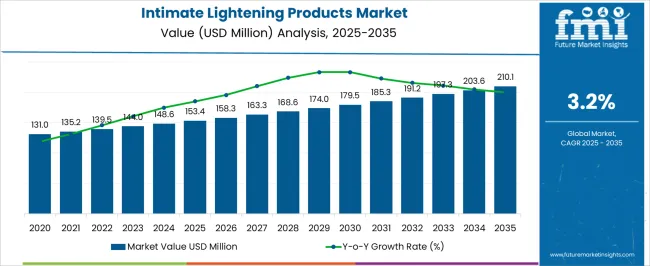

The Intimate Lightening Products Market is estimated to be valued at USD 153.4 million in 2025 and is projected to reach USD 210.1 million by 2035, registering a compound annual growth rate (CAGR) of 3.2% over the forecast period. The intimate lightening products market is valued at USD 153.4 million in 2025 and is expected to reach approximately USD 179.5 million by 2030, reflecting moderate growth over the five-year period. This growth corresponds to a compound annual growth rate (CAGR) of around 3.2%, indicating steady but cautious expansion in a niche segment of the personal care industry.

From 2025 to 2027, the market grows from USD 153.4 million to about USD 163.3 million. This period is characterized by increasing consumer interest driven by a growing emphasis on personal grooming and aesthetics. While the market faces challenges due to regulatory scrutiny and sensitivity around product safety, gradual acceptance of intimate lightening solutions in various regions supports market expansion.

Between 2028 and 2030, the market further expands to USD 179.5 million as new product formulations improve efficacy and safety profiles, attracting a wider consumer base. Marketing strategies focusing on inclusivity and education also contribute to increased demand. The intimate lightening products market experiences consistent growth driven by evolving beauty standards and a growing awareness of personal care options, albeit at a measured pace given the product category’s sensitive nature.

| Metric | Value |

|---|---|

| Intimate Lightening Products Market Estimated Value in (2025 E) | USD 153.4 million |

| Intimate Lightening Products Market Forecast Value in (2035 F) | USD 210.1 million |

| Forecast CAGR (2025 to 2035) | 3.2% |

The intimate lightening products market is witnessing strong traction, driven by rising awareness around personal grooming, increased acceptance of intimate care products, and the influence of social and digital media on beauty preferences. A growing emphasis on self-care and wellness, coupled with evolving cultural perceptions of skin aesthetics, has led to increased product usage across diverse consumer demographics.

Brand communication strategies focusing on inclusivity and dermatological safety have contributed to destigmatizing the segment and expanding its customer base. Regulatory approvals of safer, plant-based formulations and investment in dermatologically tested product development have improved consumer trust.

As e-commerce penetration deepens and discreet online availability becomes more common, the market is expected to benefit from increased accessibility and direct-to-consumer brand strategies.

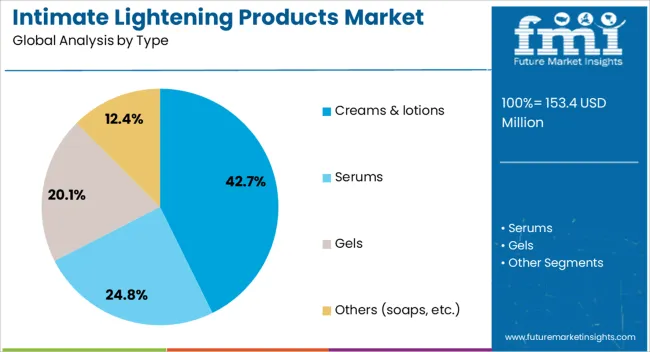

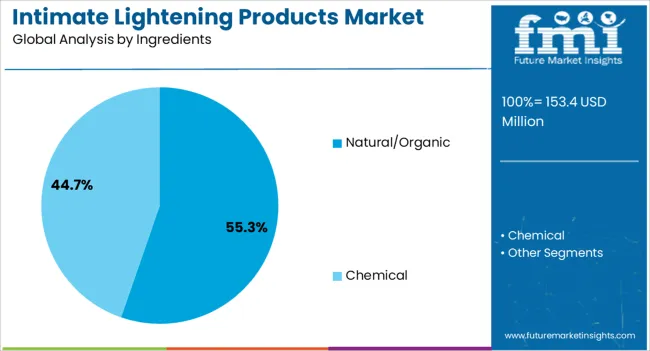

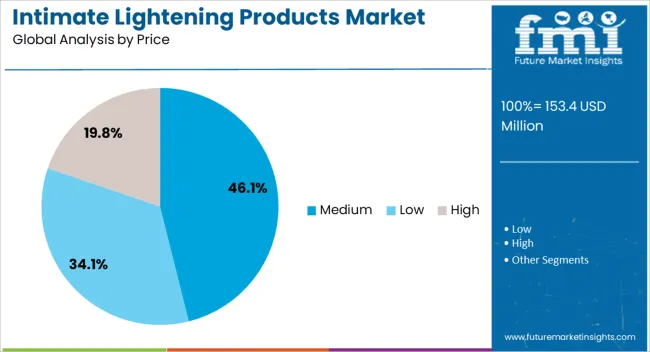

The intimate lightening products market is segmented by type, ingredients, price, age group, consumer group, distribution channel, and geographic regions. The intimate lightening products market is divided by type into Creams & lotions, Serums, Gels, and Others (soaps, etc.). In terms of ingredients, the intimate lightning products market is classified into natural and Organic and Chemical. Based on the price of the intimate lighting products, the market is segmented into Medium, Low, and High. The intimate lightning products market is segmented by age group into 20-35 years, Below 20 years, 35-50 years, and Above 50 years. The consumer group of the intimate lightning products market is segmented into Female and Male. The distribution channel of the intimate lightning products market is segmented into E-Commerce and Offline. Regionally, the intimate lightning products industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Creams and lotions are expected to contribute 42.7% of total revenue in the intimate lightening products market by 2025, making them the leading product type. The ease of topical application, superior absorption, and suitability for daily use across skin types has enabled this position.

These formulations offer better control over dosage and target application compared to sprays or gels, making them the preferred choice for consumers seeking visible, localized results. Dermatologist recommendations and the introduction of multi-functional formulations combining lightening, moisturizing, and soothing properties have reinforced the dominance of this category.

Additionally, their compatibility with natural ingredients and reduced risk of irritation have made creams and lotions the go-to segment among safety-conscious buyers.

Natural and organic ingredients are projected to hold 55.3% of the overall revenue share in 2025, emerging as the dominant choice among ingredient categories. This preference has been shaped by heightened consumer sensitivity toward synthetic chemicals, potential side effects, and long-term skin health.

Growing demand for herbal extracts, fruit enzymes, and essential oils has encouraged manufacturers to reformulate products using eco-certified and bioactive compounds. Enhanced transparency in labeling and the growing influence of clean beauty standards have further accelerated this trend.

With natural ingredients perceived as gentler and more compatible with sensitive skin, their use in intimate lightening products has become a key decision-making factor, particularly among health-conscious and first-time users.

The medium price range is expected to account for 46.1% of the market share in 2025, establishing it as the most preferred pricing tier. This dominance is being driven by the balance it offers between quality and affordability, making it accessible to a broader consumer base without compromising perceived product efficacy.

Brands operating in this tier have focused on value-added features such as dermatological testing, organic certification, and multi-benefit formulas. The rise of online reviews, influencer endorsements, and customer testimonials has played a pivotal role in building trust around mid-range products.

As consumers become more informed and selective, demand is expected to grow within this price band where safety, brand reputation, and visible outcomes intersect effectively.

The intimate lightening products market is witnessing steady growth as consumers increasingly seek cosmetic solutions for skin tone uniformity and aesthetic enhancement in sensitive areas. Rising awareness of personal grooming, evolving beauty standards, and expanding product availability through online and retail channels are key drivers. However, concerns about safety, product efficacy, and cultural sensitivities pose challenges. Innovations in gentle, natural formulations and enhanced marketing strategies aimed at education and transparency offer significant opportunities. Regional preferences and regulatory frameworks also influence market dynamics and adoption rates.

Consumers are paying more attention to intimate care and grooming, contributing to growing demand for intimate lightening products. This demand is fueled by evolving beauty ideals that emphasize even skin tone and smoothness, alongside rising confidence in using cosmetic products for intimate areas. Social media and influencer marketing have also played a role in normalizing and promoting these products. Accessibility through e-commerce platforms allows discreet purchasing, broadening reach across demographics. The rise in disposable income in emerging markets and increased focus on self-care routines support consistent growth. Brands are expanding product ranges to include creams, gels, and serums formulated specifically for delicate skin, attracting a wider audience.

Safety remains a critical concern in the intimate lightening segment due to the sensitivity of the application areas. Some products have faced scrutiny over harsh chemicals or irritants that can cause allergic reactions or long-term skin damage. Regulatory agencies in various countries impose strict guidelines on permissible ingredients and labeling requirements to protect consumers. Lack of standardization and counterfeit products in unregulated markets exacerbate risks. Manufacturers must invest in clinical testing, dermatological approvals, and transparent communication to build trust. Adherence to local regulations and educating consumers on proper usage are essential to mitigate health risks. These challenges can slow market expansion but also encourage development of safer, more effective formulations.

To address consumer concerns, brands are focusing on innovation by incorporating natural, plant-based ingredients known for gentle skin brightening and soothing properties. Ingredients such as licorice extract, vitamin C, kojic acid alternatives, and aloe vera are popular for their efficacy and safety profiles. Advances in formulation techniques allow for improved absorption and targeted effects without irritation. Manufacturers are also emphasizing fragrance-free and hypoallergenic products tailored for sensitive skin. Packaging innovations that promote hygienic application and discreet use enhance consumer experience. Such product improvements differentiate offerings in a competitive market and meet rising demand for clean-label beauty products. These trends present significant opportunities for market leaders and new entrants alike.

Cultural attitudes towards intimate lightening vary globally, influencing market growth and product acceptance. Regions such as Asia Pacific and Latin America show strong demand driven by beauty and grooming trends, while adoption in Western markets is more cautious due to ethical considerations and regulatory scrutiny. Increasing urbanization, rising female workforce participation, and enhanced awareness in developing countries create growth potential. Companies are customizing products and marketing strategies to address regional preferences and sensitivities. Expansion through digital channels and collaborations with dermatologists or beauty experts further supports market penetration. Navigating diverse regulatory environments and cultural nuances remains key for global players aiming to capitalize on emerging opportunities.

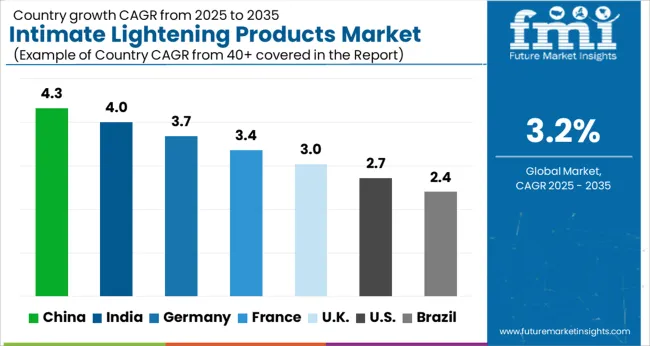

The global intimate lightening products market is growing modestly at a 3.2% CAGR, driven by increasing consumer awareness and evolving beauty standards. China leads with 4.3% growth, supported by expanding personal care industries and rising demand for specialized cosmetic products. India follows at 4.0%, fueled by growing acceptance and product availability. Germany records 3.7% growth, reflecting stringent regulatory oversight and innovation in safe formulations. The United Kingdom grows at 3.0%, driven by consumer preference for effective and gentle products. The United States, a mature market, shows 2.7% growth, shaped by regulatory compliance and increasing focus on product safety. These countries collectively influence market trends through advancements in formulation, marketing strategies, and regulatory frameworks. This report includes insights on 40+ countries; the top countries are shown here for reference.

China intimate lightening products market is expanding at a 4.3% CAGR, driven by rising beauty consciousness and growing acceptance of personal care innovations. Increasing urbanization and higher disposable incomes enable more consumers to explore specialized cosmetic treatments. The market is characterized by a surge in natural and herbal formulations responding to safety concerns. E-commerce platforms and social media influencers play a key role in product awareness and distribution. Compared to Western markets, China shows faster adoption of new trends and innovative formulations. Regulatory bodies are tightening quality controls to ensure product safety, which builds consumer trust. The market also benefits from increasing male grooming awareness, broadening the customer base.

India intimate lightening products market grows at a 4% CAGR, fueled by increasing beauty awareness and urbanization. Rising disposable incomes and growing female workforce drive demand for personal care and cosmetic treatments. While safety concerns limit aggressive product claims, manufacturers focus on gentle formulations with natural ingredients. The market is gradually shifting from traditional remedies to scientifically backed products. Social media and digital marketing enhance consumer education and acceptance. Compared to China, India market faces slower regulatory evolution but strong grassroots demand. Tier-2 and tier-3 cities are emerging as new growth areas due to expanding middle class and beauty salon networks.

Germany intimate lightening products market grows steadily at a 3.7% CAGR, reflecting cautious consumer attitudes toward cosmetic lightening due to ethical and health considerations. Demand focuses on products with proven safety, natural components, and skin-friendly formulations. Compared to Asian markets, Germany’s market is smaller and more regulated, with emphasis on transparency and ingredient disclosure. Consumers prefer multi-functional skincare products that improve overall skin tone and health rather than aggressive lightening. Dermatologists and consumer advocacy groups influence product development and acceptance. The market benefits from strong retail pharmacy presence and specialized beauty stores.

The United Kingdom market grows at a 3% CAGR, supported by steady demand for ethical and safe personal care products. Consumers increasingly prefer gentle formulations free from harmful chemicals, aligned with broader clean beauty trends. Regulatory frameworks ensure strict product safety and labeling compliance. The market emphasizes inclusivity and diversity, with brands promoting products suitable for all skin types. Compared to Germany, UK market focuses more on marketing transparency and sustainability messaging. Online retail channels and beauty salons drive distribution and consumer engagement. Awareness campaigns highlight the importance of skin health over cosmetic lightening.

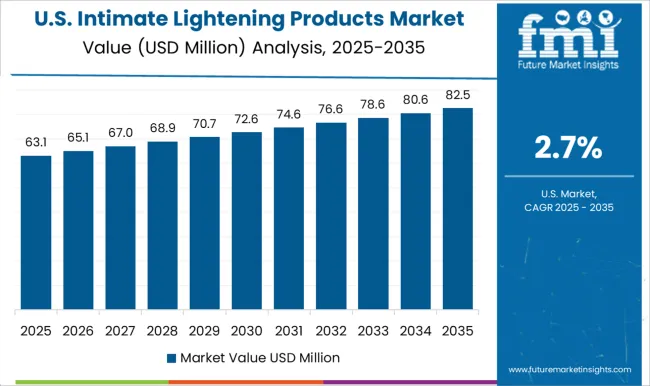

United States intimate lightening products market grows at 2.7% CAGR, reflecting cautious but steady interest in specialized personal care. Consumers demand high safety standards and clear ingredient transparency. The market features products combining lightening benefits with skin health improvement. Compared to European markets, the USA market is more fragmented with niche brands alongside mainstream offerings. Social conversations around diversity and representation influence product positioning and marketing. Regulatory oversight ensures compliance but varies by state, posing challenges. Digital platforms provide education and build consumer trust, helping to sustain market growth.

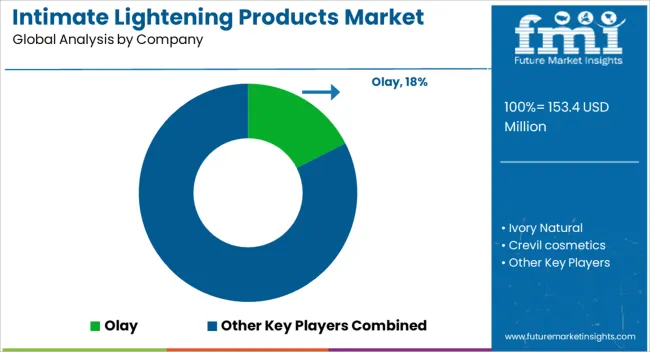

The Intimate Lightening Products Market is witnessing significant growth driven by increasing consumer awareness and demand for safe, effective solutions targeting hyperpigmentation and darkening in intimate areas. Key players in this market include well-established skincare brands such as Olay, Vichy Laboratories, Clarins, Murad, La Roche-Posay, and Dermalogica, alongside niche and natural-focused companies like Ivory Natural, Crevil Cosmetics, Divine Dierre, Amaira Natural Skincare, Pink Privates, Glytone, Kojie San, and Nufabrx.

These brands offer a variety of formulations ranging from creams, gels, serums to natural extracts, focusing on gentle yet effective ingredients suitable for sensitive skin areas. The trend leans heavily toward products with natural and organic components, addressing consumer concerns regarding chemical additives and potential side effects. Brands like Amaira Natural Skincare and Ivory Natural emphasize plant-based ingredients and hypoallergenic formulas, catering to the rising demand for clean and green beauty products. The market growth is fueled by greater acceptance and openness toward personal care for intimate areas, as well as increasing online availability and targeted marketing strategies that educate consumers about safe lightening options.

Advanced research into skin brightening agents such as niacinamide, kojic acid, arbutin, and vitamin C derivatives further propels innovation in product efficacy and safety. Geographically, the market sees strong adoption in regions such as Asia-Pacific, Latin America, and the Middle East, where cultural preferences and aesthetics play a significant role in consumer purchasing behavior. With growing awareness and technological advances, the intimate lightening products market is expected to expand steadily, emphasizing safety, efficacy, and natural formulations.

Companies in the market are developing innovative products that offer multifunctional benefits such as moisturizing, anti-aging, and soothing properties in addition to skin lightening. Personalized intimate care kits that address individual needs, such as dark spots or uneven skin tone, are gaining popularity among consumers. This customization trend is fueled by an increasing interest in personalized skincare routines.

| Item | Value |

|---|---|

| Quantitative Units | USD 153.4 Million |

| Type | Creams & lotions, Serums, Gels, and Others (soaps, etc.) |

| Ingredients | Natural/Organic and Chemical |

| Price | Medium, Low, and High |

| Age Group | 20-35 Yrs, Below 20 Yrs, 35-50 Yrs, and Above 50 Yrs |

| Consumer Group | Female and Male |

| Distribution Channel | E-Commerce and Offline |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Olay, Ivory Natural, Crevil cosmetics, Divine Dierre, Amaira Natural Skincare, Pink privates, Vichy Laboratories, Clarins, Murad, Skinceuticals, Glytone, Kojie San, La Roche-Posay, Dermalogica, and Nufabrx |

| Additional Attributes | Dollar sales vary by product type, including creams, serums, gels, and soaps; by ingredients, such as natural/organic and chemical-based formulations; by price range, spanning low, medium, and high; and by region, with Asia-Pacific leading, followed by North America and Europe. Growth is driven by increased consumer awareness, rising disposable incomes, and influences from social media and beauty standards. |

The global intimate lightening products market is estimated to be valued at USD 153.4 million in 2025.

The market size for the intimate lightening products market is projected to reach USD 210.1 million by 2035.

The intimate lightening products market is expected to grow at a 3.2% CAGR between 2025 and 2035.

The key product types in intimate lightening products market are creams & lotions, serums, gels and others (soaps, etc.).

In terms of ingredients, natural/organic segment to command 55.3% share in the intimate lightening products market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hair Lightening Products Market Size and Share Forecast Outlook 2025 to 2035

Men's Intimate Care Products Market - Trends, Growth & Forecast 2025 to 2035

Men's Intimate Hygiene Products Market Size and Share Forecast Outlook 2025 to 2035

Intimate Wash Care Product Market Forecast and Outlook 2025 to 2035

Lightening and Whitening Creams Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Lightening / Whitening Agents Market Size and Share Forecast Outlook 2025 to 2035

Products from Food Waste Industry Analysis in Korea Size, Share and Forecast Outlook 2025 to 2035

Products from Food Waste in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Products from Food Waste Market Analysis - Size, Growth, and Forecast 2025 to 2035

Intimate Lingerie Market Analysis by Growth, Trends and Forecast from 2025 to 2035

USA Products from Food Waste Market Growth – Trends, Demand & Outlook 2025-2035

Skin Lightening Product Market Size and Share Forecast Outlook 2025 to 2035

Skin Lightening Lip Balm Market Trends – Demand & Forecast 2024-2034

OLED Lightening Panels Market

Teff Products Market

Detox Products Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Algae Products Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Pulse Products Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dairy Products Market Analysis by Product Type, End Use, Distribution Channel and Region through 2035

Vacuum Products for Emergency Services Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA