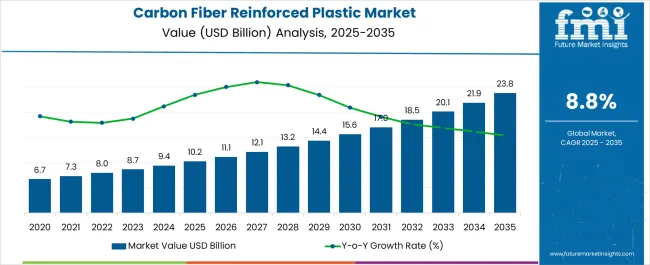

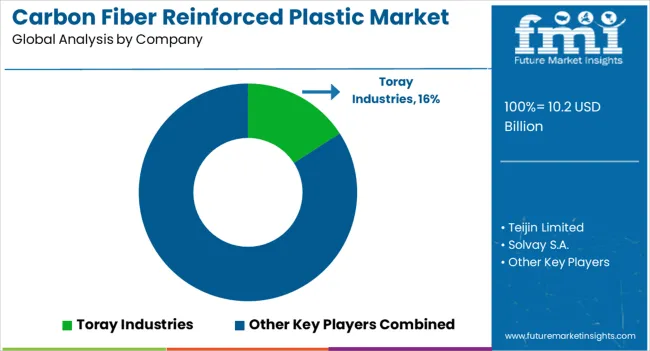

The Carbon Fiber Reinforced Plastic Market is estimated to be valued at USD 10.2 billion in 2025 and is projected to reach USD 23.8 billion by 2035, registering a compound annual growth rate (CAGR) of 8.8% over the forecast period.

| Metric | Value |

|---|---|

| Carbon Fiber Reinforced Plastic Market Estimated Value in (2025 E) | USD 10.2 billion |

| Carbon Fiber Reinforced Plastic Market Forecast Value in (2035 F) | USD 23.8 billion |

| Forecast CAGR (2025 to 2035) | 8.8% |

The carbon fiber reinforced plastic market is witnessing significant growth, driven by its critical role in delivering lightweight, high-strength, and durable materials across advanced engineering applications. Increasing demand for materials that reduce fuel consumption and enhance structural efficiency in transportation, aerospace, and energy sectors is influencing adoption. The superior strength-to-weight ratio and excellent fatigue resistance of carbon fiber reinforced plastics are making them essential in applications requiring high performance under demanding conditions.

Innovations in resin systems, fiber processing, and composite manufacturing techniques are enabling greater scalability and cost reduction, further supporting expansion. Rising emphasis on sustainability and the use of recyclable and bio-based resins are also shaping future growth opportunities.

Investments in production capacity and the integration of automation into composite manufacturing are improving efficiency and material availability As industries shift toward performance-driven, lightweight solutions, the carbon fiber reinforced plastic market is positioned for continued expansion, supported by advancements in high-volume processing technologies and growing adoption across both established and emerging end-use sectors.

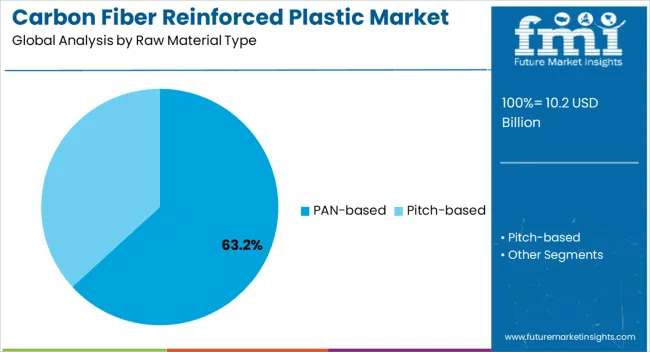

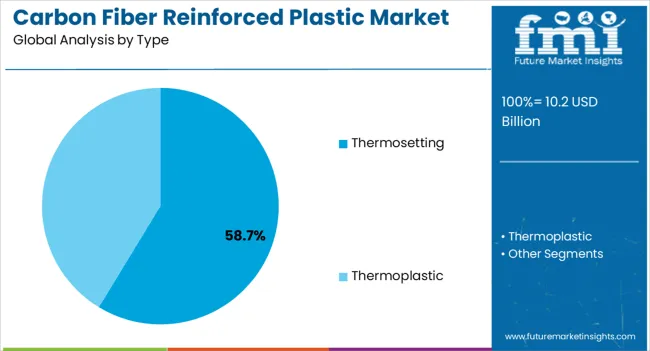

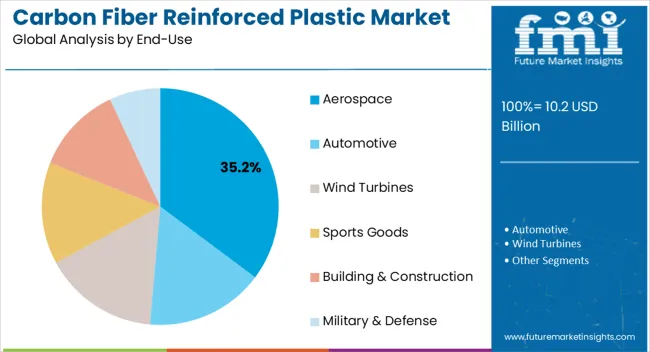

The carbon fiber reinforced plastic market is segmented by raw material type, type, end-use, and geographic regions. By raw material type, carbon fiber reinforced plastic market is divided into PAN-based and Pitch-based. In terms of type, carbon fiber reinforced plastic market is classified into Thermosetting and Thermoplastic. Based on end-use, carbon fiber reinforced plastic market is segmented into Aerospace, Automotive, Wind Turbines, Sports Goods, Building & Construction, and Military & Defense. Regionally, the carbon fiber reinforced plastic industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The PAN-based raw material type segment is projected to hold 63.2% of the carbon fiber reinforced plastic market revenue share in 2025, making it the leading raw material type. This dominance is being driven by its superior tensile strength, stiffness, and consistency, which make it highly suitable for applications demanding structural reliability. The segment’s growth is also being supported by its widespread availability and established production technologies that enable large-scale, cost-efficient manufacturing.

PAN-based carbon fibers are particularly favored in industries where mechanical performance and durability are essential, such as aerospace, automotive, and industrial applications. The material’s ability to deliver high thermal stability and excellent fatigue resistance further reinforces its position as the most widely adopted raw material type.

Ongoing advancements in precursor processing and stabilization methods are also improving yield and cost-effectiveness, ensuring long-term market preference With growing demand for lightweight and high-performance materials globally, the PAN-based segment is expected to maintain its leadership role, supported by expanding capacity and increasing application scope.

The thermosetting type segment is expected to account for 58.7% of the carbon fiber reinforced plastic market revenue share in 2025, positioning it as the dominant type category. Its leadership is attributed to the excellent mechanical properties and dimensional stability it offers once cured, providing strong performance in high-stress and high-temperature environments. The ability of thermosetting resins to form rigid cross-linked structures enhances durability and resistance to deformation, making them highly suitable for aerospace, automotive, and industrial components.

The segment’s prominence is also being reinforced by the availability of well-established processing techniques, including hand lay-up, resin transfer molding, and autoclave curing, which ensure consistent quality. Advancements in toughened epoxy and high-temperature resistant resin systems are further broadening application possibilities, particularly in aerospace structures where long-term stability is essential.

Growing adoption in high-volume automotive manufacturing, coupled with continuous improvements in cost efficiency, is supporting segment expansion As industries demand high-performance composites that can withstand extreme operating conditions, thermosetting carbon fiber reinforced plastics are expected to remain the material of choice across multiple applications.

The aerospace segment is anticipated to capture 35.2% of the carbon fiber reinforced plastic market revenue share in 2025, establishing itself as the largest end-use industry. Its leadership is being reinforced by the increasing emphasis on weight reduction to improve fuel efficiency, reduce emissions, and extend operational range of aircraft. Carbon fiber reinforced plastics are widely adopted in aircraft fuselage, wings, and structural components due to their superior strength-to-weight ratio, high fatigue resistance, and long service life.

The segment is experiencing sustained growth as aerospace manufacturers prioritize advanced materials that meet stringent regulatory standards for safety and performance. Continuous technological advancements in composite processing methods are reducing production cycle times and costs, accelerating adoption in both commercial and defense aviation.

Expanding global air travel demand, coupled with rising production of next-generation aircraft, is further supporting the segment’s growth As airlines and manufacturers focus on achieving greater efficiency and sustainability, the aerospace sector is expected to remain the most significant end-use industry driving demand for carbon fiber reinforced plastics.

Integration of CFRP in Modern Manufacturing Techniques to be a Key Trend

One of the key market trends in carbon fiber reinforced plastics is the increasing integration of automation and advanced manufacturing technologies in production processes. Companies are investing in automated layup systems, resin transfer molding, and other sophisticated methods to enhance production efficiency, reduce costs, and improve the consistency and quality of CFRP components.

The trend not only scales up the manufacturing capacity but also makes CFRP more accessible for various applications, expanding its market reach. Innovations in carbon fiber reinforced plastic technology for enhanced strength are also set to fuel sales.

Strict Environmental Regulations and Surging Emphasis on Sustainability

A key driver for the CFRP market is the growing emphasis on sustainability and environmental regulations. Industries across the board are under pressure to reduce carbon footprints and embrace green technologies.

CFRP contributes to these efforts by enabling the production of lighter, more fuel-efficient vehicles and aircraft, thereby reducing emissions. Additionally, its use in renewable energy sectors, like wind turbine blades, supports the transition to clean energy sources. This is one of the leading growth factors influencing the carbon fiber reinforced plastic market.

Growing Use in Construction and Civil Engineering Sectors to Boost Opportunities

An exciting opportunity for the CFRP market lies in its potential applications in the construction and civil engineering sectors. CFRP's high strength-to-weight ratio and durability make it an excellent candidate for reinforcing concrete structures, bridges, and other critical infrastructure.

Its use can significantly extend the lifespan of these structures while reducing maintenance costs and improving safety. This untapped market holds considerable promise as urbanization and infrastructure development continue to accelerate globally. This is further anticipated to augment the market size of carbon fiber reinforced plastics.

High Production Cost Backed by Expensive Raw Materials Hamper Sales

A significant hindrance to the widespread adoption of CFRP is its high production cost. The complex manufacturing processes, expensive raw materials, and need for specialized equipment contribute to the overall cost, making CFRP less economically viable for certain applications. This cost barrier can limit adoption, especially in price-sensitive industries, and poses a challenge for manufacturers to find cost-effective production methods without compromising the material's inherent benefits.

Sales of carbon fiber reinforced plastic (CFRP) are rising in the United States due to the country's strong focus on advancing aerospace and defense capabilities. The country's aerospace industry, home to leading manufacturers like Boeing and Lockheed Martin, demands high-performance materials that offer superior strength and weight reduction.

CFRP's exceptional properties make it ideal for constructing aircraft and spacecraft components, thereby improving fuel efficiency and payload capacity. Additionally, government investments in defense projects, which increasingly incorporate advanced materials to enhance performance and survivability, further propel demand.

In China, the surge in CFRP sales is driven by rapid industrialization and expansion of the automotive sector. China is one of the world's most significant automotive manufacturing hubs, with a growing focus on producing electric and hybrid vehicles.

CFRP plays a critical role in this transition by reducing vehicle weight, thereby extending the range of electric vehicles and improving energy efficiency. Furthermore, China's ambitious infrastructure projects and the push towards high-speed rail and urban transportation systems require durable and lightweight materials, boosting the adoption of CFRP.

The government's supportive policies and significant investments in research and development also contribute to the increased use of CFRP across various industries. Analysis of carbon fiber reinforced plastics for lightweight construction shows that China is set to remain dominant in East Asia.

Italy's rise in CFRP demand is mainly attributed to its strong presence in the luxury automotive and high-performance sports industries. Italian companies like Ferrari, Lamborghini, and Ducati are renowned for producing vehicles that prioritize speed, agility, and performance, all of which benefit significantly from the use of CFRP.

By integrating CFRP into their designs, these manufacturers can achieve better handling, acceleration, and fuel efficiency without compromising safety or aesthetic appeal. Additionally, Italy's robust fashion and design sectors are increasingly exploring the use of CFRP in high-end consumer goods, including furniture and accessories, adding to the material's growing market.

By type, demand for thermoplastic is anticipated to rise steadily through 2035. This growth is attributed to their enhanced recyclability compared to traditional thermoset-based CFRPs. Thermoplastics can be reheated and remolded multiple times without significant degradation of mechanical properties, which aligns well with increasing global emphasis on sustainability and circular economy principles. This recyclability reduces waste and allows for more efficient use of materials, addressing both environmental concerns and the need for cost-effective production solutions.

Thermoplastics also offer quick processing times, which is a significant advantage in high-volume manufacturing environments. Unlike thermosets, which require lengthy curing processes, thermoplastics can be rapidly heated, shaped, and cooled, enabling quicker production cycles.

High efficiency is particularly beneficial in the automotive industry, where manufacturers seek to streamline production to meet growing demand for lightweight, fuel-efficient vehicles. The reduced processing time leads to lower production costs and increased throughput. The aforementioned factors are anticipated to augment the carbon fiber reinforced thermoplastics market.

The demand for PAN (polyacrylonitrile)-based raw materials is rising primarily due to their superior mechanical properties. PAN-based carbon fibers exhibit high tensile strength and modulus, making these ideal for applications requiring robust and durable materials.

It makes these particularly attractive in industries such as aerospace, automotive, and construction, where performance and safety are critical. The high strength-to-weight ratio of PAN-based carbon fibers contributes to the production of lightweight yet strong components, which is essential for improving fuel efficiency and reducing emissions in the transportation sector.

Increasing use of advanced manufacturing techniques, such as automated fiber placement and 3D printing, also propels the demand for PAN-based raw materials. These advanced techniques benefit from the versatility and adaptability of PAN-based fibers, which can be processed into complex shapes and structures. The compatibility of PAN-based fibers with these cutting-edge manufacturing processes enables the production of innovative designs and lightweight structures that were previously unattainable, further boosting demand.

Key players in the carbon fiber reinforced plastic industry are increasingly adopting vertical integration strategies to enhance competitive edge. By controlling multiple stages of the supply chain- from raw material production to final product manufacturing- companies can ensure quality consistency, reduce production costs, and improve supply chain efficiency.

Such an approach allows companies to better manage resource allocation and respond more swiftly to unique demands. For instance, firms might invest in their own carbon fiber production facilities or establish strategic partnerships with raw material suppliers to secure a steady supply of high-quality precursors.

Industry Updates

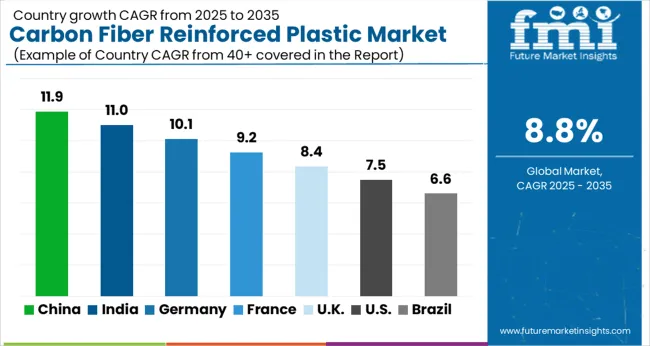

| Country | CAGR |

|---|---|

| China | 11.9% |

| India | 11.0% |

| Germany | 10.1% |

| France | 9.2% |

| UK | 8.4% |

| USA | 7.5% |

| Brazil | 6.6% |

The Carbon Fiber Reinforced Plastic Market is expected to register a CAGR of 8.8% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 11.9%, followed by India at 11.0%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 6.6%, yet still underscores a broadly positive trajectory for the global Carbon Fiber Reinforced Plastic Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 10.1%. The USA Carbon Fiber Reinforced Plastic Market is estimated to be valued at USD 3.8 billion in 2025 and is anticipated to reach a valuation of USD 7.8 billion by 2035. Sales are projected to rise at a CAGR of 7.5% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 523.5 million and USD 275.3 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 10.2 Billion |

| Raw Material Type | PAN-based and Pitch-based |

| Type | Thermosetting and Thermoplastic |

| End-Use | Aerospace, Automotive, Wind Turbines, Sports Goods, Building & Construction, and Military & Defense |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Toray Industries, Teijin Limited, Solvay S.A., Hexcel Corporation, SGL Carbon SE, Mitsubishi Rayon Co. Ltd., DowAksa Advanced Composites Holdings B.V., Formosa Plastics Corporation, Hyosung Advanced Materials, Cytec Industries Inc., Zhongfu Shenying Carbon Fiber Co. Ltd., and Jiangsu Hengshen Fibre Material Co., Ltd. |

The global carbon fiber reinforced plastic market is estimated to be valued at USD 10.2 billion in 2025.

The market size for the carbon fiber reinforced plastic market is projected to reach USD 23.8 billion by 2035.

The carbon fiber reinforced plastic market is expected to grow at a 8.8% CAGR between 2025 and 2035.

The key product types in carbon fiber reinforced plastic market are pan-based and pitch-based.

In terms of type, thermosetting segment to command 58.7% share in the carbon fiber reinforced plastic market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fiber Reinforced Plastic (FRP) Panels & Sheets Market Size and Share Forecast Outlook 2025 to 2035

Fiber-reinforced Plastic (FRP) Recycling Market Growth- Trends and Forecast 2025-2035

Glass Fiber Reinforced Plastic (GFRP) Composites Market Growth - Trends & Forecast 2025 to 2035

Fiber Reinforced Polymer Panel and Sheet Market Size and Share Forecast Outlook 2025 to 2035

Fiber Reinforced Polymer (FRP) Rebars Market Size and Share Forecast Outlook 2025 to 2035

Carbon Fiber Bike Wheelset Market Size and Share Forecast Outlook 2025 to 2035

Carbon Fiber Construction Repair Market Size and Share Forecast Outlook 2025 to 2035

Carbon Fiber Wraps Market Size and Share Forecast Outlook 2025 to 2035

Carbon Fiber Boat Hulls Market Size and Share Forecast Outlook 2025 to 2035

Carbon Fiber Composites Market Size, Growth, and Forecast 2025 to 2035

Carbon Fiber Composites for Prosthetics Market 2025-2035

Carbon Textile Reinforced Concrete Market Size and Share Forecast Outlook 2025 to 2035

Reinforced Nonwoven Plastics Market Size and Share Forecast Outlook 2025 to 2035

Basalt Fiber Reinforced Polymer BFRP Market Size and Share Forecast Outlook 2025 to 2035

Glass Reinforced Plastic (GRP) Piping Market Size and Share Forecast Outlook 2025 to 2035

Recycled Carbon Fiber Market Size and Share Forecast Outlook 2025 to 2035

Activated Carbon Fiber Market Size and Share Forecast Outlook 2025 to 2035

Demand for Carbon Fiber Composites for Prosthetics in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Carbon Fiber Composites for Prosthetics in Japan Size and Share Forecast Outlook 2025 to 2035

High Performance Carbon Fiber Precursor Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA