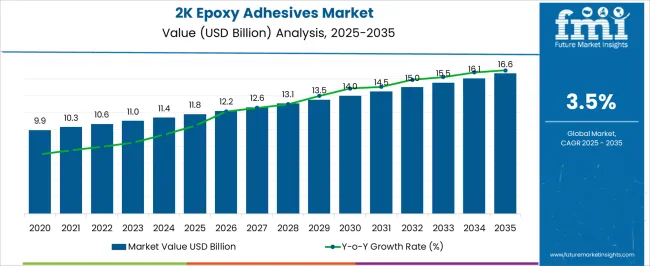

The 2K Epoxy Adhesives Market is estimated to be valued at USD 11.8 billion in 2025 and is projected to reach USD 16.6 billion by 2035, registering a compound annual growth rate (CAGR) of 3.5% over the forecast period. During the early adoption phase from 2020 to 2024, the market expanded gradually from USD 9.9 billion to USD 11.4 billion, as early industrial users tested high-performance epoxy solutions in automotive, construction, and electronics applications. Growth in this phase was driven by niche adoption, pilot projects, and awareness of the material’s superior bonding strength and chemical resistance. Stakeholders evaluated performance and cost-effectiveness, establishing the groundwork for larger-scale adoption.

Between 2025 and 2030, the market enters a scaling phase, rising from USD 11.8 billion to USD 14.5 billion. Increased production capacity, wider distribution, and standardization of applications drive this expansion. From 2030 to 2035, growth moderates during the consolidation phase, reaching USD 16.6 billion. Leading manufacturers consolidate market share, while technological maturity and established supply chains stabilize demand. By this stage, 2K Epoxy Adhesives become a mainstream choice across key sectors, with emphasis on quality, efficiency, and regulatory compliance, reflecting a mature and stable market ecosystem.

| Metric | Value |

|---|---|

| 2K Epoxy Adhesives Market Estimated Value in (2025 E) | USD 11.8 billion |

| 2K Epoxy Adhesives Market Forecast Value in (2035 F) | USD 16.6 billion |

| Forecast CAGR (2025 to 2035) | 3.5% |

The 2K epoxy adhesives market is experiencing robust growth as industries increasingly prioritize durable, high-strength bonding solutions capable of withstanding extreme operational conditions. The shift toward lightweight materials in automotive, aerospace, and industrial manufacturing has amplified the need for adhesives that can effectively bond dissimilar substrates while maintaining structural integrity. Continuous innovations in resin and hardener formulations, coupled with improved curing technologies, are enabling faster processing times and enhanced end-use performance.

Environmental regulations promoting low-VOC and solvent-free formulations are further driving advancements in epoxy adhesive chemistry. Additionally, the growing adoption of automation in assembly lines is supporting the use of adhesives that ensure consistent application quality and reduced cycle times.

The market outlook remains strong, supported by infrastructure modernization, expansion of electric mobility, and the integration of epoxy systems into composite manufacturing processes. As manufacturers seek greater design flexibility and cost efficiency, 2K epoxy adhesives are set to remain a critical component in high-performance bonding applications worldwide.

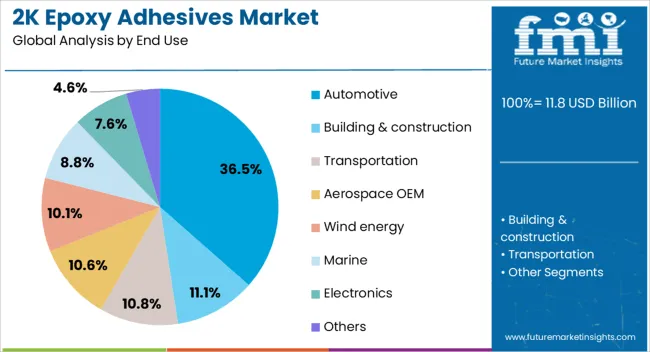

The 2K epoxy adhesives market is segmented by end use and geographic regions. By end use, the 2K epoxy adhesives market is divided into Automotive, Building & construction, Transportation, Aerospace OEM, Wind energy, Marine, Electronics, and Others. Regionally, the 2K epoxy adhesives industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The automotive end-use segment is projected to account for 36.5% of the total revenue share in the 2K epoxy adhesives market in 2025, making it the leading consumer of these bonding solutions. This dominance is being driven by the increasing use of lightweight materials such as aluminum, composites, and advanced polymers in vehicle manufacturing, which require reliable structural adhesives.

The segment’s growth has been further supported by the ability of 2K epoxy adhesives to provide superior bonding strength, vibration resistance, and thermal stability, meeting stringent automotive safety and performance standards. The integration of these adhesives in electric vehicle battery assemblies, body structures, and interior components has also contributed to higher demand.

Enhanced process efficiency through automated dispensing systems and the ability to cure under controlled conditions have made them a preferred choice for high-volume automotive production lines. As manufacturers aim to improve fuel efficiency, reduce emissions, and enhance structural durability, the use of 2K epoxy adhesives in automotive applications is expected to continue expanding.

The 2K epoxy adhesives market is expanding due to increasing demand for high-strength bonding solutions in automotive, aerospace, construction, electronics, and industrial applications. Two-component (2K) epoxies provide superior mechanical strength, chemical resistance, and thermal stability compared to single-component adhesives. Growth is driven by lightweight material bonding, structural assembly, and industrial automation. Technological innovations in fast-curing systems, low-viscosity formulations, and environmentally compliant adhesives enhance performance. Asia-Pacific shows rapid adoption, while Europe and North America focus on premium, high-performance solutions for critical applications.

2K epoxy adhesives are increasingly used for bonding metal, composites, and lightweight materials in automotive and aerospace sectors. They enable structural assembly, weight reduction, vibration damping, and enhanced corrosion resistance. Electric vehicle (EV) production drives demand for adhesives capable of bonding aluminum, carbon fiber, and thermoplastics. High-strength, fast-curing formulations support automated assembly lines and reduce cycle times. Manufacturers developing customized adhesives for specific substrate combinations, temperature ranges, and mechanical stress requirements can differentiate themselves. Until alternative bonding technologies match the combination of strength and durability, 2K epoxies will remain critical in transportation industries.

In electronics, industrial equipment, and machinery, 2K epoxy adhesives provide insulation, sealing, and protection against moisture, heat, and chemicals. Their ability to bond heterogeneous substrates such as metals, plastics, and ceramics ensures reliable performance in harsh environments. The rise of miniaturized electronic components, wearable devices, and industrial automation increases demand for precise, low-viscosity, and high-performance adhesives. Companies offering specialized formulations with UV or thermal curing options, high electrical insulation, or flame-retardant properties gain a competitive edge. Until new adhesive technologies can provide equivalent multi-functional performance, industrial and electronics applications will continue to drive growth.

Technological advancements in 2K epoxy chemistry focus on reducing curing time, enhancing workability, and improving penetration into substrates. Fast-curing formulations accelerate production in automotive and industrial assembly lines, while low-viscosity grades allow better wetting and adhesion on complex geometries. Modified epoxies with additives for improved toughness, flexibility, and chemical resistance expand application possibilities. Manufacturers investing in R&D to optimize curing kinetics, thermal stability, and shelf life differentiate themselves in competitive markets. Until universal, high-performance, quick-cure solutions are developed, innovation in formulation chemistry remains a primary driver of market adoption.

Stringent environmental regulations targeting VOCs, solvent emissions, and hazardous chemicals influence the development of 2K epoxy adhesives. Waterborne and low-VOC formulations are increasingly required in Europe and North America. Additionally, there is a growing emphasis on bio-based resins, recyclable substrates, and sustainable production processes. Companies investing in eco-friendly, high-performance adhesives can gain market preference while complying with evolving environmental norms. Until cost-effective, sustainable alternatives achieve equivalent bonding performance, regulatory compliance, and sustainability trends will remain key factors affecting product design, adoption, and competitive positioning.

| Countries | CAGR |

|---|---|

| China | 4.7% |

| India | 4.4% |

| Germany | 4.0% |

| France | 3.7% |

| UK | 3.3% |

| USA | 3.0% |

| Brazil | 2.6% |

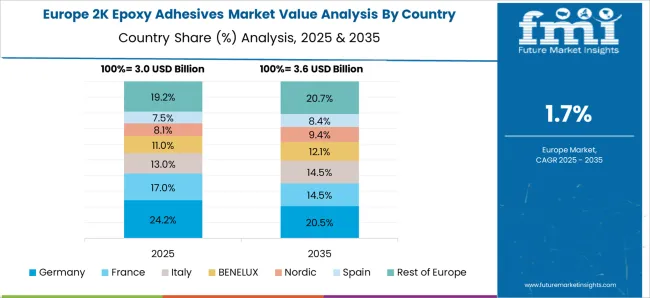

The global 2K Epoxy Adhesives Market is projected to grow at a CAGR of 3.5% through 2035, supported by increasing demand across construction, automotive, and industrial bonding applications. Among BRICS nations, China has been recorded with 4.7% growth, driven by large-scale production and deployment in construction and automotive sectors, while India has been observed at 4.4%, supported by rising utilization in industrial bonding and assembly applications. In the OECD region, Germany has been measured at 4.0%, where production and adoption for automotive, industrial, and construction bonding have been steadily maintained. The United Kingdom has been noted at 3.3%, reflecting consistent use in industrial and construction applications, while the USAhas been recorded at 3.0%, with production and utilization across automotive, construction, and industrial sectors being steadily increased. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The 2K epoxy adhesives market in China is growing at a CAGR of 4.7%, driven by the expanding automotive, construction, and industrial sectors. These adhesives offer high strength, chemical resistance, and durability, making them ideal for structural bonding, automotive assembly, electronics, and industrial maintenance. Increasing manufacturing activities, rapid urbanization, and infrastructure projects support rising demand for high-performance adhesive solutions. Technological advancements, such as improved curing times, enhanced bonding properties, and eco-friendly formulations, are widely adopted to meet regulatory standards. The automotive industry, particularly electric vehicles and commercial vehicles, heavily relies on 2K epoxy adhesives for structural components, battery packs, and body parts. Additionally, government investments in industrial safety, construction quality, and infrastructure modernization further enhance the market’s growth trajectory. Export demand for adhesive products also contributes to market expansion in China.

The 2K epoxy adhesives market in India is expanding at a CAGR of 4.4%, fueled by the growing automotive, construction, and electronics industries. High-strength adhesives are increasingly used in structural bonding, industrial assembly, and electronic device production. Infrastructure projects and urban development increase demand for durable adhesive solutions in construction and maintenance applications. The automotive sector, particularly the electric vehicle segment, relies on 2K epoxy adhesives for body assembly, battery modules, and safety components. Technological innovations, including faster curing times and enhanced chemical resistance, improve performance and reduce production downtime. Eco-friendly and low-VOC formulations are gaining traction to comply with environmental regulations and sustainability goals. Industrial safety awareness and quality standards further drive adoption across multiple sectors, positioning India as a steadily growing market for 2K epoxy adhesives.

The 2K epoxy adhesives market in Germany is projected to grow at a CAGR of 4.0%, supported by automotive, industrial, and construction sectors. High-performance adhesives are increasingly applied to metal, plastic, and composite materials for durable bonding, corrosion resistance, and structural integrity. The automotive industry drives significant demand for 2K epoxy adhesives in assembly, battery packs, and structural components. Industrial applications, including machinery maintenance, electronics, and infrastructure, also contribute to market growth. Germany’s strict environmental and quality regulations encourage the adoption of eco-friendly, low-VOC adhesive formulations. Advanced adhesive technologies, such as faster curing times and enhanced mechanical properties, improve efficiency and reduce production costs. R&D investments in adhesive formulations and application methods strengthen Germany’s competitive market position. Export demand across Europe further supports the growth of the 2K epoxy adhesives market.

The 2K epoxy adhesives market in the United Kingdom is expanding at a CAGR of 3.3%, driven by automotive, construction, and industrial applications. High-performance adhesives are increasingly used for bonding metal, plastic, and composite materials, offering durability and chemical resistance. The automotive industry, including EV manufacturing, heavily relies on 2K epoxy adhesives for structural bonding and battery assembly. Construction projects and industrial maintenance activities further support steady demand. Eco-friendly, low-VOC adhesive formulations are gaining popularity due to environmental regulations and sustainability initiatives. Technological improvements, such as faster curing times and enhanced bonding strength, improve productivity and reduce downtime. Increased awareness of industrial safety, product quality, and long-term durability strengthens market adoption. Overall, the 2K epoxy adhesives market in the UK continues to grow moderately, driven by industrial expansion and regulatory compliance.

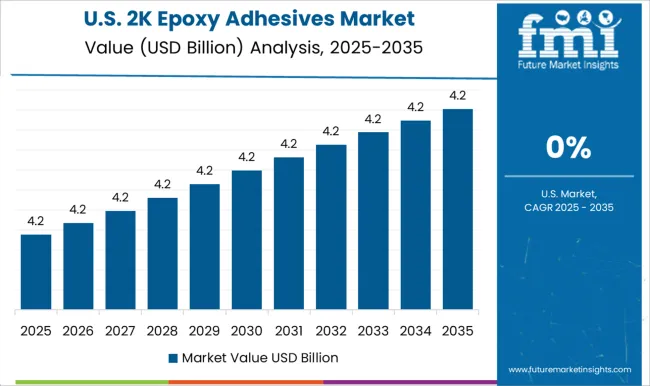

The 2K epoxy adhesives market in the United States is growing at a CAGR of 3.0%, fueled by automotive, industrial, and construction sectors. High-strength adhesives are widely used in metal, plastic, and composite bonding for structural integrity, corrosion resistance, and durability. The automotive industry, including electric vehicles and commercial vehicles, remains a major end-user, applying adhesives in assembly lines and battery components. Industrial applications, such as machinery maintenance and electronics, further drive demand. Environmental regulations and sustainability goals encourage the adoption of eco-friendly, low-VOC formulations. Technological advancements, including faster curing adhesives, improved mechanical properties, and high chemical resistance, enhance operational efficiency. Increasing industrial safety awareness, quality compliance, and product durability requirements further support market expansion. The combination of innovation, regulatory adherence, and industrial growth ensures consistent demand for 2K epoxy adhesives in the United States.

The 2K epoxy adhesives market plays a crucial role in industrial bonding applications, offering exceptional strength, chemical resistance, and durability. These adhesives, based on a two-component system (resin and hardener), are widely used in automotive, aerospace, electronics, construction, and general industrial sectors, where high-performance bonding and structural integrity are essential.

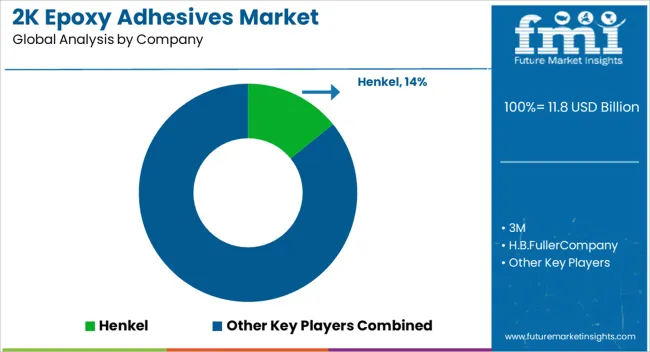

Henkel is a global leader in 2K epoxy adhesives, providing solutions tailored for industrial and automotive applications. 3M offers innovative epoxy formulations for electronics, aerospace, and assembly industries. H.B. Fuller Company and Sika deliver high-performance adhesives with a focus on durability and environmental compliance. Huntsman and Arkema leverage their chemical expertise to provide specialized adhesives for demanding industrial applications, while DuPont offers advanced solutions in structural and electronic bonding.

Other notable players include Parker, Mapei, and Permabond, which focus on high-strength, fast-curing, and versatile adhesives. Japanese manufacturers like Cemedine and Three-Bond provide technologically advanced formulations for precision bonding. Weicon, Uniseal, Panacol-Elosol, Parson Adhesives, MasterBond, and Valtech cater to niche markets, including electronics, medical devices, and industrial maintenance.

The market growth is driven by increasing industrial automation, demand for lightweight materials, and stringent quality standards requiring reliable, high-strength bonding solutions. Innovations in low-viscosity, fast-curing, and environmentally friendly epoxy adhesives are further fueling adoption. As industries seek stronger, more durable, and versatile bonding solutions, 2K epoxy adhesives remain a cornerstone of modern manufacturing and assembly processes worldwide.

| Item | Value |

|---|---|

| Quantitative Units | USD 11.8 Billion |

| End Use | Automotive, Building & construction, Transportation, Aerospace OEM, Wind energy, Marine, Electronics, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Henkel, 3M, H.B.FullerCompany, Sika, Huntsman, Arkema, DuPont, Parker, Mapei, Permabond, Cemedine, Three-Bond, Weicon, Uniseal, Panacol-Elosol, ParsonAdhesives, MasterBond, and Valtech |

| Additional Attributes | Dollar sales vary by product type, including two-component epoxy resins, hardeners, and pre-mixed systems; by application, such as automotive assembly, electronics, construction, aerospace, and industrial bonding; by end-use industry, spanning automotive, electronics, construction, and aerospace; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by rising demand for high-strength, chemical-resistant adhesives, and increasing industrial automation. |

The global 2K epoxy adhesives market is estimated to be valued at USD 11.8 billion in 2025.

The market size for the 2K epoxy adhesives market is projected to reach USD 16.6 billion by 2035.

The 2K epoxy adhesives market is expected to grow at a 3.5% CAGR between 2025 and 2035.

The key product types in 2K epoxy adhesives market are automotive, building & construction, transportation, aerospace oem, wind energy, marine, electronics and others.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

2K Coatings Market Growth – Trends & Forecast 2025 to 2035

Epoxy Type Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Epoxy Grouts Market Size and Share Forecast Outlook 2025 to 2035

Epoxy Putty and Construction Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Epoxy Active Diluent Market Size and Share Forecast Outlook 2025 to 2035

Epoxy Composite Market Size and Share Forecast Outlook 2025 to 2035

Epoxy Paint Thinner Market Growth - Trends & Forecast 2025 to 2035

Epoxy Curing Agent Market Growth - Trends & Forecast 2025 to 2035

Epoxy Paint Market Growth – Trends & Forecast 2024-2034

Asia Pacific Epoxy Resin Market Growth – Trends & Forecast 2024-2034

Epoxy Resin Market Growth – Trends & Forecast 2024-2034

Epoxy Encapsulation Material Market

Concrete Epoxy Repair Market Size and Share Forecast Outlook 2025 to 2035

Fast Curing Epoxy Adhesive Market Size and Share Forecast Outlook 2025 to 2035

Adhesives And Sealants Market Size and Share Forecast Outlook 2025 to 2035

UV Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Bioadhesives for Packaging Market

Wood Adhesives and Binders Market Size and Share Forecast Outlook 2025 to 2035

Wood Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Skin Adhesives Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA