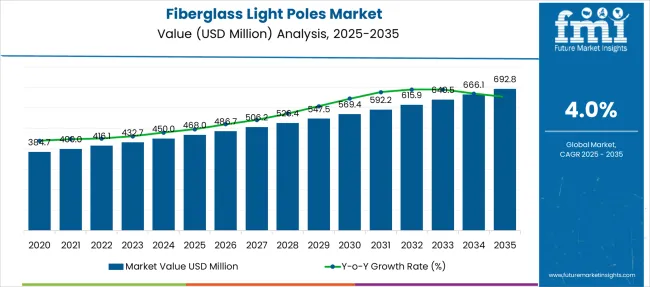

The Fiberglass Light Poles Market is estimated to be valued at USD 468.0 million in 2025 and is projected to reach USD 692.8 million by 2035, registering a compound annual growth rate (CAGR) of 4.0% over the forecast period.

| Metric | Value |

|---|---|

| Fiberglass Light Poles Market Estimated Value in (2025 E) | USD 468.0 million |

| Fiberglass Light Poles Market Forecast Value in (2035 F) | USD 692.8 million |

| Forecast CAGR (2025 to 2035) | 4.0% |

The fiberglass light poles market is witnessing steady expansion driven by increased adoption in urban infrastructure, commercial lighting, and smart city projects. Enhanced performance characteristics such as corrosion resistance, lightweight structure, and electrical non-conductivity have positioned fiberglass as a preferred alternative to traditional metal poles in moisture-prone and high-voltage environments.

With municipalities focusing on infrastructure modernization and long-term maintenance cost reduction, demand has been rising steadily across developed and developing regions. Manufacturers are investing in UV-resistant coatings, modular pole assemblies, and compatibility with IoT-enabled lighting systems, further expanding the product's applicability.

As sustainability standards tighten, fiberglass poles—offering recyclability and lower lifecycle emissions—are being integrated into energy-efficient lighting programs, making them a strategic component in future-ready urban infrastructure..

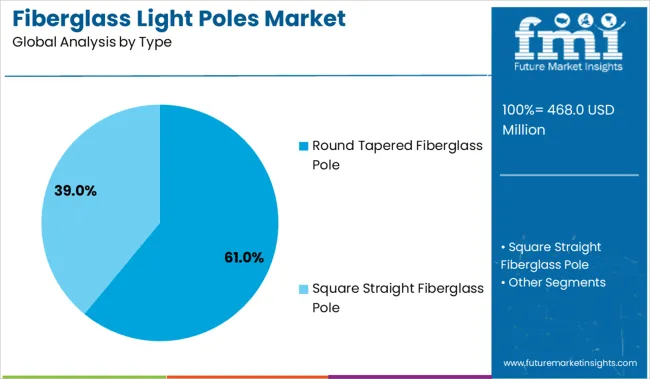

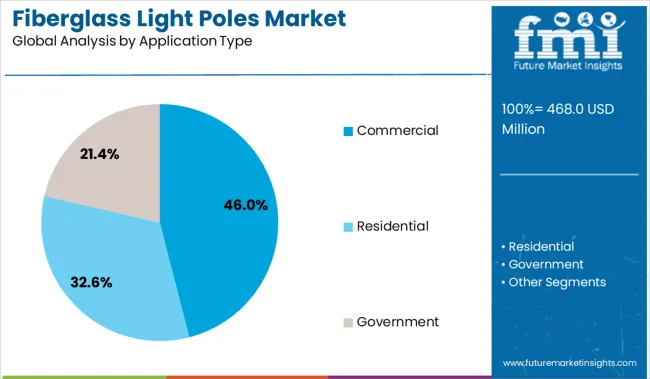

The fiberglass light poles market is segmented by type, application type and geographic regions. The fiberglass light poles market is divided by type into Round Tapered Fiberglass Pole and Square Straight Fiberglass Pole. In terms of application, the fiberglass light poles market is classified into Commercial, Residential, and Government. Regionally, the fiberglass light poles industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Round tapered fiberglass poles are projected to hold 61.0% of the total market revenue in 2025, establishing them as the leading type segment. Their widespread acceptance is being driven by a blend of aesthetic appeal, structural efficiency, and adaptability to varying wind load conditions.

The tapered design enhances stability and wind resistance while minimizing material usage, making it suitable for both low- and high-mounting applications. This segment has benefited from widespread municipal deployment in roadways, pedestrian zones, and waterfronts due to ease of installation and lower long-term maintenance requirements.

Their non-conductive and corrosion-resistant features make them ideal for coastal and humid environments. As urban planning authorities continue to prioritize safety, cost-efficiency, and modern design integration, the round tapered variant remains the go-to solution in large-scale lighting installations..

The commercial sector is anticipated to account for 46.0% of the fiberglass light poles market revenue by 2025, making it the leading application segment. This dominance is being reinforced by the growing use of fiberglass poles in business parks, retail complexes, parking facilities, and hospitality zones where durability and visual uniformity are critical.

The segment has seen a surge in deployment due to lightweight handling during installation, reduced need for grounding, and long-term savings on repainting and anti-corrosion treatments. As property developers and facility managers seek long-lasting lighting infrastructure with minimal upkeep, fiberglass poles have gained traction as a cost-effective and aesthetically versatile solution.

Furthermore, the demand for smart-ready poles in commercial campuses and outdoor advertising integration is expanding the functional value of fiberglass poles in this sector..

The fiberglass light poles market is gaining momentum due to rising demand for corrosion-resistant, lightweight alternatives to steel and concrete. Cost efficiency, grid upgrades, and aesthetic integration are further driving public and municipal adoption.

The fiberglass light poles market has been observed to benefit from a growing shift toward materials with superior corrosion resistance and lower installation weight. Steel and aluminum alternatives have often been criticized for higher maintenance and degradation under moisture-prone or coastal conditions. Fiberglass poles have been increasingly adopted for their non-conductive, weather-resilient, and impact-resistant characteristics. Preference has been notably strong across infrastructure replacement programs, particularly in the North American and European utility sectors. Pole manufacturers are expected to gain market share through resin formulation customization, height configuration flexibility, and lifecycle optimization. Passive adoption has been seen in regions with retrofitting mandates and stringent public safety norms, where fiberglass poles are preferred over legacy concrete and wood structures.

Demand acceleration has been linked to energy distribution upgrades and urban lighting redesigns. Fiberglass poles have been increasingly valued for their low labor costs, easier on-site handling, and compatibility with LED smart lighting systems. Aesthetic integration into landscaping and architectural lighting plans has been prioritized in commercial and residential districts, where traditional poles fail to deliver visual uniformity. Several municipalities and contractors have leaned toward fiberglass designs to comply with new grid modernization standards and weather event resilience. The cost-to-performance ratio has been cited as favorable, especially when factoring in reduced corrosion treatments and extended service life. As government-funded grid enhancement projects are scaled, fiberglass poles are likely to witness increased bid preference and procurement in public tenders.

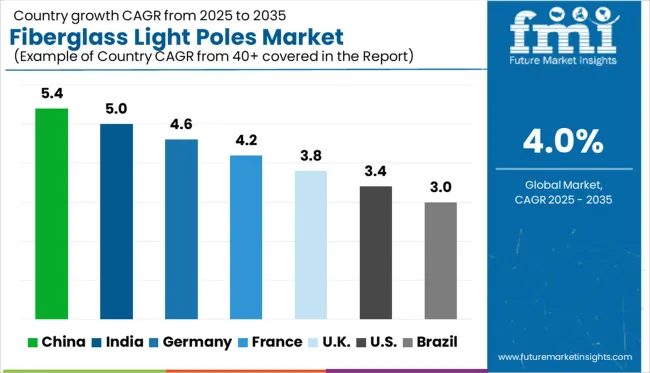

| Country | CAGR |

|---|---|

| China | 5.4% |

| India | 5.0% |

| Germany | 4.6% |

| France | 4.2% |

| UK | 3.8% |

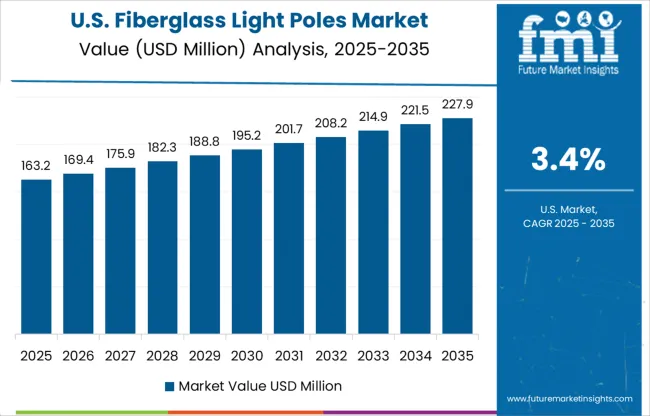

| USA | 3.4% |

| Brazil | 3.0% |

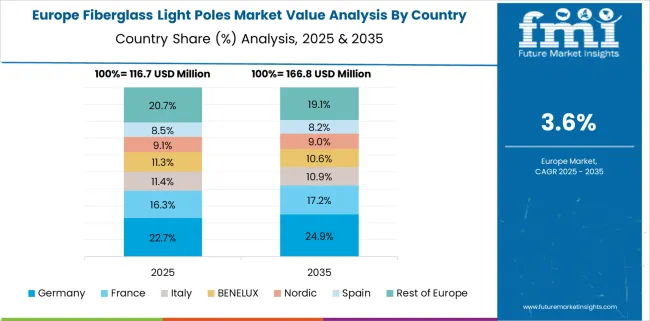

The global fiberglass light poles market is growing at a CAGR of 4.0% from 2025 to 2035, yet several nations, particularly within BRICS and key OECD regions, are exceeding this pace. China leads with a CAGR of 5.4%, fueled by widespread urban infrastructure renewal, rising investment in smart cities, and domestic production scale-up of composite materials. India follows at 5.0%, driven by aggressive rural electrification programs, rapid highway expansion, and increasing ASEAN-linked smart infrastructure collaborations. Germany, a prominent OECD player, is growing at 4.6%, supported by mandates favoring lightweight and corrosion-resistant materials for public infrastructure and transport hubs. The UK and USA lag behind with 3.8% and 3.4% growth, respectively, constrained by legacy grid systems, slower public infrastructure budgets, and delayed procurement modernization. The disparity reflects stronger demand fundamentals and government-led project pipelines in BRICS and Asian markets. The report analyzes over 40 countries, with the top five highlighted above.

The CAGR of the fiberglass light poles market in the United States remained nearly 3.4% during 2020–2024, held back by long-standing procurement inertia among legacy infrastructure operators. However, for 2025–2035, the CAGR is estimated to rise to 4.6% as grid modernization and coastal infrastructure upgrades push fiberglass adoption forward. Cost pressures and rising climate risks have increased attention toward corrosion-free, durable pole materials in hurricane-prone states. Municipal procurement strategies are being revised to accommodate lifecycle cost analysis, where fiberglass emerges as a long-term winner over steel and concrete. Smart city programs are expected to further expand the fiberglass pole footprint through integrated lighting and communications hardware.

The CAGR in the United Kingdom improved from 3.6% during 2020–2024 to 4.0% in the 2025–2035 forecast window, influenced by regulatory pressure on carbon-neutral public infrastructure. Local councils began favoring fiberglass over aluminum for pedestrian zones, coastal promenades, and energy-efficient public spaces. The market saw heightened interest in smart poles, particularly for integrating surveillance, EV charging, and 5G modules. Historically slow due to high upfront cost concerns, adoption accelerated post-2024 as import logistics stabilized and domestic resin processing capabilities scaled up. Retrofitting mandates and ecological preservation plans contributed to a more structured rollout of fiberglass poles across England and Wales.

The CAGR in India increased from 5.0% during 2020–2024 to 6.3% across 2025–2035, fueled by street lighting upgrades in urban clusters and smart village schemes. Fiberglass poles gained acceptance due to their lower weight, easy installation, and compatibility with solar lighting modules. Programs such as UJALA and Smart Cities Mission promoted composite-based lighting as part of energy conservation drives. Tier 2 and Tier 3 cities started adopting fiberglass solutions due to the limited availability of crane infrastructure required for heavier pole types. Investments by domestic fiberglass firms and JV agreements for composite pole production have made India a rapidly expanding market.

The CAGR in Germany moved from 4.6% in 2020–2024 to an estimated 5.3% during 2025–2035, driven by the federal push for durable, low-maintenance street lighting structures. Municipalities facing rising repair costs associated with rusting steel poles began transitioning to fiberglass alternatives, especially in high-rainfall zones. Sustainability-linked bond programs influenced procurement decisions at the city level, where lifecycle emissions and disposal costs became key factors. German engineering firms expanded partnerships with composite technology players to design impact-resistant poles suitable for autobahns and industrial estates. Competitive pricing and lifecycle savings have repositioned fiberglass from niche to mainstream in the public lighting space.

The CAGR in China stood at 5.4% between 2020 and 2024 and is projected to reach 6.8% from 2025 to 2035, enabled by large-scale infrastructure development and decarbonization targets. Government-led initiatives across smart cities, new townships, and expressway corridors have promoted the shift from galvanized steel to fiberglass light poles. Procurement volumes surged through 2023–2025, with urban municipal contracts preferring composite materials for their strength-to-weight benefits. Integration of 5G nodes and real-time environmental sensors in pole systems has become a standard across Tier 1 cities. Domestic manufacturers have scaled production capacity, making China a volume leader in fiberglass pole manufacturing.

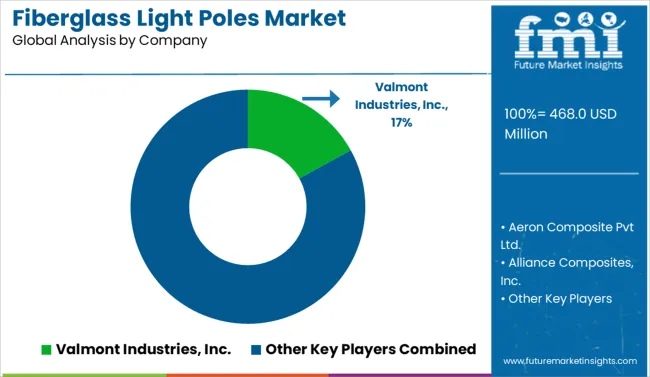

The fiberglass light poles market is driven by a mix of established manufacturers and regional specialists focused on durability, corrosion resistance, and smart lighting compatibility. Key players like Valmont Industries, Inc., Lithonia Lighting (Acuity Brands), and Elsewedy Electric are scaling innovation through advanced composite materials and pole-integrated controls for urban, highway, and utility lighting projects. These companies emphasize longer service life and lower maintenance, addressing growing municipal mandates. Regionally strong firms such as Aeron Composite Pvt Ltd., Nantong Wellgrid Composite Material, and PLP Composite Technologies, Inc., cater to BRICS and ASEAN infrastructure developments with lightweight, easy-to-install poles suitable for extreme environments. Creative Composite, Wood Preservers, and Jindal Power Corporation are also expanding their share in smart city and rural electrification projects. This global competition is fostering pricing optimization, material diversification, and region-specific pole designs for accelerating grid modernization.

In July 2024, Valmont announced a partnership with renewable energy developers to supply composite utility and light poles for wind and solar projects, signaling a strategic alignment with green infrastructure.

| Item | Value |

|---|---|

| Quantitative Units | USD 468.0 Million |

| Type | Round Tapered Fiberglass Pole and Square Straight Fiberglass Pole |

| Application Type | Commercial, Residential, and Government |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Valmont Industries, Inc., Aeron Composite Pvt Ltd., Alliance Composites, Inc., Creative Composite, Elsewedy Electric, Jindal Power Corporation, Lithonia Lighting (Acuity Brands), Main Street Lighting, Inc., NAFCO International, Inc., Nantong Wellgrid Composite Material Co., Ltd., PLP Composite Technologies, Inc., Shanghai Tung Hsing Composites Co., Ltd., and Wood Preservers, Inc. |

| Additional Attributes | Dollar sales, regional share, government procurement trends, smart city adoption rates, utility retrofitting demand, key competitors, and growth in coastal infrastructure zones. |

The global fiberglass light poles market is estimated to be valued at USD 468.0 million in 2025.

The market size for the fiberglass light poles market is projected to reach USD 692.8 million by 2035.

The fiberglass light poles market is expected to grow at a 4.0% CAGR between 2025 and 2035.

The key product types in fiberglass light poles market are round tapered fiberglass pole and square straight fiberglass pole.

In terms of application type, commercial segment to command 46.0% share in the fiberglass light poles market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fiberglass Tanks Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Fabric Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Duct Wrap Insulation Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Filters Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Electrical Enclosure Market Analysis - Size, Share & Forecast 2025 to 2035

Fiberglass Cloth Market

High Temperature Fiberglass Filter Media Market Size and Share Forecast Outlook 2025 to 2035

Light Pipe Mould Market Size and Share Forecast Outlook 2025 to 2035

Lightning Surge Protector Market Size and Share Forecast Outlook 2025 to 2035

Light Therapy Market Forecast and Outlook 2025 to 2035

Light Rail Traction Converter Market Size and Share Forecast Outlook 2025 to 2035

Light Management System Market Size and Share Forecast Outlook 2025 to 2035

Lightweight Corrugator Modules Market Size and Share Forecast Outlook 2025 to 2035

Lightening and Whitening Creams Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Lightweight Automotive Body Panels Market Size and Share Forecast Outlook 2025 to 2035

Lightening / Whitening Agents Market Size and Share Forecast Outlook 2025 to 2035

Light Control Switch Market Size and Share Forecast Outlook 2025 to 2035

Lightweight Handheld Cordless Vacuum Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Light Setting Spray Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA