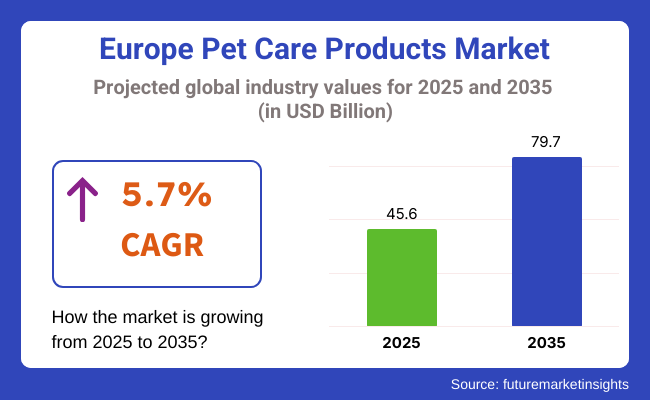

The Europe pet care products market is estimated to be valued at USD 45.6 billion in 2025 and is forecast to grow at a 5.7% CAGR from 2025 to 2035. The industry is anticipated to arrive at USD 79.7 billion by 2035. One of the key drivers for this trend is the intensified emotional connection between pet owners as well as their pets, as they spend more on premium lifestyle-improving, grooming, and wellness pet products.

Pet humanization remains a driving force in consumer trends across Europe, as pets are considered part of the family. This has led to an increased demand for high-quality personalized pet care products such as grooming equipment, cleansing products, nutrition supplements, toys, and accessories. Urbanization, one-person households, and an increase in the aging population have also contributed to an accelerated rate of pet ownership among large economies such as Germany, France, Italy and the UK.

The industry is seeing fast digitalization, with pet subscription boxes and e-commerce sites becoming mainstream buying channels. Online shopping is not just increasing accessibility but also enabling personalized suggestions and loyalty-driven models of sales. Businesses are using AI and data analytics to customize product offerings, optimize stock, and improve customer interaction.

Sustainability is becoming a key factor in brand selection. European consumers are increasingly favoring products that are biodegradable, cruelty-free and made with ethically sourced ingredients. Brands are reacting by incorporating environmentally friendly packaging, plant-based ingredients and local manufacturing approaches to minimize carbon footprints and enhance consumer confidence.

The competitive landscape consists of established multinationals and agile niche brands providing functional and therapeutic solutions. Products approved by veterinarians and backed by pet influencers are gaining robust momentum. With ongoing innovation, regulatory harmonization in the EU, and a growing emphasis on pet wellness, the industry for European pet care products will expand at a steady pace through the decade ahead.

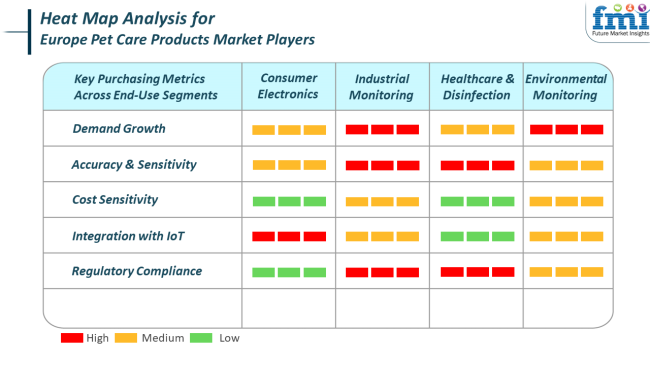

In the pet care consumer electronics industry, smart feeders, health-monitoring wearables, and GPS trackers become more in demand due to IoT adoption. Pet owners now expect mobile app compatibility without exceptions, high accuracy in behavioral tracking, and connectedness, so their demand is quite high for digitally aware care products.

Industrial monitoring overlaps with logistics and cold-chain management for fragile pet care products such as probiotics or sensitive grooming products. Accuracy of environmental control, traceability, and compliance with health specifications are major factors in business procurement decision-making.

End use in healthcare and disinfection is aimed at sanitizing products, medical grooming aids, and pet first-aid kits. Material safety and regulatory compliance are of utmost importance here. Environmental monitoring also extends to sustainable product development, especially in quantifying lifecycle impacts and sourcing practices. Companies are now harmonizing with EU green labeling schemes to appeal to environmentally aware consumers.

While undergoing consistent growth, the European pet care products industry also faces a number of strategic and structural risks. Fragmented regulation in the EU remains a problem, particularly in labeling, the use of ingredients and testing. Suppliers must navigate complex and evolving rules from country to country, which can affect the timing of industry entry and compliance costs.

Financial exposure is also a risk, where premium and voluntary pet care categories may face a contraction in demand under inflationary situations or consumer doldrums. Even when there is strength in pet ownership, consumption patterns would likely be impacted by switching to value-tier products, lowering profit margins for high-end companies.

Lastly, greater competition and the emergence of web-only pet product brands can lead to industry saturation and price pressures. Without value-added services or strong differentiation, established players will struggle to keep customers loyal. Sustaining sustainable sourcing, open communication and personalized interaction will be key to long-term competitive success in the evolving European industry.

From 2020 to 2024, the industryexpanded significantly as a result of the rise in pet humanization and the demand for improved-quality, health-focused pet products. Pet adoption rose significantly during this time, and individuals began identifying with pets as family, spending on wellness, grooming, and natural feeding products.

The rise in e-commerce was at the forefront, bringing with it convenience, greater assortment, and customized product recommendations. Green consumer behavior also began to affect product innovation, as sustainable packaging and nature-derived formulations emerged. Pet comfort, diet, and cleanliness became the new drivers, with more focus on ingredient clarity and eco-sourcing.

Between 2025 and 2035, the industry will continue to evolve as it embraces cutting-edge technologies and green practices. Smart pet devices like health-checking wearables and automatic feeders will become mainstream. Personalized nutrition and AI-recommended pet care will be incorporated in pet wellness programs.

The focus on sustainability will further increase, and the industry will be driven towards the creation of biodegradable packaging, plant-based grooming products, and cruelty-free formulations. Customers will look for ethical values, traceability, and environmental considerations, prompting brands to innovate ethically. This decade will reimagine pet care through a marriage of technology, wellness, and mindful consumption.

Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Premium, wellness-focused, and natural products | AI-powered personalization, holistic well-being, and fair sourcing |

| Organic food, green grooming, and functional treats | Smart products, tailored nutrition, and eco-friendly product materials |

| Expansion of e-commerce marketplaces and direct-to-consumer brands | Omnichannel experiences with virtual consultations and automatic subscriptions |

| Introduction of returnable packaging and environmentally friendly ingredients | Widespread use of biodegradable, cruelty-free, and low-impact solutions |

| Restricted to online channels and simple automation | Sophisticated tech such as pet wearables, intelligent monitoring, and AI-driven care planning |

| Conformity to current EU safety and welfare regulations | More rigorous enforcement of sustainability, labeling, and traceability in sourcing |

The share of cat and dog segmentation in the European pet care products industry forecasts that by 2025, cats will dominate the industry with a share of 60%, followed by dogs, with a 40% share, will be trailing behind. This scenario shows an increasing emphasis on cat care activities in view of an upswing in cat ownership and the growing prominence of specialized cat care products.

The cat's majority in the European pet care industry is being propelled by a rising trend in cat ownership in Europe. Cats are usually preferred by working people living in congested cities and apartments, and they are typically less troublesome than dogs. Consequently, a myriad of pet products is being designed for cats, more than one can imagine, ranging from cat foods, grooming supplies, and litter to health supplements.

Trends in the industry lean toward cat care and recreation, with companies like Nestlé Purina, Mars Petcare, and Royal Canin producing cat-based products and targeting different breeds, sizes, and specific health requirements. For example, Royal Canin has specialized diets focusing on breed and age-related needs.Dogs remain a major segment but slightly behind the cat segment.

Nevertheless, the dog care sector is prospering, driven by the popularity of premium dog foods, dog grooming items, and dog accessories. Major brands such as Pedigree, Hill's Pet Nutrition, and Iams provide high-quality nutritional options, treats, toys, and health-related products targeted toward different dog breeds. Even with dogs being the smaller segment, the dog care industry is incorporating personalized care, such as tailored nutrition and dental care products, plus interactive toys servicing various breeds and ages.

In Europe, the pet care products industry is segmented by sales channels, with modern trade and pet stores set to hold significant industry shares at 18% and 14%, respectively, in 2025. These two sales channels have an equally important role in the distribution of pet care products, but different factors control their industry dynamics.Modern trade is the sector for large retail chains, supermarkets, and hypermarkets, which claims an 18% share due to its convenience and accessibility to consumers.

These outlets provide a wide assortment of pet care products, often at competitive prices, and are an integral part of the retail landscape for pet owners wanting a one-stop shop for all their needs. These stores also act as a promotional platform for products, giving well-established brands and new entrants an opportunity to reach a wider audience.

The likes of Nestlé Purina and Mars Petcare rely on these modern trade channels to supply bulk quantities of their most popular dry and wet food, treats, and health products. Through promotions, these stores attract more customers, which results in increased sales for pet care products. 14% occupy the shelves as pet stores.

They are very much dedicated to the sale of products and services for pets. Though its industry is less than that of modern trade, pet stores have specialized services, expert advice, and products and services that focus on the specific needs of the pet.

Accessories, grooming tools, and health supplies, besides premium, niche, and organic pet food, will be found in such stores. For example, independent pet shops or chains like Pets at Home have an array of items, most of which are found at general retailers, that include specialty items. Therefore, important specialties like those of health care lie for pet shops in retaining their relatively small but firmly entrenched share of the industry.

| Country | CAGR (%) |

|---|---|

| UK | 6.5% |

| Germany | 6.2% |

| France | 5.9% |

| Italy | 5.6% |

The UKindustry will grow at 6.5% CAGR during the study period. The industry in the UK is experiencing outstanding growth with high levels of pet ownership and increasing humanization of pets. Consumers are investing in good quality food, grooming products, and wellness solutions, driving diversification in product categories.

The industry also benefits from heightened awareness regarding pet nutrition and health, leading to rising demand for organic, breed-based, and veterinarian-developed products. E-commerce and omnichannel retailing channels are also leading the way in offering wider access to pet care products.

Food and hygiene product subscription services are becoming popular among city pets. In addition, there is a growing demand for sustainable and eco-friendly pet products like biodegradable grooming products and packaging. The industry also witnesses regular new product launches involving the use of natural ingredients, cruelty-free formulations, and functional performance. As more households continue to treat pets as family members, spending on specialist and indulgent care products will continue to be robust through 2035.

The German industry is expected to grow at a 6.2% CAGR during the duration of the study. Germany has one of the most potent pet populations in the continent, and the industry of pet care products is already entrenched with rich penetration in foods, grooming, and accessories. Societal interest in sustainability and concern for animals' welfare is triggering demand for environmentally friendly packing as well as for additive-free natural products.

German pet owners are highly brand loyal but also increasingly open to innovation and product customization. German retailers are expanding their channels both in brick-and-mortar stores and online, which increases industry coverage and convenience. Cat popularity and demand for small dog breeds drive demand for particular diet and care products.

At the same time, health-driven categories-i.e., supplements, dental chews, and hypoallergenic grooming kits-are propelling more rapid expansion. Quality- and safety-first regulatory frameworks also foster high consumer trust in domestically produced products. Growth will be sustained over the long term by the continued merging of pet care and lifestyle categories.

The French industry is expected to grow at 5.9% CAGR during the forecast period. The French pet care industry is evolving rapidly with increased ownership of cats and dogs in urban and rural France. Product development is targeting high-quality nutrition, nutritional supplements, and premium grooming items. French consumers place great emphasis on aesthetic appeal and wellness, indicating higher demand for natural ingredients, premium packaging, and multi-functional pet care products.

Retail innovation is also coming into focus, with concept stores, specialist online shopping platforms, and in-store experiences driving consumer engagement. Also, propelling growth is concerned with pet allergies and intolerances, driving growth in customized nutritional solutions.

The increasing trend for one-person households and aging demographics is building the emotional value of pet companionship, further driving expenditures. With growing public awareness of animal health and pet hygiene, demand for advanced grooming and healthcare products is expected to register steady growth across all pet segments.

The Italian industry is expected to experience a growth of 5.6% CAGR during the forecast period. Italy's industry for pet care products is experiencing stable growth because of an increasing trend for small companion animals in urban households. This shift has contributed to the growing need for premium dry food, self-grooming products, living situations and breed-specific add-ons. With growing concern towards quality and ingredient content, increasing uptake of health-supportive recipes and functional chews is noticed.

While traditional retailing still forms the base, online outlets are becoming influential, offering easier access to merchandise and customized subscription programs. Italy is also seeing a growing demand for sustainable grooming and hygiene products, reflecting general trends in sustainability.

Although the industry is more fragmented than in northern Europe, increasing consumer tendency towards holistic pet care and lifestyle balance is fueling product growth. Innovations aimed at pet health, including CBD products and organic shampoos, are increasingly moving into the spotlight and finding acceptance in city industries.

The consolidated industry in Europe comprises dominant players and emerging brands with a variety of offerings for diverse needs, including food, grooming products, accessories, and health solutions. Large firms such as Nestlé Purina Pet Care and Trixie Heimtierbedarf GmbH & Co. KG use diverse product offerings and extensive distribution networks to sustain strong positions in the industry.

Nestlé Purina Pet Care is also active in pet food innovation that offers high-quality, nutritious food with special emphasis on natural ingredients and specialized dietary needs for pets.

Premium pet foods and pet health products are provided to customers by FressnapfTiernahrungs GmbH, JoseraPetfood GmbH & Co. KG, and Robert Bosch GmbH based on their fostering strong relationships with veterinarians and retail professionals. These players are improving their product lines by sustainability and natural ingredients.

The Clorox Company, Inc. and Spectrum Brands Holdings, Inc. are other companies that have focused on the growth of their pet care brands with products that range from cleaning items to grooming tools with accessories for pets. Garmin Europe and SportDOG Europe serve the active pet owners' industry by providing smart pet tracking and training devices.

Moreover, Ferplast S.p.A. and Zolux lead the pet accessories industry by making innovative, high-quality, durable products that make life just that little bit easier or nicer for pet owners and their pets.

Market Share Analysis by Company

| Company Name | Market Share (%) |

|---|---|

| Nestlé Purina Pet Care | 18-22% |

| Trixie Heimtierbedarf GmbH & Co. KG | 14-18% |

| Josera Petfood GmbH & Co. KG | 12-16% |

| Fressnapf Tiernahrungs GmbH | 10-14% |

| Robert Bosch GmbH | 8-12% |

| Other Players | 24-28% |

| Company Name | Offerings & Activities |

|---|---|

| Nestlé Purina Pet Care | It offers high-quality pet food, including specialized diets and natural ingredients for pets. |

| Trixie Heimtierbedarf GmbH & Co. KG | Wide range of pet products, from food to grooming accessories, focused on pet comfort and care. |

| Josera Petfood GmbH & Co. KG | Focus on premium pet food with an emphasis on natural and sustainable ingredients. |

| Fressnapf Tiernahrungs GmbH | Large assortment of pet products, including pet food, accessories, and health products, with a strong retail presence. |

| Robert Bosch GmbH | Innovating in pet care products, focusing on health solutions and premium pet foods. |

Key Company Insights

Nestlé Purina Pet Care (18-22%)

A leader in pet food with a broad portfolio that includes specialized products for various dietary needs and strong brand recognition.

Trixie Heimtierbedarf GmbH & Co. KG (14-18%)

Known for its wide range of pet care products, from food to accessories, focused on the well-being and comfort of pets.

JoseraPetfood GmbH & Co. KG (12-16%)

Provides premium pet food, focusing on sustainability and high-quality ingredients for both cats and dogs.

FressnapfTiernahrungs GmbH (10-14%)

A major player in Europe with a comprehensive range of pet products, offering both retail and online shopping platforms for pet owners.

Robert Bosch GmbH (8-12%)

Innovating with a focus on health and nutrition products, alongside providing a range of pet food and care solutions for dogs and cats.

Other Key Players

The industry is segmented into bark collars (static, vibration, spray, ultrasonic, sonic), carrier backpacks (purse carrier, sling carrier, hard kennel, other), cat litter (clumping, non-clumping), litter boxes (open top cat litter box, enclosed cat litter box, self-cleaning cat litter box, modern cat litter box, other), bowls, feeders, and waterers (plastic, ceramic, stainless steel, other), pet containment (wireless fences, in-ground fences), pet doors (electronic, non-electronic), harness & leashes (h-harness, jacket harnesses), and pet toys (feather toys, stick toys, ball toys, catnip toys, scratchers, chew toys).

The industry is divided into dog and cat.

The industry is categorized into modern trade, convenience stores, pet stores, multi-brand stores, drug stores, online retailers, and other sales channels.

The industry is segmented by countries including Germany, France, Italy, Spain, United Kingdom, Austria, Netherlands, Switzerland, Russia, and the Rest of Europe.

The industry is estimated to be USD 45.6 billion in 2025.

The industry is projected to grow to USD 79.7 billion by 2035.

The United Kingdom is expected to grow at a 6.5% CAGR.

Cats hold a leading share due to their popularity across urban households and increased demand for specialized cat care products.

Major participants include Nestlé Purina Pet Care, Trixie Heimtierbedarf GmbH & Co. KG, Josera Petfood GmbH & Co. KG, Fressnapf Tiernahrungs GmbH, Robert Bosch GmbH, Ancol Pet Products Ltd., Danish Design Pet Products Ltd., The Clorox Company, Spectrum Brands Holdings, Inc., Gor Pets Ltd., Rosewood Pet Products Ltd, Happy Pet Products Ltd, Dogtra Europe, SportDOG Europe, Garmin Europe, Num'axes, PACDOG, Sure Petcare (SureFlap), Ferplast S.p.A., Closer Pets, Catit, Zolux, and Ruffwear.

Table 1: Market Value (US$ million) Forecast, By Product Type, 2018 to 2033

Table 2: Market Volume (Units) Forecast, By Product Type, 2018 to 2033

Table 3: Market Value (US$ million) Forecast, By Pet Type, 2018 to 2033

Table 4: Market Volume (Units) Forecast, By Pet Type, 2018 to 2033

Table 5: Market Value (US$ million) Forecast, By Sales Channel, 2018 to 2033

Table 6: Market Volume (Units) Forecast, By Sales Channel, 2018 to 2033

Table 7: Market Value (US$ million) Forecast, By Country, 2018 to 2033

Table 8: Market Volume (Units) Forecast, By Country, 2018 to 2033

Table 9: Germany Market Value (US$ million) Forecast, By Product Type, 2018 to 2033

Table 10: Germany Market Volume (Units) Forecast, By Product Type, 2018 to 2033

Table 11: Germany Market Value (US$ million) Forecast, By Pet Type, 2018 to 2033

Table 12: Germany Market Volume (Units) Forecast, By Pet Type, 2018 to 2033

Table 13: Germany Market Value (US$ million) Forecast, By Sales Channel, 2018 to 2033

Table 14: Germany Market Volume (Units) Forecast, By Sales Channel, 2018 to 2033

Table 15: France Market Value (US$ million) Forecast, By Product Type, 2018 to 2033

Table 16: France Market Volume (Units) Forecast, By Product Type, 2018 to 2033

Table 17: France Market Value (US$ million) Forecast, By Pet Type, 2018 to 2033

Table 18: France Market Volume (Units) Forecast, By Pet Type, 2018 to 2033

Table 19: France Market Value (US$ million) Forecast, By Sales Channel, 2018 to 2033

Table 20: France Market Volume (Units) Forecast, By Sales Channel, 2018 to 2033

Table 21: Italy Market Value (US$ million) Forecast, By Product Type, 2018 to 2033

Table 22: Italy Market Volume (Units) Forecast, By Product Type, 2018 to 2033

Table 23: Italy Market Value (US$ million) Forecast, By Pet Type, 2018 to 2033

Table 24: Italy Market Volume (Units) Forecast, By Pet Type, 2018 to 2033

Table 25: Italy Market Value (US$ million) Forecast, By Sales Channel, 2018 to 2033

Table 26: Italy Market Volume (Units) Forecast, By Sales Channel, 2018 to 2033

Table 27: Spain Market Value (US$ million) Forecast, By Product Type, 2018 to 2033

Table 28: Spain Market Volume (Units) Forecast, By Product Type, 2018 to 2033

Table 29: Spain Market Value (US$ million) Forecast, By Pet Type, 2018 to 2033

Table 30: Spain Market Volume (Units) Forecast, By Pet Type, 2018 to 2033

Table 31: Spain Market Value (US$ million) Forecast, By Sales Channel, 2018 to 2033

Table 32: Spain Market Volume (Units) Forecast, By Sales Channel, 2018 to 2033

Table 33: UK Market Value (US$ million) Forecast, By Product Type, 2018 to 2033

Table 34: UK Market Volume (Units) Forecast, By Product Type, 2018 to 2033

Table 35: UK Market Value (US$ million) Forecast, By Pet Type, 2018 to 2033

Table 36: UK Market Volume (Units) Forecast, By Pet Type, 2018 to 2033

Table 37: UK Market Value (US$ million) Forecast, By Sales Channel, 2018 to 2033

Table 38: UK Market Volume (Units) Forecast, By Sales Channel, 2018 to 2033

Table 39: Austria Market Value (US$ million) Forecast, By Product Type, 2018 to 2033

Table 40: Austria Market Volume (Units) Forecast, By Product Type, 2018 to 2033

Table 41: Austria Market Value (US$ million) Forecast, By Pet Type, 2018 to 2033

Table 42: Austria Market Volume (Units) Forecast, By Pet Type, 2018 to 2033

Table 43: Austria Market Value (US$ million) Forecast, By Sales Channel, 2018 to 2033

Table 44: Austria Market Volume (Units) Forecast, By Sales Channel, 2018 to 2033

Table 45: Netherlands Market Value (US$ million) Forecast, By Product Type, 2018 to 2033

Table 46: Netherlands Market Volume (Units) Forecast, By Product Type, 2018 to 2033

Table 47: Netherlands Market Value (US$ million) Forecast, By Pet Type, 2018 to 2033

Table 48: Netherlands Market Volume (Units) Forecast, By Pet Type, 2018 to 2033

Table 49: Netherlands Market Value (US$ million) Forecast, By Sales Channel, 2018 to 2033

Table 50: Netherlands Market Volume (Units) Forecast, By Sales Channel, 2018 to 2033

Table 51: Switzerland Market Value (US$ million) Forecast, By Product Type, 2018 to 2033

Table 52: Switzerland Market Volume (Units) Forecast, By Product Type, 2018 to 2033

Table 53: Switzerland Market Value (US$ million) Forecast, By Pet Type, 2018 to 2033

Table 54: Switzerland Market Volume (Units) Forecast, By Pet Type, 2018 to 2033

Table 55: Switzerland Market Value (US$ million) Forecast, By Sales Channel, 2018 to 2033

Table 56: Switzerland Market Volume (Units) Forecast, By Sales Channel, 2018 to 2033

Table 57: Russia Market Value (US$ million) Forecast, By Product Type, 2018 to 2033

Table 58: Russia Market Volume (Units) Forecast, By Product Type, 2018 to 2033

Table 59: Russia Market Value (US$ million) Forecast, By Pet Type, 2018 to 2033

Table 60: Russia Market Volume (Units) Forecast, By Pet Type, 2018 to 2033

Table 61: Russia Market Value (US$ million) Forecast, By Sales Channel, 2018 to 2033

Table 62: Russia Market Volume (Units) Forecast, By Sales Channel, 2018 to 2033

Table 63: Rest of Market Value (US$ million) Forecast, By Product Type, 2018 to 2033

Table 64: Rest of Market Volume (Units) Forecast, By Product Type, 2018 to 2033

Table 65: Rest of Market Value (US$ million) Forecast, By Pet Type, 2018 to 2033

Table 66: Rest of Market Volume (Units) Forecast, By Pet Type, 2018 to 2033

Table 67: Rest of Market Value (US$ million) Forecast, By Sales Channel, 2018 to 2033

Table 68: Rest of Market Volume (Units) Forecast, By Sales Channel, 2018 to 2033

Figure 01: Market Value (US$ million) and Volume (Units) Analysis, 2018 to 2022

Figure 02: Market Value (US$ million) and Volume (Units) Forecast, 2023 to 2033

Figure 03: Market Value (US$ million) Analysis, 2018 to 2022

Figure 04: Market Value (US$ million) Forecast, 2023 to 2033

Figure 05: Market Absolute $ Opportunity Value (US$ million), 2023 to 2033

Figure 06: Market Value (US$ million) Analysis By Product Type, 2018 to 2033

Figure 07: Market Volume (Units) Analysis By Product Type, 2018 to 2033

Figure 08: Market Y-o-Y Growth (%) Projections, By Product Type, 2023 to 2033

Figure 09: Market Attractiveness By Product Type, 2023 to 2033

Figure 10: Market Value (US$ million) Analysis By Pet Type, 2018 to 2033

Figure 11: Market Volume (Units) Analysis By Pet Type, 2018 to 2033

Figure 12: Market Y-o-Y Growth (%) Projections, By Pet Type, 2023 to 2033

Figure 13: Market Attractiveness By Pet Type, 2023 to 2033

Figure 14: Market Value (US$ million) Analysis By Sales Channel, 2018 to 2033

Figure 15: Market Volume (Units) Analysis By Sales Channel, 2018 to 2033

Figure 16: Market Y-o-Y Growth (%) Projections, By Sales Channel, 2023 to 2033

Figure 17: Market Attractiveness By Sales Channel, 2023 to 2033

Figure 18: Market Value (US$ million) Analysis By Country, 2018 to 2033

Figure 19: Market Volume (Units) Analysis By Country, 2018 to 2033

Figure 20: Market Y-o-Y Growth (%) Projections, By Country, 2023 to 2033

Figure 21: Market Attractiveness By Country, 2023 to 2033

Figure 22: Germany Market Value (US$ million) Analysis By Product Type, 2018 to 2033

Figure 23: Germany Market Volume (Units) Analysis By Product Type, 2018 to 2033

Figure 24: Germany Market Y-o-Y Growth (%) Projections, By Product Type, 2023 to 2033

Figure 25: Germany Market Attractiveness By Product Type, 2023 to 2033

Figure 26: Germany Market Value (US$ million) Analysis By Pet Type, 2018 to 2033

Figure 27: Germany Market Volume (Units) Analysis By Pet Type, 2018 to 2033

Figure 28: Germany Market Y-o-Y Growth (%) Projections, By Pet Type, 2023 to 2033

Figure 29: Germany Market Attractiveness By Pet Type, 2023 to 2033

Figure 30: Germany Market Value (US$ million) Analysis By Sales Channel, 2018 to 2033

Figure 31: Germany Market Volume (Units) Analysis By Sales Channel, 2018 to 2033

Figure 32: Germany Market Y-o-Y Growth (%) Projections, By Sales Channel, 2023 to 2033

Figure 33: Germany Market Attractiveness By Sales Channel, 2023 to 2033

Figure 34: France Market Value (US$ million) Analysis By Product Type, 2018 to 2033

Figure 35: France Market Volume (Units) Analysis By Product Type, 2018 to 2033

Figure 36: France Market Y-o-Y Growth (%) Projections, By Product Type, 2023 to 2033

Figure 37: France Market Attractiveness By Product Type, 2023 to 2033

Figure 38: France Market Value (US$ million) Analysis By Pet Type, 2018 to 2033

Figure 39: France Market Volume (Units) Analysis By Pet Type, 2018 to 2033

Figure 40: France Market Y-o-Y Growth (%) Projections, By Pet Type, 2023 to 2033

Figure 41: France Market Attractiveness By Pet Type, 2023 to 2033

Figure 42: France Market Value (US$ million) Analysis By Sales Channel, 2018 to 2033

Figure 43: France Market Volume (Units) Analysis By Sales Channel, 2018 to 2033

Figure 44: France Market Y-o-Y Growth (%) Projections, By Sales Channel, 2023 to 2033

Figure 45: France Market Attractiveness By Sales Channel, 2023 to 2033

Figure 46: Italy Market Value (US$ million) Analysis By Product Type, 2018 to 2033

Figure 47: Italy Market Volume (Units) Analysis By Product Type, 2018 to 2033

Figure 48: Italy Market Y-o-Y Growth (%) Projections, By Product Type, 2023 to 2033

Figure 49: Italy Market Attractiveness By Product Type, 2023 to 2033

Figure 50: Italy Market Value (US$ million) Analysis By Pet Type, 2018 to 2033

Figure 51: Italy Market Volume (Units) Analysis By Pet Type, 2018 to 2033

Figure 52: Italy Market Y-o-Y Growth (%) Projections, By Pet Type, 2023 to 2033

Figure 53: Italy Market Attractiveness By Pet Type, 2023 to 2033

Figure 54: Italy Market Value (US$ million) Analysis By Sales Channel, 2018 to 2033

Figure 55: Italy Market Volume (Units) Analysis By Sales Channel, 2018 to 2033

Figure 56: Italy Market Y-o-Y Growth (%) Projections, By Sales Channel, 2023 to 2033

Figure 57: Italy Market Attractiveness By Sales Channel, 2023 to 2033

Figure 58: Spain Market Value (US$ million) Analysis By Product Type, 2018 to 2033

Figure 59: Spain Market Volume (Units) Analysis By Product Type, 2018 to 2033

Figure 60: Spain Market Y-o-Y Growth (%) Projections, By Product Type, 2023 to 2033

Figure 61: Spain Market Attractiveness By Product Type, 2023 to 2033

Figure 62: Spain Market Value (US$ million) Analysis By Pet Type, 2018 to 2033

Figure 63: Spain Market Volume (Units) Analysis By Pet Type, 2018 to 2033

Figure 64: Spain Market Y-o-Y Growth (%) Projections, By Pet Type, 2023 to 2033

Figure 65: Spain Market Attractiveness By Pet Type, 2023 to 2033

Figure 66: Spain Market Value (US$ million) Analysis By Sales Channel, 2018 to 2033

Figure 67: Spain Market Volume (Units) Analysis By Sales Channel, 2018 to 2033

Figure 68: Spain Market Y-o-Y Growth (%) Projections, By Sales Channel, 2023 to 2033

Figure 69: Spain Market Attractiveness By Sales Channel, 2023 to 2033

Figure 70: United Kingdom Market Value (US$ million) Analysis By Product Type, 2018 to 2033

Figure 71: United Kingdom Market Volume (Units) Analysis By Product Type, 2018 to 2033

Figure 72: United Kingdom Market Y-o-Y Growth (%) Projections, By Product Type, 2023 to 2033

Figure 73: United Kingdom Market Attractiveness By Product Type, 2023 to 2033

Figure 74: United Kingdom Market Value (US$ million) Analysis By Pet Type, 2018 to 2033

Figure 75: United Kingdom Market Volume (Units) Analysis By Pet Type, 2018 to 2033

Figure 76: United Kingdom Market Y-o-Y Growth (%) Projections, By Pet Type, 2023 to 2033

Figure 77: United Kingdom Market Attractiveness By Pet Type, 2023 to 2033

Figure 78: United Kingdom Market Value (US$ million) Analysis By Sales Channel, 2018 to 2033

Figure 79: United Kingdom Market Volume (Units) Analysis By Sales Channel, 2018 to 2033

Figure 80: United Kingdom Market Y-o-Y Growth (%) Projections, By Sales Channel, 2023 to 2033

Figure 81: United Kingdom Market Attractiveness By Sales Channel, 2023 to 2033

Figure 82: Austria Market Value (US$ million) Analysis By Product Type, 2018 to 2033

Figure 83: Austria Market Volume (Units) Analysis By Product Type, 2018 to 2033

Figure 84: Austria Market Y-o-Y Growth (%) Projections, By Product Type, 2023 to 2033

Figure 85: Austria Market Attractiveness By Product Type, 2023 to 2033

Figure 86: Austria Market Value (US$ million) Analysis By Pet Type, 2018 to 2033

Figure 87: Austria Market Volume (Units) Analysis By Pet Type, 2018 to 2033

Figure 88: Austria Market Y-o-Y Growth (%) Projections, By Pet Type, 2023 to 2033

Figure 89: Austria Market Attractiveness By Pet Type, 2023 to 2033

Figure 90: Austria Market Value (US$ million) Analysis By Sales Channel, 2018 to 2033

Figure 91: Austria Market Volume (Units) Analysis By Sales Channel, 2018 to 2033

Figure 92: Austria Market Y-o-Y Growth (%) Projections, By Sales Channel, 2023 to 2033

Figure 93: Austria Market Attractiveness By Sales Channel, 2023 to 2033

Figure 94: Netherlands Market Value (US$ million) Analysis By Product Type, 2018 to 2033

Figure 95: Netherlands Market Volume (Units) Analysis By Product Type, 2018 to 2033

Figure 96: Netherlands Market Y-o-Y Growth (%) Projections, By Product Type, 2023 to 2033

Figure 97: Netherlands Market Attractiveness By Product Type, 2023 to 2033

Figure 98: Netherlands Market Value (US$ million) Analysis By Pet Type, 2018 to 2033

Figure 99: Netherlands Market Volume (Units) Analysis By Pet Type, 2018 to 2033

Figure 100: Netherlands Market Y-o-Y Growth (%) Projections, By Pet Type, 2023 to 2033

Figure 101: Netherlands Market Attractiveness By Pet Type, 2023 to 2033

Figure 102: Netherlands Market Value (US$ million) Analysis By Sales Channel, 2018 to 2033

Figure 103: Netherlands Market Volume (Units) Analysis By Sales Channel, 2018 to 2033

Figure 104: Netherlands Market Y-o-Y Growth (%) Projections, By Sales Channel, 2023 to 2033

Figure 105: Netherlands Market Attractiveness By Sales Channel, 2023 to 2033

Figure 106: Switzerland Market Value (US$ million) Analysis By Product Type, 2018 to 2033

Figure 107: Switzerland Market Volume (Units) Analysis By Product Type, 2018 to 2033

Figure 108: Switzerland Market Y-o-Y Growth (%) Projections, By Product Type, 2023 to 2033

Figure 109: Switzerland Market Attractiveness By Product Type, 2023 to 2033

Figure 110: Switzerland Market Value (US$ million) Analysis By Pet Type, 2018 to 2033

Figure 111: Switzerland Market Volume (Units) Analysis By Pet Type, 2018 to 2033

Figure 112: Switzerland Market Y-o-Y Growth (%) Projections, By Pet Type, 2023 to 2033

Figure 113: Switzerland Market Attractiveness By Pet Type, 2023 to 2033

Figure 114: Switzerland Market Value (US$ million) Analysis By Sales Channel, 2018 to 2033

Figure 115: Switzerland Market Volume (Units) Analysis By Sales Channel, 2018 to 2033

Figure 116: Switzerland Market Y-o-Y Growth (%) Projections, By Sales Channel, 2023 to 2033

Figure 117: Switzerland Market Attractiveness By Sales Channel, 2023 to 2033

Figure 118: Russia Market Value (US$ million) Analysis By Product Type, 2018 to 2033

Figure 119: Russia Market Volume (Units) Analysis By Product Type, 2018 to 2033

Figure 120: Russia Market Y-o-Y Growth (%) Projections, By Product Type, 2023 to 2033

Figure 121: Russia Market Attractiveness By Product Type, 2023 to 2033

Figure 122: Russia Market Value (US$ million) Analysis By Pet Type, 2018 to 2033

Figure 123: Russia Market Volume (Units) Analysis By Pet Type, 2018 to 2033

Figure 124: Russia Market Y-o-Y Growth (%) Projections, By Pet Type, 2023 to 2033

Figure 125: Russia Market Attractiveness By Pet Type, 2023 to 2033

Figure 126: Russia Market Value (US$ million) Analysis By Sales Channel, 2018 to 2033

Figure 127: Russia Market Volume (Units) Analysis By Sales Channel, 2018 to 2033

Figure 128: Russia Market Y-o-Y Growth (%) Projections, By Sales Channel, 2023 to 2033

Figure 129: Russia Market Attractiveness By Sales Channel, 2023 to 2033

Figure 130: ROE Market Value (US$ million) Analysis By Product Type, 2018 to 2033

Figure 131: ROE Market Volume (Units) Analysis By Product Type, 2018 to 2033

Figure 132: ROE Market Y-o-Y Growth (%) Projections, By Product Type, 2023 to 2033

Figure 133: ROE Market Attractiveness By Product Type, 2023 to 2033

Figure 134: ROE Market Value (US$ million) Analysis By Pet Type, 2018 to 2033

Figure 135: ROE Market Volume (Units) Analysis By Pet Type, 2018 to 2033

Figure 136: ROE Market Y-o-Y Growth (%) Projections, By Pet Type, 2023 to 2033

Figure 137: ROE Market Attractiveness By Pet Type, 2023 to 2033

Figure 138: ROE Market Value (US$ million) Analysis By Sales Channel, 2018 to 2033

Figure 139: ROE Market Volume (Units) Analysis By Sales Channel, 2018 to 2033

Figure 140: ROE Market Y-o-Y Growth (%) Projections, By Sales Channel, 2023 to 2033

Figure 141: ROE Market Attractiveness By Sales Channel, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Europe Polyvinyl Alcohol Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Europe Cruise Market Forecast and Outlook 2025 to 2035

Europe Massage Therapy Service Market Size and Share Forecast Outlook 2025 to 2035

Europe Cement Market Analysis Size and Share Forecast Outlook 2025 to 2035

European Union Tourism Industry Size and Share Forecast Outlook 2025 to 2035

Europe Injection Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

Europe Injection Moulders Market Size and Share Forecast Outlook 2025 to 2035

Europe and MENA Generic Oncology Drug Market Size and Share Forecast Outlook 2025 to 2035

Europe Masking Tapes Market Size and Share Forecast Outlook 2025 to 2035

Europe Liners Market Size and Share Forecast Outlook 2025 to 2035

Europe Dermal Fillers Market Size and Share Forecast Outlook 2025 to 2035

Europe Trolley Bus Market Size and Share Forecast Outlook 2025 to 2035

Europe Protease Market Size and Share Forecast Outlook 2025 to 2035

Europe Luxury Packaging Market Size and Share Forecast Outlook 2025 to 2035

Europe & USA Consumer Electronics Packaging Market Size and Share Forecast Outlook 2025 to 2035

Europe Plant-Based Meal Kit Market Size and Share Forecast Outlook 2025 to 2035

Europe Temperature Controlled Packaging Solutions Market Size and Share Forecast Outlook 2025 to 2035

Europe Rubber Derived Unrefined Pyrolysis Oil Market Size and Share Forecast Outlook 2025 to 2035

Europe's Golden Generation Travel Market Size and Share Forecast Outlook 2025 to 2035

Europe Automotive Night Vision System Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA