The global market for car care products market is anticipated to grow steadily with a projected market size of USD 57.69 billion in 2025 which is further reaching around USD 97.69 billion by 2035, at a CAGR rate of 5.5%. This growth is driven by some factor such as increasing vehicle ownership, aesthetic awareness, and product innovation.

One of the main drivers is the growing demand for vehicle appearance enhancement and maintenance. Consumers are increasingly valuing the resale value and longevity of their vehicles, and this results in increased demand for products like protective coatings, tire dressings, glass cleaners, waxes, and polishes.

Increased middle-class earnings and urbanization in emerging markets are also propelling the market further. Vehicle owners in countries across Asia-Pacific, Latin America, and the Middle East are increasingly investing in professional as well as do-it-yourself car detailing, resulting in sales of basic as well as premium care products increasing.

The increasing phenomenon of vehicle personalization and high-end car buying is also widening the market. People owning high-end cars are particularly in favor of high-performance cleaning and protective products that preserve the vehicle's exterior and interior looks while providing long-term protection against the damage of weather conditions.

However, the market has some limitations. Following environmental regulations on the chemical composition of auto care products poses a challenge to manufacturers. Control over volatile organic compounds (VOCs) and other hazardous ingredients is forcing companies to re-engineer products, increasing R&D costs and impacting speed to market.

However, the market offers a number of opportunities. The increasing demand for biodegradable and green products is driving innovation in green chemistry. Companies that focus on sustainability and transparency in formulation and sourcing are achieving competitive edge among environmentally aware consumers and regulatory authorities.

E-commerce is another key growth driver. Internet platforms have brought car care products within reach, particularly in rural and underpenetrated markets. Consumers now compare reviews, view tutorials, and select specialist products for their precise needs-all from the comfort of their smartphones or laptops.

Some of the major trends on the rise include waterless car wash products, ceramic coatings, and one-kit detailing solutions. Professional detailing too is growing, especially in major cities where time-constrained buyers want convenience and expert attention rather than DIY techniques.

Value Metrics

| Market Metrics | Values |

|---|---|

| Industry Size (2025E) | USD 57.69 billion |

| Industry Value (2035F) | USD 97.69 billion |

| CAGR (2025 to 2035) | 5.5%. |

The global car care products industry is growing gradually due to the growing ownership of vehicles, consumer awareness about the upkeep of automobiles, and innovations in formulating products.

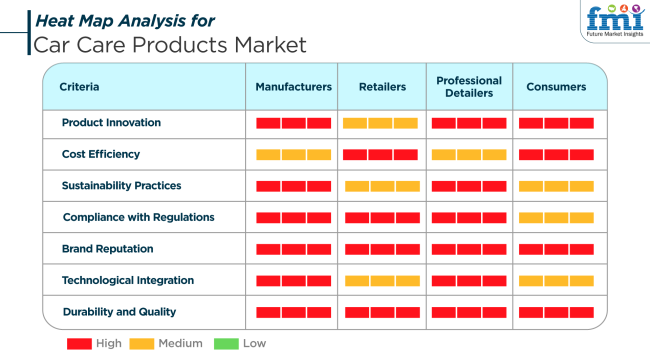

Companies are investing in research for their products, coming up with complicated cleansing items as well as protecting covers with advanced toughness and user friendliness. There is also growing emphasis on sustainability practices with the creation of environmentally friendly products that reduce environmental footprint.

Merchants are concerned with cost-effectiveness and reputation, choosing products that compromise on cost but maintain quality to address the variety of consumers. Growth in online business websites has made products widely accessible, and merchants can serve a large client base.

Commercial detailers demand good-quality, high-tech products that produce higher quality and better results, coupled with greater efficiency. Products meeting regulatory requirements and being durable in nature are more favored in order to deliver customer satisfaction and ensure repeat orders.

Customers are more and more inclined towards do-it-yourself car care, appreciating products that are simple to use, affordable, and eco-friendly. The increasing vehicle personalization trend has also created demand for dedicated care products that preserve and improve vehicle appearance.

In general, the market is marked by a move towards new, sustainable, and user-friendly car care solutions that meet the changing needs of all the stakeholders involved.

Between 2020 and 2024, the market for car care products witnessed a growth in demand due to the growing popularity of DIY car care, vehicle appearance, and increasing vehicle sales. Consumers insisted on good quality cleaning agents, waxes, ceramic coating, and interior care products to maintain their vehicles in good condition despite the variable weather conditions and road contaminants.

The shift towards green and biodegradable cleaning agents gained speed as environmental concerns grew. Growth in e-commerce portals such as Amazon and Walmart also helped greatly towards product accessibility through bundled packs and subscription-based auto-care products.

Automotive detailing businesses also expanded the scope of their offerings to include nano-ceramic coatings, graphene-based protection, and waterless car wash products, addressing the demands of eco-conscious consumers.

From 2025 to 2035, the industry will transform with innovation in AI-powered auto-maintenance recommendations, smart car detailing robots, and super-durable coatings. Innovation will be driven by sustainability as firms create plant-based waxes, biodegradable tire dressings, and carbon-free production.

The market will also see growth in electric vehicle-specific care products, such as heat-resistant battery heat-proof paint protection films and interior cleaners for vegan leather seats. Subscription services providing automatic refills of necessary car care products will gain popularity, improving the convenience for customers.

Increased demand for premium and luxury car segment growth will further drive the demand for premium detailing solutions, and augmented reality (AR) technology will change the way at-home car care tutorials and virtual product testing experiences are done.

A Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Do-it-yourself car upkeep trend, increased vehicle ownership, and expansion of automotive detailing services. | Intelligent car-care technologies, electric vehicle-specific products, and AI-enabled maintenance. |

| Green cleaners, ceramic sealants, and waterless wash solutions. | Nano-durable coatings, plant-extracted waxes, and intelligent detailing robots. |

| E-commerce growth, subscription-type auto-care packs, and nano-ceramic protection. | Virtual reality tutorials, AI-based maintenance recommendations, and virtual product simulation. |

| Biodegradable cleaning agents and water-conserving car wash products. | Carbon-neutral manufacturing, plant-based protectants, and environmentally friendly tire dressings. |

| One-size-fits-all automotive care products for all vehicles. | Heat paint, EV treatments, and bespoke vegan leather protection. |

| Increased online retailers and pre-packaged automotive care packages. | Comes the age of autonomous subscription plans and AI-recommended auto detailing. |

| Luxury detailing treatments and waxes for luxury vehicles. | Mass ultra-premium automotive care products, including graphene-based protectants and smart coatings. |

The industry of car care products is exposed to raw material price risk volatility. Supply chain disruptions and pandemic conditions in the worldwide economy are interrupting supplies of ingredients like waxes, polymers and detergent. Rising costs, however, may cause product prices to appreciate, potentially decreasing consumer demand and negatively impacting their profit margins.

Market competition is another key risk. Numerous brands compete with new cleaners, polishes, and protectants. Price wars and intense marketing campaigns are prevalent due to high competition. Opportunities for upstart brands to be heard are few, and market giants dominate distribution channels, restricting entry points for newcomers.

Manufacturers are fighting because of environmental policy. Chemicals in car care products Many governments have strict limitations on the chemicals that can be utilized in car care products to assist in safeguarding the environment. Non-compliance with these regulations can lead to fines, product recalls or even prohibition, which is why companies need to invest in sustainable formulations.

Changing consumer trends also increase market growth. The appearance of waterless car wash products and do-it-yourself (DIY) car cleaning fashions can reduce the demand for conventional car wash products. There, also, electric cars (EVs) could alter the method or the manner consumers would maintain their vehicles, that is, OEM makers could be required to shift their product lines. Last, consumers may spend less money on automobile care products in hard times.

A car owner will invest more money in crucial things (put this into your head), and the cars that have an elegant luxurious touch come into less demand, and it does not matter if there is washing or polishing of rags. Unstable economic times mean that producers need to embrace spick-and-span priced options and entirely new incentives wherever feasible in order to meet demand.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 3.5% |

| UK | 3.6% |

| France | 3.4% |

| Germany | 3.7% |

| Italy | 3.9% |

| South Korea | 4.0% |

| Japan | 3.6% |

| China | 5.4% |

| Australia | 3.9% |

| New Zealand | 3.8% |

The USA automotive vehicle care market will grow at a compound annual growth rate (CAGR) of 3.5% between 2025 and 2035. Growth is fueled by a high level of vehicle ownership and increasing consumer sophistication about vehicle upkeep. Strong automobile culture and availability of prominent automobile care product brands are the principal drivers of growth in the market.

The increasing DIY car care and detailing culture also increased the demand for quality car care products even more. In addition, the availability of an incredibly large number of products offered by retail chains and the internet supports market growth, and the USA emerges as one of the largest contributors to the world car care products market.

The car care products market in the UK is projected to grow at a CAGR of 3.6% during the forecast period. The increased demand for eco-friendly car care products is consistent with the high level of environmental awareness in the nation. Individuals are opting for products that are safe for their vehicles as well as the environment.

Besides, the do-it-yourself car care trend is becoming increasingly popular, with numerous people opting to clean and maintain their vehicles. This synergy between eco-awareness and autonomy in car maintenance will propel market expansion in the future.

The French car care products market for the automotive sector is expected to expand at a CAGR of 3.4% over 2025 to 2035. The nation's rich automobile history and focus on vehicles look to drive the constant demand for auto care products.

The increasing popularity of professional detailing services for cars, coupled with a rising number of car aficionados committed to vehicle looks, drives the market growth. Besides that, the adoption of premium and innovative car care solutions is increasing, which signifies consumers' willingness to pay higher prices for high-quality products for their automobiles.

Germany will be experiencing a CAGR of 3.7% in the car care products market during the forecast period. Being a global automotive market hub, Germany emphasizes vehicle looks and maintenance a lot, thereby creating demand for high-quality car care products.

The availability of major car care product manufacturers and a well-developed distribution network also enhances market growth. The DIY car maintenance and detailing culture among German consumers also enhances the growing demand for high-quality car care products, making Germany a top market in Europe.

Italy's automotive care product market is expected to grow at a CAGR of 3.9% during 2025 to 2035. The nation's affluent vehicle culture and increasing consumer interest in vehicles look to drive this trend of growth.

Car wash products are one of the highest-in-demand groups, with increasingly more and more consumers buying high-end solutions to keep their cars clean. Further, the expansion of professional car detailing companies and the growing awareness among consumers of vehicle preservation methods also drive the market's growth.

The South Korean car care products market is expected to grow with a CAGR of 4.0% during the forecast period. Growth is driven by a growing number of car owners and a focus on the appearance and maintenance of vehicles.

Rising demand for professional car detailing services and an increasing number of car enthusiasts are driving demand for premium car care products. The shift toward emerging car care technologies and consumer demand for green products are representative of consumer trends, which also spur market expansion.

The Japanese market for car care products is forecasted to grow at a 3.6% CAGR from 2025 to 2035. Increased attention of consumers to car care, along with the increasing trend of car detailing services, is driving the market primarily.

Technological advancements in autos and the growth of e-commerce portals have also benefited the products and range of car care products for consumers. The demand for high-performance car care products, particularly with a focus on durability and efficiency, is gaining slowly.

The Chinese car care product market is expected to grow at a CAGR of 5.4% from 2025 to 2035. The swift growth of the auto segment and the growing middle-class population with increasing disposable incomes drive this high growth.

Increasing demand for high-performance car care products, especially among urban consumers, has driven the development of this market. The widespread use of e-commerce websites has also increased the supply of goods and exposure to customers. Additionally, the growth in professional car wash and detailing services and high-end car maintenance solutions is defining the market scenario.

The Australian car care products market will register a CAGR of 3.9% during the forecast period. The increasing trend towards do-it-yourself car repair and maintenance, along with the availability of a broad range of car care products, fuels market expansion.

There is a rising consumer preference for eco-friendly and biodegradable products, consistent with the nation's high level of environmental awareness. The market is also experiencing expanding demand for ceramic coatings and precision car detailing products, all of which are fueling market expansion.

The car care product market in New Zealand is also expected to attain a CAGR of 3.8% between 2025 and 2035. Ongoing growth in motor vehicle possession and rising interest in car upkeep and detailing have spurred the development of the market.

Shifting trends towards ecological and biodegradable car care products are governing consumer choices. Other than that, increased global vehicle trends and accessibility to advanced auto maintenance services via Internet commerce platforms are principal promoters of market growth.

The Car Care Products Market is anticipated to grow at a steady rate in the year 2025 because of the increasing ownership of vehicles, a higher level of consumer awareness about maintenance, and demand for high-quality auto detailing solutions. Of the different types of products available in the market, fresheners account for about 35% of the market share, while cleaning products are close behind, making up 30%.

The freshener segment that tops the market share at 35% has been popular with owners of private vehicles, taxi services, and ride-sharing fleets such as Uber and Lyft. As the world transitions into using more natural and chemical-free components, so is the preference of the consumers leading toward hot, renewable sources that are organic ingredients in fresheners.

Renowned companies such as Little Trees, Febreze, and California Scents have all these fresheners without fail; that is, they are available in gel-based, spray-based, and hanging formats. It covers a wide spectrum of market sensitivity.

Studies have proven that scented surroundings create a sense of enhanced driver alertness and relieve stress and thus promote increased sales. Moreover, high-end luxury car owners like Mercedes-Benz and BMW offer fragrance diffusers as a part of creating beauty in cars and thus cultivating this position's growth.

This cleaning products segment, which covers a broad spectrum of items such as car shampoos, waxes, polishes, interior cleaners, and tire cleaners, holds a share of 30%. There is an unprecedented rush towards waterless car wash and ceramic coat treatments because more consumers across the globe have turned to eco-friendliness as their use of water is minimized.

The significant players in this segment are Turtle Wax, Armor All, and Meguiar's, with their advanced nano-coating and protective sealant formulations that assure durability as well as ease of maintenance. E-commerce, too, has contributed much to making these specialized cleaning solutions easily available; the most popular online platforms are Amazon and AutoZone.

The Car Care Products Market in 2025 is expected to grow mainly alongside increasing consumer demand for vehicle maintenance and aesthetic enhancement. Application-wise, interior car care products occupy a leading share of 55%, while exterior car care products take up 45% of the market.

The interior car care segment, holding 55% of the market share, is boosted by rising hygiene concerns, odor control, and upholstery protection. Products such as dashboard cleansers, leather conditioners, carpet shampoos, and antimicrobial sprays are all the rage among consumers wanting to keep a clean, fresh-scented, and germ-free cabin environment.

The rise of shared mobility services such as Uber and Lyft is causing vehicle owners to invest more in interiors to ensure pleasant experiences for passengers. The pandemic has brought more focus on disinfectant-based cleaners that help remove bacteria and viruses from steering wheels, touchscreens, and air vents.

Leading brands such as Meguiar's, Chemical Guys, and 3M provide special interior detailing products with UV-protective coatings that help prevent the fading and cracking of dashboards. External car care contributes 45% of the market and includes items such as car wax, polishes, ceramic coatings, tire dressings, and glass cleaners.

The emergence of automated car washes, waterless cleaning technology, and self-healing protective films drives innovations in this category. Increasing paint oxidation, scratches, and environmental damage are some of the consumer concerns raising demand for long-term protective and high-gloss finish products. Brands like Turtle Wax, Sonax, and Armor All are coming up with graphene-based enhancements and water-hating, effective coatings that increase durability against dirt, rain, and UV.

The global market for car care products is currently in steady growth as consumers become increasingly aware of vehicle maintenance, car ownership continues to rise, and DIY detailing solutions become popular. The market trend is shifting toward increasing demands for high-performance cleaning, polishing, and protective solutions as new developments in automotive coatings and surface protection technologies emerge.

Ceramic coating innovation, graphene for infused products, and even waterless car wash alternatives are changing the shape of the market itself. As sustainability is a cause of concern, eco-friendly, biodegradable and pH-balanced formulations have gained importance. The introduction of smart applicator tools and automated dispensing systems will further aid in user convenience.

The tide of e-commerce boosts direct-to-consumer sales. The sale of subscription-based car care kits and bundled detailing products is gaining traction. The professional detailing sector also segments growth and the growing number of auto spas and mobile detailing service providers is driving curiosity among car owners.

Companies are investing in research and development to emerge with longer-lasting protective coats and UV-resistant treatments, according to the need for changing climatic conditions. By teaming up with automotive service centers, car dealers as well as online marketplaces, a wider reach for products is obtainable. Furthermore, branding strategies that focus on professional-grade performance and sustainability are significant competitive differentiators in the industry's competitive landscape.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| 3M | 18 |

| Sonax GmbH | 15 |

| Turtle Wax Inc. | 14 |

| Adolf Würth GmbH & Co KG | 12 |

| Soft99 Corp | 10 |

| Other Companies | 31 |

| Company Name | Key Offerings/Activities |

|---|---|

| 3M | Offers high-performance car waxes, ceramic coatings, and professional detailing products. |

| Sonax GmbH | Specializes in premium car polishes, interior cleaning solutions, and protective coatings. |

| Turtle Wax Inc. | Provides budget-friendly waxes, ceramic sprays, and waterless wash products. |

| Adolf Würth GmbH & Co KG | Focuses on professional-grade automotive maintenance and surface protection products. |

| Soft99 Corp | Offers Japanese-engineered coatings, sealants, and glass protection solutions. |

Key Company Insights

3M (18%)

3M remains a leader in the car care products market, leveraging its advanced technology in protective coatings, polishes, and detailing solutions. The company continues to invest in eco-friendly formulations and high-performance ceramic coatings to meet evolving consumer needs.

Sonax GmbH (15%)

Sonax is recognized for its premium car polishes and detailing products, especially in the European market. The company’s focus on professional and consumer-grade solutions has strengthened its brand loyalty.

Turtle Wax Inc. (14%)

A well-known brand in the consumer segment, Turtle Wax is expanding its portfolio with ceramic-infused products and easy-to-use detailing solutions. The company has a strong retail and e-commerce presence, enhancing its market reach.

Adolf Würth GmbH & Co KG (12%)

Würth specializes in automotive maintenance and detailing products, primarily catering to professional users and auto repair businesses. The company’s strong distribution network supports its competitive position.

Soft99 Corp (10%)

A leader in the Japanese market, Soft99 is known for its innovative coatings, glass protectants, and long-lasting waxes. The brand continues to expand internationally, capitalizing on high-performance and specialized detailing solutions.

Other Key Players (31% Combined)

The market includes Cleaning Products, Polishing & Waxing Products, Fresheners, and Others, catering to various car maintenance needs.

Segmentation covers Interior and Exterior applications, addressing both inside and outside vehicle care.

Key sales channels include Supermarkets and Hypermarkets, Specialty Stores, and Online Retail, reflecting diverse purchasing preferences.

The market spans North America, Latin America, Europe, Asia Pacific, and the Middle East & Africa, highlighting global demand trends.

The market is estimated to be worth USD 57.69 billion in 2025.

The market is expected to see consistent growth, with sales projected to reach approximately USD 97.69 billion by 2035.

China is anticipated to grow at a CAGR of 5.4% over the forecast period.

The interior car care segment remains dominant, as demand for cleaning, conditioning, and protective solutions increases.

Leading companies include 3M, Sonax GmbH, Turtle Wax Inc., Adolf Würth GmbH & Co KG, Soft99 Corp, Shell Plc, Pidilite Industries Ltd, Holt Lloyd International Ltd, Tetrosyl Ltd, and Cartec BV.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Product, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Application, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Product, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 20: Latin America Market Volume (Units) Forecast by Product, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 25: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Europe Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 28: Europe Market Volume (Units) Forecast by Product, 2018 to 2033

Table 29: Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 30: Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 32: Europe Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 33: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Asia Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 35: Asia Pacific Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 36: Asia Pacific Market Volume (Units) Forecast by Product, 2018 to 2033

Table 37: Asia Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 38: Asia Pacific Market Volume (Units) Forecast by Application, 2018 to 2033

Table 39: Asia Pacific Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 40: Asia Pacific Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 41: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: MEA Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: MEA Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 44: MEA Market Volume (Units) Forecast by Product, 2018 to 2033

Table 45: MEA Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 46: MEA Market Volume (Units) Forecast by Application, 2018 to 2033

Table 47: MEA Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 48: MEA Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 10: Global Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 14: Global Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 18: Global Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 21: Global Market Attractiveness by Product, 2023 to 2033

Figure 22: Global Market Attractiveness by Application, 2023 to 2033

Figure 23: Global Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Product, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 34: North America Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 38: North America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 42: North America Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 45: North America Market Attractiveness by Product, 2023 to 2033

Figure 46: North America Market Attractiveness by Application, 2023 to 2033

Figure 47: North America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Product, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 58: Latin America Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 62: Latin America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 66: Latin America Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Product, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Europe Market Value (US$ Million) by Product, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 75: Europe Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 76: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Europe Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 82: Europe Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 83: Europe Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 85: Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 86: Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 87: Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 88: Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 89: Europe Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 90: Europe Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 91: Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 93: Europe Market Attractiveness by Product, 2023 to 2033

Figure 94: Europe Market Attractiveness by Application, 2023 to 2033

Figure 95: Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 96: Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Asia Pacific Market Value (US$ Million) by Product, 2023 to 2033

Figure 98: Asia Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 99: Asia Pacific Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 100: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Asia Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 103: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Asia Pacific Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 106: Asia Pacific Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 107: Asia Pacific Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 108: Asia Pacific Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 109: Asia Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 110: Asia Pacific Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 111: Asia Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 112: Asia Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 113: Asia Pacific Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 114: Asia Pacific Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 115: Asia Pacific Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 116: Asia Pacific Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 117: Asia Pacific Market Attractiveness by Product, 2023 to 2033

Figure 118: Asia Pacific Market Attractiveness by Application, 2023 to 2033

Figure 119: Asia Pacific Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 120: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 121: MEA Market Value (US$ Million) by Product, 2023 to 2033

Figure 122: MEA Market Value (US$ Million) by Application, 2023 to 2033

Figure 123: MEA Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 124: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: MEA Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 127: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: MEA Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 130: MEA Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 131: MEA Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 132: MEA Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 133: MEA Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 134: MEA Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 135: MEA Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 136: MEA Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 137: MEA Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 138: MEA Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 139: MEA Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 140: MEA Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 141: MEA Market Attractiveness by Product, 2023 to 2033

Figure 142: MEA Market Attractiveness by Application, 2023 to 2033

Figure 143: MEA Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 144: MEA Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Suncare Products Market Size and Share Forecast Outlook 2025 to 2035

Skincare Products Market Size and Share Forecast Outlook 2025 to 2035

Sun Care Products Market Analysis – Growth, Applications & Outlook 2025–2035

Nail Care Products Market Growth, Trends and Forecast from 2025 to 2035

Facial Care Products Market Size and Share Forecast Outlook 2025 to 2035

Dental Care Products Market Size and Share Forecast Outlook 2025 to 2035

Personal Care Products Filling System Market Size and Share Forecast Outlook 2025 to 2035

The Dementia Care Products Market is segmented by Memory Exercise & Activity Products, Daily Reminder Products and Dining Aids from 2025 to 2035

Men’s Skincare Products Market Size, Growth, and Forecast for 2025 to 2035

Pregnancy Care Products Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Post Shave Care Products Market Size and Share Forecast Outlook 2025 to 2035

Baby Teeth Care Products Market Size and Share Forecast Outlook 2025 to 2035

Europe Pet Care Products Market Growth, Trends and Forecast from 2025 to 2035

Incontinence Care Products Market Size and Share Forecast Outlook 2025 to 2035

Buffering Skincare Products Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Baby Personal Care Products Market Analysis - Size & Growth 2025 to 2035

Tea-Based Skin Care Products Market Analysis by Product Type, Tea Type, Skin Type, Sales Channel and Region from 2025 to 2035

Men's Intimate Care Products Market - Trends, Growth & Forecast 2025 to 2035

Critical Care Patient Monitoring Products Market Forecast and Outlook 2025 to 2035

Astringent Skin Care Products Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA