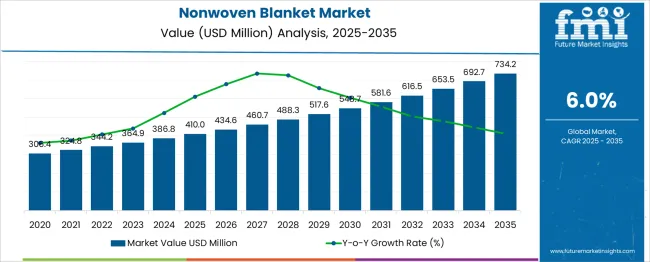

The Nonwoven Blanket Market is estimated to be valued at USD 410.0 million in 2025 and is projected to reach USD 734.2 million by 2035, registering a compound annual growth rate (CAGR) of 6.0% over the forecast period. A peak-to-trough analysis based on the extended data (2020–2035) shows that the market’s trough occurred in 2020 at USD 306.4 million, representing the lowest point before sustained growth. From this trough, the market expanded steadily to 324.8 million in 2021, 344.2 million in 2022, and 364.9 million in 2023, signalling recovery and demand normalization.

By 2024, the value climbed to 386.8 million, setting the stage for the forecast period starting in 2025 at 410.0 million. The peak projected for 2035 is 734.2 million, indicating a total increase of USD 427.8 million from the lowest point in 2020 and a growth multiplier of approximately 2.4x over 15 years. The first half of the forecast period (2025–2030) contributes USD 107.6 million, while the second half adds USD 216.6 million, confirming a back-weighted growth pattern. This peak-to-trough shift highlights strong structural demand from bedding, hospitality, and healthcare applications. Manufacturers focusing on sustainable fibres, improved durability, and efficient supply chains will benefit from this long-term upward trajectory.

| Metric | Value |

|---|---|

| Nonwoven Blanket Market Estimated Value in (2025 E) | USD 410.0 million |

| Nonwoven Blanket Market Forecast Value in (2035 F) | USD 734.2 million |

| Forecast CAGR (2025 to 2035) | 6.0% |

The nonwoven blanket market reveals a steady acceleration pattern throughout the forecast timeline, with minimal signs of volatility or mid-term deceleration. From its early base, the market demonstrates linear but compounding growth, driven by increased application across bedding, medical disposables, disaster relief kits, and institutional usage. The progression from mid-300s to over 700 million USD aligns with rising demand from hospitals, hotels, and emergency response agencies seeking lightweight, thermally efficient, and hygienic alternatives to traditional woven textiles.

While initial growth between 2020 and 2025 appears modest, the years following 2025 reflect a more pronounced expansion curve, attributed to improved production capabilities, supply chain consolidation, and growing preference for recyclable and low-cost nonwoven materials. The segment does not display a deceleration trend; instead, adoption is forecast to strengthen as regional procurement policies in Asia-Pacific and Middle Eastern countries shift toward disposable and semi-reusable materials in institutional care settings.

In developed markets, value addition through design variation, skin-friendly laminates, and antibacterial coatings is enhancing price realization. No steep inflection is projected, suggesting a consistent growth environment anchored by demand diversification rather than cyclicality. This growth pattern indicates a gradual, technology-backed acceleration without sharp tapering, placing the market in a long mid-growth phase before eventual maturity.

Rising demand for lightweight, cost-effective, and single-use bedding solutions in healthcare and hospitality environments is driving widespread adoption. Improvements in nonwoven manufacturing techniques are enhancing the softness, durability, and barrier properties of these blankets, making them viable alternatives to traditional textiles. Regulatory emphasis on infection control and waste reduction continues to accelerate the shift toward nonwoven solutions.

Future opportunities are expected to arise from innovation in biodegradable materials, customization of designs for premium segments, and expanding applications beyond medical use. Collaborative initiatives between nonwoven manufacturers and end-users are paving the way for long-term market expansion and standardization of quality benchmarks.

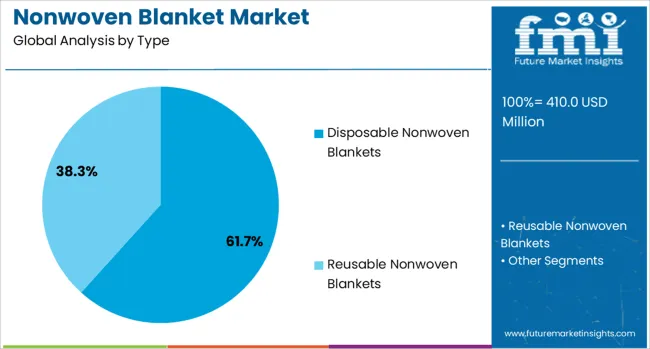

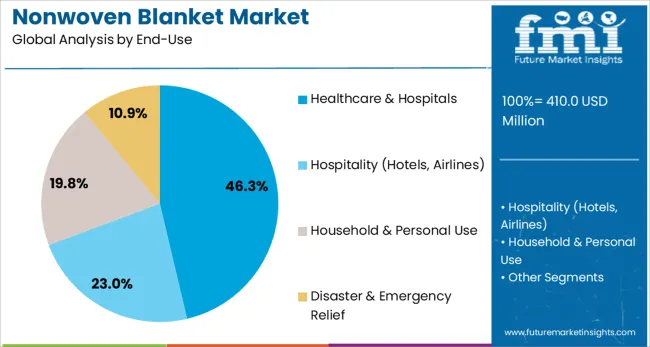

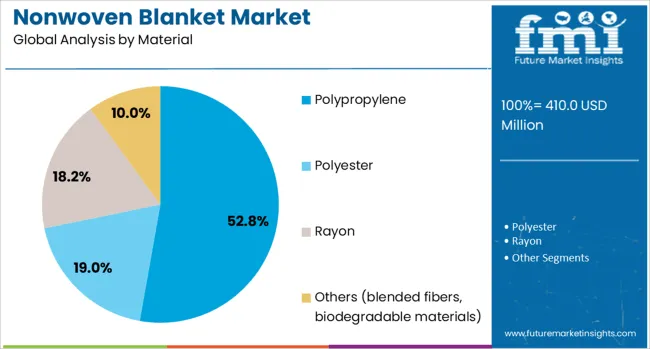

The nonwoven blanket market is segmented by type, end-use, material, and geographic regions. The nonwoven blanket market is divided by type into Disposable Nonwoven Blankets and Reusable Nonwoven Blankets. The end-use of the nonwoven blanket market is classified into Healthcare & Hospitals, Hospitality (Hotels, Airlines), Household & Personal Use, and Disaster & Emergency Relief. The nonwoven blanket market is segmented into Polypropylene, Polyester, Rayon, and Others (blended fibers, biodegradable materials). Regionally, the nonwoven blanket industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by type, disposable nonwoven blankets are projected to account for 61.7% of the total market revenue in 2025, affirming their leadership in the category. This dominance is attributed to increasing awareness of hygiene standards and infection control protocols, particularly in medical and travel environments where reuse is discouraged.

The convenience of single-use products, which eliminate laundering and cross-contamination risks, has strengthened their preference among institutional buyers. Advancements in cost-effective production and improved material performance have also supported their widespread deployment.

Disposable options have aligned well with operational priorities in fast-paced settings, where efficiency and safety take precedence. Their ability to comply with stringent cleanliness standards while offering competitive pricing has further entrenched their position as the preferred type.

Segmented by end use, healthcare and hospitals are expected to capture 46.3% of the market revenue in 2025, establishing themselves as the largest consumer segment. This leadership is driven by the sector’s critical need for sterile, disposable bedding solutions that minimize the risk of healthcare-associated infections.

The operational efficiency offered by nonwoven blankets in hospital settings has contributed to their increased adoption, enabling quicker turnover of patient rooms without compromising hygiene. Institutional procurement practices favor products that comply with strict regulatory standards while reducing laundry costs and resource consumption.

The focus on patient safety and cost containment within healthcare facilities has reinforced the prominence of this segment, making it the primary driver of demand within the market.

When segmented by material, polypropylene is anticipated to hold 52.8% of the market revenue in 2025, maintaining its leading position among materials used. This leadership is underpinned by the material’s favorable balance of strength, softness, and cost-effectiveness, which has made it a material of choice for nonwoven blanket manufacturing.

Its lightweight yet durable nature allows for efficient production while meeting the performance expectations of end-users in healthcare and hospitality sectors. The versatility of polypropylene has enabled manufacturers to develop blankets with enhanced breathability and barrier properties, further supporting its dominance.

Its compatibility with existing manufacturing infrastructure and ability to deliver consistent quality at scale have solidified its standing as the most widely used material in this market.

Nonwoven blankets are lightweight textile products formed from bonded fibers without weaving or knitting. Common materials include polypropylene, polyester, and rayon blends. These blankets are used in hygiene products, medical disposables, hospitality, and industrial filtration sectors. Demand is driven by needs for disposable, cost-effective coverings in healthcare settings, guest services, and filtration support. Manufacturers offering high absorbency, softness, tear resistance, and low lint generation are well positioned to meet user requirements. Products designed for consistent performance, easy handling, and safe disposal are shaping purchasing choices among hospitals, hotels, and hygiene product firms seeking reliable nonwoven blanket solutions.

Hybrid solar wind diesel solutions have been deployed to reduce diesel dependency and extend generator maintenance intervals. Integration of solar and wind power through advanced controllers allows dynamic load sharing and efficient battery charging sequences. Intelligent energy management systems have been introduced to monitor power flow, optimize resource utilization, and maintain voltage quality during demand fluctuations. These systems have supported power availability in critical infrastructure projects where fuel delivery constraints and logistics challenges exist. Applications in telecom towers, island resorts, and off-grid construction projects have accelerated adoption due to high operational cost savings from reduced fuel consumption and improved generator uptime.

Market expansion has been limited by volatility in raw material prices such as polypropylene and polyester fibers, which affects production costs. High-grade nonwoven materials are costlier, limiting adoption when budgets are constrained. Lack of awareness in smaller institutions and hospitality segments about proper use and disposal of nonwoven blankets has reduced adoption in some markets. Quality inconsistency from low-cost producers has led to lint shedding or poor absorbency, reducing performance reliability. Disposal regulations and restrictions on single-use textile waste in some regions have deterred procurement. Supply chain disruptions affecting fiber availability and production planning have further posed challenges to consistent market growth.

Opportunities are emerging in customized nonwoven blanket formats designed for specific end-use cases such as patient recovery, spa treatments, cosmetic services, and industrial filtration support. Partnerships with hospitals, clinics, and hotel chains enable bundled supply contracts and recurring demand. Supply to mobile healthcare units and disaster relief programs offers potential for bulk usage. Innovation in multi-layered blankets combining absorbent backing with soft top layers for comfort is opening product differentiation paths. Integration of antimicrobial finishes or moisture-wicking textile layers can add value. Subscription delivery models for hygiene providers and rental linen services could create reliable recurring revenue channels for nonwoven blanket suppliers.

The trend toward multi-layer nonwoven blankets featuring absorbent core layers combined with soft top fabrics has gained traction. Fabrics integrating moisture-wicking, odor-control, or antimicrobial treatments are becoming increasingly popular in medical and hospitality verticals. Development of compact roll formats and pre-cut blanket sheets designed for easy dispensing and fast change-out is being adopted. Use of colored, fragrance-infused, or pattern-printed nonwovens is growing in spa and guest service settings. Interest in recyclable fiber blends and reduced lint shedding formats is rising among procurement professionals. Suppliers offering consistent quality control, functional textile features, and user convenience continue to establish purchasing standards across application segments.

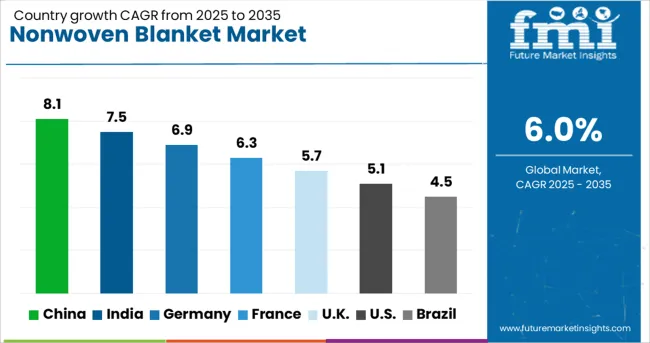

| Country | CAGR |

|---|---|

| China | 8.1% |

| India | 7.5% |

| Germany | 6.9% |

| France | 6.3% |

| UK | 5.7% |

| USA | 5.1% |

| Brazil | 4.5% |

The nonwoven blanket market is projected to expand at a CAGR of 6.0% between 2025 and 2035, driven by rising applications in insulation, bedding, and automotive interiors. Increased use in construction for thermal and acoustic insulation supports market expansion globally. China, with a CAGR of 8.1%, leads growth through large-scale production and export of cost-effective nonwoven blankets. India follows at 7.5%, supported by strong demand in residential projects and growing automotive applications. Among developed economies, Germany (6.9%) focuses on premium-grade nonwovens for energy-efficient building materials, while France (6.3%) leverages adoption in home furnishing and healthcare. The United Kingdom (5.7%) shows consistent growth through demand in bedding, commercial interiors, and specialized industrial applications. The analysis includes over 40 countries, with the top five detailed below.

China is projected to record an 8.1% CAGR, significantly higher than the global average, supported by large-scale manufacturing and diversified applications of nonwoven blankets. Construction projects for residential and commercial buildings fuel demand for thermal and acoustic insulation. Automotive interiors represent another major segment, where nonwoven blankets enhance soundproofing and passenger comfort. Chinese manufacturers dominate global supply with cost-competitive products while investing in automation to boost production efficiency. The bedding and home furnishing segments also show steady growth due to changing lifestyle preferences. Online and offline retail networks play a critical role in market penetration, while export opportunities to Southeast Asia and Africa remain strong.

India is forecast to achieve 7.5% CAGR, driven by increasing residential construction and the adoption of nonwoven blankets for bedding and furnishing applications. The home textiles segment remains the largest consumer category, supported by urban housing projects and growing demand for comfort-driven products. The automotive sector is witnessing rising use of nonwoven blankets for interior soundproofing and thermal insulation. Indian manufacturers are expanding capacity with high-speed production technologies while focusing on affordable yet durable solutions to meet diverse consumer requirements. Retail networks and e-commerce platforms enhance distribution, making products widely accessible across metropolitan and semi-urban markets. Export opportunities for cost-effective blankets are also gaining momentum in the Middle East and African countries.

Germany is expected to register 6.9% CAGR, supported by advanced applications in construction, automotive, and industrial sectors. Demand for nonwoven blankets is increasing in energy-efficient building materials where thermal insulation is a key factor. Automotive interiors also utilize nonwoven blankets to improve passenger comfort and reduce noise. German manufacturers emphasize precision engineering and high-quality raw materials to cater to both domestic and export markets. Investment in automation and composite technologies ensures better durability and performance. Distribution through specialty stores and online platforms enhances consumer access, while growing demand for lightweight and high-strength materials drives continuous innovation.

France is forecast to grow at 6.3% CAGR, with significant demand originating from home textiles and healthcare sectors. Bedding products remain a leading application, supported by increased consumer spending on comfort and interior aesthetics. Hospitals and healthcare facilities are utilizing nonwoven blankets for patient care due to their lightweight and cost-effective properties. The construction industry also contributes through the adoption of insulation applications. French manufacturers are focusing on modular production lines to enhance efficiency and customization options for specific use cases. Retail channels, combined with strong e-commerce growth, improve product availability and category penetration across residential and institutional buyers.

The United Kingdom is projected to grow at 5.7% CAGR, driven by rising demand for bedding, furnishing, and commercial interior applications. The hospitality industry and office spaces increasingly adopt nonwoven blankets for aesthetic appeal and functional benefits such as sound absorption. Residential demand continues to grow through bedding and home décor segments. Automotive and transportation sectors are using nonwoven blankets for insulation purposes, further supporting market penetration. UK manufacturers prioritize high-performance materials with improved durability to meet the expectations of institutional buyers. Online marketplaces and direct-to-consumer channels provide efficient distribution, creating recurring revenue streams for leading brands.

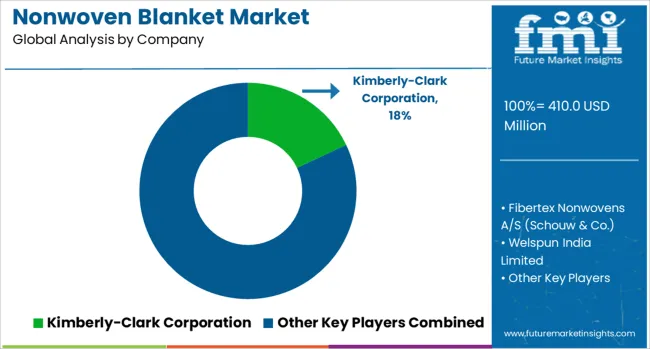

The nonwoven blanket market is moderately fragmented, featuring global and regional players such as Kimberly-Clark Corporation, Fibertex Nonwovens A/S (Schouw & Co.), Welspun India Limited, AutoTech Nonwovens Private Limited, Suominen Corporation, Freudenberg Group, Fiberweb India Limited, and Asahi Kasei Corporation. These companies cater to diverse sectors including automotive insulation, home furnishings, healthcare, and industrial applications, with nonwoven blankets offering superior thermal insulation, acoustic absorption, and lightweight performance.

Kimberly-Clark and Suominen leverage their expertise in hygiene and medical-grade nonwovens to supply high-quality blankets for hospital bedding and protective uses. Fibertex Nonwovens and Freudenberg focus on automotive-grade blankets optimized for noise reduction and heat resistance, while Welspun India and Fiberweb India deliver cost-effective solutions for home textiles and bedding. Asahi Kasei strengthens its position through advanced fiber technologies and engineered nonwoven solutions designed for durability and comfort. The market demonstrates medium entry barriers, driven by capital requirements for specialized bonding and thermal lamination technologies, along with compliance with fire safety and quality certifications.

Competitive differentiation is shaped by factors such as fiber blend composition, softness, durability, and sustainability of raw materials. Strategic initiatives include automation in production for consistent quality, customization for OEM specifications, and expanding presence in Asia-Pacific due to rising demand for automotive and residential insulation. Future growth will be propelled by innovation in eco-friendly fibers, enhanced thermal resistance, and integration of multi-functional properties like antimicrobial and moisture management, positioning companies with strong R&D capabilities and global distribution networks for long-term leadership.

| Item | Value |

|---|---|

| Quantitative Units | USD 410.0 Million |

| Type | Disposable Nonwoven Blankets and Reusable Nonwoven Blankets |

| End-Use | Healthcare & Hospitals, Hospitality (Hotels, Airlines), Household & Personal Use, and Disaster & Emergency Relief |

| Material | Polypropylene, Polyester, Rayon, and Others (blended fibers, biodegradable materials) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Kimberly-Clark Corporation, Fibertex Nonwovens A/S (Schouw & Co.), Welspun India Limited, AutoTech Nonwovens Private Limited, Suominen Corporation, Freudenberg Group, Fiberweb India Limited, and Asahi Kasei Corporation |

| Additional Attributes | Dollar sales by application (automotive insulation, home textiles, healthcare, and industrial blankets) and bonding technique (thermal, mechanical, chemical), with demand driven by comfort, durability, and acoustic performance. Regional dynamics show Asia-Pacific as the fastest-growing market supported by automotive manufacturing hubs, while North America and Europe lead in high-performance and specialty nonwoven blankets. Innovation trends focus on lightweight structures with high thermal efficiency, improved acoustic properties, and recyclable fiber blends for enhanced functionality |

The global nonwoven blanket market is estimated to be valued at USD 410.0 million in 2025.

The market size for the nonwoven blanket market is projected to reach USD 734.2 million by 2035.

The nonwoven blanket market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in nonwoven blanket market are disposable nonwoven blankets and reusable nonwoven blankets.

In terms of end-use, healthcare & hospitals segment to command 46.3% share in the nonwoven blanket market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Nonwoven Fabrics Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Filter Media Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Furniture Construction Sheeting Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Packaging Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Floor Covers Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Weed Control Fabric Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Crop Cover Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Sponges Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Air Conditioning Filter Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Flanging Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Decking Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Containers Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Baby Diaper Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Protective Clothing Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Polyester Fabric Market Growth – Trends & Forecast 2025 to 2035

Nonwovens Converting Machine Market

Nonwovens Printing Machine Market

PP Nonwovens Market Size and Share Forecast Outlook 2025 to 2035

Reinforced Nonwoven Plastics Market Size and Share Forecast Outlook 2025 to 2035

Staples PP Nonwovens Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA