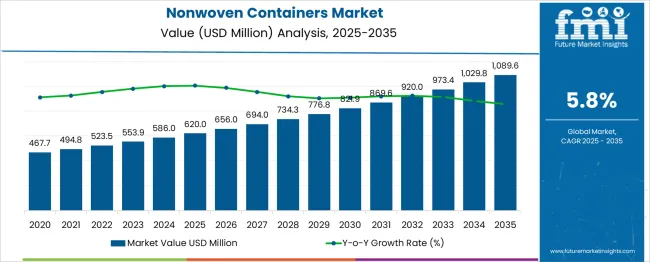

The Nonwoven Containers Market is estimated to be valued at USD 620.0 million in 2025 and is projected to reach USD 1089.6 million by 2035, registering a compound annual growth rate (CAGR) of 5.8% over the forecast period. Examining historical trends from 2020 to 2025 shows a compound rise from USD 467.7 million in 2020 to USD 620.0 million in 2025, indicating a growth of 32.5% over five years. The consistent year-over-year gains from USD 467.7 million to USD 494.8 million (5.8%), USD 494.8 million to USD 523.5 million (5.8%), and so forth demonstrate steady value creation without volatility or contraction. In terms of market share erosion or gain, the segment is currently gaining share across applications where sustainable, lightweight, and recyclable packaging alternatives are replacing traditional plastics and rigid formats.

Industries such as agriculture, food service, and consumer goods are driving demand for nonwoven containers due to their biodegradability, flexibility, and cost-efficiency. As regulations tighten around single-use plastics, nonwoven container solutions are becoming preferred choices. There is no evidence of market share erosion within the nonwoven segment itself; instead, it is cannibalizing share from conventional packaging formats. Therefore, the analysis strongly supports that the Nonwoven Containers Market is gaining market share, both in volume and value, across multiple end-use verticals.

| Metric | Value |

|---|---|

| Nonwoven Containers Market Estimated Value in (2025 E) | USD 620.0 million |

| Nonwoven Containers Market Forecast Value in (2035 F) | USD 1089.6 million |

| Forecast CAGR (2025 to 2035) | 5.8% |

The nonwoven containers market is experiencing notable growth as sustainability imperatives, convenience trends, and advancements in nonwoven technologies converge to redefine packaging solutions. Rising demand for lightweight, durable, and eco-conscious containers has driven adoption across multiple industries, particularly where single-use plastics face increasing restrictions.

Manufacturers are leveraging nonwoven materials to offer customizable, cost-efficient, and hygienic options that align with consumer expectations for sustainable yet functional packaging. Future expansion is anticipated as innovations in bio-based fibers and improved production processes make nonwoven containers more competitive in both quality and price.

Policy support favoring recyclable and compostable materials, coupled with a shift toward premium packaging in retail and food services, is expected to open new avenues for growth and wider market penetration.

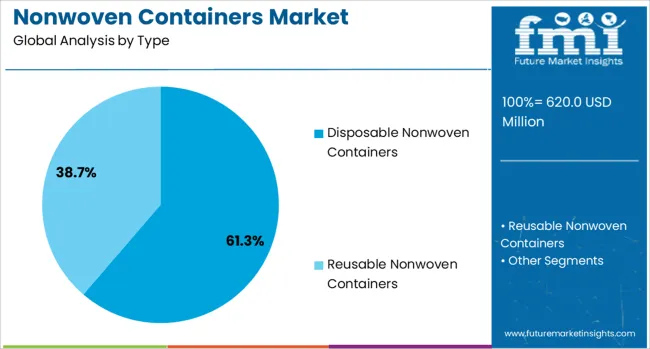

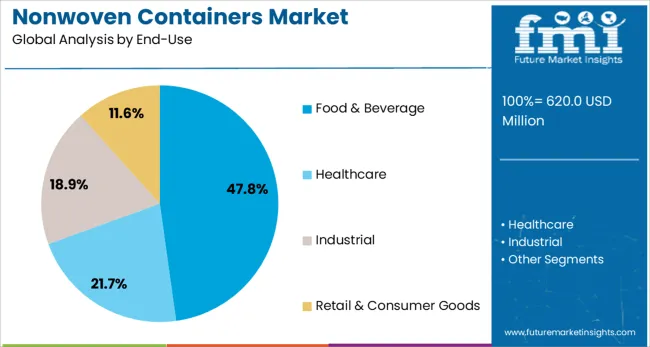

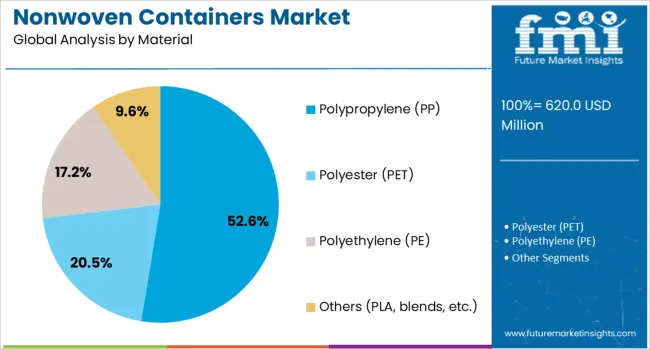

The nonwoven containers market is segmented by type, end-use, material, and geographic regions. The nonwoven containers market is divided into Disposable Nonwoven Containers and Reusable Nonwoven Containers. In terms of end-use, the nonwoven containers market is classified into Food & Beverage, Healthcare, Industrial, Retail & Consumer Goods. The nonwoven containers market is segmented into Polypropylene (PP), Polyester (PET), Polyethylene (PE), and Others (PLA, blends, etc.). Regionally, the nonwoven containers industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by type, disposable nonwoven containers are projected to hold 61.3% of the total market revenue in 2025, establishing themselves as the leading type segment. This leadership has been supported by heightened preference for single-use yet environmentally responsible solutions in sectors where hygiene and convenience remain critical.

Nonwoven technologies have enabled the development of disposable containers that are both sturdy and compliant with waste reduction mandates, making them attractive for short-cycle applications. Their lightweight and cost-efficient nature has facilitated large-scale adoption in catering, retail, and delivery services where rapid turnover and operational efficiency are paramount.

The ability to maintain product integrity while minimizing environmental impact has positioned disposable nonwoven containers as the preferred choice in scenarios requiring single-use functionality without compromising on sustainability objectives.

Segmenting by end use shows that the food and beverage industry is forecast to capture 47.8% of the market revenue in 2025, securing its position as the dominant industry segment. This dominance has been reinforced by the sector’s continuous need for hygienic, functional, and sustainable packaging solutions that meet evolving consumer preferences and regulatory expectations.

The widespread adoption of takeout and delivery services, along with increasing scrutiny on packaging waste, has compelled food service providers and retailers to shift toward nonwoven alternatives. These containers have been recognized for their ability to protect product quality while offering an environmentally responsible image to consumers.

Enhanced performance in terms of breathability, moisture resistance, and structural strength has further encouraged their deployment, particularly in fast-paced and high-volume settings where reliability and compliance play critical roles.

When segmented by material, polypropylene PP is expected to hold 52.6% of the market revenue in 2025, maintaining its leadership among material choices. This prominence has been driven by polypropylene’s optimal balance of durability, processability, and recyclability, which has made it the material of choice for nonwoven containers.

Its ability to deliver high tensile strength, resistance to moisture and chemicals, and versatility in forming various shapes has supported its widespread use in demanding applications. Polypropylene has enabled manufacturers to produce cost-effective and high-quality containers that align with sustainability goals while meeting stringent functional requirements.

Continued innovations in recycling processes and material enhancements have further bolstered its standing as the preferred material, enabling consistent performance across diverse industries and applications.

The Nonwoven Containers Market is gaining traction as industries seek lightweight, breathable, and cost-effective alternatives to traditional packaging and storage. These containers, made from spunbond, meltblown, or needle-punched nonwovens, are widely used in agriculture, horticulture, automotive, and industrial applications. Their ability to balance durability with airflow and moisture regulation makes them suitable for plant pots, bulk handling bags, and component packaging. With demand increasing for reusable and flexible material handling solutions, suppliers are expanding capacity and investing in product customization to meet industry-specific requirements.

Widespread use of nonwoven containers in the horticulture sector has been a significant growth driver. Grow bags made from spunbond nonwovens offer excellent breathability, root pruning benefits, and water retention control, making them ideal for fruit and vegetable cultivation in both open fields and controlled environments. Unlike rigid pots, nonwoven grow bags conform to soil shape and can be folded and reused, improving storage and transport efficiency for nurseries and greenhouse operators. Container farming initiatives across Asia and Europe have accelerated the adoption of these materials in rooftop gardens, hydroponic systems, and reforestation projects. Manufacturers are producing UV-resistant and biodegradable variants to address weather exposure and sustainability preferences. With seasonal crop cycles demanding consistent and scalable solutions, the horticulture industry continues to source millions of nonwoven containers annually. High-volume orders from nurseries, urban farms, and export-oriented plantations ensure steady market demand across key growing regions.

In industrial packaging and logistics, companies are shifting toward nonwoven containers as an alternative to heavier plastic or metal bins. These containers, often designed as flexible tote bags or liners, are used for transporting auto parts, electronics, and chemicals that require breathable and non-abrasive surfaces. Nonwovens offer advantages such as reduced tare weight, ease of folding for return shipments, and minimal surface marking on delicate components. Automotive and electronics manufacturers are adopting these containers for just-in-time delivery systems and parts handling in assembly lines. Logistics providers also favor nonwoven materials for temporary storage bins due to their ease of customization and low cost. Unlike rigid packaging, these containers can be quickly sized or labeled for specific inventory workflows. Adoption is expanding in Eastern Europe, Southeast Asia, and Latin America, where low-cost handling systems are prioritized. Supply chains focused on modularity and minimal material waste increasingly turn to nonwoven container formats.

Demand for customized nonwoven containers is prompting regional players to set up localized manufacturing and convertor facilities. Each industry sector has unique needs, from anti-static properties in electronics packaging to UV stability for agricultural use. Small-batch production and the need for fast turnaround times encourage proximity between suppliers and end users. For example, greenhouses often require season-specific container dimensions or fabric densities to support plant type and climate conditions. Similarly, auto suppliers prefer containers with reinforced stitching, zip closures, or color coding for part identification. These specifications require adaptive, small-scale manufacturing capacity, which large centralized factories cannot always fulfill. As a result, local producers offering rapid prototyping, sampling, and tailored fabrication are gaining a competitive edge. Proximity to customers also reduces logistics costs and ensures responsiveness to changing requirements. Regional players focused on vertical integration and client-specific services are expanding their share in this evolving container market.

Despite functional advantages, nonwoven containers face skepticism around durability and long-term reliability, especially in demanding environments. In industries like construction or bulk commodities, buyers often prefer heavy-duty plastic or metal bins that withstand abrasive handling and extended outdoor exposure. Nonwoven fabrics, especially lighter grades, are perceived as susceptible to tearing, UV degradation, or moisture damage when not properly treated. This perception limits their adoption in applications where physical stress or weather fluctuations are frequent. In addition, low-cost woven polypropylene or jute containers still dominate certain markets due to their established supply chains and proven resilience. Educating buyers on material specifications, expected lifespan, and correct usage protocols remains a challenge for suppliers. Without certifications or standardized grading systems, many procurement teams hesitate to shift away from traditional, rigid formats. Overcoming these perception hurdles will require clear performance benchmarks, demonstrations, and long-term field validation from trusted industry stakeholders.

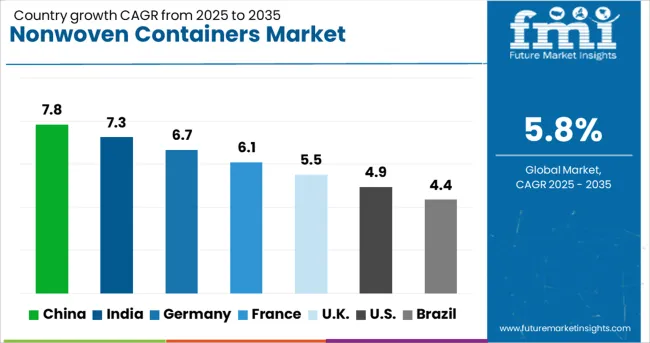

| Country | CAGR |

|---|---|

| China | 7.8% |

| India | 7.3% |

| Germany | 6.7% |

| France | 6.1% |

| UK | 5.5% |

| USA | 4.9% |

| Brazil | 4.4% |

The global nonwoven containers market is projected to grow at a CAGR of 5.8% through 2035, supported by increased application in horticulture, packaging, and storage solutions. Among BRICS nations, China leads with 7.8% growth, driven by widespread adoption in nursery operations and bulk transport. India follows at 7.3%, where demand has been supported by agricultural distribution channels and retail packaging use. In the OECD region, Germany reports 6.7% growth, aided by structured production systems and consistent industrial uptake. France, growing at 6.1%, has utilized nonwoven containers across landscaping, floriculture, and biodegradable packaging segments. The United Kingdom, at 5.5%, reflects stable demand through garden centers, institutional buyers, and export packaging. Market performance has been shaped by material classification rules, product labeling requirements, and sector-specific usage protocols. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The nonwoven containers market in China has recorded a CAGR of 7.8%, supported by increased usage across horticulture, seedling transport, and lightweight packaging segments. Agricultural cooperatives have adopted spunbond nonwoven grow bags for root-sensitive plant varieties. Container nurseries have shifted toward breathable pots for urban greenery and balcony gardening. Industrial users have used rigid-structured containers for bulk material movement. OEM packaging firms have integrated nonwoven inserts into custom tote bins for parts delivery. Municipal landscaping departments have issued seasonal tenders for nonwoven-based planting systems. Compostable variants have entered rotation among environmentally conscious farming collectives. Local distributors have scaled up inventory in larger capacities to match nursery expansion. Textile processors have converted excess spunbond stock into structured formats suited for soil load-bearing needs.

Nonwoven containers market in India has expanded at a CAGR of 7.3%, led by adoption in smallholder farms, terrace gardening, and sapling trade. Grow bag manufacturers have sourced spunbond and needlepunch fabrics to develop UV-resistant, reusable containers. State agriculture departments have distributed subsidized kits featuring nonwoven pots for community farming initiatives. E-commerce players in the gardening segment have boosted awareness of air-pruning benefits offered by breathable grow bags. Demand has also been generated by floriculture and spice nurseries situated near metro belts. Local sewing units have converted standard sheets into folded edge containers with reinforced stitching. Retail chains dealing in garden supplies have stocked round and square variants catering to potting sizes below 20 liters.

In Germany, nonwoven containers market has maintained a CAGR of 6.7%, supported by usage in modular horticulture systems, community greenhouses, and seedling production lines. Landscape architects have integrated structured nonwoven pots in rooftop vegetable gardens and mobile planter arrays. Vertical farming setups have employed shallow fabric trays for hydroponic stage propagation. Retail nurseries have supplied containerized herbs and indoor plants in biodegradable spunbond carriers. Specialty textile processors have aligned capacity toward low-weight, high-permeability fabric formats. University-led agricultural experiments have incorporated nonwoven containers for root aeration studies. Compostable nonwoven bags have been introduced for kitchen gardening and school green clubs. Design emphasis has been placed on drainage and UV-resistance parameters.

France nonwoven containers market has moved ahead with a CAGR of 6.1%, driven by deployment in seasonal plant trade, greenhouse cultivation, and soil-less farming models. Seedling producers have adopted stitched nonwoven bags with adjustable root venting zones. Community garden organizers have used breathable containers to extend growing periods for root vegetables. Urban markets have seen increased use of collapsible grow bags sold through garden centers. Farm input suppliers have bundled nonwoven containers into horticultural kits targeting balcony growers. Composting enthusiasts have used lined nonwoven containers for green waste reduction trials. Flexible tote formats have supported home-grower packaging during peak nursery seasons. Design services have promoted pre-printed container labeling for species identification.

The United Kingdom has registered a CAGR of 5.5% in the nonwoven containers market, with demand driven by horticultural societies, home-based plant propagation, and limited-space farming. Local cooperatives have favored nonwoven grow bags for improved water management and reduced transplant stress. Urban growers have used fabric pots in windowsill and balcony setups. Educational farm kits have included small-volume containers tailored for herbs and microgreens. Tool and seed retailers have offered combo packs featuring nutrient media and reusable bags. Rural garden centers have promoted bulk purchase options for seasonal growers. Design fabricators have developed cylindrical formats with side handles for easier movement. New interest has emerged in liner-based nonwoven containers used within wooden frames and raised beds.

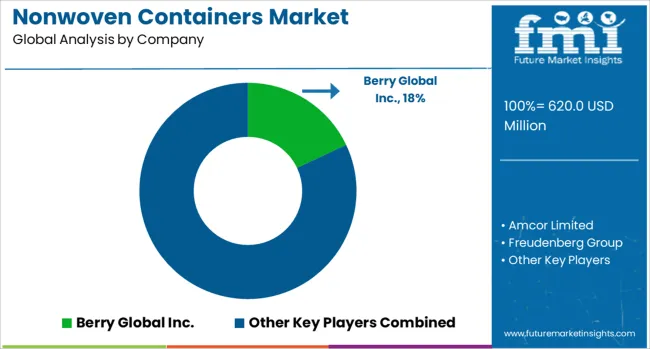

The nonwoven containers market is supported by a diverse group of manufacturers specializing in packaging solutions that combine nonwoven materials with functional container designs for healthcare, personal care, food, and industrial applications. Berry Global Inc. leads the market with a wide portfolio of nonwoven-based packaging products that offer lightweight, breathable, and durable solutions for hygienic and moisture-sensitive contents. Amcor Limited and Freudenberg Group are key players known for integrating nonwoven fabrics into flexible and semi-rigid container systems, meeting the growing demand for sustainable and high-performance packaging across global supply chains. PF Nonwovens and Mitsui Chemicals contribute significantly through material innovation, supplying high-quality nonwoven substrates used in customized container formats, particularly for pharmaceutical and medical uses.

CCL Industries and Gerresheimer AG have expanded their capabilities to include nonwoven-lined and hybrid packaging for precision dosing, sterile containment, and enhanced product protection. Emerging players like Masterchem and PET Power are gaining traction in the European market by offering versatile, cost-effective packaging solutions that incorporate nonwoven elements to improve tactile quality, ventilation, or protective layering. As the industry shifts toward eco-friendly and functional packaging, suppliers are focusing on recyclable, breathable, and contamination-resistant designs that align with regulatory and consumer demands. The market continues to evolve with a growing emphasis on combining nonwoven material benefits such as softness, flexibility, and barrier protection with advanced container engineering to serve sectors requiring both hygiene and performance.

On December 31, 2024, Mexican eco-packaging company Bocup (also known as eCup in the USA) officially expanded into the American market by launching its biodegradable, recyclable, nonwoven and compostable containers in Laredo, Texas. The company specializes in plant-based, circular-economy packaging designed for single-use food service and catering applications.

| Item | Value |

|---|---|

| Quantitative Units | USD 620.0 Million |

| Type | Disposable Nonwoven Containers and Reusable Nonwoven Containers |

| End-Use | Food & Beverage, Healthcare, Industrial, and Retail & Consumer Goods |

| Material | Polypropylene (PP), Polyester (PET), Polyethylene (PE), and Others (PLA, blends, etc.) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Berry Global Inc., Amcor Limited, Freudenberg Group, PFNonwovens, Mitsui Chemicals, CCL Industries, Gerresheimer AG, Masterchem, and PET Power |

| Additional Attributes | Dollar sales by nonwoven containers type including rigid trays, flexible pouches, tubs, and clamshells, by application in food & beverage, pharmaceuticals, consumer goods, personal care, and electronics packaging, and by geographic region including North America, Europe, and Asia‑Pacific; demand driven by sustainable packaging trends, e‑commerce growth, and hygiene requirements; innovation in recyclable polypropylene-based materials, antimicrobial coatings, and compostable designs; costs influenced by raw PP prices, meltblown/spunbond technology investment, and production scalability; and emerging use cases in eco‑friendly food containers, returnable medical packaging, and customizable retail packaging solutions |

The global nonwoven containers market is estimated to be valued at USD 620.0 million in 2025.

The market size for the nonwoven containers market is projected to reach USD 1,089.6 million by 2035.

The nonwoven containers market is expected to grow at a 5.8% CAGR between 2025 and 2035.

The key product types in nonwoven containers market are disposable nonwoven containers and reusable nonwoven containers.

In terms of end-use, food & beverage segment to command 47.8% share in the nonwoven containers market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Nonwoven Fabrics Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Filter Media Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Furniture Construction Sheeting Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Packaging Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Floor Covers Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Weed Control Fabric Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Crop Cover Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Sponges Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Air Conditioning Filter Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Flanging Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Decking Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Baby Diaper Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Protective Clothing Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Blanket Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Polyester Fabric Market Growth – Trends & Forecast 2025 to 2035

Nonwovens Converting Machine Market

Nonwovens Printing Machine Market

PP Nonwovens Market Size and Share Forecast Outlook 2025 to 2035

Reinforced Nonwoven Plastics Market Size and Share Forecast Outlook 2025 to 2035

Staples PP Nonwovens Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA