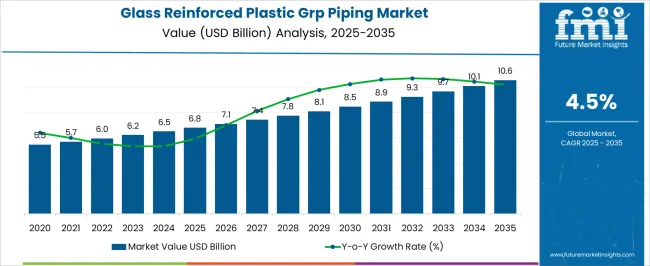

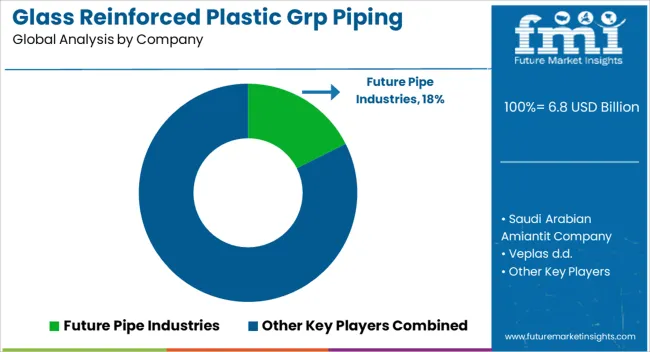

The Glass Reinforced Plastic (GRP) Piping Market is estimated to be valued at USD 6.8 billion in 2025 and is projected to reach USD 10.6 billion by 2035, registering a compound annual growth rate (CAGR) of 4.5% over the forecast period. In the initial five years, the market shows consistent year-over-year increases ranging between 3.8% and 5.4%. Starting at USD 6.8 billion in 2025, it reaches approximately USD 8.5 billion by 2030. The annual growth during this period averages around 4.4%, highlighting steady adoption driven by demand for durable and corrosion-resistant piping systems in various industrial sectors.

From 2030 to 2035, the market continues its upward trajectory with yearly growth rates fluctuating slightly between 4.1% and 5.0%. The value climbs from USD 8.5 billion to USD 10.6 billion, reflecting sustained interest in GRP piping. This phase consolidates the market’s maturity, with incremental but steady expansion driven by infrastructure development and replacement needs. Overall, the market demonstrates stable growth supported by consistent investments and ongoing industrial applications.

| Metric | Value |

|---|---|

| Glass Reinforced Plastic (GRP) Piping Market Estimated Value in (2025E) | USD 6.8 billion |

| Glass Reinforced Plastic (GRP) Piping Market Forecast Value in (2035F) | USD 10.6 billion |

| Forecast CAGR (2025 to 2035) | 4.5% |

The glass reinforced plastic (GRP) piping market is advancing steadily due to increasing demand for corrosion-resistant, lightweight, and cost-efficient piping systems across energy, water, and industrial sectors. GRP piping is being adopted as a strategic alternative to metal due to its lower lifecycle maintenance costs and ease of installation.

The market has witnessed growth through infrastructural investments in oil and gas, desalination, and wastewater treatment, where chemical resistance and longevity are prioritized. Additionally, global efforts to decarbonize infrastructure are encouraging the adoption of composite materials with better energy performance.

Manufacturers are increasingly developing customized solutions to meet stringent mechanical performance, pressure resistance, and regulatory standards. Future growth is likely to be driven by adoption in offshore environments, expansion of industrial facilities in emerging markets, and rising emphasis on long-life pipeline systems with minimal environmental degradation.

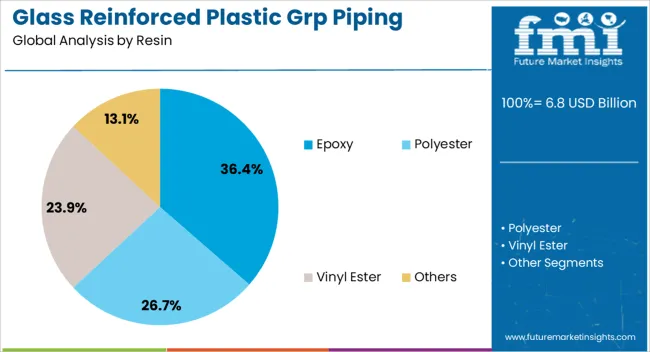

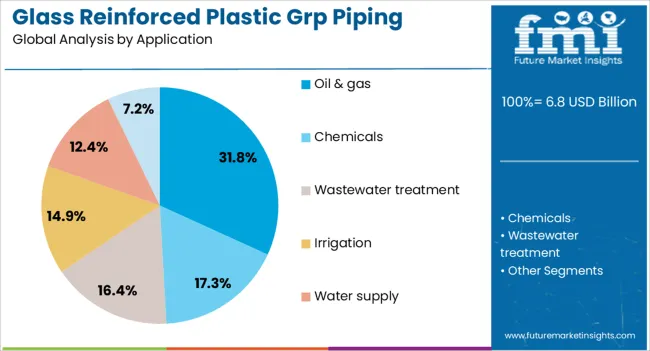

The glass reinforced plastic (GRP) piping market is segmented by resin, application, and geographic regions. By resin, the glass reinforced plastic (GRP) piping market is divided into Epoxy, Polyester, Vinyl Ester, and Others. In terms of application, the glass reinforced plastic (GRP) piping market is classified into Oil & gas, Chemicals, Wastewater treatment, Irrigation, Water supply, and Others (pulp & paper, power generation, mining, etc.). Regionally, the glass reinforced plastic (GRP) piping industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Epoxy resin is projected to account for 36.40% of the GRP piping market revenue in 2025, making it the leading resin type. This position is supported by epoxy’s superior mechanical strength, thermal stability, and high adhesion to reinforcing fibers.

Epoxy-based GRP pipes offer excellent resistance to corrosive environments, making them particularly suitable for high-pressure and high-temperature applications. Their dimensional stability and fatigue resistance have made them a preferred choice in demanding sectors such as energy and chemicals.

The compatibility of epoxy resin with various curing agents and its ability to withstand aggressive media have also improved its adoption across complex industrial fluid networks. Moreover, technological advances in epoxy formulation and processing are enabling more sustainable and durable solutions, aligning with long-term project lifecycle expectations.

The oil and gas sector is expected to contribute 31.80% of the GRP piping market’s revenue in 2025, making it the largest application segment. Growth in this segment has been driven by increasing deployment of GRP pipes in upstream and downstream oil infrastructure for transporting water, brine, crude, and process fluids.

The material’s corrosion resistance and low weight have reduced operational costs associated with maintenance and replacement of traditional steel pipelines. GRP piping’s ability to maintain structural integrity in corrosive and high-pressure environments has proven advantageous for offshore platforms and onshore terminals.

Additionally, ease of fabrication, joint integrity, and insulation compatibility have positioned GRP solutions as viable for long-distance pipelines and modular process systems. Rising exploration activities in challenging geographies and the need for cost-efficient transport systems continue to drive the segment’s dominance.

The GRP piping market is growing as industries increasingly seek corrosion-resistant, lightweight, and durable piping solutions. GRP pipes are favored in sectors like water treatment, oil and gas, chemical processing, and infrastructure due to their long service life and low maintenance needs. Growing environmental regulations and infrastructure modernization projects are driving adoption globally. Despite challenges such as high initial costs and technical installation requirements, advancements in manufacturing and composite materials are expanding applications. The market benefits from increasing investment in sustainable and efficient piping systems.

GRP pipes are extensively used where traditional materials like steel or concrete face corrosion or chemical attack. Their resistance to saltwater, acids, and alkalis makes them ideal for wastewater treatment plants, desalination, and offshore oil platforms. This durability reduces downtime and maintenance costs, making GRP a preferred choice in harsh environments. As industries seek to extend asset life and improve operational efficiency, the adoption of GRP piping increases. Additionally, lightweight properties simplify transportation and installation, especially in remote or difficult-to-access locations, broadening market potential across multiple sectors.

Recent advances in resin formulations, fiber reinforcement techniques, and production processes improve the mechanical strength and chemical resistance of GRP pipes. Continuous filament winding and pultrusion methods enable customized pipe designs with superior quality and uniformity. Innovations also focus on reducing production time and waste, lowering overall costs. Enhanced standards and certifications ensure reliability, helping GRP pipes gain acceptance in critical infrastructure projects. Manufacturers are also exploring hybrid composites and flame-retardant materials to meet specific industry requirements, fostering broader market penetration and supporting long-term growth.

Despite operational benefits, GRP piping systems often require specialized installation knowledge and equipment, which can increase upfront project costs. Proper handling and joining techniques are crucial to maintaining pipe integrity and preventing leaks. This installation complexity can deter smaller contractors or projects with limited technical expertise. Additionally, the initial cost of GRP pipes is generally higher than conventional materials, posing budget challenges in cost-sensitive markets. To overcome these barriers, suppliers offer training programs, on-site technical support, and turnkey solutions that simplify deployment. Educating end-users on long-term cost savings and durability helps justify investment despite higher initial expenses.

Global infrastructure development, particularly in water and wastewater management, drives significant demand for GRP piping. Urbanization and stricter environmental standards necessitate reliable piping solutions for municipal projects. Furthermore, the oil and gas sector’s focus on corrosion mitigation and pipeline longevity fuels growth in GRP pipe usage. Chemical processing plants and power generation facilities also increasingly adopt GRP pipes for their resistance to harsh chemicals and high temperatures. Emerging economies investing in industrial expansion and infrastructure upgrades present substantial growth opportunities. Strategic partnerships between manufacturers and EPC contractors facilitate market access and customized solutions, supporting sustained market advancement.

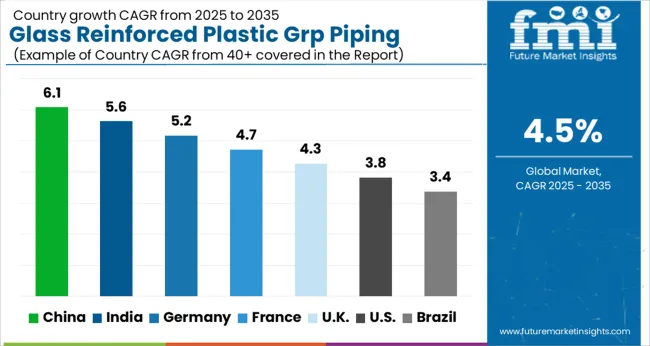

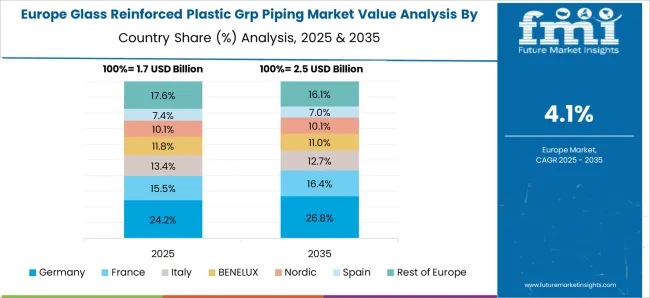

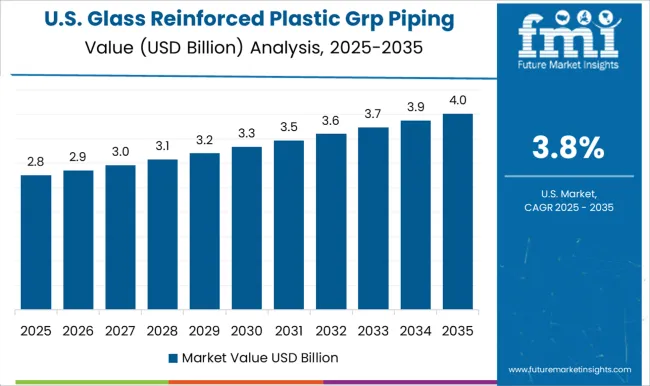

The global GRP piping market is growing at a 4.5% CAGR, driven by increasing infrastructure development and demand for corrosion-resistant piping solutions. Among BRICS nations, China leads with 6.1% growth, supported by large-scale industrial and construction projects. India follows at 5.6%, fueled by expanding water management and infrastructure initiatives. In the OECD region, Germany records 5.2% growth, reflecting high quality standards and technological innovation. The United Kingdom grows at 4.3%, driven by maintenance and replacement of aging pipelines. The United States, a mature market, shows 3.8% growth, shaped by stringent regulatory norms and advanced material adoption. These countries collectively influence market trends through advancements in material science, regulatory compliance, and sustainable infrastructure development. This report includes insights on 40+ countries; the top countries are shown here for reference.

China glass reinforced plastic (GRP) piping market is expanding at a 6.1% CAGR, propelled by rapid industrialization and infrastructure development. GRP piping is favored for its corrosion resistance, lightweight, and durability in water treatment, chemical plants, and oil and gas sectors. Compared to Western markets, China sees accelerated adoption driven by government initiatives supporting smart city and environmental projects. Domestic manufacturers invest heavily in research and production capacity, aiming to meet growing demand for sustainable and cost-effective piping solutions. The increase in wastewater treatment plants and desalination projects further fuels market expansion. Urbanization and industrial growth amplify the need for robust piping networks with longer service life. China leads in market scale and innovation adoption, positioning it as a dominant player in GRP piping.

India glass reinforced plastic piping market is growing at a 5.6% CAGR, driven by infrastructural upgrades and rising industrial applications. Increasing investments in water supply, wastewater management, and oil and gas pipelines fuel GRP piping demand. Compared to China, India is catching up with growing awareness of GRP advantages such as corrosion resistance and lightweight installation. The government’s push towards sustainable urban development and clean water initiatives supports market growth. Local manufacturers and joint ventures with foreign companies enhance product availability and technological know-how. Additionally, private sector investments in chemical and power plants create new opportunities. India’s focus on improving pipeline longevity and reducing maintenance costs contributes to increasing GRP piping adoption.

Germany glass reinforced plastic piping market is progressing at a 5.2% CAGR, backed by stringent environmental regulations and demand for durable infrastructure materials. Germany prioritizes high-quality, long-lasting piping solutions with minimal environmental impact, favoring GRP in water treatment and chemical industries. Compared to Asian markets, Germany emphasizes innovation in materials with enhanced strength and resistance properties. Industrial modernization and maintenance of aging pipeline systems drive replacement with GRP. The country’s commitment to circular economy principles promotes recycling and reuse initiatives related to GRP piping. Collaborations between research institutions and manufacturers accelerate development of advanced composite materials. Germany’s mature infrastructure market values reliability, environmental compliance, and technological advancement in GRP piping applications.

United Kingdom glass reinforced plastic piping market is growing at a 4.3% CAGR, shaped by sustainable infrastructure projects and maintenance needs. The UK increasingly uses GRP piping in water supply, sewage systems, and industrial applications due to its corrosion resistance and ease of installation. Compared to Germany, the UK market experiences moderate growth, influenced by government regulations promoting sustainable materials. Demand for GRP piping rises in urban renewal and smart city projects, integrating modern construction standards. Suppliers focus on providing customized solutions tailored to project specifications and environmental conditions. Emphasis on lifecycle cost savings and reduced maintenance drives preference for GRP over traditional materials. The UK market reflects balanced development based on environmental priorities and infrastructure renewal.

United States glass reinforced plastic piping market is expanding at a 3.8% CAGR, supported by demand in water infrastructure modernization and industrial sectors. The USA market favors GRP piping for its corrosion resistance, lightweight nature, and cost-effectiveness in large-scale projects. Compared to Europe and Asia, the USA growth is steady but slower due to mature infrastructure and competition from alternative materials. Investments in wastewater treatment plants and oil and gas pipelines create ongoing opportunities. Environmental regulations encourage use of sustainable and long-lasting piping materials like GRP. Suppliers incorporate technological advancements including improved resin formulations to enhance durability. The USA market focuses on balancing performance, cost, and environmental impact for gradual adoption of GRP piping.

The Glass Reinforced Plastic (GRP) piping market is characterized by strong competition among specialized manufacturers who focus on delivering corrosion-resistant, lightweight, and durable piping solutions across industries like water management, oil & gas, and infrastructure.

Future Pipe Industries leads with a global footprint and a diverse product range tailored for high-pressure applications, leveraging advanced manufacturing technologies to ensure performance and longevity. Saudi Arabian Amiantit Company complements this by providing integrated piping systems and value-added services, targeting large-scale projects in the Middle East and beyond. European players such as Veplas d.d. and Enduro Composites emphasize innovation through high-quality composite materials and customization capabilities, catering to demanding environmental conditions. HOBAS and Harwal Group are renowned for their focus on water and wastewater applications, offering solutions with proven resistance to chemical and mechanical stresses. Companies like Hanwei Energy Services and Composite Pipes Industry cater to the energy sector with robust GRP piping suited for harsh operating environments.

Regional manufacturers including Dubai Pipes Factory, Plasticon Composites, and Smithline Reinforced Composites focus on competitive pricing and local market adaptability, supporting infrastructure growth in emerging economies. Graphite India Limited and China National Building Material Company strengthen the Asian market presence with broad portfolios that combine GRP with other composite technologies. This fragmented yet specialized landscape drives continuous innovation in material science, manufacturing efficiency, and application-specific solutions, positioning GRP piping as a versatile alternative to traditional materials.

National Oilwell Varco is a leading player in the GRP piping market, particularly for offshore oil and gas applications. The company focuses on innovative GRP solutions that provide high resistance to corrosive elements and improve the lifespan of pipeline systems. Their flexible and lightweight GRP pipes are increasingly used in harsh environmental conditions such as deep-sea drilling and offshore platforms. They are also expanding their presence in emerging markets to meet the growing demand for infrastructure solutions.

| Item | Value |

|---|---|

| Quantitative Units | USD 6.8 Billion |

| Resin | Epoxy, Polyester, Vinyl Ester, and Others |

| Application | Oil & gas, Chemicals, Wastewater treatment, Irrigation, Water supply, and Others (pulp & paper, power generation, mining, etc.) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Future Pipe Industries, Saudi Arabian Amiantit Company, Veplas d.d., Enduro Composites, HOBAS, Harwal Group, Hanwei Energy Services Corp., Composite Pipes Industry, Dubai Pipes Factory, Graphite India Limited, Plasticon Composites, Fibrex, Sarplast, Smithline Reinforced Composites, Industrial Plastic Systems, China National Building Material Company, Global Pipe, Technobell, and Superlit Pipe Industries |

| Additional Attributes | Dollar sales in the Glass Reinforced Plastic (GRP) Piping Market vary by application (water treatment, oil & gas, construction, chemical processing), product type (pipes, fittings, joints), end-use industry (infrastructure, industrial, municipal), and region (North America, Europe, Asia-Pacific). Growth is driven by corrosion resistance demand, infrastructure development, and durability needs. |

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Glass Fiber Reinforced Plastic (GFRP) Composites Market Growth - Trends & Forecast 2025 to 2035

Glass Mat Thermoplastic Market Size and Share Forecast Outlook 2025 to 2035

Reinforced Nonwoven Plastics Market Size and Share Forecast Outlook 2025 to 2035

Fiber Reinforced Plastic (FRP) Panels & Sheets Market Size and Share Forecast Outlook 2025 to 2035

Fiber-reinforced Plastic (FRP) Recycling Market Growth- Trends and Forecast 2025-2035

High Heat Glass Reinforced Polyamide 66 Market Size and Share Forecast Outlook 2025 to 2035

Laboratory Glassware and Plasticware Market

Carbon Fiber Reinforced Plastic Market Size and Share Forecast Outlook 2025 to 2035

Glass Rolling Forming Machine Market Size and Share Forecast Outlook 2025 to 2035

Glass Liquor Bottle Market Size and Share Forecast Outlook 2025 to 2035

Plastic Tubes for Effervescent Tablets Market Size and Share Forecast Outlook 2025 to 2035

Plastic Banding Market Size and Share Forecast Outlook 2025 to 2035

Plastic Tube Market Size and Share Forecast Outlook 2025 to 2035

Glass Bottles Market Forecast and Outlook 2025 to 2035

Plastic Jar Packaging Market Forecast and Outlook 2025 to 2035

Plastic Cases Market Size and Share Forecast Outlook 2025 to 2035

Plastic Jar Industry Analysis in the United States Size and Share Forecast Outlook 2025 to 2035

Glass Laser Engraving Machine Market Size and Share Forecast Outlook 2025 to 2035

Glass Restoration Kit Market Size and Share Forecast Outlook 2025 to 2035

Glass Bottle and Container Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA