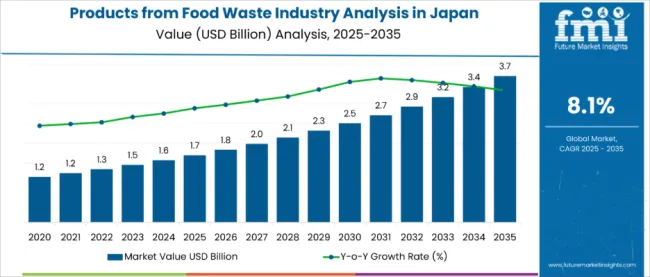

Sales of products from food waste in Japan are estimated at USD 1.7 billion in 2025, are projected to reach USD 3.7 billion by 2035, reflecting a CAGR of 8.1% over the forecast period. This growth reflects both expanding consumer awareness of sustainability and increased adoption of circular economy principles across multiple regions.

The rise in demand is linked to government policies promoting waste reduction, growing environmental consciousness, and technological advancements in food waste processing. Regional consumption patterns show significant variation, with Kanto leading in biogas production and textile applications, while Tohoku focuses on eco-friendly fertilizers and biodegradable packaging solutions.

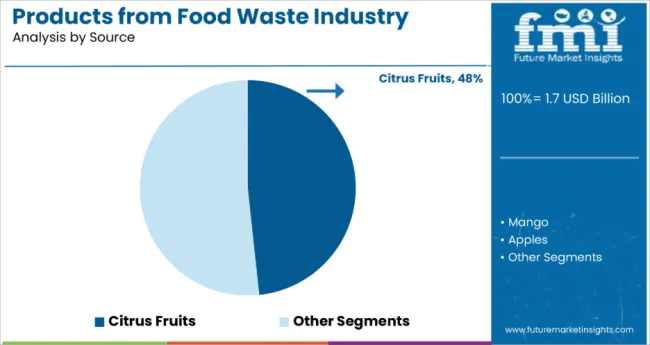

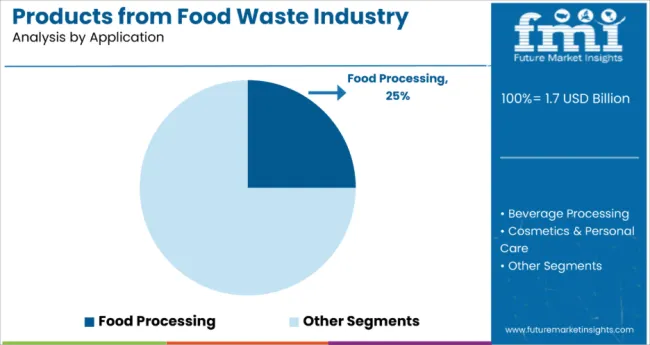

The largest contribution to demand continues to come from food processing applications, which are expected to account for 25% of total sales in 2025, owing to strong infrastructure development, regulatory support, and manufacturing scale efficiencies. By source material, citrus fruits represent a significant segment with 48% share, driven by abundant byproduct availability from juice processing operations and established extraction technologies for valuable compounds.

Consumer adoption is particularly concentrated among environmentally conscious businesses and government initiatives supporting circular economy models. While processing costs remain a consideration, technological innovations have improved efficiency and reduced operational expenses. Regional specialization is emerging, with Kanto excelling in energy recovery and textile production, Tohoku leading in agricultural applications, and Chubu developing innovative food rescue programs and biochemical extraction processes.

The products from food waste segment in Japan is classified across several categories. By source, the key materials include mango, apples, grapes, citrus fruits, carrots, beetroot, and other fruits and vegetables including berries. By application, the segment spans food processing, beverage processing, cosmetics and personal care, animal feed, and other uses including dietary supplements and nutraceuticals. By region, coverage includes Kanto, Chubu, Kinki, Kyushu and Okinawa, Tohoku, and the rest of Japan.

Citrus fruits are projected to drive significant innovation in 2025, supported by abundant byproduct availability from juice processing operations and established extraction technologies for valuable compounds. Other sources such as mango, apples, and vegetables are growing steadily, each serving distinct processing applications.

Products from food waste in Japan are utilized across diverse applications spanning multiple industries. Food processing is expected to remain the primary application in 2025, followed by animal feed and cosmetics applications. Processing strategies are evolving to match technological capabilities, with growth coming from both traditional and innovative applications.

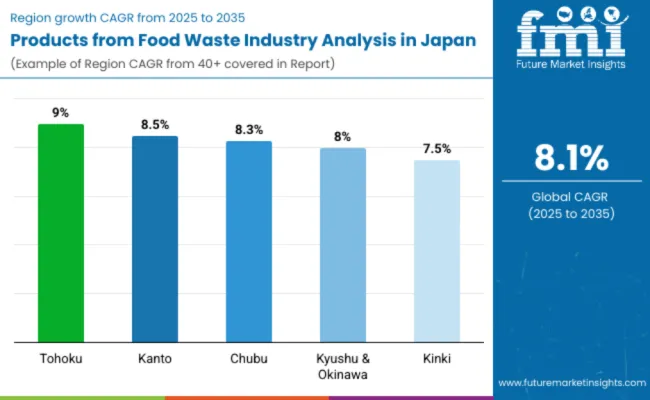

| Region | CAGR (2025 to 2035) |

|---|---|

| Tohoku | 9.0% |

| Kanto | 8.5% |

| Chubu | 8.3% |

| Kyushu & Okinawa | 8.0% |

| Kinki | 7.5% |

From 2025 to 2035, Tohoku leads the products from food waste with a projected CAGR of 9.0%, reflecting strong agricultural integration and advanced waste-to-value processing. Kanto follows at 8.5%, driven by urban consumption patterns and large-scale recycling infrastructure. Chubu’s 8.3% growth is supported by manufacturing expertise and the incorporation of bioenergy applications from waste. Kinki records 7.5% growth, focusing on premium, small-batch innovations. Kyushu & Okinawa, at 8.0%, leverages tourism and agricultural waste streams for niche, high-value products.

Sales of products from food waste in Tohoku are projected to grow at a CAGR of 9.0%, supported by the region’s strong agricultural foundation that ensures a consistent supply of raw materials for recycling and value-added processing. Food waste from fruit and vegetable farming is being channeled into eco-friendly fertilizers, biogas, and biodegradable packaging solutions.

Strong links between local farms and processors provide a steady input for biomass conversion. Government-led programs encourage waste-to-energy projects, and rural innovation hubs are experimenting with biochemical extraction for pigments and functional additives. Distribution improvements are enhancing accessibility, positioning Tohoku as a leading hub for food waste valorization.

Kanto demand for products from food waste is set to rise at a CAGR of 8.5%, driven by Tokyo’s large-scale consumption and advanced recycling systems. The region’s dense urban population produces significant food waste, which is increasingly diverted toward energy recovery, packaging materials, and cosmetic formulations.

Food manufacturers and beverage companies are leveraging citrus and fruit byproducts for natural extracts and additives. Kanto also benefits from well-developed logistics networks that support large-scale distribution of recycled materials. Strategic collaboration between municipalities and private enterprises is ensuring higher waste recovery rates, strengthening the region’s role as a processing and distribution powerhouse.

Chubu revenue from products derived from food waste is forecast to expand at a CAGR of 8.3%, supported by the region’s strong manufacturing base and innovation in biomass processing. Traditional industries such as sake brewing generate significant byproducts, which are now being converted into fertilizers, bio-packaging, and biochemical applications.

Emerging projects focus on integrating food waste into bioenergy production and advanced material development. Chubu’s central location enhances supply chain efficiency, enabling nationwide distribution of recycled products. Partnerships between processors and established industrial companies are helping scale new technologies and improve overall waste recovery efficiency.

Products from food waste in Kinki are expected to grow at a CAGR of 7.5%, with Osaka and Kyoto leading initiatives in premium and artisanal product applications. Food waste is being repurposed into functional ingredients for specialty foods, natural additives for beverages, and eco-friendly cosmetic formulations. Culinary culture and high consumer awareness are fostering demand for transparent sourcing and innovative products. Small and medium-sized enterprises are developing niche solutions such as natural pigments, essential oils, and biodegradable films. The combination of traditional gastronomy with modern recycling strategies positions Kinki as an important contributor to Japan’s food waste utilization.

Demand for products from food waste in Kyushu & Okinawa is anticipated to expand at a CAGR of 8.0%, driven by the region’s tourism sector and strong agricultural base. Local producers are using fruit waste, especially from tropical crops, to develop unique packaging materials, eco-friendly souvenirs, and specialty food additives.

Agricultural byproducts are also being integrated into animal feed and aquaculture inputs, creating a circular resource cycle. Regional branding initiatives emphasize environmental responsibility, making food-waste-derived products appealing to visitors and consumers. Collaboration between tourism operators, local farmers, and processors is fostering high-value niche product development.

The competitive environment is characterized by a mix of established waste management companies, technology developers, and emerging sustainability-focused enterprises. Processing capability and distribution networks rather than product diversity remain the decisive success factors: the leading suppliers collectively process thousands of tons of food waste annually and maintain comprehensive coverage across multiple application areas.

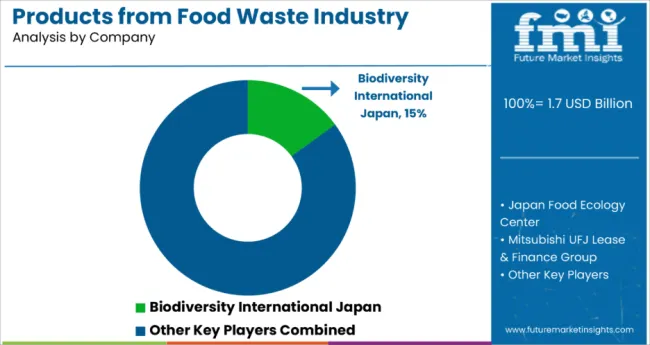

Biodiversity International Japan represents a mature participant in environmental solutions. The organization focuses on comprehensive sustainability programs, biodiversity conservation initiatives, and circular economy development. Its approach integrates environmental protection with waste reduction, giving it strong positioning in policy development and community engagement while maintaining national coverage through government partnerships and NGO networks.

Japan Food Ecology Center operates as a specialized processing facility leveraging advanced waste conversion technologies. The center focuses on efficient food waste processing, technology development for waste-to-product conversion, and research collaboration with academic institutions. Operational capabilities include large-scale processing infrastructure, advanced separation and conversion technologies, and comprehensive quality control systems supporting reliable product output.

Mitsubishi UFJ Lease & Finance Group provides financial infrastructure and equipment leasing services supporting the development of food waste processing operations. The company leverages extensive financial networks and equipment financing capabilities to enable facility development, technology adoption, and operational scaling for food waste processing enterprises across Japan.

Japan Food Ecology System develops integrated solutions combining waste collection, processing, and product development. Recent initiatives focus on systematic approaches to food waste management, technology integration across the processing chain, and development of standardized processing protocols that ensure consistent product quality and environmental performance.

Other significant players include TOYOKOH Inc., Tokyo Eco Recycle Co. Ltd., and Onkyo Ecosystems Co. Ltd., each focusing on specialized applications including equipment manufacturing, recycling services, and ecosystem development. These companies contribute essential capabilities in processing technology, operational services, and system integration that support sector development across multiple applications and regions.

Private sector initiatives through retail partnerships, municipal programs, and technology development are expanding processing capacity and product applications. Academic collaboration through universities and research institutions provides ongoing innovation in processing methods, product development, and efficiency improvements, putting development pressure on traditional waste management approaches while supporting advancement toward comprehensive circular economy implementation.

| Item | Value |

| Quantitative Units (2025) | USD 1.7 Billion |

| By Source | Mango, Apples, Grapes, Citrus Fruits, Carrots, Beetroot, and Others (Berries, etc.) |

| By Application | Food Processing, Beverage Processing, Cosmetics & Personal Care, Animal Feed, and Others (Dietary Supplements and Nutraceuticals) |

| Regions Covered | Kanto, Tohoku, Chubu, Kinki, Kyushu & Okinawa, and Rest of Japan |

| Top Companies Profiled | Crust Group, Suntory, Oisix, Aeropowder, Bio-bean Ltd., Circular Systems S.P.C., Fruitcycle, GroCycle, Jrink Juicery, Misfit Foods, ReGrained LLC, and Rise Products |

| Additional Attributes | Government policies promoting waste reduction; adoption of circular economy principles; growing environmental awareness; technological advancements in food waste processing; regional specialization in applications (biogas, eco-fertilizers, packaging, biochemicals); increasing business and consumer adoption of sustainable products |

In 2025, the total sales of products from food waste in Japan will be valued at USD 1.7 billion.

By 2035, the sales of products from food waste in Japan are forecasted to reach USD 3.7 billion, reflecting a CAGR of 8.1%.

Food processing leads the end-use segment with a 25% share in 2025, followed by animal feed and cosmetics applications.

Tohoku and Kanto are expected to lead growth, with Tohoku focusing on eco-friendly fertilizers and biodegradable packaging, and Kanto on biogas production and textile applications.

Citrus fruits dominate the source material category with a 48% share in 2025, supported by abundant byproduct availability from juice processing operations.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Products from Food Waste Market Analysis - Size, Growth, and Forecast 2025 to 2035

Products from Food Waste Industry Analysis in Korea Size, Share and Forecast Outlook 2025 to 2035

USA Products from Food Waste Market Growth – Trends, Demand & Outlook 2025-2035

Teff Products Market

Detox Products Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Algae Products Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Pulse Products Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dairy Products Market Analysis by Product Type, End Use, Distribution Channel and Region through 2035

Almond Products Market Size and Share Forecast Outlook 2025 to 2035

Bamboo Products Market Analysis – Trends & Growth 2025 to 2035

Luxury Products For Kids Market - Trends, Growth & Forecast 2025 to 2035

Chicory Products Market Size and Share Forecast Outlook 2025 to 2035

Crystal Products Market Size and Share Forecast Outlook 2025 to 2035

Suncare Products Market Size and Share Forecast Outlook 2025 to 2035

Ziplock Products Market Size and Share Forecast Outlook 2025 to 2035

Corn Co-Products Market

Global Moringa Products Market Outlook – Trends, Demand & Forecast 2025–2035

Make-Up Products Packaging Market Size and Share Forecast Outlook 2025 to 2035

Sun Care Products Market Analysis – Growth, Applications & Outlook 2025–2035

Car Care Products Market Trends - Growth, Demand & Analysis 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA