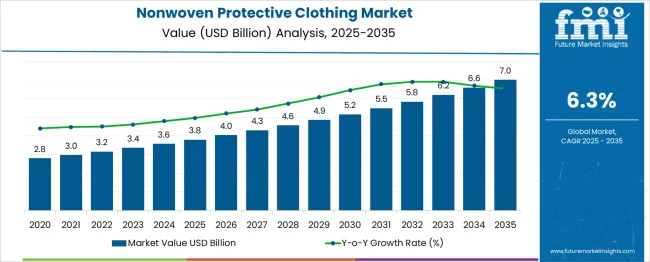

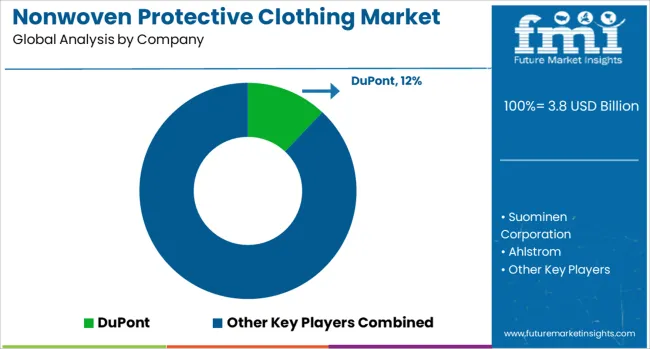

The Nonwoven Protective Clothing Market is estimated to be valued at USD 3.8 billion in 2025 and is projected to reach USD 7.0 billion by 2035, registering a compound annual growth rate (CAGR) of 6.3% over the forecast period. This early-phase growth is driven by increasing demand for protective clothing in industrial, healthcare, and cleanroom applications.

The rise in regulatory requirements for safety gear, particularly in hazardous environments such as manufacturing plants, healthcare settings, and laboratories, contributes to the adoption of nonwoven protective materials due to their durability and cost-effectiveness. The second half (2030 to 2035) will contribute USD 2.8 billion, representing 58.6% of the total growth, reflecting continued demand as industries continue to prioritize worker safety and hygiene.

Annual increments during the first phase average USD 0.28 billion per year, while later years are expected to see stronger growth driven by increasing adoption in emerging economies and the expanding use of nonwoven protective materials in new sectors. Manufacturers focusing on higher-performance fabrics, eco-friendly options, and cost-effective production will capture significant value in this USD 4.2 billion growth opportunity.

| Metric | Value |

|---|---|

| Nonwoven Protective Clothing Market Estimated Value in (2025 E) | USD 3.8 billion |

| Nonwoven Protective Clothing Market Forecast Value in (2035 F) | USD 7.0 billion |

| Forecast CAGR (2025 to 2035) | 6.3% |

The nonwoven protective clothing market is experiencing sustained growth as demand for high-performance, disposable, and cost-effective protective apparel continues to rise across critical industries. This expansion is being driven by heightened awareness of workplace safety, stricter regulatory standards, and an increasing emphasis on infection control in healthcare and industrial environments.

Advancements in nonwoven fabric technologies and manufacturing processes are enabling the production of lightweight yet durable garments that meet stringent protection requirements while ensuring wearer comfort. The future outlook remains positive, supported by ongoing innovation in material science, rising investment in occupational health initiatives, and a growing preference for disposable clothing to minimize contamination risks.

The convergence of operational efficiency goals and regulatory compliance is paving the path for broader adoption, particularly in healthcare, pharmaceuticals, and manufacturing sectors.

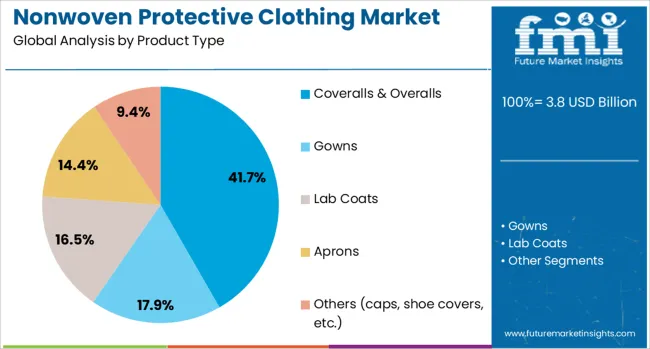

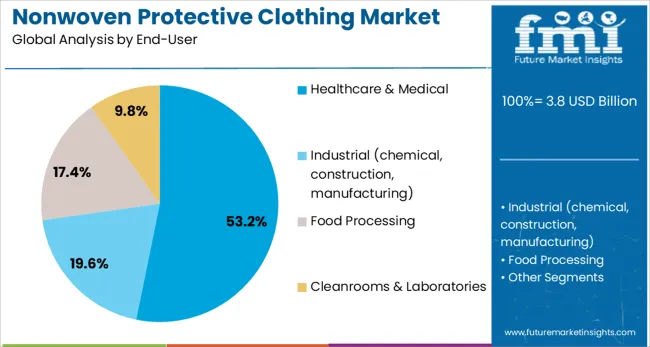

The nonwoven protective clothing market is segmented by product type, end-user, material, and geographic regions. By product type, the nonwoven protective clothing market is divided into Coveralls & Overalls, Gowns, Lab Coats, Aprons, and others (caps, shoe covers, etc.). In terms of end-users of the nonwoven protective clothing market, it is classified into Healthcare & Medical, Industrial (chemical, construction, manufacturing), Food Processing, Cleanrooms & Laboratories.

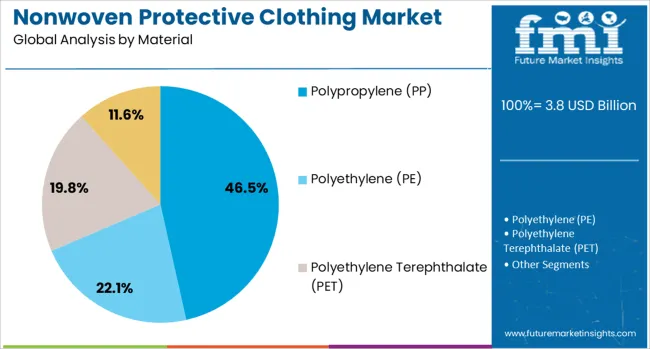

The nonwoven protective clothing market is segmented into Polypropylene (PP), Polyethylene (PE), Polyethylene Terephthalate (PET), and Others (spunbond-meltblown-spunbond, SMS; microporous films, etc.). Regionally, the nonwoven protective clothing industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by product type, coveralls and overalls are projected to hold 41.7% of the total market revenue in 2025, establishing themselves as the leading product segment. This leadership has been reinforced by their comprehensive design, which provides full-body protection against particulate, liquid, and biological hazards, making them indispensable in high-risk environments.

Their ease of use and cost-effectiveness have supported widespread deployment in industries requiring stringent contamination control. Manufacturing advancements have improved the breathability and durability of these garments while maintaining necessary protective barriers, enhancing user compliance and satisfaction.

Operational needs for standardized protective solutions and their ability to meet diverse regulatory requirements have firmly positioned coveralls and overalls as the most preferred product type in the market.

Segmented by end user, healthcare and medical is expected to account for 53.2% of the nonwoven protective clothing market revenue in 2025, maintaining its dominance. This prominence has been driven by the critical need for effective infection control and personal protection in healthcare facilities, laboratories, and emergency response settings.

The increasing frequency of pandemics, rising hospital-acquired infection rates, and heightened focus on patient and staff safety have necessitated large-scale adoption of disposable protective apparel. Institutional commitment to stringent hygiene protocols and compliance with occupational safety regulations has further accelerated uptake in this segment.

Additionally, growing investments in healthcare infrastructure and the emphasis on preparedness for public health emergencies have reinforced the healthcare and medical sector’s leading position in driving market demand.

When segmented by material, polypropylene is projected to capture 46.5% of the market revenue in 2025, securing its position as the dominant material segment. This leadership has been enabled by the material’s superior barrier properties, lightweight nature, and cost-efficiency, which collectively meet the key requirements of protective clothing applications.

Polypropylene’s adaptability to different nonwoven fabric technologies has facilitated the production of garments that offer optimal protection, comfort, and breathability. Its availability in a wide range of fabric weights and finishes has allowed manufacturers to tailor products for specific end uses, enhancing versatility and market appeal.

The ability of polypropylene to provide reliable protection while supporting high-volume, economically viable production has solidified its role as the material of choice in the nonwoven protective clothing market.

The nonwoven protective clothing market is fueled by rising demand for safety gear across industrial sectors, including healthcare and chemicals. Opportunities are expanding in these industries, driven by increasing safety regulations and the need for protective wear. Trends toward customization and multifunctionality are shaping the market, while challenges related to high production costs and material shortages persist. Overcoming these hurdles through supply chain optimization will be crucial for continued market growth by 2025.

The nonwoven protective clothing market is experiencing growth driven by increased demand across industrial sectors such as manufacturing, healthcare, and construction. Nonwoven fabrics provide an effective barrier against hazards like chemicals, dust, and physical injuries, making them a preferred choice for safety apparel. Rising regulations in occupational health and safety are further propelling demand for protective clothing. By 2025, the need for affordable, high-performance protective clothing is expected to continue fueling market expansion.

Opportunities in the nonwoven protective clothing market are growing in healthcare and chemical industries, where the demand for protective gear is rising. Nonwoven fabrics offer lightweight, breathable, and durable solutions for industries requiring high levels of protection. The need for disposable protective clothing in healthcare settings, especially during medical procedures, creates significant potential. By 2025, increased demand for protective wear in hazardous environments will continue to expand market opportunities, particularly in the healthcare and chemical sectors.

Emerging trends in the nonwoven protective clothing market show an increased focus on customization and functionality. Protective clothing solutions are evolving to cater to specific industry needs, with innovations in fabric properties such as flame resistance, waterproofing, and anti-static capabilities. The rising demand for multi-functional protective wear, especially in specialized industrial settings, is expected to shape future market growth. By 2025, manufacturers are anticipated to increasingly offer customized, high-performance protective clothing to meet industry-specific safety standards.

Despite its growth potential, the nonwoven protective clothing market faces challenges related to high production costs and material shortages. Nonwoven fabrics require specialized equipment and raw materials, which can drive up production expenses. Additionally, fluctuations in the availability and cost of these materials can impact manufacturers' ability to meet growing demand. These challenges may slow market growth, particularly in price-sensitive regions. Cost optimization and securing reliable supply chains will be essential for overcoming these barriers by 2025.

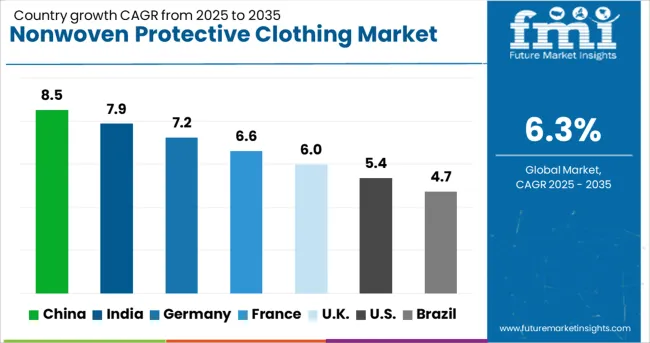

| Country | CAGR |

|---|---|

| China | 8.5% |

| India | 7.9% |

| Germany | 7.2% |

| France | 6.6% |

| UK | 6.0% |

| USA | 5.4% |

| Brazil | 4.7% |

The global nonwoven protective clothing market is projected to grow at a 6.3% CAGR from 2025 to 2035. China leads with a growth rate of 8.5%, followed by India at 7.9%, and Germany at 7.2%. The United Kingdom records a growth rate of 6%, while the United States shows the slowest growth among the profiled markets at 5.4%. These differences in growth rates are driven by factors such as the increasing demand for protective clothing in industrial, healthcare, and personal protective equipment (PPE) applications. Emerging markets like China and India are witnessing higher growth due to rapid industrialization, increased awareness of safety standards, and rising health concerns, while more mature markets like the USA and the UK experience steady growth due to established demand and regulatory compliance. This report includes insights on 40+ countries; the top markets are shown here for reference.

The nonwoven protective clothing market in China is growing rapidly, with a projected CAGR of 8.5%. China’s expanding industrial and manufacturing sectors, along with growing awareness of workplace safety, are major factors driving the demand for nonwoven protective clothing. The country’s high level of industrial activity, particularly in construction, manufacturing, and chemicals, requires protective clothing to ensure worker safety. Additionally, the growing need for personal protective equipment (PPE) due to health concerns, coupled with China’s rising healthcare infrastructure, is contributing to the market’s growth. Government regulations and safety standards further support the adoption of nonwoven protective clothing across various industries.

The nonwoven protective clothing market in India is projected to grow at a CAGR of 7.9%. India’s growing industrial sectors, particularly in construction, chemicals, and pharmaceuticals, are driving the demand for protective clothing. As India continues to expand its industrial base and implement stricter safety regulations, the need for high-quality, durable, and cost-effective protective clothing is increasing. Furthermore, India’s growing healthcare sector and increasing demand for PPE in response to health concerns are contributing to market expansion. The growing trend of health and safety awareness in the workplace is also supporting the adoption of nonwoven protective clothing.

The nonwoven protective clothing market in Germany is projected to grow at a CAGR of 7.2%. Germany’s industrial strength, particularly in automotive, chemicals, and manufacturing, drives a strong demand for nonwoven protective clothing. The increasing awareness of workplace safety, along with stringent safety regulations and standards, fuels the market for protective clothing in Germany. Additionally, the growth of the healthcare and pharmaceutical sectors is contributing to the rising demand for PPE. Germany’s focus on sustainability and eco-friendly production methods also drives the adoption of nonwoven materials, which are considered environmentally friendly compared to traditional alternatives.

The nonwoven protective clothing market in the United Kingdom is projected to grow at a CAGR of 6%. The UK’s industrial sectors, including chemicals, healthcare, and construction, drive the demand for protective clothing solutions. The government’s stringent workplace safety regulations and the increasing focus on worker protection contribute to steady market growth. The rise of health concerns, particularly in response to pandemics and other global health threats, has further increased the demand for personal protective equipment (PPE), including nonwoven clothing. The UK’s mature market, combined with a strong focus on sustainability and eco-friendly alternatives, supports steady demand for nonwoven materials.

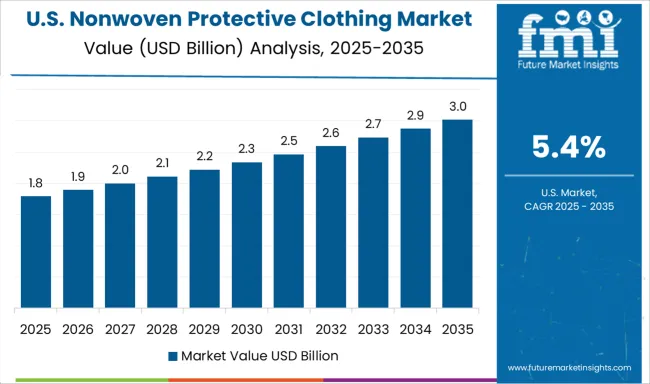

The nonwoven protective clothing market in the United States is expected to grow at a CAGR of 5.4%. While the USA market is mature, demand for nonwoven protective clothing remains steady, primarily driven by the healthcare, manufacturing, and construction sectors. Increased awareness of workplace safety and the rising demand for personal protective equipment (PPE) due to global health concerns are major growth drivers. The USA market is also benefiting from innovations in nonwoven materials, offering more efficient and cost-effective protective clothing options. While growth is slower than emerging markets, the USA continues to be a key market for protective clothing solutions.

The nonwoven protective clothing market is dominated by DuPont, which leads with its high-performance, durable protective fabrics used in a variety of applications, including industrial, medical, and hazardous environments. DuPont’s dominance is reinforced by its extensive experience in material science, strong R&D focus, and global reach, providing tailored protective clothing solutions for workers in critical industries.

Key players such as Suominen Corporation, Ahlstrom, and Freudenberg SE maintain significant market shares by offering advanced nonwoven materials designed to provide comfort, barrier protection, and durability for protective clothing. These companies focus on developing innovative, lightweight, and breathable nonwovens that meet safety and regulatory standards.

Emerging players like Filmquest Group, Inc., Johns Manville, and Kimberly-Clark are expanding their market presence by providing specialized nonwoven protective clothing materials for niche sectors such as cleanroom environments, medical, and biohazard protection. Their strategies include enhancing the material properties of nonwovens, such as flame resistance, antimicrobial protection, and water resistance, to cater to diverse industrial needs.

Market growth is driven by the increasing demand for personal protective equipment (PPE) in healthcare, industrial safety, and environmental protection, along with heightened awareness of worker safety. Innovations in nonwoven fabric technologies, including advanced barrier fabrics, multi-layer designs, and sustainable options, are expected to shape competitive dynamics and foster continued expansion in the global nonwoven protective clothing market.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.8 Billion |

| Product Type | Coveralls & Overalls, Gowns, Lab Coats, Aprons, and Others (caps, shoe covers, etc.) |

| End-User | Healthcare & Medical, Industrial (chemical, construction, manufacturing), Food Processing, and Cleanrooms & Laboratories |

| Material | Polypropylene (PP), Polyethylene (PE), Polyethylene Terephthalate (PET), and Others (spunbond-meltblown-spunbond, SMS; microporous films, etc.) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | DuPont, Suominen Corporation, Ahlstrom, Filmquest Group, Inc., Johns Manville, Freudenberg SE, Kimberly-Clark, Toray, Avintiv, Inc. (Berry Global), and Asahi Kasei Corporation |

| Additional Attributes | Dollar sales by fabric type and application, demand dynamics across healthcare, industrial, and consumer sectors, regional trends in nonwoven protective clothing adoption, innovation in antimicrobial and breathable materials, impact of regulatory standards on safety and performance, and emerging use cases in pandemic preparedness and hazardous material handling. |

The global nonwoven protective clothing market is estimated to be valued at USD 3.8 billion in 2025.

The market size for the nonwoven protective clothing market is projected to reach USD 7.0 billion by 2035.

The nonwoven protective clothing market is expected to grow at a 6.3% CAGR between 2025 and 2035.

The key product types in nonwoven protective clothing market are coveralls & overalls, gowns, lab coats, aprons and others (caps, shoe covers, etc.).

In terms of end-user, healthcare & medical segment to command 53.2% share in the nonwoven protective clothing market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Nonwoven Fabrics Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Filter Media Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Furniture Construction Sheeting Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Packaging Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Floor Covers Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Weed Control Fabric Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Crop Cover Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Sponges Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Air Conditioning Filter Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Flanging Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Decking Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Containers Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Baby Diaper Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Blanket Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Polyester Fabric Market Growth – Trends & Forecast 2025 to 2035

Nonwovens Converting Machine Market

Nonwovens Printing Machine Market

PP Nonwovens Market Size and Share Forecast Outlook 2025 to 2035

Reinforced Nonwoven Plastics Market Size and Share Forecast Outlook 2025 to 2035

Staples PP Nonwovens Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA