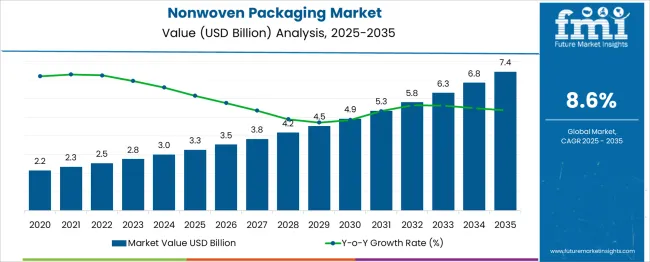

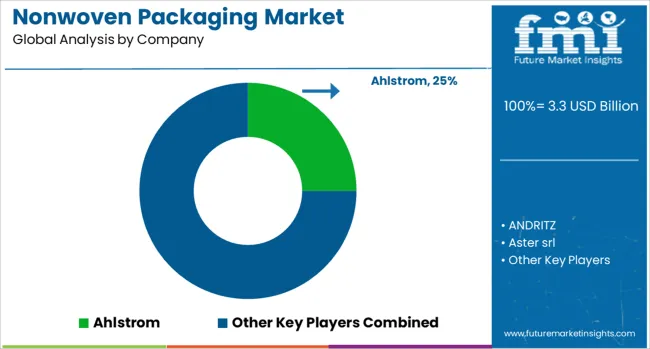

The Nonwoven Packaging Market is estimated to be valued at USD 3.3 billion in 2025 and is projected to reach USD 7.4 billion by 2035, registering a compound annual growth rate (CAGR) of 8.6% over the forecast period. Between 2025 and 2030, the market is expected to increase from USD 3.3 billion to USD 4.9 billion, driven by rising demand for sustainable packaging solutions and the growing trend of incorporating eco-friendly materials into consumer products. Year-on-year analysis reveals steady growth, with values reaching USD 3.5 billion in 2026 and USD 3.8 billion in 2027, driven by increasing consumer demand for recyclable and biodegradable packaging.

By 2028, the market is forecasted to hit USD 4.2 billion, advancing to USD 4.5 billion in 2029 and USD 4.9 billion by 2030. Growth will be further reinforced by innovations in nonwoven fabric technologies that enhance strength, flexibility, and functionality. Manufacturers are likely to focus on offering lightweight, high-performance, and cost-effective nonwoven packaging solutions to meet consumer demand across various industries, including food and beverage, healthcare, and personal care. These dynamics position nonwoven packaging as a significant player in the shift towards sustainable packaging solutions.

| Metric | Value |

|---|---|

| Nonwoven Packaging Market Estimated Value in (2025 E) | USD 3.3 billion |

| Nonwoven Packaging Market Forecast Value in (2035 F) | USD 7.4 billion |

| Forecast CAGR (2025 to 2035) | 8.6% |

The nonwoven packaging market is witnessing strong growth, driven by increasing demand for sustainable, lightweight, and cost-effective packaging solutions across industries. The shift from conventional woven and plastic-based materials toward nonwoven formats is being propelled by their superior durability, recyclability, and aesthetic appeal.

Growing consumer awareness of environmental impact and regulatory measures restricting single-use plastics have created favorable conditions for adoption. The market is also benefitting from advancements in material science, enabling the production of high-strength, customizable nonwoven fabrics suited for diverse applications.

Future growth opportunities are expected to arise from continued innovation in biodegradable and compostable nonwoven materials, expansion of retail and e-commerce channels, and rising preference for premium, reusable packaging options. The confluence of these factors is creating a strong foundation for sustained expansion and broader penetration across end-use sectors.

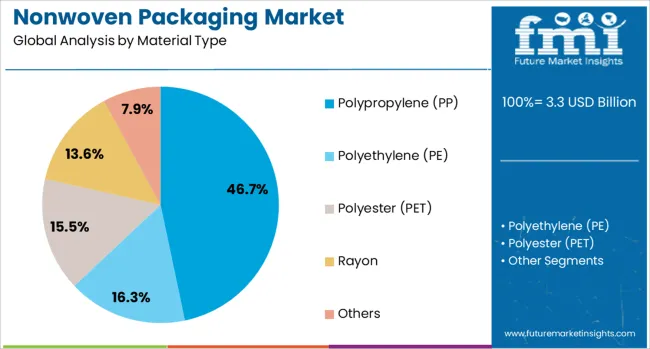

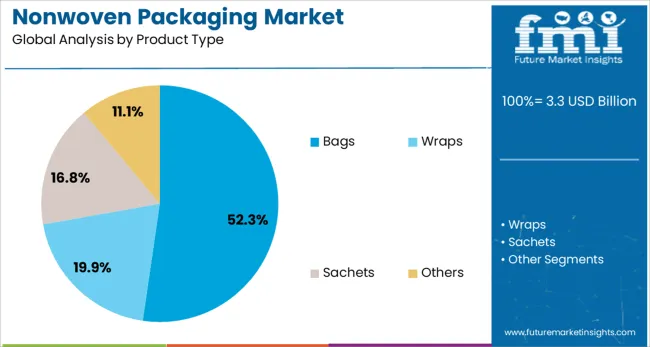

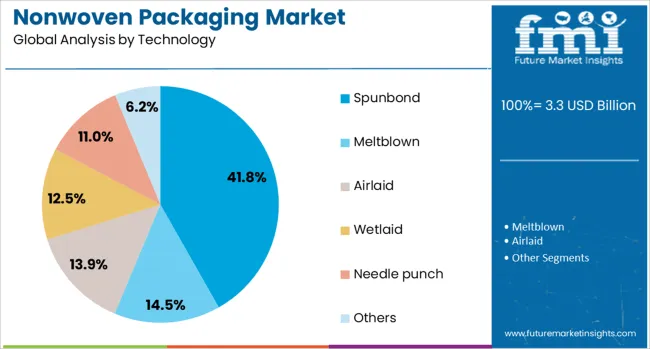

The nonwoven packaging market is segmented by material type, product type, technology, end-use industry, and geographic regions. By material type, the nonwoven packaging market is divided into Polypropylene (PP), Polyethylene (PE), Polyester (PET), and others. In terms of product type, the nonwoven packaging market is classified into Bags, Wraps, Sachets, and others. Based on technology, the nonwoven packaging market is segmented into Spunbond, Meltblown, Airlaid, Wetlaid, Needle punch, and others. By end-use industry, the nonwoven packaging market is segmented into Food & beverage, Healthcare, Consumer goods, Industrial, Agriculture, Retail, and others. Regionally, the nonwoven packaging industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by material type, polypropylene accounts for 46.7% of the total market revenue in 2025, positioning it as the leading material. This dominance is attributed to the material’s inherent qualities, such as lightweight strength, cost efficiency, and ease of processing.

Its compatibility with various nonwoven technologies has allowed manufacturers to produce high-quality, reusable packaging at scale. Polypropylene has also gained preference due to its recyclability and ability to meet regulatory standards, making it a preferred choice for environmentally conscious brands.

In terms of product type, bags are projected to hold 52.3% of the market revenue in 2025, establishing themselves as the most prominent product category. Their leadership is supported by growing consumer and retailer demand for convenient, reusable, and visually appealing carry solutions.

Bags have become an essential component of retail, promotional, and grocery packaging due to their functionality and capacity to serve as a branding medium. The ability to produce them in various sizes, designs, and strength levels has further enhanced their appeal.

Segmented by technology, spunbond is expected to capture 41.8% of the market revenue in 2025, maintaining its position as the leading technology segment. This prominence is underpinned by its cost-effectiveness, high production speed, and ability to produce uniform and durable fabrics suitable for packaging.

The simplicity and efficiency of the spunbond process have made it widely adopted by manufacturers seeking to meet growing market demand while ensuring product quality. Its adaptability to different material types and capability to produce lightweight yet strong fabrics have further strengthened its position.

The nonwoven packaging market is driven by the increasing demand for cost-effective, lightweight, and durable packaging solutions. Key opportunities exist in the food and consumer goods sectors, where nonwoven materials are becoming more widely adopted. Trends like smart packaging and material innovations are shaping the market, while challenges such as high material costs and production complexity persist. By 2025, overcoming these barriers and leveraging advancements in functionality will help ensure continued market growth.

The nonwoven packaging market is experiencing growth due to the increasing demand for lightweight and cost-effective packaging materials. Nonwoven fabrics provide a durable, flexible, and economical alternative to traditional packaging materials like plastic and cardboard. The shift towards more efficient and versatile packaging options is a key driver, especially in industries such as food and beverage and consumer goods. By 2025, continued consumer preference for practical, low-cost packaging is expected to fuel further expansion of the nonwoven packaging sector.

Opportunities for the nonwoven packaging market lie in the increasing adoption of nonwoven materials in food and consumer goods packaging. These materials offer excellent moisture resistance and breathability, making them ideal for packaging fresh produce, snacks, and other perishable goods. With the rising demand for convenient and effective packaging solutions, nonwoven fabrics are becoming increasingly popular for both primary and secondary packaging applications. These trends are expected to continue growing through 2025, contributing to further market expansion.

Emerging trends in the nonwoven packaging market include the growing focus on functional packaging solutions. Smart packaging, which integrates sensors and tracking features, is gaining traction for its ability to enhance product traceability and improve shelf-life management. The development of advanced nonwoven materials, which offer greater strength and protection while maintaining flexibility, is also a key trend. By 2025, the demand for more intelligent, multifunctional packaging solutions will likely drive further innovations in nonwoven packaging materials.

Despite the growth potential, the nonwoven packaging market faces challenges due to high material costs and complex production processes. The cost of raw materials, especially nonwoven fibers, can fluctuate, impacting the overall profitability of manufacturers. Additionally, the production process for nonwoven fabrics can be labor-intensive and require specialized machinery, further driving up costs. These challenges may limit market growth, especially in regions with budget constraints. Overcoming these hurdles will require greater supply chain optimization and cost management strategies by 2025.

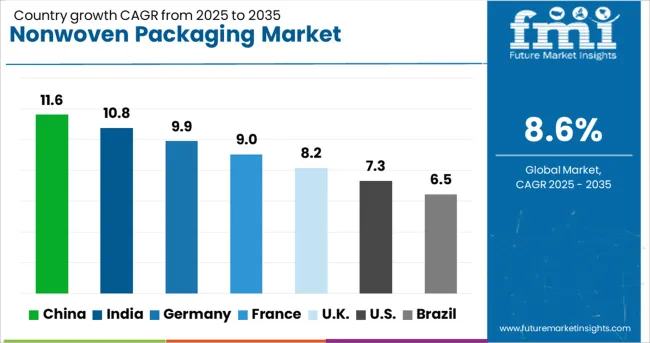

| Country | CAGR |

|---|---|

| China | 11.6% |

| India | 10.8% |

| Germany | 9.9% |

| France | 9.0% |

| UK | 8.2% |

| USA | 7.3% |

| Brazil | 6.5% |

The global nonwoven packaging market is projected to grow at a 8.6% CAGR from 2025 to 2035. China leads with a growth rate of 11.6%, followed by India at 10.8%, and France at 9.0%. The United Kingdom records a growth rate of 8.2%, while the United States shows the slowest growth at 7.3%. These varying growth rates are influenced by increasing consumer demand for sustainable packaging solutions, growth in e-commerce, and industrial packaging needs. Emerging markets like China and India are witnessing rapid adoption due to increased manufacturing and retail expansion, while mature markets like the USA and the UK experience steadier growth driven by existing demand and regulatory pressures toward sustainability.

The nonwoven packaging market in China is growing rapidly, with a projected CAGR of 11.6%. China’s booming retail and e-commerce industries, combined with rising consumer demand for sustainable packaging solutions, are key drivers of market growth. The country’s strong manufacturing base, coupled with increasing industrial and commercial activities, is contributing to the demand for nonwoven packaging materials. Furthermore, China’s growing environmental concerns and government regulations aimed at reducing plastic waste are pushing for the adoption of eco-friendly alternatives, including nonwoven packaging. This growth is supported by advancements in manufacturing technologies and the increasing availability of nonwoven materials in packaging applications.

The nonwoven packaging market in India is projected to grow at a CAGR of 10.8%. India’s expanding retail and food industries, along with a growing focus on sustainable packaging, are driving the demand for nonwoven packaging materials. As consumer awareness of environmental issues increases, more businesses are seeking alternatives to plastic packaging. Additionally, India’s growing e-commerce sector is further fueling demand for lightweight, durable, and sustainable packaging solutions. The country’s industrial growth, coupled with government initiatives to promote eco-friendly packaging, is expected to continue driving the market’s expansion in the coming years.

The nonwoven packaging market in France is expected to grow at a CAGR of 9.0%. France’s strong focus on sustainability and reducing environmental impact is driving the adoption of nonwoven packaging solutions. The growing demand for eco-friendly packaging, particularly in the food and beverage industry, is significantly contributing to market growth. France’s regulatory framework, which includes strict packaging waste and recycling laws, further accelerates the shift toward nonwoven and sustainable materials. Additionally, the increasing demand for innovative and biodegradable packaging in France’s robust retail and e-commerce sectors is driving the market’s expansion.

The nonwoven packaging market in the United Kingdom is projected to grow at a CAGR of 8.2%. The UK commitment to sustainability and reducing plastic waste is fueling the demand for nonwoven and other eco-friendly packaging materials. As consumers and businesses continue to prioritize sustainability, the adoption of nonwoven packaging solutions is becoming increasingly popular. The UK growing e-commerce industry and increasing demand for sustainable packaging in sectors such as food, healthcare, and retail are further driving market growth. Despite slower growth compared to emerging markets, the UK remains a significant market for nonwoven packaging.

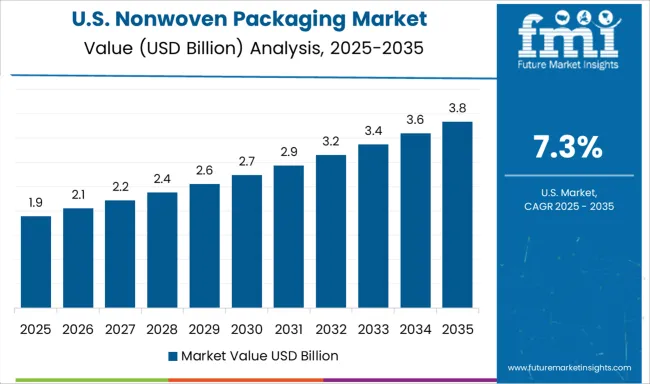

The nonwoven packaging market in the United States is expected to grow at a CAGR of 7.3%. The USA market for nonwoven packaging is driven by increasing consumer demand for eco-friendly solutions and sustainability initiatives across industries. The growing e-commerce sector, particularly in the food, healthcare, and retail industries, is contributing to steady demand for nonwoven materials. While market growth is slower compared to emerging markets, government regulations and rising consumer preference for sustainable packaging alternatives are expected to support continued adoption of nonwoven packaging materials in the USA

The nonwoven packaging market exhibits moderate barriers to entry, primarily due to high capital investment in advanced production equipment, compliance with international packaging and environmental standards, and the need for technical expertise in fiber engineering and material performance. New entrants must navigate stringent regulations on food contact safety, biodegradability, and recycling certifications while establishing reliable supply chains. Regional expansion strategies are increasingly focused on high-growth markets in Asia-Pacific, Latin America, and the Middle East, where rising e-commerce, packaged food demand, and cosmetic industries present significant opportunities.

Leading players leverage joint ventures, localized production, and distribution partnerships to capture market share efficiently, ensuring both cost optimization and adherence to regional compliance standards. Market challenges include fluctuating raw material prices, evolving environmental regulations, and intensifying competition from established companies with strong R&D capabilities. Companies must innovate in sustainable fibers, multi-layered nonwovens, and biodegradable or recyclable solutions while maintaining packaging performance.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.3 Billion |

| Material Type | Polypropylene (PP), Polyethylene (PE), Polyester (PET), Rayon, and Others |

| Product Type | Bags, Wraps, Sachets, and Others |

| Technology | Spunbond, Meltblown, Airlaid, Wetlaid, Needle punch, and Others |

| End Use Industry | Food & beverage, Healthcare, Consumer goods, Industrial, Agriculture, Retail, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Ahlstrom, ANDRITZ, Aster srl, BENZ Packaging, CK Fabrics, Felix Nonwovens, and Jayashree Spun Bond |

| Additional Attributes | Dollar sales by material type and application, demand dynamics across food, healthcare, and consumer goods sectors, regional trends in nonwoven packaging adoption, innovation in biodegradable and recyclable materials, impact of regulatory standards on sustainability and safety, and emerging use cases in eco-friendly packaging solutions and supply chain optimization. |

The global nonwoven packaging market is estimated to be valued at USD 3.3 billion in 2025.

The market size for the nonwoven packaging market is projected to reach USD 7.4 billion by 2035.

The nonwoven packaging market is expected to grow at a 8.6% CAGR between 2025 and 2035.

The key product types in nonwoven packaging market are polypropylene (pp), polyethylene (pe), polyester (pet), rayon and others.

In terms of product type, bags segment to command 52.3% share in the nonwoven packaging market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Packaging Supply Market Size and Share Forecast Outlook 2025 to 2035

Packaging Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tubes Market Size and Share Forecast Outlook 2025 to 2035

Packaging Jar Market Forecast and Outlook 2025 to 2035

Packaging Barrier Film Market Size and Share Forecast Outlook 2025 to 2035

Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Packaging Laminate Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Fabrics Market Size and Share Forecast Outlook 2025 to 2035

Packaging Burst Strength Test Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tapes Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Packaging Materials Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Filter Media Market Size and Share Forecast Outlook 2025 to 2035

Packaging Labels Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Furniture Construction Sheeting Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Floor Covers Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Weed Control Fabric Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Crop Cover Market Size and Share Forecast Outlook 2025 to 2035

Packaging Equipment Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Sponges Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Air Conditioning Filter Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA