The fiber optics market is estimated to be valued at USD 9.7 billion in 2025 and is projected to reach USD 24.1 billion by 2035, registering a compound annual growth rate (CAGR) of 9.5% over the forecast period. The growth contribution index reveals the relative impact of various periods within the forecast, highlighting phases of acceleration and stabilization. The market starts at USD 6.2 billion in 2025 and increases steadily, reaching USD 9.7 billion by 2029. This early-phase growth is largely driven by the expanding adoption of fiber optics in telecommunications, data centers, and broadband infrastructure, where high-speed internet demand is a key growth factor.

Between 2029 and 2031, the market experiences a significant boost, with the value rising from USD 9.7 billion to USD 10.6 billion. This period sees increased contributions from emerging technologies like 5G networks, smart cities, and the Internet of Things (IoT), which are driving demand for faster, more reliable data transmission solutions.

From 2031 to 2035, the growth rate intensifies, with the market reaching USD 24.1 billion by 2035. This surge is primarily attributed to further advancements in optical networking technologies, increased investments in infrastructure development, and the growing need for fiber optics in industries such as healthcare, automotive, and industrial automation.

Telecommunications engineers evaluate fiber optic specifications based on attenuation characteristics, dispersion properties, and installation environment compatibility when designing network architectures for long-haul transmission, metropolitan area networks, and last-mile connectivity solutions.

Cable selection involves analyzing core diameter, cladding specifications, and protective jacket materials while considering mechanical strength requirements, environmental resistance, and splice compatibility factors necessary for reliable network performance.

Procurement decisions balance initial cable costs against operational efficiency metrics including signal loss minimization, maintenance accessibility, and future capacity expansion capabilities that influence total cost of ownership calculations.

Technology advancement prioritizes bend-insensitive fiber designs, higher core count cables, and specialized coatings that improve installation efficiency while maintaining optical performance characteristics. Manufacturers develop ribbon fiber technologies, micro-duct systems, and blow-in installation methods that reduce deployment costs while increasing cable density capabilities within existing conduit infrastructure.

Coating innovations encompass water-blocking materials, flame-retardant compounds, and rodent-resistant barriers that enhance cable durability while addressing specific installation environment challenges.

Service provider relationships involve coordination between cable manufacturers, telecommunications carriers, and installation contractors to establish supply chain networks that address project scheduling, inventory management, and technical support requirements.

Contract negotiations include performance specifications, delivery guarantees, and warranty provisions that protect network investment while ensuring reliable cable supply throughout multi-phase infrastructure projects. Partnership development encompasses collaboration with equipment manufacturers, testing instrument providers, and installation tool suppliers to deliver integrated fiber optic solutions that optimize network deployment efficiency.

| Metric | Value |

|---|---|

| Fiber Optics Market Estimated Value in (2025 E) | USD 9.7 billion |

| Fiber Optics Market Forecast Value in (2035 F) | USD 24.1 billion |

| Forecast CAGR (2025 to 2035) | 9.5% |

The fiber optics market is experiencing consistent growth driven by escalating data traffic, digital transformation across industries, and the expansion of high-speed communication networks. Demand for low-latency, high-bandwidth connectivity has significantly accelerated fiber optic infrastructure deployment across both developed and emerging economies.

Technological advancements in optical components and growing investments in 5G, cloud computing, and IoT ecosystems are further supporting adoption. Government initiatives focused on broadband penetration and smart city development are reinforcing market expansion.

The market outlook remains favorable as enterprises and telecom providers prioritize future-proof connectivity solutions that ensure speed, reliability, and minimal signal loss across long distances.

The fiber optics market is segmented by fiber type, cable type, deployment, end user, and geographic regions. By fiber type, the fiber optics market is divided into Glass fibers and Plastic optical fibers. In terms of cable type, the fiber optics market is classified into Single-mode and Multi-mode. Based on deployment, the fiber optics market is segmented into Underground, Aerial, and Underwater.

The end users of the fiber optics market are segmented into Telecommunication, Power utilities, Aerospace & defense, Data center, and Others. Regionally, the fiber optics industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The glass fibers segment is expected to account for 57.20% of the overall market revenue by 2025 within the fiber type category, positioning it as the dominant segment. This growth is attributed to its superior transmission capabilities, high tensile strength, and resistance to electromagnetic interference.

Glass fibers are widely used in long-distance and high-performance networks where signal integrity and durability are critical. Their compatibility with advanced network infrastructures and low signal attenuation has further supported widespread adoption.

As telecom and data service providers continue to expand high capacity networks, glass fibers remain the preferred choice for robust and future ready optical cabling.

The single-mode cable segment is projected to contribute 63.50% of total market revenue by 2025 within the cable type category, establishing it as the market leader. This is due to its capability to support long-distance communication with minimal signal loss and high bandwidth transmission.

Single-mode fibers are essential for backbone infrastructure in telecom and data center applications, where scalability and performance are crucial. Their use in 5G rollout, submarine communication, and long-haul connectivity has accelerated adoption.

The ability to deliver reliable and high-speed data transmission over extended distances has solidified single-mode’s dominance within the cable type segment.

The underground deployment segment is expected to hold 48.90% of total market revenue by 2025 within the deployment category, making it the leading approach. The need for protected, durable, and stable installation in both urban and rural environments drives this dominance.

Underground fiber networks offer reduced exposure to environmental hazards, physical damage, and weather-related disruptions, ensuring consistent performance. Urban planning authorities and telecom providers have prioritized underground deployment to minimize maintenance costs and enhance network reliability.

As broadband demand rises and infrastructure resilience becomes a priority, underground deployment continues to be the most preferred method for laying fiber optic cables.

The fiber optics market is witnessing significant growth driven by the increasing demand for high-speed data transmission and internet connectivity. Fiber optic cables, known for their ability to transmit data over long distances with minimal loss and high bandwidth, are essential for meeting the needs of modern communication systems. As global data traffic continues to rise, especially with the expansion of 5G networks, cloud computing, and IoT devices, the need for fiber optic infrastructure is expanding. Innovations in fiber optic technology, including advancements in materials and manufacturing processes, are also contributing to market growth, making fiber optics more accessible and efficient for various industries.

The primary driver of the fiber optics market is the increasing demand for high-speed internet and data transmission capabilities across industries. The rise in video streaming, cloud computing, and IoT devices is driving the need for faster and more reliable data transfer systems. Fiber optics, with their ability to offer ultra-high-speed communication over long distances, are ideal for meeting these demands. Telecommunications companies are investing heavily in fiber optic infrastructure to provide faster internet services, particularly in rural and underserved areas. Additionally, the growing adoption of 5G technology is further propelling the market, as fiber optics are essential for the backhaul infrastructure of 5G networks.

Despite the growth potential, the fiber optics market faces challenges related to high installation costs and infrastructure limitations. Installing fiber optic cables requires significant capital investment in terms of materials, labor, and equipment. This can be a barrier for smaller businesses or regions with limited budgets, especially in areas with existing copper or wireless networks. Additionally, fiber optic installation involves digging trenches or other infrastructure modifications, which can be time-consuming and expensive. The availability of skilled labor for installation and maintenance is another challenge that can slow down the adoption of fiber optic systems. Overcoming these challenges requires continued advancements in installation techniques and cost-reduction strategies.

The fiber optics market presents significant opportunities, particularly with the expansion of 5G networks and the development of smart cities. As 5G technology requires faster and more efficient data transmission, fiber optics play a critical role in the backhaul infrastructure, connecting base stations to central networks. With the global rollout of 5G networks, there is an increasing demand for fiber optic cables to support high-speed data transfer. Additionally, the growing focus on smart cities, which rely on interconnected devices and real-time data exchange, is driving the need for robust fiber optic infrastructure. These trends present a promising growth trajectory for the fiber optics market as these technologies continue to proliferate.

A key trend in the fiber optics market is the continuous advancements in fiber optic technology, including improvements in materials and manufacturing processes. Innovations such as photonic crystal fibers, hollow-core fibers, and improved fiber coatings are enhancing the performance and efficiency of fiber optic cables. Additionally, the increasing adoption of fiber-to-the-home (FTTH) systems, particularly in residential broadband networks, is driving market growth. FTTH allows consumers to access ultra-high-speed internet directly through fiber optic cables, offering faster speeds and better reliability compared to traditional copper-based systems. As these technologies evolve, the fiber optics market is expected to continue expanding, with broader adoption across various industries and regions.

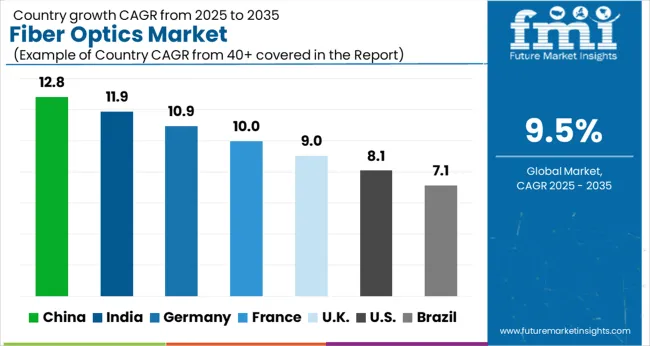

| Country | CAGR |

|---|---|

| China | 12.8% |

| India | 11.9% |

| Germany | 10.9% |

| France | 10.0% |

| UK | 9.0% |

| USA | 8.1% |

| Brazil | 7.1% |

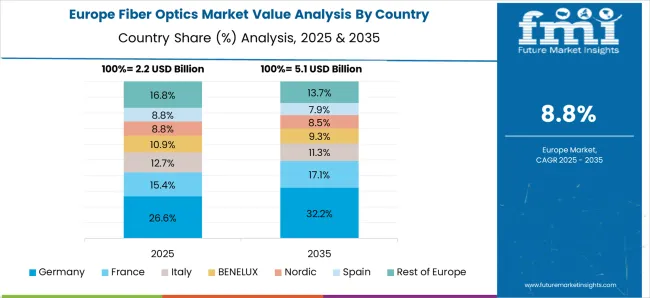

The global fiber optics market is projected to grow at a global CAGR of 9.5% from 2025 to 2035. China leads the market with a growth rate of 12.8%, followed by India at 11.9%. France records a growth rate of 10.0%, while the UK shows 9.0% and the USA follows at 8.1%. The market is primarily driven by the increasing demand for high-speed internet, advancements in telecommunication infrastructure, and the growth of cloud computing. China and India are leading the growth due to rapid digital transformation, infrastructure development, and government support for telecommunications. Developed economies like France, the UK, and the USA are witnessing steady growth driven by advancements in fiber-optic technologies and growing demand for data transmission solutions. The analysis spans over 40+ countries, with the leading markets shown below.

The fiber optics market in China is expanding at a 12.8% CAGR, driven by the country’s rapid digital transformation, strong government support for telecommunications, and growing demand for high-speed internet. The Chinese government’s “Broadband China” initiative, which focuses on expanding fiber-optic networks across urban and rural areas, is significantly contributing to the market’s growth. The growing e-commerce, cloud computing, and smart city projects are fueling demand for advanced fiber-optic solutions. The telecom industry in China is rapidly adopting fiber optics to meet the increasing data demands of consumers, further accelerating market expansion.

The fiber optics market in India is expected to grow at an 11.9% CAGR, supported by the rapid expansion of telecommunication infrastructure, government initiatives, and rising internet penetration. As the country undergoes significant digital transformation, the demand for faster and more reliable internet services is pushing the adoption of fiber-optic technologies. The Indian government’s support for projects like the National Optical Fiber Network (NOFN) and Smart Cities Mission is contributing to the rapid deployment of fiber-optic networks across the country. The growing adoption of cloud computing and IoT is driving the demand for high-speed, high-capacity data transmission solutions.

The fiber optics market in France is projected to grow at a 10.0% CAGR, fueled by the growing demand for high-speed internet and advances in telecommunication infrastructure. France is investing heavily in expanding its fiber-optic network, particularly in rural areas, to ensure universal access to fast internet services. France’s commitment to modernizing its communication networks, including the rollout of fiber-to-the-home (FTTH) connections, is further accelerating market growth. The increasing adoption of data-intensive applications, such as video streaming and cloud services, is also driving demand for fiber-optic solutions in the country’s telecommunication industry.

The UK fiber optics market is expected to expand at a 9.0% CAGR, driven by increasing demand for broadband services, fiber-optic internet connectivity, and the need for high-speed data transmission solutions. The UK government’s Digital Infrastructure Programme, which focuses on improving broadband infrastructure across the country, is supporting the expansion of fiber-optic networks. The UK telecom industry is adopting fiber-optic technologies to enhance internet speeds and meet the growing demand for high-bandwidth services. The increasing shift toward cloud computing and data-intensive technologies is fueling the demand for fiber-optic solutions.

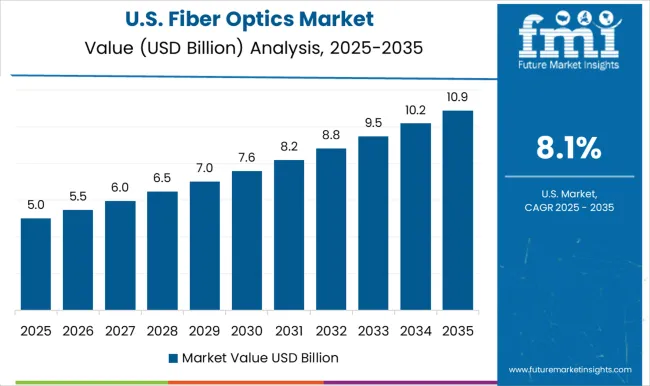

The USA fiber optics market is projected to grow at an 8.1% CAGR, supported by the increasing demand for faster internet speeds, growing reliance on cloud computing, and the expansion of data centers. The USA government and private sector investments in telecommunication infrastructure are driving the deployment of fiber-optic networks across urban and rural areas. The rise in demand for data-intensive applications, such as video streaming and online gaming, is further contributing to the need for fiber-optic solutions. The USA telecom industry’s continued shift toward fiber-optic technologies, along with the expansion of 5G networks, is also accelerating market growth.

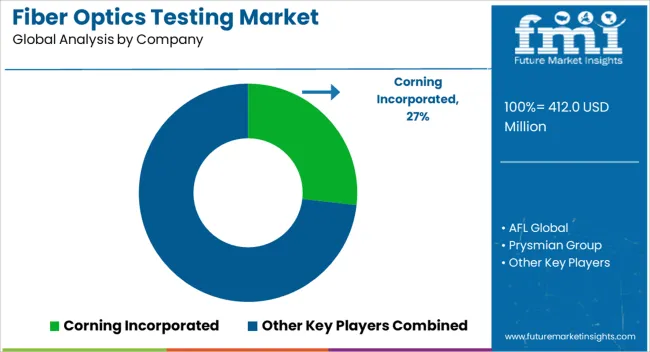

The fiber optics market is experiencing robust growth due to the increasing demand for high-speed data transmission, advancements in telecommunications, and the expanding adoption of fiber-optic networks for internet connectivity and data center infrastructure. Key players in the market include STL Tech (Sterlite Technologies Ltd.), TE Connectivity Ltd., Corning Incorporated, Newport Corporation (MKS Instruments Inc.), Broadcom Inc., CommScope Holding Company Inc., and Fiberoptics Technology Incorporated.

STL Tech (Sterlite Technologies Ltd.) and Corning Incorporated are market leaders, offering a wide range of fiber optic cables and solutions for telecommunications, broadband, and enterprise networks. TE Connectivity Ltd. focuses on innovative fiber-optic connectivity solutions, serving industries like automotive, healthcare, and industrial sectors.

Broadcom Inc. and Newport Corporation (now part of MKS Instruments) specialize in optoelectronics and laser technologies that enable high-performance fiber optic networks, crucial for data communication and high-speed internet. CommScope Holding Company Inc. provides fiber optic infrastructure solutions, with a strong presence in the broadband, wireless, and enterprise markets. Fiberoptics Technology Incorporated offers specialized fiber optic solutions for industrial and military applications, catering to niche markets.

| Item | Value |

|---|---|

| Quantitative Units | USD 9.7 Billion |

| Fiber Type | Glass fibers and Plastic optical fibers |

| Cable Type | Single-mode and Multi-mode |

| Deployment | Underground, Aerial, and Underwater |

| End User | Telecommunication, Power utilities, Aerospace & defense, Data center, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled |

STL Tech (Sterlite Technologies Ltd.), TE Connectivity Ltd., Corning Incorporated, Newport Corporation (MKS Instruments Inc.), Broadcom Inc., CommScope Holding Company Inc., Fiberoptics Technology Incorporated |

| Additional Attributes | Dollar sales by product type (fiber optic cables, connectors, transmitters, receivers) and end-use segments (telecommunications, data centers, industrial, healthcare). Demand dynamics are driven by the growing need for high-speed data transmission, expanding communication networks, and the shift towards 5G technology. Regional trends show strong growth in North America, Europe, and Asia-Pacific, with increasing investments in network infrastructure and innovations in fiber optic technology fueling market expansion. |

The global fiber optics market is estimated to be valued at USD 9.7 billion in 2025.

The market size for the fiber optics market is projected to reach USD 24.1 billion by 2035.

The fiber optics market is expected to grow at a 9.5% CAGR between 2025 and 2035.

The key product types in fiber optics market are glass fibers and plastic optical fibers.

In terms of cable type, single-mode segment to command 63.5% share in the fiber optics market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fiber Optics Testing Market Size and Share Forecast Outlook 2025 to 2035

Medical Fiber Optics Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Fiber Optics Market Growth - Trends & Forecast 2025 to 2035

Fiber Optic Probe Hydrophone (FOPH) Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Centrifugal Fan Market Size and Share Forecast Outlook 2025 to 2035

Fiber to the Home Market Size and Share Forecast Outlook 2025 to 2035

Fiber Based Packaging Market Size and Share Forecast Outlook 2025 to 2035

Fiber Lid Market Forecast and Outlook 2025 to 2035

Fiberglass Tanks Market Size and Share Forecast Outlook 2025 to 2035

Fiber Sorter Market Size and Share Forecast Outlook 2025 to 2035

Fiber Reinforced Polymer Panel and Sheet Market Size and Share Forecast Outlook 2025 to 2035

Fiber Optic Tester Market Size and Share Forecast Outlook 2025 to 2035

Fiber Laser Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Market Size and Share Forecast Outlook 2025 to 2035

Fiber Spinning Equipment Market Size and Share Forecast Outlook 2025 to 2035

Fiber Reinforced Plastic (FRP) Panels & Sheets Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Fabric Market Size and Share Forecast Outlook 2025 to 2035

Fiber Optic Connectivity Market Size and Share Forecast Outlook 2025 to 2035

Fiber Optic Collimating Lens Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Duct Wrap Insulation Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA