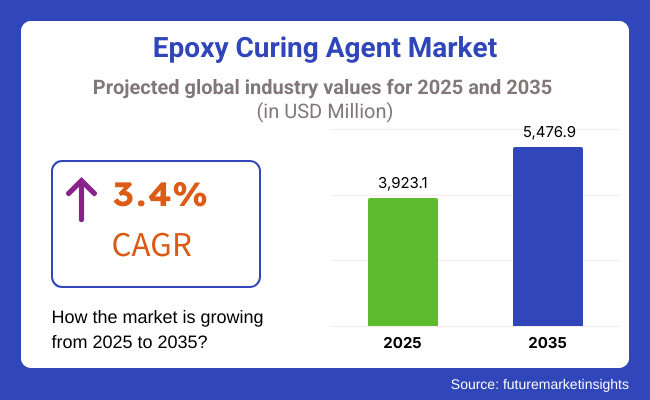

The global epoxy curing agent market is expected to grow steadily between 2025 and 2035, driven by rising demand from construction, automotive, aerospace, and electronics sectors. The market is projected to reach USD 3,923.1 million in 2025 and expand to USD 5,476.9 million by 2035, reflecting a compound annual growth rate (CAGR) of 3.4% during the forecast period.

Epoxy curing agents represent one of the key ingredients in epoxy resin formulations, and though their main objective is to serve in the mechanism of resin hardening, they also participate in the enhancement of mechanical strength, durability, and chemical resistance in coatings, adhesives, and composites. The demand for high-performance coatings, lightweight materials in the automotive and aerospace industries, and superior bonding solutions in electronics and electrical applications are the factors which are pushing the market upwards.

Furthermore, the progress in bio-based and low-VOC curing agents, as well as rising use in renewable energy infrastructure, are the central ideas driving modernization. Manufacturers are focusing more on sustainability, energy efficiency, and performance optimization, and thus are investing in the development of eco-friendly and high-performance curing agent formulations.

The construction of new roads and bridges, the widespread use of epoxy coatings, and the quick development of composite materials are the main forces behind the market growth. Furthermore, the surge in the use of curing agents in wind energy, automotive structural adhesives, and marine coatings is anticipated to propel market demand.

Thermal curing has the highest share in the market of epoxy curing agents mainly due to its remarkable mechanical strength, high temperature resistance, and permanent durability. It is the most common curing method in high-performance coatings, adhesives, composites, and electronic encapsulation, which is achieved with heat-activated crosslinking for optimal epoxy performance. The automotive, aerospace, and electrical manufacturing sectors appreciate the fact that thermally cured epoxy systems can function at extreme temperatures, as well as tolerate chemical exposure and mechanical stress quite well.

Epoxy properties can be engineered to meet the requirements of specific industries by changing thermal curing agents since they are more flexible as compared to UV and catalytic curing. In addition, thermal curing agents still keep being the primary option in the area of needing high-load capacity adhesives and coatings because of their absorbed strength characteristics and duration.

The trend of UV curing being more and more used is particularly noticeable in such branches as paint and coatings, adhesives, and electronics where the needed factors are fast curing time, low energy consumption, and solvent-free processing. In contrast to thermal curing, which necessitates high temperatures, UV curing instantly polymerizes when exposed to UV light, hence, it results in reduced production time and energy costs.

The paint and coatings sector lies in the fact that it is the predominant consumer of UV-curable epoxy curing agents since it provides high-gloss finishes, exceptional abrasion resistance, and excellent weather ability. Furthermore, it is worth mentioning the use of UV-cured epoxy encapsulates and coatings by the electronics manufacturers to prevent moisture and corrosion that could cause damage to the circuit boards, sensors, and microchips.

Due to the environmental laws forcing industries to seek out alternatives to VOCs (volatile organic compounds), the introduction of UV-curing epoxy agents is, in turn, catalysing the application of these agents in sustainable manufacturing and the development of eco-friendly products.

The paint and coatings industry, which is the largest market segment and thus consumes most of the epoxy curing agents, is majorly used in the application area. One of the main reasons for the paint and coatings market growth is the need for corrosion protection and excellent quality coatings; this is why the automotive, industrial, and marine applications largely go for it.

The most common way to guard steel, concrete, and composite materials against exposed, harsh environments, chemicals, and mechanical damage is to cover them with epoxy resin. The recent trend of infrastructural development and industrial expansion is the driving force for the protective coatings in epoxy curing agents in sectors like oil & gas, pipelines, bridges, and marine vessels where long-term corrosion & weather exposure resistance is of utmost importance.

Furthermore, by incorporating decorative epoxy coatings on the floors, countertops, and furniture, there is a surge in the need for epoxy resins that cure quickly, are high-strength, and have better resistance to UV and abrasion.

The electrical and electronics sector is facing a great demand for epoxy curing agents because they are used for applications related to potting, encapsulation and insulation in electronic components. Epoxy-based formulations teroformene in dielectric strength, thermal stability, and moisture barrier characteristics so there be are to use protective agents for printed circuit boards (PCBs), transformers, semiconductors, and high-voltage electrical equipment.

The fast rise of 5G technology, electric vehicles (EVs), moreover, the miniaturization factor in new devices has all contributed to the demand for high-performance epoxy adhesives and coatings. Manufacturers are on the way to present novel models, such as the low-outgassing, thermally conductive, and fast-curing epoxy formulations which are tailored for the requirements of the following era of electronics and high-performance electrical insulation systems.

North America is still a significant market for epoxy curing agents with the main driver being the requirement in aerospace, automotive, and infrastructure applications. The states like the USA and Canada have had a surplus of funds that are spent on green buildings, smart coatings, and advanced composite materials, which are all the things that drive the production and therefore the use of epoxy curing agents.

This is happening even though the Environmental Protection Agency(EPA) has set rules against the disposal of volatile organic compounds(VOCs) causing companies to be inventive and promote the creation of water-based and bio-based epoxy curing agents. Furthermore, the fast-rising production of electric vehicles (EVs) and car parts made of lightweight materials is behind the growth of epoxy-based adhesives and composites.

The expansion of the European epoxy curing agent market is mainly due to the environmental laws being strictly implemented, solid manufacturing production, and the continuous growth in the use of composite materials in the aerospace and wind energy industries. A few of the countries, including Germany, France, and the UK, are dealing with the introduction of low-emission, high-performance curing agents as a means of following the EU's sustainability directives.

The growth of offshore wind energy projects in the North Sea is the main factor that stimulates the epoxy-based coatings and adhesives for blade turbine manufacturing. Moreover, automotive light weighting, the development of railway infrastructure, and the rise in the market of anti-corrosion coatings are all backing the growth of the market in Europe.

The epoxy curing agent market in the Asia-Pacific region is the fastest-growing due to the influence of rapid industrialization, the increase in construction projects, and the rise in the production of automobiles. The leading countries in epoxy resin consumption are China, India, Japan, and South Korea, particularly for protective coatings, adhesives, and electrical laminates. China is increasing its industrial base and commercial infrastructure, leading to high demand for epoxy coatings that perform at a superior level in hardware floor covering, viaducts, and sky-high builds.

In India, the growing base of renewable energy sources in this case wind power is helping the manufacturers of these wind generator blades and other parts of the structures to deal with a demand for durable epoxy materials. Meanwhile, Japan and South Korea are at the forefront of progress in electronics and semiconductor industries, which in turn raises the demand for high-performance epoxy adhesives.

The Middle East and Africa (MEA) region is showing an increasing need for epoxy curing agents and mainly oil and gas infrastructure, marine coatings, and industrial construction. States like Saudi Arabia, UAE, and South Africa are pouring money into the acquisition of corrosion-resistant coatings for their pipes, offshore structures, and transport systems.

Furthermore, the development of large projects such as airports, highways, and smart city constructions is the force driving the market for composite materials that are durable, long-lasting, and epoxy-based. The establishment of new chemical processing facilities and the transformation of heavy industries in the region also bring additional support to the sector.

Stringent Environmental Regulations on Epoxy-Based Materials

The rising restrictions on VOC emissions, hazardous chemicals, and proper waste disposal are in fact, one of the main obstacles to the growth of the epoxy curing agent market. Respective regulatory bodies, for example, the REACH in Europe and the EPA in North America, are deploying restrictions on solvent-based epoxy formulations and thus, manufacturers Freestylers needed to come up with low-VOC and with water-based curing agents as the suitable alternatives.

Adherence to environmental regulations for workplace safety, air quality, and chemical exposure brings along the problem of production costs and reformulation complexities. Even though the bio-based and low-emission curing agents are a good alternative, the issues that they are associated with, such as high production costs and performance limits and, therefore, they are resisted mainly in cost-sensitive industries.

Worker safety issues related to amine and anhydride exposure during operations with epoxy curing agents are the factors that force the companies to produce better, absolutely safe products which have the same characteristics like strength and durability as in the original formulations.

High Raw Material Costs and Supply Chain Disruptions

Epoxy curing agent sector is heavily weighted on the petrochemical-derived goods, making it extra vulnerable to the surveillance of the crude oil markets, the loss of trust in the supply networks, and also the security issues in the world. The non-availability of the most important raw materials, the increase in transport rates, and the surging of energy costs directly affect production expenses and create non-stable market conditions.

Problems in the worldwide supply chain, especially in the Asian-Pacific production hubs, resulted in the postponement of the delivery of raw materials and the jump of prices for resins, hardeners and chemical additives. Because of the growing demand for special curing agents in the high-performance niche, price fluctuations and procurement disruptions are becoming more of a problem.

In response to this, companies are looking beyond the suppliers they usually work with, seeking opportunities for alternative raw materials, and are also putting in place locally-based strategies for production with the aim of the reduction of costs and the establishment of a resilient supply chain.

Advancements in Bio-Based and Low-VOC Epoxy Curing Agents

The increasing global emphasis on sustainability and green chemistry is creating opportunities for bio-based epoxy curing agents derived from renewable sources such as plant oils, bio-phenols, and natural resins. Manufacturers are developing low-VOC, non-toxic, and environmentally friendly formulations to comply with regulatory standards and meet consumer preferences for eco-friendly coatings and adhesives.

The advancement of waterborne epoxy curing agents, which offer high durability and corrosion resistance while minimizing environmental impact, is gaining traction in construction, marine, and industrial applications. Additionally, innovations in self-healing and nano-enhanced epoxy formulations are expanding the market potential for smart coatings and high-performance composites.

Growing Demand in Wind Energy, Automotive, and Infrastructure Sectors

The expansion of wind energy projects worldwide is driving demand for epoxy curing agents used in turbine blade manufacturing, structural bonding, and corrosion-resistant coatings. As governments push for renewable energy targets, epoxy-based solutions are becoming critical for wind farm infrastructure and grid components.

The automotive industry's transition to lightweight materials and EV battery advancements is also fueling demand for epoxy adhesives, structural composites, and protective coatings. Automakers are focusing on enhancing vehicle efficiency, crash resistance, and sustainability, leading to higher adoption of epoxy-based materials.

Additionally, the growing investment in high-performance infrastructure projects, including bridges, tunnels, airports, and metro networks, is boosting demand for long-lasting, high-strength epoxy coatings and sealants. As construction activities rise globally, the epoxy curing agent market is expected to expand significantly.

The years from 2020 to 2024, the epoxy curing agent market experienced impressive growth due to the increasing need for high-quality coatings, rapid industrialization, and developments in composite materials. Curing agents used in epoxies were essential in sectors like construction, automotive, aerospace, marine, electrical & electronics, and wind energy.

The need for long-lasting, heat-resistant, environmentally friendly, and chemically stable formulations of epoxy riches demand for amine-based, anhydride, and polyamide curing agents. Additionally, the development of low-VOC (volatile organic compound) and fast curing epoxy systems has increased multifaceted operational efficiency and sustainability. However, the challenges included raw material price fluctuations, strict environmental regulations, and limited acceptance in price-sensitive markets.

The epoxy curing agent market is set to transform into an era of bio-based curing agents, AI-managed resin formulation optimization, and high-efficiency nanomaterial-enhanced epoxy systems. The journey to eco-friendly coatings, archetype-composite with a low mass, and AI-joined epoxy production will the drive sales booming on this market. In addition, grapheminfused epoxy systems, 3D-printed resin structures, and self-healing epoxy coatings will be the innovations in the industry that will change the way it develops.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Industrial Growth & Infrastructure Development | High demand for epoxy curing agents in protective coatings, adhesives, and construction materials. |

| Sustainability & Green Chemistry Initiatives | Introduction of low-VOC and solvent-free epoxy curing agents to meet environmental regulations. |

| Advancements in Lightweight & High-Performance Composites | Expansion of epoxy-based carbon fiber composites in automotive, aerospace, and wind energy applications. |

| Electric Vehicles & Automotive Coatings Demand | Use of epoxy coatings and adhesives in automotive manufacturing for corrosion resistance and weight reduction. |

| Marine & Aerospace Epoxy Innovations | Increasing adoption of epoxy curing agents in marine anti-fouling coatings and aerospace structural components. |

| Electronics & Semiconductor Industry Expansion | High demand for epoxy-based encapsulants, potting compounds, and circuit board protection. |

| Market Growth Drivers | Growth fueled by expansion in construction, automotive, wind energy, and industrial coatings. |

| Market Shift | 2025 to 2035 |

|---|---|

| Industrial Growth & Infrastructure Development | AI-assisted formulation of high-performance epoxy resins for self-healing and nanocomposite-enhanced applications. |

| Sustainability & Green Chemistry Initiatives | Widespread adoption of bio-based and plant-derived curing agents, reducing carbon footprint in epoxy applications. |

| Advancements in Lightweight & High-Performance Composites | Next-gen graphene-reinforced epoxy curing agents for ultra-lightweight and high-strength composite structures. |

| Electric Vehicles & Automotive Coatings Demand | Self-healing, AI-optimized epoxy coatings with anti-corrosion and thermal insulation properties for EV battery protection. |

| Marine & Aerospace Epoxy Innovations | Hydrophobic, saltwater-resistant epoxy resins with AI-driven durability assessment for extended service life in extreme environments. |

| Electronics & Semiconductor Industry Expansion | Development of ultra-thin, AI-controlled, thermally conductive epoxy systems for advanced microelectronics and 6G technology. |

| Market Growth Drivers | Market expansion driven by smart epoxy systems, self-repairing coatings, and next-gen composite materials for aerospace and EVs. |

The market for epoxy curing agents in the United States is reaching a steady pace of growth due to the increasing need in construction, automotive, and aerospace sectors. The fast increase in usage of epoxy-based coatings and adhesives in infrastructure projects, industrial flooring, and protective coatings is what drives the market progress. The infrastructure investment and jobs act of the Biden administration is to be the leading factor that would result in the increase of needs of original high-performance epoxy resins and curing agents for roadways, bridges, and water treatment plants.

Also, the automotive and aerospace industries are more and more adopting the use of composite materials that are lighter in weight, and in this process, epoxy curing agents provide mechanical strength and durability. The introduction of curing agents that are low in VOC and the trend of water-based epoxy are acquiring power totally fueled along by green building applications, especially when the general concern over volatile organic compound (VOC) emissions has come up.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 3.6% |

The UK epoxy curing agent market is on the way to progress at a reasonable rate due to the construction sector, the increasing use of epoxy-based coatings in marine applications, and the demand for sustainable materials. The priority of the UK on the green building standard is, in fact, the cause for the increase in the use of low-emission epoxy curing agents in flooring, paints, and adhesives.

In addition, shipbuilding and offshore wind energy sectors are also using more epoxy coatings for corrosion protection in marine environments. The increase of electric vehicle (EV) manufacturing in the UK also rises the use of epoxy-based adhesives and encapsulants, especially for EV batteries and lightweight structural components.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 3.2% |

The European Union epoxy curing agent market is flourishing due to rigid environmental laws, increasing demand in wind energy applications, and expanding infrastructure projects. Countries like Germany, France, and Italy are at the forefront of adopting eco-friendly epoxy curing agents due to the directives from the EU reducing VOC emissions in coatings and adhesives.

The increase in wind turbine installations is the primary contributory factor since wind blade manufacturing depends on the use of epoxy curing agents. The automotive sector’s shift to lightweight and electric vehicles is another factor in the rise of epoxy-based adhesives and composites.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 3.4% |

In Japan, the epoxy curing agent sector is thriving due to a surge in the demand for heavy-duty coatings, automotive advancements, and electronic manufacturing. Japan's automobile and aerospace industries are at the forefront of utilizing epoxy composites for the production of lighter and more fuel-efficient vehicle components.

Besides, Japan has proven to be the utmost leader in the global semiconductor and electronics manufacturing with the common usage of epoxy curing agents in the manufacturing process of printed circuit boards, encases, and adhesives shows a constant rise.

On the other hand, industrial and marine applications deal with protective epoxy coatings, which includes coastal infrastructure and shipbuilding. The mind-set changes from biodegradable and low-toxicity epoxy curing agents is the huge driving force behind the innovation of eco-friendly construction through and green electronics production.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.1% |

The market for epoxy curing agents in South Korea is growing due to rapid industrialization, more investments in EV battery manufacturing, and the construction sector bullshit. The country is the most important producer of semiconductor and display and due to that demand for high-purity epoxy coatings and adhesives is high. Another important push is from the country getting green models such as electric futuristic vehicles (EVs), for instance, used in insulation, thermal management systems, and composites of less weight.

Furthermore, the expansion of smart factories and advanced manufacturing is also helping the demand of epoxy-based industrial coatings and adhesives. South Korea is taking further steps in the process by reducing VOC emissions, which is the reason why the market is changing to water-based, low-solvent epoxy curing agents in paints, coatings, and adhesives.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 3.3% |

The global market for epoxy curing agent is witnessing a consistent expansion due to the increasing requirement of these agents in construction, automotive, aerospace, electrical, and industrial coatings. The role of epoxy curing agents in the mechanical, chemical, and thermal resistance of epoxy resins is vital. Accordingly, they are essential in the case of adhesives, coatings, composites, and electrical encapsulation applications too.

In a way, the market is determined by the low-VOC and water-based curing agents which have been adopted by more people as their first choice, and this has led to the development of the associated investments both in this area and in high-performance epoxy systems. The top manufacturers have now been busy making more sophisticated curing agents, optimizing them for performance on high-strength coatings, and expanding their application to infrastructure and industrial protective coatings.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Huntsman Corporation | 10-12% |

| Evonik Industries AG | 9-11% |

| Olin Corporation | 8-10% |

| Cardolite Corporation | 6-8% |

| BASF SE | 5-7% |

| Other Companies (combined) | 51-61% |

| Company Name | Key Offerings/Activities |

|---|---|

| Huntsman Corporation | A global leader in amine-based and polyamide epoxy curing agents, offering high-performance solutions for coatings, adhesives, and composites. |

| Evonik Industries AG | Develops specialty amine and anhydride curing agents, integrating low-VOC and high-durability properties for industrial applications. |

| Olin Corporation | Specializes in amine-based and cycloaliphatic curing agents, ensuring fast curing, high thermal stability, and corrosion resistance. |

| Cardolite Corporation | Provides bio-based and waterborne epoxy curing agents, focusing on sustainable and eco-friendly formulations. |

| BASF SE | Offers high-performance epoxy curing agents, integrating low-VOC coatings and fast-curing formulations for protective coatings. |

Key Company Insights

Huntsman Corporation

Hydesman is the number one amine-based and polyamide curing agent’s maker in the world, besides that it is actively offering high-performance epoxy formulations for coatings, adhesives, and composites. Araldite and Jeffamine series from the producer are the fastest curing, most chemically resistant, and most durable options available. The company is launching a new eco-friendly project for low-VOC curing agents, which will later be the basis of environment-friendly and sustainable solutions for the industrial sector.

Evonik Industries AG

Evonik is a pharmaceutical company that provides specialty amine and anhydride curing agents, focusing on those for epoxy formulations with low emission and high durability. The Aquafina and Enamine grades from the firm incorporate low-VOC technology, which means it is viable to generate both eco-friendly and hard-wearing coatings. Evonik is continuing the expansion of its bio-based curing agent product line, therefore, making a significant impact on the sustainability focus in the industrial and protective coatings sectors.

Olin Corporation

Olin is a strong supplier of epoxy curing agents and is also known for its amine-based and cycloaliphatic formulations to be used for high-performance coatings, composites, and adhesives. The D.E.H. series of the company is often associated with quick curing, corrosion resistance, and excellent adhesion, making them ideal for marine, construction, and industrial applications. Olin is actively working on tasks that are set to improve the thermal resistant epoxy curing agent solutions, which are primarily aimed at the aerospace and automotive industries that involve high temperatures.

Cardolite Corporation

Bio-based and waterborne epoxy curing agents are the specialty area of Cardolite, a company that promotes environmentally friendly and low-emission options for coatings and composites. NX to 2026 and Ultra LITE series of the brand curable with high-performance, offer excellent flexibility and impact resistance. Cardolite has made a commitment to the expansion of its green chemistry solutions, which are specifically aimed at reducing emisssions inindustrial and construction sectors.

BASF SE

BASF is a leading innovator in the development of epoxy curing agents with formulations for coatings, adhesives, and electrical encapsulation that are high-strength, and fast-curing resistant. The company's Laromin and Baxxodur series include low-VOC and high-performance curing systems that allow for further increased durability and resilience to harsh conditions. BASF is focusing on the research of smart epoxy formulas including the use of AI for the enhancement of material properties in industrial use.

Amines, Anhydrides, Polyamides, Phenols, Lewis Acid, Others

Standard, Fast Cure, High Performance, Low-Temperature, Heat-Resistant, Water-Resistant, UV-Resistant

Catalytic Curing, Thermal Curing, UV Curing

Paint and Coating, Adhesives and Sealants, Electrical and Electronics, Composites, Tooling and Molding, Others

North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, Middle East & Africa

The global epoxy curing agents market is projected to reach USD 3,923.1 million by the end of 2025.

The market is anticipated to grow at a CAGR of 3.4% over the forecast period.

By 2035, the epoxy curing agents market is expected to reach USD 5,476.9 million.

The thermal curing segment is expected to dominate due to its widespread applications in coatings, adhesives, and composites, particularly in industries such as construction, automotive, and electronics, where high-strength and durable epoxy formulations are required.

Key players in the epoxy curing agents market include Evonik Industries AG, Huntsman Corporation, Hexion Inc., Cardolite Corporation, and Gabriel Performance Products.

Table 01: Global Market Size Volume (Tons) Analysis and Forecast By Raw Material, 2018 to 2033

Table 02: Global Market Size Volume (Tons) Analysis and Forecast By Raw Material, 2023 to 2033

Table 03: Global Market Size Value (US$ Million) Analysis and Forecast By Raw Material, 2018 to 2033

Table 04: Global Market Size Volume (Tons) Analysis and Forecast By Grade, 2018 to 2033

Table 05: Global Market Size Volume (Tons) Analysis and Forecast By Grade, 2023 to 2033

Table 06: Global Market Size (US$ Million) Analysis and Forecast By Grade, 2018 to 2033

Table 07: Global Market Volume (Tons) Analysis and Forecast By Cure Mechanism, 2018 to 2022

Table 08: Global Market Size Volume (Tons) Analysis and Forecast By Cure Mechanism, 2023 to 2033

Table 09: Global Market Size (US$ Million) Analysis and Forecast By Cure Mechanism, 2018 to 2033

Table 10: Global Market Size Volume (Tons) Analysis and Forecast By End Use, 2018 to 2022

Table 11: Global Market Size Volume (Tons) Analysis and Forecast By End Use, 2023 to 2033

Table 12: Global Market Size (US$ Million) Analysis and Forecast By End Use, 2018 to 2033

Table 13: Global Market Size Volume (Tons) Analysis and Forecast By Region, 2018 to 2022

Table 14: Global Market Size Volume (Tons) Analysis and Forecast By Region, 2023 to 2033

Table 15: Global Market Size Value (US$ Million) Analysis and Forecast By Region, 2018 to 2033

Table 16: Global Market Size Value (US$ Million) Analysis and Forecast By Region, 2023 to 2033

Table 17: North America Market Size (US$ Million) and Volume (Tons) Analysis and Forecast By Country, 2018 to 2033

Table 18: North America Market Size Volume (Tons) Analysis and Forecast By Raw Material, 2018 to 2033

Table 19: North America Market Size Value (US$ Million) Analysis and Forecast By Raw Material, 2018 to 2033

Table 20: North America Market Size (US$ Million) and Volume (Tons) Analysis and Forecast By Grade, 2018 to 2033

Table 21: North America Market Size (US$ Million) and Volume (Tons) Analysis and Forecast By Cure Mechanism, 2018 to 2033

Table 22: North America Market Size (US$ Million) and Volume (Tons) Analysis and Forecast By End Use, 2018 to 2033

Table 23: Latin America Market Size (US$ Million) and Volume (Tons) Analysis and Forecast By Country, 2018 to 2033

Table 24: Latin America Market Size Volume (Tons) Analysis and Forecast By Raw Material, 2018 to 2033

Table 25: Latin America Market Size Value (US$ Million) Analysis and Forecast By Raw Material, 2018 to 2033

Table 26: Latin America Market Size (US$ Million) and Volume (Tons) Analysis and Forecast By Grade, 2018 to 2033

Table 27: Latin America Market Size (US$ Million) and Volume (Tons) Analysis and Forecast By Cure Mechanism, 2018 to 2033

Table 28: Latin America Market Size (US$ Million) and Volume (Tons) Analysis and Forecast By End Use, 2018 to 2033

Table 29: Western Europe Market Size (US$ Million) and Volume (Tons) Analysis and Forecast By Country, 2018 to 2033

Table 30: Western Europe Market Size Volume (Tons) Analysis and Forecast By Raw Material, 2018 to 2033

Table 31: Western Europe Market Size Value (US$ Million) Analysis and Forecast By Raw Material, 2018 to 2033

Table 32: Western Europe Market Size (US$ Million) and Volume (Tons) Analysis and Forecast By Grade, 2018 to 2033

Table 33: Western Europe Market Size (US$ Million) and Volume (Tons) Analysis and Forecast By Cure Mechanism, 2018 to 2033

Table 34: Western Europe Market Size (US$ Million) and Volume (Tons) Analysis and Forecast By End Use, 2018 to 2033

Table 35: Eastern Europe Market Size (US$ Million) and Volume (Tons) Analysis and Forecast By Country, 2018 to 2033

Table 36: Eastern Europe Market Size Volume (Tons) Analysis and Forecast By Raw Material, 2018 to 2033

Table 37: Eastern Europe Market Size Value (US$ Million) Analysis and Forecast By Raw Material, 2018 to 2033

Table 38: Eastern Europe Market Size (US$ Million) and Volume (Tons) Analysis and Forecast By Grade, 2018 to 2033

Table 39: Eastern Europe Market Size (US$ Million) and Volume (Tons) Analysis and Forecast By Cure Mechanism, 2018 to 2033

Table 40: Eastern Europe Market Size (US$ Million) and Volume (Tons) Analysis and Forecast By End Use, 2018 to 2033

Table 41: Russia and Belarus Market Size Volume (Tons) Analysis and Forecast By Raw Material, 2018 to 2033

Table 42: Russia and Belarus Market Size Value (US$ Million) Analysis and Forecast By Raw Material, 2018 to 2033

Table 43: Russia and Belarus Market Size (US$ Million) and Volume (Tons) Analysis and Forecast By Grade, 2018 to 2033

Table 44: Russia and Belarus Market Size (US$ Million) and Volume (Tons) Analysis and Forecast By Cure Mechanism, 2018 to 2033

Table 45: Russia and Belarus Market Size (US$ Million) and Volume (Tons) Analysis and Forecast By End Use, 2018 to 2033

Table 46: Balkan and Baltics Market Size Volume (Tons) Analysis and Forecast By Raw Material, 2018 to 2033

Table 47: Balkan and Baltics Market Size Value (US$ Million) Analysis and Forecast By Raw Material, 2018 to 2033

Table 48: Balkan and Baltics Market Size (US$ Million) and Volume (Tons) Analysis and Forecast By Grade, 2018 to 2033

Table 49: Balkan and Baltics Market Size (US$ Million) and Volume (Tons) Analysis and Forecast By Cure Mechanism, 2018 to 2033

Table 50: Balkan and Baltics Market Size (US$ Million) and Volume (Tons) Analysis and Forecast By End Use, 2018 to 2033

Table 51: Central Asia Market Size Volume (Tons) Analysis and Forecast By Raw Material, 2018 to 2033

Table 52: Central Asia Market Size Value (US$ Million) Analysis and Forecast By Raw Material, 2018 to 2033

Table 53: Central Asia Market Size (US$ Million) and Volume (Tons) Analysis and Forecast By Grade, 2018 to 2033

Table 54: Central Asia Market Size (US$ Million) and Volume (Tons) Analysis and Forecast By Cure Mechanism, 2018 to 2033

Table 55: Central Asia Market Size (US$ Million) and Volume (Tons) Analysis and Forecast By End Use, 2018 to 2033

Table 56: China Market Size Volume (Tons) Analysis and Forecast By Raw Material, 2018 to 2033

Table 57: China Market Size Value (US$ Million) Analysis and Forecast By Raw Material, 2018 to 2033

Table 58: China Market Size (US$ Million) and Volume (Tons) Analysis and Forecast By Grade, 2018 to 2033

Table 59: China Market Size (US$ Million) and Volume (Tons) Analysis and Forecast By Cure Mechanism, 2018 to 2033

Table 60: China Market Size (US$ Million) and Volume (Tons) Analysis and Forecast By End Use, 2018 to 2033

Table 61: Japan Market Size Volume (Tons) Analysis and Forecast By Raw Material, 2018 to 2033

Table 62: Japan Market Size Value (US$ Million) Analysis and Forecast By Raw Material, 2018 to 2033

Table 63: Japan Market Size (US$ Million) and Volume (Tons) Analysis and Forecast By Grade, 2018 to 2033

Table 64: Japan Market Size (US$ Million) and Volume (Tons) Analysis and Forecast By Cure Mechanism, 2018 to 2033

Table 65: Japan Market Size (US$ Million) and Volume (Tons) Analysis and Forecast By End Use, 2018 to 2033

Table 66: South Korea Market Size Volume (Tons) Analysis and Forecast By Raw Material, 2018 to 2033

Table 67: South Korea Market Size Value (US$ Million) Analysis and Forecast By Raw Material, 2018 to 2033

Table 68: South Korea Market Size (US$ Million) and Volume (Tons) Analysis and Forecast By Grade, 2018 to 2033

Table 69: South Korea Market Size (US$ Million) and Volume (Tons) Analysis and Forecast By Cure Mechanism, 2018 to 2033

Table 70: South Korea Market Size (US$ Million) and Volume (Tons) Analysis and Forecast By End Use, 2018 to 2033

Table 71: South Asia & Pacific Market Size (US$ Million) and Volume (Tons) Analysis and Forecast By Country, 2018 to 2033

Table 72: South Asia & Pacific Market Size Volume (Tons) Analysis and Forecast By Raw Material, 2018 to 2033

Table 73: South Asia & Pacific Market Size Value (US$ Million) Analysis and Forecast By Raw Material, 2018 to 2033

Table 74: South Asia & Pacific Market Size (US$ Million) and Volume (Tons) Analysis and Forecast By Grade, 2018 to 2033

Table 75: South Asia & Pacific Market Size (US$ Million) and Volume (Tons) Analysis and Forecast By Cure Mechanism, 2018 to 2033

Table 76: South Asia & Pacific Market Size (US$ Million) and Volume (Tons) Analysis and Forecast By End Use, 2018 to 2033

Table 77: Middle East & Africa Market Size (US$ Million) and Volume (Tons) Analysis and Forecast By Country, 2018 to 2033

Table 78: Middle East & Africa Market Size Volume (Tons) Analysis and Forecast By Raw Material, 2018 to 2033

Table 79: Middle East & Africa Market Size Value (US$ Million) Analysis and Forecast By Raw Material, 2018 to 2033

Table 80: Middle East & Africa Market Size (US$ Million) and Volume (Tons) Analysis and Forecast By Grade, 2018 to 2033

Table 81: Middle East & Africa Market Size (US$ Million) and Volume (Tons) Analysis and Forecast By Cure Mechanism, 2018 to 2033

Table 82: Middle East & Africa Market Size (US$ Million) and Volume (Tons) Analysis and Forecast By End Use, 2018 to 2033

Figure 01: Global Historical Market Volume (Tons) Analysis, 2018 to 2022

Figure 02: Global Current and Future Market Volume (Tons) Analysis, 2023 to 2033

Figure 03: Global Historical Value (US$ Million), 2018 to 2022

Figure 04: Global Value (US$ Million) Forecast, 2023 to 2033

Figure 05: Global Absolute $ Opportunity, 2018 to 2023 and 2033

Figure 06: Global Market Share and BPS Analysis By Raw Material, 2023 and 2033

Figure 07: Global Market Y-o-Y Growth Projections By Raw Material, 2023 to 2033

Figure 08: Global Market Attractiveness Analysis By Raw Material, 2023 to 2033

Figure 09: Global Market Absolute $ Opportunity By Amines Segment, 2018 to 2033

Figure 10: Global Market Absolute $ Opportunity By Anhydrides Segment, 2018 to 2033

Figure 11: Global Market Absolute $ Opportunity By Polyamides Segment, 2018 to 2033

Figure 12: Global Market Absolute $ Opportunity By Phenols Segment, 2018 to 2033

Figure 13: Global Market Absolute $ Opportunity By Lewis Acids Segment, 2018 to 2033

Figure 14: Global Market Absolute $ Opportunity By Others Segment, 2018 to 2033

Figure 15: Global Market Share and BPS Analysis By Grade, 2023 and 2033

Figure 16: Global Market Y-o-Y Growth Projections By Grade, 2023 to 2033

Figure 17: Global Market Attractiveness Analysis By Grade, 2023 to 2033

Figure 18: Global Market Absolute $ Opportunity By Standard Segment, 2018 to 2033

Figure 19: Global Market Absolute $ Opportunity By Fast Cure Segment, 2018 to 2033

Figure 20: Global Market Absolute $ Opportunity By High-Performance Segment, 2018 to 2033

Figure 21: Global Market Absolute $ Opportunity By Low-Temperature Segment, 2018 to 2033

Figure 22: Global Market Absolute $ Opportunity By Heat-Resistant Segment, 2018 to 2033

Figure 23: Global Market Absolute $ Opportunity By Water-Resistant Segment, 2018 to 2033

Figure 24: Global Market Absolute $ Opportunity By UV-Resistant Segment, 2018 to 2033

Figure 25: Global Market Share and BPS Analysis By Cure Mechanism, 2023 and 2033

Figure 26: Global Market Y-o-Y Growth Projections By Cure Mechanism, 2023 to 2033

Figure 27: Global Market Attractiveness Analysis By Cure Mechanism, 2023 to 2033

Figure 28: Global Market Absolute $ Opportunity By Catalytic Curing Segment, 2018 to 2033

Figure 29: Global Market Absolute $ Opportunity By Thermal Curing Segment, 2018 to 2033

Figure 30: Global Market Absolute $ Opportunity By UV Curing Segment, 2018 to 2033

Figure 31: Global Market Absolute $ Opportunity By Room Temp. Curing Segment, 2018 to 2033

Figure 32: Global Market Share and BPS Analysis By End Use, 2023 and 2033

Figure 33: Global Market Y-o-Y Growth Projections By End Use, 2023 to 2033

Figure 34: Global Market Attractiveness Analysis By End Use, 2023 to 2033

Figure 35: Global Market Absolute $ Opportunity By Paints and Coatings Segment, 2018 to 2033

Figure 36: Global Market Absolute $ Opportunity By Adhesive and Sealants Segment, 2018 to 2033

Figure 37: Global Market Absolute $ Opportunity By Electrical and Electronics Segment, 2018 to 2033

Figure 38: Global Market Absolute $ Opportunity By Composites Segment, 2018 to 2033

Figure 39: Global Market Absolute $ Opportunity By Tooling and Molding Segment, 2018 to 2033

Figure 40: Global Market Absolute $ Opportunity By Others Segment, 2018 to 2033

Figure 41: Global Market Value Share and BPS Analysis By Region, 2023 and 2033

Figure 42: Global Market Y-o-Y Growth Projections By Region, 2023 to 2033

Figure 43: Global Market Attractiveness Analysis By Region, 2023 to 2033

Figure 44: Global Market Absolute $ Opportunity By North America Segment, 2018 to 2033

Figure 45: Global Market Absolute $ Opportunity By Latin America Segment, 2018 to 2033

Figure 46: Global Market Absolute $ Opportunity By Western Europe Segment, 2018 to 2033

Figure 47: Global Market Absolute $ Opportunity By Eastern Europe Segment, 2018 to 2033

Figure 48: Global Market Absolute $ Opportunity By Russia and Belarus Segment, 2018 to 2033

Figure 49: Global Market Absolute $ Opportunity By Balkan and Baltics Segment, 2018 to 2033

Figure 50: Global Market Absolute $ Opportunity By Central Asia Segment, 2018 to 2033

Figure 51: Global Market Absolute $ Opportunity By China Segment, 2018 to 2033

Figure 52: Global Market Absolute $ Opportunity By Japan Segment, 2018 to 2033

Figure 53: Global Market Absolute $ Opportunity By South Korea Segment, 2018 to 2033

Figure 54: Global Market Absolute $ Opportunity By South Asia & Pacific Segment, 2018 to 2033

Figure 55: Global Market Absolute $ Opportunity By Middle East & Africa Segment, 2018 to 2033

Figure 56: North America Market Share and BPS Analysis By Country– 2023 and 2023

Figure 57: North America Market Y-o-Y Growth Projection By Country, 2023 to 2033

Figure 58: North America Market Attractiveness Index By Country, 2023 to 2033

Figure 59: North America Market Share and BPS Analysis By Raw Material, 2023 and 2033

Figure 60: North America Market Y-o-Y Growth Projections By Raw Material, 2023 to 2033

Figure 61: North America Market Attractiveness Analysis By Raw Material, 2023 to 2033

Figure 62: North America Market Share and BPS Analysis By Grade, 2023 and 2033

Figure 63: North America Market Y-o-Y Growth Projections By Grade, 2023 to 2033

Figure 64: North America Market Attractiveness Analysis By Grade, 2023 to 2033

Figure 65: North America Market Share and BPS Analysis By Cure Mechanism, 2023 and 2033

Figure 66: North America Market Y-o-Y Growth Projections By Cure Mechanism, 2023 to 2033

Figure 67: North America Market Attractiveness Analysis By Cure Mechanism, 2023 to 2033

Figure 68: North America Market Share and BPS Analysis By End Use, 2023 and 2033

Figure 69: North America Market Y-o-Y Growth Projections By End Use, 2023 to 2033

Figure 70: North America Market Attractiveness Analysis By End Use, 2023 to 2033

Figure 71: Latin America Market Share and BPS Analysis By Country– 2023 and 2023

Figure 72: Latin America Market Y-o-Y Growth Projection By Country, 2023 to 2033

Figure 73: Latin America Market Attractiveness Index By Country, 2023 to 2033

Figure 74: Latin America Market Share and BPS Analysis By Raw Material, 2023 and 2033

Figure 75: Latin America Market Y-o-Y Growth Projections By Raw Material, 2023 to 2033

Figure 76: Latin America Market Attractiveness Analysis By Raw Material, 2023 to 2033

Figure 77: Latin America Market Share and BPS Analysis By Grade, 2023 and 2033

Figure 78: Latin America Market Y-o-Y Growth Projections By Grade, 2023 to 2033

Figure 79: Latin America Market Attractiveness Analysis By Grade, 2023 to 2033

Figure 80: Latin America Market Share and BPS Analysis By Cure Mechanism, 2023 and 2033

Figure 81: Latin America Market Y-o-Y Growth Projections By Cure Mechanism, 2023 to 2033

Figure 82: Latin America Market Attractiveness Analysis By Cure Mechanism, 2023 to 2033

Figure 83: Latin America Market Share and BPS Analysis By End Use, 2023 and 2033

Figure 84: Latin America Market Y-o-Y Growth Projections By End Use, 2023 to 2033

Figure 85: Latin America Market Attractiveness Analysis By End Use, 2023 to 2033

Figure 86: Western Europe Market Share and BPS Analysis By Country– 2023 and 2023

Figure 87: Western Europe Market Y-o-Y Growth Projection By Country, 2023 to 2033

Figure 88: Western Europe Market Attractiveness Index By Country, 2023 to 2033

Figure 89: Western Europe Market Share and BPS Analysis By Raw Material, 2023 and 2033

Figure 90: Western Europe Market Y-o-Y Growth Projections By Raw Material, 2023 to 2033

Figure 91: Western Europe Market Attractiveness Analysis By Raw Material, 2023 to 2033

Figure 92: Western Europe Market Share and BPS Analysis By Grade, 2023 and 2033

Figure 93: Western Europe Market Y-o-Y Growth Projections By Grade, 2023 to 2033

Figure 94: Western Europe Market Attractiveness Analysis By Grade, 2023 to 2033

Figure 95: Western Europe Market Share and BPS Analysis By Cure Mechanism, 2023 and 2033

Figure 96: Western Europe Market Y-o-Y Growth Projections By Cure Mechanism, 2023 to 2033

Figure 97: Western Europe Market Attractiveness Analysis By Cure Mechanism, 2023 to 2033

Figure 98: Western Europe Market Share and BPS Analysis By End Use, 2023 and 2033

Figure 99: Western Europe Market Y-o-Y Growth Projections By End Use, 2023 to 2033

Figure 100: Western Europe Market Attractiveness Analysis By End Use, 2023 to 2033

Figure 101: Eastern Europe Market Share and BPS Analysis By Country– 2023 and 2023

Figure 102: Eastern Europe Market Y-o-Y Growth Projection By Country, 2023 to 2033

Figure 103: Eastern Europe Market Attractiveness Index By Country, 2023 to 2033

Figure 104: Eastern Europe Market Share and BPS Analysis By Raw Material, 2023 and 2033

Figure 105: Eastern Europe Market Y-o-Y Growth Projections By Raw Material, 2023 to 2033

Figure 106: Eastern Europe Market Attractiveness Analysis By Raw Material, 2023 to 2033

Figure 107: Eastern Europe Market Share and BPS Analysis By Grade, 2023 and 2033

Figure 108: Eastern Europe Market Y-o-Y Growth Projections By Grade, 2023 to 2033

Figure 109: Eastern Europe Market Attractiveness Analysis By Grade, 2023 to 2033

Figure 110: Eastern Europe Market Share and BPS Analysis By Cure Mechanism, 2023 and 2033

Figure 111: Eastern Europe Market Y-o-Y Growth Projections By Cure Mechanism, 2023 to 2033

Figure 112: Eastern Europe Market Attractiveness Analysis By Cure Mechanism, 2023 to 2033

Figure 113: Eastern Europe Market Share and BPS Analysis By End Use, 2023 and 2033

Figure 114: Eastern Europe Market Y-o-Y Growth Projections By End Use, 2023 to 2033

Figure 115: Eastern Europe Market Attractiveness Analysis By End Use, 2023 to 2033

Figure 116: Russia and Belarus Market Share and BPS Analysis By Raw Material, 2023 and 2033

Figure 117: Russia and Belarus Market Y-o-Y Growth Projections By Raw Material, 2023 to 2033

Figure 118: Russia and Belarus Market Attractiveness Analysis By Raw Material, 2023 to 2033

Figure 119: Russia and Belarus Market Share and BPS Analysis By Grade, 2023 and 2033

Figure 120: Russia and Belarus Market Y-o-Y Growth Projections By Grade, 2023 to 2033

Figure 121: Russia and Belarus Market Attractiveness Analysis By Grade, 2023 to 2033

Figure 122: Russia and Belarus Market Share and BPS Analysis By Cure Mechanism, 2023 and 2033

Figure 123: Russia and Belarus Market Y-o-Y Growth Projections By Cure Mechanism, 2023 to 2033

Figure 124: Russia and Belarus Market Attractiveness Analysis By Cure Mechanism, 2023 to 2033

Figure 125: Russia and Belarus Market Share and BPS Analysis By End Use, 2023 and 2033

Figure 126: Russia and Belarus Market Y-o-Y Growth Projections By End Use, 2023 to 2033

Figure 127: Russia and Belarus Market Attractiveness Analysis By End Use, 2023 to 2033

Figure 128: Balkan and Baltics Market Share and BPS Analysis By Raw Material, 2023 and 2033

Figure 129: Balkan and Baltics Market Y-o-Y Growth Projections By Raw Material, 2023 to 2033

Figure 130: Balkan and Baltics Market Attractiveness Analysis By Raw Material, 2023 to 2033

Figure 131: Balkan and Baltics Market Share and BPS Analysis By Grade, 2023 and 2033

Figure 132: Balkan and Baltics Market Y-o-Y Growth Projections By Grade, 2023 to 2033

Figure 133: Balkan and Baltics Market Attractiveness Analysis By Grade, 2023 to 2033

Figure 134: Balkan and Baltics Market Share and BPS Analysis By Cure Mechanism, 2023 and 2033

Figure 135: Balkan and Baltics Market Y-o-Y Growth Projections By Cure Mechanism, 2023 to 2033

Figure 136: Balkan and Baltics Market Attractiveness Analysis By Cure Mechanism, 2023 to 2033

Figure 137: Balkan and Baltics Market Share and BPS Analysis By End Use, 2023 and 2033

Figure 138: Balkan and Baltics Market Y-o-Y Growth Projections By End Use, 2023 to 2033

Figure 139: Balkan and Baltics Market Attractiveness Analysis By End Use, 2023 to 2033

Figure 140: Central Asia Market Share and BPS Analysis By Raw Material, 2023 and 2033

Figure 141: Central Asia Market Y-o-Y Growth Projections By Raw Material, 2023 to 2033

Figure 142: Central Asia Market Attractiveness Analysis By Raw Material, 2023 to 2033

Figure 143: Central Asia Market Share and BPS Analysis By Grade, 2023 and 2033

Figure 144: Central Asia Market Y-o-Y Growth Projections By Grade, 2023 to 2033

Figure 145: Central Asia Market Attractiveness Analysis By Grade, 2023 to 2033

Figure 146: Central Asia Market Share and BPS Analysis By Cure Mechanism, 2023 and 2033

Figure 147: Central Asia Market Y-o-Y Growth Projections By Cure Mechanism, 2023 to 2033

Figure 148: Central Asia Market Attractiveness Analysis By Cure Mechanism, 2023 to 2033

Figure 149: Central Asia Market Share and BPS Analysis By End Use, 2023 and 2033

Figure 150: Central Asia Market Y-o-Y Growth Projections By End Use, 2023 to 2033

Figure 151: Central Asia Market Attractiveness Analysis By End Use, 2023 to 2033

Figure 152: China Market Share and BPS Analysis By Raw Material, 2023 and 2033

Figure 153: China Market Y-o-Y Growth Projections By Raw Material, 2023 to 2033

Figure 154: China Market Attractiveness Analysis By Raw Material, 2023 to 2033

Figure 155: China Market Share and BPS Analysis By Grade, 2023 and 2033

Figure 156: China Market Y-o-Y Growth Projections By Grade, 2023 to 2033

Figure 157: China Market Attractiveness Analysis By Grade, 2023 to 2033

Figure 158: China Market Share and BPS Analysis By Cure Mechanism, 2023 and 2033

Figure 159: China Market Y-o-Y Growth Projections By Cure Mechanism, 2023 to 2033

Figure 160: China Market Attractiveness Analysis By Cure Mechanism, 2023 to 2033

Figure 161: China Market Share and BPS Analysis By End Use, 2023 and 2033

Figure 162: China Market Y-o-Y Growth Projections By End Use, 2023 to 2033

Figure 163: China Market Attractiveness Analysis By End Use, 2023 to 2033

Figure 164: Japan Market Share and BPS Analysis By Raw Material, 2023 and 2033

Figure 165: Japan Market Y-o-Y Growth Projections By Raw Material, 2023 to 2033

Figure 166: Japan Market Attractiveness Analysis By Raw Material, 2023 to 2033

Figure 167: Japan Market Share and BPS Analysis By Grade, 2023 and 2033

Figure 168: Japan Market Y-o-Y Growth Projections By Grade, 2023 to 2033

Figure 169: Japan Market Attractiveness Analysis By Grade, 2023 to 2033

Figure 170: Japan Market Share and BPS Analysis By Cure Mechanism, 2023 and 2033

Figure 171: Japan Market Y-o-Y Growth Projections By Cure Mechanism, 2023 to 2033

Figure 172: Japan Market Attractiveness Analysis By Cure Mechanism, 2023 to 2033

Figure 173: Japan Market Share and BPS Analysis By End Use, 2023 and 2033

Figure 174: Japan Market Y-o-Y Growth Projections By End Use, 2023 to 2033

Figure 175: Japan Market Attractiveness Analysis By End Use, 2023 to 2033

Figure 176: South Korea Market Share and BPS Analysis By Raw Material, 2023 and 2033

Figure 177: South Korea Market Y-o-Y Growth Projections By Raw Material, 2023 to 2033

Figure 178: South Korea Market Attractiveness Analysis By Raw Material, 2023 to 2033

Figure 179: South Korea Market Share and BPS Analysis By Grade, 2023 and 2033

Figure 180: South Korea Market Y-o-Y Growth Projections By Grade, 2023 to 2033

Figure 181: South Korea Market Attractiveness Analysis By Grade, 2023 to 2033

Figure 182: South Korea Market Share and BPS Analysis By Cure Mechanism, 2023 and 2033

Figure 183: South Korea Market Y-o-Y Growth Projections By Cure Mechanism, 2023 to 2033

Figure 184: South Korea Market Attractiveness Analysis By Cure Mechanism, 2023 to 2033

Figure 185: South Korea Market Share and BPS Analysis By End Use, 2023 and 2033

Figure 186: South Korea Market Y-o-Y Growth Projections By End Use, 2023 to 2033

Figure 187: South Korea Market Attractiveness Analysis By End Use, 2023 to 2033

Figure 188: South Asia and Pacific Market Share and BPS Analysis By Country– 2023 and 2023

Figure 189: South Asia and Pacific Market Y-o-Y Growth Projection By Country, 2023 to 2033

Figure 190: South Asia and Pacific Market Attractiveness Index By Country, 2023 to 2033

Figure 191: South Asia & Pacific Market Share and BPS Analysis By Raw Material, 2023 and 2033

Figure 192: South Asia & Pacific Market Y-o-Y Growth Projections By Raw Material, 2023 to 2033

Figure 193: South Asia & Pacific Market Attractiveness Analysis By Raw Material, 2023 to 2033

Figure 194: South Asia & Pacific Market Share and BPS Analysis By Grade, 2023 and 2033

Figure 195: South Asia & Pacific Market Y-o-Y Growth Projections By Grade, 2023 to 2033

Figure 196: South Asia & Pacific Market Attractiveness Analysis By Grade, 2023 to 2033

Figure 197: South Asia & Pacific Market Share and BPS Analysis By Cure Mechanism, 2023 and 2033

Figure 198: South Asia & Pacific Market Y-o-Y Growth Projections By Cure Mechanism, 2023 to 2033

Figure 199: South Asia & Pacific Market Attractiveness Analysis By Cure Mechanism, 2023 to 2033

Figure 200: South Asia & Pacific Market Share and BPS Analysis By End Use, 2023 and 2033

Figure 201: South Asia & Pacific Market Y-o-Y Growth Projections By End Use, 2023 to 2033

Figure 202: South Asia & Pacific Market Attractiveness Analysis By End Use, 2023 to 2033

Figure 203: Middle East and Africa Market Share and BPS Analysis By Country– 2023 and 2023

Figure 204: Middle East and Africa Market Y-o-Y Growth Projection By Country, 2023 to 2033

Figure 205: Middle East and Africa Market Attractiveness Index By Country, 2023 to 2033

Figure 206: Middle East & Africa Market Share and BPS Analysis By Raw Material, 2023 and 2033

Figure 207: Middle East & Africa Market Y-o-Y Growth Projections By Raw Material, 2023 to 2033

Figure 208: Middle East & Africa Market Attractiveness Analysis By Raw Material, 2023 to 2033

Figure 209: Middle East & Africa Market Share and BPS Analysis By Grade, 2023 and 2033

Figure 210: Middle East & Africa Market Y-o-Y Growth Projections By Grade, 2023 to 2033

Figure 211: Middle East & Africa Market Attractiveness Analysis By Grade, 2023 to 2033

Figure 212: Middle East & Africa Market Share and BPS Analysis By Cure Mechanism, 2023 and 2033

Figure 213: Middle East & Africa Market Y-o-Y Growth Projections By Cure Mechanism, 2023 to 2033

Figure 214: Middle East & Africa Market Attractiveness Analysis By Cure Mechanism, 2023 to 2033

Figure 215: Middle East & Africa Market Share and BPS Analysis By End Use, 2023 and 2033

Figure 216: Middle East & Africa Market Y-o-Y Growth Projections By End Use, 2023 to 2033

Figure 217: Middle East & Africa Market Attractiveness Analysis By End Use, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Epoxy Resin Industry Analysis in Asia Pacific Size and Share Forecast Outlook 2025 to 2035

Epoxy Type Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Epoxy Grouts Market Size and Share Forecast Outlook 2025 to 2035

Epoxy Putty and Construction Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Epoxy Active Diluent Market Size and Share Forecast Outlook 2025 to 2035

Epoxy Composite Market Size and Share Forecast Outlook 2025 to 2035

Epoxy Paint Thinner Market Growth - Trends & Forecast 2025 to 2035

Epoxy Paint Market Growth – Trends & Forecast 2024-2034

Epoxy Resin Market Growth – Trends & Forecast 2024-2034

Epoxy Encapsulation Material Market

2K Epoxy Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Concrete Epoxy Repair Market Size and Share Forecast Outlook 2025 to 2035

Fast Curing Epoxy Adhesive Market Size and Share Forecast Outlook 2025 to 2035

High Performance Epoxy Coating Market Size and Share Forecast Outlook 2025 to 2035

Curing Oven Market Analysis Size and Share Forecast Outlook 2025 to 2035

Tire Curing Press Market Growth - Trends & Forecast 2025 to 2035

Tire Curing Bladder Release Agent Market Size and Share Forecast Outlook 2025 to 2035

Paint Curing Lamp Market Size and Share Forecast Outlook 2025 to 2035

Light Curing Adhesives Market

TBR Hydraulic Curing Press Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA