing networks.

Revenue from adhesives and sealants in India is expanding at a CAGR of 7.5%, supported by accelerating infrastructure development and growing manufacturing capabilities across automotive and consumer goods sectors. The expanding construction industry and increasing adoption of modern building practices are driving demand for professional-grade adhesive and sealant solutions. Manufacturing facilities and suppliers are gradually establishing capabilities to serve the growing population of industrial and construction customers.

Infrastructure modernization programs and industrial development initiatives are creating opportunities for specialized adhesive and sealant suppliers that can support diverse application requirements. Professional training and certification programs are developing technical expertise among applicators, enabling comprehensive bonding solutions that meet international quality and performance standards nationwide.

Demand for adhesives and sealants in Germany is projected to grow at a CAGR of 6.9%, supported by the emphasis on automotive innovation and precision manufacturing technologies. German manufacturers are implementing comprehensive adhesive and sealant solutions that meet stringent quality standards and environmental regulations. The market is characterized by focus on technical excellence, advanced formulation development, and compliance with comprehensive safety requirements.

Automotive industry investments are prioritizing advanced bonding technologies that demonstrate superior performance and reliability while meeting German engineering standards. Professional certification programs are ensuring comprehensive technical expertise among suppliers, enabling specialized adhesive and sealant products that support diverse manufacturing applications and export requirements.

Demand for adhesives and sealants in France is expanding at a CAGR of 6.3%, driven by established automotive manufacturing and growing aerospace industry requirements. French industrial manufacturers are incorporating advanced adhesive technologies into production processes that meet demanding performance specifications. The market benefits from comprehensive research capabilities and established supply chains serving both domestic and international customers.

Aerospace industry development is facilitating adoption of specialized adhesive and sealant formulations that provide superior performance under extreme operating conditions. Professional quality standards are ensuring comprehensive technical capabilities among suppliers, enabling specialized products that meet evolving industry requirements and certification standards.

Demand for adhesives and sealants in the United Kingdom is projected to grow at a CAGR of 5.7%, supported by active construction markets and established consumer goods manufacturing. British manufacturers are implementing comprehensive adhesive and sealant solutions to meet regulatory requirements and customer expectations. The market is characterized by focus on sustainability, product safety, and compliance with comprehensive environmental standards.

Construction industry investments are enabling standardized sealant applications across building and infrastructure projects, providing consistent performance and comprehensive coverage throughout regional markets. Professional development programs are ensuring specialized technical expertise among suppliers, enabling comprehensive adhesive and sealant capabilities supporting evolving regulatory requirements.

Demand for adhesives and sealants in the United States is expanding at a CAGR of 5.1%, driven by established industrial infrastructure and continuous product innovation across manufacturing sectors. American manufacturers are establishing comprehensive adhesive and sealant supply chains to serve diverse customer requirements. The market benefits from advanced research capabilities and comprehensive distribution systems throughout regional markets.

Industrial sector consolidation is enabling standardized adhesive and sealant applications across multiple facilities, providing consistent service quality and comprehensive coverage throughout domestic markets. Professional training programs are developing specialized technical expertise among suppliers, enabling comprehensive bonding capabilities supporting evolving manufacturing requirements.

Revenue from adhesives and sealants in Brazil is growing at a CAGR of 4.5%, driven by expanding construction activities and developing automotive manufacturing capabilities. The country's established chemical industry is gradually integrating advanced adhesive and sealant production to serve growing domestic demand. Industrial facilities and suppliers are investing in production capabilities to address evolving market requirements.

Construction industry development programs are facilitating adoption of advanced sealant technologies that support comprehensive building applications across residential and commercial sectors. Professional service development initiatives are enhancing technical capabilities among producers, enabling specialized adhesive and sealant products that meet evolving construction and industrial requirements.

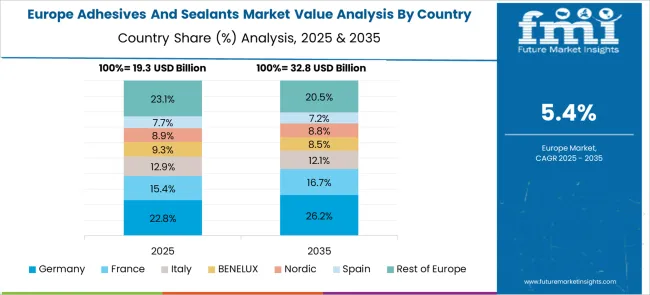

The adhesives and sealants market in Europe is projected to grow steadily across major countries, with Germany leading the regional market development. The United Kingdom maintains strong demand for adhesive and sealant products, supported by established manufacturing industries and comprehensive construction activities. France demonstrates consistent growth in adhesive adoption, driven by automotive manufacturing and infrastructure development projects.

Germany is expected to maintain its leadership position in European adhesives and sealants consumption, supported by its advanced manufacturing infrastructure and strong automotive industry. The country benefits from comprehensive research and development capabilities and established supply chain networks serving both domestic and export markets.

The adhesives and sealants market is defined by competition among chemical manufacturers, specialty adhesive producers, and industrial supply companies. Companies are investing in advanced formulation technologies, sustainable production processes, comprehensive quality systems, and technical expertise to deliver high-performance, reliable, and cost-effective adhesive and sealant solutions. Strategic partnerships, technological innovation, and geographic expansion are central to strengthening product portfolios and market presence.

Henkel AG, Germany-based, offers comprehensive adhesive and sealant products with focus on industrial applications and technical expertise. 3M Company, United States, provides diversified adhesive solutions integrated with advanced material technologies. Ashland Inc., United States, delivers specialized adhesive formulations with emphasis on performance and sustainability. Avery Denison Corporation focuses on pressure-sensitive adhesive technologies and labeling applications. H B Fuller, United States, emphasizes industrial adhesive solutions and customer service excellence.

Sika AG, Switzerland, provides construction sealants and specialty adhesive systems. Pidilite Industries, India, offers consumer and industrial adhesive products with regional market expertise. Huntsman, United States, delivers polyurethane-based adhesive solutions. Wacker Chemie AG, Germany, provides silicone sealant technologies, while RPM International Inc., United States, Dow, United States, and Kuraray Co., Ltd., Japan, offer specialized adhesive and sealant expertise, standardized manufacturing processes, and reliable supply capabilities across global and regional networks.

| Items | Values |

| Quantitative Units | USD 138.1 billion |

| Technology | Water based, solvent based, hot melt, reactive & others |

| Product | Acrylic, PVA, polyurethane, styrenic block, epoxy, EVA, silicones, polyvinyl acetate, and other products |

| Application | Paper & packaging, consumer & DIY, building & construction, furniture & woodworking, footwear & leather, automotive & transportation, medical, assembly, packaging, and other applications |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Henkel AG, 3M Company, Ashland Inc., Avery Denison Corporation, H B Fuller, Sika AG, Pidilite Industries, Huntsman, Wacker Chemie AG, RPM International Inc., Dow, Kuraray Co., Ltd. |

| Additional Attributes | Dollar sales by technology, product, and application, regional demand trends across North America, Europe, and Asia-Pacific, competitive landscape with established manufacturers and emerging suppliers, production capabilities for sustainable versus conventional formulations, integration with advanced manufacturing technologies and automated application systems, innovations in bio-based adhesive formulations and specialized performance development, and adoption of smart bonding solutions with enhanced durability and environmental compliance for comprehensive industrial applications. |

The global adhesives and sealants market is estimated to be valued at USD 77.1 billion in 2025.

The market size for the adhesives and sealants market is projected to reach USD 138.1 billion by 2035.

The adhesives and sealants market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in adhesives and sealants market are water based, solvent based, hot melt and reactive & others.

In terms of adhesives product outlook, acrylic segment to command 36.7% share in the adhesives and sealants market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Silicone Adhesives And Sealants Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Adhesives and Sealants Market Size and Share Forecast Outlook 2025 to 2035

Adhesives for Electric Vehicle Power Batteries Market Forecast and Outlook 2025 to 2035

UV Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Bioadhesives for Packaging Market

Wood Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Skin Adhesives Market

Wood Adhesives and Binders Market Size and Share Forecast Outlook 2025 to 2035

Spray Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Dental Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Medical Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Acrylic Adhesives Market Growth - Trends & Forecast 2025 to 2035

2K Epoxy Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Hot Melt Adhesives Market Growth - Trends & Forecast 2025 to 2035

Footwear Adhesives Market

Anaerobic Adhesives Market

Industrial Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Windscreen Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Laminating Adhesives Market Growth - Trends & Forecast 2025 to 2035

Topical Bioadhesives Market - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA