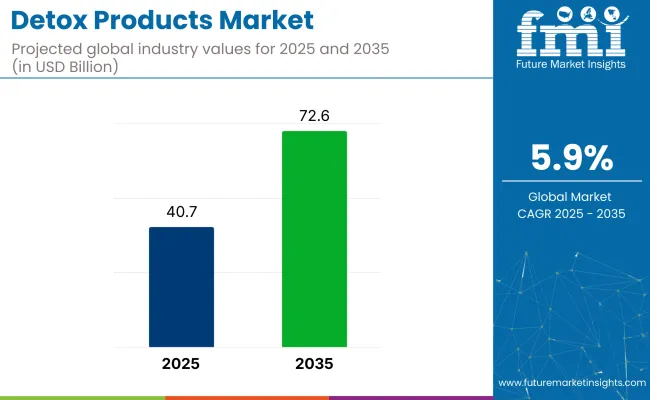

The global detox products market is projected to grow from USD 40.7 billion in 2025 to USD 72.6 billion by 2035, registering a CAGR of 5.9%.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 40.7 billion |

| Industry Value (2035F) | USD 72.6 billion |

| CAGR (2025 to 2035) | 5.9% |

The market expansion is driven by rising health consciousness, preference for natural and organic products, and increasing demand for functional foods and beverages offering cleansing and wellness benefits. Detox teas, juices, and supplements continue to gain traction among consumers seeking natural remedies for weight management, digestion, and immunity boosting.

The market holds a 100% share in the detox functional foods and beverages market as it forms its direct category. Within the broader functional foods market, detox products account for approximately 12%, driven by teas, juices, and supplements addressing gut health and immunity.

In the overall health and wellness products market, detox items hold nearly 4%, reflecting their positioning alongside vitamins and supplements. They contribute 2% to the global food and beverage market due to their niche focus, while their share in the vast consumer products market remains minimal below 0.3%, given its highly diversified nature.

Government regulations impacting the market focus on product safety, labeling standards, and health benefit claims to protect consumers and ensure authenticity. Regulatory bodies like the USA FDA, EFSA in Europe, and FSSAI in India enforce guidelines around permissible ingredients, organic certifications, and marketing claims. Compliance with these regulations is crucial for manufacturers to build consumer trust, expand global market access, and mitigate legal risks while promoting health-focused detox solutions.

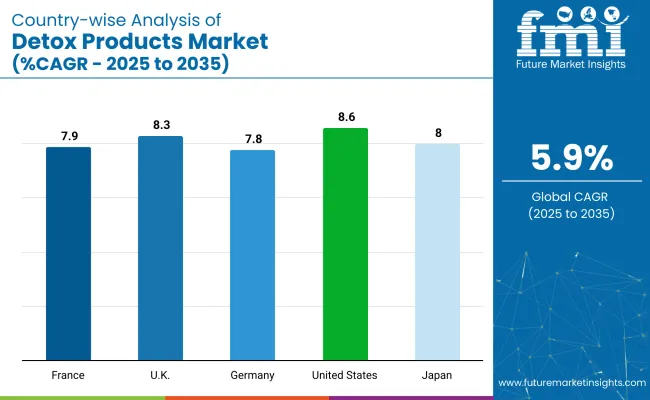

The USA is projected to be the fastest-growing market, expanding at a CAGR of 8.6% from 2025 to 2035. Supermarkets and hypermarkets will lead the sales channel segment with a 31% share, while organic detox products will dominate the nature segment with a 35% share. The UK is also expected to grow steadily at a CAGR of 8.3%.

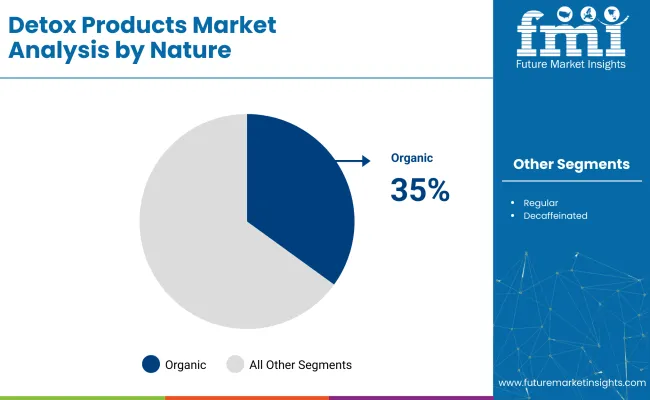

The detox products market is segmented by product type, nature, sales channel, and region. By product type, the market is divided into detox teas, detox juices and smoothies, detox supplements and powders, and coffees. Based on nature, the market is classified into organic, regular, and decaffeinated.

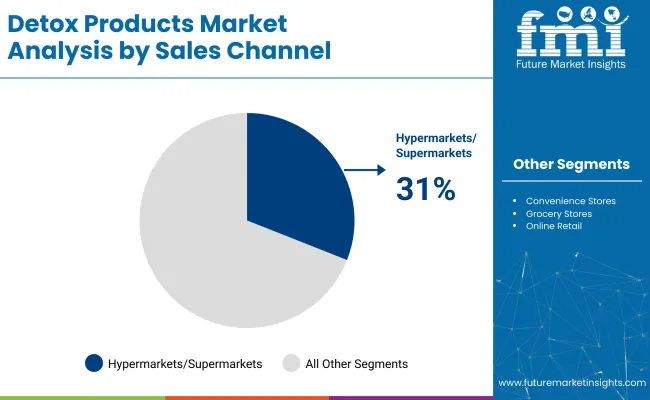

By sales channel, the market is divided into hypermarkets/supermarkets, convenience stores,pharmacy and drugstores, grocery stores, food specialty stores, and online retail. Regionally, the market is classified into North America, Latin America, Western Europe, South Asia, East Asia, Eastern Europe, and the Middle East & Africa.

Detox teas are projected to lead the product type segment, capturing 27% of the market share in 2025. These products are widely used for natural cleansing and weight management.

Organic is expected to lead the nature segment with a 35% market share in 2025. This growth is driven by rising consumer awareness, premium product demand, and evolving clean-label trends.

Supermarkets and hypermarkets are expected to dominate the sales channel segment, accounting for 31% of the global market share by 2025. Growth is driven by convenient access to a wide range of trusted liver health supplement brands under one roof, allowing consumers to make informed, immediate purchase decisions.

The global detox products market is experiencing steady growth, driven by increasing health consciousness and the rising demand for natural, organic, and functional food and beverage solutions. Detox products play a crucial role in supporting digestion, weight management, and overall wellness, aligning with consumer preferences for preventive health and clean-label offerings.

Recent Trends in the Detox Products Market

Challenges in the Detox Products Market

USA leads with the highest projected CAGR of 8.6% from 2025 to 2035, fueled by rising health consciousness, increasing incidence of lifestyle-related disorders, and a strong shift toward natural and organic detox solutions. While, developed economies such as the USA (8.6% CAGR), UK (8.3%), and Japan (8%) are expanding at a steady 1.37-1.41x of the global growth rate.

Japan leads with its strong heritage in matcha, sencha, and fermented probiotic detox beverages, aligning with preventive health and longevity trends. Germany and France leverage their robust herbal and organic tea markets, with EU directives accelerating natural product adoption. The USA market emphasizes detox supplements, teas, and influencer-driven juice cleanses, while the UK focuses on organic herbal teas and wellness tonics. As the market adds over USD 31.87 billion globally by 2035, both tradition-led and innovation-driven regions will shape long-term demand.

The report covers in-depth analysis of 40 plus countries; five top-performing OECD countries are highlighted below.

The sales of detox products in Japan are projected to grow at a CAGR of 8% from 2025 to 2035. Growth is driven by cultural emphasis on preventive health, traditional teas, and fermented probiotic drinks.

The Germany detox products revenue is projected to grow at a CAGR of 7.8% during the forecast period. EU organic certifications, herbal traditions, and clean-label consumer expectations are pushing adoption of detox teas and supplements.

The demand for detox products in France is projected to grow at a 7.9% CAGR during the forecast period. Demand is driven by national health awareness campaigns, organic certification mandates, and consumer preference for herbal detox teas.

The USA detox products market is projected to grow at 8.6% CAGR from 2025 to 2035. High-purity detox drinks are in demand in health-conscious urban populations, while supermarkets and e-commerce platforms remain major sales channels.

The UK detox products revenue is projected to grow at a CAGR of 8.3% from 2025 to 2035. Growth is supported by a preference for organic herbal teas, traditional remedies, and clean-label wellness beverages.

The market is moderately consolidated, with leading players like Herbalife International Inc., Amway Corporation, Glanbia Plc, Nature’s Sunshine Products Inc., and Mallinckrodt PLC dominating the industry. These companies provide a diverse range of detox teas, supplements, juices, and powders catering to consumers seeking weight management, digestive health, and overall wellness benefits. Herbalife International Inc. focuses on herbal detox teas and weight management products, while Amway Corporation specializes in natural dietary supplements and functional beverages.

These players deliver protein-enriched detox powders and performance nutrition solutions and offers herbal detox supplements targeting digestion and liver health. Other key players like Sun Pharmaceutical Industries Ltd., Mylan N.V., Teva Pharmaceutical Industries Ltd., Novartis AG, and Biodelivery Sciences International Inc. contribute by providing advanced health products, supplements, and therapies supporting detoxification and wellness needs across global markets.

Recent Detox Products Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 40.7 billion |

| Projected Market Size (2035) | USD 72.6 billion |

| CAGR (2025 to 2035) | 5.9% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameter | USD billion for value/volume in units |

| Product Type Analyzed | Detox Teas, Detox Juices and Smoothies, Detox Supplements and Powders, and Coffees |

| Nature Analyzed | Organic, Regular, and Decaffeinated |

| Sales Channel Analyzed | Hypermarkets/Supermarkets, Convenience Stores, Pharmacy and Drugstores, Grocery Stores, Food Specialty Stores, and Online Retail |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, and Middle East & Africa |

| Countries Covered | United States, Canada, Brazil, United Kingdom, Germany, France, Italy, China, Japan, India, South Korea, Australia |

| Key Players Influencing the Market | Herbalife International Inc., Amway Corporation, Glanbia Plc, Nature’s Sunshine Products Inc., Mallinckrodt PLC., Sun Pharmaceutical Industries Ltd., Mylan N.V., Teva Pharmaceutical Industries Ltd., Novartis AG, Biodelivery Sciences International Inc. |

| Additional Attributes | Dollar sales by product type, share by nature, regional demand growth, policy influence, clean-label trends, competitive benchmarking |

The segment includes detox teas, juices and smoothies, supplements and powders, and coffees.

The diverse sales channels of detox products are supermarkets/hypermarkets, convenience stores, pharmacy and drugstores, grocery stores, food specialty stores, and online retail.

Detox products are found in organic, regular, and decaffeinated nature.

Information about the leading countries of North America, Latin America, Western Europe, South Asia and Pacific, East Asia, and the Middle East and Africa is given.

The market is valued at USD 40.7 billion in 2025.

The market is forecast to reach USD 72.6 billion by 2035, reflecting a CAGR of 5.9%.

Supermarkets and hypermarkets will lead the sales channel segment, accounting for 31% of the global market share in 2025.

Organic detox products will dominate the nature segment with a 35% share in 2025.

The USA is anticipated to be the fastest-growing market, with a CAGR of 8.6% from 2025 to 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Analysis and Growth Projections for Detox Drink market

Detox face Oil Market

Charcoal-Based Detox Masks Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Feed Mycotoxin Detoxifiers Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

TerraCotta Clay for Detoxification Market Size and Share Forecast Outlook 2025 to 2035

Products from Food Waste Industry Analysis in Korea Size, Share and Forecast Outlook 2025 to 2035

Products from Food Waste in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Products from Food Waste Market Analysis - Size, Growth, and Forecast 2025 to 2035

USA Products from Food Waste Market Growth – Trends, Demand & Outlook 2025-2035

Teff Products Market

Algae Products Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Pulse Products Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dairy Products Market Analysis by Product Type, End Use, Distribution Channel and Region through 2035

Almond Products Market Size and Share Forecast Outlook 2025 to 2035

Bamboo Products Market Analysis – Trends & Growth 2025 to 2035

Luxury Products For Kids Market - Trends, Growth & Forecast 2025 to 2035

Chicory Products Market Size and Share Forecast Outlook 2025 to 2035

Crystal Products Market Size and Share Forecast Outlook 2025 to 2035

Make-Up Products Packaging Market Size and Share Forecast Outlook 2025 to 2035

Suncare Products Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA