The fiber based packaging market is experiencing strong growth driven by rising sustainability demands, increasing environmental regulations, and growing consumer preference for eco-friendly materials. Market expansion is being supported by the transition away from single-use plastics and the rising adoption of biodegradable and recyclable packaging solutions across multiple industries.

Continuous innovation in fiber processing, coating technologies, and structural design is enhancing product durability and moisture resistance, making fiber-based solutions viable even for complex packaging needs. The current market scenario reflects an accelerated shift among manufacturers toward renewable raw materials, supported by government initiatives and circular economy models.

The future outlook remains positive as brand owners and retailers prioritize sustainable packaging alternatives to align with carbon reduction goals Growth rationale is based on cost efficiency, recyclability, and consumer-driven demand for environmentally responsible products, positioning fiber-based packaging as a critical component of the global packaging transformation and ensuring long-term industry expansion.

| Metric | Value |

|---|---|

| Fiber Based Packaging Market Estimated Value in (2025 E) | USD 314.7 billion |

| Fiber Based Packaging Market Forecast Value in (2035 F) | USD 379.8 billion |

| Forecast CAGR (2025 to 2035) | 1.9% |

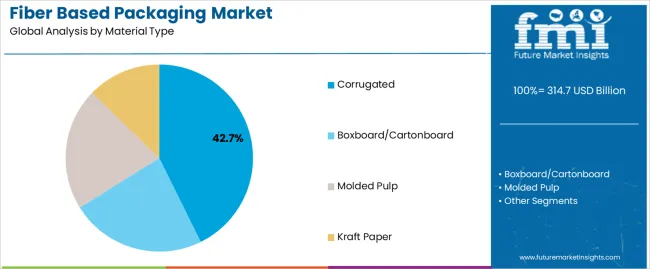

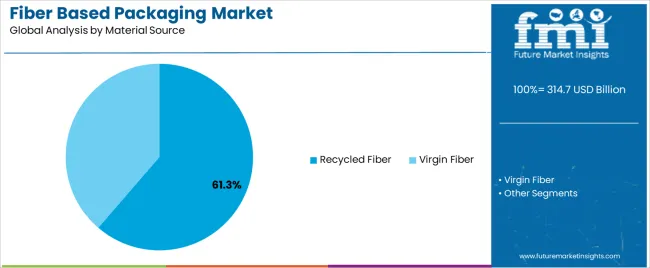

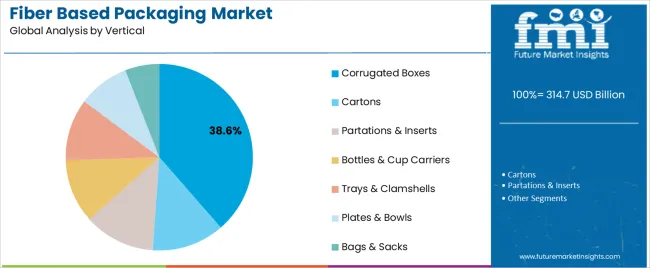

The market is segmented by Material Type, Material Source, and Vertical and region. By Material Type, the market is divided into Corrugated, Boxboard/Cartonboard, Molded Pulp, and Kraft Paper. In terms of Material Source, the market is classified into Recycled Fiber and Virgin Fiber. Based on Vertical, the market is segmented into Corrugated Boxes, Cartons, Partations & Inserts, Bottles & Cup Carriers, Trays & Clamshells, Plates & Bowls, and Bags & Sacks. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The corrugated segment, accounting for 42.70% of the material type category, has emerged as the leading segment due to its strength, structural versatility, and wide applicability in shipping and logistics. Demand has been reinforced by e-commerce growth and increased global trade volumes requiring durable and lightweight packaging solutions.

Technological advancements in linerboard and fluting materials have enhanced stacking performance and moisture resistance, extending usage across diverse end-user sectors. Cost-effectiveness and recyclability have further strengthened adoption, particularly in retail and industrial packaging.

Manufacturers are optimizing corrugated production through automation and sustainable sourcing, ensuring consistent quality and reduced environmental footprint Continued innovation in barrier coatings and digital printing technologies is expected to sustain segment leadership and drive value-added growth across domestic and international packaging applications.

The recycled fiber segment, holding 61.30% of the material source category, has maintained dominance due to increasing environmental regulations and corporate commitments to sustainability. The segment’s growth is supported by efficient waste collection systems, advancements in recycling technologies, and strong consumer acceptance of recycled materials.

Cost advantages compared to virgin fiber and reduced energy consumption in production have further enhanced its competitiveness. Demand has been reinforced by the packaging industry’s focus on circularity and resource optimization.

Leading manufacturers are investing in closed-loop systems to improve fiber recovery and maintain performance consistency The trend toward lightweight yet durable recycled fiber packaging is expected to continue, ensuring this segment retains its leading market position and contributes significantly to overall market sustainability objectives.

The corrugated boxes segment, representing 38.60% of the vertical category, has been leading due to its essential role in e-commerce, retail, and industrial shipping applications. Growth has been accelerated by increasing global online sales and the requirement for protective, customizable, and cost-efficient packaging.

The segment benefits from widespread manufacturing infrastructure and the ability to incorporate recycled materials without compromising strength or quality. Corrugated boxes offer excellent printability, enabling brand differentiation and communication of sustainability values.

Demand stability is being maintained through continuous product innovations, automation in box production, and enhanced logistics compatibility Expansion into temperature-sensitive and premium product packaging is expected to further strengthen this segment’s dominance, supporting consistent revenue growth and sustained market leadership across global supply chains.

The material type that predominates in the market is corrugated. Recycled fiber is the top source in the market.

Corrugated packaging is expected to account for 57.1% of the market share by material type in 2025. Factors driving the growth of corrugated packaging are:

| Attributes | Details |

|---|---|

| Top Material Type | Corrugated |

| Market Share (2025) | 57.1% |

Recycled fiber is anticipated to account for 75.5% of the market share in 2025. Some of the factors for the growth of recycled fiber as a source are:

| Attributes | Details |

|---|---|

| Top Material Source | Recycled Fiber |

| Market Share (2025) | 75.5% |

Advancements in the packaging sector in the Asia Pacific are helping the market’s progress in the region. Rapidly accelerating manufacturing facilities are also aiding the market’s cause in the Asia Pacific.

Imposing of sustainability measures by regulatory authorities in Europe is seeing an increasing number of industrialists switch to fiber based packaging. Propulsion of online sales is also bettering the market’s prospects in Europe.

| Countries | CAGR (2025 to 2035) |

|---|---|

| China | 3.7% |

| India | 4.1% |

| South Korea | 2.2% |

| Thailand | 3.1% |

| Spain | 2.1% |

The market is anticipated to register a CAGR of 4.1% in India for the forecast period. Some of the factors driving the growth of the market in the country are:

South Korea is set to see the market expand at a CAGR of 2.2% over the forecast period. Prominent factors driving the growth of the market are:

The market is expected to register a CAGR of 3.7% in China over the forecast period. Some of the factors driving the growth of the market in China are:

The market is set to progress at a CAGR of 3.1% in Thailand for the forecast period. Factors influencing the growth of the market in Thailand include:

The market is expected to register a CAGR of 2.1% in Spain over the period from 2025 to 2035. Some of the reasons for the growth of fiber based packaging in the country are:

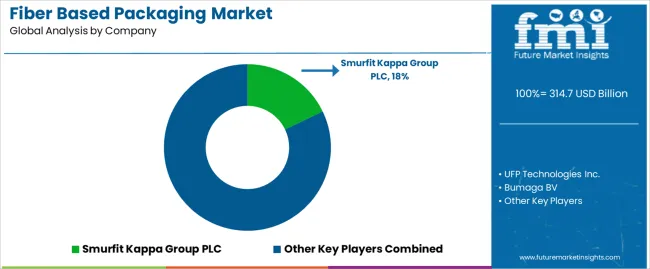

The molded fiber market is highly fragmented, with no single player having a dominant position in the global market. Rather, small-scale players and startups are thriving in the market with the help of innovative techniques of manufacturing.

Players in the fiber based packaging market are partnering with enterprises in end-user industries for advertising purposes. Partnerships are also being established with fellow market players to establish greater control over demand.

Recent Developments in the Fiber Based Packaging Market

The global fiber based packaging market is estimated to be valued at USD 314.7 billion in 2025.

The market size for the fiber based packaging market is projected to reach USD 379.8 billion by 2035.

The fiber based packaging market is expected to grow at a 1.9% CAGR between 2025 and 2035.

The key product types in fiber based packaging market are corrugated, boxboard/cartonboard, molded pulp and kraft paper.

In terms of material source, recycled fiber segment to command 61.3% share in the fiber based packaging market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Assessing Fiber-Based Packaging Market Share & Industry Trends

Fiber Lid Market Forecast and Outlook 2025 to 2035

Fiberglass Tanks Market Size and Share Forecast Outlook 2025 to 2035

Fiber Sorter Market Size and Share Forecast Outlook 2025 to 2035

Fiber Reinforced Polymer Panel and Sheet Market Size and Share Forecast Outlook 2025 to 2035

Fiber Optic Tester Market Size and Share Forecast Outlook 2025 to 2035

Fiber Laser Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Market Size and Share Forecast Outlook 2025 to 2035

Fiber Spinning Equipment Market Size and Share Forecast Outlook 2025 to 2035

Fiber Reinforced Plastic (FRP) Panels & Sheets Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Fabric Market Size and Share Forecast Outlook 2025 to 2035

Fiber Optic Connectivity Market Size and Share Forecast Outlook 2025 to 2035

Fiber Optic Collimating Lens Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Duct Wrap Insulation Market Size and Share Forecast Outlook 2025 to 2035

Fiber Optics Testing Market Size and Share Forecast Outlook 2025 to 2035

Fiber Laser Coding System Market Size and Share Forecast Outlook 2025 to 2035

Fiber Optics Market Size and Share Forecast Outlook 2025 to 2035

Fiber Reinforced Polymer (FRP) Rebars Market Size and Share Forecast Outlook 2025 to 2035

Fiber Supplements Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Filters Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA