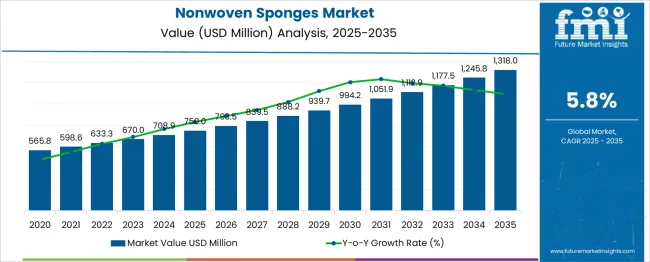

The Nonwoven Sponges Market is estimated to be valued at USD 750.0 million in 2025 and is projected to reach USD 1318.0 million by 2035, registering a compound annual growth rate (CAGR) of 5.8% over the forecast period. This growth reflects a steady CAGR of 5.8%, driven by increasing demand for nonwoven sponges in healthcare, household, and industrial cleaning applications. In the first five-year phase (2025–2030), the market is expected to grow from USD 750 million to USD 1,012 million, adding USD 262 million, which accounts for 46.1% of the total incremental growth, driven by advances in sponge manufacturing and wider adoption in medical and cleaning products.

The second phase (2030–2035) contributes USD 306 million, representing 53.9% of incremental growth, reflecting increased penetration in new industries such as automotive cleaning, hospitality, and foodservice sectors. Annual increments will rise from USD 55 million in the early years to USD 72 million by 2035, driven by growing applications and the demand for high-quality, eco-friendly sponges. Manufacturers focusing on product innovation, sustainability, and cost-effective solutions will capture the largest share of this USD 568 million opportunity, particularly in regions emphasizing green products and advanced cleaning technologies.

| Metric | Value |

|---|---|

| Nonwoven Sponges Market Estimated Value in (2025 E) | USD 750.0 million |

| Nonwoven Sponges Market Forecast Value in (2035 F) | USD 1318.0 million |

| Forecast CAGR (2025 to 2035) | 5.8% |

The nonwoven sponges market is undergoing sustained growth as healthcare providers increasingly prioritize infection control, cost efficiency, and regulatory compliance in wound care and surgical procedures. Demand for sterile and high-absorbency products has intensified, supported by rising surgical volumes and stringent hygiene standards in clinical settings.

Manufacturers are responding with innovations in material composition and sterilization techniques to meet evolving clinical needs. The market’s future outlook is shaped by continued investment in healthcare infrastructure, rising patient awareness regarding post-operative care, and growing emphasis on single-use products to minimize cross-contamination risks.

Emerging trends such as biodegradable materials and improved manufacturing automation are paving the way for wider adoption, particularly in both developed and emerging healthcare systems. This trajectory reflects the intersection of technological advancement, regulatory focus on patient safety, and the imperative to optimize operational workflows within medical facilities.

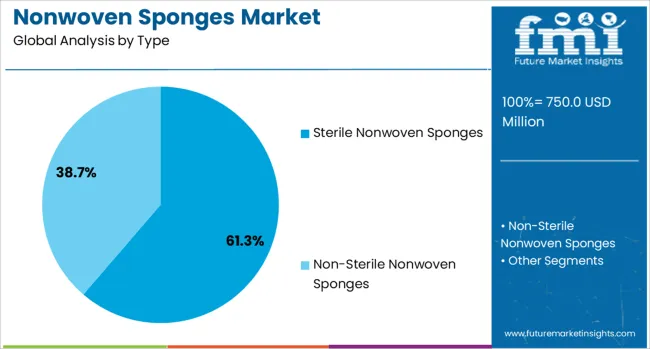

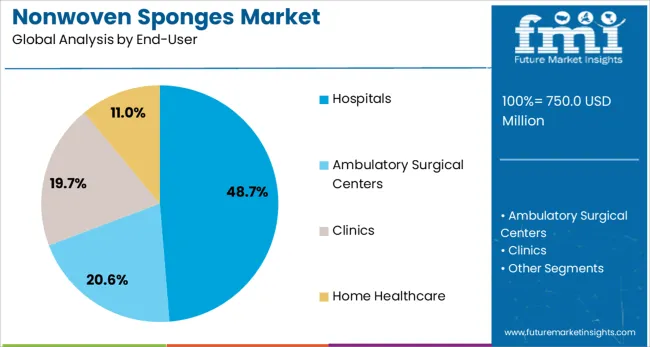

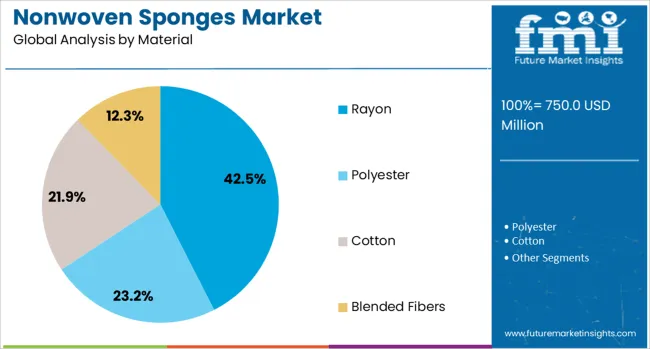

The nonwoven sponges market is segmented by type, end-user, material, and geographic regions. By type, the nonwoven sponges market is divided into Sterile Nonwoven Sponges and Non-Sterile Nonwoven Sponges. In terms of end-users of the nonwoven sponges market, it is classified into Hospitals, Ambulatory Surgical Centers, Clinics, and Home Healthcare. The nonwoven sponges market is segmented into Rayon, Polyester, Cotton, and Blended Fibers. Regionally, the nonwoven sponges industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by type, sterile nonwoven sponges are expected to account for 61.30% of total market revenue in 2025, positioning it as the dominant type. This leadership is attributed to heightened requirements for sterility assurance in operating rooms and wound management to prevent infections.

The segment’s growth has been supported by hospitals’ preference for ready-to-use, sterilized products that reduce preparation time and lower the risk of contamination during procedures. Enhanced manufacturing processes ensuring consistent quality and compliance with global sterilization standards have further reinforced adoption.

The convenience of eliminating in-house sterilization, coupled with improved shelf life and cost effectiveness in bulk procurement, has sustained the prominence of sterile nonwoven sponges. This has been complemented by rising patient expectations for higher hygiene standards, driving healthcare providers to favor sterile variants over their non-sterile counterparts.

Segmented by end user, hospitals are projected to capture 48.7% of the nonwoven sponges market revenue in 2025, maintaining their leading position. This dominance is underpinned by the sheer volume of surgical and wound care procedures conducted within hospital settings, where adherence to strict infection control protocols is critical.

Hospitals have prioritized single-use, disposable products like nonwoven sponges to comply with regulatory guidelines and minimize the risk of hospital-acquired infections. Centralized purchasing and established supplier networks have enabled hospitals to negotiate favorable terms, ensuring a consistent supply of high-quality products.

Furthermore, the ability to integrate these sponges seamlessly into standardized surgical kits and procedural workflows has strengthened their utilization in hospitals. The ongoing expansion of hospital infrastructure, particularly in emerging economies, alongside increasing procedural complexity, has ensured the continued leadership of this segment.

When segmented by material, rayon is anticipated to hold 42.5% of the market revenue in 2025, establishing it as the leading material segment. This prominence has been driven by rayon’s superior absorbency, softness, and compatibility with sensitive skin, making it highly suitable for wound care and surgical applications.

Its cost efficiency compared to alternative materials, combined with its ability to maintain structural integrity even when saturated, has reinforced its widespread adoption. Manufacturers have capitalized on rayon’s favorable properties by optimizing blends and manufacturing techniques to enhance performance and meet stringent clinical requirements.

The material’s adaptability to both sterile and non-sterile formats, as well as its proven record of patient comfort and clinician preference, has solidified its leadership in the market. Additionally, the scalability of rayon-based production has supported a consistent supply, meeting the growing demand from healthcare providers globally.

The nonwoven sponges market is driven by increasing demand in healthcare and personal care sectors, where the need for absorbent and gentle products is rising. Opportunities exist in personal hygiene products and customized sponges for specific applications. Emerging trends in customization and antimicrobial features are shaping the market. However, challenges such as high raw material costs and production complexity may limit market growth. By 2025, overcoming these hurdles through efficient production and cost management will ensure continued market expansion.

The nonwoven sponges market is benefiting from the growing demand for high-performance sponges in medical and healthcare sectors. Nonwoven sponges are favored for their superior absorbency, softness, and minimal irritation, making them ideal for wound care and surgical applications. Increasing hospital visits and medical procedures are boosting their adoption. By 2025, the healthcare industry's need for effective, cost-efficient products will continue to drive the growth of nonwoven sponges, particularly in wound management and hygiene products.

The nonwoven sponges market is experiencing significant opportunities in the personal care and hygiene products industry. Nonwoven sponges are increasingly being used in products like facial cleansing wipes, makeup removers, and bath sponges due to their ability to offer gentle exfoliation and superior moisture retention. This market is expanding as consumers look for practical, eco-friendly alternatives to traditional cotton products. By 2025, increased consumer demand for versatile and effective personal care products will continue to shape market growth.

Emerging trends in the nonwoven sponges market point toward customization and multi-functional designs. Manufacturers are increasingly focused on providing sponges that cater to specific applications, such as exfoliating sponges for skincare or surgical sponges for hospitals. Additionally, the trend toward antimicrobial treatments in nonwoven sponges is rising, as consumers and healthcare professionals seek products that offer enhanced protection. These trends are expected to shape the market, with continued product diversification anticipated by 2025 to meet various consumer and healthcare needs.

Despite its growth, the nonwoven sponges market faces challenges related to rising raw material costs and production complexity. The prices of nonwoven fabrics and fibers can fluctuate, which impacts the overall cost structure of sponges. Additionally, specialized production techniques required for specific sponge functionalities, such as anti-bacterial treatments or exfoliation properties, add to the complexity and cost. These factors can limit the accessibility of nonwoven sponges, especially in price-sensitive markets, hindering overall market growth potential by 2025.

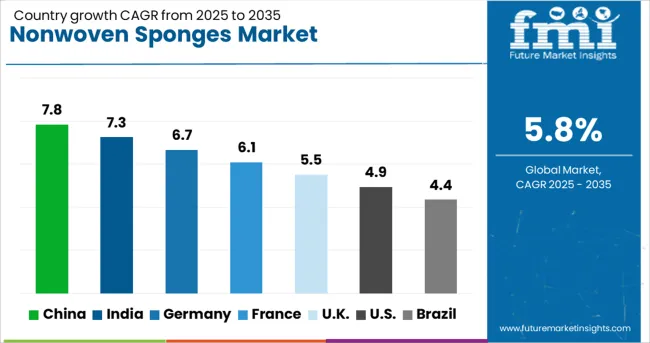

| Country | CAGR |

|---|---|

| China | 7.8% |

| India | 7.3% |

| Germany | 6.7% |

| France | 6.1% |

| UK | 5.5% |

| USA | 4.9% |

| Brazil | 4.4% |

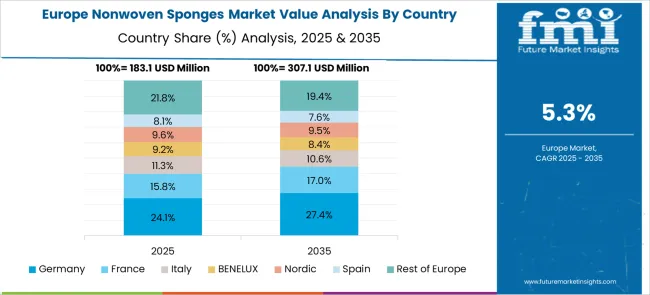

The global nonwoven sponges market is projected to grow at a 5.8% CAGR from 2025 to 2035. China leads with a growth rate of 7.8%, followed by India at 7.3%, and France at 6.1%. The United Kingdom records a growth rate of 5.5%, while the United States shows the slowest growth at 4.9%. These differences in growth rates are driven by regional demand for nonwoven sponges in healthcare, industrial, and personal care applications. Emerging markets like China and India are experiencing higher growth due to rapid industrialization, rising disposable incomes, and increasing healthcare and consumer goods demand, while more mature markets like the USA and the UK see steady growth due to established markets and innovation-driven demand. This report includes insights on 40+ countries; the top markets are shown here for reference.

The nonwoven sponges market in China is growing rapidly, with a projected CAGR of 7.8%. China’s growing healthcare, personal care, and industrial sectors are major contributors to this market’s growth. The country’s increasing disposable income and rising demand for healthcare products, particularly in wound care and personal hygiene, are driving the adoption of nonwoven sponges. Additionally, China’s growing focus on industrial applications such as cleaning, surface preparation, and product packaging further supports market expansion. The availability of cost-effective nonwoven sponge materials, coupled with advancements in manufacturing technologies, ensures China remains a dominant player in the global market.

The nonwoven sponges market in India is projected to grow at a CAGR of 7.3%. India’s expanding healthcare sector, coupled with increasing demand for hygienic and cost-effective solutions, is driving market growth. The growing awareness of wound care, personal hygiene, and cleaning products among the middle-class population is boosting the adoption of nonwoven sponges. Moreover, the expansion of industrial sectors such as automotive and manufacturing, which require nonwoven sponges for cleaning and surface preparation, further drives market demand. The increased focus on affordable healthcare and government initiatives to improve health infrastructure support market growth.

The nonwoven sponges market in France is expected to grow at a CAGR of 6.1%. France’s growing demand for personal care products, healthcare solutions, and industrial cleaning applications is contributing to the rise in nonwoven sponge usage. The country’s robust healthcare system, coupled with increasing consumer preference for nonwoven sponges in wound care and hygiene, drives market growth. Additionally, the rising trend of eco-friendly products and sustainability in France is fostering the demand for nonwoven sponges made from biodegradable and natural fibers. France’s ongoing investments in healthcare innovation and sustainability further support the adoption of nonwoven sponges.

The nonwoven sponges market in the United Kingdom is projected to grow at a CAGR of 5.5%. The UK’s strong healthcare sector, along with increasing demand for personal hygiene products and wound care solutions, continues to support steady growth in the nonwoven sponges market. The country’s growing emphasis on sustainable and eco-friendly products also drives the demand for nonwoven sponges made from biodegradable materials. The increasing use of nonwoven sponges in industrial cleaning, automotive, and manufacturing applications further fuels market growth, although the market is more mature compared to emerging economies, leading to slower growth.

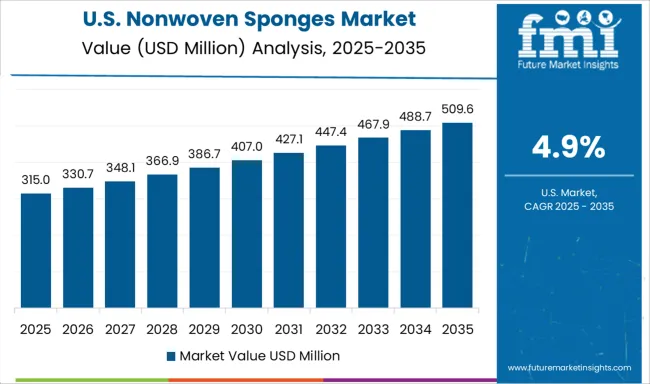

The nonwoven sponges market in the United States is expected to grow at a CAGR of 4.9%. While the USA market is mature, the demand for nonwoven sponges continues to be driven by healthcare, personal care, and industrial applications. The need for wound care, surgical applications, and hygiene products fuels steady demand for nonwoven sponges. Furthermore, the growth of the cleaning industry and increased awareness of eco-friendly products contribute to market expansion. Despite slower growth compared to emerging markets, the USA remains a key market for nonwoven sponges, supported by continuous product innovation and a strong healthcare infrastructure.

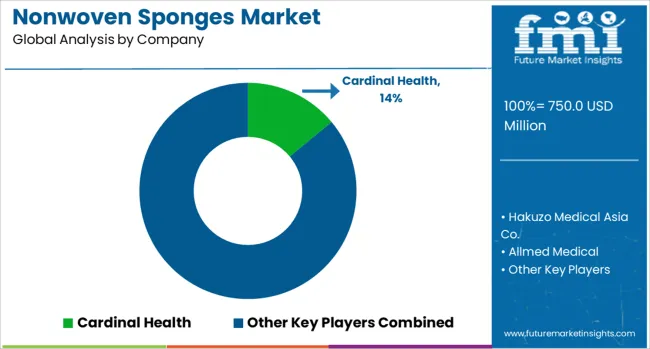

The nonwoven sponges market is dominated by Cardinal Health, which leads with its high-quality nonwoven sponges used in a range of medical applications, including wound care, surgical procedures, and infection prevention. Cardinal Health’s dominance is supported by its extensive distribution network, innovative product designs, and commitment to providing effective, sterile solutions for healthcare providers worldwide. Key players such as B. Braun, Ahlstrom-Munksjö Oyj, and Lohmann & Rauscher maintain significant market shares by offering advanced nonwoven sponges with superior absorbency, softness, and barrier properties. These companies focus on ensuring patient safety while enhancing comfort and functionality in medical settings.

Emerging players like Hakuzo Medical Asia Co., Allmed Medical, Winner Medical Ltd., and Mölnlycke are expanding their market presence by providing specialized nonwoven sponges for specific healthcare needs, such as surgical sponges, wound dressings, and absorbent pads. Their strategies include improving material quality, ensuring sterility, and offering cost-effective solutions for a wide range of medical institutions. Market growth is driven by the increasing demand for non-invasive medical products, the rise in surgical procedures, and the need for superior wound care solutions. Innovations in nonwoven technology, including antimicrobial treatments, enhanced absorbency, and biodegradable materials, are expected to continue shaping competitive dynamics and drive growth in the global nonwoven sponges market.

| Item | Value |

|---|---|

| Quantitative Units | USD 750.0 Million |

| Type | Sterile Nonwoven Sponges and Non-Sterile Nonwoven Sponges |

| End-User | Hospitals, Ambulatory Surgical Centers, Clinics, and Home Healthcare |

| Material | Rayon, Polyester, Cotton, and Blended Fibers |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Cardinal Health, Hakuzo Medical Asia Co., Allmed Medical, Hartmann, Winner Medical, Ltd, Ahlstrom-Munksjö Oyj, Lohmann & Rauscher, B. Braun, Zhende Medical, McKesson Corporation, Textil Planas Oliveras Sa, DeRoyal Industries, Jianerkang, Mölnlycke, Owens & Minor, Crosstex International, Inc. (Cantel Medical), and Kettenbach |

| Additional Attributes | Dollar sales by material type and application, demand dynamics across healthcare, cleaning, and cosmetic sectors, regional trends in nonwoven sponge adoption, innovation in absorbency and softness technologies, impact of regulatory standards on hygiene and safety, and emerging use cases in medical wound care and industrial cleaning solutions. |

The global nonwoven sponges market is estimated to be valued at USD 750.0 million in 2025.

The market size for the nonwoven sponges market is projected to reach USD 1,318.0 million by 2035.

The nonwoven sponges market is expected to grow at a 5.8% CAGR between 2025 and 2035.

The key product types in nonwoven sponges market are sterile nonwoven sponges and non-sterile nonwoven sponges.

In terms of end-user, hospitals segment to command 48.7% share in the nonwoven sponges market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Nonwoven Fabrics Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Filter Media Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Furniture Construction Sheeting Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Packaging Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Floor Covers Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Weed Control Fabric Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Crop Cover Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Air Conditioning Filter Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Flanging Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Decking Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Containers Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Baby Diaper Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Protective Clothing Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Blanket Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Polyester Fabric Market Growth – Trends & Forecast 2025 to 2035

Nonwovens Converting Machine Market

Nonwovens Printing Machine Market

PP Nonwovens Market Size and Share Forecast Outlook 2025 to 2035

Reinforced Nonwoven Plastics Market Size and Share Forecast Outlook 2025 to 2035

Staples PP Nonwovens Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA