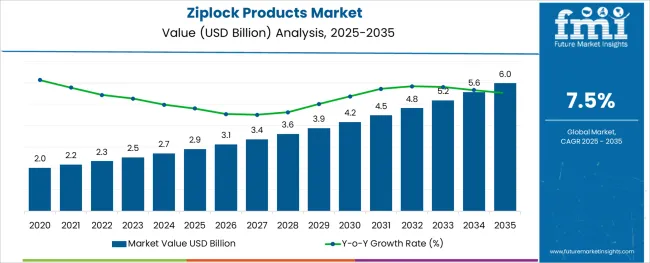

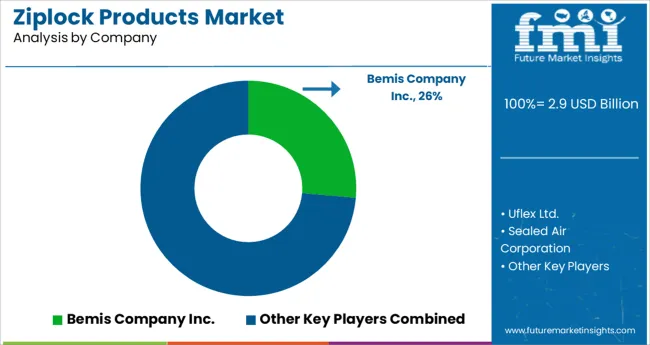

The Ziplock Products Market is estimated to be valued at USD 2.9 billion in 2025 and is projected to reach USD 6.0 billion by 2035, registering a compound annual growth rate (CAGR) of 7.5% over the forecast period.

The ziplock products market is experiencing robust growth driven by increasing consumer preference for reusable and resealable packaging across food, personal care, and household product segments. The demand for packaging that preserves freshness, reduces spillage, and supports convenience in storage and transportation is steadily rising.

Shifts in lifestyle patterns, especially in urban regions, are prompting the adoption of ziplock formats for portion control and on the go usage. Regulatory trends discouraging single use plastics are also encouraging consumers and manufacturers to invest in durable, multi use alternatives.

Advancements in closure technology and material engineering have enabled improved seal strength, transparency, and custom branding capabilities. The overall market outlook remains optimistic as brands continue to seek sustainable, user friendly, and aesthetically versatile packaging solutions to enhance product visibility and shelf appeal.

The market is segmented by Product Type, Material, Closure Type, and End Use and region. By Product Type, the market is divided into Flat Pouch and Stand-up Pouch. In terms of Material, the market is classified into Plastic, Laminates, Paper, and Others. Based on Closure Type, the market is segmented into Slider zip and Press to Close. By End Use, the market is divided into Food, Personal Care & Cosmetics, Pharmaceuticals, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

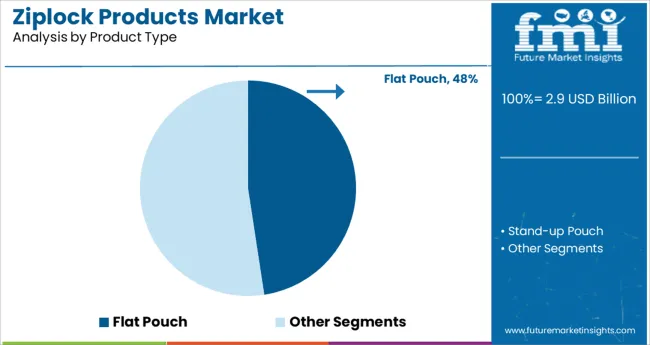

The flat pouch format is expected to contribute 47.60% of total revenue by 2025 within the product type category, making it the leading segment. This dominance can be attributed to its lightweight structure, low material usage, and efficient storage benefits.

Flat pouches are widely used in food and pharmaceutical packaging due to their ability to maintain product integrity while minimizing bulk. Their ease of manufacturing and compatibility with automated filling lines support large scale production.

Additionally, the format allows for simplified transportation and reduced shipping costs. As sustainability and cost efficiency become strategic priorities, the flat pouch continues to gain preference, reinforcing its position as the top performing product type in the ziplock products market.

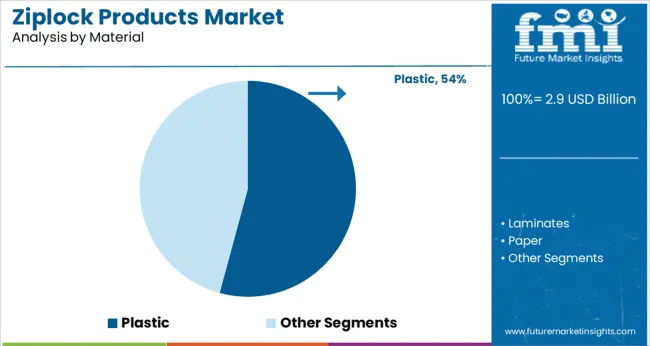

The plastic material segment is anticipated to account for 54.20% of total market revenue by 2025, positioning it as the dominant material choice. This leadership is driven by plastic’s inherent flexibility, moisture resistance, and durability which make it ideal for both perishable and non perishable goods.

Plastic based ziplock products offer excellent seal integrity and customizable transparency which supports consumer trust and product presentation. Additionally, advancements in recyclable and bio based plastic formulations are helping align this segment with global sustainability goals.

Its affordability, ease of processing, and long shelf life capabilities make plastic the preferred material for ziplock product manufacturing across diverse end use industries.

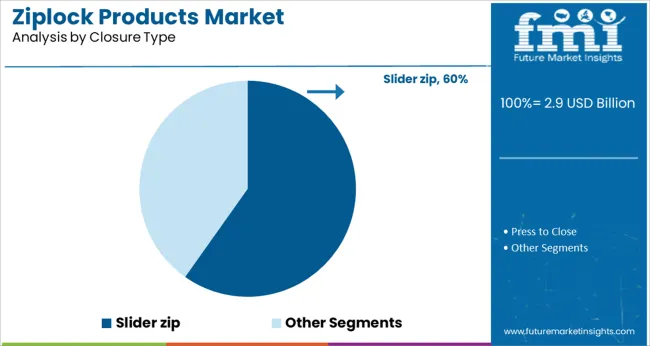

The slider zip segment is projected to hold 59.80% of total revenue by 2025 in the closure type category, leading the market by a significant margin. Its dominance stems from ease of use, repeatable sealing strength, and consumer preference for user friendly packaging.

Slider zips offer reliable closure mechanisms which enhance the usability of resealable bags, especially for elderly users and in multi use product scenarios. The tactile feedback and audible snap provided by slider mechanisms improve confidence in sealing which is critical for products requiring freshness preservation.

Brands are increasingly incorporating slider zips in premium packaging designs to elevate perceived value and user experience. As convenience continues to drive packaging innovation, slider zip closures maintain their market edge due to their functionality, appeal, and broad applicability.

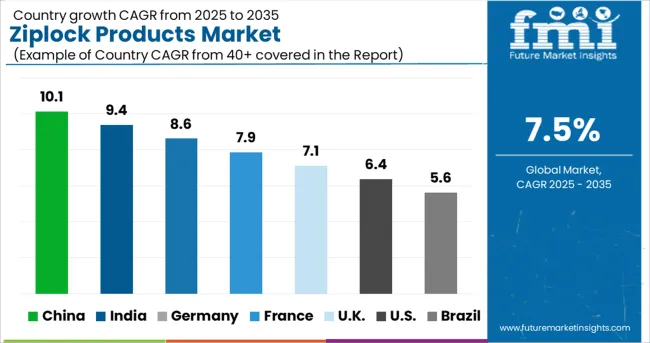

The global demand for ziplock products grew at a steady pace during the historical period from 2020 to 2024 and reached a market valuation of USD 2.7 billion at the end of 2024. However, with growing usage across the food, pharmaceutical, and residential sectors, the overall ziplock products market is set to thrive at 7.5% CAGR between 2025 and 2035.

Ziplock products are re-sealable bags with two stripes, and interlocking structures, which can be pressed together to close and open again by simply pulling them off. This ziplock is an add-on feature on pouches in packaging and is made of flexible polymers of plastic and metal foils. Ziplock pouches are used in a wide range of sectors, including food, medicines, and other industrial uses.

Increasing variety in the retail sector stimulates new sales by affecting packaging differentiation. Ziplock pouches are such additions in the packaging sector that can be used for a variety of goods and employed in households too. These pouches are primarily employed in stand-up and flat formats, with the stand-up ziplock pouch being commonly favoured by manufacturing companies due to their structural integrity and ability to stand out of all products.

Many consumers are preferring this type of packaging to traditional plastic and paper bags. Consumers tend to buy products that are equipped with zip locks for better usability, and this factor is helping the ziplock products market to propel further.

Extensive Application Across Various Industries Ziplock Products Driving

Ziplock pouches and bags are gaining popularity due to their multipurpose nature. The effortless opening and closing facility of such bags deem them a significant part of food product packaging. Several manufacturers are using ziplock bags as primary packaging.

PET plastic bags and aluminium laminated bags are commonly used for food products while aluminium laminated ziplocks are ideal for powdered products, as they are effective in keeping moisture away.

Manufacturers commonly use such ziplock pouches, as they are cost-effective, flexible, help in the preservation, and leave a positive impact on customers. The use of zip lock bags is becoming common in households along with its increased use in industrial applications.

These pouches are helpful for storing vegetables and other food products in refrigerators. Besides food products, products such as medicines, clothes, and many other things are stored in ziplock bags. For household use, there are different sizes available for various commodities and such factors are increasingly attracting new consumers toward product adoption.

Implementation of Strict Environmental Regulations and Use of Alternative Packages Growing Limiting Market Expansion

Several factors are restraining the growth of ziplock products market. Environmental regulations in different countries, recycling issues, and the availability of rigid containers and biodegradable packaging products are the key restraints.

The majority of materials utilized for ziplock pouch packaging are dangerous to the environment, such as PE (Polyethylene) and PVC (Polyvinyl Chloride). The regional government and the FDA (Food and Drug Administration) have implemented stringent laws that limit the use of synthetic materials, such as PVC.

Countries like China have completely banned the production and use of ultrathin HDPE (High-Density Polyethylene) bags, which are also a threat to the environment. As a result, there is a greater demand for environmentally sustainable items by manufacturers.

Active packaging, recyclable, and biodegradable packaging materials are also a threat to the growth of the ziplock products market. Food manufacturers, especially meat and fresh produce processing industries are utilizing active packaging and smart packaging.

This packaging helps in keeping the inner material safe from external as well as internal factors. They also help in monitoring the quality of the contents. Due to the negative environmental impact of plastic, manufacturers are starting to look for biodegradable options available in the market.

Constant Product Innovation and Development Boosting Sales in China

As per FMI, China holds around 61.7% share of the East Asia market and it is likely to exhibit strong growth during the forecast period. This can be attributed to the rapid expansion of the food and cosmetic sectors, the development of new cost-effective solutions, and the heavy presence of leading packaging giants.

China is one of the biggest markets for ziplock products. People in China are highly focused on efficient space utilization and the use of convenient products. This tendency is due to the constant development and innovation in different sectors.

There are several manufacturers of plastic ziplock bags and pouches across China who are continuously striving to manufacture pouches by using specially laminated food-grade material. Many manufacturers export ziplock bags and other airtight-containing products to different countries, out of which the USA, India, and Vietnam are the top three importing countries.

Hence, a rise in the export of packaging solutions will also boost the ziplock products market in China over the next ten years.

Increased Number of Applications in Households Boosting Demand in the USA

According to Future Market Insights, demand for ziplock pouches across the USA is expected to grow at a healthy pace during the forecast period owing to the rapid expansion of the food service industry and increasing adoption across households.

American people use ziplock bags in everyday life for a variety of applications. Ziplock bags are common in American households for storing food and leftovers. People also use these pouches to carry food with them, as ziplock bags are more adaptable and take up less room than airtight containers and tiffins. In 2024, more than 9 million consumers used ziplock bags to take food items with them.

Similarly, the rapid growth of pharmaceutical and personal care industries coupled with the increasing adoption of ziplock pouches across these sectors because of their ease of use and storage convenience is expected to boost sales in the USA market through 2035.

Stand-up Pouch to Remain Highly-Sought After Product Type

Based on product type, the global ziplock market is segmented into flat pouches and stand-up pouches. Among these, FMI predicts the stand-up pouch to remain the top-selling product type during the forecast period. This can be attributed to the rising usage of stand-up ziplock pouches across food and pharmaceutical industries on account of their various benefits.

Users prefer stand-up ziplock pouches because they are strong, have good structural integrity, and have a pleasing appearance. Not only household customers, but manufacturers also utilize these stand-up pouches for food products. Snacks and packaged food products are stored in these stand-up ziplock pouches to keep them safe and eliminate the risk of contamination.

Food Segment to Generate Maximum Revenues

Based on end use, the food segment holds the largest share of the global ziplock products market and it is expected to generate significant revenues during the next ten years. This can be attributed to the increasing adoption of ziplock pouches for packaging food products.

Ziplock pouches are commonly used for packaging food items. They have commonly used in homes and food manufacturing industries as they are easy to seal and promise higher food safety. Nearly 68% of people prefer ziplock bags to pack food while going on tours or packing lunch in the USA.

Key players in the ziplock products market are Bemis Company Inc., Ziploc, Uflex Ltd., Sealed Air Corporation, Winpak Ltd., Constantia Flexibles Group GmbH, Glenroy Inc., Huhtamaki Oyj, Sonoco Products Company, Clondalkin Group Holdings B.V., Ampac Holdings LLC, Flair Flexible Packaging Corporation, Asahi Kasei, Berry Global Inc., AE Adams (Henfield) Ltd., Printpack Inc., and others.

These players are constantly upgrading their portfolios by introducing novel products with enhanced features. Further, they are adopting strategies such as mergers, partnerships, acquisitions, facility expansions, and collaborations to expand their global footprint.

For instance

| Attribute | Details |

|---|---|

| Estimated Market Size (2025) | USD 2.9 billion |

| Projected Market Size (2035) | USD 6.0 billion |

| Anticipated Growth Rate (2025 to 2035) | ~7.5% CAGR |

| Historical Data Available for | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in billion, Volume in Units, and CAGR from 2025 to 2035 |

| Segments Covered | Product Type, Material, Closure Type, End Use, and Region |

| Country Covered | The USA, Canada, Mexico, Germany, The United Kingdom, France, Italy, Spain, Russia, India, Thailand, China, India, Japan, Australia, Brazil, Argentina, Colombia, audi Arabia, UAE, South Africa |

| Key Companies Profiled |

Bemis Company Inc.; Uflex Ltd.; Sealed Air Corporation; Winpak Ltd.; Constantia Flexibles Group GmbH; Glenroy Inc.; Huhtamaki Oyj; Sonoco Products Company; Clondalkin Group Holdings B.V.; Ampac Holdings LLC; Flair Flexible Packaging Corporation; Berry Global Inc.; Asahi Kasei; Ziploc; AE Adams (Henfield) Ltd.; Printpack Inc.; Others |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

The global ziplock products market is estimated to be valued at USD 2.9 billion in 2025.

It is projected to reach USD 6.0 billion by 2035.

The market is expected to grow at a 7.5% CAGR between 2025 and 2035.

The key product types are flat pouch and stand-up pouch.

plastic segment is expected to dominate with a 54.2% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Self-sealing Ziplock Bag Market Size and Share Forecast Outlook 2025 to 2035

Products from Food Waste Industry Analysis in Korea Size, Share and Forecast Outlook 2025 to 2035

Products from Food Waste in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Products from Food Waste Market Analysis - Size, Growth, and Forecast 2025 to 2035

USA Products from Food Waste Market Growth – Trends, Demand & Outlook 2025-2035

Teff Products Market

Detox Products Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Algae Products Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Pulse Products Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dairy Products Market Analysis by Product Type, End Use, Distribution Channel and Region through 2035

Almond Products Market Size and Share Forecast Outlook 2025 to 2035

Bamboo Products Market Analysis – Trends & Growth 2025 to 2035

Luxury Products For Kids Market - Trends, Growth & Forecast 2025 to 2035

Chicory Products Market Size and Share Forecast Outlook 2025 to 2035

Crystal Products Market Size and Share Forecast Outlook 2025 to 2035

Make-Up Products Packaging Market Size and Share Forecast Outlook 2025 to 2035

Suncare Products Market Size and Share Forecast Outlook 2025 to 2035

Global Moringa Products Market Outlook – Trends, Demand & Forecast 2025–2035

Corn Co-Products Market

Skincare Products Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA