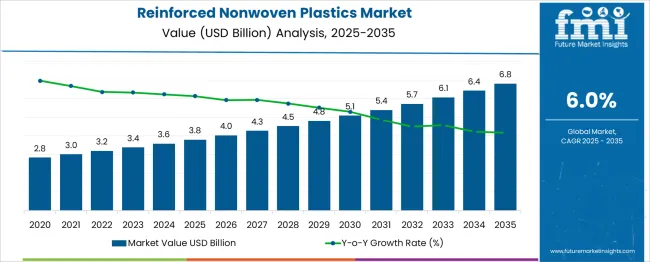

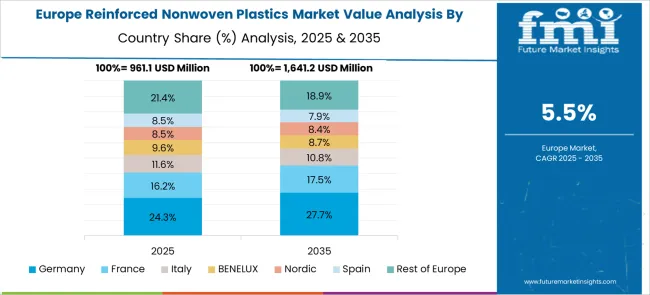

The Reinforced Nonwoven Plastics Market is estimated to be valued at USD 3.8 billion in 2025 and is projected to reach USD 6.8 billion by 2035, registering a compound annual growth rate (CAGR) of 6.0% over the forecast period. Analysis of regional growth imbalance indicates that Asia-Pacific is likely to emerge as the dominant growth engine, driven by extensive industrial manufacturing, automotive production, and infrastructure development. The region’s adoption of reinforced nonwoven plastics for lightweight composites and construction materials is expected to accelerate steadily, contributing a significant share of the overall market value throughout the forecast period. Incremental annual market growth in Asia-Pacific is projected to outpace other regions, reflecting both higher demand volumes and competitive local production capabilities. Europe is positioned in a mature phase, with growth primarily influenced by regulatory frameworks favoring high-performance and sustainable materials.

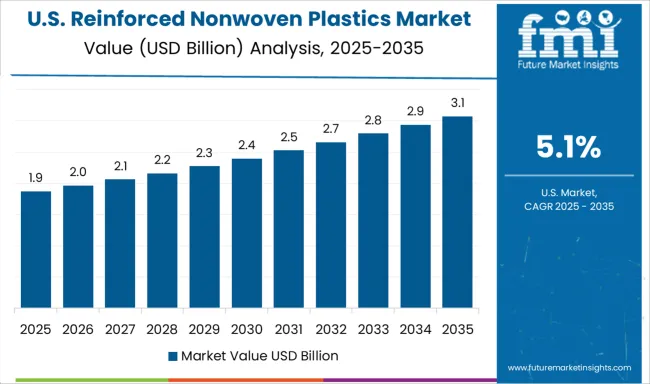

Market expansion in Europe is moderate, as investments focus on upgrading existing production lines and enhancing material properties, which support gradual increases in market value from 2025 to 2035. The North America exhibits steady but slower growth compared to Asia-Pacific, with market adoption driven by automotive and industrial applications. Competitive pressures and higher labor costs contribute to a measured pace of expansion, though technological innovations help maintain relevance and moderate CAGR contributions.

| Metric | Value |

|---|---|

| Reinforced Nonwoven Plastics Market Estimated Value in (2025 E) | USD 3.8 billion |

| Reinforced Nonwoven Plastics Market Forecast Value in (2035 F) | USD 6.8 billion |

| Forecast CAGR (2025 to 2035) | 6.0% |

The reinforced nonwoven plastics market is witnessing a stable growth trajectory driven by the convergence of durability requirements, cost efficiency, and sustainability considerations across various industries. Demand is being supported by the material’s ability to deliver superior mechanical strength, thermal resistance, and lightweight characteristics, aligning with evolving construction and industrial standards.

Increasing infrastructure investments and stringent regulations on environmental performance are encouraging broader adoption of reinforced nonwoven solutions. Continuous innovations in manufacturing processes and advancements in material compositions are expected to unlock further opportunities, enabling higher customization and improved performance. Strategic collaborations between material producers and end-use industries are paving the path for expanded applications and long-term market penetration.

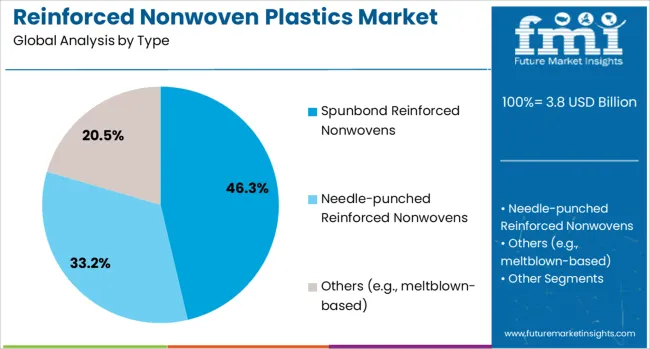

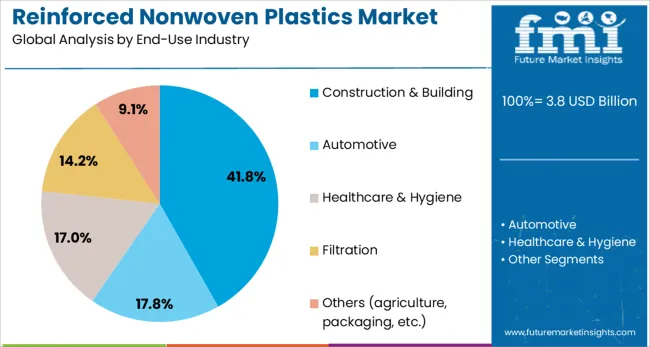

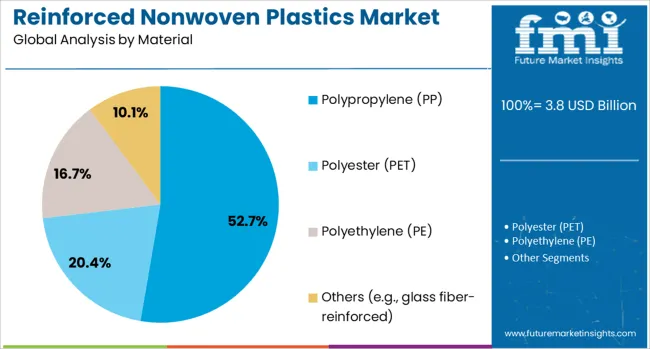

The reinforced nonwoven plastics market is segmented by type, end-use industry, material, and geographic regions. By type, the reinforced nonwoven plastics market is divided into Spunbond Reinforced Nonwovens, Needle-punched Reinforced Nonwovens, and Others (e.g., meltblown-based). In terms of end-use industry, the reinforced nonwoven plastics market is classified into Construction & Building, Automotive, Healthcare & Hygiene, Filtration, and Others (agriculture, packaging, etc.). The reinforced nonwoven plastics market is segmented into Polypropylene (PP), Polyester (PET), Polyethylene (PE), and Others (e.g., glass fiber-reinforced). Regionally, the reinforced nonwoven plastics industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by type, spunbond reinforced nonwovens are expected to hold 46.3% of the total market revenue in 2025, emerging as the dominant type segment. This leadership is attributed to the inherent advantages of spunbond technology, which provides superior tensile strength, consistent quality, and cost-effective production.

The segment has benefited from its suitability for high-volume manufacturing and its compatibility with a wide range of finishing processes that enhance durability and aesthetic appeal. Its performance in applications requiring uniformity, breathability, and recyclability has further reinforced its adoption.

Additionally, the scalability of production and low variability in product characteristics have made spunbond reinforced nonwovens a preferred choice for industries demanding reliability and high throughput.

Segmented by end use industry, construction and building is projected to account for 41.8% of the market revenue in 2025, maintaining its position as the leading industry segment. This prominence is underpinned by the growing use of reinforced nonwoven plastics in roofing membranes, insulation layers, and moisture barriers, where durability and compliance with energy efficiency norms are critical.

The segment has been strengthened by increasing investments in both residential and commercial infrastructure, which prioritize materials that combine strength with lightweight properties. Enhanced demand for weather-resistant and fire-retardant construction materials has also supported their widespread utilization.

Furthermore, the ability of reinforced nonwoven plastics to reduce installation time and improve long-term maintenance performance has solidified their role as a trusted solution in modern construction practices.

When segmented by material, polypropylene PP is forecast to capture 52.7% of the market revenue in 2025, establishing itself as the leading material segment. This dominance is driven by polypropylene’s favorable combination of strength, chemical resistance, and affordability, making it well-suited for a variety of reinforcement applications.

The material’s lightweight nature and high recyclability have enhanced its attractiveness in industries focused on sustainability and operational efficiency. Its compatibility with advanced manufacturing techniques and its ability to deliver consistent performance under varying environmental conditions have contributed significantly to its widespread adoption.

The balance of cost, performance, and versatility has enabled polypropylene to maintain its leadership as the material of choice in reinforced nonwoven plastics manufacturing.

The market has been expanding due to increasing demand for lightweight, durable, and high-performance materials in automotive, construction, and packaging sectors. These plastics are utilized to enhance mechanical strength, thermal stability, and chemical resistance in composite applications. Market growth has been supported by advancements in fiber reinforcement, polymer formulations, and manufacturing technologies. Rising industrial production, adoption of energy-efficient materials, and the need for longer service life in end-use applications have further driven the deployment of reinforced nonwoven plastics across diverse industries globally.

The automotive and transportation sectors have been significant contributors to the reinforced nonwoven plastics market due to the demand for lightweight, durable, and cost-effective materials. These plastics have been utilized in interior panels, dashboards, door trims, and under-the-hood components to reduce vehicle weight and improve fuel efficiency without compromising strength. High-performance reinforcements, including glass, carbon, and natural fibers, have been incorporated to enhance stiffness, impact resistance, and thermal stability. Manufacturers have increasingly adopted advanced thermoforming, compression molding, and extrusion processes to ensure uniform fiber distribution and consistent mechanical properties. The regulatory requirements for fuel efficiency and emission reduction have encouraged the use of reinforced nonwoven plastics, supporting widespread adoption across passenger vehicles, commercial trucks, and electric mobility platforms in Europe, North America, and Asia-Pacific.

Reinforced nonwoven plastics have been increasingly deployed in construction and industrial sectors for insulation panels, roofing membranes, wall cladding, and protective barriers. Their lightweight, high-strength, and corrosion-resistant properties have enabled improved structural performance and durability. Thermal insulation, soundproofing, and fire resistance requirements have driven the use of reinforced nonwoven composites in building materials. Industrial equipment and protective coatings have also benefited from chemical resistance and dimensional stability provided by reinforced nonwoven plastics. Manufacturers have focused on developing materials compatible with adhesives, coatings, and laminates to enhance versatility. The advancements in polymer reinforcement and processing techniques have enabled larger-scale applications with consistent quality. Infrastructure development, urban expansion, and industrial modernization have thus significantly contributed to the adoption of reinforced nonwoven plastics in construction and industrial applications globally.

Technological improvements in fiber reinforcement, polymer blending, and processing techniques have strengthened the reinforced nonwoven plastics market. Development of hybrid fibers, high-performance polymers, and nano-fillers has enhanced tensile strength, thermal stability, and chemical resistance. Automated production systems, advanced extrusion, and thermoforming techniques have improved uniformity, surface quality, and production efficiency. Integration of recycled fibers and sustainable polymers has also supported environmental objectives while maintaining mechanical performance. Research in flame retardancy, UV stability, and lightweight composites has expanded the suitability of reinforced nonwoven plastics across automotive, aerospace, and industrial sectors. These innovations have made reinforced nonwoven plastics a preferred choice for manufacturers seeking high-performance materials capable of meeting stringent design, regulatory, and operational requirements globally.

The growing focus on sustainable packaging and lightweight materials has presented new growth opportunities for reinforced nonwoven plastics. These materials have been utilized in flexible packaging, protective wrappings, and reusable containers to provide strength, tear resistance, and chemical stability. The use of bio-based polymers, recycled fibers, and environmentally friendly adhesives has further enhanced their applicability in eco-conscious markets. E-commerce expansion, cold chain logistics, and the demand for cost-effective protective packaging have increased the adoption of reinforced nonwoven plastics. The innovations in multilayer composites and biodegradable reinforcements have enabled applications in food, pharmaceuticals, and consumer goods sectors. The convergence of sustainability goals, industrial growth, and packaging innovation is expected to drive further expansion of reinforced nonwoven plastics across multiple global markets.

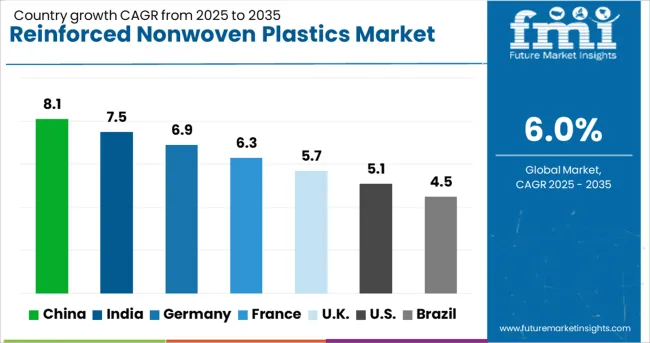

| Country | CAGR |

|---|---|

| China | 8.1% |

| India | 7.5% |

| Germany | 6.9% |

| France | 6.3% |

| UK | 5.7% |

| USA | 5.1% |

| Brazil | 4.5% |

The market is projected to expand at a CAGR of 6.0% between 2025 and 2035, driven by increased use in automotive components, construction materials, and packaging applications. China leads with an 8.1% CAGR, supported by robust manufacturing capabilities and growing industrial adoption. India follows at 7.5%, fueled by rising demand in infrastructure and automotive sectors. Germany, at 6.9%, benefits from advanced production technologies and high-quality standards. The UK, with a 5.7% CAGR, is witnessing steady growth through construction and packaging applications. The USA, at 5.1%, experiences moderate expansion due to adoption in industrial and consumer products. This report includes insights on 40+ countries; the top markets are shown here for reference.

The industry in China is anticipated to grow at a CAGR of 8.1% from 2025 to 2035, driven by increasing applications in automotive interiors, construction materials, and industrial packaging. Manufacturers are introducing high-strength lightweight materials to enhance performance and durability. Adoption of eco-friendly and recyclable reinforced plastics is gaining traction among industrial buyers. Strategic alliances between domestic producers and global technology providers are facilitating innovation in fiber reinforcement and polymer blends. Demand in commercial construction projects is supporting steady market expansion. The integration of advanced production techniques and automated manufacturing lines is strengthening efficiency and quality control.

The Indian market is forecast to expand at a CAGR of 7.5%, supported by rising adoption in packaging, infrastructure projects, and industrial components. Local manufacturers are focusing on producing lightweight and high-strength materials suited for domestic applications. Increasing interest in recyclable and sustainable reinforced plastics is driving market acceptance. Industrial packaging for chemicals and electronics is a key growth driver. Partnerships with international polymer technology firms are accelerating product innovation and quality enhancements. Regional infrastructure projects and industrial parks are contributing to higher demand for durable, reinforced nonwoven solutions.

Germany is expected to register a CAGR of 6.9%, driven by automotive, construction, and energy sector applications. Demand is focused on high-performance materials with precise mechanical properties and long service life. German manufacturers are integrating advanced fiber reinforcement techniques and eco-friendly polymers. Industrial adoption of lightweight panels and insulation materials is rising. Research and development investments are enhancing durability and production efficiency. Regulatory standards for material safety and environmental compliance are further shaping market trends.

The United Kingdom is projected to grow at a CAGR of 5.7%, driven by increasing demand in construction, automotive, and industrial packaging. Manufacturers are focusing on producing lightweight and durable reinforced plastics with enhanced structural performance. Adoption of recyclable materials is rising due to regulatory and environmental considerations. Demand for industrial packaging and infrastructure applications is contributing to steady market expansion. Partnerships with international material technology providers are supporting innovation and quality improvements.

The United States market is forecast to expand at a CAGR of 5.1%, driven by adoption in packaging, automotive, and construction sectors. Demand is focused on high-strength, lightweight reinforced plastics for industrial and commercial applications. Manufacturers are integrating automated production and quality control systems to optimize efficiency. Recyclable and eco-friendly materials are increasingly preferred in construction and packaging applications. Strategic partnerships with global polymer technology providers are facilitating product innovation. Adoption in industrial packaging and automotive interiors continues to support market growth.

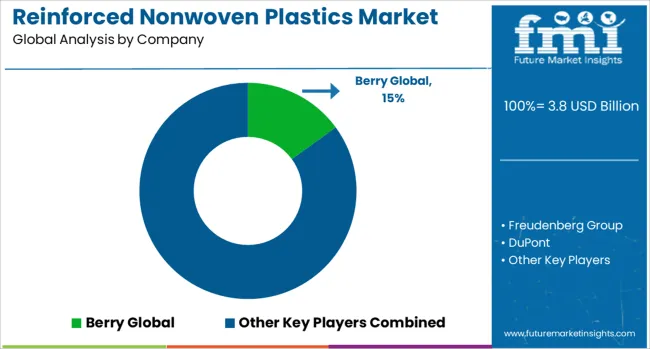

The market is dominated by multinational material science companies and specialized industrial fiber producers, offering solutions across automotive, construction, filtration, and hygiene sectors. Berry Global delivers engineered nonwoven composites with enhanced mechanical strength and chemical resistance for automotive interiors and industrial applications. Freudenberg Group focuses on high-performance nonwoven laminates tailored for filtration, insulation, and lightweight structural components, leveraging advanced fiber bonding technologies. DuPont and Kimberly-Clark Corporation provide durable, versatile nonwoven sheets for hygiene products, packaging, and protective coverings, emphasizing product reliability and regulatory compliance.

Ahlstrom-Munksjö supplies reinforced nonwovens for construction and filtration, integrating sustainability-driven material options and enhanced barrier properties. Johns Manville delivers nonwoven composites for thermal and acoustic insulation in buildings and vehicles, optimizing performance and ease of installation. Toray Industries offers high-strength nonwoven laminates for industrial and automotive applications, combining polymer expertise with precise fiber engineering to meet specific durability and weight requirements. Barriers to entry include high material processing costs, specialized machinery, and strict quality certifications, favoring companies with established manufacturing infrastructure and R&D capabilities. Firms capable of delivering tailored solutions with consistent performance and global support networks are well-positioned to capture growth in the expanding reinforced nonwoven plastics market.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.8 Billion |

| Type | Spunbond Reinforced Nonwovens, Needle-punched Reinforced Nonwovens, and Others (e.g., meltblown-based) |

| End-Use Industry | Construction & Building, Automotive, Healthcare & Hygiene, Filtration, and Others (agriculture, packaging, etc.) |

| Material | Polypropylene (PP), Polyester (PET), Polyethylene (PE), and Others (e.g., glass fiber-reinforced) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Berry Global, Freudenberg Group, DuPont, Kimberly-Clark Corporation, Ahlstrom-Munksjö, Johns Manville, and Toray Industries |

| Additional Attributes | Dollar sales by material type and end-use industry, demand dynamics across automotive, construction, packaging, and medical sectors, regional trends in adoption across North America, Europe, and Asia-Pacific, innovation in lightweight composites, biodegradable polymers, and enhanced mechanical properties, environmental impact of polymer sourcing, production waste, and recyclability, and emerging use cases in sustainable packaging, automotive interior panels, and high-performance filtration media. |

The global reinforced nonwoven plastics market is estimated to be valued at USD 3.8 billion in 2025.

The market size for the reinforced nonwoven plastics market is projected to reach USD 6.8 billion by 2035.

The reinforced nonwoven plastics market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in reinforced nonwoven plastics market are spunbond reinforced nonwovens, needle-punched reinforced nonwovens and others (e.g., meltblown-based).

In terms of end-use industry, construction & building segment to command 41.8% share in the reinforced nonwoven plastics market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fiber Reinforced Polymer Panel and Sheet Market Size and Share Forecast Outlook 2025 to 2035

Fiber Reinforced Plastic (FRP) Panels & Sheets Market Size and Share Forecast Outlook 2025 to 2035

Fiber Reinforced Polymer (FRP) Rebars Market Size and Share Forecast Outlook 2025 to 2035

Glass Reinforced Plastic (GRP) Piping Market Size and Share Forecast Outlook 2025 to 2035

Scrim Reinforced Films Market Size, Share & Forecast 2025 to 2035

Fiber-reinforced Plastic (FRP) Recycling Market Growth- Trends and Forecast 2025-2035

Central Reinforced Tape Market Size and Share Forecast Outlook 2025 to 2035

Particle Reinforced Aluminum Matrix Composite Brake Disc for Electric Automobiles Market Size and Share Forecast Outlook 2025 to 2035

Steel Wire Reinforced Polyethylene Pipe Market Size and Share Forecast Outlook 2025 to 2035

Glass Fiber Reinforced Plastic (GFRP) Composites Market Growth - Trends & Forecast 2025 to 2035

Carbon Fiber Reinforced Plastic Market Size and Share Forecast Outlook 2025 to 2035

Basalt Fiber Reinforced Polymer BFRP Market Size and Share Forecast Outlook 2025 to 2035

Carbon Textile Reinforced Concrete Market Size and Share Forecast Outlook 2025 to 2035

High Heat Glass Reinforced Polyamide 66 Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Fabrics Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Filter Media Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Furniture Construction Sheeting Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Packaging Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Floor Covers Market Size and Share Forecast Outlook 2025 to 2035

Nonwoven Weed Control Fabric Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA