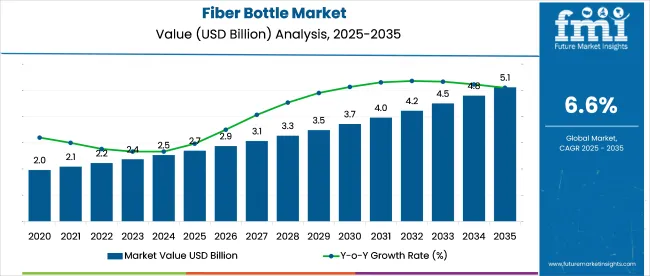

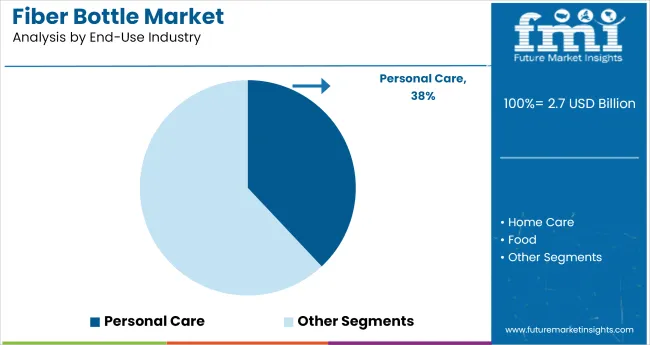

The fiber bottle market is likely to grow to USD 2.7 billion in 2025. Demand is projected to rise to USD 5.1 billion by 2035 at 6.6% CAGR.

| Attribute | Value |

|---|---|

| Market Size (2025) | USD 2.7 billion |

| Market Size (2035) | USD 5.1 billion |

| CAGR (2025 to 2035) | 6.6% |

Sales are driven by increasing demand across beverages, home care, and personal care products. These bottles use molded pulp or paper-based composites, often paired with minimal polymer linings to meet barrier requirements. Their lower resin content appeals to producers seeking packaging with reduced environmental load. Developments in forming, drying, and surface finishing are improving efficiency and performance. Fiber bottles are being introduced in refill systems, dry product lines, and sample SKUs, with growing acceptance among retailers updating packaging portfolios to reduce traditional plastic formats.

As of 2025, fiber bottles form a minor part of their overarching markets. In the global packaging landscape, estimated at over USD 1.2 trillion, their presence remains below 0.05%, with adoption limited to pilot-scale applications. Beverage packaging, a USD 200 billion segment, sees fiber bottles contributing around 0.1%, largely within bottled water and craft beverages. In personal care, uptake is lower-under 0.03%, with fiber formats still in testing for items like shampoo and lotion.

Paper-based packaging, a USD 400 billion market, includes fiber bottles at under 0.1%, overshadowed by folding cartons and molded trays. In compostable packaging, estimated near USD 10 billion, fiber bottles represent around 0.4% of the market, supported by interest in plastic-free rigid containers. Technical hurdles around barrier performance and industrial filling compatibility continue to restrict broader deployment.

Matthias Zachert, CEO of LANXESS AG, views fiber bottles as a structural shift in liquid packaging that requires coordinated progress across science, manufacturing, and recovery systems. He explains that LANXESS has developed bio-based barrier coatings that address oxygen and moisture pressure without hindering recyclability.

These advancements remove a key technical barrier that has historically limited fiber bottle adoption in beverages and personal care. Zachert presents this as evidence that performance and material recovery can be integrated at scale, reflecting LANXESS’s approach to engineering packaging solutions that meet commercial and environmental expectations without trade-offs.

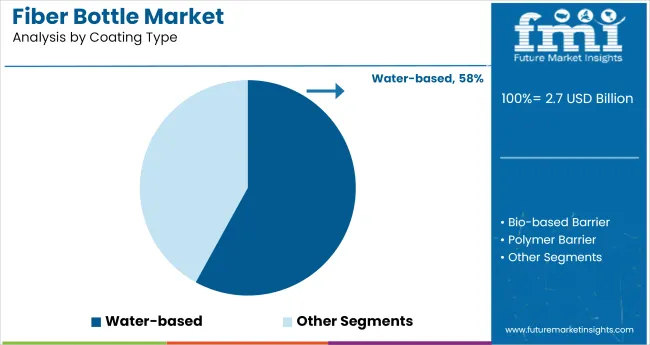

Adoption of fiber bottles has centered around water-based coatings and beverage applications, where shelf-life, barrier uniformity, and mold precision drive decision-making. Format conversion among liquid packaging suppliers is driven by tooling standardization, cap torque specifications, and compatibility with rotary and linear fill lines.

Water-based coatings account for 58% of fiber bottle demand due to their low curing temperatures (below 90°C) and thin-layer film uniformity (<8 microns). They offer moderate oxygen transmission rates (OTR <1.0 cc/m²/day) suitable for short-shelf-life beverages. Brands like Carlsberg, Lactalis, and Just Water have adopted these coatings for mass-scale fiber bottles, especially for chilled juices and milk drinks. Coating lines utilize UV-assisted drying or forced-air curing chambers to maintain throughput above 200 bottles/minute. Water-based barriers also ease recyclability, enabling mono-material sortation in fiber streams with no polymer residue above 1% by weight.

Beverage applications comprise 42% of total fiber bottle usage, driven by adoption in water, flavored drinks, and dairy. The shift to molded pulp formats is fueled by interest in alternatives to PET and HDPE, particularly for 250-750 mL formats. Brands such as Nestlé, Coca-Cola, and PepsiCo are testing pilot batches across EU and USA markets. Average bottle wall thickness ranges between 0.6-1.2 mm, with vertical load-bearing capacity exceeding 6.5 kg. Bottle forming molds must retain dimensional accuracy within ±0.2 mm across production cycles to maintain fit with automated de-palletizing and filling systems.

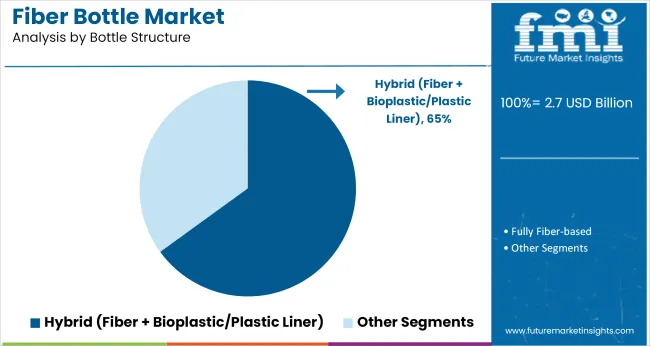

Hybrid bottles with internal bioplastic or polymer liners remain the most commercially available format, especially in high-shelf-life applications like dairy or juice. Typically composed of outer molded fiber shell (60-70% by weight) and internal liner (PLA or thin PET), these designs support oxygen barrier levels <0.5 cc/m²/day. Manufacturers such as Paboco, PA Consulting, and Billerud offer hybrid formats for filling lines operating up to 220 BPM. Liner-blown formats are induction-sealed post-fill to ensure leak integrity under 2 bar internal pressure.

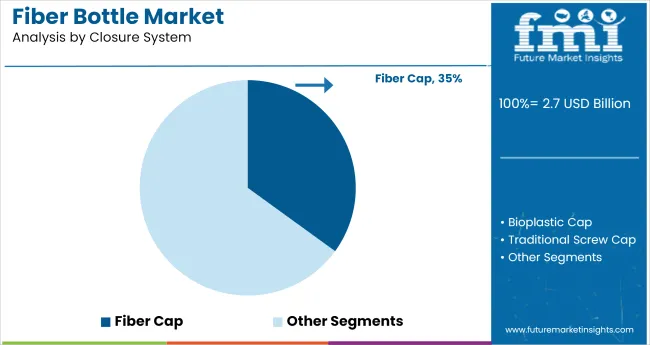

Fiber-based caps are replacing traditional screw caps in short-cycle drinks and single-serve SKUs. These caps are compression-molded from wet-formed pulp or pressed dry fiber, supporting torque thresholds of 0.3 Nm with push-and-twist locking designs. Companies like Blue Ocean Closures, Pulpex, and Stora Enso are scaling fiber cap lines with mold cycle times of 2.5-3.5 seconds. While not suitable for carbonated applications yet, fiber caps are sufficient for still beverages and personal care liquids with low vapor pressure.

Personal care brands are adopting fiber bottles for lotions, shampoos, and cleansers in 250 mL to 500 mL formats. The emphasis is on packaging appearance and tactile feel, often achieved through micro-embossed textures on fiber shells. Manufacturers such as L’Oréal, Davines, and Seventh Generation have piloted fully fiber or hybrid bottles. Internal liners are required for chemical pH stability (pH 4-9), while spray and pump integration use snap-in fiber collars with tolerance windows under 0.3 mm.

Fiber bottle adoption improved warehouse turnover, cut changeover times, and reduced product loss in Northern Europe. Field trials confirmed structural reliability in beverage and personal care uses. Despite cost pressures from pulp and biopolymer inputs, producers are offsetting expenses through localized materials and standardized closures, though automation limitations continue to affect margins.

Inventory Shifts and Line-Speed Adjustments in Fiber Bottle Filling

Beverage and personal care fillers reduced warehouse holding times after recalibrating production lines for fiber bottle formats. Across Denmark and the Netherlands, average storage time dropped from 68 to 47 days in Q1 2025 following integration of pressure-sensitive conveyors and bottle guides tailored for pulp-based structures.

Co-packers in Germany operating shared lines now clock a 23% faster changeover time when switching from PET to fiber substrates, aided by pre-molded inserts and standardized cap interfaces. UK brands restructured monthly production schedules to accommodate shorter curing cycles, leading to an 11% reduction in excess finished goods.

Performance Validation Across Beverage and Body Care Applications

Consumer field testing by Aarhus University in late 2024 reported 87% retention of structural integrity across chilled and ambient formats after 30 days of use, when using dual-layer fiber bottles with internal biopolymer lining. In Finland, trial runs of carbonated drinks in reinforced paper-based bottles showed no cap-blow failure across batches of 10,000 units.

Shampoo producers in Canada completed shelf-life equivalence testing under ASTM D4169 transport simulation, clearing the format for national rollout. French mineral water brands introduced fiber prototypes for still water, reporting 28% higher trial participation among eco-focused customer segments during store-based samplings.

Input Cost Pressure and Manufacturing Constraints

Producers faced tighter margin spreads due to pulp input inflation and resin-layer sourcing variability. Nordic fiber pulp prices moved 12% higher YoY by May 2025, while costs for thin bioplastic linings rose 8% across East Asia. Mold cycle times remained longer than PET equivalents, constraining throughput by 15-22% in high-volume lines.

Labour demands for bottle finishing added complexity at manual-trim stages. To counter rising unit economics, some producers switched to regionally sourced waste fiber blends, lowering raw material cost by 9% at the expense of lighter color consistency. Others entered co-development deals with closure makers to unify cap-fit profiles, shaving off per-unit assembly time.

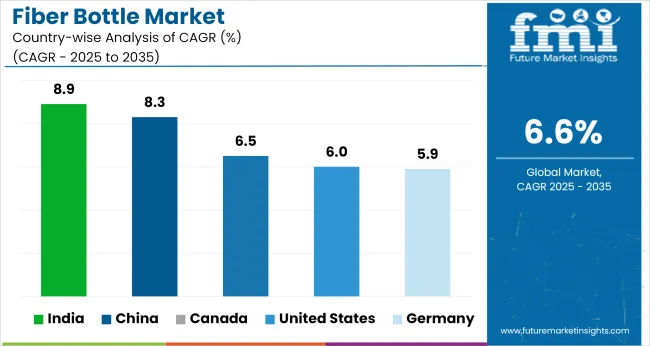

| Countries | CAGR (2025 to 2035) |

|---|---|

| India | 8.9% |

| China | 8.3% |

| Canada | 6.5% |

| United States | 6.0% |

| Germany | 5.9% |

The demand is forecast to expand at a 6.6% CAGR between 2025 and 2035. Among the five countries profiled, India (BRICS) sees the steepest upward momentum at 8.9%, followed by China (BRICS) at 8.3%. Canada (OECD) posts 6.5%, while the USA and Germany, both OECD members, trail slightly at 6.0% and 5.9%, respectively.

Compared to the global average, India exceeds by +35%, China by +26%, while Canada remains near-par, and the USA and Germany fall short by -9% and -11%. India’s domestic paper bottle capacity additions and brand-led trials across foodservice are key contributors. China shows increased fiber mold integration in FMCG categories. Canada’s moderate pace links to controlled retail pilot activity. Also,the USA and Germany reflect bottlenecks in converting conventional PET lines and sourcing molded pulp suited for bottle-grade applications.

The report covers detailed analysis of 40+ countries, with the top five countries shared as a reference

The fiber bottle market in the USA is projected to grow at a CAGR of 6.0% from 2025 to 2035, with demand expected to exceed 52,000 metric tons by 2035. Early adoption is concentrated in personal care and specialty beverage segments, with brands trialing molded fiber bottles lined with thin polymer barriers. Limited barrier technology and co-packing flexibility have restricted rollout scale, but consumer acceptance in eco-alternative formats remains strong. Regulatory pressures on single-use plastics are prompting legacy players to assess fiber bottle feasibility in niche formats.

Canada’s fiber bottle market is expected to grow at a CAGR of 6.5% through 2035, with annual demand likely to reach 19,000 metric tons by the end of the forecast window. Key growth drivers include small-format beverage launches and policy-aligned innovation grants supporting fiber-based alternatives. Several trials are ongoing across eastern provinces in the craft beverage and household care sectors. Retail buyers have shown positive feedback for molded bottles paired with biodegradable caps and inner linings, though mass-market scalability remains a hurdle.

Germany is forecasted to see fiber bottle demand grow at a CAGR of 5.9% between 2025 and 2035, with volume likely to reach 46,000 metric tons by 2035. The country’s emphasis on circular material systems and extended producer responsibility is fostering a design shift toward alternative packaging substrates. Fiber bottles are being explored in premium mineral water, floor cleaner concentrates, and refill formats for cosmetics. Local converters are collaborating with Scandinavian and Benelux suppliers for fiber preform development and barrier integration.

The fiber bottle market in China is anticipated to grow at a CAGR of 8.3% between 2025 and 2035, with demand projected to exceed 138,000 metric tons by 2035. Driven by innovation-led procurement and pressure to reduce plastic dependence, the segment is expanding across personal care and RTD beverage sectors. Fiber molding infrastructure is growing rapidly, backed by government pilot funding and private capital. Domestic companies are actively filing patents for fiber bottle forming techniques and novel barrier coatings.

The fiber bottle market in India is forecast to expand at a CAGR of 8.9% over the 2025 to 2035 period, with projected demand nearing 102,000 metric tons by 2035. Domestic brands in hair oil, floor cleaner, and herbal beverage categories are piloting fiber bottles to diversify away from PET and HDPE. Cost control remains central, with most trials focusing on locally sourced bamboo pulp and recycled fiber blends. Distribution is skewed toward metro areas, where early adopters are concentrated.

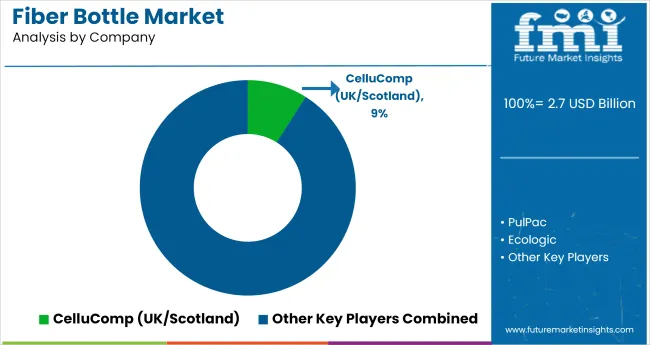

The market remains highly competitive during the forecast period. The CelluComp utilizes vegetable-based nanocellulose to create durable, plastic-free containers, while PulPac's dry-forming process significantly reduces manufacturing time and energy consumption. Ecologic's composite paper-bioresin bottles demonstrate effective barrier properties without synthetic liners. Emerging solutions include RyPax'sthermally treated bamboo bottles with natural antimicrobial features and FLOW Eco Bottle's coating-free, spiral-wound construction. Industrial partners like Jabil are adopting high-speed production techniques from other manufacturing sectors.

The market faces key challenges in achieving extended product shelf life and matching plastic bottle production speeds, driving cross-industry R&D collaborations. Current developments focus on enhancing material performance while maintaining compatibility with existing filling infrastructure and end-of-life processing systems.

Recent Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 2.7 billion |

| Projected Market Size (2035) | USD 5.1 billion |

| CAGR (2025 to 2035) | 6.6% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projection Period | 2025 to 2035 |

| Quantitative Units | USD billion for value |

| Bottle Structure (Segment 1) | Fully Fiber-based, Hybrid (Fiber + Bioplastic/Plastic Liner) |

| Coating Type (Segment 2) | Water-based, Bio-based Barrier, Polymer Barrier |

| Closure System (Segment 3) | Fiber Cap, Bioplastic Cap, Traditional Screw Cap |

| Application Areas (Segment 4) | Dairy Products, Juices, Water, Personal Care, Home Care |

| End-Use Industries (Segment 5) | Beverage, Personal Care, Home Care, Food |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Ecologic, PulPac, CelluComp, RyPax, OtaraPack, Papacks, FLOW Eco Bottle, Green Valley, Jabil, CMPC Maderas |

| Additional Attributes | Dollar sales analyzed across bottle structure and closure types, share by end-use sectors with rising demand from beverage and personal care categories, increasing use in dairy and juice packaging to replace traditional PET, integration into premium personal care lines and refill models, region-specific coating adaptations to comply with recyclability and composting protocols, manufacturing concentration in Europe and North America supporting cross-border supply to Asia-Pacific and Latin America |

Fully Fiber-based, Hybrid (Fiber + Bioplastic/Plastic Liner)

Water-based, Bio-based Barrier, Polymer Barrier

Fiber Cap, Bioplastic Cap, Traditional Screw Cap

Dairy Products, Juices, Water, Personal Care, Home Care

Beverage, Personal Care, Home Care, Food

North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Central Asia, Russia and Belarus, Balkan & Baltic Countries, Middle East and Africa

The fiber bottle market is expected to reach USD 5.1 billion by 2035, up from USD 2.7 billion in 2025.

The market is projected to grow at a CAGR of 6.6% over the forecast period.

Water-based coatings are forecast to account for 58% of protective lining usage in 2025.

Beverage applications are estimated to capture 42% of total fiber bottle demand in 2025.

India leads with a forecast CAGR of 8.9% from 2025 to 2035.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Flax Fiber Bottle Market Analysis – Growth & Forecast 2025-2035

Fiber Optic Probe Hydrophone (FOPH) Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Centrifugal Fan Market Size and Share Forecast Outlook 2025 to 2035

Fiber to the Home Market Size and Share Forecast Outlook 2025 to 2035

Fiber Based Packaging Market Size and Share Forecast Outlook 2025 to 2035

Fiber Lid Market Forecast and Outlook 2025 to 2035

Fiberglass Tanks Market Size and Share Forecast Outlook 2025 to 2035

Fiber Sorter Market Size and Share Forecast Outlook 2025 to 2035

Fiber Reinforced Polymer Panel and Sheet Market Size and Share Forecast Outlook 2025 to 2035

Fiber Optic Tester Market Size and Share Forecast Outlook 2025 to 2035

Fiber Laser Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Market Size and Share Forecast Outlook 2025 to 2035

Fiber Spinning Equipment Market Size and Share Forecast Outlook 2025 to 2035

Bottle Sealing Wax Market Size and Share Forecast Outlook 2025 to 2035

Bottle Filling Machines Market Size and Share Forecast Outlook 2025 to 2035

Bottle Shippers Market Size and Share Forecast Outlook 2025 to 2035

Fiber Reinforced Plastic (FRP) Panels & Sheets Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Fabric Market Size and Share Forecast Outlook 2025 to 2035

Bottled Water Packaging Market Size and Share Forecast Outlook 2025 to 2035

Fiber Optic Connectivity Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA