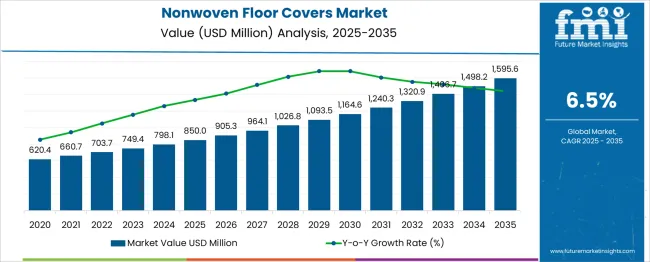

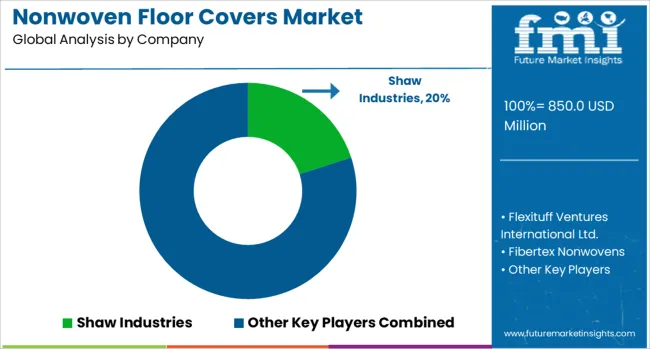

The Nonwoven Floor Covers Market is estimated to be valued at USD 850.0 million in 2025 and is projected to reach USD 1595.6 million by 2035, registering a compound annual growth rate (CAGR) of 6.5% over the forecast period. The market demonstrates steady expansion, with revenues rising from USD 620.4 million in 2020 to USD 1,595.6 million in 2035, indicating an absolute dollar opportunity of USD 975.2 million over the 15-year period. Growth is primarily driven by the rising demand for durable, hygienic, and easy-to-install floor protection solutions across commercial, residential, and industrial applications.

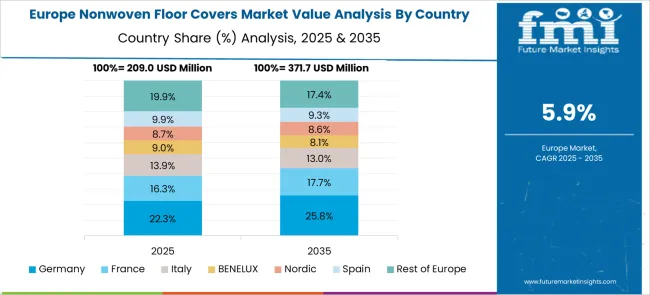

North America and Europe are leading regions, reflecting increased renovation activities, heightened awareness about floor hygiene, and adoption in high-traffic areas such as hospitals, offices, and retail spaces. The period between 2025 and 2035 presents significant opportunities, as the market grows by USD 745.6 million, highlighting a substantial revenue potential for manufacturers and distributors. Asia Pacific is expected to emerge as a high-growth region, driven by urbanization, infrastructural development, and expanding commercial construction activities, contributing roughly 25-30% of the market share by 2035. Additionally, innovations in nonwoven materials offering better durability, environmental sustainability, and cost efficiency are further expanding the market reach. Collectively, these factors ensure that the Nonwoven Floor Covers Market remains a lucrative segment within the broader nonwoven materials industry.

| Metric | Value |

|---|---|

| Nonwoven Floor Covers Market Estimated Value in (2025E) | USD 850.0 million |

| Nonwoven Floor Covers Market Forecast Value in (2035F) | USD 1595.6 million |

| Forecast CAGR (2025 to 2035) | 6.5% |

The nonwoven floor covers market is experiencing consistent growth as sustainability priorities, cost efficiency, and evolving construction trends drive demand across commercial and residential spaces. Rising emphasis on quick installation, recyclability, and lightweight materials has positioned nonwoven floor covers as a preferred choice over traditional alternatives.

Industry momentum is further supported by increasing refurbishment activities, demand for temporary flooring solutions in events and exhibitions, and heightened awareness of eco-friendly building materials. Future growth is expected to benefit from technological advances in manufacturing processes that improve durability and aesthetics while maintaining affordability.

Companies are also responding to stricter environmental norms and customer expectations by innovating with recycled and low-emission materials, paving the way for wider market adoption and deeper penetration into premium segments.

The nonwoven floor covers market is segmented by material, application, distribution channel, and geographic regions. By material, the nonwoven floor covers market is divided into Polypropylene, Polyester, Polyamide, and others. In terms of application, the nonwoven floor covers market is classified into Commercial, Residential, and Industrial. Based on distribution channel, the nonwoven floor covers market is segmented into Direct Sales, Retail Stores, and Online Channels. Regionally, the nonwoven floor covers industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

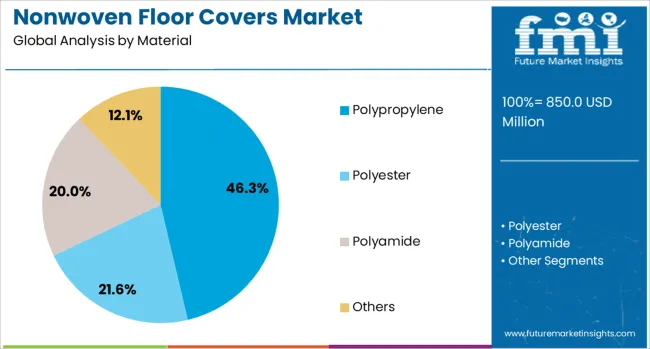

When segmented by material, polypropylene is projected to account for 46.3% of the total market revenue in 2025, making it the leading material choice. This leadership has been driven by the material’s versatility, cost effectiveness, and favorable mechanical properties, which have made it a go-to option for both temporary and permanent floor cover applications.

Its resistance to moisture, chemicals, and wear has enhanced its suitability in high traffic and demanding environments, contributing to widespread adoption. Manufacturers have increasingly utilized polypropylene due to its ease of processing and ability to incorporate recycled content, aligning with sustainability goals while maintaining performance.

The ability of polypropylene to deliver a balance between durability, design flexibility, and affordability has consolidated its dominant position in the market.

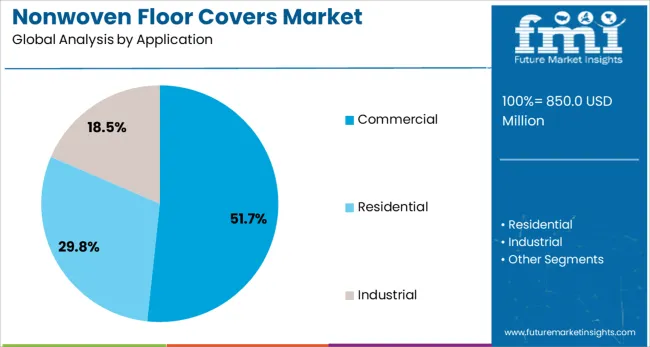

Segmented by application, the commercial segment is expected to hold 51.7% of the market revenue in 2025, securing its place as the largest application area. This dominance has been underpinned by significant demand from offices, retail spaces, hospitality venues, and event settings where durability and easy maintenance are critical.

The commercial sector has increasingly adopted nonwoven floor covers for their ability to deliver aesthetic appeal alongside functional benefits such as quick installation and removal, which is essential in temporary or frequently updated spaces. Businesses have leveraged these products to enhance interior environments while managing costs and minimizing downtime during renovations.

The strong alignment of nonwoven floor covers with the operational and design needs of commercial environments has reinforced this segment’s leading market share.

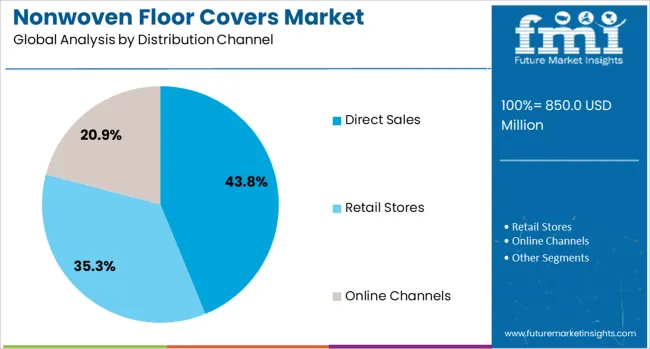

When segmented by distribution channel, direct sales are projected to represent 43.8% of market revenue in 2025, positioning it as the dominant channel. This leadership has been supported by manufacturers’ strategic focus on building direct relationships with large clients such as construction firms, corporate customers, and event organizers.

Direct sales have enabled suppliers to offer customized solutions, competitive pricing, and responsive service, which have been crucial in securing bulk orders and fostering long-term partnerships. The ability to maintain better control over the sales process, customer experience, and feedback mechanisms has further strengthened the appeal of direct engagement.

As businesses prioritize efficiency and tailored offerings, direct sales have emerged as the most effective route to market for nonwoven floor cover providers.

The nonwoven floor covers market is expanding as commercial, residential, and industrial sectors seek cost-effective, protective flooring solutions. Nonwoven materials are widely used during construction, renovation, and maintenance projects to prevent damage, reduce dust, and provide temporary protection for finished floors. Rising construction and infrastructure activities, along with increasing awareness of efficient protection methods, are driving market growth. North America and Europe lead due to advanced construction practices and regulatory standards, while Asia-Pacific shows rising adoption with growing urban development and construction projects. Innovations in lightweight, durable, tear-resistant, and water-repellent nonwoven fabrics improve usability and performance. Additionally, the demand for disposable, hygienic, and easy-to-install floor protection products is fueling expansion across residential and commercial applications.

Nonwoven floor covers are essential for protecting hardwood, tile, and carpeted surfaces during construction and refurbishment. They prevent scratches, paint spills, dust accumulation, and moisture damage, ensuring project quality and reducing repair costs. Contractors, builders, and homeowners increasingly prefer disposable and reusable floor covers for convenience, cost efficiency, and labor savings. Industrial applications, including event setups and logistics, also drive demand for high-strength nonwoven covers. Manufacturers are enhancing products with anti-slip coatings, water resistance, and abrasion resistance to increase safety and durability. Rising awareness of floor protection practices, combined with busy construction schedules and high-value flooring investments, ensures continued adoption of nonwoven floor covers across commercial and residential segments.

Advancements in nonwoven material technology are improving the performance of floor covers. Techniques such as spunbond, meltblown, and composite laminates enhance durability, tear resistance, and moisture protection. Lightweight and flexible designs simplify installation and removal while maintaining strong protection. Anti-slip coatings, UV resistance, and eco-friendly material options add functional and environmental benefits. Manufacturers are producing multi-layered products to combine cushioning, protection, and durability. Consistent thickness, high tensile strength, and uniform coverage ensure effective surface protection across varied flooring types. Continuous research in nonwoven fibers and laminates supports higher performance standards and differentiates products in competitive markets, meeting the evolving needs of construction, renovation, and maintenance projects.

The nonwoven floor covers market benefits from efficient supply chains, regional production, and scalable manufacturing capabilities. Lightweight packaging and bulk availability allow easy transport and onsite deployment, reducing labor and logistics costs. Manufacturers offering standardized quality and customizable sizes strengthen brand credibility and adoption. Construction companies and contractors often rely on recurring seasonal orders, ensuring sustained demand. Regional markets vary based on construction activity, flooring types, and project scale, influencing product offerings and distribution strategies. Companies focusing on reliable production, regional warehouses, and strategic partnerships enhance market penetration. The combination of operational efficiency, product versatility, and robust supply networks drives continued growth in global nonwoven floor cover adoption.

North America and Europe dominate the nonwoven floor covers market due to high-value construction projects, strict quality standards, and advanced adoption of protective materials. Asia-Pacific is emerging rapidly, fueled by expanding urbanization, industrialization, and residential construction. Latin America and the Middle East are gradually adopting nonwoven floor covers as awareness of efficient floor protection spreads. Manufacturers are tailoring product designs and fabric weights to meet regional climate, flooring type, and project requirements. Collaborations with construction firms and distributors strengthen market presence in emerging economies. Regional market dynamics, including regulatory standards, construction growth, and project scale, directly influence product design, adoption rates, and global market expansion for nonwoven floor covers.

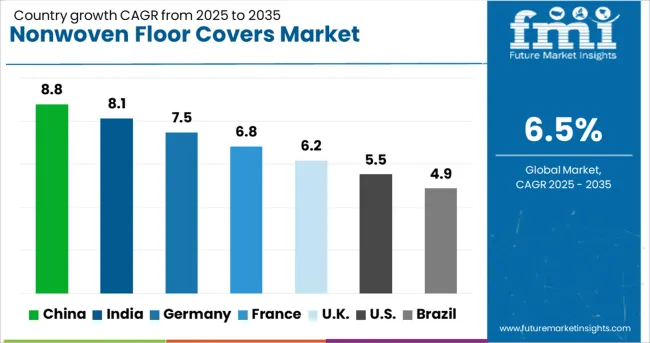

| Country | CAGR |

|---|---|

| China | 8.8% |

| India | 8.1% |

| Germany | 7.5% |

| France | 6.8% |

| UK | 6.2% |

| USA | 5.5% |

| Brazil | 4.9% |

The nonwoven floor covers market is anticipated to expand at a CAGR of 6.5%, driven by growing demand for protective and hygienic flooring solutions across residential, commercial, and industrial sectors. China leads with 8.8% growth, fueled by large-scale construction activities and rising adoption of disposable and reusable floor covers. India follows at 8.1%, as safety and cleanliness standards increase in commercial spaces and healthcare facilities. Germany records 7.5% growth, supported by the demand for high-quality and environmentally compliant nonwoven flooring materials. The UK demonstrates 6.2% growth, reflecting usage in event spaces, hospitals, and cleanroom environments. The USA shows 5.5% growth, with a focus on durable and cost-effective protective floor solutions. This report includes insights on 40+ countries; the top countries are shown here for reference.

China leads the nonwoven floor covers market with 8.8% growth. Rapid urbanization and construction activity drive demand for protective flooring materials. Compared to India, China benefits from large-scale industrial production and advanced textile technology. Nonwoven floor covers are widely used in commercial buildings, residential projects, and industrial facilities to prevent damage during construction and renovation. Manufacturers invest in high-quality, durable, and eco-friendly materials to meet growing market requirements. Government initiatives promoting sustainable building practices encourage adoption of protective coverings. Expansion of e-commerce platforms facilitates product distribution to end users. The rise in real estate projects, particularly in urban areas, supports consistent demand. Overall, China combines industrial capability, innovation, and sustainability focus to lead the global nonwoven floor covers market.

India’s nonwoven floor covers market grows at 8.1%, driven by increasing construction and renovation activities. Compared to Germany, India emphasizes cost-effective solutions for residential and commercial projects. Demand is particularly strong in urban centers experiencing rapid infrastructure development. Manufacturers offer versatile materials to cater to temporary and permanent protective needs. Government programs promoting modern construction practices encourage wider adoption. Investments in production facilities enhance product availability and quality. Eco-friendly materials gain traction among environmentally conscious customers. Expansion of distribution networks in tier-2 and tier-3 cities increases market reach. Overall, India combines affordability, construction growth, and environmental awareness to strengthen its position in the nonwoven floor covers market.

Germany shows steady growth at 7.5% in the nonwoven floor covers market. Strict building regulations and high-quality standards drive demand for durable floor protection materials. Compared to the United Kingdom, Germany emphasizes recyclable and environmentally friendly materials. Nonwoven floor covers are commonly used during construction, remodeling, and industrial applications to prevent surface damage. Research focuses on enhancing material strength, tear resistance, and water repellency. Government initiatives encourage sustainable building practices, promoting adoption among commercial and residential sectors. Export opportunities within Europe further support market stability. Overall, Germany combines strict regulations, quality focus, and sustainability to maintain a resilient nonwoven floor covers market.

The United Kingdom nonwoven floor covers market grows at 6.2%, driven by residential and commercial renovation projects. Compared to the United States, the UK emphasizes environmentally friendly products and regulatory compliance. Builders increasingly adopt nonwoven floor covers to protect surfaces from scratches, dust, and spills. Construction and refurbishment projects in urban areas contribute significantly to market growth. Research in biodegradable and recyclable materials supports sustainable building initiatives. Expansion of online and offline distribution channels ensures widespread availability. Overall, the UK focuses on sustainability, surface protection, and material quality to strengthen the nonwoven floor covers market.

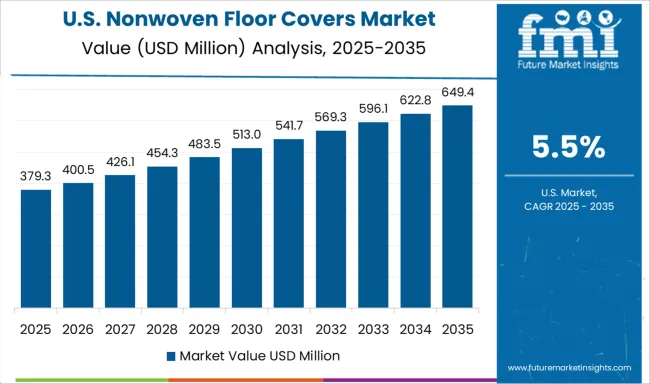

The United States advances at 5.5% in the nonwoven floor covers market. Growth is fueled by residential construction, commercial projects, and industrial applications. Compared to China, the US emphasizes high-performance, durable, and reusable materials. Builders and contractors adopt nonwoven covers to protect flooring during construction and maintenance activities. Innovation focuses on lightweight, tear-resistant, and environmentally friendly products. Expansion in urban infrastructure projects supports consistent demand. E-commerce and retail distribution channels enhance market reach. Overall, the United States combines innovation, durability, and sustainable practices to maintain steady growth in the nonwoven floor covers market.

The nonwoven floor covers market presents notable barriers to entry due to high-capital requirements for advanced manufacturing facilities, specialized equipment for producing high-performance fabrics, and stringent compliance with building, safety, and environmental regulations. New entrants must also overcome technical challenges related to moisture resistance, abrasion durability, and product uniformity to meet industry standards. Regional expansion strategies are concentrated on emerging markets in Asia, Latin America, and the Middle East, where rapid urban development, industrial infrastructure growth, and rising commercial construction drive demand. Established players leverage local partnerships, distribution networks, and localized production capabilities to penetrate these regions effectively, while maintaining cost-efficiency and supply chain reliability.

Market challenges include fluctuating raw material costs, evolving regulatory standards for eco-friendly and recyclable materials, and growing customer expectations for high-quality, durable, and visually appealing products. Additionally, competitive pressure from established brands with strong R&D and distribution networks makes differentiation difficult for smaller players. Companies must continuously innovate in material composition, thickness, and protective performance while aligning with sustainability trends and ensuring operational efficiency. These factors collectively define the competitive intensity and strategic considerations for companies aiming to succeed in the global nonwoven floor covers market.

| Item | Value |

|---|---|

| Quantitative Units | USD 850.0 Million |

| Material | Polypropylene, Polyester, Polyamide, and Others |

| Application | Commercial, Residential, and Industrial |

| Distribution Channel | Direct Sales, Retail Stores, and Online Channels |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Shaw Industries, Flexituff Ventures International Ltd., Fibertex Nonwovens, Lentex S.A., Johns Manville, and Mohawk Industries, Inc. |

| Additional Attributes | Dollar sales in the Nonwoven Floor Covers Market vary by material type including polypropylene, polyester, and polyethylene, application across residential, commercial, and industrial flooring, and region covering North America, Europe, and Asia-Pacific. Growth is driven by increasing construction activities, demand for temporary protective solutions, and rising awareness of hygiene and surface protection. |

The global nonwoven floor covers market is estimated to be valued at USD 850.0 million in 2025.

The market size for the nonwoven floor covers market is projected to reach USD 1,595.6 million by 2035.

The nonwoven floor covers market is expected to grow at a 6.5% CAGR between 2025 and 2035.

The key product types in nonwoven floor covers market are polypropylene, polyester, polyamide and others.

In terms of application, commercial segment to command 51.7% share in the nonwoven floor covers market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Floor-standing Brain Function Monitor Market Size and Share Forecast Outlook 2025 to 2035

Floor Screed Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Fabrics Market Size and Share Forecast Outlook 2025 to 2035

Floor Standing Filtered Bottle Filling Stations Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Filter Media Market Size and Share Forecast Outlook 2025 to 2035

Floor Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Floor Transition Strips Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Floor Scales Market Size and Share Forecast Outlook 2025 to 2035

Floor Lamp Market Size and Share Forecast Outlook 2025 to 2035

Floor Cleaning and Mopping Machine Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Furniture Construction Sheeting Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Packaging Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Weed Control Fabric Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Crop Cover Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Sponges Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Air Conditioning Filter Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Flanging Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Decking Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Containers Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Baby Diaper Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA