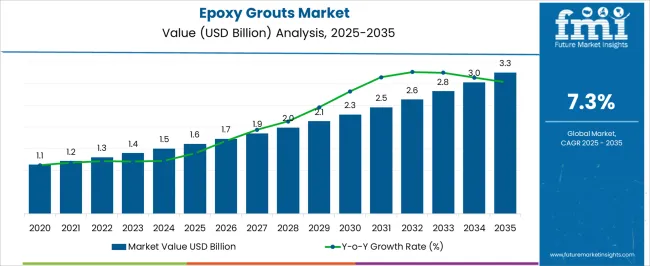

The epoxy grouts market is expected to expand from USD 1.6 billion in 2025 to USD 3.3 billion by 2035, at a CAGR of 7.3%. The half-decade weighted growth analysis highlights how momentum has been distributed unevenly across the forecast window, with distinct phases of acceleration visible in the data trend.

Between 2020 and 2025, growth was steady but moderate, with values rising from USD 1.1 billion in 2020 to USD 1.6 billion in 2025, reflecting a compound rise of USD 0.5 billion over five years. This initial block was largely driven by steady construction demand and gradual penetration of epoxy-based materials in flooring and tile joint applications. The period from 2025 to 2030, however, shows a stronger weighted expansion, with values moving from USD 1.6 billion to USD 2.3 billion. This five-year interval accounted for a larger absolute gain of 0.7 billion, reflecting increased adoption in commercial construction, industrial facilities, and infrastructure maintenance. By the following block, from 2030 to 2035, the market gains another 1.0 billion, moving from USD 2.3 billion to USD 3.3 billion. This phase carries the heaviest contribution in the overall weighted analysis, signifying accelerated adoption of high-performance grouting systems, resistance to chemicals, and durability in high-traffic environments. Weighted analysis shows the strongest compound effect in the latter half, positioning the market to benefit from structural growth drivers beyond 2035.

| Metric | Value |

|---|---|

| Epoxy Grouts Market Estimated Value in (2025 E) | USD 1.6 billion |

| Epoxy Grouts Market Forecast Value in (2035 F) | USD 3.3 billion |

| Forecast CAGR (2025 to 2035) | 7.3% |

The epoxy grouts market holds a specialized but significant role across multiple parent domains, with shares shaped by its superior performance compared to conventional cementitious grouts. Within the construction chemicals market, epoxy grouts represent nearly 6 to 7%, positioned alongside admixtures, waterproofing agents, and concrete repair materials as a high-value niche. In the adhesives and sealants market, their share is about 4 to 5%, given their function as both bonding and filling agents where chemical resistance and mechanical strength are critical. The flooring and tiling materials market shows stronger reliance, with epoxy grouts contributing almost 10 to 12%, since they are preferred in commercial kitchens, hospitals, and industrial floors for stain resistance, hygiene, and longevity.

Within the industrial maintenance and repair materials market, epoxy grouts hold close to 8 to 9%, widely applied in machinery foundations, vibration dampening, and anchoring applications in chemical and power plants. In the infrastructure and civil engineering materials market, their share is estimated at 5 to 6%, as they are used in high-load structures such as bridges, airports, and wastewater treatment facilities, where durability under stress and chemical exposure is essential.

The market’s expansion is being supported by the superior durability, chemical resistance, and low maintenance requirements of epoxy-based formulations compared to traditional cementitious alternatives.

The increasing adoption of flooring and wall applications in residential, commercial, and industrial projects has been driven by the demand for enhanced aesthetic appeal and long-term performance. Regulatory emphasis on quality standards and the rising preference for products with high stain and abrasion resistance are further contributing to market penetration.

Ongoing innovations in resin chemistry and installation techniques are enhancing the usability of epoxy grouts, making them suitable for diverse environments, including moisture-prone and high-traffic areas. With urban infrastructure development accelerating globally and premium construction materials becoming the norm, the epoxy grouts market is well-positioned for sustained growth, supported by both new construction activities and refurbishment trends.

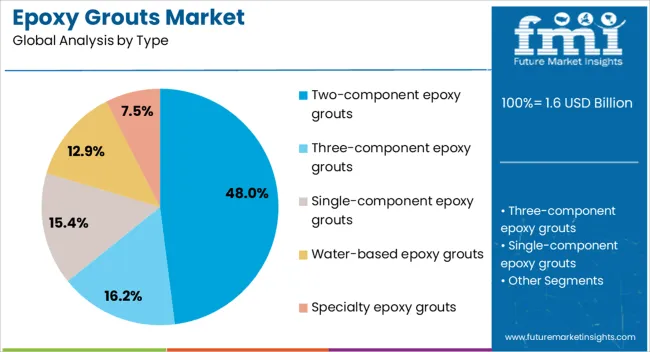

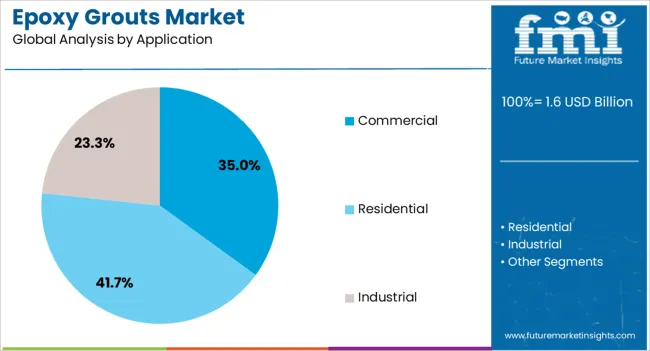

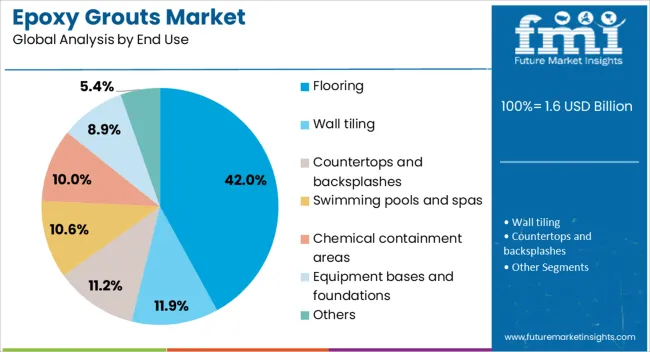

The epoxy grouts market is segmented by type, application, end use, distribution channel, and geographic regions. By type, epoxy grouts market is divided into Two-component epoxy grouts, Three-component epoxy grouts, Single-component epoxy grouts, Water-based epoxy grouts, and Specialty epoxy grouts. In terms of application, epoxy grouts market is classified into Commercial, Residential, Industrial, Infrastructure, and Others. Based on end use, epoxy grouts market is segmented into Flooring, Wall tiling, Countertops and backsplashes, Swimming pools and spas, Chemical containment areas, Equipment bases and foundations, and Others. By distribution channel, epoxy grouts market is segmented into Distributors and wholesalers, Direct sales, Retail, Online retail, and Others. Regionally, the epoxy grouts industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The two-component epoxy grouts segment is projected to hold 48% of the Epoxy Grouts market revenue share in 2025, making it the leading type segment. This leadership is being driven by its superior mechanical strength, exceptional bonding properties, and high resistance to water, chemicals, and stains. The two-component formulation enables excellent adhesion and uniform color consistency, which is critical for maintaining both functionality and aesthetics in demanding applications.

Contractors and builders have favored this type for its longevity and ability to withstand heavy loads in commercial, industrial, and residential settings. Additionally, its compatibility with a wide variety of tile materials and finishes has widened its applicability.

Ease of maintenance and reduced need for frequent repairs have further enhanced its cost-effectiveness over time. As construction quality standards continue to rise globally, the two-component epoxy grouts segment is expected to maintain its strong position by meeting the performance demands of modern building projects.

The commercial application segment is anticipated to account for 35% of the Epoxy Grouts market revenue share in 2025, making it the leading application area. Growth in this segment has been supported by large-scale adoption in hospitality, retail, office, and healthcare facilities where durability, hygiene, and visual appeal are essential.

Epoxy grouts have been increasingly chosen for commercial spaces due to their ability to resist stains, abrasions, and chemical spills, ensuring long-lasting performance under heavy foot traffic. The low porosity of epoxy grouts minimizes water absorption, reducing the risk of bacterial growth and facilitating easier cleaning, which aligns with stringent hygiene requirements.

Additionally, the ability to maintain color and finish over time has made them a preferred choice in high-visibility commercial interiors. The shift toward premium construction materials and the increasing emphasis on sustainable, low-maintenance solutions have reinforced the dominance of epoxy grouts in commercial projects, securing this segment’s leading position.

The flooring end use segment is expected to capture 42% of the Epoxy Grouts market revenue share in 2025, positioning it as the largest end-use category. The segment’s leadership is supported by the growing demand for durable, seamless, and visually appealing flooring solutions in both commercial and residential environments. Epoxy grouts offer exceptional resistance to wear, chemicals, and moisture, making them ideal for floors exposed to heavy usage and harsh conditions.

Their ability to create a smooth, non-porous surface ensures easy cleaning and maintenance while enhancing hygiene standards. The compatibility of epoxy grouts with a wide variety of tile and stone materials has broadened their application range, from high-traffic retail spaces to industrial facilities.

Additionally, advancements in color and texture options have increased their appeal in design-focused projects. With infrastructure investments rising and the emphasis on long-lasting performance growing, the flooring segment is set to retain its dominant market position in the years ahead.

Epoxy grouts are gaining traction where hygiene, stain resistance, and chemical durability are non negotiable across kitchens, healthcare, laboratories, pools, and production floors. Higher cost, installer skill needs, pot life sensitivity, and documentation workloads remain the main restraints, making trials and mockups important before rollout. Opportunity is strongest in retrofit and hygiene critical jobs, supported by rapid cure grades, decorative options, and system warranties. Trends emphasize smoother workability, longer open time, improved packaging, low VOC lines, and stronger technical libraries. Vendors offering training, on site support, and reliable color control are positioned to secure repeat specifications.

Adoption has been rising as projects demand grout systems that resist chemicals, stains, abrasion, and water ingress across food processing lines, commercial kitchens, healthcare corridors, laboratories, and wet leisure facilities. Epoxy grouts deliver dense, non porous joints with strong bond strength and color stability under aggressive cleaning regimes. Large format porcelain, quarry tile, and vitrified surfaces have been paired with narrow joints where consistent filling and flush finishes are required. Architects and specifiers prefer epoxy when hygiene codes, slip resistance targets, and washdown schedules must be supported by durable tile assemblies. Contractors value prematched color packs, improved workability grades, and wider temperature application windows that ease scheduling. Facility managers favor predictable cleaning, reduced regrouting frequency, and resistance to common acids, alkalis, oils, and dyes. As lifecycle cost receives higher weighting in tender evaluations, epoxy solutions are being viewed as a practical path to longer service life in demanding environments.

Barriers remain centered on higher material cost, skilled labor availability, and process sensitivity. Two or three component systems require precise measuring, thorough mixing, and disciplined pot life control, which raises training needs and rework risk. Substrate preparation, joint cleanliness, and ambient conditions are decisive; poor practice leads to haze, tackiness, or incomplete cure. Application effort is higher than cementitious options, and cleanup windows can be short, so teams must stage sections and manage lighting, ventilation, and access. Worker safety protocols for skin contact, ventilation, and solvent use increase supervision duties. Supply volatility for epoxy resins, amine hardeners, and micronized fillers can lengthen lead times and complicate color continuity across phases. UV exposure on exteriors may drive yellowing if general purpose grades are misapplied. Documentation for food zone use, VOC limits, and chemical resistance often requires project specific submittals. These realities keep pre construction trials and mockups essential.

Clear opportunity exists in hygiene critical refurbishments and fast track upgrades where shutdown windows are short. Rapid cure and low sag grades allow overnight turnarounds in supermarkets, commissaries, and hospitality back of house areas. Pools, spas, and water features benefit from hydrophobic fillers and smooth, dense joints that resist biofilm formation. Pharmaceutical suites and cleanrooms require chemical resistant, low porosity joints that tolerate repeated sanitizing, which positions epoxy as a preferred specification. Decorative ranges with metallic or fine aggregate effects enable premium retail and hospitality zones without sacrificing performance. Pre proportioned kits, color stable pigments, and extended working time variants reduce installer stress on complex layouts. Warranty backed system selling that pairs membranes, epoxy adhesives, movement joint sealants, and cleaners is being prioritized by buyers seeking single accountability. Training academies, certified installer networks, and digital calculators for coverage and cure planning are opening new channels for specification pull.

Market direction points to smoother trowel feel, longer open time, and easier washdown through refined resin to filler ratios and specialty surfactants. Low odor and low VOC lines are being selected to support occupied renovations. UV stable colorants and anti yellowing additives are entering exterior focused catalogs. Cartridge and pouch packaging reduce weighing errors and speed small area repairs. Epoxy grout floats, washable sponges, emulsifying cleaners, and haze removers are being bundled as kits to standardize results. BIM objects, CSI formatted guide specs, and chemical resistance charts are being issued to accelerate approvals. Digital submittal libraries with test reports for compressive strength, water absorption, and stain resistance are now expected. Regional blending hubs and color labs shorten custom matches for retail rollouts. The competitive edge is likely to favor suppliers that combine dependable formulations with field training, on site commissioning support, and responsive technical documentation.

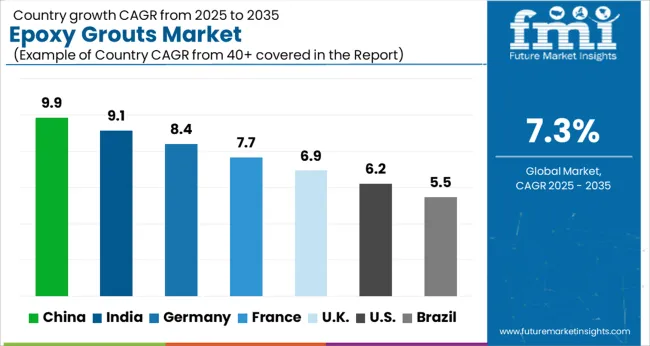

| Country | CAGR |

|---|---|

| China | 9.9% |

| India | 9.1% |

| Germany | 8.4% |

| France | 7.7% |

| UK | 6.9% |

| USA | 6.2% |

| Brazil | 5.5% |

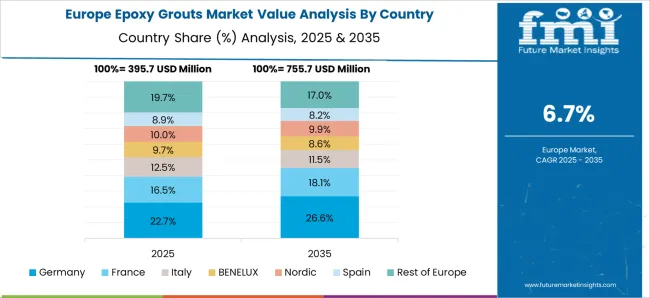

The epoxy grouts market is projected to expand globally at a CAGR of 7.3% from 2025 to 2035. China leads with 9.9%, followed by India at 9.1% and France at 7.7%, while the UK grows at 6.9% and the USA posts 6.2%. China and India register strong growth premiums of +2.6% and +1.8% above baseline, supported by large-scale construction and infrastructure programs. France benefits from renovation-focused demand, while the USA sees strong uptake in housing, healthcare, and decorative applications. The USA, though slower, remains highly valuable due to industrial and institutional projects requiring strong and durable grout solutions. The analysis includes over 40+ countries, with the leading markets detailed below.

The epoxy grouts market in China is projected to grow at a CAGR of 9.9% from 2025 to 2035, making it the fastest-growing region globally. Rising construction activity across residential, commercial, and infrastructure projects is significantly supporting demand. Epoxy grouts are being adopted in high-traffic areas such as metro stations, airports, and industrial flooring due to their durability and chemical resistance. Domestic tile and flooring manufacturers are increasingly recommending epoxy-based solutions to meet rising consumer preference for long-lasting finishes. Global producers are also strengthening their presence through partnerships with Chinese distributors and construction companies. The ongoing expansion of urban housing, coupled with large-scale industrial projects, is creating consistent demand.

The epoxy grouts market in France is projected to grow at a CAGR of 7.7% from 2025 to 2035. Growth is influenced by strong renovation activity, particularly in urban housing and public infrastructure. French consumers place emphasis on aesthetics and durability, driving demand for epoxy-based grouts in kitchens, bathrooms, and outdoor tiling. High adoption is also seen in commercial flooring for restaurants, retail, and healthcare facilities where easy cleaning and long service life are required. Domestic and European suppliers emphasize compliance with EU standards, focusing on low-VOC and environmentally conscious product formulations. Integration with premium tiles and natural stone installations is another factor encouraging uptake.

The epoxy grouts market in France is projected to grow at a CAGR of 7.7% from 2025 to 2035. Growth is influenced by strong renovation activity, particularly in urban housing and public infrastructure. French consumers place emphasis on aesthetics and durability, driving demand for epoxy-based grouts in kitchens, bathrooms, and outdoor tiling. High adoption is also seen in commercial flooring for restaurants, retail, and healthcare facilities where easy cleaning and long service life are required. Domestic and European suppliers emphasize compliance with EU standards, focusing on low-VOC and environmentally conscious product formulations. Integration with premium tiles and natural stone installations is another factor encouraging uptake.

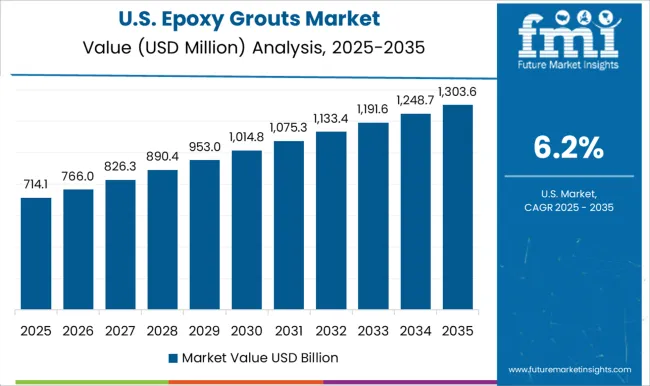

The epoxy grouts market in the United States is expected to grow at a CAGR of 6.2% from 2025 to 2035. The demand is anchored in commercial flooring, residential renovations, and infrastructure upgrades. Epoxy grouts are valued for their chemical resistance, strength, and ability to withstand heavy loads, making them preferred in industrial and institutional projects. Domestic manufacturers emphasize innovation in easy-to-apply formulations to reduce installation time and labor costs. Importers also play a role in supplying specialty products, especially for decorative and premium applications. Renovation activity in urban housing, combined with steady demand from retail and hospitality sectors, is further driving adoption. Water-resistant and hygienic grouts are also finding expanded usage in healthcare and food service flooring projects.

The epoxy grouts market in the UK is forecast to grow at a CAGR of 6.9% from 2025 to 2035. Market demand is supported by steady commercial construction and housing renovation trends. The UK tiling sector is increasingly adopting epoxy grouts for bathrooms, kitchens, and wet-room applications, driven by their durability and resistance to moisture. Imports play a substantial role, though local suppliers are gaining ground by catering to specialized applications. The healthcare and education sectors are adopting epoxy grouts to meet hygiene and safety standards in high-traffic areas. Decorative finishes with color-stable and stain-resistant epoxy formulations are becoming popular in luxury housing projects. The replacement and renovation cycle of existing housing stock is expected to remain an important driver for demand.

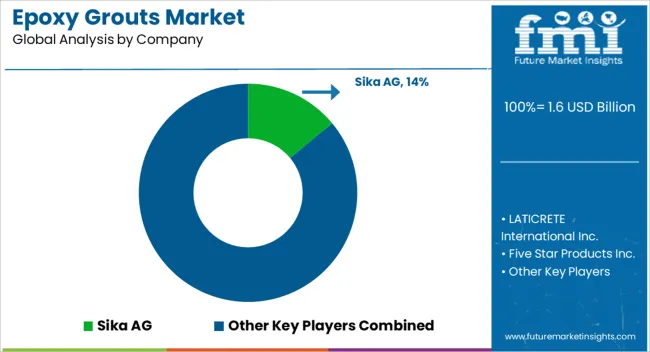

Competition in the epoxy grouts sector has been strongly influenced by chemical formulation expertise, curing performance, adhesion strength, and application versatility across residential, commercial, and industrial flooring segments. Sika AG has established a commanding position through high-performance, fast-curing epoxy grouts that offer superior chemical resistance, mechanical strength, and compatibility with large-format tiles, making them suitable for heavy-duty applications and complex architectural projects. LATICRETE International Inc. has concentrated on innovative epoxy blends that provide stain resistance, low shrinkage, and enhanced workability, supporting rapid installation without compromising long-term durability. Five Star Products Inc. has emphasized color uniformity, durability, and resistance to heavy foot traffic, catering to commercial, institutional, and high-usage environments.

Euclid Chemical Company has reinforced competitiveness by providing specialty epoxy grouts with rapid set times, thermal and chemical resilience, and compatibility with a wide range of substrates, ensuring adaptability for diverse construction scenarios. MAPEI S.p.A. has leveraged its global distribution network to deliver epoxy solutions designed for industrial coatings, decorative flooring, and heavy-duty construction projects, combining functional performance with aesthetic versatility. Hexion has focused on high-solid resin systems and chemical-resistant formulations, addressing industrial and marine installations where extreme conditions demand robust mechanical and chemical performance. Atul Ltd has positioned itself by offering cost-efficient epoxy blends with local availability and technical support, targeting large-scale construction projects and regional building initiatives. Differentiation in the market has been achieved through optimized resin chemistries, enhanced color and finish consistency, faster curing cycles, improved mechanical performance, and strict adherence to ASTM C580 and EN 13888 standards. Companies have also emphasized user-friendly application formats, two-component kits, and technical guidance, creating added value for contractors, architects, and industrial clients. Innovation in resin systems, broad substrate compatibility, and specialized chemical resistance have collectively shaped competitive positioning, while regional and global expansion strategies continue to influence market leadership. The combination of technical performance, application efficiency, and regulatory compliance remains critical for sustaining differentiation and driving adoption across multiple end-use sectors.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.6 Billion |

| Type | Two-component epoxy grouts, Three-component epoxy grouts, Single-component epoxy grouts, Water-based epoxy grouts, and Specialty epoxy grouts |

| Application | Commercial, Residential, Industrial, Infrastructure, and Others |

| End Use | Flooring, Wall tiling, Countertops and backsplashes, Swimming pools and spas, Chemical containment areas, Equipment bases and foundations, and Others |

| Distribution Channel | Distributors and wholesalers, Direct sales, Retail, Online retail, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Sika AG, LATICRETE International Inc., Five Star Products Inc., Euclid Chemical Company, MAPEI S.p.A., Hexion, and Atul Ltd |

| Additional Attributes | Dollar sales by product type (chemical-resistant, rapid-curing, high-strength), application format (pre-mixed, two-component kits), and end use (residential, commercial, industrial, infrastructure). Demand dynamics are driven by tile installation growth, industrial flooring expansion, and renovation activities. Regional trends indicate strong uptake in North America and Europe, with increasing adoption in Asia Pacific supported by construction and infrastructure investments. |

The global epoxy grouts market is estimated to be valued at USD 1.6 billion in 2025.

The market size for the epoxy grouts market is projected to reach USD 3.3 billion by 2035.

The epoxy grouts market is expected to grow at a 7.3% CAGR between 2025 and 2035.

The key product types in epoxy grouts market are two-component epoxy grouts, _standard epoxy grouts, _water-cleanable epoxy grouts, _chemical-resistant epoxy grouts, _others, three-component epoxy grouts, _industrial grade, _commercial grade, _others, single-component epoxy grouts, water-based epoxy grouts, specialty epoxy grouts, _fast-setting epoxy grouts, _flexible epoxy grouts, _high-temperature resistant epoxy grouts, _antimicrobial epoxy grouts and _others.

In terms of application, commercial segment to command 35.0% share in the epoxy grouts market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Epoxy Casting Potting Resin Market Size and Share Forecast Outlook 2025 to 2035

Epoxy Resin Industry Analysis in Asia Pacific Size and Share Forecast Outlook 2025 to 2035

Epoxy Type Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Epoxy Putty and Construction Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Epoxy Active Diluent Market Size and Share Forecast Outlook 2025 to 2035

Epoxy Composite Market Size and Share Forecast Outlook 2025 to 2035

Epoxy Paint Thinner Market Growth - Trends & Forecast 2025 to 2035

Epoxy Curing Agent Market Growth - Trends & Forecast 2025 to 2035

Epoxy Paint Market Growth – Trends & Forecast 2024-2034

Epoxy Resin Market Growth – Trends & Forecast 2024-2034

Epoxy Encapsulation Material Market

2K Epoxy Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Concrete Epoxy Repair Market Size and Share Forecast Outlook 2025 to 2035

Injection Epoxy Chemical Anchors Market Size and Share Forecast Outlook 2025 to 2035

Fast Curing Epoxy Adhesive Market Size and Share Forecast Outlook 2025 to 2035

High Performance Epoxy Coating Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA