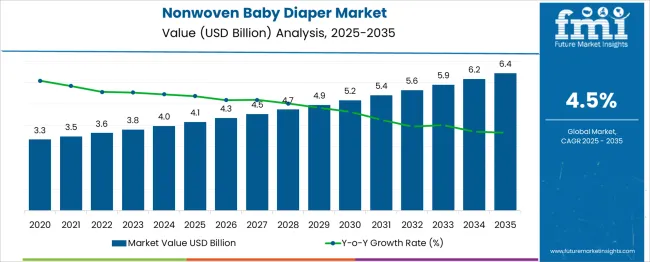

The Nonwoven Baby Diaper Market is estimated to be valued at USD 4.1 billion in 2025 and is projected to reach USD 6.4 billion by 2035, registering a compound annual growth rate (CAGR) of 4.5% over the forecast period. From 2025 to 2035, values rise consistently from USD 4.1 billion to USD 6.4 billion, reflecting growing demand driven by factors such as rising birth rates, increased awareness about infant hygiene, and improved product innovations. Analyzing the year-over-year (YoY) growth, the market experiences a steady expansion with an average annual increment of approximately USD 0.15 billion in the early years (2023-2027), gradually increasing to around USD 0.20 billion annually between 2030 and 2035. This consistent growth reflects rising consumer preference for disposable, convenient, and eco-friendly nonwoven diapers.

The expanding middle-class population and increasing healthcare awareness in emerging economies fuel demand. The market’s gradual yet persistent growth underscores its resilience, supported by technological advancements in materials that improve comfort and absorbency. Tthe nonwoven baby diaper market demonstrates a robust growth trajectory with strong absolute dollar gains, highlighting significant opportunities for manufacturers and investors over the next decade.

| Metric | Value |

|---|---|

| Nonwoven Baby Diaper Market Estimated Value in (2025 E) | USD 4.1 billion |

| Nonwoven Baby Diaper Market Forecast Value in (2035 F) | USD 6.4 billion |

| Forecast CAGR (2025 to 2035) | 4.5% |

The nonwoven baby diaper market is advancing steadily as rising birth rates in developing regions, increasing awareness of hygiene, and technological innovations in nonwoven materials reshape the industry dynamics. Consumer preference for highly absorbent, skin-friendly, and breathable diapers has accelerated the adoption of advanced nonwoven fabrics that deliver superior performance.

Manufacturers are focusing on sustainability and comfort, introducing products that minimize skin irritation while reducing environmental impact. Market momentum is also being supported by urbanization, improved distribution channels, and premiumization trends in emerging economies.

Continued research in biodegradable materials, coupled with initiatives to lower production costs, is expected to open further opportunities. The integration of smart manufacturing practices and a focus on delivering differentiated consumer experiences are paving the way for sustained growth in the market.

The nonwoven baby diaper market is segmented by type, category, diaper size, pack size, absorption level, age, price, and geographic regions. The nonwoven baby diaper market is divided into Disposable and Reusable. In terms of the category, the nonwoven baby diaper market is classified into PantTaped. Based on diaper size, the nonwoven baby diaper market is segmented into Medium, Small/Extra small, Large, and Extra large. The nonwoven baby diaper market is segmented by pack size into 40-60 count, 0-20 count, 20-40 count, and above 60 count.

The absorption level of the nonwoven baby diaper market is segmented into High and Low. The nonwoven baby diaper market is segmented into 6-18 months, 0-6 months, 18-24 months, and above 2 years. The price of the nonwoven baby diaper market is segmented into Medium, Low, and High. Regionally, the nonwoven baby diaper industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

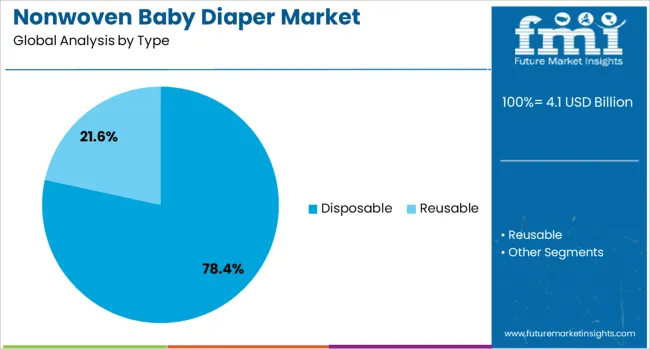

When segmented by type, the disposable segment is projected to account for 78.40% of the total market revenue in 2025, maintaining its leadership position. This dominance is being attributed to the convenience and hygiene benefits offered by disposable diapers, which align with the fast-paced lifestyles of modern parents.

The wide availability of disposable options in retail and online channels, coupled with continual improvements in absorbency and skin protection, has further strengthened their adoption. Manufacturers have been introducing thinner, lighter, and more efficient products that enhance user comfort while simplifying disposal, supporting their continued preference over reusable alternatives.

The established manufacturing infrastructure and economies of scale have allowed this segment to sustain its cost-effectiveness, reinforcing its position as the preferred choice among consumers.

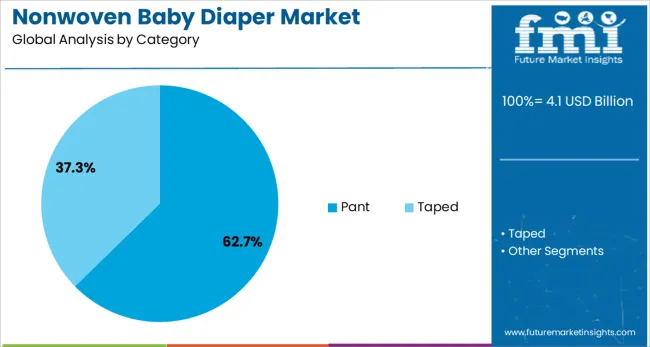

Segmented by category, the pant segment is expected to hold 62.7% of the market revenue in 2025, establishing itself as the leading category. This segment’s growth has been driven by the ease of use, superior fit, and improved comfort provided by pant-style diapers compared to traditional taped options.

Parents have been increasingly opting for pant diapers due to their convenience in quick changes, particularly for active babies and toddlers. The segment’s prominence is further supported by product innovations focused on stretchable waistbands, soft nonwoven layers, and enhanced breathability, which have resonated strongly with consumer expectations.

Retail promotions and targeted marketing campaigns highlighting the benefits of pant-style diapers have reinforced their popularity, enabling this category to capture a significant share of the market.

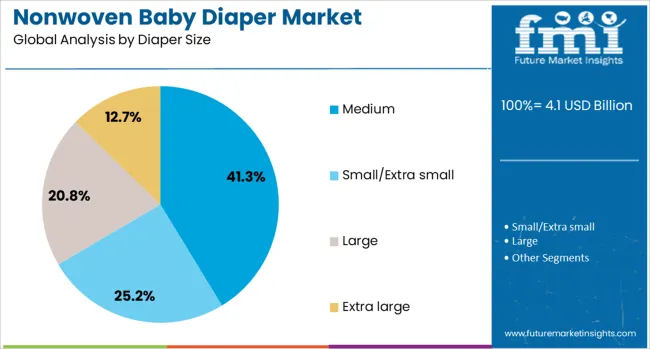

When segmented by diaper size, the medium segment is forecast to contribute 41.3% of the market revenue in 2025, positioning it as the leading size category. This leadership has been sustained by the fact that a majority of infants and toddlers fall into the weight and age range served by medium-sized diapers, resulting in higher consumption.

Manufacturers have focused on optimizing the fit and absorption performance of medium-sized diapers to cater to the most active growth phase of babies, enhancing their appeal. Retail stocking practices and promotional strategies have been aligned to ensure maximum availability of medium-sized products, further strengthening their share.

Additionally, the segment benefits from a balanced combination of usage duration and frequency, which has contributed to its dominance within the overall market.

The Nonwoven Baby Diaper Market is expanding steadily as parents seek products that offer superior comfort, absorbency, and skin protection for infants. Nonwoven materials contribute softness, breathability, and efficient fluid management, which are critical for preventing diaper rash and enhancing baby care. Increasing birth rates in emerging regions and rising disposable incomes support greater adoption of premium diapers. Manufacturers focus on innovations in materials and design, including eco-friendly options and improved fit, to meet diverse consumer preferences and regulatory standards related to safety and hygiene.

Parents increasingly prioritize baby diapers that provide exceptional comfort and prevent skin irritation, driving demand for advanced nonwoven materials. These materials offer softness and breathability while efficiently locking in moisture, reducing the risk of diaper rash. Baby diapers now commonly feature multi-layered nonwoven fabrics designed for quick absorption and dryness. Manufacturers are incorporating hypoallergenic, dermatologically tested fabrics to ensure safety for sensitive infant skin. The market benefits from rising awareness about infant hygiene and health, particularly in urban and semi-urban areas. Product differentiation also comes through ergonomic designs that improve fit and flexibility for active babies. This growing focus on comfort and skin health supports premium diaper sales, encouraging manufacturers to enhance nonwoven fabric technologies continually.

Environmental concerns push manufacturers to develop eco-friendly nonwoven materials that are biodegradable or sourced from renewable fibers. Disposable diapers traditionally contribute to landfill waste, prompting demand for greener alternatives without sacrificing performance. Companies invest in sustainable sourcing, recycling, and production methods to create diapers that appeal to environmentally conscious consumers. Efforts include using plant-based fibers, reducing chemical treatments, and optimizing nonwoven fabric blends for lower environmental impact. Some brands offer compostable diaper lines targeting niche markets willing to pay a premium. Regulatory frameworks in various countries encourage or mandate increased use of sustainable materials in baby care products. This shift encourages innovation and broadens consumer options, helping brands build long-term trust and loyalty while addressing ecological concerns.

Emerging economies with increasing birth rates, improving healthcare infrastructure, and growing middle-class populations present significant growth opportunities for nonwoven baby diapers. Rising disposable income and urbanization lead to greater adoption of disposable diapers over traditional cloth alternatives. In these regions, awareness campaigns and distribution expansion into rural and semi-urban areas help boost market penetration. Local manufacturers are investing in production capacity and tailoring product offerings to regional preferences, including cost-effective and premium diaper ranges. Additionally, government health initiatives promoting infant hygiene indirectly support market growth. Expansion of organized retail and e-commerce platforms further enhances accessibility and convenience for consumers. This demographic and economic transition in emerging markets positions them as key growth drivers for global diaper manufacturers seeking volume and value gains.

The nonwoven baby diaper market is highly competitive, with both global giants and regional players investing heavily in product innovation and marketing. Companies differentiate through patented nonwoven fabric technologies, superior absorption systems, and ergonomic designs that enhance baby comfort. Branding and packaging also play crucial roles in influencing consumer loyalty and premium positioning. Strategic partnerships with healthcare professionals and pediatricians support brand credibility and educational outreach. Private-label products continue to gain traction, especially in cost-sensitive markets, creating pricing pressures. In response, manufacturers focus on value-added features like wetness indicators, breathable waistbands, and hypoallergenic linings to justify premium prices. Marketing emphasizes trust, safety, and innovation to capture discerning parents. This competitive environment drives continuous R&D, product diversification, and channel expansion, shaping the market’s dynamic growth.

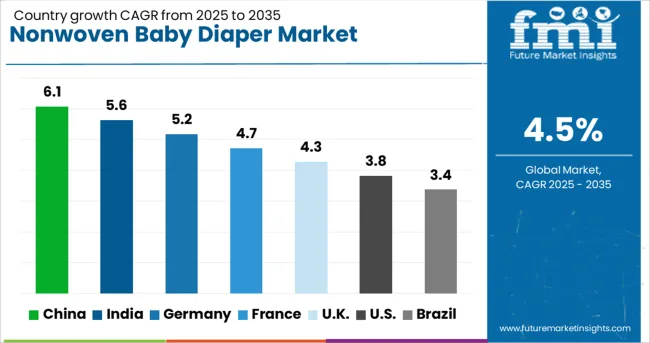

| Country | CAGR |

|---|---|

| China | 6.1% |

| India | 5.6% |

| Germany | 5.2% |

| France | 4.7% |

| UK | 4.3% |

| USA | 3.8% |

| Brazil | 3.4% |

The global nonwoven baby diaper market is projected to grow at a CAGR of 4.5% through 2035, supported by ongoing demand in infant care, healthcare facilities, and retail sectors. Among BRICS nations, China leads with 6.1% growth, driven by large-scale production and expanding domestic consumption. India follows at 5.6%, where rising birth rates and increased product availability have influenced market expansion. In the OECD region, Germany reports 5.2% growth, backed by high product quality standards and established supply chains. France, growing at 4.7%, has maintained steady demand through hospitals and retail pharmacies. The United Kingdom, at 4.3%, reflects consistent usage within both private and public caregiving environments. Market dynamics have been shaped by product safety regulations, absorbency benchmarks, and labeling requirements. This report includes insights on 40+ countries; the top five markets are shown here for reference.

Growth in the nonwoven baby diaper market in China has been recorded at a CAGR of 6.1%, driven by expanding healthcare access and rising newborn populations. Domestic manufacturers have increased production capacity by introducing ultra-absorbent core materials combined with soft nonwoven layers for enhanced comfort. Distribution channels have broadened to include tier-two and tier-three cities where disposable diapers are increasingly adopted over traditional alternatives. Retailers have diversified product portfolios with varying sizes and absorbency levels to meet regional preferences. The demand for hypoallergenic and breathable diaper variants has increased, especially in urban centers. Contract producers have ramped up specialty nonwoven fabrics to support major brands. Packaging innovations aimed at easy handling and disposal have also been implemented.

India has witnessed steady growth in the nonwoven baby diaper market at a CAGR of 5.6%, primarily supported by rising awareness of infant hygiene and increased disposable income. Local manufacturers have adopted breathable nonwoven fabric technologies to improve diaper comfort in hot climates. The rural and semi-urban sectors have shown increased acceptance of disposable diapers, driving demand for cost-efficient and mid-range products. Retail chains and online platforms have expanded accessibility, especially during festival seasons and promotions. Product development has focused on leak-proof designs combined with soft elastic waistbands. Educational campaigns on diaper usage and disposal methods have also contributed to market expansion. Packaging tailored for easy portability has been introduced to meet consumer convenience requirements.

A CAGR of 5.2% has been observed in Germany’s nonwoven baby diaper market, driven by a preference for high-performance products meeting strict regulatory standards. Diapers featuring superabsorbent polymers combined with biodegradable nonwoven layers have been adopted to reduce environmental impact. Manufacturers have focused on dermatologically tested fabrics to minimize skin irritation and allergies. Retailers have increased availability of premium and organic diaper lines to cater to eco-conscious consumers. Distribution networks have enhanced supply chain efficiencies to maintain consistent product availability. Innovations in wetness indicators and adjustable fasteners have been integrated to improve user convenience. Specialized packaging designed for recycling and minimal waste has been promoted across stores.

Growth of 4.7% CAGR has been recorded in France’s nonwoven baby diaper market as demand rises for gentle, breathable diapers with effective leak protection. Production facilities have adopted multilayer nonwoven structures that improve softness and moisture distribution. Retailers have responded to consumer preferences by stocking fragrance-free and dermatologically safe diaper options. Pediatricians and healthcare providers have supported adoption by recommending products that reduce rash incidences. Promotional activities have focused on highlighting hypoallergenic materials and natural fiber blends. Packaging innovations include compact designs for space-saving storage and enhanced portability. Seasonal demand spikes have been managed through improved inventory strategies across regional warehouses.

The United Kingdom has registered a CAGR of 4.3% in the nonwoven baby diaper market, fueled by consumer demand for gentle, high-absorbency products suited for sensitive skin. Manufacturers have integrated elasticized side panels and breathable nonwoven back sheets to improve fit and ventilation. Retailers have expanded product ranges to include hypoallergenic and dermatologically approved diapers targeting newborns and toddlers. Distribution channels have improved accessibility through pharmacy chains and e-commerce platforms. Brands have invested in packaging designs that support resealing and disposal convenience. Medical professionals have advocated for products that reduce diaper dermatitis risk, further increasing adoption. Consumer education on diaper disposal and environmental impact has also been intensified.

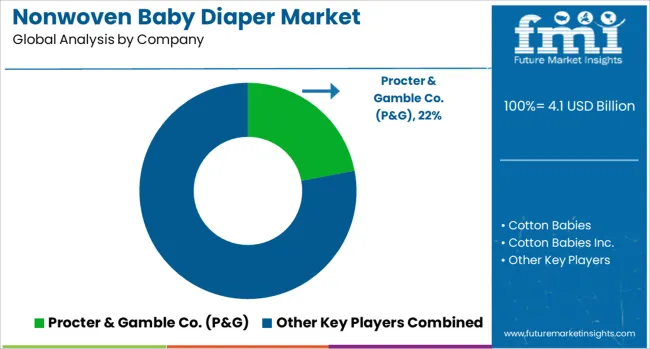

From 2020 to 2024, the nonwoven baby diaper market was dominated by well-established manufacturers like Procter & Gamble Co. (P&G), Kimberly-Clark Corp., Unicharm Corp., and Hengan International Group. These players capitalized on their robust supply chains, advanced nonwoven technologies, and strong brand loyalty to lead the market. Emphasis was placed on improving absorbency, skin-friendliness, and eco-conscious materials to address growing consumer demands. Mid-sized companies such as Drylock Technologies NV and First Quality Enterprises Inc. competed by offering cost-effective solutions and regional customization, while niche brands like Cotton Babies and The Honest Co. targeted organic and natural product segments.

The competitive environment was marked by product innovation through incremental technology advancements and strategic partnerships, with a focus on expanding distribution channels in emerging markets. Looking forward, the market is expected to face disruption from software-driven smart diaper solutions and sensor-enabled wearables that monitor infant health and hygiene in real-time. Startups integrating IoT and AI technologies are anticipated to challenge traditional manufacturers by offering personalized care products and data-driven insights. This digital transformation will compel legacy players to innovate beyond product features and embrace technology-led value propositions to stay competitive in an increasingly connected and health-conscious consumer landscape.

On July 9, 2025, Ontex Group began rolling out bioSAP a bio-based superabsorbent polymer for baby diapers. The new material delivers up to 15–25% reduction in carbon footprint, replacing conventional SAP while maintaining performance across selected products.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.1 Billion |

| Type | Disposable and Reusable |

| Category | Pant and Taped |

| Diaper Size | Medium, Small/Extra small, Large, and Extra large |

| Pack Size | 40-60 count, 0-20 count, 20-40 count, and Above 60 count |

| Absorption Level | High and Low |

| Age | 6-18 months, 0-6 months, 18-24 months, and Above 2 years |

| Price | Medium, Low, and High |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Procter & Gamble Co. (P&G), Cotton Babies, Cotton Babies Inc., Drylock Technologies NV, First Quality Enterprises, Inc., Hengan International Group Company Ltd., Johnson & Johnson Pvt Ltd., KAO Corp., KCWW, Kimberly-Clark Corp., Mamy Poko, Phillips Healthcare, Svenska Cellulosa Aktiebolaget SCA, The Hain, The Honest Co., and Unicharm Corp. |

| Additional Attributes | Dollar sales by device type including manual and electric choppers, capacity and blade configurations, and end-user segment such as residential or commercial kitchens; demand boosted by home cooking trends, food safety focus, and convenience-driven lifestyles; innovation in multi-functional modular design and cordless models; cost shaped by component sourcing and brand positioning; and rising use in meal prep apps, catering, and small-scale operations. |

The global nonwoven baby diaper market is estimated to be valued at USD 4.1 billion in 2025.

The market size for the nonwoven baby diaper market is projected to reach USD 6.4 billion by 2035.

The nonwoven baby diaper market is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in nonwoven baby diaper market are disposable and reusable.

In terms of category, pant segment to command 62.7% share in the nonwoven baby diaper market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Nonwoven Fabrics Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Filter Media Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Furniture Construction Sheeting Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Packaging Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Floor Covers Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Weed Control Fabric Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Crop Cover Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Sponges Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Air Conditioning Filter Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Flanging Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Decking Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Containers Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Protective Clothing Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Blanket Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Polyester Fabric Market Growth – Trends & Forecast 2025 to 2035

Nonwovens Converting Machine Market

Nonwovens Printing Machine Market

PP Nonwovens Market Size and Share Forecast Outlook 2025 to 2035

Reinforced Nonwoven Plastics Market Size and Share Forecast Outlook 2025 to 2035

Staples PP Nonwovens Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA