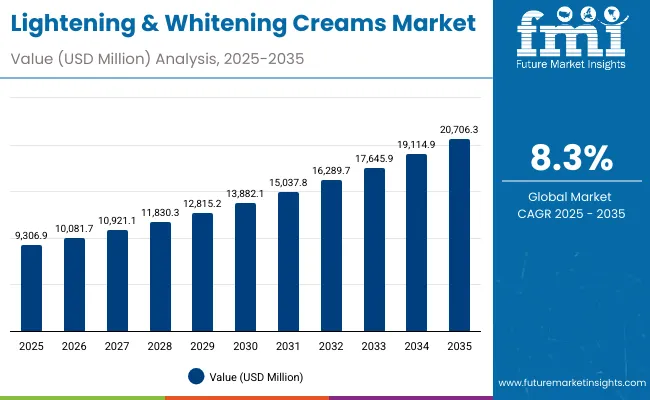

The Lightening & Whitening Creams Market is expected to record a valuation of USD 9,306.9 million in 2025 and USD 20,706.3 million in 2035, with an increase of USD 11,399.4 million, which equals a growth of 193% over the decade. The overall expansion represents a CAGR of 8.3% and nearly a 2X increase in market size.

During the first five-year period from 2025 to 2030, the market rises from USD 9,306.9 million to USD 13,882.1 million, adding USD 4,575.2 million, which accounts for 40% of the total decade growth. This phase reflects steady adoption of daily brightening creams and targeted dark spot correctors, supported by stronger ingredient transparency, skin tone-unifying actives, and greater penetration in Asia. Antioxidant brighteners lead this period, accounting for 57.3% share, driven by clean-label and non-hydroquinone-based formulations.

The second half from 2030 to 2035 contributes USD 6,824.2 million, equal to 60% of total growth, as the market advances from USD 13,882.1 million to USD 20,706.3 million. This acceleration is driven by wider adoption of tyrosinase inhibitor formulations, peptide-enhanced creams, and AI-driven personalization in premium whitening lines. Online retail expansion, hybrid skincare formats, and biotechnology-based brightening actives further strengthen brand differentiation, with serum and cream categories together exceeding 80% of total value by 2035.

Lightening & Whitening Creams Market Key Takeaways

| Metric | Value |

|---|---|

| Lightening & Whitening Creams Market Estimated Value in (2025E) | USD 9,306.9 million |

| Lightening & Whitening Creams Market Forecast Value in (2035F) | USD 20,706.3 million |

| Forecast CAGR (2025 to 2035) | 8.3% |

From 2020 to 2024, the Lightening & Whitening Creams Market expanded steadily, driven by growing awareness of uneven skin tone and post-acne mark correction across Asia and Europe. During this period, the market was led by cream-based formulations, which contributed over 70% of total revenues, while serums and targeted correctors emerged as fastest-growing formats. Competitive differentiation focused on ingredient transparency, dermatologist-backed claims, and efficacy against hyperpigmentation, with brands such as Olay and L’Oréal Paris investing heavily in R&D on non-hydroquinone alternatives. Digital marketing and cross-border e-commerce channels became key growth drivers during this phase.

Demand for Lightening & Whitening Creams is set to reach USD 9,306.9 million in 2025, with value expansion accelerating through 2035 as clean beauty and personalized skincare gain traction. By the end of the forecast period, software-like personalization tools and AI-driven skin diagnostics will account for over 20% of engagement touchpoints, shifting competitive advantage toward brands offering digital ecosystem integration. Leading players are adopting hybrid go-to-market strategies that combine premium dermocosmetic lines with mass-affordable variants to retain market relevance across regions. Emerging entrants are focusing on probiotic, peptide, and antioxidant-based actives, creating a diversified competitive landscape where efficacy, data-driven formulation, and sustainability define brand leadership.

Consumers are increasingly opting for dermatologically tested products featuring safe, non-hydroquinone ingredients such as niacinamide, vitamin C, and tyrosinase inhibitors. This shift, supported by growing awareness of long-term skin health and prevention of pigmentation, has expanded adoption across women and unisex categories. Moreover, the influence of beauty influencers and digital skin analysis tools continues to drive repeat purchases in premium and mass retail segments.

The rapid digitalization of beauty retail and AI-powered skin diagnostic tools is enabling precise product recommendations, boosting conversion rates for lightening and whitening creams. Global brands are integrating digital skin-mapping technologies and data-backed formulation advice to enhance consumer engagement. The rise of online-exclusive launches, subscription models, and social commerce has further accelerated category growth across key markets such as China, India, and Japan.

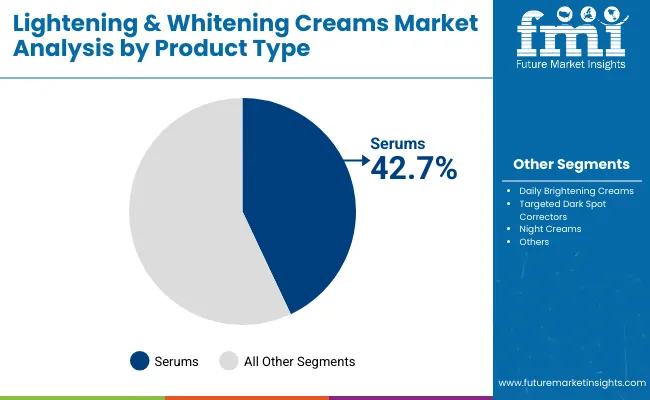

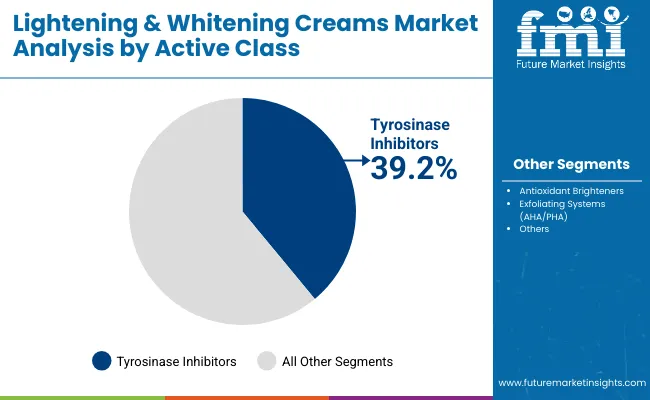

The Lightening & Whitening Creams Market is segmented by product type, active class, skin concern, distribution channel, end user, and region. By product type, the market includes daily brightening creams, targeted dark spot correctors, night creams, and serums, representing both treatment-focused and maintenance-based formulations. Based on active class, key categories comprise tyrosinase inhibitors, antioxidant brighteners, and exfoliating systems (AHA/PHA), which collectively drive efficacy across melanin suppression, cell renewal, and tone correction.

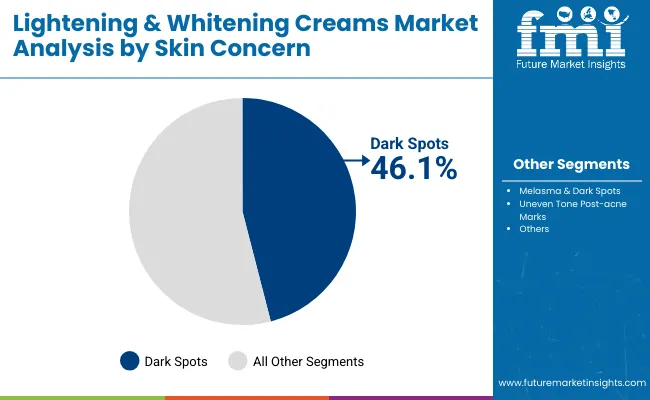

Under skin concern, segmentation includes melasma & dark spots, uneven tone, and post-acne marks, each demanding specific formulation technologies and application regimens. By distribution channel, the market is divided into e-commerce, pharmacies/drugstores, specialty beauty retail, and mass retail, reflecting both digital and offline consumer engagement. End-user segments cover women, men, and unisex consumers, with the women’s category retaining the largest share. Regionally, the market spans North America, Europe, East Asia, South Asia & Pacific, Latin America, and the Middle East & Africa, with India, China, and Japan emerging as high-growth economies driven by evolving skincare routines and rising premium product accessibility.

| Product Type | Value Share% 2025 |

|---|---|

| Serums | 42.7% |

| Others | 57.3% |

The serums segment is projected to contribute 42.7% of the Lightening & Whitening Creams Market revenue in 2025, maintaining its lead as the most dynamic product category. This growth is fueled by the increasing consumer preference for lightweight, fast-absorbing formulations enriched with active brightening agents like vitamin C, niacinamide, and arbutin. Serums deliver targeted results for dark spots, uneven tone, and pigmentation, appealing to consumers seeking visible outcomes within shorter timeframes. The segment’s momentum is also supported by premium positioning, high-margin pricing, and brand innovation focused on multi-active and probiotic-based formulas. As personalization and AI-driven skincare diagnostics expand, serums are expected to remain central to product innovation and routine-based whitening solutions through 2035.

| Active Class | Value Share% 2025 |

|---|---|

| Tyrosinase inhibitors | 39.2% |

| Others | 60.8% |

The tyrosinase inhibitors segment is anticipated to hold 39.2% of market share in 2025, supported by their proven efficacy in suppressing melanin formation and treating hyperpigmentation. These actives, such as kojic acid, licorice extract, and arbutin, are increasingly preferred in both cream and serum formulations due to their safety profiles compared to hydroquinone. Demand is also driven by dermatological endorsement and the rise of hybrid products that combine enzyme blockers with antioxidant brighteners for synergistic effects. Innovation in stabilized ingredient delivery systems, including encapsulation and slow-release mechanisms, further strengthens efficacy and consumer trust. The segment will continue gaining traction, especially across Asia-Pacific markets where tone-corrective skincare is deeply embedded in beauty routines.

| Skin Concern | Value Share% 2025 |

|---|---|

| Dark spots | 46.1% |

| Others | 53.9% |

The dark spot correction segment is projected to account for 46.1% of the Lightening & Whitening Creams Market revenue in 2025, solidifying its role as the core application area. Consumers increasingly seek long-term solutions for pigmentation, melasma, and post-acne marks, driving demand for clinically validated formulations. This segment benefits from innovations in niacinamide-based complexes, alpha-arbutin blends, and peptide-enhanced brightening systems. The influence of social media and dermatologist-backed marketing campaigns has also boosted awareness of targeted brightening regimens. With advanced formulations emphasizing repair, barrier protection, and radiance improvement, dark spot correction is expected to remain the dominant growth driver within the Lightening & Whitening Creams Market through the next decade.

Rising Demand for Non-Hydroquinone and Dermatologist-Approved Formulations

The market is driven by a global shift toward safe, clinically tested, and non-hydroquinone-based formulations. Consumers increasingly prefer actives such as niacinamide, vitamin C, arbutin, and kojic acid due to fewer side effects and long-term skin compatibility. This change aligns with regulatory restrictions on hydroquinone in many countries, compelling brands to innovate with natural and biotechnological ingredients. Dermatologist endorsements and improved product transparency have strengthened consumer trust, leading to higher adoption across both premium and mass-market segments, particularly in Asia and Europe.

Growth of E-commerce and Personalized Digital Beauty Platforms

Rapid expansion of e-commerce and AI-driven beauty platforms is transforming product accessibility and engagement in the Lightening & Whitening Creams Market. Advanced skin analysis tools and digital shade-matching algorithms allow personalized recommendations based on tone, texture, and pigmentation. Online-exclusive product launches and influencer-led campaigns enhance brand visibility and cross-border sales. Subscription-based skincare services and digital consultations are gaining traction, particularly among Gen Z and urban millennials. This tech-enabled personalization has made skincare more results-oriented and data-driven, fueling consistent revenue growth across emerging and developed markets alike.

Regulatory Restrictions and Consumer Backlash on Whitening Claims

Stringent cosmetic regulations and rising criticism of "skin whitening" narratives are constraining market expansion. Several countries have imposed bans or strict labeling standards on products implying racial or color-based superiority. Brands are forced to rebrand offerings using terms like "brightening," "radiance," or "tone-evening" to align with inclusivity-driven marketing. Moreover, growing consumer awareness about unrealistic beauty standards and potential skin barrier damage from overuse of actives limits aggressive product positioning. Compliance costs, reformulation needs, and social scrutiny collectively pose significant challenges to maintaining growth momentum across key markets.

Integration of Biotechnology and AI in Brightening Formulations

A defining trend in the Lightening & Whitening Creams Market is the integration of biotechnology and AI for next-generation product development. Brands are utilizing bioengineered ingredients such as peptides, enzymes, and fermented extracts to improve skin tone safely and sustainably. Concurrently, AI-driven diagnostic systems analyze individual skin conditions to recommend personalized regimens, optimizing efficacy and consumer satisfaction. This convergence of biocosmetic innovation and data analytics enhances transparency, traceability, and precision in formulation. It marks a shift from generic whitening products to science-backed, adaptive skincare systems offering measurable results and long-term skin health.

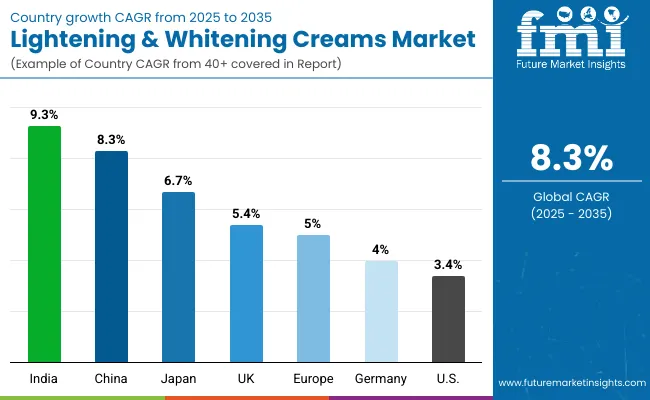

| Countries | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 8.3% |

| USA | 3.4% |

| India | 9.3% |

| UK | 5.4% |

| Germany | 4.0% |

| Japan | 6.7% |

| Europe | 5.0% |

The global Lightening & Whitening Creams Market demonstrates strong regional divergence in adoption and growth pace, shaped by demographic shifts, skincare awareness, and evolving beauty standards. Asia-Pacific leads as the fastest-growing region, anchored by India (9.3%) and China (8.3%), driven by rising disposable income, urbanization, and cultural emphasis on complexion enhancement. Expanding e-commerce penetration and rapid acceptance of dermatologically backed, non-hydroquinone formulations have accelerated growth. India’s dynamic retail structure and localized product innovation continue to propel mass and premium category expansion simultaneously.

Japan (6.7%) maintains stable growth, supported by advanced formulation science, high product quality standards, and the integration of probiotic and peptide-based brightening agents. Europe registers a steady performance at an overall 5.0% CAGR, with the UK (5.4%) and Germany (4.0%) showing resilience through a shift toward clean beauty and tone-balancing skincare aligned with sustainability mandates. Brands in Europe increasingly emphasize skin health over fairness, rebranding whitening lines under inclusive terms like "radiance" and "even tone."

In contrast, North America exhibits moderate expansion, with the USA (3.4%) reflecting market maturity and slower adoption due to regulatory scrutiny and cultural sensitivity around whitening claims. Growth here is largely driven by premium brightening serums and digital beauty diagnostics that support personalized skin treatment. Across all key markets, digital retail ecosystems, AI-driven skin analysis, and inclusivity-led branding are reshaping category dynamics, with Asia-Pacific sustaining leadership through volume, innovation, and cross-border brand proliferation.

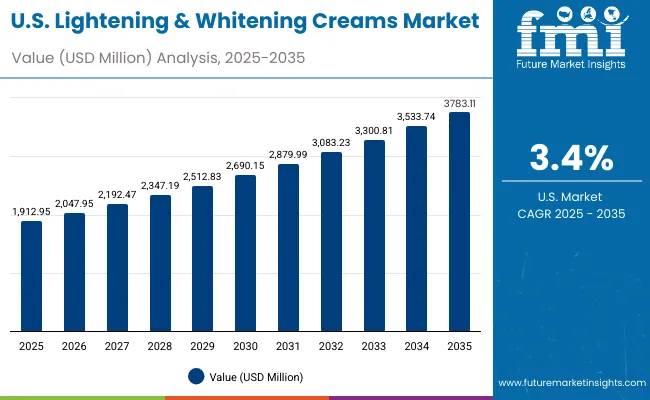

| Year | USA Lightening & Whitening Creams Market (USD Million) |

|---|---|

| 2025 | 1912.95 |

| 2026 | 2047.95 |

| 2027 | 2192.47 |

| 2028 | 2347.19 |

| 2029 | 2512.83 |

| 2030 | 2690.15 |

| 2031 | 2879.99 |

| 2032 | 3083.23 |

| 2033 | 3300.81 |

| 2034 | 3533.74 |

| 2035 | 3783.11 |

The Lightening & Whitening Creams Market in the United States is projected to grow at a CAGR of 3.4%, reflecting stable but moderate expansion. Growth is supported by rising demand for brightening serums and tone-correcting products among premium skincare consumers. Increased awareness of hyperpigmentation, sun damage, and age-related dark spots has driven innovation in niacinamide- and vitamin C-based formulations. The adoption of dermatologist-endorsed and fragrance-free products is increasing, particularly through digital dermatology channels.

The Lightening & Whitening Creams Market in the United Kingdom is forecast to grow at a CAGR of 5.4% through 2035, supported by clean beauty adoption and reformulation of brightening products under inclusive branding. The market reflects a pivot from "whitening" to "radiance" and "tone-evening" skincare, aligning with ethical marketing and transparency standards. Sustainable sourcing, cruelty-free certification, and locally manufactured premium creams are gaining traction.

India is witnessing rapid growth at a CAGR of 9.3%, the highest globally in this segment. Rising disposable incomes, strong beauty consciousness, and penetration of mass-premium brands have propelled demand. Urban consumers favor multi-action formulations that combine sun protection, hydration, and brightening. The rural market is expanding due to improved accessibility through e-commerce and influencer-led marketing.

The Lightening & Whitening Creams Market in China is projected to grow at a CAGR of 8.3%, driven by advanced product innovation and rising skincare sophistication. Local and international brands are leveraging peptide-based and enzyme-inhibitor technologies for melanin control and radiance improvement. Social media platforms such as WeChat and Tmall dominate product discovery, while clinical beauty chains boost sales through dermatologist partnerships.

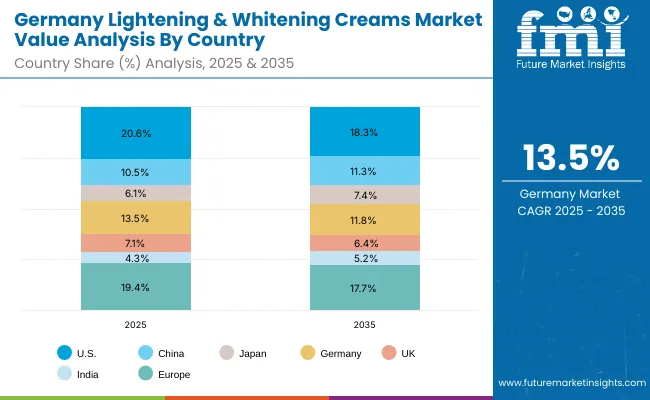

| Countries | 2025 Share (%) |

|---|---|

| USA | 20.6% |

| China | 10.5% |

| Japan | 6.1% |

| Germany | 13.5% |

| UK | 7.1% |

| India | 4.3% |

| Europe | 19.4% |

| Countries | 2035 Share (%) |

|---|---|

| USA | 18.3% |

| China | 11.3% |

| Japan | 7.4% |

| Germany | 11.8% |

| UK | 6.4% |

| India | 5.2% |

| Europe | 17.7% |

Germany holds a 13.5% share in 2025, projected to moderate to 11.8% by 2035, growing at a CAGR of 4.0%. The market’s trajectory reflects Germany’s preference for dermatologically safe, scientifically substantiated, and sustainably sourced formulations. The segment is driven by high consumer trust in pharmacy-led skincare and dermocosmetic brands, which emphasize transparency, ingredient purity, and efficacy validation. Demand is strong for vitamin C, niacinamide, and arbutin-based brightening creams, while hydroquinone-free and fragrance-free options dominate clinical retail shelves.

The shift from "whitening" to "radiance" and "even-tone" messaging has become central to brand positioning due to strict EU advertising and labeling regulations. Local manufacturers, particularly in Germany’s cosmetic hubs, are investing in clean-label innovation, recyclable packaging, and microbiome-safe actives. The rise of hybrid formulascombining tone correction, hydration, and anti-aginghas further increased premiumization within the segment.

Germany’s market structure remains consolidated, with established European players like Beiersdorf (Nivea), L’Oréal, and La Roche-Posay leading through clinical-grade claims and pharmacy distribution. Online beauty retailers and dermocosmetic e-shops are expanding access to premium brightening products. Sustainable product certifications, eco-conscious consumers, and dermatologist collaboration continue to reinforce Germany’s position as a benchmark for responsible, efficacy-driven skincare innovation in Europe.

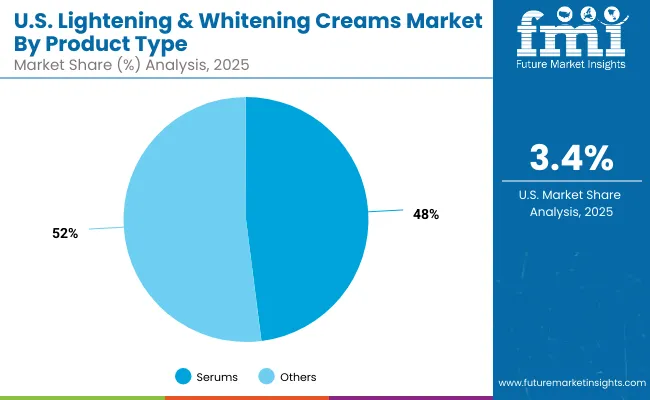

| USA By Product Type | Value Share% 2025 |

|---|---|

| Serums | 48% |

| Others | 51.9% |

In the United States, the Lightening & Whitening Creams Market is projected to expand steadily at a CAGR of 3.4% through 2035. Serums account for 48% of total market value in 2025, reflecting the growing consumer inclination toward lightweight, fast-absorbing, and high-efficacy formulations. These are particularly favored for addressing dark spots, photoaging, and uneven tone. The demand is driven by dermatological innovations, ingredient transparency, and increased adoption of clinical-grade skincare through both e-commerce and dermatology-led retail channels.

Major brands, including Olay, Clinique, Kiehl’s, and The Ordinary, are leading innovation with brightening serums featuring stabilized vitamin C, niacinamide, and alpha-arbutin. The market also reflects a cultural shift from "whitening" to "brightening" and "skin clarity", aligning with inclusive beauty narratives. The rise of digital skincare diagnostics and AI-based consultation platforms further strengthens consumer personalization and trust.

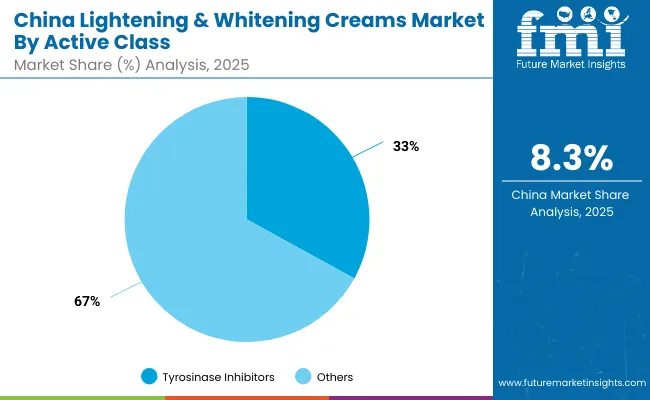

| China By Active Class | Value Share% 2025 |

|---|---|

| Tyrosinase inhibitors | 32.6% |

| Others | 67.4% |

In China, the Lightening & Whitening Creams Market is one of the most dynamic globally, expected to record a CAGR of 8.3% through 2035. In 2025, tyrosinase inhibitors account for 32.6% of total market value, underscoring their importance in addressing hyperpigmentation and achieving a brighter, even skin tone. Consumers increasingly favor formulations combining enzyme inhibitors with antioxidants and moisturizing agents to deliver visible results without irritation. Demand is particularly high among younger consumers seeking prevention-based skincare solutions that focus on clarity, radiance, and long-term tone balance.

The opportunity landscape is strengthened by local innovation, with domestic brands leveraging biotechnological actives and botanical extracts to compete against global giants. The government’s support for domestic cosmetic manufacturing and e-commerce growth across platforms like Tmall and Douyin enables rapid product diffusion. Premiumization and hybrid beauty trends merging whitening with barrier repair and hydration are redefining consumer expectations.

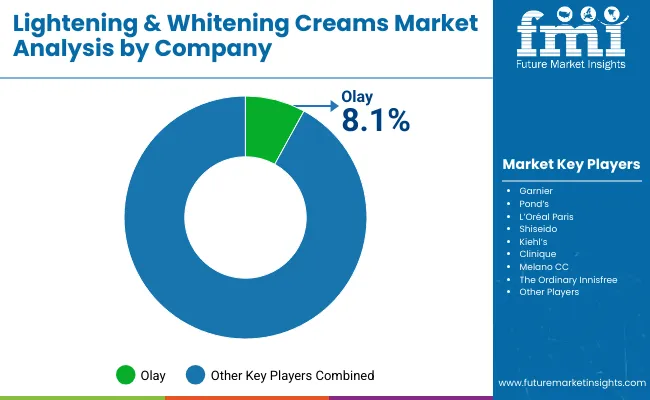

The Lightening & Whitening Creams Market is moderately fragmented, dominated by a blend of global cosmetic giants and emerging regional challengers. Olay leads with an 8.1% share, supported by its strong product portfolio in brightening serums and multi-action creams fortified with niacinamide and vitamin C. Other leading players, including L’Oréal Paris, Garnier, Shiseido, Pond’s, The Ordinary, Kiehl’s, and Innisfree, compete through a mix of premium and mass-market offerings targeting uneven tone, pigmentation, and dullness.

Competition is increasingly shaped by clean beauty innovation, AI-enabled skincare personalization, and hybrid product launches combining brightening with hydration and anti-aging benefits. Brands are differentiating through clinical validation, dermatologist endorsements, and ingredient transparency. Digital transformation remains key companies are leveraging e-commerce platforms, influencer marketing, and virtual skin analysis tools to deepen consumer engagement. Regional players in Asia, such as Melano CC and Innisfree, are expanding global footprints by offering high-performance formulations at competitive price points.

Key Developments in Lightening & Whitening Creams Market

| Item | Value |

|---|---|

| Quantitative Units | USD 9,306.9 Million |

| Product Type | Daily brightening creams, Targeted dark spot correctors, Night creams, Serums |

| Active Class | Tyrosinase inhibitors, Antioxidant brighteners, Exfoliating systems (AHA/PHA) |

| Skin Concern | Melasma & dark spots, Uneven tone, Post-acne marks |

| Channel | E-commerce, Pharmacies/drugstores, Specialty beauty retail, Mass retail |

| End User | Women, Men, Unisex |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Olay, Garnier, Pond’s, L’Oréal Paris, Shiseido, Kiehl’s, Clinique, Melano CC, The Ordinary, Innisfree |

| Additional Attributes | Dollar sales by product type and active ingredient category, adoption trends in brightening serums and targeted dark spot correctors, rising demand for non-hydroquinone formulations and dermatologically tested actives, segment-specific growth across women’s skincare, men’s grooming, and unisex brightening ranges, digital sales segmentation through e-commerce and specialty retail, integration with AI-based skin diagnostics and personalized skincare platforms, regional trends shaped by clean beauty and ingredient transparency movements, and innovations in tyrosinase inhibitors, antioxidant complexes, and exfoliating systems (AHA/PHA) that enhance efficacy and consumer trust. |

The global Lightening & Whitening Creams Market is estimated to be valued at USD 9,306.9 million in 2025.

The market size for the Lightening & Whitening Creams Market is projected to reach USD 20,706.3 million by 2035.

The Lightening & Whitening Creams Market is expected to grow at a 8.3% CAGR between 2025 and 2035.

The key product types in the Lightening & Whitening Creams Market are daily brightening creams, targeted dark spot correctors, night creams, and serums, each addressing different skin concerns such as melasma, uneven tone, and post-acne pigmentation.

In terms of active class, antioxidant brighteners are projected to command a major share of 57.3% in 2025, driven by strong consumer preference for gentle, non-hydroquinone, and multi-functional brightening solutions suitable for all skin types.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Lightening / Whitening Agents Market Size and Share Forecast Outlook 2025 to 2035

Whitening Gold Peptide Complex Market Size and Share Forecast Outlook 2025 to 2035

Skin Lightening Product Market Size and Share Forecast Outlook 2025 to 2035

Hair Lightening Products Market Size and Share Forecast Outlook 2025 to 2035

Skin Lightening Lip Balm Market Trends – Demand & Forecast 2024-2034

OLED Lightening Panels Market

Teeth Whitening Market Size and Share Forecast Outlook 2025 to 2035

Teeth Whitening Pens Market - Growth, Demand & Trends 2025 to 2035

The Dental Whitening Lamps Market is segmented by Product, Light Source and End User from 2025 to 2035

Firming Creams and Serums Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Optical Whitening Agents Market Size and Share Forecast Outlook 2025 to 2035

Intimate Lightening Products Market Size and Share Forecast Outlook 2025 to 2035

Slugging Creams Market Size and Share Forecast Outlook 2025 to 2035

Anti-Aging Creams & Serums Market Size and Share Forecast Outlook 2025 to 2035

Anti-Wrinkle Creams Market Size and Share Forecast Outlook 2025 to 2035

Body Firming Creams Market Growth & Forecast 2025-2035

Eczema Relief Creams Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Muscle Relaxing Creams Market Size and Share Forecast Outlook 2025 to 2035

Plant-Based Ice Creams Market Analysis by Form, Product Type, Flavor, Source, Sales Channel, and Region through 2035

Moisturizing Body Creams Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA