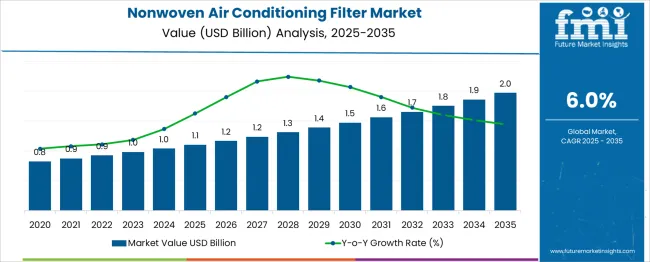

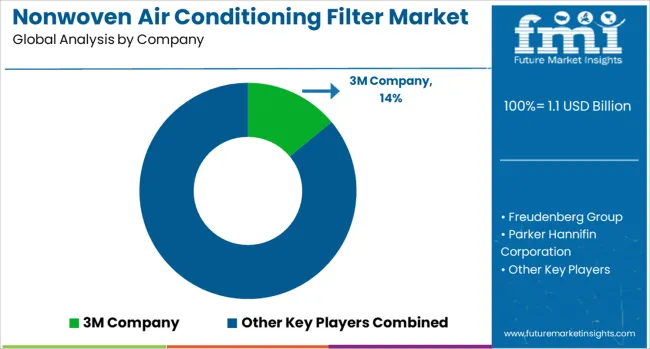

The Nonwoven Air Conditioning Filter Market is estimated to be valued at USD 1.1 billion in 2025 and is projected to reach USD 2.0 billion by 2035, registering a compound annual growth rate (CAGR) of 6.0% over the forecast period. Between 2025 and 2030, the market shows steady momentum, with estimated values rising from USD 1.1 billion to approximately USD 1.47 billion, reflecting a five-year increase of USD 0.37 billion. This consistent rise is fueled by growing demand for clean air systems in both residential and commercial HVAC applications, particularly in urban and industrial zones with heightened concerns around air quality. The CAGR of 6.0% indicates a moderate but healthy expansion pace, suggesting a stable and sustained adoption curve. Key factors include the effectiveness of nonwoven filters in capturing fine particles, their low resistance to airflow, and compatibility with energy-efficient systems.

The industry is also supported by the global emphasis on improving indoor air quality and regulatory moves around ventilation standards. Moreover, rising awareness of airborne pathogens and particulate pollutants continues to influence both new installations and aftermarket replacement cycles. The market’s long-term trajectory points to a durable demand foundation, driven by health-conscious infrastructure and filter performance reliability.

| Metric | Value |

|---|---|

| Nonwoven Air Conditioning Filter Market Estimated Value in (2025 E) | USD 1.1 billion |

| Nonwoven Air Conditioning Filter Market Forecast Value in (2035 F) | USD 2.0 billion |

| Forecast CAGR (2025 to 2035) | 6.0% |

The nonwoven air conditioning filter market is undergoing notable growth as energy efficiency regulations, indoor air quality concerns, and sustainability initiatives converge to redefine filtration standards. Rising awareness of the health impact of airborne pollutants has driven demand for high-performance, easy-to-maintain filters in both residential and commercial environments.

Manufacturers are increasingly focusing on enhancing filter efficiency, reducing energy consumption, and ensuring compliance with stricter environmental guidelines. Advancements in nonwoven materials offering superior dust-holding capacity, durability, and cost-effectiveness have further strengthened market adoption.

Future growth is anticipated to benefit from continued urbanization, increasing investments in green buildings, and technological innovation in filter media composition. The ability of nonwoven filters to combine operational efficiency with environmental benefits is paving the way for their sustained preference across end-use sectors.

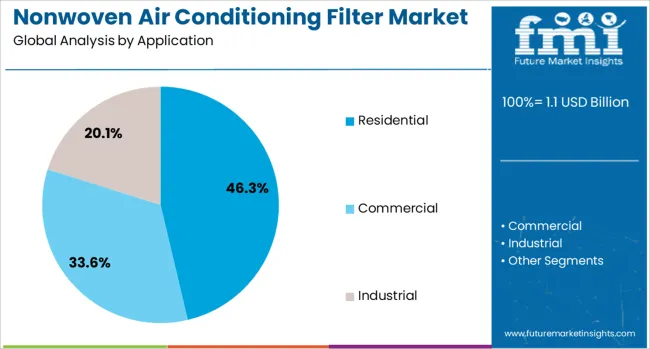

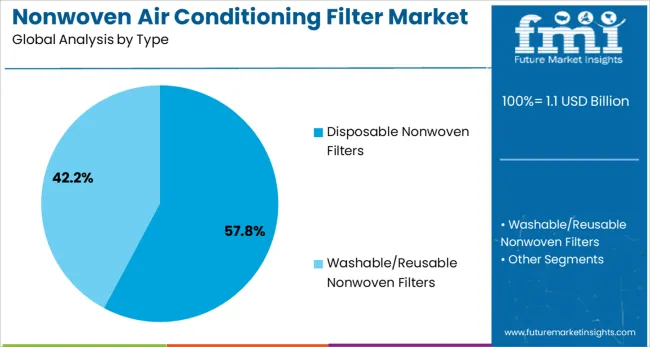

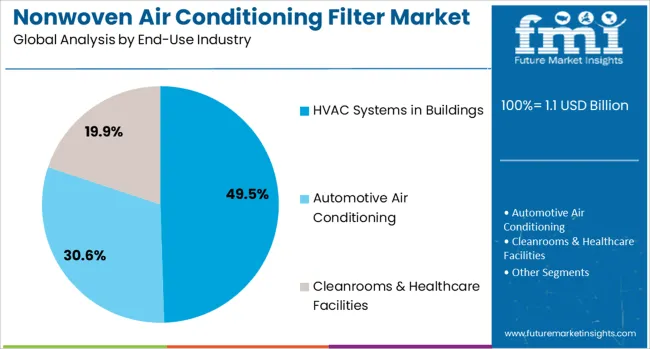

The nonwoven air conditioning filter market is segmented by application, type, end-use industry, and geographic regions. By application, the nonwoven air conditioning filter market is divided into Residential, Commercial, and Industrial. In terms of type, the nonwoven air conditioning filter market is classified into Disposable Nonwoven Filters and Washable/Reusable Nonwoven Filters. The end-use industry of the nonwoven air conditioning filter market is segmented into HVAC Systems in Buildings, Automotive Air Conditioning, Cleanrooms & Healthcare Facilities. Regionally, the nonwoven air conditioning filter industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by application the residential segment is expected to account for 46.3% of total market revenue in 2025 positioning itself as the largest application segment. This leadership has been supported by heightened consumer focus on maintaining healthy indoor air quality within homes coupled with rising awareness of the adverse health effects of particulate matter and allergens.

Growing urban populations living in compact spaces with limited ventilation have increased reliance on air conditioning systems equipped with effective filtration. The residential sector has also benefited from increasing disposable incomes, enabling consumers to adopt higher-quality disposable and reusable filter solutions.

In addition, rising sales of smart and energy-efficient HVAC units integrated with advanced filters have further reinforced the prominence of this segment by addressing both health and energy considerations.

In terms of type the disposable nonwoven filters segment is projected to capture 57.8% of the total market revenue in 2025 making it the leading type. This dominance has been driven by the convenience and cost-effectiveness of single-use filters which eliminate the need for maintenance and ensure consistent performance over their designed lifespan.

The segment has gained traction as building operators and homeowners increasingly prioritize ease of replacement and compliance with indoor air quality standards without incurring additional cleaning costs. Technological improvements in disposable nonwoven media enhancing dust retention and airflow efficiency have further cemented its appeal.

The segment’s leadership has also been reinforced by its suitability for both residential and commercial installations where regular filter changes are mandated by operational protocols or health guidelines.

Segmenting by end use industry shows that HVAC systems in buildings are expected to hold 49.5% of the market revenue in 2025 solidifying their position as the top industry segment. This leadership has been attributed to widespread use of centralized air conditioning systems in commercial residential and institutional buildings where maintaining indoor air quality and regulatory compliance is critical.

The segment has been bolstered by increasing investments in energy-efficient buildings and retrofitting projects aimed at reducing operational costs while improving occupant health. Growing emphasis on green building certifications and sustainability goals has led operators to adopt nonwoven filters that offer higher efficiency with lower energy penalties.

Furthermore the proliferation of smart building technologies and tighter enforcement of air quality standards have ensured that HVAC systems equipped with advanced nonwoven filters remain at the forefront of demand.

The nonwoven air conditioning filter market is expanding as HVAC systems evolve toward better air purification and operational efficiency. These filters, made from synthetic fibers or natural blends, offer superior dust-holding capacity, airflow, and low resistance compared to traditional materials. Growth is influenced by rising indoor air quality concerns, expanding commercial infrastructure, and demand for energy-efficient HVAC systems. Manufacturers are focusing on media customization, multi-layer filtration, and electrostatic charge retention to meet stricter filtration standards across residential, automotive, and industrial segments.

As awareness around indoor air pollution intensifies, nonwoven air conditioning filters are being adopted more widely in residential, healthcare, and commercial spaces. Unlike standard fiberglass filters, nonwoven materials can trap finer particulates such as pollen, bacteria, and mold spores while maintaining airflow. Demand is particularly strong in urban and industrialized zones where airborne contaminants exceed acceptable limits. Building owners are retrofitting HVAC units with higher-grade filters to improve occupant comfort and health outcomes. In schools, hospitals, and office buildings, facility managers are under pressure to ensure HVAC systems meet regulatory air quality benchmarks. The market is also benefiting from consumer behavior shifts, with more households purchasing advanced filters for personal use. This is encouraging OEMs and aftermarket suppliers to develop higher MERV-rated products with longer service life. As awareness spreads via public health advisories and building code revisions, nonwoven filters are becoming integral to air quality management strategies.

Rapid construction of commercial buildings, retail outlets, and high-density housing is creating demand for high-performance HVAC filtration systems. Nonwoven air conditioning filters are increasingly being installed in new builds as well as upgrades of older infrastructure. HVAC OEMs are embedding multi-layer nonwoven filters to meet air purification and energy-saving mandates. Government-led infrastructure programs in Asia, the Middle East, and parts of Europe have emphasized HVAC system modernization, directly supporting filter market growth. In parallel, retrofitting of older buildings in North America and Europe is accelerating as owners seek to meet environmental compliance and improve indoor conditions. Filter suppliers are leveraging these trends by offering modular and easily replaceable nonwoven cartridges tailored for different air handler configurations. As ventilation requirements grow more complex due to space constraints and varying climates, the need for consistent, efficient air filtration across facilities boosts demand for scalable nonwoven filter solutions.

Manufacturers are investing in R&D to develop high-performance nonwoven filter media that deliver better dust holding capacity, pressure drop stability, and antimicrobial resistance. Polypropylene, polyester, and bi-component fibers are being engineered to enhance porosity and filtration efficiency without sacrificing airflow. Some suppliers are using electrospun nanofiber coatings and meltblown layers to achieve finer particulate capture, particularly for PM2.5 and allergens. These innovations allow nonwoven filters to compete with HEPA-grade products in terms of particulate control while maintaining lower energy consumption. In automotive HVAC systems, lightweight composite nonwoven filters are being adopted for cabin air filtration, meeting both space and efficiency requirements. Companies are also customizing filters for specific use cases, such as moisture-resistant variants for humid climates or odor-control filters with activated carbon integration. Material upgrades help OEMs meet emerging HVAC standards globally while offering performance differentiation. The continued push for durability and performance extends product replacement intervals, adding aftermarket value.

Despite growing interest, cost-sensitive buyers often prefer cheaper fiberglass or foam filters over nonwoven alternatives, particularly in price-competitive markets. While nonwoven filters offer longer life and better filtration, their higher upfront cost can deter adoption in mass residential or budget-sensitive industrial segments. Small and medium-sized HVAC installers may also lack technical training to promote nonwoven solutions effectively. Additionally, varying standards for filter rating systems across regions (e.g., MERV, ISO ePM, or EN779) create confusion for end-users when selecting appropriate filters. The lack of global harmonization makes product comparison and cross-border marketing more complex. In emerging economies, awareness remains low, and nonwoven filter usage is limited mainly to high-end commercial projects or specific industrial applications. To overcome these challenges, filter manufacturers must invest in customer education, supply chain cost optimization, and the development of universally understood performance labeling systems that help position nonwoven filters as a practical, long-term solution.

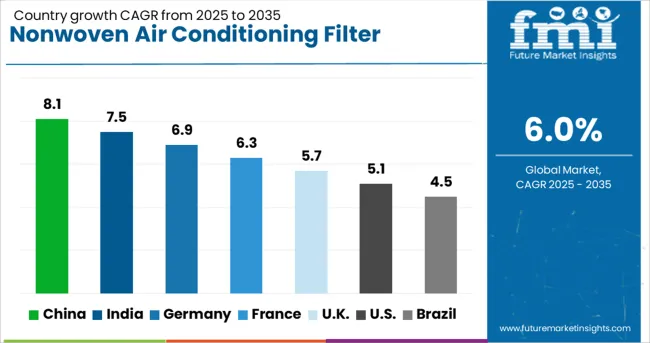

| Country | CAGR |

|---|---|

| China | 8.1% |

| India | 7.5% |

| Germany | 6.9% |

| France | 6.3% |

| UK | 5.7% |

| USA | 5.1% |

| Brazil | 4.5% |

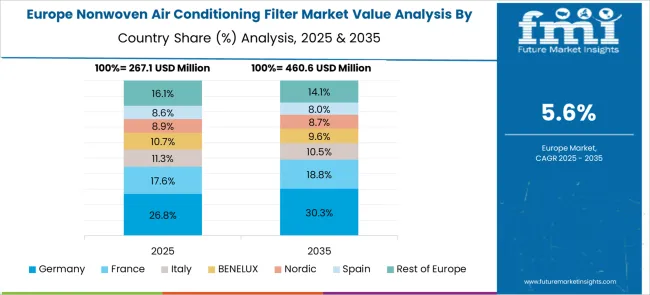

The global nonwoven air conditioning filter market is expected to grow at a CAGR of 6.0% through 2035, supported by rising demand in residential, commercial, and industrial ventilation systems. Among BRICS nations, China leads with 8.1% growth, driven by large-scale HVAC installations and increasing domestic production. India follows at 7.5%, where urban infrastructure projects and rising air quality concerns have boosted filter adoption. In the OECD region, Germany reports 6.9% growth, backed by building code compliance and strong aftermarket demand. France, growing at 6.3%, has maintained steady procurement in office spaces, transport systems, and healthcare facilities. The United Kingdom, at 5.7%, reflects consistent usage in commercial properties and institutional buildings. Market trends have been influenced by filtration efficiency standards, maintenance guidelines, and air system design specifications. This report includes insights on 40+ countries; the top five markets are shown here for reference.

In China, the nonwoven air conditioning filter market has been growing at a CAGR of 8.1%, supported by volume demand from residential HVAC systems, commercial complexes, and transport ventilation units. Manufacturers have scaled up supply of meltblown and needle-punched filter media for integration into multi-layer filtration designs. High-traffic urban zones have prompted the adoption of filters with enhanced particle retention capacity. Suppliers have responded by offering roll stock materials for centralized duct systems and split AC units. Prefabricated filter cassettes have been distributed through e-commerce and specialty HVAC retailers. Engineering firms have specified nonwoven inserts in ventilation schemes for metro and airport projects. Public sector procurement has favored washable variants for facility-level maintenance. Filtration fabric converters have aligned production with regional air quality indices.

India has observed solid growth in the nonwoven air conditioning filter market, reporting a CAGR of 7.5%, led by installations in commercial offices, healthcare facilities, and hospitality spaces. HVAC service contractors have preferred needle-punched and thermally bonded nonwoven materials for ease of retrofitting and pressure drop consistency. Builders of mid-scale commercial buildings have sourced panel inserts incorporating electrostatically charged nonwoven layers. Air conditioning service providers have utilized these filters in split systems across hospitality and retail chains. OEM vendors have developed modular cartridge designs suited for apartment installations. Seasonal replacement cycles have been promoted via maintenance contracts, with demand peaking during pre-summer HVAC servicing periods. Air filter distributors have diversified inventory to include both disposable and semi-reusable formats.

Germany has advanced steadily in the nonwoven air conditioning filter segment, recording a CAGR of 6.9%, supported by usage in residential energy-efficient buildings and regulated industrial environments. HVAC equipment suppliers have preferred multi-layer nonwoven filter mats with high particulate retention and thermal stability. Building codes have influenced filter design to ensure compatibility with low-noise, low-resistance airflow configurations. Facility managers have sourced electrostatically enhanced nonwoven sheets for variable air volume systems. OEM system manufacturers have integrated pleated designs with rigid nonwoven frames for central air handling units. Regulatory oversight has encouraged usage of certified filter media compliant with EN779 and ISO 16890 standards. Engineering consultants have specified filter types based on duct size and occupancy levels.

France has experienced consistent uptake in the nonwoven air conditioning filter market, registering a CAGR of 6.3%, as adoption has increased across housing cooperatives, institutional buildings, and renovation projects. Builders have installed pocket and flat panel filter types constructed using high-loft nonwoven media. Multi-family dwellings have utilized compact replaceable filters in wall-mounted units. Nonwoven suppliers have partnered with filter frame assemblers to offer hybrid media solutions suited for both particulate and odor filtration. Procurement by public schools and libraries has emphasized low-maintenance variants with steady airflow characteristics. HVAC refurbishment firms have relied on filters customized for aged duct infrastructure. Product catalogs have expanded to include antimicrobial-treated nonwovens used in hospitals and elderly care homes.

The United Kingdom has seen moderate but steady progress in the nonwoven air conditioning filter market, marked by a CAGR of 5.7%, with demand emerging from offices, retail chains, and public facilities. Nonwoven inserts have been adopted for use in packaged rooftop units and variable fan speed systems. Maintenance contractors have procured filters in pre-cut panel formats for fast replacement during site visits. Education campuses have introduced mid-efficiency filters made with thermally bonded nonwovens for centralized air systems. System integrators have favored electrostatic charge layers to improve particulate removal in high-traffic public interiors. Regional HVAC wholesalers have stocked a wide range of sizes compatible with standard UK housing and light commercial models.

From 2020 to 2024, the nonwoven air conditioning filter market was led by dominant mechanical filtration manufacturers and Tier-1 OEMs, who maintained a stronghold through established distribution networks, material innovation, and integration with HVAC and automotive systems. Key players such as 3M Company, Freudenberg Group, Parker Hannifin Corporation, MANN+HUMMEL, and Donaldson Company secured significant market share by offering high-efficiency filters tailored for residential, commercial, and industrial applications. These suppliers focused on improving particulate capture, airflow optimization, and regulatory compliance, which positioned them as trusted sources for conventional air filtration solutions.

However, the competitive landscape is now shifting as software-driven startups and steer-by-wire innovators begin to challenge these traditional leaders. Companies like Camfil AB, Ahlstrom, and Filtration Group Corporation are actively incorporating sensor technologies, IoT integration, and data-based monitoring into their filter solutions, offering smarter, adaptive performance. These advancements reflect a growing demand for real-time air quality tracking, predictive maintenance, and energy-efficient operation. Traditional suppliers such as American Air Filter Company (Daikin Applied Americas Inc.), Koch Filter, and Delta Filtration are responding by modernizing their product lines with connected capabilities and enhanced sustainability features. As digital transformation accelerates across the HVAC and clean air sectors, future competitiveness will rely on the ability to blend reliable nonwoven materials with intelligent system integration. This evolution marks a decisive shift from pure mechanical performance to hybrid solutions combining physical filtration with smart technologies.

On August 2, 2024, Hollingsworth & Vose formally launched PlusZero™, a new line of high-performance nonwoven filter media manufactured without using PFAS (per- and polyfluoroalkyl substances). PlusZero delivers performance and cost-efficiency comparable to traditional products while supporting sustainability goals. As mentioned in Hollingsworth & Vose’s official press release on their website.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.1 Billion |

| Application | Residential, Commercial, and Industrial |

| Type | Disposable Nonwoven Filters and Washable/Reusable Nonwoven Filters |

| End-Use Industry | HVAC Systems in Buildings, Automotive Air Conditioning, and Cleanrooms & Healthcare Facilities |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | 3M Company, Freudenberg Group, Parker Hannifin Corporation, MANN+HUMMEL, Camfil AB, Ahlstrom, Donaldson Company, American Air Filter Company (Daikin Applied Americas Inc.), Filtration Group Corporation, Koch Filter, and Delta Filtration |

| Additional Attributes | Dollar sales by nonwoven air conditioning filter type including panel filters, pocket filters, and pleated filters, by application in residential HVAC, commercial buildings, automotive cabins, and industrial ventilation, and by geographic region including North America, Europe, and Asia-Pacific; demand driven by rising air quality concerns, HVAC system expansion, and health regulations; innovation in electrostatic media, antimicrobial coatings, and recyclable filter materials; costs influenced by synthetic fiber, meltblown media, and production scale; and emerging use cases in smart HVAC systems, energy-efficient buildings, and climate-resilient infrastructure. |

The global nonwoven air conditioning filter market is estimated to be valued at USD 1.1 billion in 2025.

The market size for the nonwoven air conditioning filter market is projected to reach USD 2.0 billion by 2035.

The nonwoven air conditioning filter market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in nonwoven air conditioning filter market are residential, commercial and industrial.

In terms of type, disposable nonwoven filters segment to command 57.8% share in the nonwoven air conditioning filter market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Nonwoven Fabrics Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Furniture Construction Sheeting Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Packaging Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Floor Covers Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Weed Control Fabric Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Crop Cover Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Sponges Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Flanging Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Decking Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Containers Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Baby Diaper Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Protective Clothing Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Blanket Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Polyester Fabric Market Growth – Trends & Forecast 2025 to 2035

Nonwovens Converting Machine Market

Nonwovens Printing Machine Market

Nonwoven Filter Media Market Size and Share Forecast Outlook 2025 to 2035

PP Nonwovens Market Size and Share Forecast Outlook 2025 to 2035

Reinforced Nonwoven Plastics Market Size and Share Forecast Outlook 2025 to 2035

Staples PP Nonwovens Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA