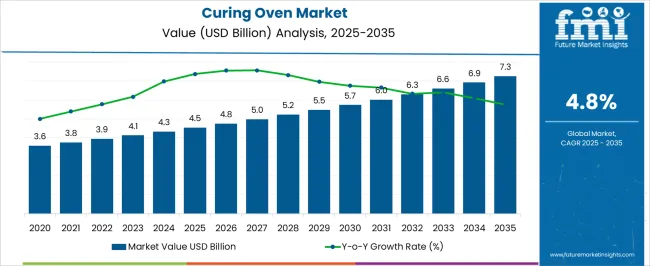

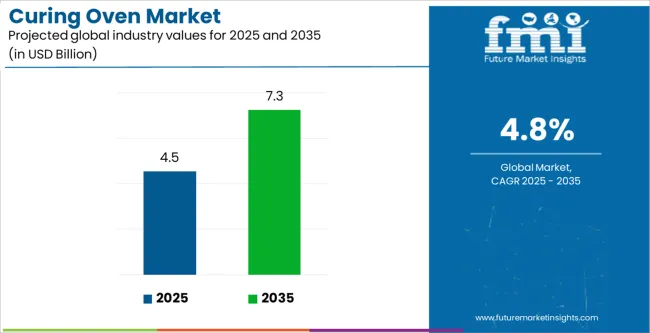

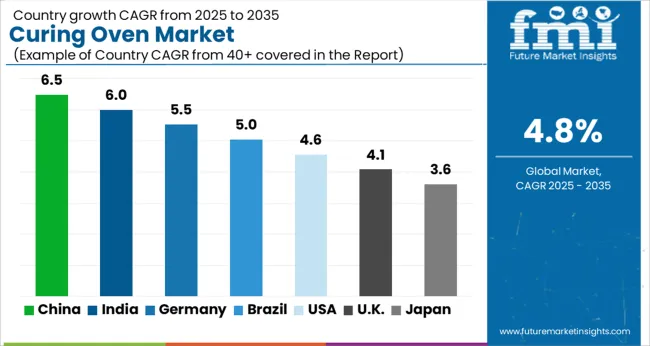

The Curing Oven Market is estimated to be valued at USD 4.5 billion in 2025 and is projected to reach USD 7.3 billion by 2035, registering a compound annual growth rate (CAGR) of 4.8% over the forecast period.

| Metric | Value |

|---|---|

| Curing Oven Market Estimated Value in (2025 E) | USD 4.5 billion |

| Curing Oven Market Forecast Value in (2035 F) | USD 7.3 billion |

| Forecast CAGR (2025 to 2035) | 4.8% |

The curing oven market is experiencing steady growth, supported by the increasing demand for precision heating solutions across diverse industries such as automotive, aerospace, and general manufacturing. Industry publications and corporate announcements have emphasized the growing role of curing ovens in delivering consistent thermal processing required for coatings, adhesives, composites, and advanced materials.

The market has been shaped by rising investment in energy-efficient technologies, with manufacturers focusing on ovens that reduce operational costs while maintaining strict quality standards. Additionally, the shift toward electric heating systems reflects the broader transition to sustainable industrial practices, with companies adopting clean energy technologies to align with regulatory frameworks.

Batch ovens, in particular, are being widely deployed for small- to medium-scale production due to their flexibility and ability to accommodate varied load sizes. Looking ahead, continuous advancements in automation, process monitoring, and smart control systems are expected to enhance oven performance, ensuring wider adoption across industrial applications. Emerging economies with growing industrial bases are also contributing significantly to market expansion through infrastructure development and localized manufacturing growth.

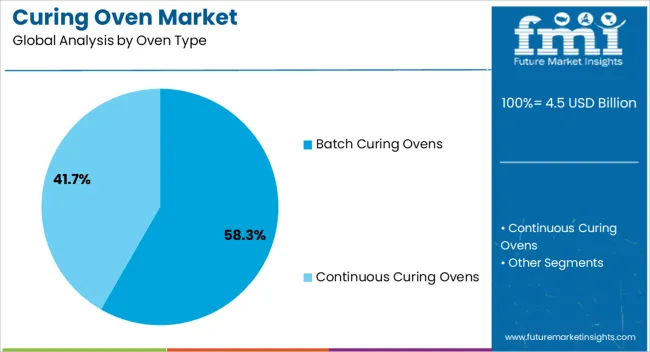

The Batch Curing Ovens segment is projected to account for 58.3% of the curing oven market revenue in 2025, establishing itself as the leading oven type. Growth in this segment has been driven by its operational flexibility, enabling manufacturers to cure a wide variety of products in smaller, controlled volumes.

Industries have favored batch curing ovens for their ability to accommodate diverse product sizes and varying curing cycles without the need for continuous operation. Production facilities have increasingly adopted these ovens in scenarios where customization, product testing, and limited batch runs are required.

Additionally, the segment’s growth has been reinforced by the relatively lower capital investment compared to large-scale continuous ovens, making them suitable for both established manufacturers and small enterprises. As industrial manufacturing diversifies into advanced materials and coatings, batch curing ovens are expected to retain their leadership due to their adaptability and cost-effectiveness.

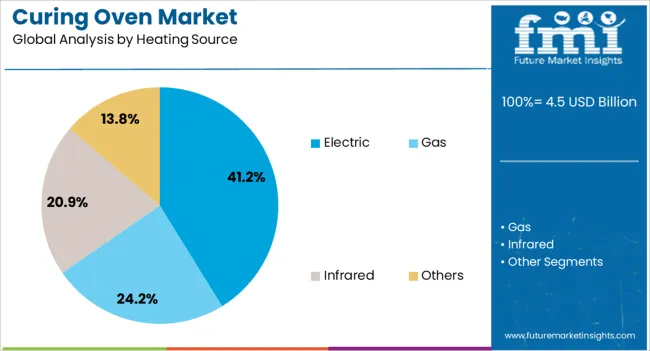

The Electric segment is projected to contribute 41.2% of the curing oven market revenue in 2025, reflecting the growing emphasis on energy-efficient and environmentally friendly heating solutions. This segment’s expansion has been supported by regulatory initiatives encouraging the reduction of fossil fuel consumption and the adoption of clean energy technologies in industrial operations.

Electric curing ovens have been increasingly chosen for their precise temperature control, consistent heating distribution, and lower emissions compared to gas-fired alternatives. Furthermore, advancements in power electronics and heating element design have improved energy efficiency and reduced operating costs, strengthening their appeal among manufacturers.

Industrial users have also highlighted the safety and ease of integration of electric ovens into automated production systems. With sustainability goals driving corporate investment strategies, the Electric segment is expected to see further adoption across multiple industries seeking compliance with environmental standards and reduced carbon footprints.

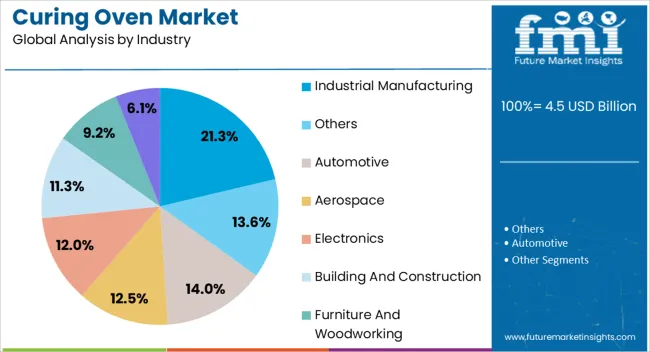

The Industrial Manufacturing segment is projected to hold 21.3% of the curing oven market revenue in 2025, maintaining its position as the leading industry segment. Growth has been underpinned by the increasing use of curing ovens in processing coatings, adhesives, and composites essential to manufacturing operations.

Industrial plants have utilized curing ovens to ensure durability, surface protection, and performance consistency of finished products. Reports from manufacturing associations have indicated a rise in demand for high-performance materials, particularly in machinery, tools, and fabricated components, where curing ovens play a critical role.

The expansion of industrial facilities in emerging economies has also amplified demand, as manufacturers prioritize modern, energy-efficient equipment to meet international quality standards. Additionally, integration of digital monitoring systems and IoT-enabled ovens has enhanced process control and reduced downtime in industrial operations. As industrial manufacturing continues to grow globally, curing ovens are expected to remain integral in ensuring product reliability and operational efficiency.

The initial investment needed for positioning a curing and drying manufacturing unit is significant. This constrains the entry of new and smaller producers and the expansion of their operations.

The accelerated advancement in technology portrays traditional curing and drying oven models as obsolete. The producers are obligated to steadily invest in research and development to outshine technological trends and present modern approaches to customers.

| Attributes | Details |

|---|---|

| Market Value for 2020 | USD 3259.00 million |

| Market Value for 2025 | USD 4068.10 million |

| Market CAGR from 2020 to 2025 | 4.50% |

The segmented curing oven market analysis is included in the following subsection. Based on comprehensive studies, the batch oven sector is controlling the oven type category. Followed by, the industrial manufacturing sector takes precedence in the industry category.

| Segment | Batch Curing Oven |

|---|---|

| Share (2025) | 58.30% |

Flexibility in production process cataloguing enhances operational efficiency by curbing idle time and permitting effective resource adoption. Their affordability makes them attractive to producers with an assortment of production needs and proffers an economical alternative for lower amounts.

Batch curing and drying ovens are flexible, permitting a wider degree of production flexibility by obliging an assortment of product sizes and shapes in a single cycle. Batch-curing and drying ovens enable providers to amplify their product portfolio and respond to the demand by facilitating personalization and experimentation.

| Segment | Industrial Manufacturing |

|---|---|

| Share (2025) | 21.30% |

Curing ovens provide economical solutions that cut production costs and surge profit margins for industrial firms. The adoption of curing ovens improves operational flexibility by satisfying a variety of industrial demands, including those for adhesives and coatings.

The reputation and competition of industrial manufacturers are improved by the amplified durability and reliability of goods that are obtained through accurate curing and drying procedures. In industrial manufacturing, curing and drying ovens provide reliable performance and quality assurance that make adherence to rigid industry standards and regulations less complicated.

The curing oven market can be observed in the subsequent tables, which focus on the leading regions in North America, Europe, and Asia Pacific. A comprehensive evaluation demonstrates that Asia Pacific has enormous curing and drying oven market opportunities.

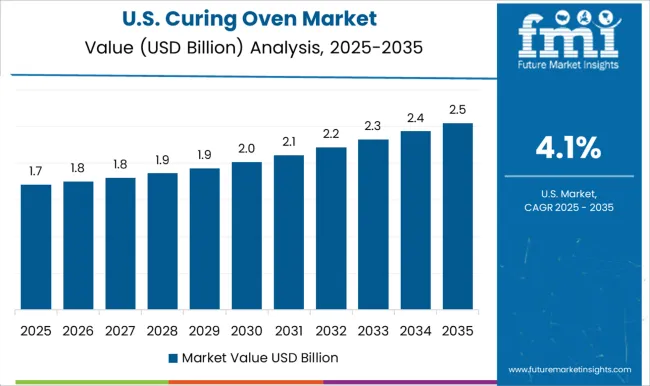

Demand Analysis of Curing Oven in North America

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 3.70% |

| Canada | 4.30% |

The stronger focus on fuel efficiency is surging the adoption of curing oven technologies. Strict bylaws regarding the control of carbon emissions inspire the merger of sustainable solutions to curing and drying ovens. The evolving investments in research and development sustain innovation in curing and drying oven designs customized to particular industrial requirements.

The ascending demand for high-performing curing ovens in the aerospace and automotive industries augments the market growth. Technological innovations like infrared curing are gaining popularity, offering better curing times and diminished energy usage

Perspectives for Curing Oven in Europe

| Countries | CAGR (2025 to 2035) |

|---|---|

| France | 4.70% |

| Spain | 4.50% |

| Italy | 4.30% |

| United Kingdom | 4.10% |

| Germany | 3.90% |

The evolving pharmaceutical industries in France amplify the demand for reliable ovens to warrant the effectiveness of healthcare products. The expanding market for quality cured products in the food sector strengthens the adoption of curing oven technologies in France. With a concentration on sustainability, French producers are progressively putting money into curing ovens fitted with earth-conscious attributes to curb ecological impact.

Government schemes encouraging imperishable energy adoption are facilitating the incorporation of solar-powered ovens in Spain. Spain's promising aerospace industry thrives on the demand for specialized ovens proficient in satisfying strict performance and safety benchmarks for integrated materials. The trend towards modification and personalization in consumer products soars the adoption of small-scale curing and drying ovens by artisans and craftsmen of Spain.

Potential of the Asia Pacific Curing Oven Industry

| Countries | CAGR (2025 to 2035) |

|---|---|

| India | 5.10% |

| Australia | 4.30% |

| South Korea | 4.10% |

| Japan | 3.90% |

| China | 3.30% |

As the Indian government focuses more on renewable energy, projects are escalating the growth of the curing and drying oven market in India, specifically in solar panel production. The expanding pharmaceutical sector, with strict rules, intensifies the adoption of curing and drying ovens for productive drug production.

The concentration on infrastructure evolution in India strengthens the adoption of curing ovens in the construction and fabricating industries. Ascending awareness concerning food safety and hygiene principles reinforces the demand for curing ovens in the agri-food industry in India. The curing and drying oven industry in India is upbeat in the proliferating electronics and automotive sectors, boosting demand for these solutions.

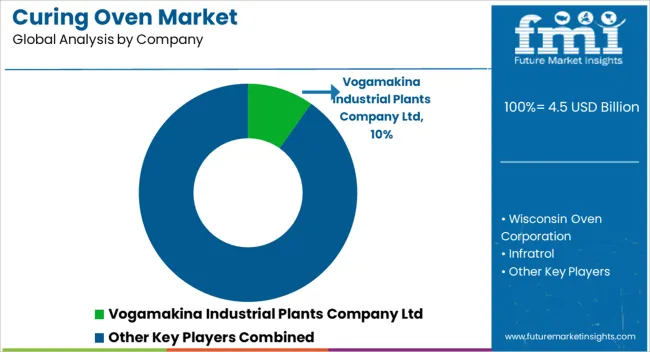

Several prominent curing oven manufacturers stand out in the market's competitive environment, each fostering innovation and growth within the sector. The main curing and drying oven producers spur competition through their dedication to quality, innovations in technology, and a wide array of products.

Among the major curing and drying oven vendors recognized for their innovations and dependability are Sailham, JPW Design and Manufacturing, and Catalytic Industrial Systems. The market's competitive dynamics are augmented by the distinctive strengths and skills that JLS Redditch Ltd, KE Hui Feiyan Shebei, and Thermal Product Solutions (TPS) bring to the table.

While Steelman Industries, Armature Coil Equipment, and Reputation Sincere DianZi offer distinctive solutions and services that meet the needs, LEWCO, WISCONSIN OVEN, and DIMA Group are preferred for being integral to the evolution of the curing and drying oven industry.

With International Thermal Systems, Changlu Group, Heller Industries, Despatch Industries, ONCE, Genlab Limited, Spooner Industries, and HENGXINDA Painting that are involved, the competitive atmosphere is strengthened, stimulating breakthroughs and soaring the market forward.

Noteworthy Observations

| Company | Genlab |

|---|---|

| Headquarter | United Kingdom |

| Portfolio |

|

| Company | Thermal Product Solutions (TPS) |

|---|---|

| Headquarter | United States |

| Portfolio |

|

| Company | Despatch Industries |

|---|---|

| Headquarter | United States |

| Portfolio |

|

Latest Developments

| Company | Heller Industries |

|---|---|

| Headquarter | United States |

| Breakthroughs |

|

| Company | The Middleby Corporation |

|---|---|

| Headquarter | United States |

| Breakthroughs |

|

| Company | LEWCO |

|---|---|

| Headquarter | United States |

| Breakthroughs |

|

The global curing oven market is estimated to be valued at USD 4.5 billion in 2025.

The market size for the curing oven market is projected to reach USD 7.3 billion by 2035.

The curing oven market is expected to grow at a 4.8% CAGR between 2025 and 2035.

The key product types in curing oven market are batch curing ovens and continuous curing ovens.

In terms of heating source, electric segment to command 41.2% share in the curing oven market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Tire Curing Bladder Release Agent Market Size and Share Forecast Outlook 2025 to 2035

Tire Curing Press Market Growth - Trends & Forecast 2025 to 2035

Paint Curing Lamp Market Size and Share Forecast Outlook 2025 to 2035

Epoxy Curing Agent Market Growth - Trends & Forecast 2025 to 2035

Light Curing Adhesives Market

TBR Hydraulic Curing Press Market Size and Share Forecast Outlook 2025 to 2035

Competitive Landscape of Oven Bag Providers

Oven Market Analysis – Growth, Demand & Forecast 2024-2034

Oven Bag Market by Bag Type & Cooking Application from 2024 to 2034

Woven Medical Tape Market Size and Share Forecast Outlook 2025 to 2035

Woven Bag Market Trends – Growth & Demand 2024-2034

Endovenous Laser Therapy Market Size and Share Forecast Outlook 2025 to 2035

Hypoventilation Management Market - Growth & Treatment Innovations 2025 to 2035

Nonwoven Fabrics Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Filter Media Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Furniture Construction Sheeting Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Packaging Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Floor Covers Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Weed Control Fabric Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Crop Cover Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA