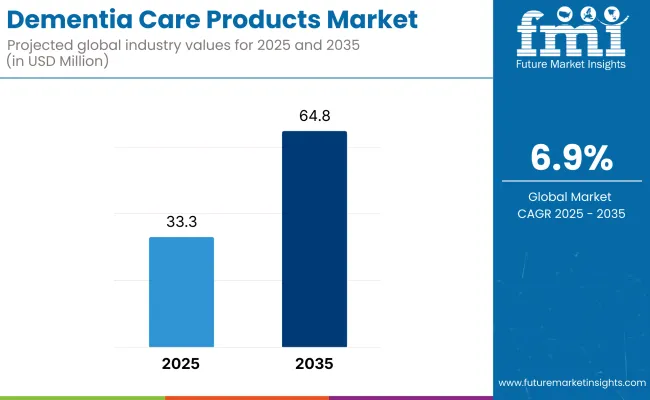

The dementia care products market is expected to reach USD 33.3 Million by 2025 and is expected to steadily grow at a CAGR of 6.9% to reach USD 64.8 Million by 2035. In 2024, dementia care products market have generated roughly USD 31.1 Million in revenues.

Dementia care products are personalized equipment, devices, that aid elderly patients and their caregivers to live independently. Few of the products include memory aids, GPS tracking devices, adaptive wear, sensory stimulation products, and home safety devices.

An increasing cases of dementiain elderly population is one of the major reasons for the adoption of products. Countries across the globe are increasingly aware of early treatment and instilling in-home care; thus, both medical practitioners and families are looking for better ways to manage cognitive loss.

Moreover, through advances that improve technologies, wearable sensors, and the development of reminder apps have consequently led to efficiency and convenience in product use. Additionally, increase in number of training programs for the caregivers, as well as a more narrowed approach on aging-in-place initiatives, have increased the demand for this type of product in the market.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 33.3 Million |

| Industry Value (2035F) | USD 64.8 Million |

| CAGR (2025 to 2035) | 6.9% |

The years between 2020 and 2024 witnessed a strong influences on the adoption of dementia care products. The COVID-19 pandemic proved to be a very significant driving force, which led to increase in adoption of remote monitoring and home care products for high-risk populations. An increased acceptance of digital technologies such as GPS tracking devices, fall sensor devices, and reminder software further anticipated the market growth.

Awareness campaigns at the international level on world Alzheimer's month, and intensifying international attention towards mental health, further raised the stakes towards dementia. Thus, policies and financing towards senior citizen home-based care were established in developed countries, where subsidies for assistive technologies were included. Furthermore, increasing desirability and the potential for general adoption of health facilities in homes further anticipates the growth of the dementia care products in the market.

Easy accessibility of dementia care products in North America will infinitely grow because of the increasing senior citizens and a gradual increase in dementia occurrence, especially Alzheimer disease. With early detection and long-term management measures due to a well-established health infrastructure in the region, the need for products to support memory aids, monitoring systems, and safety devices will strengthen progressively.

Market growth is also attributed to high awareness levels among patients and caregivers, as well as supporting government funds and policies in place for the elderly and home-based care. In addition, there is fast adoption of smart dementia care devices in institutional and home environments, attributable to the expansion of telehealth and remote monitoring.

Aging radicalization or aging in place of governments in the region by providing home care is part of the trend oriented toward promoting usage of assistive devices like memory aids, GPS devices, and fall sensors. Complementary to such policies are elderly care financing and public enlightenment campaigns on the various benefits of such home care solutions.

The development of healthcare technology innovation in Europe offers more comprehensive and easy-to-use solutions for dementia care. Product availability and access across the continent have attracted partnerships among the healthcare organizations and tech firms with patient advocacy organizations.

One of the major reasons why there is growth in dementia care product sales in Asia Pacific countries is because of the fast population aging, particularly in Japan, China, and South Korea. This phenomenon goes along with the rising prevalence of dementia and the increasing public awareness of early detection.Smaller family sizes and urbanization have further added to the demand for assistive technologies in the treatment of dementia.

The health technologies have been made affordable, and there has been an increase in digital health platforms; hence, this made the dementia care products easily available to the people. Growing investments from regional players as well as from international companies further inflate the product supply and distribution.

Lack of caregiver awareness and training on effective use of the tools hinders their Market Growth

Most caregivers, particularly family members with no formal medical experience, do not know how to properly apply or use memory aids, communication devices, or safety devices. This results in underutilization or incorrect use, preventing the products from having the maximum effects.

Cultural stigma over dementia in some geographies further discourages families from even going for help or buying care products, and hence, allows very little adoption of them. Even if they do exist, they cannot be helpful without appropriate guidance or support from healthcare systems which would otherwise promote long-term usage. This requires targeted education campaigns, improvement of caregiver support schemes, and more partnerships between product developers and health practitioners.

Growing shift toward home-based and community-centered careposses new business opportunities in the market

With countries all over the globe gearing toward reducing their institutional care requirement, families have taken on a greater burden of responsibility in caring for demented relatives under their roofs. This creates a high demand for practical and user-friendly products-such as medication organizers, orientation clocks, wearable identification tags, and easy-to-use remote communication tools-.

These things, moreover, are boosted by government subsidies in such markets as Europe and Asia Pacific-policy incentives as well as aging-in-place programs-into acquiring those types of products. Companies that emphasize affordability, simplicity, and culturally appropriate design can capture this emerging market.

Growth of Home-Based Dementia Care Market anticipates the Growth of the Market

Home-based dementia care services are growing and generating demand for products relating to dementia care. With health care costs skyrocketing and increased focus on aging at home, caregivers and families have the ever-increasing reliance upon supportive products for daily living, safety, and behavior management.

Easy-to-use phones, motion-sensing nightlights, and personal location equipment are examples of what have now become must-have products. Not only does home-based care minimize emotional strain on the individual, but it also frees the needy person from institutionalization. Companies are responding with sleek products that are very easily installed and quite convenient for caregivers. Moving people from care in facilities is molding a strong enduring market for innovation and growth in dementia care products.

Expansion of Product Lines by Medical Device Companiesdemonstrating Growth of the Market

Medical device vendors have realized the need to include in their product offerings devices intended purely for dementia care because the demand for such presently untapped niches grows. Earlier manufacturers that were geriatric focused or generic household health accessories can now add new products such as pill reminding dispensers, orientation clocks, simple-to-operate communication devices, or wander-prevention solutions.

This move also helps companies in diversifying their portfolios within the geriatric care category. The presence of well-established medical device firms in this market also add credibility for the product, broaden the distribution channels, and open access through hospitals, pharmacies, and eldercare service providers.

Personalization and User-Centered Product Design

One of the current trends in dementia care products is the shift to personalization and user-centered design. Since dementia affects people differently, there is increasing need for products to fulfill individual stages and symptoms of the disorder, e.g. products designed for early-stage users with mild memory loss, while others address needs in advanced stages such as prevention from falling and communication support.

Manufacturers are now using caregiver input and real-life use cases in product design, thereby making solutions intuitive and tailored to the user's setting and restrictions. It also builds trust and long-term usage among caregivers with repeat buying and greater brand loyalty in a sensitive and expanding market.

Integration of Dementia Care Products in Community-Based Programs

Trend towards the embedding of dementia products within broader community health and social care initiatives is growing. Increasingly, non-profits and local governments employ products such as wristbands for identification purposes, safety kits for home, and memory books into community outreach programs.

These materials are made accessible to consumers through community dementia-friendly campaign initiatives and mobile health clinics plus senior centers. They give the possibility of integrating products into the wider net of public health initiatives, thus building more comprehensive settings and increasing awareness, accessibility, and early adoption at community level.

From 2020 to 2024, the market for dementia care products continuously grew due to increasing cases of dementia, caregiver burden, and the demand for home care, especially brought on by the COVID-19 pandemic. Safety tools, memory aids, and monitoring devices saw significant increased use during these years. Among other things, the transition towards community-based care, greater accessibility of products, and better education for caregivers will further drive adoption, turning dementia care products into arguably the most important segment of geriatric healthcare.

| Category | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Development of dementia-specific national plans and public health guidelines in nations such as the UK, Japan, and Australia. Pilot programs and subsidies initiated |

| Technological Advancements | Streamlined design of mobility aids, clocks, and memory aids. Launch of easy-to-use remote communication and safety products (e.g., ID bracelets, motion sensors). |

| Consumer Demand | Strong demand for home-based care tools throughout and after COVID-19. Family caregivers looked for low-maintenance, dependable solutions for monitoring and safety. |

| Market Growth Drivers | Aging population, growing dementia incidence, and greater caregiver burden. Government and awareness campaigns helped increase product visibility. |

| Sustainability | First efforts to minimize packaging waste and encourage reusable care devices. Emphasis on product longevity to minimize replacement cycles. |

| Category | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Create a better convergence of international policies to facilitate aging in place. Increase public funding for dementia care-relevant items and caregiver support items |

| Technological Advancements | Multi-Purpose Integration (e.g., medication reminder with alert functions). |

| Consumer Demand | Growing consumer demand for discreet, dignified, and lifestyle-integrated dementia products. |

| Market Growth Drivers | Scaling up elderly care infrastructure and integrating digital health and culturally tailored products. |

| Sustainability | Increased focus on the environmentally friendly product portfolio, recyclable packaging, and carbon-neutral distribution systems in conformity with global ESG norms for health care. |

Advancing age of the population in the US, the rapid increase in the incidence of dementia is being witnessed. Besides, increasing the burden of caregiving and growing awareness of the impacts of dementia result in increased demands in safety devices, memory aids, and monitoring systems. Such a strong market is backed by health reform and the emerging digital health solutions, along with increasing in-home care services.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

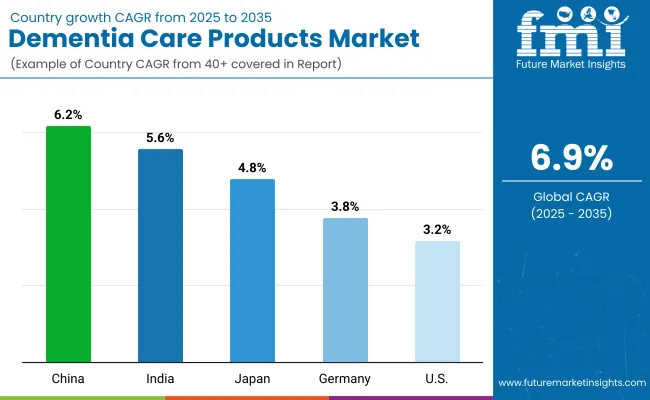

| United States | 3.2% |

Market Outlook

The aging population in the country and the support of the government for in-home services for the elderly are the two most important drivers for dementia care products in Germany. The solid healthcare system in the country and rising awareness about dementia raise the demand for assistive devices. The market appears bright by promoting simple and effective care solutions that support the country's aging-in-place policies.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 3.8% |

Market Outlook

In India, the elderly population is growing and family-based dementia care is the major growth driver for adopting dementia care products. Awareness programs are also bringing impetus for this market along with increasing access to healthcare. The future looks bright with demand expected to flow for cheaper, simpler products in both urban and rural markets.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 5.6% |

A major driver contributing to the dementia care products in China is the fast-growing aged population, accompanied by a reform emphasis placed by the government on eldercare. As awareness concerning dementia increases, so do demands for monitoring systems and safety devices, mostly in urban areas. The market prospects seem very bright and ever-expanding, supported through upward adoption galvanization by healthcare policy and urbanization.

Market Growth Drivers

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 6.2% |

Japan is one of the most aged countries in the world, and thus, quality dementia care products would be ideally suited for the market. The stimulus for this demand would be the government's focus on aging-in-place and community care, along with high awareness among citizens regarding dementia. With a forward thrust for high-tech, user-friendly care solutions designed for the elderly of Japan, the market looks clear of hurdles in expanding.

Market Growth Drivers

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.8% |

The Personal Safety Products segment dominates the market in order to ensure the safety of individuals with dementia

An individual affected by such a disease becomes lost and may even go out of the house, or injure him. Items such as GPS tracking systems, fall alarms, and personal emergency response systems help the caregivers in remote monitoring of patients, taking swift actions if required, and giving the patients a kind of autonomy without the added risks that could either come from wandering or unexpected medical incidents, hence making it applicable for both healthcare institutions and family caregivers. The rapidly developing phase of Bathroom Safety Products.

The Bathroom Safety Products segment is growing at a significant rate due to the high risk of falls and injuries in the bathroom

Bathroom Safety Products segment is the fastest-growing segment as it minimizes decreased and falling that pose highly enormous risk especially within the bathroom-settings hazards for dementia patients. While the disease advances, those patients are heard to lose balance, coordination, and movement, thereby increasing chances of slips and falls.

Independent living will be noted and improved with bathroom aids such as grab rails, elevated toilet seats, and no-skid mats. Rapid expansion in this area is driven by the increasing number of elderly individuals and awareness regarding fall prevention among dementia patients.

Home-care setting dominates the market as aging in place has become a key focus for individuals with dementia and their families

The trend for home care settings is that it leads the dementia care products market, mainly because it is the most important factor when considering aging in place and also by families living with dementia. Most individuals with dementia are willing to stay at home for as long as possible in order to have independence and comfort.

Devices such as safety monitoring systems, drug reminders and memory aids enable caregivers to deliver care in the home environment, giving one-on-one attention, and minimizing the institutionalization stress. The escalating healthcare expenditures coupled with technology advances in remote care are now making home care the first choice in dementia care.

The Long-Term Care Centers segment holds a substantial share of the market as these facilities provide specialized care for patients

The Long-Term Care Centers segment holds a bulk market share inasmuch as the centers extend specialized care and monitoring for patients suffering from advanced stages of dementia who require 24-hour supervision. Further breeding of the dementia patient population demands a dedicated care by more individuals, which cannot be fully offered by home care.

Long-term care facilities, having different dementia-specific products-from security appliances to cognitive therapy equipment and special beds-induce appropriate symptom management and quality of life improvement. Professional services directed toward older populations, along with governmental support, tend to also boost this segment's contribution to the market.

Innovative products and strategic alliances between manufacturers and healthcare organizations or institutions concerning elder care further fuel the competition. Emphasizing user-friendliness, the major players concentrate on developing feature-rich products such as intelligent safety devices, reminder systems, and cognitive stimulation devices for home and long-term care applications. Meanwhile, traditional and regional players are increasing the competition by offering culturally sensitive, affordable solutions toward caregiving needs, and hence, are increasing their presence in Asia Pacific and other emerging economies.

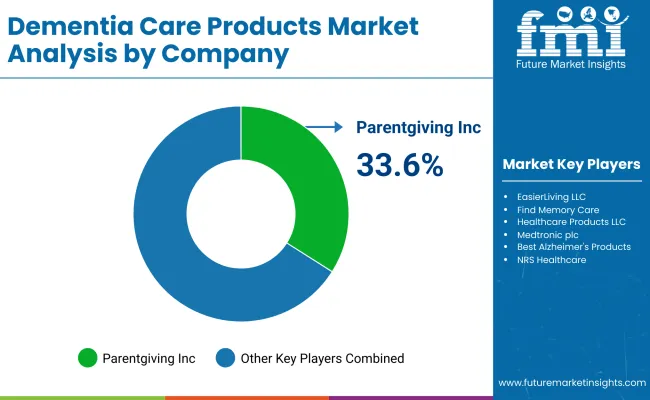

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Parentgiving , Inc. | 33.6% to 38.5% |

| EasierLiving , LLC | 20.4% to 22.6% |

| Find Memory Care | 15.1% to 17.2% |

| Healthcare Products LLC | 4.6% to 6.8% |

| Other Companies (combined) | 12.1% to 15.4% |

| Company Name | Key Offerings/Activities |

|---|---|

| Parentgiving , Inc. | Drugs and safety devices for home use are made available for people with dementia as well as fall prevention devices and alarms, safety alarms, incontinence aid, etc |

| EasierLiving , LLC | Empowers devices for medication reminders, GPS tracking devices, and daily living aids to make home accommodation for dementia patients better. |

| Find Memory Care | Find Memory Care refers families to dementia care centers in addition to recommending individualized care options, such as sensory tools and cognitive aids. |

| Healthcare Products LLC | Healthcare Products LLC provides adaptive dining aids, bathroom safety aids, and fall prevention aids that center on simplicity and affordability. |

Key Company Insights

Parentgiving, Inc.

Parentgiving dominates the D2C dementia care segment with a robust e-commerce platform providing a range of curated products for home safety, memory support, and incontinence. Additional caregiver-centered resources, care kit bundling, and subscription services give the commissioned advantage of being the first choice for aging-in-place care.

EasierLiving, LLC

EasierLiving provides reasonably simple and economical assistant solutions for medication management, fall prevention, and various tracking tools. The company's strength lies in caregiver education, the selection of products focused on user needs, and touchless access online, bridging the gap between clinical demands and home care implementation.

Find Memory Care

As a dementia care navigation platform, Find Memory Care distinguishes itself by fusing product guidance with facility placement services. Its focus on patient-centric solutions and partnership with memory care communities adds to its credibility in matching tools to patient-centric care stages.

Memory Exercise & Activity Products, Daily Reminder Products, Bathroom Safety Products, Dining Aids, Communication Products, Personal Safety Products, and Other Product Types

Home Care Settings and Long-term Care Centers

The overall market size for dementia care products market was USD 33.3 Million in 2025.

The dementia care products market is expected to reach USD 64.8 Million in 2035.

Rising dementia diagnosis rates and support extended by government and NGOs anticipates the growth of the dementia care products market.

The top key players that drives the development of dementia care products market are Parentgiving, Inc., EasierLiving, LLC, Find Memory Care and Healthcare Products LLC.

Personal safety products segment by product type is expected to dominate the market during the forecast period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 4: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 7: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 10: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 11: Western Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 12: Western Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 13: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 15: Eastern Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 16: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 17: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 18: South Asia and Pacific Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 19: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 21: East Asia Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 22: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 23: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 24: Middle East and Africa Market Value (US$ Million) Forecast by End User, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by End User, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 6: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 7: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 13: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 14: Global Market Attractiveness by End User, 2023 to 2033

Figure 15: Global Market Attractiveness by Region, 2023 to 2033

Figure 16: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 17: North America Market Value (US$ Million) by End User, 2023 to 2033

Figure 18: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 19: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 20: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 21: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 23: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 24: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 28: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 29: North America Market Attractiveness by End User, 2023 to 2033

Figure 30: North America Market Attractiveness by Country, 2023 to 2033

Figure 31: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 32: Latin America Market Value (US$ Million) by End User, 2023 to 2033

Figure 33: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 34: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 35: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 36: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 38: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 39: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 41: Latin America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 42: Latin America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 43: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 44: Latin America Market Attractiveness by End User, 2023 to 2033

Figure 45: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 46: Western Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 47: Western Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 48: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 49: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 50: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 51: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 52: Western Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 53: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 54: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 55: Western Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 56: Western Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 57: Western Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 58: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 59: Western Europe Market Attractiveness by End User, 2023 to 2033

Figure 60: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 61: Eastern Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 62: Eastern Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 63: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 64: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 65: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 66: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 67: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 68: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 69: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 70: Eastern Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 71: Eastern Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 72: Eastern Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 73: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 74: Eastern Europe Market Attractiveness by End User, 2023 to 2033

Figure 75: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 76: South Asia and Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 77: South Asia and Pacific Market Value (US$ Million) by End User, 2023 to 2033

Figure 78: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 79: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 80: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 81: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 82: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 83: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 84: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 85: South Asia and Pacific Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 86: South Asia and Pacific Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 87: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 88: South Asia and Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 89: South Asia and Pacific Market Attractiveness by End User, 2023 to 2033

Figure 90: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 91: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 92: East Asia Market Value (US$ Million) by End User, 2023 to 2033

Figure 93: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 96: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 97: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 98: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 99: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 100: East Asia Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 101: East Asia Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 102: East Asia Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 103: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 104: East Asia Market Attractiveness by End User, 2023 to 2033

Figure 105: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 106: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 107: Middle East and Africa Market Value (US$ Million) by End User, 2023 to 2033

Figure 108: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 109: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 110: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 111: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 112: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 113: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 114: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 115: Middle East and Africa Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 116: Middle East and Africa Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 117: Middle East and Africa Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 118: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 119: Middle East and Africa Market Attractiveness by End User, 2023 to 2033

Figure 120: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Suncare Products Market Size and Share Forecast Outlook 2025 to 2035

Skincare Products Market Size and Share Forecast Outlook 2025 to 2035

Sun Care Products Market Analysis – Growth, Applications & Outlook 2025–2035

Car Care Products Market Trends - Growth, Demand & Analysis 2025 to 2035

Nail Care Products Market Growth, Trends and Forecast from 2025 to 2035

Facial Care Products Market Size and Share Forecast Outlook 2025 to 2035

Dental Care Products Market Size and Share Forecast Outlook 2025 to 2035

Personal Care Products Filling System Market Size and Share Forecast Outlook 2025 to 2035

Men’s Skincare Products Market Size, Growth, and Forecast for 2025 to 2035

Pregnancy Care Products Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Post Shave Care Products Market Size and Share Forecast Outlook 2025 to 2035

Baby Teeth Care Products Market Size and Share Forecast Outlook 2025 to 2035

Europe Pet Care Products Market Growth, Trends and Forecast from 2025 to 2035

Incontinence Care Products Market Size and Share Forecast Outlook 2025 to 2035

Buffering Skincare Products Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Baby Personal Care Products Market Analysis - Size & Growth 2025 to 2035

Tea-Based Skin Care Products Market Analysis by Product Type, Tea Type, Skin Type, Sales Channel and Region from 2025 to 2035

Men's Intimate Care Products Market - Trends, Growth & Forecast 2025 to 2035

Astringent Skin Care Products Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Dispersing Skin Care Products Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA