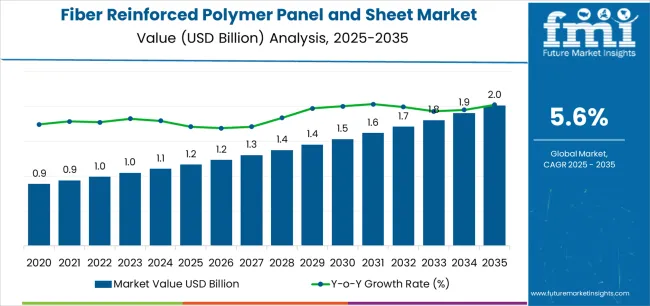

The Fiber Reinforced Polymer Panel and Sheet Market is estimated to be valued at USD 1.2 billion in 2025 and is projected to reach USD 2.0 billion by 2035, registering a compound annual growth rate (CAGR) of 5.6% over the forecast period.

The fiber reinforced polymer (FRP) panel and sheet market is experiencing sustained growth, driven by the need for lightweight, high-strength materials across industrial and structural applications. Increasing infrastructure investments, vehicle weight reduction initiatives, and the preference for corrosion-resistant materials have accelerated demand.

The market benefits from advancements in resin chemistry and fiber technology, enhancing mechanical performance and design flexibility. FRP materials offer superior strength-to-weight ratios compared to metals, reducing maintenance requirements and extending service life.

Adoption is expanding in transportation, construction, and energy industries where performance reliability and longevity are prioritized. With environmental considerations promoting the use of recyclable and durable composites, the FRP panel and sheet market is positioned for consistent long-term growth, supported by technological progress and global sustainability goals.

| Metric | Value |

|---|---|

| Fiber Reinforced Polymer Panel and Sheet Market Estimated Value in (2025 E) | USD 1.2 billion |

| Fiber Reinforced Polymer Panel and Sheet Market Forecast Value in (2035 F) | USD 2.0 billion |

| Forecast CAGR (2025 to 2035) | 5.6% |

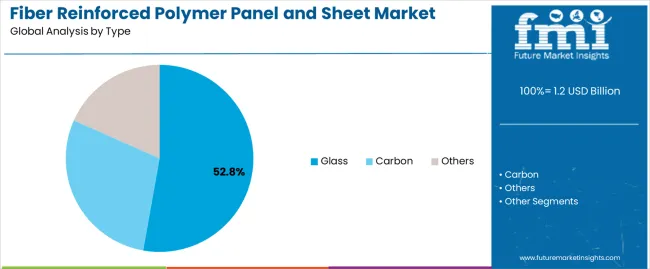

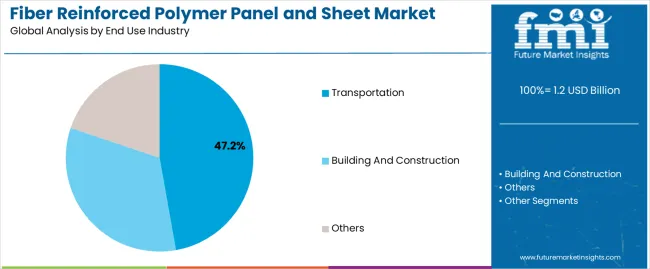

The market is segmented by Type and End Use Industry and region. By Type, the market is divided into Glass, Carbon, and Others. In terms of End Use Industry, the market is classified into Transportation, Building And Construction, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The glass segment dominates the type category, accounting for approximately 52.8% share of the FRP panel and sheet market. This leadership is attributed to the segment’s balanced properties of strength, flexibility, and cost-efficiency, making it the preferred choice for a wide range of applications.

Glass fiber composites are widely used due to their superior corrosion resistance, thermal stability, and ease of fabrication. The segment benefits from established manufacturing processes and a well-developed supply chain, ensuring scalability and affordability.

Increasing demand in automotive, aerospace, and civil infrastructure projects where material performance and durability are critical continues to support its growth. With ongoing innovations in resin bonding and fiber alignment, the glass segment is expected to maintain its strong market presence through the forecast period.

The transportation segment leads the end-use industry category with approximately 47.2% share, driven by growing adoption of lightweight materials to improve fuel efficiency and reduce emissions. FRP panels and sheets are increasingly used in vehicle bodies, aircraft interiors, and railway components due to their structural integrity and design versatility.

The segment benefits from stringent regulatory standards encouraging the reduction of vehicle weight while maintaining safety and performance. Improved impact resistance and corrosion durability have made FRP materials an attractive alternative to steel and aluminum in transportation manufacturing.

With the rise of electric vehicles and ongoing efforts toward energy efficiency, the transportation segment is expected to sustain its dominance, reinforced by continuous material innovation and manufacturing optimization.

The scope for fiber reinforced polymer panel and sheet rose at a 7.5% CAGR between 2020 and 2025. The global market is anticipated to grow at a moderate CAGR of 5.9% over the forecast period 2025 to 2035.

The market experienced steady growth during the historical period from 2020 to 2025, driven by factors such as increasing infrastructure development, demand for lightweight and durable materials, and advancements in manufacturing technology.

Fiber reinforced polymer materials were increasingly adopted across various industries including construction, automotive, aerospace, marine, and renewable energy sectors due to their superior performance characteristics and cost effectiveness.

Ongoing technological advancements in fiber reinforced polymer manufacturing processes LED to the development of innovative products with enhanced properties such as improved strength, durability, fire resistance, and environmental sustainability.

Looking ahead to the forecast period from 2025 to 2035, the market is expected to witness significant growth. New applications and technologies are likely to emerge, expanding the market opportunities for fiber reinforced polymer materials in areas such as biocomposites, digital manufacturing, and smart building solutions.

Rapid urbanization and population growth, particularly in emerging economies, will fuel the demand for affordable and sustainable housing solutions, creating opportunities for fiber reinforced polymer based construction systems and prefabricated building components.

Infrastructure development projects, particularly in emerging economies, are driving the demand for construction materials including fiber reinforced polymer panels and sheets.

The need for durable, cost effective, and sustainable materials in infrastructure projects such as bridges, buildings, and transportation facilities presents significant growth opportunities for the fiber reinforced polymer market.

The initial investment costs associated with fiber reinforced polymer materials, including raw materials, manufacturing equipment, and specialized production processes, can be relatively high compared to traditional materials, which is expected to deter some potential customers, particularly in industries with limited capital or budget constraints.

The below table showcases revenues in terms of the top 5 leading countries, spearheaded by Korea and Japan. The countries are expected to lead the market through 2035.

| Countries | Forecast CAGRs from 2025 to 2035 |

|---|---|

| The United States | 6.2% |

| China | 6.4% |

| The United Kingdom | 6.5% |

| Japan | 7.2% |

| Korea | 7.8% |

The fiber reinforced polymer panel and sheet market in the United States expected to expand at a CAGR of 6.2% through 2035. Increased infrastructure investment by the government and private sectors in the country is driving the demand for durable and sustainable construction materials like fiber reinforced polymer panels and sheets.

The country is witnessing significant growth in renewable energy projects, including wind farms, solar power plants, and hydropower installations.

Fiber reinforced polymer panels and sheets are used in renewable energy infrastructure for applications such as turbine blades, nacelles, solar panel enclosures, and hydroelectric components, driving market growth in the renewable energy sector.

The fiber reinforced polymer panel and sheet market in the United Kingdom is anticipated to expand at a CAGR of 6.5% through 2035. The aerospace industry in the country is a significant consumer of fiber reinforced polymer panels and sheets for aircraft production.

The maritime industry in the country relies on fiber reinforced polymer panels and sheets for marine and naval applications, including boat building, shipbuilding, offshore platforms, and port infrastructure.

Fiber reinforced polymer materials offer resistance to corrosion, UV degradation, and harsh marine environments, driving market growth in the marine sector.

Fiber reinforced polymer panel and sheet trends in China are taking a turn for the better. A 6.4% CAGR is forecast for the country from 2025 to 2035. The country is the largest automotive market in the world, with increasing demand for lightweight and high performance materials in vehicle production.

Fiber reinforced polymer panels and sheets offer lightweight alternatives to traditional materials like steel and aluminum, enabling automakers to achieve weight reduction targets without compromising on safety or structural integrity.

Ongoing advancements in fiber reinforced polymer manufacturing technologies, resin formulations, and composite materials enhance product performance, quality, and cost effectiveness in China.

Manufacturers are investing in research and development to develop innovative fiber reinforced polymer solutions that meet the evolving needs of customers and regulatory requirements in diverse industries.

The fiber reinforced polymer panel and sheet market in Japan is poised to expand at a CAGR of 7.2% through 2035. Government initiatives and incentives, such as subsidies, tax breaks, and funding for research and development, encourage the adoption of advanced materials like fiber reinforced polymer panels and sheets in Japan.

The incentives promote innovation, investment, and market growth in industries that utilize fiber reinforced polymer materials for infrastructure development, renewable energy projects, transportation, and manufacturing.

Increasing market expansion and collaboration among industry stakeholders, including manufacturers, suppliers, distributors, and end users, contribute to the growth of the fiber reinforced polymer panel and sheet market in Japan.

Collaborative efforts to develop new applications, expand product offerings, and address customer needs drive market expansion and competitiveness in the industry.

The fiber reinforced polymer panel and sheet market in Korea is anticipated to expand at a CAGR of 7.8% through 2035. Korea is a leading hub for electronics manufacturing, including consumer electronics, semiconductors, and displays.

Fiber reinforced polymer panels and sheets find applications in the electronics industry for components such as printed circuit boards, housing enclosures, and structural supports due to their lightweight, durable, and insulating properties.

Korea is investing in water and wastewater treatment infrastructure to address environmental concerns and ensure access to clean water. Fiber reinforced polymer panels and sheets are used in water treatment facilities for applications such as tanks, pipes, and structural supports due to their corrosion resistance and durability in harsh chemical environments.

The below table highlights how glass segment is projected to lead the market in terms of fiber type, and is expected to account for a CAGR of 5.8% through 2035. Based on end user industry, the transportation segment is expected to account for a CAGR of 5.7% through 2035.

| Category | CAGR from 2025 to 2035 |

|---|---|

| Glass | 5.8% |

| Transportation | 5.7% |

Based on fiber type, the glass segment is expected to continue dominating the fiber reinforced polymer panel and sheet market. Glass fibers offer excellent strength to weight ratios, making them ideal reinforcement materials for polymer matrices in fiber reinforced polymer panels and sheets.

Glass fibers exhibit excellent resistance to corrosion, moisture, and chemical exposure, making them suitable for use in harsh environmental conditions. Fiber reinforced polymer panels and sheets reinforced with glass fibers are commonly used in marine, automotive, chemical processing, and infrastructure applications where corrosion resistance is essential for long term performance.

In terms of end user industry, the transportation segment is expected to continue dominating the fiber reinforced polymer panel and sheet market. The transportation industry, including automotive, aerospace, and marine sectors, is increasingly focused on reducing vehicle weight to improve fuel efficiency and meet regulatory standards for emissions reduction.

Fiber reinforced polymer panels and sheets offer significant weight savings compared to traditional materials like steel, aluminum, and fiberglass, making them attractive for lightweighting applications in vehicles, aircraft, ships, and trains.

Fiber reinforced polymer panels and sheets reinforced with fibers such as glass, carbon, and aramid offer excellent strength to weight ratios, making them suitable for structural components and exterior body panels in transportation vehicles.

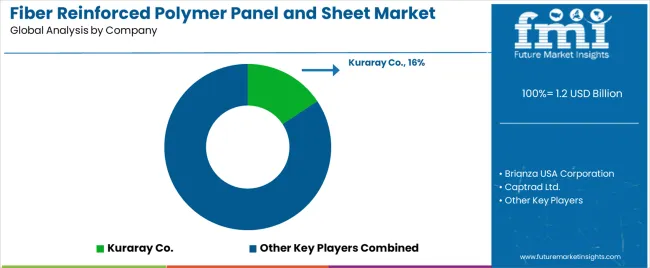

The competitive landscape of the fiber reinforced polymer panel and sheet market is characterized by a diverse array of players, ranging from multinational corporations to regional manufacturers and niche suppliers.

Competition within the fiber reinforced polymer panel and sheet market intensifies, as the demand for lightweight, durable, and sustainable construction materials continues to rise across various industries, driven by factors such as innovation, product differentiation, quality standards, and customer service.

Company Portfolio

| Attribute | Details |

|---|---|

| Estimated Market Size in 2025 | USD 1.2 billion |

| Projected Market Valuation in 2035 | USD 2.0 billion |

| Value-based CAGR 2025 to 2035 | 5.6% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | Value in USD billion |

| Key Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; The Middle East & Africa |

| Key Market Segments Covered | Fiber Type, End User Industry, Region |

| Key Countries Profiled | The United States, Canada, Brazil, Mexico, Germany, France, France, Spain, Italy, Russia, Poland, Czech Republic, Romania, India, Bangladesh, Australia, New Zealand, China, Japan, South Korea, GCC countries, South Africa, Israel |

| Key Companies Profiled | Brianza USA Corporation; Captrad Ltd.; Crane Composites Inc.; Dofrp (Miyabi FRP); Hill & Smith Holdings PLC; Kal-Lite; Kalwall; Krempel GmbH; Panolam Industries International Inc.; Redwood Plastics and Rubber |

The global fiber reinforced polymer panel and sheet market is estimated to be valued at USD 1.2 billion in 2025.

The market size for the fiber reinforced polymer panel and sheet market is projected to reach USD 2.0 billion by 2035.

The fiber reinforced polymer panel and sheet market is expected to grow at a 5.6% CAGR between 2025 and 2035.

The key product types in fiber reinforced polymer panel and sheet market are glass, carbon and others.

In terms of end use industry, transportation segment to command 47.2% share in the fiber reinforced polymer panel and sheet market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fiber Based Packaging Market Size and Share Forecast Outlook 2025 to 2035

Fiber Lid Market Forecast and Outlook 2025 to 2035

Fiberglass Tanks Market Size and Share Forecast Outlook 2025 to 2035

Fiber Sorter Market Size and Share Forecast Outlook 2025 to 2035

Fiber Optic Tester Market Size and Share Forecast Outlook 2025 to 2035

Fiber Laser Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Market Size and Share Forecast Outlook 2025 to 2035

Fiber Spinning Equipment Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Fabric Market Size and Share Forecast Outlook 2025 to 2035

Fiber Optic Connectivity Market Size and Share Forecast Outlook 2025 to 2035

Fiber Optic Collimating Lens Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Duct Wrap Insulation Market Size and Share Forecast Outlook 2025 to 2035

Fiber-Based Blister Pack Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Fiber Optics Testing Market Size and Share Forecast Outlook 2025 to 2035

Fiber Laser Coding System Market Size and Share Forecast Outlook 2025 to 2035

Fiber Optics Market Size and Share Forecast Outlook 2025 to 2035

Fiber Supplements Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Filters Market Size and Share Forecast Outlook 2025 to 2035

Fiber Optic Test Equipment Market Outlook - Size, Share & Forecast 2025 to 2035

Fiberglass Light Poles Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA